Académique Documents

Professionnel Documents

Culture Documents

5the Real Gold Man at Goldman Sachs He Called Gold Crash Right - ET Dt. 19-04-13

Transféré par

Rajat KaushikTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

5the Real Gold Man at Goldman Sachs He Called Gold Crash Right - ET Dt. 19-04-13

Transféré par

Rajat KaushikDroits d'auteur :

Formats disponibles

The Real Gold Man at Goldman Sachs: He Called Gold Crash Right ET dt.

19-04-1

WHITNEY MCFERRON & NICHOLAS LARKIN

Goldman Sachss Jeffrey Currie got ahead of golds biggest collapse since 1980 last week

because he saw two signals most others missed !rices that had risen for 1" straight years as

in#estors sought a ha#en asset failed to rally amid turmoil in Cyprus Gold holdings in e$change

traded funds tumbled at a time when interest rates remained low Currie% the banks &'(year(old

global commodities research head with a !h) in economics from the *ni#ersity of Chicago%

issued his sell recommendation on +pril 10% before gold fell 1,- in a two(session plunge that

ended on +pril 1.% the biggest decline in ,, years /organ Stanley and 0ank of +merica

followed Goldman% and the slump wiped out almost 11 billion of hedge fund manager John

!aulsons personal wealth 2ou had a whole group of obser#ations that should ha#e created a

substantial rally in gold prices% but they didnt% Currie said by telephone from 3ew 2ork 4he

fact that gold did not rally on Cyprus amid the bad *S data that occurred in that time period

created the con#iction we needed

C!"r#s $e%!

Gold rose 1- in the week after /arch 1' when Cyprus announced an unprecedented le#y on

bank deposits% before erasing gains the following two weeks 4he countrys finance minister said

on +pril 1& it may sell gold reser#es to get international aid% helping e$tend a slump this week

after the metal fell into a bear market +pril 1" 0ullion capped a record annual run last year as

nations pledged more stimulus to bolster economic growth Currie% who manages a team of 11

research analysts% first cut the banks outlook for gold prices in )ecember% and then again in

5ebruary% before recommending a short position on +pril 10 4he banks 1"(month forecast is for

prices to reach 11%,90 an ounce 4he target for the end of "01& is 11%"60 and prices may drop

below 11%"00 temporarily% he said

&a#lson '#tloo(

Golds price drop hasnt changed billionaire !aulsons intermediate to long(term outlook on the

precious metal% said John 7eade% partner and global strategist at !aulson 8 Co in 3ew 2ork in a

statement on +pril 1.0ond buying by go#ernments will increase demand for gold e#en as the

commodity is going through one of its periodic ad9ustments Curries correct gold

recommendation came as he celebrated his 16th year at Goldman Sachs on +pril 1. :e 9oined

the bank after earning his doctorate from the *ni#ersity of Chicago in 199'% and became a

managing director in "00" and partner in "008 :e mo#ed to the 3ew 2ork office last year from

;ondon% where he worked since "00, and ser#ed as <uropean co(head of economics%

commodities and strategy research from "010 to "01" =n#estors who followed Curries

recommendation on gold would ha#e earned returns of about 1"- not the best call hes e#er

made =n "006% he made a bullish recommendation on oil that yielded ",- 4he price of crude

touched a 19(month low in January "006 in 3ew 2ork before surging to a record 11&6"6 a

barrel in July the ne$t year +nother bullish recommendation on a basket of commodities in "011

yielded ",-% while a bet on higher oil in "01" lost ,'- =n "006% it was much more of a

contrarian call than the recent one% Currie said >e were fighting the tape in the sense that you

had a substantial pullback in commodity prices into the first ?uarter of "006 4his time% if you

look at a chart% gold was trending downward consistently% so this was less of a contrarian call

than ones we#e made in the past >hile futures a#eraged a record 11%'61 last year% prices were

already in a fi#e(month slump through 5ebruary that was the worst since 1996 and a month

