Académique Documents

Professionnel Documents

Culture Documents

Safal Niveshak Investment

Transféré par

Trilok Chand GuptaDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Safal Niveshak Investment

Transféré par

Trilok Chand GuptaDroits d'auteur :

Formats disponibles

Lesson #1: Why Invest in Stock

Markets?

Value Investing for Smart People is a course that will teach you the simple and sensible

strategies to invest in the stock markets to grow your wealth over the long term.

But since this is the very first lesson, let us answer this question to start off with

Why invest at all?

All of us have a long list of financial goals, starting with things like paying the EM of our

house, putting food on the table, and paying all other bills so that we live comfortable

lives.

!hen you work your way down the list, you get to things like replacing the old car, buying

a second house, putting the kids through college, and retiring.

"ou see, most of our wants # and you might associate with this # will e$ceed our

e$pected lifetime earnings. %his is even before you include a lu$ury car and a foreign

holiday that you&ve promised your wife.

'ow to you plan to meet all these e$penses( )emember, we&ve already said that most of

these e$penses will e$ceed your e$pected lifetime earnings.

*o how do plan to meet at least the critical financial needs that will arise in the future #

like putting the kids through college, and your own retirement(

"ou already work so hard to earn money to meet your e$penses and save for the future.

"ou toil hard, you sacrifice your personal life, and sometimes your health in the race to

earn more and more money.

But amidst all this, how much thought do you give to that fact that you can take help from

+someone else& as well to earn us more money to help you meet all your financial goals in

the future.

,et me cut it short here. %hat +someone else& is none other than your own money # what

you are earning and saving today.

"es, your own money can earn money for youand lots of it- .eople who are rich know

this for a fact. But most of us in the middle class don&t.

After all, our school and college education has never taught us this way to earn money.

And neither have our parents.

!hat we have always learnt is to study well, get a good /ob, earn money, and save for

the future. 0obody has really told us that there&s one more aspect to our working and

earning life # investing for the future.

%his is the reason most ndian middle1class households +save& money # in safe deposits

of banks and post offices, or in the form of gold and silver # and rarely +invest&. "ou might

be one of them too.

But do you know how much our money grows when kept in these +safe& places(

A bank account can give you a ma$imum of 2134 interest per year. A bank fi$ed deposit

or a post office saving will give you somewhat better, but only 5164. 7old and silver

won&t earn you anything till the time you don&t sell them. And as far as property is

concerned, in a normal year, it can rise at an 819:4 rate as well.

;Aren&t these good returns(< you might ask. 0ot really, let me say-

!hile calculating your +real& return from all these or any other avenue, we must also take

into account the +inflation& factor.

n simple terms, inflation is nothing but a rise in prices of things that we consume. *o, if

we are paying )s =: a kg for onions today while these were costing )s 9: a kg one year

back, the rate of inflation is a whopping 3::4. But this is an e$ception.

nflation is ndia has generally been in the =164 range over the past many years. And it is

e$pected to remain in this range in the future as well, notwithstanding sharp spikes and

falls in between.

*o, when you calculate the +real& return on your investment, you must reduce the inflation

rate from your total return. ,ike, if your bank account gives you an annual interest of 34

while inflation is at =4, your real return equals a negative 94 >194?. And if a fi$ed

deposit gives you 84, your real return will stand at 24 >84 minus =4?.

0ow do you think that this kind of return is fine, especially when inflation rate is only

going to rise in the future >given the rising shortage of everything we consume?(

t isn&t. mean this is not what we can call +growth of our money&. nflation actually eats

into our money. And how(

,et&s assume that you have )s 9:: with you are looking to buy onions. At a rate of )s 9:

per kg, you will end up buying 9: kg of it. But what is the price rises to )s =: a kg after

one year while you still have only )s 9:: to spend(

n that case, you will be able to buy only @ kg of onions. %hat&s the negative effect of

inflation # the value of every rupee you will have in the future will be lesser than the value

of that one rupee today. And that&s the where the concept of investing and inflation

comes into play. %o grow your money fast at a time when inflation is eating into it is very

important.

Aorget onions. ,ook at the total cost of living that is rising at such a fast pace these days

that that we need to prepare ourselves well to meet our future financial obligations. And

these can include our children&s high education and marriage, our parents& healthcare

needs, and our own retirement. All these are big e$pense items and as such we need to

save and invest a lot to collect their kind of money over the ne$t =, 9:, 9=, or @: years.

,et us now look at how many years you will take to accumulate )s 9: lac for your new

born daughter&s higher education 98 years down the line, if we start with )s @ lac today.

!e will assume real returns >total return minus inflation of =4? of different avenues to

arrive at this number.

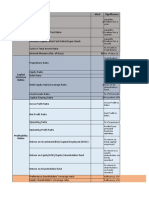

'ere&s the chart that shows it all.

Note: Real returns (shown inside brackets) are calculated assuming inflation rate of !

As the above chart shows, the only way to meet you target of reaching )s 9: lac >if you

start with )s @ lac today? in 98 years is to invest in stocks. !hile your bank AB will not

get you anywhere, the property route will take a much longer time that what your

requirement >of 98 years? permits.

%hese calculations are not based on some random numbers. %hese are e$actly what

these investment avenues have earned over the long term in the past.

%hus we arrive at the fascinating >though risky? world of stock markets # one of the most

critical investment avenues that can help you achieve your long term financial goals.

/ust said that stock market is a risky place, but so are our lives. %here is always a risk in

anything we do. But then, with the right education and research, we can minimiCe that

risk. And as we get more education, we can better decide how much risk we want to take

and conversely how much return we can make safely.

Dnderstanding the risks is the first step toward minimiCing them. n fact, it is possible to

make 9:19=4 annual return on your stock market investment with almost no risk. But

only if you know what you are doing.

%here are many paths you can go down when you get into investing in the stock market.

But there&s one thing you can be sure of. !ith education and research you will make

money.

Lesson #2: Hey, You Call This

Investin?

"I am reall# shocked to hear #our stor#$ Ravi% &ut how did #ou manage to do this'( I said

in a tone of s#mpath# mi)ed with sarcasm*

"I don+t know Vishal* I had been so careful all this while with m# investments* &ut despite

that$ I have lost ever#thing in the crash* ,# stock portfolio is down in the dumps%( Ravi

sounded utterl# depressive*

"-ou call that investing' &u#ing stocks without a hint of what #ou were getting into' It+s

like flirting with someone and then sa#ing that #ou were serious all this while%(

still remember this small conversation with a friend sometime in Ectober @::8. %his

gentleman, my classmate from school, had been a bright student in the past. 'e was a

practicing doctor, but had no clue about investing in the stock markets.

But one fine day, on advice from some of his patients >yes, even patients can give

doctors some +painful& advice?, took his first step into the stock markets only to see his

savings burn in the crash that followed.

*ometimes wonder how even intelligent people >like my doctor friend? fall into the trap

of playing with their hard1earned money without knowing what they are getting into.

%hey work so hard for many years to become successful students, professionals, and

businessmen. And then, in a small phase of mindlessness, lose their entire savings /ust

because +someone& advised them a way to become rich fast.

Most of such people have had the luck to meet call what they are doing as +investing&.

f the father of investing # or let me say +sensible investing& # Ben/amin 7raham were to

hear that, he&d turned over in his grave-

7raham was the first to clearly define what +investing& actually is, and how it differs from

what most people do in the stock markets >like my friend did? i.e., speculate.

n what is known as the best book on investing ever written # %he ntelligent nvestor #

7raham differentiated investment and speculation asF

!"n invest#ent o$eration %investin& is one 'hich, u$on

thorouh analysis, $ro#ises sa(ety o( $rinci$al an) an a)e*uate

return+ ,$erations not #eetin these re*uire#ents are

s$eculative+-

%his definition of investing isn&t difficult to understand.

n fact, it can easily be understood if we break it down to its three key elements.

