Académique Documents

Professionnel Documents

Culture Documents

Capital Market

Transféré par

maggyfinCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Capital Market

Transféré par

maggyfinDroits d'auteur :

Formats disponibles

Capital markets are financial markets for the buying and selling of long-term debt or equity-

backed securities. These markets channel the wealth of savers to those who can put it to

long-term productive use, such as companies or governments making long-term

investments.

[1]

Financial regulators, such as the UK's Bank of England (BoE) or the U.S.

Securities and Exchange Commission (SEC), oversee the capital markets in their

jurisdictions to protect investors against fraud, among other duties.

Modern capital markets are almost invariably hosted on computer-based electronic

trading systems; most can be accessed only by entities within the financial sector or the

treasury departments of governments and corporations, but some can be accessed directly

by the public.

[2]

There are many thousands of such systems, most serving only small parts

of the overall capital markets. Entities hosting the systems include stock exchanges,

investment banks, and government departments. Physically the systems are hosted all over

the world, though they tend to be concentrated in financial centres like London, New York,

and Hong Kong. Capital markets are defined as markets in which money is provided for

periods longer than a year.

[3]

A key division within the capital markets is between the primary markets and secondary

markets. In primary markets, new stock or bond issues are sold to investors, often via a

mechanism known as underwriting. The main entities seeking to raise long-term funds on

the primary capital markets are governments (which may be municipal, local or national)

and business enterprises (companies). Governments tend to issue only bonds, whereas

companies often issue either equity or bonds. The main entities purchasing the bonds or

stock include pension funds, hedge funds, sovereign wealth funds, and less commonly

wealthy individuals and investment banks trading on their own behalf. In the secondary

markets, existing securities are sold and bought among investors or traders, usually on

an exchange, over-the-counter, or elsewhere. The existence of secondary markets

increases the willingness of investors in primary markets, as they know they are likely to be

able to swiftly cash out their investments if the need arises.

[4]

A second important division falls between the stock markets (for equity securities, also

known as shares, where investors acquire ownership of companies) and the bond

markets (where investors become creditors).

[4]

Vous aimerez peut-être aussi

- Economics Final Study GuideDocument3 pagesEconomics Final Study Guidemavrik719Pas encore d'évaluation

- Global Finance and Electronic BankingDocument16 pagesGlobal Finance and Electronic BankingKrishaPas encore d'évaluation

- Capital MarketDocument6 pagesCapital Marketmdsabbir100% (1)

- Business Activity: Revision QuestionsDocument1 pageBusiness Activity: Revision QuestionsFarrukhsg100% (1)

- Lesson 1 - CAPITAL MARKETDocument16 pagesLesson 1 - CAPITAL MARKETkim che100% (4)

- Introduction To Financial MarketsDocument7 pagesIntroduction To Financial MarketsMuhammad Azhar SaleemPas encore d'évaluation

- International Financial MarketDocument36 pagesInternational Financial MarketSmitaPas encore d'évaluation

- Financial Market & InstrumentDocument73 pagesFinancial Market & InstrumentSoumya ShettyPas encore d'évaluation

- Risk Management in Financial MarketDocument49 pagesRisk Management in Financial MarketAashika ShahPas encore d'évaluation

- Financial Markets and Financial InstrumentsDocument80 pagesFinancial Markets and Financial Instrumentsabhijeit86100% (2)

- Portfolio InvestmentDocument129 pagesPortfolio Investmentanchal1987Pas encore d'évaluation

- Cost Data PDFDocument30 pagesCost Data PDFGimhan GodawattePas encore d'évaluation

- Capital Markets Are: Financial Markets Debt Equity SecuritiesDocument2 pagesCapital Markets Are: Financial Markets Debt Equity SecuritiesDeana PhillipsPas encore d'évaluation

- Capital MarketsDocument3 pagesCapital MarketsSalkam PradeepPas encore d'évaluation

- Introduction To Finacial Markets Final With Refence To CDSLDocument40 pagesIntroduction To Finacial Markets Final With Refence To CDSLShoumi Mahapatra100% (1)

- Capital MarketDocument15 pagesCapital Marketरजनीश कुमारPas encore d'évaluation

- Navigation Search: Capital Markets AreDocument15 pagesNavigation Search: Capital Markets AreDeepak SharmaPas encore d'évaluation

- Finl Markets and FinDocument24 pagesFinl Markets and FinLunaPas encore d'évaluation

- FMI NotesDocument93 pagesFMI Notesjain_ashish_19888651Pas encore d'évaluation

- 3.the Money Market Refers To A Segment of The Financial Market Where ShortDocument6 pages3.the Money Market Refers To A Segment of The Financial Market Where Shortkhageswarsingh865Pas encore d'évaluation

