Académique Documents

Professionnel Documents

Culture Documents

Chapter 15 - Excise Tax2013

Transféré par

JadeFerrerCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Chapter 15 - Excise Tax2013

Transféré par

JadeFerrerDroits d'auteur :

Formats disponibles

BUSINESS AND TRANSFER TAXATION 6th Edition (BY: VALENCIA & ROXAS) 115

SUGGESTED ANSWERS

Ch!t"# $%: EXCISE TAXES

C&A'TER $%

EXCISE TAXES

Problem 15 1

1. False excise tax is also imposed on luxurious goods and mineral products.

2. False excise tax imposed to vehicles is based on the value of the vehicles, hence, an example of advalorem tax.

3. True

4. False The primar purpose of excise tax is for regulation and protection.

5. True

!. False "1 per #ilo

$. False 2%& of the 'holesale price.

(. True )t is the same as distilled spirits.

*. False +xcise tax is a business tax.

1%. False +xcise tax is an indirect tax.

11. True

12. False "1% per ton means based on measure, hence, specific excise tax.

13. False sub,ect to excise tax of "%.$* per #ilo.

Problem 15 2

1. True

2. False +xcise tax is also imposed on imported goods.

3. False +xcise tax is paid upon transfer or release from the -ureau of .ustoms.

4. True

5. False net retail price or retail price basicall excludes /0T and excise tax.

!. False 1"2 is a separate and distinct product from processed gas.

$. True

(. False 0lcohol products for medicinal purposes are exempt from excise tax.

*. False The excise taxes imposed on imported articles are paid to the -ureau of .ustoms.

1%. False 3ub,ect to excise tax upon production or importation.

11. True

12. True

Problem 15 3

1. 4 !. 0 11. .

2. 4 $. 4 12. -

3. - (. 0 13. .

4. - *. 4 14. -

5. 4 1%. 4

Problem 15 4 C

Total sales " 1,2%%,%%%

4ivided b net retail price per cigar !%%

5umber of cigar sold at "!%% each 2,%%%

6ultiplied b excise tax on cigar sold at "!%% each 7"5% 8 915& x 1%%:; !5

Total excise tax " 13%,%%%

Problem 15 5

1. Not in the choices

Total sales excluding /0T 9"15*,5%%<1.12: "142,411

4ivided b net retail price per liter 14.5%

5umber of liters produced *,(21

6ultiplied b applicable excise tax per liter " 12.3%

+xcise tax "12%,$*(

2. 5ot in the choices

Total sales including /0T "15*,5%%

0dd= +xcise tax 12%,$*(

Total amount of sales including /0T and excise tax "2(%,2*(

Problem 15 6 A

+xcise tax 9"11.!5 x 2%%: " 2,33%

Problem 15 7 D

Tax>exempt

Problem 15 8 A

+xcise tax per proof liter " 11.!5

6ultiplied b proof liters 92%% x 12 x $5%<1,%%%: 1,(%%

+xcise tax paable "2%,*$%

Problem 15 9 B

First "2,1%%,%%% " 512,%%%

+xcess 9"1,*%%,%%% x !%&: 1,14%,%%%

+xcise tax "1,!52,%%%

Problem 15 10 A

+xempt from excise tax, hence, " %.

