Académique Documents

Professionnel Documents

Culture Documents

Financial Statements of HSY

Transféré par

Aqsa UmerDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Financial Statements of HSY

Transféré par

Aqsa UmerDroits d'auteur :

Formats disponibles

HSY

Financial analysis

12/13/2012

Submitted by : Aqsa Omer

Anam Afzal

Chandni Saleem

Submitted to : Mamm huma Fatima

Programme : Bba(hons) eve 5

th

semester

University of education bank road campus

Table of Contents

Acknowledgement

Introduction

History

Balance Sheet

Profit And Loss Statement

Financial Ratios

Financial Ratio Analysis

Liquidity Ratios

Current Ratio

Quick Ratio

Activity Ratio

Inventory Turnover

Average Collection Period

Average Payment Period

Total Asset Turnover

Debt Ratios

Debt Ratio

Times Interest Earned Ratio

Profitability Ratios

Gross Profit Margin

Operating Profit Margin

Net Profit Margin

Earnings Per Share

Return On Total Asset

Return On Common Equity

Acknowledgement

The directors are thankful to the shareholders, financial

institutions and customers of the company who have

extended their support in one way or the other to the cause

of the company. The directors also place on record their

appreciation for dedicated services rendered by the

employees of the company during this period.

I ntroduction

HSY

Hassan Sheheryar Yasin (HSY) is a big name comes in

the list of top Pakistani fashion designers. He was born in

Lahore, graduated from the Pakistan School of Fashion

Design in 2000 also a member of BOD of the same

institution. Hassan has introduced himself as a fashion

choreographer. He also proved himself as a designer in

several fashion shows in Pakistan and abroad. Yasin

reveals his brand title HSY in the year 2000.

The designer has introduced HSY collection of home

furniture, interior accessories, and soft furnishings in

2005. He has also introduced HSY brand jewelry. HSY

won Lux Style Fashion Designer award of the Year 2005.

He also received Best Couture Designer award at DFW,

Dubai, the Most Stylish Fashion Icon at the MTV Style

Awards in 2009.HSY has a numerous range of dresses for

men and women in bridal wear, formal wear and lawn

collections for summer.

Fashion designer HSY is considered among the top

Pakistani Fashion designers.

