Académique Documents

Professionnel Documents

Culture Documents

AIS 301 701 Practice Exam 3 Final Version

Transféré par

RafaelAlexandrian0 évaluation0% ont trouvé ce document utile (0 vote)

89 vues16 pagesPractice Accounting Exam

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentPractice Accounting Exam

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

89 vues16 pagesAIS 301 701 Practice Exam 3 Final Version

Transféré par

RafaelAlexandrianPractice Accounting Exam

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 16

1

ACCT IS 301 / 701 Financial Reporting I

Spring 2014

Practice Exam Exam 3

(This practice exam provides an example of the nature and types of questions on the actual

exam. It is not intended to be representative of the length or difficulty of the actual exam)

Note: Solutions are at the end of the exam

Multiple Choice - Circle the best answer for each question.

1. Brust Co., a retailer, made cash sales during the month of October of $132,600. The sales are

subject to a 6% sales tax that was also collected (included in the $132,600). Which of the

following would not be included in the summary journal entry to reflect the sale transactions?

a. Debit Cash for $132,600.

b. Credit Sales Tax Payable for $7,506.

c. Credit Sales for $125,094.

d. Credit Sales Tax Payable for $7,956.

2. If bonds are issued initially at a premium and the effective-interest method of amortization is

used, interest expense in the earlier years will be

a. greater than if the straight-line method were used.

b. greater than the amount of the interest payments.

c. the same as if the straight-line method were used.

d. less than if the straight-line method were used.

3. If bonds are issued between interest dates, the entry on the books of the issuing corporation

could include a

a. debit to Interest Payable.

b. credit to Interest Receivable.

c. credit to Interest Expense.

d. credit to Unearned Interest.

2

4. At December 31, 2013 the following balances existed on the books of Evans Corporation:

Bonds Payable $2,000,000

Discount on Bonds Payable 160,000

Interest Payable 50,000

Unamortized Bond Issue Costs 120,000

If the bonds are retired on January 1, 2014, at 102 plus accrued interest, what will Evans report as a

loss on redemption?

a. $370,000

b. $320,000

c. $270,000

d. $200,000

5 Dekker Corp. purchased its own par value stock on January 1, 2014 for $20,000 and debited the

treasury stock account for the purchase price. The stock was subsequently sold for $12,000. The

$8,000 difference between the cost and sales price should be recorded as a deduction from

a. paid-in capital from treasury stock to the extent that previous net "gains" from sales of the

same class of stock are included therein; otherwise, from retained earnings.

b. paid-in capital from treasury stock without regard as to whether or not there have been

previous net "gains" from sales of the same class of stock included therein.

c. retained earnings.

d. net income.

6. Dukan Corporation has 50,000 shares of $10 par common stock authorized. The following

transactions took place during 2013, the first year of the corporations existence:

Sold 5,000 shares of common stock for $18 per share.

Issued 5,000 shares of common stock in exchange for a patent valued at $100,000.

At the end of the Dukans first year, total paid-in capital amounted to

a. $40,000.

b. $90,000.

c. $100,000.

d. $190,000.

3

7. Gasser Company estimates its warranty expense as 4% of net sales.

Net sales 2013$1,500,000

Warranty Liability account:

Balance, Dec. 31, 2012. $10,000 debit before adjustment

Balance, Dec. 31, 2013..$50,000 credit after adjustment

Which one of the following entries was made to record the 2013 estimated warranty expense?

a. Warranty Expense ............................ 60,000

Retained Earnings (prior-period adjustment) 10,000

Warranty Liability ...................... 50,000

b. Warranty Expense ............................ 50,000

Retained Earnings (prior-period adjustment) 10,000

Warranty Liability ...................... 60,000

c. Warranty Expense ............................ 40,000

Warranty Liability ...................... 40,000

d. Warranty Expense ............................ 60,000

Warranty Liability ...................... 60,000

8. On January 1, 2014, Bohannon, Inc., declared a 10% stock dividend on its common stock when

the market value of the common stock was $20 per share. Stockholders' equity before the

stock dividend was declared consisted of:

Common stock, $10 par value, authorized 200,000 shares;

issued and outstanding 120,000 shares $1,200,000

Additional paid-in capital on common stock 150,000

Retained earnings 700,000

Total stockholders' equity $2,050,000

What was the effect on Bohannons retained earnings as a result of the above transaction?

a. $120,000 decrease

b. $240,000 decrease

c. $400,000 decrease

d. $200,000 decrease

4

9. The printing costs and legal fees associated with the issuance of bonds, according to GAAP,

should

a. be expensed when incurred.

b. be reported as a deduction from the face amount of bonds payable.

c. be accumulated in a deferred charge account and amortized over the life of the bonds.

d. deferred credit to be amortized over life of new debt.