Problem 15 11 B

1ocal 'holesale price "15%,%%%

6ultiplied b percent of excise tax 2%&

+xcise tax " 3%,%%%

Problem 15 12 A

5one

Problem 15 13 B

+xcise tax on=

-un#er oils 92%,%%% liters x "%.3%: " !,%%%

2rease 92,%%% x "4.5%: *,%%%

1ubricating oil 9(,%%% x "4.5%: 3!,%%%

Total "51,%%%

1ess= .reditable excise tax on bun#er oils !,%%%

+xcise tax "45,%%%

Problem 15 14 A

?ero

Problem 15 15

+xcise tax per metric ton of coal " 1%

6ultiplied b metric tons of coal produced 1,%%%

+xcise tax "1%,%%%

Problem 15 16

+xcise taxes=

For ear 2%%5 and 2%%!= 91%% x 5% x 1% x "25: "1,25%,%%%

For ear 2%%$ and 2%%(= 91%% x 5% x 1% x "2!.%!: "1,3%3,%%%

For ear 2%%* and 2%1%= 91%% x 5% x 1% x "2$.1!: "1,35(,%%%

For ear 2%11= 91%% x 5% x 1% x "2(.3%: "1,415,%%%

Problem 15 17

+xcise tax=

91,%%% x 12 x .$5% x "11.!5: " 1%4,(5%

91,%%% x 12 x 1 x "252: 3,%24,%%%

"3,12(,(5%

Problem 15 18

a. 915,%%%,%%%<1,%%%: x "1 " 15,%%%

b. 91,%%%,%%% x "%.$*: $*%,%%%

c. 95%,%%% x "2: 1%%,%%%

d. 91%%,%%% x "!.35: !35,%%%

e. 95,%%% x 5%% x 1%&: 25%,%%%

Total excise tax "1,$*%,%%%

Problem 15 19

First "!%%,%%% " 12,%%%

+xcess 9"2%%,%% x 2%&: 4%,%%%

+xcise tax " 52,%%%

Problem 15 20

"urchase price per car "1,5%%,%%%

.ustom duties !%%,%%%

6ar#>up 9"2,1%%,%%% x 3%&: !3%,%%%

Total "2,$3%,%%%

0dd= +xcise tax on "2,1%%,%%% "512,%%%

+xcess 9"!3%,%%% x !%&: 3$(,%%% (*%,%%%

Total sales price inclusive of excise tax and /0T "3,!2%,%%%

Problem 15 21

Total #ilograms of copper 91,%%% tons x 25& x 1,%%% #g.:

6ultipl b 'orld price per #ilogram

Total in @3 dollars

6ultipl b exchange rate of peso per dollar

Total

6ultipl b excise tax rate

+xcise tax

25%,%%%

A%.!%

A 15%,%%%

"5%

" $,5%%,%%%

2&

" 15%,%%%

Problem 15 22

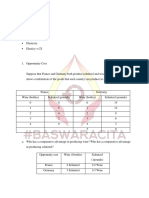

Gold Copper Total

Quantity (tons of concentrate) 100 100

Multiplied by kilogram per ton 1,000 1,000

Total kilogram 100,000 100,000

Multiplied by gram per kilogram 1,000 1,000

Total grams 100,000,000 100,000,000

Multiplied by percent of metal content 0.0! ".00!

#ctual grams of metals 0,000 ",000,000

Multiplied by market price per gram $ % $0.01

Total in dollars $1&0,000 $"0,000

Multiplied by peso rate per dollar '&0 '&0

Totals in pesos '(,&00,000 '1,%00,000

Multiplied by applicable e)cise ta) rate ! 1!

*)cise ta) '1(,000 '1%,000 '10,000

Vous aimerez peut-être aussi

- Chapter 15 Excise TaxDocument3 pagesChapter 15 Excise Taxjhienell0% (1)

- Excise For ManufacturersDocument160 pagesExcise For ManufacturersPraveen CoolPas encore d'évaluation

- What To Know Re Vat Reform Law (Ra 9337)Document5 pagesWhat To Know Re Vat Reform Law (Ra 9337)biancairizaPas encore d'évaluation

- Notf.19 2000 CeDocument2 pagesNotf.19 2000 Cepatelpratik1972Pas encore d'évaluation

- Chapter 12 - Excise TaxDocument4 pagesChapter 12 - Excise TaxAilah Biruar ÜPas encore d'évaluation

- Telephone Cable and Connector Box Price ListDocument72 pagesTelephone Cable and Connector Box Price ListBenadict JoshuaPas encore d'évaluation

- Answers To Practice Questions: Making Investment Decisions With The Net Present Value RuleDocument15 pagesAnswers To Practice Questions: Making Investment Decisions With The Net Present Value RuleAndrea RobinsonPas encore d'évaluation

- M06 Bade 9418 04 Ch05aDocument15 pagesM06 Bade 9418 04 Ch05aLeon ZhangPas encore d'évaluation

- Application Economics of Public PolicyDocument13 pagesApplication Economics of Public Policyfilipa barbosaPas encore d'évaluation

- Excise TaxesDocument34 pagesExcise TaxesShaine Ann QuilantangPas encore d'évaluation

- LP Two Variables MoreDocument10 pagesLP Two Variables MoreMohammad Nazmul IslamPas encore d'évaluation

- I. Reduce Costs and Enhance ValueDocument10 pagesI. Reduce Costs and Enhance Valuehana_kimi_91Pas encore d'évaluation

- Presentation - by Deepak SuriDocument56 pagesPresentation - by Deepak SuriLiliana BaileyPas encore d'évaluation