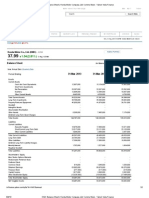

Assets Dec 31

2009

Dec 31

2010

Dec 31

2011

Cash and

Equivalents

253.6

884.6 693.7

TOTAL CASH

AND SHORT

TERM

INVESTMEN

T

253.6

884.6 693.7

Accounts

Receivable

410.4

390.1 399.5

Inventory

519.7 533.6 649.0

Prepaid

Expenses

147.2

134.4 159.7

Other

Current

Assets

14.7

6.7 7.9

TOTAL

CURRENT

ASSETS

1,385.4

2,005.2 2,046.6

NET

PROPERTY

PLANT AND

EQUIPMENT

1,404.8

1,437.7 1,559.7

Long-Term

Investments

9.2

36.5 40.7

Goodwill

571.6 524.1 516.7

Other

Intangibles

125.5

123.1 111.9

Other Long-

Term Assets

174.2

124.7 98.0

TOTAL

ASSETS

3,675.0

4,272.7 4,412.2

LIABILITIES &

EQUITY

Accounts

Payable

287.9 410.7

420.0

Accrued

Expenses

535.5

576.1 604.8

Short-Term

Borrowings

24.1 24.1 42.1

Current Portion 15.2 270.3 97.6

of Long-Term

Debt/Capital

Lease

Other Current

Liabilities

10.9

8.3 7.4

TOTAL

CURRENT

LIABILITIES

910.6

1,298.8 1,173.8

Long-Term

Debt

1,502.7

1,541.8 1,748.5

Minority

Interest

39.9

35.3 23.6

Other

Liabilities, Total

501.3

494.5 617.3

TOTAL

LIABILITIES

2,914.7

3,335.1 3,539.6

Common Stock

359.9 359.9 359.9

Additional Paid

in Capital

394.7

434.9 490.8

Retained

Earnings

4,148.4

4,374.7 4,699.6

Treasury Stock

-3,979.6 -4,052.1 -4,259.0

Comprehensive

Income and

Other

-202.8

-215.1 -442.3

TOTAL

COMMON

EQUITY

720.5

902.3 849.0

TOTAL EQUITY

760.3 937.6 872.6

TOTAL

LIABILITIES

AND EQUITY

3,675.0

4,272.7 4,412.2

Dec 31

2009

Dec 31

2010

Dec 31

2011

Revenues 5,298.7 5,671.0 6,080.8

TOTAL

REVENUES

5,298.7

5,671.0 6,080.8

Cost of

Goods Sold

3,235.4

3,242.2 3,503.8

GROSS

PROFIT

2,063.3

2,428.9 2,577.0

Selling

General &

Admin

Expenses,

Total

1,202.6

1,425.0 1,472.8

OTHER

OPERATING

EXPENSES,

TOTAL

1,202.6

1,425.0 1,472.8

OPERATING

INCOME

860.7

1,003.9 1,104.2

Interest

Expense

-91.3

-91.8 -94.8

Interest and

0.9 1.3 2.6

Investment

Income

NET

INTEREST

EXPENSE

-90.5

-90.5 -92.2

EBT,

EXCLUDING

UNUSUAL

ITEMS

770.3

913.3 1,012.0

Merger &

Restructuring

Charges

-99.1

-98.6 -49.2

Other

Unusual

Items, Total

--

-5.9 --

Other

Unusual

Items

--

-5.9 --

EBT,

INCLUDING

UNUSUAL

ITEMS

671.1

808.9 962.8

Income Tax

Expense

235.1

299.1 333.9

Earnings

from

Continuing

Operations

436.0

509.8 629.0

NET INCOME

436.0 509.8 629.0

NET INCOME

TO

COMMON

INCLUDING

EXTRA ITEM

436.0 509.8 629.0

NET INCOME

TO

COMMON

EXCLUDING

EXTRA ITEMS

436.0 509.8 629.0

2009 2010 2011

Current Ratio 1.52 1.54 1.74

Quick Ratio 0.81 1.04 1.19

2009 2010 2011

Inventory

Turnover

5.84 6.18 6.00

Average

Collection

Period

28.8 25.1 23.9

Average

Payment

97.9 114.5 106.3

Period

Total Asset

Turnover

13.52 13.76 14.70

2009 2010 2011

Gross Profit

Margin

38.75 42.59 41.64

Operating

Profit Margin

14.3% 15.9% 17.35%

Net Profit

Margin

8.23 8.99 10.34

Earnings Per

Share

33.36 28.39 25.67

Return On

Total Asset

13.52

13.76

14.70

Return On

Common

Equity

83.59

62.83

71.83

2009 2010 2011

Debt Ratio 2.00

1.64 1.98

Times

Interest

Earned Ratio

0

0

0

Vous aimerez peut-être aussi

- University of Sargodha BBA Program DetailsDocument44 pagesUniversity of Sargodha BBA Program DetailsMuhammad SaadPas encore d'évaluation

- FFCDocument17 pagesFFCAmna KhanPas encore d'évaluation

- Final Internship Guidelines 2012Document5 pagesFinal Internship Guidelines 2012Haris JavedPas encore d'évaluation

- Automobile Industry Financial AnalysisDocument26 pagesAutomobile Industry Financial AnalysisSaiyd Ihtixam AehsunPas encore d'évaluation

- Js - Camels AnalysisDocument7 pagesJs - Camels AnalysisTammy DavisPas encore d'évaluation

- Ashok LeylandDocument13 pagesAshok LeylandDiptiPas encore d'évaluation

- PSO & SHELL ComparisonDocument22 pagesPSO & SHELL ComparisonSabeen JavaidPas encore d'évaluation

- Fin516 Week5 HW ScribdDocument2 pagesFin516 Week5 HW ScribdmsspellaPas encore d'évaluation

