Académique Documents

Professionnel Documents

Culture Documents

4the Side Effects of The Cyprus Cure - ET Dt. 20-03-13

Transféré par

Rajat KaushikTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

4the Side Effects of The Cyprus Cure - ET Dt. 20-03-13

Transféré par

Rajat KaushikDroits d'auteur :

Formats disponibles

The Side Effects of the Cyprus Cure ET dt.

20-03-13

The proposed package shows how EU measures become the problem rather than the solution

Satyajit Das

It will be ironic if Cyprus, one of the smallest countries in Europe with little over 1 million

people and 0!" of the EU economically, were to prove a key infle#ion point in the crisis

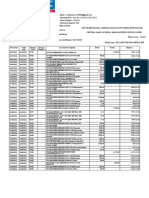

Cyprus needs around 1$%1& billion to recapitali'e its banks (around 10 billion) and for general

government operations including debt servicing ( $%& billion euro)*hile small in nominal terms

and well within EUs resources, the amount is large relative to Cypruss +,- of 1& billion The

package proposed by EU incorporates privati'ation of state assets, increase in corporate ta#es

(from 10" to 1.!") and withholding ta#es on capital income (to .&") and restructuring of

e#isting bank or sovereign debt /ost controversially, ordinary depositors will face a ta# on

Cypriot bank deposits, amounting to a permanent write down in the nominal value of their

deposits The deposit levy will be 0$!" on less than 100,000 (the ceiling for EU account

insurance) and 11" for deposits above that amount In return, depositors will receive shares in

the relevant banks The unprecedented write down of bank deposits, e#pected to raise !& billion,

is motivated by many factors 2ne, the I/3 participation re4uires the debt level to be

sustainable The write%off of depositors reduces debt and also the si'e of the re4uired bailout

package to Cyprus to 10 billion Two, Cypriot banks have limited amounts of subordinated or

senior unsecured debt (that are cleared only after other lenders are repaid)This means a write

down of bondholders would only raise between 1 and . billion, below the re4uired amount

Three, as in the case of the +reek debt restructuring, the European Central 5ank (EC5) and

others are unwilling to take losses on their e#posure

Capital Flight

3our, restructuring Cypruss sovereign debt is risky because many bonds are governed by English

law where the right of the creditors are more protected 6ny attempt to restructure these while

insulating official creditors from losses would invite litigation 3ive, +ermany, 3inland and

7olland are increasingly concerned about losses on bailout loans +erman Chancellor 6ngela

/erkel does not want concern about actual cash losses to +erman ta#payers to affect her

prospects in the 8eptember .019 elections 8i#, +ermany wants to prevent any bailout fund

flowing to :ussian depositors, such as oligarchs or organi'ed criminals who have used Cypriot

banks to launder money The ta# on depositors is a significant e#pansion of the principal of -8I

(private sector involvement), which was applied in the case of +reece and presented by EU as a

one%off measure *hereas in +reece losses were allocated to sovereign as well as ;unior and

subordinated bank bond holders, the Cyprus measures e#tend burden%sharing to ordinary small

depositors *hatever the case for the Cyprus package, it risks grave side effects 2ne, it may

trigger capital flight from banks in +reece, -ortugal, Ireland, Italy and 8pain, based on depositor

concerns about loss of capital in any future debt restructuring If capital flight accelerates, then

the EC5, national central banks and governments will have to intervene

Crisis Will Worsen

Two, the Cyprus bail%in provision will make it difficult for European banks, especially in

vulnerable countries, to raise new deposits or issue bonds Three, the Cyprus arrangements

undermine the credibility of EC5 and EU and measures announced last year to combat the crisis,

which have underpinned the recent relative stability 6fter Cyprus, it will be difficult for

countries like Italy and 8pain to ask for EU and EC5 assistance, if re4uired, knowing that if a

future debt restructuring is necessary then domestic ta#payers face a loss on bank deposits The

EUs much vaunted banking union was rightly critici'ed for failing to provide funds to undertake

any re4uired recapitali'ation of banks and the lack of a consistent deposit protection scheme in

the region Cyprus highlights these shortcomings 3our, the Cyprus package highlights the

increasing reluctance of countries like +ermany and 3inland to support weaker EU members