9. Airst, 7raham says that you as an investor must thoroughly analyse a company,

and the soundness of its underlying business operations. !hat he means alternatively

is that an investment in a stock without understanding its underlying company is

purely speculation.

@. %he second important task for you is to identify all the potential risks associated

with the investment so that you can protect yourself against chances of serious

losses.

2. %he third key element of 7raham&s definition is that an investor must aspire for

only an +adequate& return on his stock market investments # any rate if return,

however low, which the investor is willing to accept, provided he acts with reasonable

intelligence. 'e must not go after +e$traordinary& performance, which is what the stock

market e$perts usually promise to dupe gullible investors.

%he combined practice of these key elements is what investing is all about.

Invest, to #eet your li(e.s oals

"ou must have some dreams and goals in life. "ou also realise that most of these

dreams and goals require money.

*o whether it is the dream of spending your @=th wedding anniversary traveling around

the world, or the goal of saving enough money for your child&s higher education, you

need to have enough money at your disposal whenever you need it.

%he good part here is that you usually need this kind of money 9:19=, or sometime even

@: years from the time you first start investing your savings.

*o you have ample time to see your investments grow and build into a huge corpus that

you can use to meet your dreams and goals.

But /ust because someone advises you a +sure1shot& way to get rich fast by speculating in

the stock markets, you spend your entire life&s savings in speculation only to lose

everything when the markets take a bad turn.

!/ut, is s$eculation a sin?-

%his is what most of my friends whom warn against speculating in the stock markets ask

me. And &m glad you also want to know this.

*ee, there is no doubt that speculation is bad. *peculators are always obsessed with

predicting the future of stock prices, which is in fact a near impossibility.

*peculators thus depend not only on their own forecasting skills, but they also go by the

baseless and biased predictions of brokers or stock market e$perts appearing on

business channels. %hey try to guess the future, which is ne$t to impossible-

But for better or worse, the speculative or gambling instinct is a core part of every

human&s nature.

"ou and both want to speculate at some points in our lives. And stock markets are no

different.

*o what 7raham has also said is that even if an investor wants to speculate, it

>speculation? must be a restrained activity. t must be controlled by the amount of money

you use in speculation.

"ou can call it +sin money&, and it must be not more than =4 of the total funds you have

for investment.

0ever increase this level of sin money i.e., money you use to speculate in stocks. %his

way you won&t go overboard with your speculation.

The Invest#ent0S$eculation 1yra#i)

But this requires a lot of discipline. And the discipline says that you must never equate

speculation with serious investing. %his is because as soon as speculation becomes a

serious activity, it gets e$tremely dangerous for you.

'ere, remember what the famous American author Mark %wain once saidF

!There are t'o ti#es in a #an.s li(e 'hen he shoul) not

s$eculate: 'hen he can.t a((or) it, an) 'hen he can+-

Anyways, stay tuned for the ne$t lesson, because here&s where things start to get

interesting. &m going to give you some specifics about the kinds of strategies that work

well to make money from stock markets, and in a sensible and easy1going way.

Lesson #2: There.s " /usiness /ehin)

3very Stock

f were to ask you to bet your money on the future success of one of your classmates or

colleagues, whom would you choose(

!ould you bet on your best friend amongst these people(

Er would you bet on the most capable person >assuming that you friend is not the most

capable out there?(

f can trust your G, betting on the most capable person would make greater sense for

you than betting on your best friend.

%he same philosophy holds true while investing in stocks. "ou must not put your money

on a stock whose name you like the most or whose chairman is your best friend.

nstead, you must invest in the stock of a business you believe has the ma$imum

potential.

But this is one reality that most investors forget # that

!4 a stock is not 5ust a $iece o( $a$er that has a na#e, 6ut a

share o( a 6usiness that has real assets an) $ro(its+-

!hile buying a stock, you should take the same approach as you would if you were

buying an entire business. %he only difference is that instead of buying the whole of the

business, or a partnership in the business, you are only buying a tiny share.

Investin.s nine #ost i#$ortant 'or)s

;nvesting is most intelligent when it is most businesslike,< said Ben 7raham.

As per 7raham&s best student !arren Buffett, these are the nine most important words

ever written about investing. And rightly so-

%he biggest differentiating trait of Buffett&s own investing philosophy is the clear

understanding that stocks are representative of businesses, and not /ust pieces of paper.

%he idea of buying a stock without understanding the company&s operating functions # its

products and services, management quality, employee relations, raw material sources

and e$penses, plant and equipment, capital reinvestment requirements, and needs for

working capital # is unacceptable.

%his mentality reflects the attitude of a business owner as opposed to a stock owner, and

is the only mentality an investor should have.

Ewners of stocks who perceive that they merely own a piece of paper are far removed

from the company&s financial statements.

%hey behave as if the stock market&s ever1changing price is a more accurate reflection of

their stock&s value than the business&s balance sheet, income statement, and cash flows.

Aor Buffett and all other successful investors , the activities of a stock owner and a

business owner are closely connected. Both should look at ownership of a business in

the same way.

As Buffett saysF

!I a# a 6etter investor 6ecause I a# a 6usiness#an an) a 6etter

6usiness#an 6ecause I a# an investor+-

As e$plained in +%he !arren Buffett !ay& by )obert 'agstrom, these are some of the key

questions that you must answer to understand the business of a company.

7uestions you #ust ans'er to un)erstan) a co#$any.s

6usiness

,et&s discuss them in some detail here.

Guestions on the core business

1+ Is the 6usiness si#$le an) un)erstan)a6le?

0ever invest in a business you do not understand, for you can&t see the future

opportunities and challenges before they arise.

2+ 8oes the 6usiness have a consistent o$eratin history?

.ast performance is no guarantee for future success, but it shows if a business can

operate under varying business conditions.

2+ 8oes the 6usiness have (avoura6le lon ter# $ros$ects?

+*ustainable business& is the key word here. *tay away from companies that operate on

trends and fads that can go out1dated in the future. ,ook for business that can sustain in

the long term.

Guestions on management quality

9+ Is #anae#ent rational?

0ow this is a very important part of an investor&s business analysis. %he rationality of the

management and its ability to deploy cash in a profitable manner is what separates a

good business from a bad one.

:+ Is #anae#ent can)i) %(rank& 'ith its sharehol)ers?

"ou don&t want to get into a future *atyam, right( ,ook for managers that admit mistakes

and take complete responsibility of their actions.

;+ 8oes #anae#ent resist the institutional i#$erative?

nstitutional imperative is the need for managers to act like their peers, no matter how

irrational their actions may seem. Avoid managers who have the tendency to give in to

peer pressure.

Guestions on financial position

<+ What is the return on e*uity?

As we will understand later, return on equity is one of the most important metric for

evaluating the profitability of companies. Earnings can be manipulated, but return on

equity will show how worthy a business is.

=+ What are the $ro(it #arins?

A company that can convert its sales into profits is a successful business. %he key is to

keep costs at the minimum, and go for higher profits instead of higher market share.

Avoid companies with low margins.

!e will discuss all these above1mentioned points in the subsequent lessons of +Halue

nvesting for *mart .eople&. %ill then, /ust remember what Buffett saidF

!I( a 6usiness )oes 'ell, the stock eventually (ollo's+-

Lesson #9: >no' Your Circle o( Co#$etence,

an) Stay Well Within It

".hat did #ou stud# in #our college$ Ravi'( I asked m# friend*

"-ou know Vishal that I am a doctor% .h# are #ou asking this unintelligent /uestion'( Ravi looked at me

with disgust* 0e was alread# disappointed seeing his stocks crash and savings wiped out* 1nd now he

had to face such /uestions from me*

"2h oka#$ so #ou studied how medicines work on a human bod#$ right' &ut what made #ou invest in a

banking compan# then' 3o #ou know how a bank works'(

"No Vishal% &ut are #ou telling me that a doctor can+t invest in a banking stock'(

"No$ I am not sa#ing that% .hat I am sa#ing is that #ou must not invest in a banking stock if #ou don+t

understand how a bank works*(

Ravi looked with confusion at me as I continued$ "If #ou don+t know wh# rising interest rates suggest and

how it is different from what rising blood pressure indicates$ #ou have no right investing in a banking

stock*(

"ou see, we generally do not know the answers to questions from sub/ects we have not studied in the

past. And we are humble in accepting our ignorance on such sub/ects.