- Human Resource Management: Textile Institue of PakistanDocument19 pagesHuman Resource Management: Textile Institue of PakistanSaba FatmiPas encore d'évaluation

- Working Capital Management in Reliance Industries LimitedDocument5 pagesWorking Capital Management in Reliance Industries LimitedVurdalack666Pas encore d'évaluation

- Gul Ahmad and Kohinoor AnalysisDocument20 pagesGul Ahmad and Kohinoor AnalysisShazil Ahmad100% (1)

- 2 - Time Value of MoneyDocument68 pages2 - Time Value of MoneyDharmesh GoyalPas encore d'évaluation

- Working Capital Analysis of RITES LTDDocument72 pagesWorking Capital Analysis of RITES LTDSachin ChadhaPas encore d'évaluation

- IFM - Problem On BopDocument6 pagesIFM - Problem On BopSatya KumarPas encore d'évaluation

- Ceramic IndustryDocument17 pagesCeramic IndustryIshtiaq Ahmed NishatPas encore d'évaluation

- Organizing Structure of ACIDocument13 pagesOrganizing Structure of ACIArminAhsanPas encore d'évaluation

- B. Ed. Prospectus 2011Document16 pagesB. Ed. Prospectus 2011deepak4uPas encore d'évaluation

- Financial Ratios NestleDocument23 pagesFinancial Ratios NestleSehrash SashaPas encore d'évaluation

- Final Report of Financial Statement Analysis of Packages Limited LahoreDocument138 pagesFinal Report of Financial Statement Analysis of Packages Limited Lahoreshahid Ali100% (1)

- Financial Analysis of Dewan Mushtaq GroupDocument26 pagesFinancial Analysis of Dewan Mushtaq Groupسید نیر سجاد البخاري100% (2)

- Business Plan Zulkifli CollectionDocument58 pagesBusiness Plan Zulkifli CollectionSiti Salmiah SohaimiPas encore d'évaluation

- Valuation of Square PharmaceuticalsDocument17 pagesValuation of Square PharmaceuticalsSoleman AliPas encore d'évaluation

- Training Methods of RelianceDocument7 pagesTraining Methods of RelianceSanika Acharya100% (1)

- Darson Securities PVT LTD Internship ReportDocument90 pagesDarson Securities PVT LTD Internship Report333FaisalPas encore d'évaluation

- Answer Costs of Al Shaheer Corporation Going PublicDocument3 pagesAnswer Costs of Al Shaheer Corporation Going PublicSyed Saqlain Raza JafriPas encore d'évaluation

- Marketing Plan of PIADocument44 pagesMarketing Plan of PIAawais chishtyPas encore d'évaluation

- Financial Management Course OutlineDocument2 pagesFinancial Management Course OutlineRosenna99Pas encore d'évaluation

- Atlas HondaDocument17 pagesAtlas Hondaanum fatimaPas encore d'évaluation

- Gul Ahmed-Phase 3Document3 pagesGul Ahmed-Phase 3Hashim Ayaz KhanPas encore d'évaluation

- INTI College-Assignment Report TMK2111Document27 pagesINTI College-Assignment Report TMK2111aurisiaPas encore d'évaluation

- Analysis of Financial StatementsDocument49 pagesAnalysis of Financial Statementsnimra farooq0% (1)

- Advance Financial Management AssignmentDocument4 pagesAdvance Financial Management AssignmentRishabh JainPas encore d'évaluation

- PDF Internship Report LcwuDocument125 pagesPDF Internship Report LcwuKashif IftikharPas encore d'évaluation

- Report On HBL PDFDocument60 pagesReport On HBL PDFWaseem AkbarPas encore d'évaluation

- Impact of Mergers On Stock PricesDocument30 pagesImpact of Mergers On Stock PricessetushardaPas encore d'évaluation

- Final Management Project InterloopDocument19 pagesFinal Management Project InterloopShakir Abdullah50% (2)

- Meezan Bank - Report 2Document87 pagesMeezan Bank - Report 2SaadatPas encore d'évaluation