- Iii. Trade Policies and Practices by Measure (1) I: WT/TPR/S/194 Trade Policy ReviewDocument22 pagesIii. Trade Policies and Practices by Measure (1) I: WT/TPR/S/194 Trade Policy ReviewPolymath MacLeanPas encore d'évaluation

- MCA CONTINUOUS ASSESSMENT INTERNAL TEST- I REGULATIONS – 2009 I SEMESTER (2011-2014) MC9215 ACCOUNTING AND FINANCIAL MANAGEMENTDocument5 pagesMCA CONTINUOUS ASSESSMENT INTERNAL TEST- I REGULATIONS – 2009 I SEMESTER (2011-2014) MC9215 ACCOUNTING AND FINANCIAL MANAGEMENTanglrPas encore d'évaluation

- Managerial Economics EMBA ProgramDocument14 pagesManagerial Economics EMBA ProgramSatish Kumar KarnaPas encore d'évaluation

- Distillation Column Design MulticomponentDocument23 pagesDistillation Column Design Multicomponentsuleman205100% (1)

- Managerial AssaignmentDocument20 pagesManagerial AssaignmentShaheen MahmudPas encore d'évaluation

- Macroeconomics ProjectDocument7 pagesMacroeconomics Projectflo_guaPas encore d'évaluation

- Tax Efficiency and Deadweight LossDocument7 pagesTax Efficiency and Deadweight LossDemetrio Pardo HerreraPas encore d'évaluation

- IT Final Ch.5.2023Document5 pagesIT Final Ch.5.2023Amgad ElshamyPas encore d'évaluation

- Problems: Plant Design and Economics For Chemical Engineers Fifth Edition 6-1 The PurcDocument4 pagesProblems: Plant Design and Economics For Chemical Engineers Fifth Edition 6-1 The PurcVincent AntonioPas encore d'évaluation

- Chapter 15 Excise TaxDocument8 pagesChapter 15 Excise TaxGeraldPas encore d'évaluation

- South Dakota Microbrewery Pricing StrategyDocument6 pagesSouth Dakota Microbrewery Pricing StrategySana Khan100% (1)

- Linear Programming Formulation Problems SolutionsDocument14 pagesLinear Programming Formulation Problems SolutionsNakkolopPas encore d'évaluation

- Please Do Not Write On This Examination FormDocument9 pagesPlease Do Not Write On This Examination FormSamia KhalidPas encore d'évaluation

- Oppc Noncomp GuideDocument3 pagesOppc Noncomp GuidejrladduPas encore d'évaluation

- Qarsam Ilyas Roll No 7: A Brief Introduction To Lagrange Multipliers and Its Economic ApplicationDocument21 pagesQarsam Ilyas Roll No 7: A Brief Introduction To Lagrange Multipliers and Its Economic ApplicationQarsam IlyasPas encore d'évaluation

- BUS322Tutorial8 SolutionDocument10 pagesBUS322Tutorial8 Solutionjacklee1918100% (1)

- Environmental TaxesDocument9 pagesEnvironmental TaxesBúp Cassie100% (1)

- Diktat PieDocument9 pagesDiktat PieShafa RasendriyaPas encore d'évaluation

- Grennell FarmDocument11 pagesGrennell FarmvenkeeeeePas encore d'évaluation

- Minimum Corporate Income Tax: A Bane or A Boon? by Rosalino G. Fontanosa, Cpa, MbaDocument14 pagesMinimum Corporate Income Tax: A Bane or A Boon? by Rosalino G. Fontanosa, Cpa, MbaanggandakonohPas encore d'évaluation

- Crude Oil Viscosity Models and Data Data Quality Control ProceduresDocument52 pagesCrude Oil Viscosity Models and Data Data Quality Control Procedures13670319Pas encore d'évaluation

- Padma 5Document46 pagesPadma 5prospereducation100% (2)

- 1 EnergyDocument34 pages1 EnergyDragan TadicPas encore d'évaluation

- Present Value of The Investment Project Assuming The Company Has An 8% Hurdle RateDocument15 pagesPresent Value of The Investment Project Assuming The Company Has An 8% Hurdle RategerralanuzaPas encore d'évaluation

- OPTIMIZING OIL PRODUCTIONDocument8 pagesOPTIMIZING OIL PRODUCTIONNatasha Marie Irving-PattersonPas encore d'évaluation

- Big V Telecom BrochureDocument4 pagesBig V Telecom BrochurejericvazPas encore d'évaluation