- Capital Market: Financial Market Debt Equity SecuritiesDocument33 pagesCapital Market: Financial Market Debt Equity SecuritiesRohit JainPas encore d'évaluation

- MarketDocument7 pagesMarketVerlyn ElfaPas encore d'évaluation

- Module 11Document7 pagesModule 11Trayle HeartPas encore d'évaluation

- Financial Markets and Their Role in EconomyDocument6 pagesFinancial Markets and Their Role in EconomyMuzammil ShahzadPas encore d'évaluation

- A Quanittative Study of Nepalese Stock ExchangeDocument87 pagesA Quanittative Study of Nepalese Stock ExchangenirajPas encore d'évaluation

- Capital MarketsDocument8 pagesCapital Marketsrupeshmore145Pas encore d'évaluation

- Stock MarketDocument9 pagesStock MarketFrank KenyanPas encore d'évaluation

- Topic 1Document7 pagesTopic 1Jeffrey RiveraPas encore d'évaluation

- (NR) Financial Markets and InstitutionDocument8 pages(NR) Financial Markets and InstitutionMichael MendozaPas encore d'évaluation

- Financial MarketsDocument2 pagesFinancial MarketsSaira Ishfaq 84-FMS/PHDFIN/F16Pas encore d'évaluation

- Capital Market: From Wikipedia, The Free EncyclopediaDocument8 pagesCapital Market: From Wikipedia, The Free EncyclopediaAvneetPalSinghPas encore d'évaluation

- The Global Financial System Has Seven Basic Economic FunctionsDocument5 pagesThe Global Financial System Has Seven Basic Economic FunctionsArpitaPas encore d'évaluation

- Money MarketDocument25 pagesMoney Marketvicky_n007Pas encore d'évaluation

- Capital Market: Versus Money MarketsDocument21 pagesCapital Market: Versus Money MarketsVienPas encore d'évaluation

- Types of Financial Markets Stock Markets: Secondary Market NasdaqDocument6 pagesTypes of Financial Markets Stock Markets: Secondary Market NasdaqLuise MauiePas encore d'évaluation

- Module 04 Financial Markets and InstrumentsDocument13 pagesModule 04 Financial Markets and InstrumentsGovindPas encore d'évaluation

- FM 02 - Mfis NotesDocument7 pagesFM 02 - Mfis NotesCorey PagePas encore d'évaluation

- Ty Bba Project1Document37 pagesTy Bba Project1Shivam KharulePas encore d'évaluation

- Written Report On International Capital Markets and Emerging MarketsDocument6 pagesWritten Report On International Capital Markets and Emerging Marketsgene peraltaPas encore d'évaluation

- Key Takeaways: Understanding The Financial MarketsDocument4 pagesKey Takeaways: Understanding The Financial MarketsAk LelouchKaiPas encore d'évaluation

- 2 What Is Capital MarketDocument3 pages2 What Is Capital MarketGigiPas encore d'évaluation

- Drive: Summer 2016 Program: MBA Semester: 3 Subject Code: MB0036 Subject Name: Financial System and Commercial BankingDocument21 pagesDrive: Summer 2016 Program: MBA Semester: 3 Subject Code: MB0036 Subject Name: Financial System and Commercial BankingPalash DavePas encore d'évaluation

- Capital MarketDocument2 pagesCapital MarketShail DoshiPas encore d'évaluation

- Capital MarketDocument8 pagesCapital MarketAbhinav KuchhalPas encore d'évaluation

- Capital MarketDocument8 pagesCapital MarketAbhinav KuchhalPas encore d'évaluation

- FINMA 2105 - Chapter 2Document13 pagesFINMA 2105 - Chapter 2John Lloyd Gonzales AlvarezPas encore d'évaluation

- BFI Financial MarketsDocument7 pagesBFI Financial MarketsAbdul Wahid BataloPas encore d'évaluation

- Capital MarketDocument3 pagesCapital MarketDumitru Madalin AlexandruPas encore d'évaluation

- Raja Shekar ReddyDocument42 pagesRaja Shekar ReddypavithrajiPas encore d'évaluation

- Capital MarketDocument66 pagesCapital MarketPriya SharmaPas encore d'évaluation

- Financial MarketDocument5 pagesFinancial MarketRoxanne Jhoy Calangi VillaPas encore d'évaluation

- Financial Markets. An OverviewDocument3 pagesFinancial Markets. An OverviewEmmanuelle RojasPas encore d'évaluation