But things get different when it comes to investing in the stock markets. !e have no qualms in going

beyond the boundaries of what we know.

!e have no doubts before treading beyond our +circle of competence&.

Aor most investors, investing outside their +circle of competence& is what creates the ma$imum losses.

What.s your ?circle o( co#$etence.?

n simple terms, your circle of competence with respect to investing defines your understanding about

certain businesses.

%he businesses that you understand fall within the circle, and the ones you don&t understand fall outside

it.

As !arren Buffett, the world&s most successful investor ever, has said so oftenF

!You )on.t have to 6e an e@$ert on every co#$any, or even

#any+ You only have to 6e a6le to evaluate co#$anies 'ithin

your circle o( co#$etence+ The siAe o( that circle is not very

i#$ortantB kno'in its 6oun)aries, ho'ever, is vital+-

%his means that you as an investor need to restrict yourself to the businesses you know # businesses

you can understand.

Dnderstanding one&s circle of competence is a very necessary discipline in investing. %hose who do not

do this are left to suffer.

8ra' your o'n circle as /u((ett )i) his4

Buffett&s investing process involved creating three lists of companies # n, Eut, and %oo 'ard.

/u((ett.s List o( Co#$anies

%his was his way of sticking to his circle of competence, however small it was.

As he said, ;!e have a ton of doubts on all kinds of things, and we /ust forget about those.<

nteresting, isn&t it(

But then

The key i)ea 6ehin) the circle o( co#$etence is not its siAe C the

nu#6er o( 6usinesses you can un)erstan) C 6ut your

a'areness a6out its siAe C the nu#6er o( 6usinesses ?you kno'.

you can un)erstan)+

%his means that a simple and understandable business is one within your +circle of competence&.

t isn&t important how big that circle is. t is important how well you have defined its perimeter.

A business will be +within& your circle of competence if you fully understand the underlying economics of

itF

'ow it works(

!hat drives its growth(

!hat makes it profitable(

'ow does it stand against its competitors(

'ow does it manage its raw material costs(

"ou need to have the answers to such questions, and others like these to make sure that you

understand the business. %o invest in something you do not understand can have disastrous

consequences.

Ask your doctor friend who invested in dotcom companies in @::: without understating what the

underlying businesses were.

Er ask your software engineer cousin who invested in real estate companies in late @::6, without

understating the huge risks that lied on the balance sheets of these companies.

f you can&t find businesses within your circle of competence, don&t /ust e$pand the circleor at least

spend some time studying industries outside your circle before crossing the boundaries.

,esson I=F Jnow %he ,anguage of Business

It isn.t rocket scienceD

;!hen in )ome, do as the )omans do,< goes the famous saying. !hat this saying suggests is that you

need to know the language and customs of people when you visit an unknown society. Boing so is

polite, and also advantageous.

%he same holds true when you enter the +investing society&. Before you enter, your gate pass must show

that you understand the language of business.

And what&s the language of business( 0umbers.

0umbers speak the language of business.

f you don&t understand the numbers that businesses use to communicate with you, the investor, the

investing society can be like a maCe. "ou won&t know where you are, and you won&t know how to come

out in case of a fire.

But believe me, if you can read a nutrition label on your bo$ of corn flakes, or you know how to read

your home loan statement, you can learn to read basic financial statements.

%he basics aren&t difficult and they aren&t rocket science.

!e all remember Kuba 7ooding Lr.&s immortal line from the movie Lerry Maguire, ;*how me the

money-<

%hat&s what financial statements do.

%hese statements appear in the company&s annual report, and are broadly classified into three

categoriesF

1+ /alance Sheet

t is also known as the *tatement of Ainancial .osition and reports on a company&s assets, liabilities,

and equity >also known as shareholders& funds? at a given point in time.

%he assets side of a balance sheet shows what a business +owns& # the factory, building, car, machines,

computers, etc. %he liabilities side represents what a business +owes&.

Assume you bought a house using a housing loan, and also put in some money from your own pocket.

n this case, your house will fall on the asset side of your personal balance sheet. %he housing loan will

be a liability. %he money you infused from your own pocket will be your equity.

%here are several others assets and liabilities that are included in a balance sheet, as you can see in

the following image of an actual balance sheet. .ick up a high school accounting book, and you can

learn it all from there.

Sa#$le /alance Sheet

n simple terms, a balance sheet shows how a company stands at a given moment. %here is no such

thing as a balance sheet covering the year @:9:. t can only be for a single date, for e$ample, March 29,

@:9:.

2+ 1ro(it E Loss State#ent

Also known as the *tatement of Komprehensive ncome, the .rofit and ,oss statement >or a .M,?

reports on a company&s income, e$penses, and profits over a period of time.

*o if you start a business manufacturing televisions, all the money you spend on buying raw materials

for manufacturing television sets, and all money you earn selling them in a year will come in the .M,.

Sa#$le 1EL State#ent

2+ Cash Flo' State#ent

%he cash flow statement is the most important of all statements, because it shows the movement >inflow

and outflow? of all cash during a year. And cash, as you must know, is the most precious resource for a

business.

Sa#$le Cash Flo' State#ent

Ho' these state#ents hel$?

*o these were the three key financial statements through which businesses talk to investors. %hese

statements help businesses showcaseF

9. .erformance during the year gone by # !hether the year was a good one of bad one for the

company.

@. 'ow strong the business is # %he stronger a business, the more capable it is to face slowdown

and competition.

2. %he level of profitability # a highly profitable business gets the ma$imum investor attention.

3. !hether the business is guCCling cash or releasing a lot of it # %he former type of business is

hated by intelligent investors, and the latter loved.

%he ability to read financial statements and understand what they convey will open up several areas for

you to analyse stocks, buy the good ones, and ignore the bad ones.

By knowing how to read and analyse financial statements, you will be able toF

9. Dnderstand how a specific company has performed in the past.

@. Dnderstand whether the company is doing a profitable business or is running loss1making

operations.

2. *eparate well1performing companies from the bad ones that are losing money for

shareholders.

3. Jnow if a company is using faulty accounting to inflate its sales andNor profits.

=. )ealise that some stocks you already own in your portfolio, are actually dud businesses that

are doomed to fail.

"es, this fifth realisation is the most striking aspect of your understanding of the financial statements.

have met several investors over the past few years # some from within my e$tended family, some from

among my previous company&s clients, and some /ust by the way.

!hat has amaCed me is that a ma/ority of these investors # and several have been old timers in the

stock markets # know little or nothing about identifying a good balance sheet from a bad one. And it&s

not by chance that almost all these investors have a large proportion of their portfolios invested in bad

stocksNweak companies.

But don&t blame them for their ignorance, which they have misunderstood for bliss all these years.

%heir source of stock ideas have been brokers, friends and relatives # people whom you can consider

least likely to tell you how a goodNbad balance sheet looks like.

.robably you might have been one of their types. And if that&s the case, don&t worry.

!e have /ust studied the key financial statements that you need to read in a company&s annual report to

make out how it is doing.

0ow, let us move a bit deeper, and understand some key financial terms and ratios that you must know

in order to make a /udgement on a good business versus a bad business.

%his is going to be a pretty long lesson, so you can read it over the ne$t few days before you get the

ne$t lesson. !hile the sub/ect is boring by nature, &ve tried to make it as easy and interesting as

possible.