before Goldman Sachs ad#ised selling the metal Gold is now "8- below its September "011

record 3ot all of Curries recommended trades are winners 4he bet on higher copper prices that

was recommended on /arch 1 has lost about 1&98 a tonne% according to an +pril 1' report from

the bank

Glo)al Mar(et

Currie% who li#es in 5airfield% Connecticut% said he tra#els 1," days out of the year /embers of

his research team are based in 3ew 2ork% ;ondon% Singapore% :ong @ong and Sydney *nlike

e?uities which are by definition regional% commodities are truly a global market% Currie said

4hats one reason why =m on the road so much% because of that =ts predominantly corporate

players in the market% so =m not going to places like 0oston or Aurich >ere going to places

like ;agos and Johannesburg% as opposed to where the in#estors are 0loomberg

Jeffrey Currie, Global Coo!i"ie# Re#ear$% Hea!, Gol!a& Sa$%#

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- M2 Universal: Case PresentationDocument12 pagesM2 Universal: Case PresentationKalyan MukkamulaPas encore d'évaluation

- ISB - PM - Week 2 - Required Assignment 2.4 - TemplateDocument3 pagesISB - PM - Week 2 - Required Assignment 2.4 - Templatesriram marinPas encore d'évaluation

- A Blueprint For Scaling Voluntary Carbon Markets To Meet The Climate ChallengeDocument7 pagesA Blueprint For Scaling Voluntary Carbon Markets To Meet The Climate ChallengeMardanPas encore d'évaluation

- FICM Class Evaluation 2013 14Document1 pageFICM Class Evaluation 2013 14Rajat KaushikPas encore d'évaluation

- 9dollar As Reserve Currency FT Mar13 2013Document8 pages9dollar As Reserve Currency FT Mar13 2013Rajat KaushikPas encore d'évaluation

- 9NYSE Euronext To Take Over Tainted Libor - ET Dt. 10-07-13Document1 page9NYSE Euronext To Take Over Tainted Libor - ET Dt. 10-07-13Rajat KaushikPas encore d'évaluation

- Swap Traders' Morning Fix Under Scrutiny: by Michael Mackenzie, Tom Braithwaite and Kara Scannell in New YorkDocument4 pagesSwap Traders' Morning Fix Under Scrutiny: by Michael Mackenzie, Tom Braithwaite and Kara Scannell in New YorkRajat KaushikPas encore d'évaluation

- 9swap Trading FT April 2013Document1 page9swap Trading FT April 2013Rajat KaushikPas encore d'évaluation

- 7final Guidelines On Securitisation of Standard Assets - Aug2012Document28 pages7final Guidelines On Securitisation of Standard Assets - Aug2012Rajat KaushikPas encore d'évaluation

- 5sebi Has Completely Changed The Way Trading Takes Place in India - ET Dt. 22-05-2013Document2 pages5sebi Has Completely Changed The Way Trading Takes Place in India - ET Dt. 22-05-2013Rajat KaushikPas encore d'évaluation

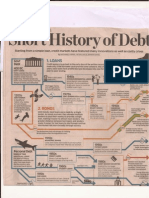

- 5history of Debt-1Document1 page5history of Debt-1Rajat KaushikPas encore d'évaluation

- 5RIL Plans To Borrow $2 B To Refinance Debt - ET Dt. 06-04-13Document1 page5RIL Plans To Borrow $2 B To Refinance Debt - ET Dt. 06-04-13Rajat KaushikPas encore d'évaluation

- 5release of Data April2013 WSJDocument4 pages5release of Data April2013 WSJRajat KaushikPas encore d'évaluation

- 5history of Debt-2Document1 page5history of Debt-2Rajat KaushikPas encore d'évaluation

- 5FMC Suspends Two Brokers For Guar Trade Irregularities - ET Dt. 24-01-12Document1 page5FMC Suspends Two Brokers For Guar Trade Irregularities - ET Dt. 24-01-12Rajat KaushikPas encore d'évaluation