- FMI (Chapter 2)Document14 pagesFMI (Chapter 2)snowblack.aggPas encore d'évaluation

- Financial MarketsDocument18 pagesFinancial MarketsMuhammad YamanPas encore d'évaluation

- Finantial Institution by ADDocument27 pagesFinantial Institution by ADDaniyal AwanPas encore d'évaluation

- Ty Bba Project1Document39 pagesTy Bba Project1Shivam KharulePas encore d'évaluation

- Module-1: Financial MarketsDocument41 pagesModule-1: Financial MarketsPeeYush SahuPas encore d'évaluation

- Ifim Units 3&4Document19 pagesIfim Units 3&4kushalPas encore d'évaluation

- Solution Manual For Principles of Managerial Finance Brief 8th Edition ZutterDocument24 pagesSolution Manual For Principles of Managerial Finance Brief 8th Edition Zuttermichellelewismqdacbxijt100% (47)

- Capital Market Efficiency in IndiaDocument54 pagesCapital Market Efficiency in IndiaSteven ChristianPas encore d'évaluation

- An Overview of Financial SystemDocument4 pagesAn Overview of Financial SystemYee Sin MeiPas encore d'évaluation

- Components of Financial SystemDocument11 pagesComponents of Financial SystemromaPas encore d'évaluation

- International Business Projects:: Featured DocumentsDocument3 pagesInternational Business Projects:: Featured DocumentsmaggyfinPas encore d'évaluation

- GovernmentDocument6 pagesGovernmentmaggyfinPas encore d'évaluation

- Zero Defect PhilosophyDocument11 pagesZero Defect PhilosophymaggyfinPas encore d'évaluation

- Corporatocracy: Mobocracy RepublicDocument4 pagesCorporatocracy: Mobocracy RepublicmaggyfinPas encore d'évaluation

- Derivatives MarketDocument1 pageDerivatives MarketmaggyfinPas encore d'évaluation

- P - NotesDocument4 pagesP - NotesmaggyfinPas encore d'évaluation

- Understanding 7 Basic Principles of InsuranceDocument9 pagesUnderstanding 7 Basic Principles of InsuranceLam-Dien TranPas encore d'évaluation

- Performance AppraisalDocument22 pagesPerformance AppraisalmaggyfinPas encore d'évaluation

- BRR 2013 14 - tcm114 364167 PDFDocument24 pagesBRR 2013 14 - tcm114 364167 PDFmaggyfinPas encore d'évaluation

- Chapter 1 - Introduction To Forward Contracts - PPT PDFDocument16 pagesChapter 1 - Introduction To Forward Contracts - PPT PDFmaggyfinPas encore d'évaluation

- Recruitment and SelectionDocument18 pagesRecruitment and SelectionmaggyfinPas encore d'évaluation

- HR ProjectDocument5 pagesHR ProjectmaggyfinPas encore d'évaluation

- Intro To HRMDocument14 pagesIntro To HRMmaggyfinPas encore d'évaluation

- Scribd DocumentDocument1 pageScribd DocumentmaggyfinPas encore d'évaluation

- LiquidationDocument11 pagesLiquidationmaggyfinPas encore d'évaluation

- HR ProjectDocument5 pagesHR ProjectmaggyfinPas encore d'évaluation

- Scribd Documescribd DocumentntDocument1 pageScribd Documescribd DocumentntmaggyfinPas encore d'évaluation

- Ig-Bang Capital Market Reforms On The CardsDocument3 pagesIg-Bang Capital Market Reforms On The CardsmaggyfinPas encore d'évaluation

- Reserve Bank of India-Central Bank of India: HistoryDocument22 pagesReserve Bank of India-Central Bank of India: HistorymaggyfinPas encore d'évaluation

- Usage: Mechanics and Valuation BasicsDocument3 pagesUsage: Mechanics and Valuation BasicsmaggyfinPas encore d'évaluation

- International BankingDocument46 pagesInternational BankingDang Thu ThuyPas encore d'évaluation

- FinalDocument17 pagesFinalmaggyfinPas encore d'évaluation

- General Insurance Market in IndiaDocument56 pagesGeneral Insurance Market in IndiaCHAITRA NAIK100% (5)

- Reason Behind Kingfisher Airlines FailureDocument6 pagesReason Behind Kingfisher Airlines FailureShona BaroiPas encore d'évaluation

- En-Us EulaDocument3 pagesEn-Us Eulaleez1000Pas encore d'évaluation

- Read Me (Condition Zero - Xtreme Edition)Document2 pagesRead Me (Condition Zero - Xtreme Edition)Vimal Singh ChauhanPas encore d'évaluation