*o let&s get started.

1+ SalesGHevenue

*ales is what a company earns by selling its products or services. Aor e$ample, if Kompany A sells 9::

units of a product at )s =: per unit, its sales will be )s =,::: >or 9:: multiplied by =:?.

!hile the sales figure is /ust the entry point to your understanding of a company&s financials, it is

important to know how the company is doing on this front. Aor, without sales, there won&t be any

business.

%racking a company&s sales growth over a number of years >at least 9: years? gives a good indication of

its siCe and stability. A company with a stable growth in sales over a 9:1year period is generally

considered better as compared to a company that has a rapid yet volatile sales growth history.

2+ Iet 1ro(it

%his is +the& figure most investors look out for in a company&s .M, account. 0et profit represents the

money left over with a company after reducing all kinds of e$penses from its sales. 0et profit is akin to

your monthly savings after paying for all household e$penses from your monthly income. ,ike sales,

looking at the long term performance of net profits gives a good indication of a company&s financial

health and stability.

2+ ,$eratin #arin, or 1ro(ita6ility

.rofit >like net profit, as we discussed above? is what a business earns after it reduces all e$penses from

its sales. But profit is a number and does not e$plain much on an as1is basis. !hat is more important for

you as an investor is the +profitability +, which is equal to the money a business makes for every rupee of

its sales.

Assume Kompany A sells toys worth )s 9:: in a year and earns a profit of )s 3:. Kompany B sells toys

worth )s =: in the same year and earns a profit of )s 2:. 'ere, the profit of company A is higher than

profit of company B >3: O 2:?.

But when to comes to profitability, that of company B is better than that of company A >2: divided by =:

is greater than 3: divided by 9::?. Always remember, profitability is more important than profit in

understanding how a business is doing.

n highly competitive industries, a more profitable business has a greater fle$ibility to reduce prices to

fight competition. A more profitable business also generates more cash to spend on its e$pansion and

pay dividends to its shareholders.

9+ 8e$reciation

All the fi$ed assets, e$cept land, that a company owns >like plant, machinery, computers, automobiles,

etc.? are sub/ect to a gradual loss of value through age and use. %he allowance made for this loss of

value is known as depreciation >or obsolescence, depletion, and amortiCation?.

%he amount of depreciation to be charged each year is based on the value of the property >usually

taken at the cost it was bought at?, its e$pected life, and the salvage or scrap value when it is retired.

,et&s understand with an e$ample. "ou buy a car for your personal use at a cost of )s =::,:::. %he

e$pected life of this car is = years, and your e$pected scrap value is )s =:,::: >at which it can be sold

off after = years?. n this case, the annual depreciation charge will be 9N=th of )s 3=:,::: >)s =::,:::

minus )s =:,:::?. %his gives )s P:,::: as the annual depreciation charge. A company will reduce such

an amount from its operating profits every year.

'owever, note one important thing here. Bepreciation is a non1cash charge i.e., a company does not

have to +pay& depreciation to anyone. t only needs to reduce the depreciation amount from its operating

profits.

0ow, since it reduces this amount from its operating profits, the ta$ it has to pay to the government also

gets reduced >as net profit before ta$ comes down due to reduction of depreciation e$penses from the

operating profit. Money so saved can be used by the company to replace the depreciated asset after the

end of its useful life.

%his is the core reason behind the concept of depreciation # it enables companies to save ta$es every

year so that it can accumulate money so saved to buy replace its old assets after cross their useful

lives.

Note: In case #ou have an# doubts4problems understanding the financial concepts as e)plained in this

lesson$ please fee free to send me a message using the 5ontact page$ and I+ll be able to e)plain #ou

further*

:+ 3*uity

Also known as shareholders& funds or book value, equity is the money shareholders >like you? put in the

business. Equity is a very important concept in financial analysis because a very rough relationship

tends to e$ist between the amount invested in a business and its earnings.

t is true that in many individual cases we find companies with small book values earning large profits,

while others with large book values earn little or nothing. "et, as Ben/amin 7raham suggests in his 6he

Interpretation of 7inancial Statements >one book you must read to understand financial statements?, in

these cases some attention must be given to the book value situation, for there is always a possibility

that large earnings on book valueNinvested capital may attract competition and thus prove temporary.

;+ 8e6t

Equity is what belongs to the owners of the business >shareholders like you?, debt is what is borrowed

>from banks and others? by the owners of the business. !hile the owners of equity >shareholders? have

a claim on the company&s earnings >by way of dividends?, those that e$tend debt to companies >like

banks? receive interest payments every year.

!hile debt isn&t a dangerous figure on the balance sheet, too much debt can be a cause of concern.

%his is especially when this debt is not backed by almost equal or higher amount of equity.

*o, as a thumb rule, a debt to equity ratio >BNE? of higher than one, and consistently for several years, is

a cause for concern. 'owever, a reducing level of BNE, or one that is already less than :.=$ >or =:4?, is

a comfortable situation.

<+ Workin Ca$ital

As you can see in the sample balance sheet as shown above, there are two items named +current

assets& and current liabilities&.

Kurrent assets are those that are immediately convertible into cash or which, in due course of business,

tend to be converted into cash within a reasonably short time >ma$imum one year?. *uch assets includeF

9. Kash and equivalents

@. )eceivables >money that a company has to receive from its customers for the goods or

services that have already been sold?

2. nventories >goods that the company has produced but are waiting to be sold, or raw materials

and semi1finished goods that the company holds in its stock?

*ince these assets can be converted into cash in a short time, they are collectively known as +current

assets&.

En the other side, i.e., on the liability side of the balance sheet lie +current liabilities& that represent the

amount a company owes to its vendors who have supplied it with raw materials to semi1finished goods,

and are waiting to be paid. *uch vendors are known as creditors of the company. Apart from creditors,

all the debts of the company that will be repaid within one year are classified under current liabilities.

0ow, coming to +working capital&, it is the figure arrived at by reducing current liabilities from current

assets. *o,

.orking capital 8 5urrent 1ssets 9 5urrent :iabilities

!orking capital is a consideration of ma/or importance in determining the financial strength of a

manufacturing company. %his is because the study of working capital results in knowing whether the

company is in a position to carry on its normal day1to1day business comfortably without any financial

constraints.

*hortage of working capital >when current assets that can be converted to cash and not enough to cover

current liabilities that must be paid out soon? results in slow payment of bills.

%his results in poor credit rating of the company, which subsequently means that the company not /ust

needs to borrow short term funds to meet its day1to1day e$penses, it also has to pay higher interest in

the money so raised.

An important ratio you can work out here is the amount of working capital per rupee of sales. ,ower the

ratio, lower is the working capital requirement of the company, and the more financially strong it is.

Note: In case #ou have an# doubts4problems understanding the financial concepts as e)plained in this

lesson$ please fee free to send me a message using the 5ontact page$ and I+ll be able to e)plain #ou

further*

=+ Free Cash Flo'

Kash >as you can see in the balance sheet above? is what a business holds in banks and other

investments. But the concept of free cash flow >AKA? is entirely different.

AKA is what a business is left with at the end of every year after it takes care of its capital e$pansion

and working capital needs. *o if you look at the cash flow statement in the previous slide, the AKA will

be calculated asF

AKA Q Kash flow from operations # Kapital e$penditures

Q )s 2:==.6P lac # )s 6@@.92 lac

Q )s @222.55 lac

n simple terms, AKA tracks the money a business has generated by the end of each year. t&s the cash

that is left over with the company at the end of the year, after it pays all its bills and pays for any new

capital e$penditures. t is what it has left over to pay investors. And that is why AKA is one of the most

important numbers you must track as a shareholder in a company.