- 5indian Bond Market WP Nipfp 2012Document22 pages5indian Bond Market WP Nipfp 2012Rajat KaushikPas encore d'évaluation

- 5fiis and Mkts em Apr8 2013Document4 pages5fiis and Mkts em Apr8 2013Rajat KaushikPas encore d'évaluation

- Debt Funds Are Not As "Safe" As They Sound.: Safety Is Not AssuredDocument5 pagesDebt Funds Are Not As "Safe" As They Sound.: Safety Is Not AssuredRajat KaushikPas encore d'évaluation

- 3rupee Collapse An Unnecessary Scare - ET Dt. 12-04-13Document1 page3rupee Collapse An Unnecessary Scare - ET Dt. 12-04-13Rajat KaushikPas encore d'évaluation

- 5BSE Becomes The Hub For SMEs - ET Dt. 16-04-13Document1 page5BSE Becomes The Hub For SMEs - ET Dt. 16-04-13Rajat KaushikPas encore d'évaluation

- 4IPOs Fail To Live Up To Their Price - ET Dt. 16-04-13Document3 pages4IPOs Fail To Live Up To Their Price - ET Dt. 16-04-13Rajat KaushikPas encore d'évaluation

- 5commodity Cycle-April 2013Document3 pages5commodity Cycle-April 2013Rajat KaushikPas encore d'évaluation

- 4partnership Enterprise - ET Dt. 05-03-2012Document4 pages4partnership Enterprise - ET Dt. 05-03-2012Rajat KaushikPas encore d'évaluation

- 4the Side Effects of The Cyprus Cure - ET Dt. 20-03-13Document2 pages4the Side Effects of The Cyprus Cure - ET Dt. 20-03-13Rajat KaushikPas encore d'évaluation

- 4IPO MCX Overbid 54 Imes To Rs.35000 Cr. ET Dt. 25-02-2012Document2 pages4IPO MCX Overbid 54 Imes To Rs.35000 Cr. ET Dt. 25-02-2012Rajat KaushikPas encore d'évaluation

- 2ready For The Swan Song - ET Dt. 01-05-13Document3 pages2ready For The Swan Song - ET Dt. 01-05-13Rajat KaushikPas encore d'évaluation

- 3mon Pol-State of Financial Sector Regulation and Competition in India-November 13-2011Document21 pages3mon Pol-State of Financial Sector Regulation and Competition in India-November 13-2011Rajat KaushikPas encore d'évaluation

- 3india Lending Rate April2013 WSJDocument2 pages3india Lending Rate April2013 WSJRajat KaushikPas encore d'évaluation

- 2will Hit 60 On Worsening Pitch - ET Dt. 12-04-13Document1 page2will Hit 60 On Worsening Pitch - ET Dt. 12-04-13Rajat KaushikPas encore d'évaluation

- 2pangs of Separation Debt MGMT & Monetary Policy - ET Dt. 28-03-13Document3 pages2pangs of Separation Debt MGMT & Monetary Policy - ET Dt. 28-03-13Rajat KaushikPas encore d'évaluation

- 2RBI Panel On Mon Pol-WSJ-Jan21-2014Document2 pages2RBI Panel On Mon Pol-WSJ-Jan21-2014Rajat KaushikPas encore d'évaluation

- 2panel Moots 2 Financial Regulators - ET Dt.23!03!13Document1 page2panel Moots 2 Financial Regulators - ET Dt.23!03!13Rajat KaushikPas encore d'évaluation

- Marketing CH 13 Pricing Concepts For Establishing Value: Study Online atDocument3 pagesMarketing CH 13 Pricing Concepts For Establishing Value: Study Online atConner DowneyPas encore d'évaluation

- Organization and Management: Module 4: Quarter 1, Week 3 & 4Document18 pagesOrganization and Management: Module 4: Quarter 1, Week 3 & 4juvelyn luegoPas encore d'évaluation