- Central Banks & State Bank of PakistanDocument33 pagesCentral Banks & State Bank of PakistanQaiser AbbasPas encore d'évaluation

- Marketing Project Report On Measuring Success of New Product in Indian Auto Mobile Industry1Document66 pagesMarketing Project Report On Measuring Success of New Product in Indian Auto Mobile Industry1sneyadavPas encore d'évaluation

- Chapter-1 Internship Report On Bank of KhyberDocument37 pagesChapter-1 Internship Report On Bank of KhyberAhmad AliPas encore d'évaluation

- HMC Balance Sheet - Honda Motor Company, LTD PDFDocument2 pagesHMC Balance Sheet - Honda Motor Company, LTD PDFPoorvi JainPas encore d'évaluation

- An Overview of BRAC Bank LimitedDocument4 pagesAn Overview of BRAC Bank LimitedHuq Ziaul100% (1)

- Corporate Financial Analysis with Microsoft ExcelD'EverandCorporate Financial Analysis with Microsoft ExcelÉvaluation : 5 sur 5 étoiles5/5 (1)

- Value Chain Management Capability A Complete Guide - 2020 EditionD'EverandValue Chain Management Capability A Complete Guide - 2020 EditionPas encore d'évaluation

- Second Phase: Toyota Analysis Project IFE MatrixDocument7 pagesSecond Phase: Toyota Analysis Project IFE MatrixAnonymous 1hE9917mpzPas encore d'évaluation

- Final Citi BankDocument9 pagesFinal Citi BankBilal EhsanPas encore d'évaluation

- BA1530 AssignmentDocument7 pagesBA1530 Assignmentsimonsingh2004Pas encore d'évaluation

- Internship Report: University of DhakaDocument45 pagesInternship Report: University of Dhakaketan dontamsettiPas encore d'évaluation

- FM Sheet 4 (JUHI RAJWANI)Document8 pagesFM Sheet 4 (JUHI RAJWANI)Mukesh SinghPas encore d'évaluation

- GUPTA - Export Import Management-MC GRAW HILL INDIA (2017)Document354 pagesGUPTA - Export Import Management-MC GRAW HILL INDIA (2017)rUTHPas encore d'évaluation

- Fin Statement Analysis - Atlas BatteryDocument34 pagesFin Statement Analysis - Atlas BatterytabinahassanPas encore d'évaluation

- Impact of Virtual Advertising in Sports EventsDocument19 pagesImpact of Virtual Advertising in Sports EventsRonak BhandariPas encore d'évaluation

- Presentation On:-: Export Sales Organization & Export Sales Man (Recruiting & Training)Document26 pagesPresentation On:-: Export Sales Organization & Export Sales Man (Recruiting & Training)Vivek Kumar SharmaPas encore d'évaluation

- Bata Aradhana 2Document26 pagesBata Aradhana 2Aradhana DixitPas encore d'évaluation

- FINN 341A-Financial Institutions and Markets - Fall 2011Document8 pagesFINN 341A-Financial Institutions and Markets - Fall 2011BurakPas encore d'évaluation

- Factoring and ForfaitingDocument34 pagesFactoring and ForfaitingStone HsuPas encore d'évaluation

- SFM - Forex - QuestionsDocument23 pagesSFM - Forex - QuestionsVishal SutarPas encore d'évaluation

- Precision Turned Products World Summary: Market Values & Financials by CountryD'EverandPrecision Turned Products World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Lecture Common Size and Comparative AnalysisDocument28 pagesLecture Common Size and Comparative AnalysissumitsgagreelPas encore d'évaluation

- Highlights of Education Loan To Iim StudentsDocument4 pagesHighlights of Education Loan To Iim StudentsChinkal NagpalPas encore d'évaluation

- NoteDocument3 pagesNotePriya GoyalPas encore d'évaluation

- Afar-03: Corporate Liquidation: - T R S ADocument4 pagesAfar-03: Corporate Liquidation: - T R S AJenver BuenaventuraPas encore d'évaluation

- E-Payment in GhanaDocument32 pagesE-Payment in GhanaSammy AcquahPas encore d'évaluation