J+ Heturn on e*uity

)eturn on equity, or )EE, is one of the most useful tools to determine how well management creates

value for shareholders. %he formula isF

R2; 8 Net profit 4 ;/uit#

!e&ve already discussed both +net profit& and +equity& in this lesson, so you must not have any problem

calculating the )EE.

%he legendary investor, !arren Buffett believes that the return that a company gets on its equity is one

of the most important factors in making successful stock investments.

As such, the higher the )EE, the better it is for shareholders, as it indicates that the management has

allocated capital >equity? in a profitable way.

A higher )EE also means that surplus funds can be invested to improve business operations without

the owners of the business >shareholders? having to invest more capital.

t also means that there is less need to borrow, which is a positive sign for the business >we read above

the perils of borrowing more?.

1K+ 8ivi)en)

Ene of the most loved words in a shareholder&s dictionary, +dividend& is a payment made to the

shareholders >owners? of a company, out of the company&s profits. Most ndian companies usually pay

dividends on a yearly basis while some also do it quarterly.

*o why is dividend important( *imply because it comes out of a company&s profits. Er, more

specifically, its free cash flow. A consistent, rising dividend payment is usually a hallmark of a solid, well1

run business that generates substantial, consistent cash flow.

All things equal, that equates to a relatively stable business and a stock that might be a little less volatile

than the market at1large. n other words, companies that pay consistent and rising dividends are usually

lower risk than companies that don&t pay dividends.

*ee, these are some of the basic yet among the more important concepts that you must know as an

investor. "ou will get data for all these terms and ratios in a company&s annual report.

"our /ust need to pull out the relevant data, make necessary calculations, and check for yourself the

financial health of the company.

Anyways, won&t go further into the sub/ect here, as that would require the space of a book.

!hat you can do is pick up a high school accounting book or basic book on finance and that will teach

you everything you&ll need to know about understanding financial statements.

"ou might ask # s there a way can invest without understanding financial statements(

Ef course, there&s a way. But it&s very much like climbing Mount Everest without knowing

mountaineering.

"ou might still reach the peak, but the chances are miniscule.

"ou know that, don&t you(

Lesson #;: It.s "ll "6out The Intrinsic Lalue

Kan you compare the price of a Mercedes *1Klass and that of a Maruti18::(

Ef course, one costs )s 5: lac while the other costs less than )s 2 lac. And you can compare )s 5: lac

with )s 2 lac.

But then, is that the right comparison( mean, isn&t this the same as comparing apples to oranges(

%he two cars have different values in terms of lu$ury, safety, quality, and brand value. *o comparing

them /ust on their prices won&t be the right idea. "ou need to see the difference in their values.

After all

!1rice is 'hat you $ay+ Lalue is 'hat you et+-

%he same goes for stocks. A )s =: stock might be considered cheaper than a )s =:: stock. But that&s

an incorrect way of looking at it, /ust like comparing the price of a Mercedes with a Maruti18::.

As we learnt in the third lesson, a stock is not a piece of paper but a share in a business. *o it is

important to compare a stock&s price with the company&s business value >and not with anything else,

ever-? to ascertain whether it is cheap or e$pensive as compared to another stock, and also in isolation.

%he )s =: stock might be backed by a business whose value is )s @= # thus a price1to1value of @ times

>=: divided by @=?. En the other hand, the )s =:: stock might be backed by a business whose value is

)s 9,::: # thus a price1to1value of /ust :.= times >=:: divided by 9,:::?.

!hat this means is that the first stock is priced at @ times the business value, while the second stock is

priced at thus :.= times >or =:4? the business value.

0ow, which is cheaper( %he )s =: stock, or the )s =:: stock( Based on this short analysis, the )s =::

stock definitely looks cheaper. sn&t it(

Anyways, the idea of this discussion is to bring to light the key investing concept of +intrinsic value&. n

simpler terms, you can also call it the +core business value&.

*o, why you should calculate intrinsic value(

!To calculate intrinsic value is vital+ It is one secret to

success(ul investin that you can.t a((or) to inore+ You nee) to

calculate the intrinsic value 6ecause you #ust not 6uy any

stock at any $rice+-

%he price you are paying is the ultimate determinant for the rate of return that you&ll be earning from a

stock. %he higher the price you pay for it, the lower will be your return. As simple as that-

And that is why you need to know how much a stock is really worth. Ence you know its intrinsic value,

you can identify if the stock is trading cheap or e$pensive. A very high stock price as compared to the

business& intrinsic value means that the stock is e$pensive >like our first stock above?. And a low price

as compared to the intrinsic value means that the stock is cheap >like the second stock as discussed

above?.

%hese are general rules of thumb. !e will understand the specifics of how much price to intrinsic value

makes a stock cheap or e$pensive in the ne$t two lessons. And we will also study the different ways you

can calculate the intrinsic value of a stock.

But for starters, remember that intrinsic value is an estimate rather than a precise figure. And it is an

estimate that must be changed with changes in the variables that are used to calculate it >don&t worry,

we will study all that in the ne$t two lessons-?

Lesson #7: Calculating Intrinsic Value-

Part I

Moving ahead from the previous lesson on the basics and purpose of intrinsic value,

lets now move a bit further into this very important subject for value investors.

Lets learn something about the different ways you can calculate the intrinsic value of

a stock.

But first, heres the easiest and the most important definition of intrinsic value that

youll come across anywhere. This is what arren Buffett wrote to his companys

shareholders in !""#$

%e define intrinsic value as the discounted value of the cash that can be taken out

of a business during its remaining life.&

'n simpler terms, intrinsic value of an asset is the discounted value of the e(pected

cash flows that that asset can earn over its life.

Cash I know, ut whats the discounted value!

'n his definition of intrinsic value, Buffett mentions that the intrinsic value is nothing

but the )discounted value of cash that can be taken out of a business.

Lets understand these two key terms *

!. +ash

,. -iscounted value

Most investors believe that understanding the term )cash is akin to understanding the

.nglish alphabets.

But your see, cash isnt as simple as +/0/1/2.

+ash is not what a company earns when it sells its products or services. 0nd it is

neither the profits a company makes during the year after paying its operating

e(penses 3like raw material costs, employee salaries, sales 4 marketing costs,

administrative costs5, interest, depreciation and ta(es.

+ash is beyond these * sales and profits.

Cash is what re"ains with a usiness at the end of a #ear and after $a#ing for

the cost of an#thing and ever#thing a usiness u#s and $a#s for during the #ear%

1o it is a much/refined form of profits. But it is what remains with a company after

also paying off the dividends, cost of new plant 4 machinery and buildings 3or capital

cost5, and working capital changes 3and adding back depreciation which is a non/cash

charge5.

This cash is also known as )free cash flow, and it is the ultimate measure of a

companys profitability.

By looking at free cash flow, you can see whether a company is actually making any

money and you can get a sense of what its spending its money on.

Lets now turn our attention to the second critical element of Buffetts definition * the

)discounted value.

-iscounted value is used to define the present value of future cash flows. 1o it is also

known as the )present value.

Let us understand this concept using a simple e(ample.

'f ' offer you 6s !77,777 and you could receive it now or in !7 years, when would

you take it8 Most likely you would say, %9ow.&

This is because you already know that money received now is more valuable to you

than money received in the future, simply because you can invest this money 36s

!77,7775 to earn interest on it for the ne(t !7 years.

9ow assume that the interest rate that a bank is willing to offer you for 6s !77,777

that you deposit it there now is !7:. 1o your cash flow for the ne(t !7 years will look

like this$

PV when cash flows are constant &as in ank de$osits'

; 0ssuming interest rate of !7:, which will also be the discount rate

hat this table shows is that if you deposit 6s !77,777 in a bank at !7: interest rate,

you will earn 6s !7,777 as interest 3cash flow5 for the ne(t !7 years, plus your capital

36s !77,7775 at the end of the tenth year.