- Valuation of Colgate-PalmoliveDocument9 pagesValuation of Colgate-PalmoliveMichael JohnsonPas encore d'évaluation

- Hellenic Open University: School of Social SciencesDocument12 pagesHellenic Open University: School of Social Sciencesgiorgos1978Pas encore d'évaluation

- ECON 253-01, 03 Supplementary Exercise Multiple Choice QuestionsDocument13 pagesECON 253-01, 03 Supplementary Exercise Multiple Choice QuestionsTrinityGautreauxPas encore d'évaluation

- Pareto Analysis of Departmental InjuriesDocument14 pagesPareto Analysis of Departmental Injuriesanurag2671Pas encore d'évaluation

- Union Budget 2013-14 HighlightsDocument5 pagesUnion Budget 2013-14 HighlightsArun HariharanPas encore d'évaluation

- GSM Call Drop Optimization GuideDocument14 pagesGSM Call Drop Optimization GuideHammadi GharsPas encore d'évaluation

- Beer Duty Return by Keyconsulting UKDocument2 pagesBeer Duty Return by Keyconsulting UKKeyconsulting UKPas encore d'évaluation

- Morgan Stanley OilDocument19 pagesMorgan Stanley Oilephraim_tammyPas encore d'évaluation

- Chapter 13aDocument8 pagesChapter 13amas_999Pas encore d'évaluation

- Chapter 8 - Krugman and Obstfeld: EC 271 International Economic Relations Answers To Problem Set #3 Prof. MurphyDocument5 pagesChapter 8 - Krugman and Obstfeld: EC 271 International Economic Relations Answers To Problem Set #3 Prof. MurphyDaniela R. EduardoPas encore d'évaluation

- Commissioner of Internal Revenue vs. Fortune Tobacco Corporation (July 21, 2008 and September 28, 2011)Document7 pagesCommissioner of Internal Revenue vs. Fortune Tobacco Corporation (July 21, 2008 and September 28, 2011)Vince LeidoPas encore d'évaluation

- Proclamation No. 307/2002 and It Amendments Proc. No. 570/2008, 610/2008Document13 pagesProclamation No. 307/2002 and It Amendments Proc. No. 570/2008, 610/2008ሞገስ አላምረው ደጀንPas encore d'évaluation

- Aladdin Games Monte Carlo Simulation T1Document204 pagesAladdin Games Monte Carlo Simulation T1KousheekPas encore d'évaluation

- Anant Raina Ganesh Rajeev Nikhil Swati Bhala U.Prabir JaiswalDocument23 pagesAnant Raina Ganesh Rajeev Nikhil Swati Bhala U.Prabir JaiswalprabirjaisPas encore d'évaluation

- The Costs of ProductionDocument26 pagesThe Costs of ProductionAkshay DembraPas encore d'évaluation

- Expected Manufacturing Overhead Cost $2,200,000 Estimated Direct Labor-Hours 50,000 Dlhs $44 Per DLHDocument5 pagesExpected Manufacturing Overhead Cost $2,200,000 Estimated Direct Labor-Hours 50,000 Dlhs $44 Per DLHiceds01Pas encore d'évaluation

- Managerial EconomicsDocument9 pagesManagerial EconomicsAbhishek ModakPas encore d'évaluation

- Losses of petroleum products analysisDocument4 pagesLosses of petroleum products analysisJoey SchmidtPas encore d'évaluation

- Overview of Auditing and AssuranceDocument15 pagesOverview of Auditing and AssuranceJadeFerrer50% (2)

- Overview of Auditing and AssuranceDocument15 pagesOverview of Auditing and AssuranceJadeFerrer50% (2)

- Ferrer, Jade PDFDocument2 pagesFerrer, Jade PDFJadeFerrerPas encore d'évaluation

- Intangible AssetsDocument17 pagesIntangible AssetsJadeFerrerPas encore d'évaluation

- Volatility Clustering, Leverage Effects and Risk-Return Trade-Off in The Nigerian Stock MarketDocument14 pagesVolatility Clustering, Leverage Effects and Risk-Return Trade-Off in The Nigerian Stock MarketrehanbtariqPas encore d'évaluation

- Essay Sustainable Development GoalsDocument6 pagesEssay Sustainable Development GoalsBima Dwi Nur Aziz100% (1)

- Geller (LonginusRhetoric'sCure)Document27 pagesGeller (LonginusRhetoric'sCure)Miguel AntónioPas encore d'évaluation