- PF Withdrawal Application (Sample Copy)Document5 pagesPF Withdrawal Application (Sample Copy)Ashok Mahanta100% (1)

- Long Quiz 1 Acc 205Document6 pagesLong Quiz 1 Acc 205Philip LarozaPas encore d'évaluation

- Top Hidden Screte of Stock Market PDFDocument4 pagesTop Hidden Screte of Stock Market PDFAmb ReshPas encore d'évaluation

- BDO. Sec Cert Doc SouthlandDocument5 pagesBDO. Sec Cert Doc SouthlandRaysunArellanoPas encore d'évaluation

- ME/MMT: The Currency As A Public MonopolyDocument7 pagesME/MMT: The Currency As A Public MonopolyAdam Rice100% (1)

- (Kotak) Reliance Industries, October 29, 2023Document36 pages(Kotak) Reliance Industries, October 29, 2023Naushil ShahPas encore d'évaluation

- UpsDocument3 pagesUpsanandi.g9Pas encore d'évaluation

- Capital Gains Tax Questions AnsweredDocument4 pagesCapital Gains Tax Questions AnsweredRedfield GrahamPas encore d'évaluation

- The IdiotsDocument44 pagesThe IdiotsChoi Young HakPas encore d'évaluation

- CISIDocument5 pagesCISIsbdhshrm146100% (1)

- BLKL 5 Banking Industry and StructureDocument21 pagesBLKL 5 Banking Industry and Structurelinda kartikaPas encore d'évaluation

- Variable Universal Life (VUL) Insurance ExplainedDocument8 pagesVariable Universal Life (VUL) Insurance Explainedjack r100% (1)

- Balance Sheet of Kansai Nerolac PaintsDocument5 pagesBalance Sheet of Kansai Nerolac Paintssunilkumar978Pas encore d'évaluation

- CLO PrimerDocument31 pagesCLO PrimerdgnyPas encore d'évaluation

- FinancialInclusion RecentInitiativesandAssessmentDocument39 pagesFinancialInclusion RecentInitiativesandAssessmentShaneel AnijwalPas encore d'évaluation

- Review - Udayana - Baiq Sonia Toin - GBDocument9 pagesReview - Udayana - Baiq Sonia Toin - GBBaiq sonia ToinPas encore d'évaluation

- Test Bank For Macroeconomics Public and Private Choice 14th Edition James D GwartneyDocument54 pagesTest Bank For Macroeconomics Public and Private Choice 14th Edition James D GwartneyJulieJacobsrkozw100% (74)

- HomeCredit Loan Payment ScheduleDocument2 pagesHomeCredit Loan Payment ScheduleKylyn JynPas encore d'évaluation

- PDF Review Materials On Capital Budgeting DLDocument7 pagesPDF Review Materials On Capital Budgeting DLRose Ann Juleth LicayanPas encore d'évaluation

- Corporate Finance DecisionsDocument3 pagesCorporate Finance DecisionsPua Suan Jin RobinPas encore d'évaluation

- Practice set instructionsDocument36 pagesPractice set instructionsMaureen D. FloresPas encore d'évaluation

- Study online at quizlet.com/_23q1qiDocument2 pagesStudy online at quizlet.com/_23q1qiAPRATIM BHUIYANPas encore d'évaluation

- The Impact of Interest Rate On Bank Deposits Evidence From The Nigerian Banking SectorDocument18 pagesThe Impact of Interest Rate On Bank Deposits Evidence From The Nigerian Banking SectorMelson Frengki BiafPas encore d'évaluation

- Derivatives: Forward ContractsDocument4 pagesDerivatives: Forward ContractsSAITEJA DASARIPas encore d'évaluation

- 9.3 Debt InvestmentsDocument7 pages9.3 Debt InvestmentsJorufel PapasinPas encore d'évaluation

- Test Bank For Essentials of Corporate Finance 9th Edition by RossDocument24 pagesTest Bank For Essentials of Corporate Finance 9th Edition by Rosspauljohnstonapgsoemyjk98% (45)