- Imp QuestionsDocument2 pagesImp QuestionsmaggyfinPas encore d'évaluation

- Imp QuestionsDocument2 pagesImp QuestionsmaggyfinPas encore d'évaluation

- Allianz Case Study Risk ManagementDocument16 pagesAllianz Case Study Risk ManagementluzgarayPas encore d'évaluation

- AnnualReport2013 14Document405 pagesAnnualReport2013 14Smit ShinePas encore d'évaluation

- Marketing Strategies - TitanDocument44 pagesMarketing Strategies - Titanasthasaith9284Pas encore d'évaluation

- Republic of The Philippines College of Criminology Region VIIDocument3 pagesRepublic of The Philippines College of Criminology Region VIIFobe Lpt NudaloPas encore d'évaluation

- Capital Budgeting Techniques Capital Budgeting TechniquesDocument65 pagesCapital Budgeting Techniques Capital Budgeting Techniquesarslan shahPas encore d'évaluation

- Acc49 KLIBEL6 Acc 49 Ayu-Purnama D49Document8 pagesAcc49 KLIBEL6 Acc 49 Ayu-Purnama D49riniPas encore d'évaluation

- A Case Study of TanzaniaDocument15 pagesA Case Study of TanzaniaVladGrigorePas encore d'évaluation

- FinmanDocument3 pagesFinmanyechue67% (6)

- Global-Education Roger DaleDocument298 pagesGlobal-Education Roger Daleastaroth666-Pas encore d'évaluation

- Chapter 4 - Measurements of Economic GrowthDocument17 pagesChapter 4 - Measurements of Economic GrowthRio RamilPas encore d'évaluation

- Multinational Financial ManagementDocument37 pagesMultinational Financial ManagementjadudhahPas encore d'évaluation

- The Relationship Between Activity-Based Costing and Organizational SustainabilityDocument2 pagesThe Relationship Between Activity-Based Costing and Organizational Sustainabilityfirinaluvina100% (1)

- Risk Management For MBA StudentsDocument28 pagesRisk Management For MBA StudentsMuneeb Sada50% (2)

- Case Fair Oster: MacroeconomicsDocument23 pagesCase Fair Oster: Macroeconomicsroaa ghanimPas encore d'évaluation

- Contempo LessonDocument10 pagesContempo LessonAnonymous c5qeC1jJ5Pas encore d'évaluation

- Difference Between Job Costing and Process CostingDocument2 pagesDifference Between Job Costing and Process CostingJayceelyn OlavarioPas encore d'évaluation

- Philips CurveDocument7 pagesPhilips CurveMohammad Zeeshan BalochPas encore d'évaluation

- Thinking Like An Economist: Learning ObjectivesDocument19 pagesThinking Like An Economist: Learning ObjectivesandinPas encore d'évaluation

- Jpepa PDFDocument16 pagesJpepa PDFCharlene DacaraPas encore d'évaluation

- Rendleman CVDocument3 pagesRendleman CVHunter RendlemanPas encore d'évaluation

- Keywords: Economic Development, Gross Domestic Product, Islamic Finance, Stock Market, Islamic SukukDocument19 pagesKeywords: Economic Development, Gross Domestic Product, Islamic Finance, Stock Market, Islamic Sukukاحمد عرفاتPas encore d'évaluation

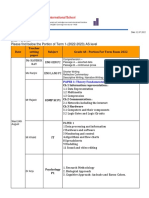

- Dear Parents, Please Find Below The Portion of Term 1 - (2022-2023) AS LevelDocument5 pagesDear Parents, Please Find Below The Portion of Term 1 - (2022-2023) AS LevelPrayrit JainPas encore d'évaluation

- CSR - Are For-Profit Business Responsible To The Society? Why or Why Not and To What Extent?Document3 pagesCSR - Are For-Profit Business Responsible To The Society? Why or Why Not and To What Extent?Tanya YablonskayaPas encore d'évaluation

- Semana 2 - Lectura 5 - Growing Through Acquisitions PDFDocument28 pagesSemana 2 - Lectura 5 - Growing Through Acquisitions PDFraiku01Pas encore d'évaluation

- The Mall Street Journal Is Considering Offering A New Service PDFDocument2 pagesThe Mall Street Journal Is Considering Offering A New Service PDFtrilocksp SinghPas encore d'évaluation

- A Quiz of RostowDocument1 pageA Quiz of RostowPedro Yañez SánchezPas encore d'évaluation

- Karlan Microeconomics 2ce - Ch. 12Document28 pagesKarlan Microeconomics 2ce - Ch. 12Gurnoor KaurPas encore d'évaluation