10. Which of the following is not an accurate representation concerning revenue recognition?

a. Revenue from selling products is recognized at the date of sale, usually interpreted to mean

the date of delivery to customers.

b. Revenue from services rendered is recognized when cash is received or when services have

been performed.

c. Revenue from permitting others to use enterprise assets is recognized as time passes or as the

assets are used.

d. Revenue from disposing of assets other than products is recognized at the date of sale.

11. When work to be done and costs to be incurred on a long-term contract can be estimated

dependably, which of the following methods of revenue recognition is preferable?

a. Installment-sales method

b. Percentage-of-completion method

c. Completed-contract method

d. None of these

12. How should the balances of progress billings and construction in process be shown at reporting

dates prior to the completion of a long-term contract?

a. Progress billings as deferred income, construction in progress as a deferred expense.

b. Progress billings as income, construction in process as inventory.

c. Net, as a current asset if debit balance, and current liability if credit balance.

d. Net, as income from construction if credit balance, and loss from construction if debit balance.

5

13. Similar to U.S. practice, IFRS requires that companies present current and noncurrent liabilities

on the face of the balance sheet with current liabilities

a. generally presented in order of magnitude.

b. presented in alphabetic order.

c. presented in order of liquidity.

d. presented in the order in which they were incurred.

14. The realization of income on installment sales transactions involves

a. recognition of the difference between the cash collected on installment sales and the cash

expenses incurred.

b. deferring the net income related to installment sales and recognizing the income as cash is

collected.

c. deferring gross profit while recognizing operating or financial expenses in the period incurred.

d. deferring gross profit and all additional expenses related to installment sales until cash is ultimately

collected.

6

PROBLEMS

Problem 1 - Stockholders Equity.

Indicate the effect of each of the following transactions on total stockholders' equity by placing an

"X" in the appropriate column.

Increase Decrease None

Effect

1. Treasury stock is resold at more than cost. _________ _________ ________

2. Operating loss for the period. _________ _________ ________

3. Retirement of bonds payable at more than

book value. _________ _________ ________

4. Declaration of a stock dividend. _________ _________ ________

5. Acquisition of machinery for common stock. _________ _________ ________

6. Conversion of bonds payable into common

stock. _________ _________ ________

7. Not declaring a dividend on cumulative

preferred stock. _________ _________ ________

8. Declaration of cash dividend. _________ _________ ________

9. Payment of cash dividend. _________ _________ ________

Hint: Where possible, prepare a journal entry to reflect the transaction to help assess the effect of

the transaction on total stockholders equity.

7

Problem 2 Installment sales.

Koenig Furniture Company concluded its first year of operations in which it made sales of $800,000,

all on installment. Collections during the year from down payments and installments totaled

$300,000. Purchases for the year totaled $400,000; the cost of merchandise on hand at the end of the

year was $80,000.

Instructions

Using the installment-sales method, make summary entries to record:

(a) the installment sales and cash collections

(b) the cost of installment sales

(c) the unrealized gross profit

(d) the realized gross profit

8

Problem 3 - Bonds

On January 1, 2013, Hayes Co. issued ten-year bonds with a face value of $200,000 and a stated

interest rate of 10%, payable semiannually on June 30 and December 31. The bonds were sold to

yield 12%. Table values are:

Present value of 1 for 10 periods at 10% .386

Present value of 1 for 10 periods at 12% .322

Present value of 1 for 20 periods at 5% .377

Present value of 1 for 20 periods at 6% .312

Present value of an ordinary annuity for 10 periods at 10% 6.145

Present value of an ordinary annuity for 10 periods at 12% 5.650

Present value of an ordinary annuity for 20 periods at 5% 12.462

Present value of an ordinary annuity for 20 periods at 6% 11.470

(a) Calculate the issue price of the bonds at January 1, 2013:

(b) Ignore your answer to part (a) and assume that the issue price was $177,000. Prepare the

amortization table for 2013 assuming the effective interest method and that amortization is recorded

on interest payment dates

Date Cash Payment Interest Expense Amortization Book Value or

Carrying Amount

9

(c) Now assume that instead of issuing the bonds on January 1, 2013, the bonds were issued on June

l, 2013 and assume that the issue price was $177,000.

Prepare the journal entry to record the issuance of the bond.

Account Debit Credit

10

Problem 4 Current Liabilities and Contingencies

Presented below is a list of transactions occurring for the Kaminsky Company in 2013:

1. Recorded cash sales of $20,000,000 which includes 6% sales tax.

2. Recorded wage expense of $350,000 for 2013, but only paid cash of $300,000 for this in 2013.

The difference was due to various amounts withheld which will be paid in 2014.

3. Became involved in a tax dispute with the IRS. As of December 31, 2013 Kaminsky Company

legal counsel believed that it was probable that the company would lose the tax dispute and

would have to pay the IRS between $80,000 and $140,000.

4. One of the Kaminsky Company manufacturing facilities in Kosovo was destroyed in

2010 during the war and recorded as a complete loss at that time. In 2013, Kaminsky Company

has been assured by the government that it will receive compensation in 2014 for the plant equal

to 70% of the plants fair value of $1,000,000. The book value of the plant was $500,000.

5. Kaminsky Company began a new policy in 2013 of providing paid vacation time for employees.

Vacation days may be taken after January 15

th

of the year following the year in which they are

earned. Kaminsky Company has chosen to value the cost of these compensated absences at

rates of pay in effect during the period when earned. Vacation time is 10% of paid time. Earned

wages for 2013 equals $350,000.

Analyze the effect of the above transactions on the Kaminsky Company 2013 financial statements by

filling in the categories indicated. Use the following codes: I = Increase D = Decrease NE = No

Effect. Also write in the dollar amount of the effect.

Hint: Where possible, prepare a journal entry to reflect the transaction to help assess the effect of

the transaction on the various financial statement components.

# Assets $ Amount Liab-

ilities

$

Amount

Net

Income

$

Amount

1.

2.

3.

4.

5.

11

Problem 5 Liabilities

At the financial statement date of December 31, 2013, the liabilities outstanding of the Showalter

Corporation included the following:

1. Cash dividends on common stock, $55,000, payable on January 15, 2014.

2. Note payable to Admire State Bank, $470,000, due January 20, 2014, which Showalter

Corporation intends to refinance.

3. Serial bonds, $1,000,000, of which $250,000 mature during 2014.

4. Note payable to Third National Bank, $300,000, due March 27, 2014, which Showalter

Corporation intends to refinance.

The following transactions occurred early in 2014:

January 5: The corporation entered into a non-cancelable financing agreement with Admire State

Bank, enabling it to borrow up to $500,000 at any time through the end of 2014. Amounts borrowed

under the agreement would bear interest at 1% above the bank's prime rate and would mature 3 years

from the date of the loan.

January 15: The cash dividends on common stock were paid.

January 19: Showalter Corporation borrowed $500,000 under the January 5 financing agreement

and used the funds to pay the Admire State Note Payable due January 20

th

.

February 1: The financial statements for 2013 were issued.

1. The amount of liabilities that should be presented as Current liabilities at December 31, 2013

equals

$_______________________

2. The amount of liabilities that should be presented as Long Term liabilities at December 31,

2013 equals

$_______________________

12

Problem 6 - Computation of selected financial ratios.