- 14.marifosque v. People 435 SCRA 332 PDFDocument8 pages14.marifosque v. People 435 SCRA 332 PDFaspiringlawyer1234Pas encore d'évaluation

- Dislocating The Sign: Toward A Translocal Feminist Politics of TranslationDocument8 pagesDislocating The Sign: Toward A Translocal Feminist Politics of TranslationArlene RicoldiPas encore d'évaluation

- Unit-2 Fourier Series & Integral: 2130002 - Advanced Engineering MathematicsDocument143 pagesUnit-2 Fourier Series & Integral: 2130002 - Advanced Engineering MathematicsDarji DhrutiPas encore d'évaluation

- The Rescue FindingsDocument8 pagesThe Rescue FindingsBini Tugma Bini Tugma100% (1)

- Ds B2B Data Trans 7027Document4 pagesDs B2B Data Trans 7027Shipra SriPas encore d'évaluation

- 150 Most Common Regular VerbsDocument4 pages150 Most Common Regular VerbsyairherreraPas encore d'évaluation

- Kerala Dinesh Beedi - WikipediaDocument12 pagesKerala Dinesh Beedi - Wikipediaaymanamna2016Pas encore d'évaluation

- Theory of Karma ExplainedDocument42 pagesTheory of Karma ExplainedAKASH100% (1)

- Understanding key abdominal anatomy termsDocument125 pagesUnderstanding key abdominal anatomy termscassandroskomplexPas encore d'évaluation

- Intertrigo and Secondary Skin InfectionsDocument5 pagesIntertrigo and Secondary Skin Infectionskhalizamaulina100% (1)

- Case Study 1Document2 pagesCase Study 1Diana Therese CuadraPas encore d'évaluation

- The Emergence of India's Pharmaceutical IndustryDocument41 pagesThe Emergence of India's Pharmaceutical Industryvivekgupta2jPas encore d'évaluation

- Aaps Pronouns-ExplainedDocument2 pagesAaps Pronouns-Explainedapi-277377140Pas encore d'évaluation

- 5.2.1 1539323575 2163Document30 pages5.2.1 1539323575 2163Brinda TPas encore d'évaluation

- Compatibility Testing: Week 5Document33 pagesCompatibility Testing: Week 5Bridgette100% (1)

- Leaflet STP2025 LightDocument2 pagesLeaflet STP2025 LightNoel AjocPas encore d'évaluation

- American Buffalo - DAVID MAMETDocument100 pagesAmerican Buffalo - DAVID MAMETRodrigo Garcia Sanchez100% (10)

- 6 Holly Fashion Case StudyDocument3 pages6 Holly Fashion Case StudyCaramalau Mirela-Georgiana0% (1)

- Mcquillin Murphy ResumeDocument1 pageMcquillin Murphy Resumeapi-253430225Pas encore d'évaluation

- PDF To Sas DatasetsDocument6 pagesPDF To Sas DatasetsSiri KothaPas encore d'évaluation

- 15-8377 - 3521 Calandria Communications L. Rivera PDFDocument20 pages15-8377 - 3521 Calandria Communications L. Rivera PDFRecordTrac - City of OaklandPas encore d'évaluation

- Coal Bed Methane GasDocument10 pagesCoal Bed Methane GasErrol SmythePas encore d'évaluation

- Ava Gardner Biography StructureDocument5 pagesAva Gardner Biography Structuredanishfiverr182Pas encore d'évaluation

- Boeing 7E7 - UV6426-XLS-ENGDocument85 pagesBoeing 7E7 - UV6426-XLS-ENGjk kumarPas encore d'évaluation

- Crypt of Cthulhu 49 1987 Cosmic-JukeboxDocument71 pagesCrypt of Cthulhu 49 1987 Cosmic-JukeboxNushTheEternal100% (3)

- Aromatic Saturation Catalysts: CRI's Nickel Catalysts KL6564, KL6565, KL6515, KL6516Document2 pagesAromatic Saturation Catalysts: CRI's Nickel Catalysts KL6564, KL6565, KL6515, KL6516Ahmed SaidPas encore d'évaluation

- SKILLS TRANSFER PLAN FOR MAINTENANCE OF NAVAL EQUIPMENTDocument2 pagesSKILLS TRANSFER PLAN FOR MAINTENANCE OF NAVAL EQUIPMENTZaid NordienPas encore d'évaluation