9ow, when you calculate the present value of each of these cash flows 3as shown in

column +5, and total it, the sum comes to 6s !77,777, which is the present value of all

these cash flows 3that total to 6s ,77,777 over this !7 year period5.

1o, as you can see from the e(ample, while you receive a total of 6s ,77,777 over

these !7 years, when you calculate the present value, the number comes to 6s !77,777

or e(actly what you had deposited in the bank.

9ow, the <uestion is, if the present value of 6s !77,777 deposited for !7 years at !7:

per year is 6s !77,777, why would someone deposit or invest money at all8

9ice <uestion, ' must say.

But please know that this is a very simplified e(planation of present value. 'n reality,

what it means is that when ' offer you 6s !77,777 and you want it now, you have the

fle(ibility to invest in a business where you e(pect cash flows to grow by !7: per

annum, instead of depositing in a bank where the cash flows remain at !7,777 each

year for the ne(t !7 years.

PV when cash flows are growing &as in a usiness'

; 0ssuming annual growth in csh flow of !7:, and discount rate of !7:

0s you can see from the table above, 6s !77,777 invested in a business earned you a

cash flow of 6s !7,777 in the first year, which is e(actly same as the bank deposit

earned you in the first year. But from second year onwards, this cash flow grew by

!7: every year.

1o at the end of !7 years, your total cash inflow totalled 6s ,=",>?#, and the present

value of this cash flow stood at 6s !,",#@>.

1o, while you invest 6s !77,777 today, the present value of your total cash flows

stands higher by 6s ,",#@>, which makes it a profitable investment.

This calculation of 6s !,",#@> minus 6s !77,777 is called as )net present value or

9AB and is at the heart if all business decisions.

0 company takes up a project or enters a new business only when the 9AB is a

positive number, as in the second e(ample above. 'f the 9AB is Cero, like in the first

e(ample where you deposited 6s !77,777 and the present value of all cash flows for

!7 years was 6s !77,777, it is a neutral case.

0s an investor, you must invest in stocks of businesses where you e(pect to earn a

positive 9AB over your investment horiCon.

0nd you can calculate the 9AB using the free cash flows a business is estimated to

earn over the ne(t !7 years.

Dnow that the 6s !,",#@> that we calculated as the present value of future cash flows,

is the )intrinsic value of this business. 0nd since this is higher than the original

investment of 6s !77,777, it makes for a good investment opportunity if the business

were to be listed on the stock e(changes.

2ere is the formula for calculation of discounted cash flow 3-+E5 or present value

3AB5 of future cash flows$

PV ( C)* + &*,k' , C)- + &*,k'- , . /0C) + &k - g'1 + &*,k'n-*

here$

PV = present value

CFi = cash flow in year i

k = discount rate

g = growth rate assumption in perpetuity beyond terminal year

TCF = the terminal year cash flow

n = the number of periods in the valuation model including the terminal year

'f you were to go through the -+E calculation e(cel, there are three key variables you

need to calculate the -+E value of a company$

!. 2sti"ates of growth in future free cash flows &)C)': Frowth in E+E over

say the ne(t !7 years, using last > years average E+E as the starting point.

3+lick here to see the calculation of E+E from a companys cash flow

statement5

,. 0er"inal growth rate: 6ate of growth in E+E after the !7th year and till

infinity.

>. 3iscount rate: 6ate at which the future cash flows must be discounted to

bring them to present value.

9ow there are three key issues that arise with these variables$

!. hat growth rate to assume for future E+E estimates8

,. hat discount rate to assume8

>. hat terminal growth rate to assume8

Let me help you with how do ' answer these <uestions for calculating -+E valuations

myself.

*% 4ow do I $redict future )C)!

0s an analyst, ' always found it difficult to predict growth rate in volumes, sales and

profits. But ' still tried to do that * after all, ' was paid to predict the futureG

2owever, as 've realised over the years, trying to find a perfect answer to the

<uestion %hat growth rate to assume8& is like trying to find a %perfect couple&. 9one

e(istG

Fiven this limitation of trying to predict the future, 've changed my way of analysis

to value stocks based on the present data rather than what will happen in the future.

Thats why ' now dont try be accurate with my E+E growth estimates. ' just try to be

reasonable and use common sense.

Eor most stocks, ' generally perform a !7/year ,/stage -+E analysis. hat this means

is that ' assume a particular growth rate for the first five years of my E+E calculations

3as you can see in my -+E e(cel5, and then another number for the ne(t five years.

' rarely go above !7/!,: annual growth rate for the first five years, and @/H: for the

ne(t five.

The best practice is to keep growth rates as low as possible.

'f the company looks undervalued with just =: annual growth in E+E over the ne(t

!7 years, you have more upside than downside.

The higher you set the growth rate, the higher you set up the downside potential.

To repeat, while assuming E+E growth rate for the future, just be reasonable and use

common sense.

0 caveat * dont take cues from the past as the past performance is rarely repeated in

the future.

-% 4ow "uch discount rate do I assu"e!

'n simple words, discount rate is the rate at which you must discount the future cash

flows 3as estimated using above growth assumptions5 to the present value.

hy present value8 Because we are trying to compare the companys intrinsic value

with its stock price %now&I.in the present.

Just to help with an e(ample, what price would you pay for an investment today if

company 0B+s future cash flow is worth 6s !,777 after ! year8

'f the discount rate is =:, you must pay 6s "=, now 3!777K!.7=5.

'f the discount rate is !7:, you must pay 6s "7" now 3!777K!.!5.

'f the discount rate is !=:, you must pay 6s H?7 now 3!777K!.!=5.

'n other words, the higher the discount rate you assume, the lower you must pay for

the stock as of now.

Einance te(tbooks and e(perts would tell you to use +apital 0sset Aricing Model

3+0AM5 to calculate discount rate. ' used +0AM myself to arrive at discount rates in

the past.

2owever, if you are worried what +0AM is, dont be because you can avoid knowing

about it and still live happily ever afterI.like ' am living.

Look at discount rate as the %annual rate of return& you want to earn from the stock.

'n other words, if you are looking to invest in a business that has comparatively higher

3business5 risk than other businesses 3like in case of most mid and small cap stocks5,

you may want to earn a !=: annual return from it.

Eor valuing such businesses, take !=: as the discount rate.

'n case of relatively safer businesses 3think 'nfosys, 2LL, +olgate5, earning around

!7/!,: annual return over the long term is a good e(pectation 3because these

businesses will also provide some stability to your portfolio during bad times5.

Eor valuing such businesses, take !7/!,: as the discount rate.

Better still, assume a constant discount rate for all companies. ' am gradually turning

to this model * of taking a constant !=: discount rate for all kind of businesses 3safe

or risky5.

%But this way, how would you adjust for the risk in each business8& you may ask.

1imple * adjust the risk in E+E growth estimates. That is where the real risk lies,

right8

5% 4ow "uch ter"inal growth rate do I assu"e!

0s ' mentioned above, ' do a !7/year E+E calculation for arriving at a stocks -+E

valuation.

But the companies 'm valuing wont cease to e(ist after !7 year. 1ome will survive

for !7 more years, some for ,7 years, and very few for =7 years.

That is where the concept of %terminal value& 3or the value after !7th year and till

eternity5 comes into picture.

The terminal value ' generally assume lies between 7: and ,:. 0ssuming higher

terminal value 3M>/#:5 is like assuming the company to grow bigger than the world

economy in the infinity, which isnt possible.

1o the idea is to keep it as low as possible. Best to keep it at 7:.

Lesson #6: Calculating Intrinsic Value-

Part II

'f you are a reader of financial newspapers, or watch business channels, you must

have come across stock market e(perts and analysts blabbering terms like )AK. or

)AKBB.

Nou must have even cursed the speaker for using such difficult terms that bounced

above your head. 'f thats the case, you are not alone.

