Académique Documents

Professionnel Documents

Culture Documents

2014 D.C. Tax Expenditure Report

Transféré par

mjneibauerCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

2014 D.C. Tax Expenditure Report

Transféré par

mjneibauerDroits d'auteur :

Formats disponibles

Government of the

District of Columbia

Vincent C. Gray

Mayor

Jeffrey S. DeWitt

Chief Financial Officer

District of Columbia

Tax Expenditure Report

Produced by the

Office of Revenue Analysis

Issued May 2014

District of Columbia Tax Expenditure Report

Page ii

(this page intentionally left blank)

Office of the Chief Financial Officer

________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page i

District of Columbia Tax Expenditure Report

Table of Contents

ACKNOWLEDGEMENTS ............................................................................................ II

INTRODUCTION........................................................................................................... III

SUMMARY DATA ON DISTRICT OF COLUMBIA TAX EXPENDITURES ...... IX

PART I: FEDERAL CONFORMITY TAX EXPENDITURES ................................. 27

EXCLUSIONS ......................................................................................................................................28

ADJUSTMENTS ................................................................................................................................116

DEDUCTIONS ...................................................................................................................................130

SPECIAL RULES ..............................................................................................................................166

PART II: LOCAL TAX EXPENDITURES ............................................................... 173

INCOME TAX .....................................................................................................................................174

REAL PROPERTY TAX ..................................................................................................................238

DEED RECORDATION AND TRANSFER TAX ......................................................................284

SALES TAX ........................................................................................................................................300

INSURANCE PREMIUM TAX .......................................................................................................321

PERSONAL PROPERTY TAX ......................................................................................................324

Office of the Chief Financial Officer

________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page ii

District of Columbia Tax Expenditure Report

Acknowledgements

This report is a product of the District of Columbia Office of Revenue Analysis (ORA). Jason

Juffras, an ORA fiscal analyst, researched all of the tax expenditures, drafted the report, and

estimated the federal conformity tax expenditures. In addition, the following ORA staff members

estimated the forgone revenues from local tax expenditures: Steven Giachetti, the director of

revenue estimation; Betty Alleyne, fiscal analyst; Lindsay Clark, fiscal analyst; Kelly Dinkins,

data manager; Daniel Muhammad, fiscal analyst; and Sharain Ward, fiscal analyst.

Individuals from other units of the Office of the Chief Financial Officer also contributed their

knowledge and expertise to the report, particularly Deborah Freis, senior policy analyst in the

Office of Economic Development Finance; Radhika Batra, policy analyst in the Office of

Economic Development Finance; and Lester Morter, exemption specialist in the Real Property

Tax Administration. I also thank the individuals from other D.C. government agencies who

provided important information on many local tax expenditure provisions.

Jeffrey S. DeWitt

Chief Financial Officer

Office of the Chief Financial Officer

________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page iii

District of Columbia Tax Expenditure Report

Introduction

D.C. Law 13-161, the Tax Expenditure Budget Review Act of 2000,

1

requires the Chief

Financial Officer to prepare a biennial tax expenditure budget that estimates the revenue loss to

the District government resulting from tax expenditures during the current fiscal year and the next

two fiscal years. The law defines tax expenditures as the revenue losses attributable to

provisions of federal law and the laws of the District of Columbia that allow, in whole or in part,

a special exclusion, exemption, or deduction from taxes or which provide a special credit, a

preferential rate of tax, or a deferral of tax liability.

2

The Chief Financial Officer prepared the first required tax expenditure budget as part of the

proposed fiscal year 2003 budget. This report, which estimates the revenue forgone due to tax

expenditures in fiscal years 2014 through 2017,

3

covers more than 200 separate tax expenditure

provisions. This tax expenditure budget expands on the analysis done in prior versions by

summarizing research and findings of the D.C. Tax Revision Commission, an expert panel

established by the Mayor and Council to conduct a comprehensive review of the Districts tax

system.

Understanding Tax Expenditures

Tax expenditures are often described as spending by another name, or disguised spending.