- Branding: Prepared By: Ben Abdeslam Souhaib BZIOUI DrissDocument9 pagesBranding: Prepared By: Ben Abdeslam Souhaib BZIOUI DrissManal ElPas encore d'évaluation

- Quizlet - SOM CH 8Document25 pagesQuizlet - SOM CH 8Bob KanePas encore d'évaluation

- Santani Wellness ResortDocument21 pagesSantani Wellness ResortNatala WillzPas encore d'évaluation

- 06.marchandising Operation-FinalDocument53 pages06.marchandising Operation-FinalChowdhury Mobarrat Haider AdnanPas encore d'évaluation

- Exam 1Document41 pagesExam 1Yogi BearPas encore d'évaluation

- Anandrathi Share Broking ProposalDocument20 pagesAnandrathi Share Broking Proposalmohammedakbar88Pas encore d'évaluation

- Ac1 1-1 3Document2 pagesAc1 1-1 3Adeirehs Eyemarket BrissettPas encore d'évaluation

- Merged (MMZG611/MBAZG611/POMZG611/QMZG611) Experiential Learning Project (ELP) The ContextDocument10 pagesMerged (MMZG611/MBAZG611/POMZG611/QMZG611) Experiential Learning Project (ELP) The ContextTriveni Shankar SinghPas encore d'évaluation

- Ppe ProblemsDocument8 pagesPpe ProblemsPeter Elijah AntonioPas encore d'évaluation

- MGT 490 Chapter 7Document22 pagesMGT 490 Chapter 7Tamzid Ahmed AnikPas encore d'évaluation

- XIMIVOUGE - LITE - FeasibilityDocument9 pagesXIMIVOUGE - LITE - FeasibilityPranav TubajiPas encore d'évaluation

- Second Summative Test in PMDocument3 pagesSecond Summative Test in PMRobelyn Fababier VeranoPas encore d'évaluation

- Daily Market Update 14.12.2021Document1 pageDaily Market Update 14.12.2021Fuaad DodooPas encore d'évaluation

- Chart Patterns, Trading, and Dan ZangerDocument5 pagesChart Patterns, Trading, and Dan ZangerLPas encore d'évaluation

- Understanding Sofr FuturesDocument16 pagesUnderstanding Sofr FuturesGeorge LiuPas encore d'évaluation

- Dealing With Monopolistic and Distorted Supply ChainsDocument20 pagesDealing With Monopolistic and Distorted Supply ChainsPratyasha PattanaikPas encore d'évaluation

- Advanced-Accounting-Part 2-Dayag-2015-Chapter-15Document31 pagesAdvanced-Accounting-Part 2-Dayag-2015-Chapter-15allysa amping100% (1)

- Product and Price ManagementDocument23 pagesProduct and Price Managementnitika pradhanPas encore d'évaluation

- Pricing Unit IIDocument18 pagesPricing Unit IIPrince kumarPas encore d'évaluation

- Thailand's Cosmetics and Beauty Products Industry: Opportunities For International BusinessDocument32 pagesThailand's Cosmetics and Beauty Products Industry: Opportunities For International BusinessBridge EstatePas encore d'évaluation

- Sale ContractDocument3 pagesSale ContractTien PhạmPas encore d'évaluation

- Inventory 1Document17 pagesInventory 1Dinesh SharmaPas encore d'évaluation

- Bonifacio Street, Davao City Bonifacio Street, Davao CityDocument1 pageBonifacio Street, Davao City Bonifacio Street, Davao CityGlee Cris S. UrbiztondoPas encore d'évaluation

- Asset Impairment - 18ADocument24 pagesAsset Impairment - 18ALinh Dang Thi ThuyPas encore d'évaluation

- Marketing PlanDocument21 pagesMarketing PlanKathleen Kaye CastilloPas encore d'évaluation