' have come across many investors who have been in the market for years, but who

still do not understand the basic difference between )price and )value 3the intrinsic

value as we discussed earlier5, forget understanding terms like AK. or AKBB.

But like investing isnt difficult 3its just made out to be difficult5, understanding these

terms and their relevance isnt hard as well.

1o lets start with the superstar of them all * the AK. ratio or price to earnings ratio.

hy superstar8 This is because AK. is by far the most popular valuation metric used

by investors and analysts to assign an intrinsic value to a stock.

The AK. ratio of a stock is a simple tool for measuring the markets temperature. 't is

calculated by dividing a stocks price by the companys earnings per share or .A1.

P/E atio = Price per share / !nnual earnings per share

1o if a companys latest years earnings 3or profits5 per share stand at 6s !7, and its

stock is trading at 6s !,7, the AK. of this stock is !, times. 'f the same stock moves

up to 6s !=7 while the earnings of the company remain at 6s !7, the AK. moves up to

!= times. 1o both the change in a stocks price and the companys earnings define

how a AK. ratio moves.

0s a general rule of thumb, higher a AK., more e(pensive is a stock as investors are

paying more for each rupee of a companys earnings.

P+2 7 8hats the right nu"er!

The <uestion is * what is the right AK. ratio that an investor must pay for a stock8

The answer * it depends. 't depends on the companys past track record, its business

strength, its financial performance, its management <uality, its competitive position,

and its past AK..

0 safe company with slow yet steady growing earnings 3like one from the consumer

goods sector5 can easily command a AK. of ,7/,= times across several years.

On the other hand, a fast growing company can sometimes trade at a AK. of >7/#7

times.

1o the point is that the AK. of a stock depends on the companys <uality as also the

overall market sentiment towards that stock.

0nd given this * that market sentiment also has a role to play in the determination of

the AK. * it isnt a perfect way to calculate intrinsic value despite the importance it

gets.

'n fact, when you calculate a companys intrinsic value using the AK., dont forget to

cross/check with the value you get using the -+E calculation 3which we discussed in

the previous lesson5.

P+2 close cousin 7 P+9V

Book value gets a lot of attention like earnings. This is simply because this number is

widely available and is very easy to calculate.

Book value of a company is simply its net worth or e<uity. Book value per share is the

net worth divided by the number of shares outstanding.

Arice to book value is thus$

Price to book value "P/#V$ = Price per share divided by #ook value per share

Before we move further, lets simplify the calculation of book value.

2ere is the table showing the latest balance sheet of 1waraj .ngines.

Look at the top of this Balance 1heet. The formula to calculate book value is$

Book Balue P .<uity capital 305 Q 6eserves 4 1urplus 3B5

P 6s !,#!."H crore Q 6s !>"?". "# crore

P 6s !=,,!.", crore

Lets now understand what book value e(actly means.

'n most cases, book value is an artificial value that appears on the liability side of a

balance sheet 3as shown above5.

0lso known as shareholders e<uity, book value represents what investors have put

into a business, including the companys undistributed earnings 3part of profits that is

not paid out as dividends5.

't is assumed that if the company were to li<uidate 3close down its business and sell

its assets5, it would receive in cash the value which is at least e<ual to its book value *

the value at which its tangible assets are carried on the books.

2owever, as a matter of fact, if the company were actually li<uidated, the value of the

assets would most probably be much less than their book value as shown on the

balance sheet 3and thus the book value as shown on the balance sheet is an artificial

value5.

The sale of inventory would most likely be at some loss. 0nd the fi(ed assets will also

be sold at a substantially lower price than what these are shown in the book 3balance

sheet5.

'n general terms, book value is considered a measure of what shareholders can take

out from a company when it is li<uidated.

'n reality, book value is the money that shareholders have )put into the business.

0nd what they get in a business li<uidation is mostly less than what they have put in.

The book value is of some importance in analysis because a very rough relationship

tends to e(ist between the amount invested in a business and its average earnings

3calculated as return on e<uity5.

't is true that in many individual cases, we find companies with small book values

earning large profits, while others with large book values earn little or nothing.

Net in these cases, some attention must be given to the book value situation, for there

is always a possibility that large earnings on the invested capital may attract

competition and thus prove temporary.

't is also possible that companies with large book values, not earning meaningful

profits now, may later be made more productive.

Overall, AKBB is often used to gauge a stocks relative value.

0 company trading at a low AKBB, particularly when compared to other companies in

its industry, is thought to be undervalued relative to its share price.

2owever, a low AKBB could also be an indication of negative investor confidence

towards the company, most likely for the reason when the company is not earning

good returns on book value.

0s such, when used in calculating the intrinsic value of a stock, AKBB must be

coupled with metrics such as AK. and 6eturn on .<uity to get a better snapshot of the

company as a whole.

Lesson #:: Insure ;our Invest"ents

8ith a <argin of safet#

Before we move ahead into this ninth lesson, just answer NesK9o to these five simple

<uestions$

!. -o you own an insurance policy8

,. -o you save money8

>. -o you keep e(tra cash 3more than you will need5 with you when you travel8

#. -o you reach the railway station an hour before the scheduled departure of

your train8

=. -o you believe that prevention is better than cure8

'f you answer )Nes to all or most of the above <uestions, you are a practitioner of

)margin of safety.

Nou keep some e(tra time and money on your hand in case things do not go as

planned * like if you run out of cash during your travel, or you get stuck in a traffic

jam while going to the catch a train.

The same )margin of safety applies even to stock market investing.

'n fact, these are often considered the three most important words in investing.

The principle of margin of safety in investing was first introduced by the )father of

value investing Benjamin Fraham.

'n simple terms, for stocksI

=<argin of safet# if the difference etween the intrinsic value of a stock

and its "arket $rice%>

This principle suggests that you must buy a stock only when it is worth more than its

price in the market.

1o if a stock is trading at 6s !77 in the market, and you calculate the companys

intrinsic value as 6s !=7, you have a margin of safety of 6s =7 3!=7 minus !775. 'n

other terms, the stock is trading at a >>: discount to the companys intrinsic value.

'f the said stock is of a high <uality company, it is advisable to buy it at any price that

is H7: or lower than the companys intrinsic value 3any price lower than 6s !,75.

0nd if the said stock is of a company that is not an e(ceptional one 3but worthy

enough for investment5, you must not buy it for more than =7: of the intrinsic value

3only if the price is lower than 6s ?=5.

=8hat "argin of safet# does is that it $rotects #ou fro" $oor decisions

and downturns in the "arket%>

1o if you pay just 6s !77 for a stock that you believe is worth 6s !=7, even if your

analysis goes wrong and the stock is actually worth less than 6s !=7, your investment

will still be safe.

Fiven that the calculation of intrinsic value 3of 6s !=7 in this e(ample5 is subjective

in nature, it is always better to have a good margin of safety while buying a stock. 0

>7/#7: margin of safety is what Fraham recommends.

This disciplined pursuit of bargains 3stocks that are available for >7/#7: less than

their intrinsic values5 makes value investing very much a risk/averse approach.

But the greatest challenge for you as an investor is to maintain that re<uired

discipline.

0he tra$ of a rate race

Most of us generally fall in the trap of following the herd. 1o we buy stocks when the

prices are rising, just because we do not want to miss out on the paper profits that our

friends, colleagues, or relatives are making by betting on rising stocks.

But then, being a value investor means standing apart from the crowd, and

challenging conventional wisdom.

't can be very lonely being a value investor practising a concept like margin of safety.

But if you can do it with utmost discipline, you can earn great returns from the stock

markets over the long run.

ith respect to margin of safety, here is what arren Buffett, whom Fraham

considered his best student, has to say$

=8e insist on a "argin of safet# in our $urchase $rice% If we calculate

the value of a co""on stock to e onl# slightl# higher than its $rice,

were not interested in u#ing% 8e elieve this "argin-of-safet#

$rinci$le, so strongl# e"$hasi?ed # 9en @raha", to e the

cornerstone of invest"ent success%>

Buffett describes margin of safety concept using this e(ample * %hen you build a

bridge, you insist it can carry >7,777 pounds, but you only drive !7,777/pound trucks

across it. 0nd that same principle works in investing.&

4ow "uch "argin is good "argin!