Policymakers use tax abatements, credits, deductions, deferrals, and exclusions to promote a wide

range of policy goals in education, human services, public safety, economic development,

environmental protection, and other areas. Instead of pursuing these objectives through direct

spending, policymakers reduce the tax liability associated with certain actions (such as hiring new

employees) or conditions (such as being blind or elderly) so that individuals or businesses can

keep and spend the money, often for particular purposes. For example, a program to expand

access to higher education could offer tax deductions for college savings instead of increasing

student loans or grants. Regardless of which approach the government uses, there is a real

resource cost in terms of forgone revenue or direct expenditures.

Tax expenditures are frequently used as a policy tool in the District of Columbia. There are two

types of tax expenditures: (1) federal conformity tax expenditures, which apply U.S. Internal

Revenue Code provisions to the D.C. personal and corporate income taxes, and (2) local tax

expenditures authorized only by D.C. law. By conforming to the federal definition of adjusted

1

D.C. Law 13-161 took effect on October 4, 2000, and is codified in 47-318 and 47-318.01 of the D.C.

Official Code.

2

See D.C. Official Code 47-318(6).

3

Although the law requires that the tax expenditure budget estimate the revenue loss for the current fiscal

year and the next two fiscal years, this report covers the current year and the following three fiscal years to

be consistent with the Districts four-year financial plan and budget. The four-year time frame for the

Districts financial plan and budget is mandated by Public Law 104-8, the District of Columbia Financial

Responsibility and Management Assistance Act of 1995. See D.C. Official Code 47-392.01(b).

Office of the Chief Financial Officer

________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page iv

gross income (with several exceptions), the District adopts most of the exclusions and deductions

from income that are part of the federal personal and corporate income tax systems. Most other

states with an income tax use federal adjusted gross income as the basis for their income tax.

An example of a federal conformity tax expenditure is the home mortgage interest deduction: the

District follows the federal practice of allowing taxpayers to deduct home mortgage interest

payments. In addition to the 112 federal conformity provisions covered in this report,

4

there are

122 tax expenditures established by local law. An example of a local tax expenditure is the

homestead deduction, which allows all D.C. taxpayers who live in their own home to deduct a

certain amount ($70,200 at the time of this writing) from the taxable value of the home. Both

federal conformity and local tax expenditures warrant regular scrutiny to make sure they are

effective, efficient, and equitable, and to highlight the tradeoffs between tax expenditures and

other programs.

Since the previous tax expenditure budget was published in 2012, policymakers have established

six new local tax expenditures. These involve (1) income tax credits for qualified social

electronic commerce companies, (2) real property tax exemptions for non-profit affordable

housing developers, (3) real property tax credits for qualified social electronic commerce

companies, (4) deed recordation tax exemptions for non-profit affordable housing developers, (5)

personal property tax exemptions for solar energy systems, and (6) personal property tax

exemptions for cogeneration systems. Within the past two years, policymakers also repealed two

local tax expenditures: a capital gains exclusion for qualified high-technology companies, and a

sales tax exemption for motor fuel (the latter resulted from a restructuring of the motor fuel tax).

Tax expenditures differ from direct expenditures in several respects. Direct spending programs in

the District receive an annual appropriation and the proposed funding levels are reviewed during

the annual budget cycle. By contrast, tax expenditures remain in place unless policymakers act to

modify or repeal them; in this respect, they are similar to entitlement programs. Direct spending

programs are itemized on the expenditure side of the budget, whereas revenues are shown in the

budget as aggregate receipts without an itemization of tax expenditures.

The tax expenditure budget aims to subject tax preferences to the same scrutiny as direct

appropriations. The itemization of tax expenditures provides policymakers with a more complete

picture of how the government uses its resources so they can consider how to allocate resources

more effectively. For example, if ineffective or outmoded tax expenditures were eliminated,

policymakers could free up resources to expand high-priority direct spending programs or cut tax

rates. This exercise is designed to provide policymakers with the information they need about tax

expenditures to make sound fiscal policy decisions.