The ability of the recently elected Cyprus government of -rime /inister <icos 6nastasiades to

pass the necessary enabling legislation is unclear, given a lack of clear parliamentary ma;ority If

Cyprus does not agree, then a default is likely and the economy may collapse very rapidly If it

agrees, the package would stave off immediate collapse but may not address Cypruss problem

6s in +reece and -ortugal, privati'ation proceeds and the revenue from increased ta#es may not

reach targets The imposition of the ta# may not raise sufficient funds 5ut it will encourage

remaining deposits to flee Cyprus 6s with +reece, there is a risk that Cyprus will need

additional assistance, entailing further write%offs in depositor=s fund Irrespective of the fate of

Cyprus, the solution adopted will e#acerbate the European debt crisis Unfortunately, in each

attempt at resolution, as shown by the proposed Cyprus package, the measures have become the

problem rather than the solution

for!er "an#er$ %as is author of E&tre!e 'oney and Traders$ (uns ) 'oney

Vous aimerez peut-être aussi

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Is Mers in Your MortgageDocument9 pagesIs Mers in Your MortgageRicharnellia-RichieRichBattiest-Collins67% (3)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- NKMen 13 90 Arbitration Hidden Secret of Indian Index and How ToDocument21 pagesNKMen 13 90 Arbitration Hidden Secret of Indian Index and How ToMohammed Asif Ali RizvanPas encore d'évaluation

- AccountStatement 3286686240 Aug04 185310 PDFDocument2 pagesAccountStatement 3286686240 Aug04 185310 PDFDarren Joseph VivekPas encore d'évaluation

- HeDocument59 pagesHearthur the great75% (8)

- VP Director Finance Securitization in USA Resume Timothy LoganDocument3 pagesVP Director Finance Securitization in USA Resume Timothy LoganTimothyLoganPas encore d'évaluation

- 5indian Bond Market WP Nipfp 2012Document22 pages5indian Bond Market WP Nipfp 2012Rajat KaushikPas encore d'évaluation

- Debt Funds Are Not As "Safe" As They Sound.: Safety Is Not AssuredDocument5 pagesDebt Funds Are Not As "Safe" As They Sound.: Safety Is Not AssuredRajat KaushikPas encore d'évaluation

- 9NYSE Euronext To Take Over Tainted Libor - ET Dt. 10-07-13Document1 page9NYSE Euronext To Take Over Tainted Libor - ET Dt. 10-07-13Rajat KaushikPas encore d'évaluation

- 5commodity Cycle-April 2013Document3 pages5commodity Cycle-April 2013Rajat KaushikPas encore d'évaluation

- 4partnership Enterprise - ET Dt. 05-03-2012Document4 pages4partnership Enterprise - ET Dt. 05-03-2012Rajat KaushikPas encore d'évaluation

- 4IPO MCX Overbid 54 Imes To Rs.35000 Cr. ET Dt. 25-02-2012Document2 pages4IPO MCX Overbid 54 Imes To Rs.35000 Cr. ET Dt. 25-02-2012Rajat KaushikPas encore d'évaluation

- 3india Lending Rate April2013 WSJDocument2 pages3india Lending Rate April2013 WSJRajat KaushikPas encore d'évaluation

- 2will Hit 60 On Worsening Pitch - ET Dt. 12-04-13Document1 page2will Hit 60 On Worsening Pitch - ET Dt. 12-04-13Rajat KaushikPas encore d'évaluation

- 2RBI Panel On Mon Pol-WSJ-Jan21-2014Document2 pages2RBI Panel On Mon Pol-WSJ-Jan21-2014Rajat KaushikPas encore d'évaluation

- Monetary Policy Statement For 2013-14 Statement by Dr. D. Subbarao, Governor, Reserve Bank of IndiaDocument5 pagesMonetary Policy Statement For 2013-14 Statement by Dr. D. Subbarao, Governor, Reserve Bank of IndiaRajat KaushikPas encore d'évaluation

- 2mon Pol-We Dont Want Flip-Flop On Policy Till Inflation Subsides - ET Dt. 26-01-12Document2 pages2mon Pol-We Dont Want Flip-Flop On Policy Till Inflation Subsides - ET Dt. 26-01-12Rajat KaushikPas encore d'évaluation