The following information pertains to Jackson Co at year end:

Preferred stock, cumulative:

Par per share $100

Dividend rate 8%

Shares outstanding 5,000

Dividends in arrears none

Common stock:

Par per share $10

Shares issued 60,000

Dividends paid per share $2.70

Market price per share $48.00

Additional paid-in capital $200,000

Unappropriated retained earnings (after closing) $135,000

Retained earnings appropriated for contingencies $150,000

Common treasury stock:

Number of shares 5,000

Total cost $125,000

Net income $370,000

Instructions

Compute (assume no changes in balances during the past year):

(a) Total amount of stockholders equity in the balance sheet

(b) Earnings per share of common stock

(c) Book value per share of common stock

(d) Payout ratio of common stock

(e) Return on common stock equity

13

Problem 7 Percentage-of-completion.

Marshall Construction Company was awarded a contract to construct an interchange at the junction

of U.S. 94 and Highway 30 at a total contract price of $8,000,000. The estimated total costs to

complete the project were $6,000,000.

Instructions

(a) Make the entry to record construction costs of $3,600,000, on construction in process to date.

(b) Make the entry to record progress billings of $2,000,000.

(c) Make the entry to recognize the profit that can be recognized to date, on a percentage-of-

completion basis.

14

Answer Key

Multiple Choice

1. d 2. a 3. c 4. b 5. a 6. d 7. d 8.b. 9. c 10. b. 11. b. 12. c. 13. c.

14. c.

Problem 1 Stockholders Equity

Increase Decrease No

Effect

1. Treasury stock is resold at more than cost. X

2. Operating loss for the period. X

3. Retirement of bonds payable at more than

book value. X

4. Declaration of a stock dividend. X

5. Acquisition of machinery for common stock. X

6. Conversion of bonds payable into common

stock. X

7. Not declaring a dividend on cumulative

preferred stock. X

8. Declaration of cash dividend. X

9. Payment of cash dividend. X

Problem 2 Installment Sales

(a) Installment Accounts Receivable ......................................................................... 800,000

Installment Sales ...................................................................................... 800,000

Cash .......................................................................................................................... 300,000

Installment Accounts Receivable .......................................................... 300,000

(b) Cost of Installment Sales ($400,000 $80,000) ................................................ 320,000

Inventory .................................................................................................. 320,000

(c) Installment Sales ..................................................................................................... 800,000

Cost of Installment Sales........................................................................ 320,000

Deferred Gross Profit (60%) ................................................................ 480,000

(d) Deferred Gross Profit (60% $300,000) .......................................................... 180,000

Realized Gross Profit on Installment Sales ......................................... 180,000

15

Problem 3 Bonds

a) (200,000 x .312) + (10,000 x 11.47) = 177,100

Book Value or

b) Cash Int Exp Amort Carrying Value

1/1/13 177,000

6/30/13 10,000 10,620 620 177,620

12/31/13 10,000 10,657 657 178,277

c)

Cash 177,000

Cash (10,000 X 5/6 or 20,000 X 5/12) 8,333 8,333

Discount on Bonds Payable 23,000

Interest Expense (or payable) 8,333

Bond Payable 200,000

Problem 4 Current Liabilities and Contingencies

# Asset Amount Liabilities Amount Net income Amount

1 I 20,000,000 I 1,132,075 I 18,867,925

2 D 300,000 I 50,000 D 350,000

3 NE 0 I 80,000 D 80,000

4 NE 0 NE 0 NE 0

5 NE 0 I 35,000 D 35,000

or 5 D 350,000 I 35,000 D 385,000

Problem 5 Liabilities

Current Liabilities

Dividends payable 55,000

Notes Payable-Third National 300,000

Current maturity of

Serial bonds 250,000

Total Current Liabilities 605,000

Long Term Liabilities

Note payable-Admiral, refinanced

in January 2014 470,000

Serial bonds 750,000

Total Long Term Liabilities 1,220,000

Total Liabilities 1,825,000

Ok if combined into one Cash

debit entry of $185,333

16

Problem 6 Computation of Selected Financial Ratios

(a) (5,000 $100) + (60,000 $10) + $200,000 + $135,000 + $150,000 $125,000

= $1,460,000.

(b) [$370,000 (5,000 $100 8%)] (60,000 5,000) = 330,000 55,000

= $6.00 per share.

(c) ($1,460,000 $500,000) (60,000 5,000) = $960,000 55,000 = $17.45 per share.

(d) $2.70 $6 = 45% or [($2.70 55,000) ($370,000 $40,000)].