Structure of the Report

This tax expenditure budget and accompanying report, prepared by the staff of the Office of

Revenue Analysis (ORA), offers extensive background information on each tax expenditure, in

addition to estimates of the revenue forgone for fiscal years 2014 through 2017. The report

provides (1) the statutory basis and year of enactment for each provision, (2) a description of the

4

A small number of federal conformity tax expenditures are not included in this report because they

concern tax benefits for industries, such as agriculture and mining, which are non-existent or almost non-

existent in the District of Columbia.

Office of the Chief Financial Officer

________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page v

tax expenditure and how it is structured, (3) the purpose of the tax expenditure, and (4) a

discussion of impacts.

The report begins with a summary table that provides an overview of the Districts tax

expenditures. The summary table classifies the tax expenditure according to the type of tax and

provides the statutory authority, year of enactment, policy area, and estimated revenue loss for

fiscal years 2014 through 2017.

The body of the report is organized into separate parts for federal conformity (Part I) and local tax

expenditures (Part II). The local tax expenditure section includes sub-sections for each of the

Districts major taxes: personal and business income taxes, real property tax, deed recordation

and transfer tax, sales tax, insurance premiums tax, and personal property tax. Each tax

expenditure is described in detail, including benefit levels (the amount of abatements, credits,

deductions, deferrals, exclusions, and exemptions) and eligibility criteria.

The different types of tax expenditures are as follows:

exclusions, which are items that are not considered part of a taxpayers gross income for

tax purposes, even though they increase his or her resources or wealth. Exclusions do not

have to be reported on a tax return but still cause adjusted gross income to be lower than

it otherwise would be. Employer contributions to health and retirement plans are

examples.

exemptions, which are per-person reductions in taxable income that taxpayers can claim

because of their status or circumstances (such as being a senior citizen).

adjustments, which are reductions in taxable income that are available to all tax filers

who meet certain criteria, whether or not they itemize their deductions. Adjustments are

also known as above-the-line deductions and are entered on the tax return.

deductions, which are reductions to taxable income that must be itemized on the tax form.

This option is not available to those who choose the standard deduction.

subtractions, which are reductions from federal adjusted gross income that are used to

derive District of Columbia adjusted gross income. Subtractions reflect income that is

taxed by the federal government but not by the D.C. government.

credits, which reduce tax liability directly instead of reducing the amount of income

subject to taxation. Credits can be refundable (if the amount of the credit exceeds tax

liability, the taxpayer gets the difference as a direct refund) or non-refundable (the

amount of the credit cannot exceed tax liability).

abatements, which are reductions in tax liability (typically real property tax liability) that

are often applied on a percentage basis or through a negotiated process.

deferrals, which delay the recognition of income to a future year or years. Because they

shift the timing of tax payments, deferrals function like interest-free loans to the taxpayer.

rebates, which are refunds provided to qualifying taxpayers as a separate payment (as

contrasted with tax credits that are first applied as a reduction of tax liability).

Office of the Chief Financial Officer

________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page vi

special rules, which is a category used for federal tax expenditures that involve blended

tax rates or special accounting procedures and do not fit neatly into any other category.

Policy and Program Areas

Each tax expenditure was classified by one of 17 policy or program areas, such as education,

health, social policy, and transportation. The policy areas, shown in the summary tables, largely

mirror the categories used by the Joint Committee on Taxation (JCT) of the U.S. Congress in

order to facilitate comparisons. Nevertheless, the categories were modified and expanded in

several cases to make them more relevant to the District of Columbia. For example, the business

and commerce category used by the JCT was changed to economic development to reflect a

policy focus of particular importance in the District, and a public safety category was added

(there are no public safety tax expenditures at the federal level).

The four policy areas with the largest number of federal conformity provisions are economic

development (28 tax expenditures), income security (15), education (12), and health (10).