- 1SBI Hits Global Bond Market To Raise $1 Billion - ET Dt. 12-04-13Document1 page1SBI Hits Global Bond Market To Raise $1 Billion - ET Dt. 12-04-13Rajat KaushikPas encore d'évaluation

- Shareholders-Equity - Part 1Document29 pagesShareholders-Equity - Part 1cj bPas encore d'évaluation

- AFS 2016 - Towncall Rural Bank, Inc. Page 28 of 42Document3 pagesAFS 2016 - Towncall Rural Bank, Inc. Page 28 of 42Judith CastroPas encore d'évaluation

- ZPPF Loan Recoverable ApplicationDocument3 pagesZPPF Loan Recoverable ApplicationNaga ManoharababuPas encore d'évaluation

- Kiwi Property Annual Report 2020 FINAL PDFDocument40 pagesKiwi Property Annual Report 2020 FINAL PDFNam PhamPas encore d'évaluation

- GIPSA HRM Benefits-1Document1 pageGIPSA HRM Benefits-1shravan workPas encore d'évaluation

- 09SKCMA002Document91 pages09SKCMA002Ammu PKPas encore d'évaluation

- Cambridge International General Certificate of Secondary EducationDocument9 pagesCambridge International General Certificate of Secondary Educationcheah_chinPas encore d'évaluation

- Record Keeping: Agricultural ScienceDocument2 pagesRecord Keeping: Agricultural ScienceKayPas encore d'évaluation

- Business Finance Week 1 and 2Document56 pagesBusiness Finance Week 1 and 2Jonathan De villaPas encore d'évaluation

- One Up On Wall StreetDocument4 pagesOne Up On Wall Streetok okPas encore d'évaluation

- Business Rules and Guidelines EVO NGTrans BCPDocument50 pagesBusiness Rules and Guidelines EVO NGTrans BCPVladimir ZidarPas encore d'évaluation

- Hoisington Investment Management - Quarterly Review and Outlook, Second Quarter 2014Document10 pagesHoisington Investment Management - Quarterly Review and Outlook, Second Quarter 2014richardck61Pas encore d'évaluation

- Trade Blotter (Incomplete + Complete)Document8 pagesTrade Blotter (Incomplete + Complete)Barry HePas encore d'évaluation

- PM Mudra Loan - How To Take Loan PDFDocument9 pagesPM Mudra Loan - How To Take Loan PDFbhramaniPas encore d'évaluation

- SYBFM Equity Market II Session I Ver 1.1Document80 pagesSYBFM Equity Market II Session I Ver 1.111SujeetPas encore d'évaluation

- Sales CasesDocument36 pagesSales Casesknicky Francisco0% (1)

- Assignment 12Document4 pagesAssignment 12Joey BuddyBossPas encore d'évaluation

- Deposits Training DocumentDocument29 pagesDeposits Training DocumentKarthikaPas encore d'évaluation

- Fin254 Project - Final 2019Document73 pagesFin254 Project - Final 2019Ahnaf SabitPas encore d'évaluation

- Gilbert Company-WPS OfficeDocument17 pagesGilbert Company-WPS OfficeTrina Mae Garcia100% (1)

- Part A Answer All The Question 4 1 4Document3 pagesPart A Answer All The Question 4 1 4jeyappradhaPas encore d'évaluation

- Commerce Eduworld: CA - Final Paper 4: Corporate and Allied LawsDocument25 pagesCommerce Eduworld: CA - Final Paper 4: Corporate and Allied LawsShubham NarkhedePas encore d'évaluation

- Women's Health West Annual Report 2013-14Document43 pagesWomen's Health West Annual Report 2013-14Women's Health WestPas encore d'évaluation

- The Sharing EconomyDocument60 pagesThe Sharing EconomyRaul Velazquez Collado100% (1)

- INVESTMENT JOURNEY - Kiran Dhanawada - VP CHINTAN BAITHAK - GOA 2015Document11 pagesINVESTMENT JOURNEY - Kiran Dhanawada - VP CHINTAN BAITHAK - GOA 2015sureshvadPas encore d'évaluation