(e) ($370,000 $40,000) ($1,460,000 $500,000) = 34.4%.

Problem 7 Percentage-of-completion

(a) Construction in Process ........................................................................................ 3,600,000

Materials, Cash, Payables, Etc. .............................................................. 3,600,000

(b) Accounts Receivable .............................................................................................. 2,000,000

Billings on Construction in Process ..................................................... 2,000,000

(c) Construction Expenses ......................................................................................... 3,600,000

Construction in Process (60% complete) ........................................................... 1,200,000

Revenue from Long-Term Contracts .................................................. 4,800,000

Vous aimerez peut-être aussi

- 153b First Grading ExamDocument7 pages153b First Grading ExamJungie Mablay WalacPas encore d'évaluation

- Midterm I 2022 KEYDocument17 pagesMidterm I 2022 KEYkuo zoePas encore d'évaluation

- Accouting ExamDocument7 pagesAccouting ExamThien PhuPas encore d'évaluation

- Intermediate Accounting Exam SolutionsDocument11 pagesIntermediate Accounting Exam SolutionsDean Craig80% (5)

- Accountancy FundasDocument14 pagesAccountancy FundasDeepak Kumar PandaPas encore d'évaluation

- 4 5953918248238974494Document8 pages4 5953918248238974494Muktar jibo0% (1)

- Final Term Examination. Intermediate AccountingDocument8 pagesFinal Term Examination. Intermediate AccountingOrtiz, Trisha Mae S.Pas encore d'évaluation

- Acc. P 2 2021 RevisionDocument8 pagesAcc. P 2 2021 RevisionSowda AhmedPas encore d'évaluation

- SDDocument19 pagesSDNitinPas encore d'évaluation

- Click Here For Answers: ACC 400 Final ExamDocument4 pagesClick Here For Answers: ACC 400 Final Examclickme12Pas encore d'évaluation

- Exam 1 Fall 11 Any Gains Solution - PostedDocument13 pagesExam 1 Fall 11 Any Gains Solution - PostedKhôi NguyênPas encore d'évaluation

- Review Session1-MidtermDocument7 pagesReview Session1-MidtermBich VietPas encore d'évaluation

- Important Mcqs Regarding Nts TestsDocument129 pagesImportant Mcqs Regarding Nts Testsk.shaikh100% (3)

- Quiz Week 1 QnsDocument7 pagesQuiz Week 1 Qnsesraa karamPas encore d'évaluation

- TT06 ReceivablesDocument9 pagesTT06 ReceivablesNguyenPas encore d'évaluation

- Exam SampleDocument10 pagesExam Samplejedwebb9156360Pas encore d'évaluation

- ACCT 3312 - Chap 17 Practice QuestionsDocument5 pagesACCT 3312 - Chap 17 Practice QuestionsVernon Dwanye LewisPas encore d'évaluation

- Intermediate Accounting Kieso 14th ch8, 9, 10, 11Document8 pagesIntermediate Accounting Kieso 14th ch8, 9, 10, 11Alessandro BattellinoPas encore d'évaluation

- Current Liabilities - QuizDocument4 pagesCurrent Liabilities - QuizArvin PaculanangPas encore d'évaluation

- Chapter 8 Liabilities Exercises T3AY2021Document6 pagesChapter 8 Liabilities Exercises T3AY2021Carl Vincent BarituaPas encore d'évaluation

- Final Exam IntermediateDocument6 pagesFinal Exam Intermediategizachew alekaPas encore d'évaluation

- Quiz Week 8 Akm 2Document6 pagesQuiz Week 8 Akm 2Tiara Eva TresnaPas encore d'évaluation

- Fsa Questions FBNDocument34 pagesFsa Questions FBNsprykizyPas encore d'évaluation

- Financial Controller 1 Pre-Final QuestionsDocument2 pagesFinancial Controller 1 Pre-Final QuestionsWen CapunoPas encore d'évaluation

- Quiz Chapter 4 - Chapter 8Document11 pagesQuiz Chapter 4 - Chapter 8Fäb RicePas encore d'évaluation

- Winter 2016 - ACC 1100 Sample FinalDocument16 pagesWinter 2016 - ACC 1100 Sample FinalCourtyPas encore d'évaluation