+oming again to the <uestion of what is an ade<uate margin of safety, the answer

varies from one investor to the ne(t. But it chiefly depends on *

!. 2ow much bad luck are you willing and able to tolerate8

,. 2ow much volatility in business values can you absorb8

>. hat is your tolerance for error8

'n short, it all boils down to how much you can afford to lose.

Losing some money is an inevitable part of investing. 'n fact, there is nothing you can

do to prevent it.

But to be a sensible and intelligent investor, you must take responsibility for ensuring

that you never lose most or all of your money.

Lsing the margin of safety concept, and by refusing to pay too much for an

investment, you minimise the chances that your wealth will ever disappear or

suddenly be destroyed.

To conclude, as Fraham reminds us, the intelligent investor must focus not just on

getting the analysis right. 2e must also insure against loss if his analysis turns out to

be wrong * as even the best analyses will be at least some of the time.

1o that was about margin of safety. Nou now know its relevance, right8

'n the ne(t 3tenth5 lesson, we will talk about a weird creature called Mr. Market, who

with his ever/changing moods, lures investors to make big investing mistakes.

But there is a way you as an investor can protect yourself from the whims of Mr.

Market. ell find )how in the ne(t lesson. 1o stay tuned.

Lesson #*A: 0he curious case of <r%

<arket

'magine yourself as a businessman, working in partnership with your friend. This

friend of yours is a strange fellow, but you have him as a partner just because of some

old family ties.

2is behaviour gets so worse that every day he appears in the office asking you to

either sell the entire business to him. Or buy the entire business from him. On both

such occasions, he also <uotes a price at which hell buy or sell the business.

0nother strange habit of your friend is that the prices he <uotes for buying or selling

the business change each day.

The day he is very optimistic about the future of this business, he will <uote a very

high price to buy or sell the business. On such days, he is ready to buy your share at a

very high price because he sees very bright prospects for the business. 0lternatively,

he is ready to sell his share of the business only at a high price.

Then there are days when he feels very depressed. On such days, he sees nothing but

trouble ahead for both business and the world. These are the occasions when he would

name a very low price, as he is terrified that if he does not do so, you would burden

him 3sell him5 with your share in the business.

'n both such cases, what would you do assuming that you arent as strange as your

friend8

'f you were a sensible businessman, you would not let his daily moods and prices

determine your view of the value of your interest in the business. Nou may be happy

to sell out to him when he <uotes you a ridiculously high price, and e<ually happy to

buy from him when his price is low.

But at the rest of the time, you would be wise enough to form your own ideas of the

value of your share in the business.

9ow replace your share in your own business with your share in someone elses

business that you own through stocks. 0nd replace your neurotic partner with the

)stock markets that offers you a different price daily for your stocks.

+all this friend as Mr. Market.

2ow much influence will Mr. Market have on your own independent view of the

stock you own8

Lsing the above e(ample, Mr. Markets ever/changing moods and ever/changing

prices must not force you into changing your view of the business. 0nd this must be

true of your stocks as well.

The above story is created using the parable of Mr. Market that was first told by

Benjamin Fraham in !"># in his )The 'ntelligent 'nvestor. .ven after almost eight

decades of being first introduced, Mr. Market remains a manic figure.

0nd just like when he was introduced, the prices <uoted by Mr. Market seem

reasonable, but often they are ridiculous.

0s an investor, you are free to either agree with his <uoted price and trade with him,

or to ignore him completely. Mr. Market wont mind this. 'nstead, he will be back the

following day to <uote another price.

The point is that you should not regard the whims of Mr. Market as determining the

value of the shares that you own. 'nstead, as Fraham suggests, you should profit from

market folly rather than participate in it.

Nou will be better off concentrating on the real life performance of the companies

whose stocks you own, rather than being too concerned with Mr. Markets often

irrational behaviour.

Lesson #**: 4e#, "ind #our ehaviourB

ere you ever punished in school for not behaving properly in the class8

'f you are like me, you must have e(perienced the happiness 3mi(ed with some

embarrassment5 of being )out/standing on a regular basisG But then, you must have

behaved well after that punishment.

1ometimes ' wonder if we as adults were always guided and punished by our teachers

for all our mistakes and mindless behaviour. Frowing up and moving out of school

gives us a lot of freedom to behave the way we want to. But then, for some of us, it

becomes a license to behave any which wayIeven at the cost of our own peace, and

money.

Talking about stock markets, the pundits will tell you that to learn to invest, you need

to read the theory books. Nou need to understand comple( accounting. Nou need to

know the jargons, the AK., the .BK.B-'T0, the 1OTA.

hat these pundits however fail to tell you is that before you get to all that investing

theory, you need to work on the practical. Nou need to study )yourselfIyour

behaviour.

8e are who we are.

Ibut our behaviour shapes us. 0nd as human research suggests, ?7: of our

behaviour is shaped by our e(periences 3the remaining >7: by our genes5.

This implies that whatever we have learnt about saving and investing from our parents

doesnt matter that much. hat matters is what we have e(perienced ourselves in our

lives and professions.

0he rain is a leaking oat

e call ourselves rational beings. The truth is that we arent rational but rationalising

beings.

The brain that sits on the top of our head isnt a flawless machine. Nes, it is powerful.

But it has its weaknesses. 'n everyday terms, we call such weaknesses as )biases.

The good part is that while we cannot e(change our brains with other people nor can

we upgrade it at a hardware shop, we can avoid mistakes that our biases cause by just

taking notice of them.

'ts just like getting into a boat. Before getting in, you would want to know about any

holes in it before you start paddling. 6ight8

Biases are such holes in our brains reasoning abilities. 0nd these biases can damage

our decision making.

2ere are five most common biases that we carry with us, and which can really have a

negative impact on our decision making capabilities, including the way we invest in

stocks.

*% Cverconfidence

0nswer this simple <uestion * %hich is the worlds only officially 2indu country8&

'ndia8 1ure8 +onfident8 Over/confident8 1orry, but you are wrongG 'ts 9epal.

9ow tell me * %0re you sure the stock you just bought will go up8& 1ee, you are

again getting over/confidentG

-% Confir"ation ias

Nou can call it )wishful thinking. +onfirmation bias appears when you see what you

want to see. 'ts a bias that makes you notice and look for information that confirms

your e(isting beliefs, whilst ignoring anything that contradicts those beliefs.

5% Dvailailit# ias

More people are killed every year from attacks by donkeys and by drowning in

swimming pools than those who die in car accidents or plane crashesG But just after a

plane crash, we give more prominence to those killers than anything else. 1o what is

the reason for that8 The answer lies in )availability bias, which is a phenomenon in

which people predict the fre<uency of an event based on how easily an e(ample can

be brought to mind.

2ey, did you hear about that company that is coming out with 'ndias biggest 'AO8

Theyre all around the media. 'm buying their stockG

E% )ra"ing

Nou may think its fine to eat a burger that is "7: fat/free. But when you turn it

around and think of it as a burger thats !7: fat, you may think twice about eating it.

Thats what )framing does to you * how you say and hear things makes a good

impact on how you respond or act. 'n investing, a =7: loss hurts more than the

pleasure from a =7: gain.

F% 4erding

hen in doubt, followG This is what the herding bias tells us. e are programmed to

feel that the consensus view must be the correct one. This mistaken belief that )not

everyone can be wrong has led to many a disastrous decision. The Freat -epression

of !",7/>7s, the dotcom boom of !"""/,777, and the more recent financial crisis are