- Wiley - Practice Exam 3 With SolutionsDocument15 pagesWiley - Practice Exam 3 With SolutionsIvan BliminsePas encore d'évaluation

- Intermediate AccountingDocument12 pagesIntermediate AccountingLeah BakerPas encore d'évaluation

- Final Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems inDocument8 pagesFinal Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems insafiqulislamPas encore d'évaluation

- Final Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems inDocument8 pagesFinal Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems insafiqulislamPas encore d'évaluation

- Qualifying Round QuestionsDocument9 pagesQualifying Round QuestionsShenne MinglanaPas encore d'évaluation

- Business Finance ExamDocument3 pagesBusiness Finance ExamChristian Joy ReyesPas encore d'évaluation

- Financial Statement AnalysisDocument18 pagesFinancial Statement AnalysisAprile Margareth HidalgoPas encore d'évaluation

- Week 2Document6 pagesWeek 2Maryane AngelaPas encore d'évaluation

- DHS Accountancy 2021Document30 pagesDHS Accountancy 2021Kuenga Geltshen100% (2)

- 2010-01-12 123253 IntermediateDocument10 pages2010-01-12 123253 IntermediateYoshidaPas encore d'évaluation

- ACCO320Midterm Fall2013FNDocument14 pagesACCO320Midterm Fall2013FNzzPas encore d'évaluation

- RevisedACFNModelExam - 2023Document15 pagesRevisedACFNModelExam - 2023Eyuel SintayehuPas encore d'évaluation

- CupDocument7 pagesCupJerauld BucolPas encore d'évaluation

- Multiple Choice On Cash Flow StatementDocument7 pagesMultiple Choice On Cash Flow StatementLongtan JingPas encore d'évaluation

- Second Semester 2020 Second Year University of Assuit Faculty of Commerce English Program " Corporation" "Test Bank"Document10 pagesSecond Semester 2020 Second Year University of Assuit Faculty of Commerce English Program " Corporation" "Test Bank"Magdy KamelPas encore d'évaluation

- MAS 1 PrelimDocument10 pagesMAS 1 PrelimRose Ann Moraga FrancoPas encore d'évaluation

- Chapter 16 2021Document2 pagesChapter 16 2021Rabie HarounPas encore d'évaluation

- Ia 2 Midterm ExamDocument13 pagesIa 2 Midterm ExamIrene Grace Edralin AdenaPas encore d'évaluation

- MT YeniDocument28 pagesMT YeniElgun ElgunPas encore d'évaluation

- Acc 603 Test 2 Fall 2011Document7 pagesAcc 603 Test 2 Fall 2011Steph Stevens0% (1)

- 6 - 262728 - Short-Term Finance and PlanningDocument5 pages6 - 262728 - Short-Term Finance and PlanningPham Ngoc VanPas encore d'évaluation

- Self Study Chapter 18 2Document18 pagesSelf Study Chapter 18 2Scott ShearerPas encore d'évaluation

- Accounting BLC Review Exam 2 Answers 2013Document17 pagesAccounting BLC Review Exam 2 Answers 2013Hassan TariqPas encore d'évaluation

- Intermediate Accounting Kieso 13e Comp. TestDocument13 pagesIntermediate Accounting Kieso 13e Comp. TestRJKcPas encore d'évaluation

- CF ReviewDocument17 pagesCF Reviewmohit_namanPas encore d'évaluation

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)D'EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Évaluation : 5 sur 5 étoiles5/5 (1)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideD'EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuidePas encore d'évaluation

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)D'EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Évaluation : 4.5 sur 5 étoiles4.5/5 (5)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)D'EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Évaluation : 5 sur 5 étoiles5/5 (1)

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)D'EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)Pas encore d'évaluation

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementD'EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementPas encore d'évaluation

- The Entrepreneur’S Dictionary of Business and Financial TermsD'EverandThe Entrepreneur’S Dictionary of Business and Financial TermsPas encore d'évaluation

- Ce22 04 TVM 1 PDFDocument36 pagesCe22 04 TVM 1 PDFEmman Joshua BustoPas encore d'évaluation

- Prac. 1Document15 pagesPrac. 1Lalaine De JesusPas encore d'évaluation

- SecuritizationDocument28 pagesSecuritizationMohit MakhijaPas encore d'évaluation

- Ipo Fact SheetDocument18 pagesIpo Fact SheetManali ShahPas encore d'évaluation

- Debt Instrument Project PDFDocument50 pagesDebt Instrument Project PDFRohit VishwakarmaPas encore d'évaluation

- Session6.Bond ValuationDocument21 pagesSession6.Bond Valuationsincere sincerePas encore d'évaluation

- Corporate FinanceDocument4 pagesCorporate Financegianluigi de rubertisPas encore d'évaluation

- Mutual Fund ScriptDocument12 pagesMutual Fund ScriptSudheesh Murali NambiarPas encore d'évaluation

- RM PPT SwapDocument10 pagesRM PPT SwappankajkubadiyaPas encore d'évaluation

- HSBC - Global Rates Ideas EM & DM - 20230106Document29 pagesHSBC - Global Rates Ideas EM & DM - 20230106Linuxx Toro TeijeiroPas encore d'évaluation

- Global Financial MarketsDocument37 pagesGlobal Financial MarketsSangram PandaPas encore d'évaluation

- Day of Turmoil As Negative Rates Strike Fear Into Global MarketsDocument24 pagesDay of Turmoil As Negative Rates Strike Fear Into Global MarketsstefanoPas encore d'évaluation

- Unicredit International Bank (Luxembourg) S.ADocument126 pagesUnicredit International Bank (Luxembourg) S.AViorel GhineaPas encore d'évaluation

- Chapter 20: Options Markets: Introduction: Problem SetsDocument19 pagesChapter 20: Options Markets: Introduction: Problem SetsAuliah SuhaeriPas encore d'évaluation

- BMAN23000A Exam Paper ACTUALDocument6 pagesBMAN23000A Exam Paper ACTUALMunkbileg MunkhtsengelPas encore d'évaluation

- Mary Croft Spiritual Economics NowDocument22 pagesMary Croft Spiritual Economics NowZodiacal Horoscopos100% (4)

- Financial Instruments: Classification, Recognition and MeasurementDocument105 pagesFinancial Instruments: Classification, Recognition and MeasurementĐỗ Thụy Minh ThưPas encore d'évaluation

- Ubs Strategy Guide 7.17Document13 pagesUbs Strategy Guide 7.17shayanjalali44Pas encore d'évaluation

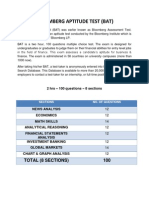

- Bloomberg Aptitude Test (BAT)Document10 pagesBloomberg Aptitude Test (BAT)Shivgan Joshi100% (1)

- DEC 2016 AnswersDocument37 pagesDEC 2016 AnswersBKS SannyasiPas encore d'évaluation

- PaperpediaDocument5 pagesPaperpediapachpind jayeshPas encore d'évaluation

- FAR Bonds and Present Value TablesDocument3 pagesFAR Bonds and Present Value Tablespoet_in_christPas encore d'évaluation

- Economictimes IndiatimeDocument5 pagesEconomictimes IndiatimeSrinivas BhupathiPas encore d'évaluation

- RMB Cement InitiationDocument76 pagesRMB Cement InitiationJul APas encore d'évaluation

- Accounting 132Document2 pagesAccounting 132Anne Marieline BuenaventuraPas encore d'évaluation

- Morgan Stanley SustainabilityDocument4 pagesMorgan Stanley SustainabilityNivedita Banerjee100% (1)

- 2023.05.10 Exercise - Audit of Financing Cycle 2 With Answers-1Document3 pages2023.05.10 Exercise - Audit of Financing Cycle 2 With Answers-1misonim.ePas encore d'évaluation

- TestReviewer Docx LDocument27 pagesTestReviewer Docx LCes100% (1)

- BDL Management Trainee FinanceDocument31 pagesBDL Management Trainee FinanceravinderPas encore d'évaluation

- AirThread Class 2020Document21 pagesAirThread Class 2020Son NguyenPas encore d'évaluation