Nevertheless, the ordering of federal conformity tax expenditures by estimated revenue loss for

each policy area (FY 2014) produces a different ranking. Income security provisions account for

the largest estimated revenue loss due to the forgone revenue from employer-provided fringe

benefits such as pension contributions, which are excluded from the employees taxable income

(as are the earnings on those contributions). Health provisions rank second in revenue loss for

federal conformity provisions, followed by housing and economic development. Many federal

tax expenditures that are classified under economic development concern the definition or timing

of different types of business income, expenses, reserves, and depreciation.

The four policy areas with the largest number of local tax expenditures are housing (28 tax

expenditures), economic development (25), and social policy (14), and income security (12).

Once again, the ordering of local tax expenditures by estimated revenue loss for each policy area

produces a different ranking.

5

The general law category (which includes constitutional and

statutory mandates for tax policy) had the largest estimated revenue loss due to the forgone

revenues from federal tax-exempt property in the District of Columbia, followed by economic

development, social policy, and housing.

Important Caveats

A particular caution about the interpretation of the revenue loss estimates in this report deserves

emphasis. The forgone revenue estimates are intended to measure what is being spent through

the tax system, or alternatively, the amount of relief or subsidy provided through each provision.

Nevertheless, the forgone revenue is not identical to the amount of revenue that could be gained

by repealing the tax expenditure. There are three main reasons why:

First, the estimates of revenue loss are static and therefore do not reflect behavioral

changes that might occur if a tax expenditure were repealed. For example, if the District

eliminated the local supplement to the federal earned income tax credit, people might

reduce their hours of work and their income tax payments could also drop.

5

The estimated revenue loss in these calculations was for FY 2014.

Office of the Chief Financial Officer

________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page vii

Second, the revenue loss for each tax expenditure is estimated independently, which does

not account for interaction effects among different tax provisions. For example, D.C. law

establishes that taxpayers may not claim both the local supplement to the earned income

tax credit and the D.C. low-income credit. If the local earned income credit were

abolished, more taxpayers might then claim the low-income credit.

Third, the D.C. government may not be able to collect the full amount owed due to

administrative reasons. For example, if the District disallowed for local income tax

purposes an exemption or exclusion that is allowed on the federal income tax (a process

known as decoupling), the District would probably not recoup all of the forgone

revenue. That is because taxpayers would have to make a separate calculation on their

District income taxes to add back the dollars that had been excluded, and compliance

with this requirement would not be universal (nor would audits detect all violations).

Because of the factors described above, the total forgone revenue from tax expenditures is not

equivalent to the sum of the individual estimates of forgone revenue. As the U.S. Government

Accountability Office has stated:

While sufficiently reliable as a gauge of general magnitude, the sum of the

individual revenue loss estimates has important limitations in that any

interactions between tax expenditures will not be reflected in the sum Thus,

the revenue loss from all or several tax expenditures together might be greater or

less than the sum of the estimated revenue losses from the individual tax

expenditures, and no measure of the size or the magnitude of these potential

interactions or behavioral responses to all or several tax expenditures is

available.

6

Methodology

Summary statistics from D.C. tax returns were an important source of data for the tax expenditure

budget and were particularly useful for estimating the forgone revenue from local income tax

provisions. Unfortunately, in many instances tax expenditures cannot be estimated from available

tax data because they involve income, property, or economic activity that is not taxed, and the

relevant information is never reported to the Office of Tax and Revenue (OTR). Therefore, ORA

often used data from federal agencies (such as the Census Bureau and the Bureau of Economic

Analysis) and D.C. government agencies to estimate the number of beneficiaries and the revenue

lost from certain tax expenditures.

OTR generally lacks information on federal conformity tax expenditures because the amounts

excluded are not reported and the amounts deducted are subtracted from federal adjusted gross

income, which is the starting point for a D.C. income tax return. Therefore, ORAs federal

conformity estimates represent a District of Columbia portion of the nationwide tax expenditure

6

U.S. Government Accountability Office, Government Performance and Accountability: Tax Expenditures

Represent a Substantial Federal Commitment and Need to Be Reexamined (GAO-05-960, September

2005), p. 3.

Office of the Chief Financial Officer

________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page viii

estimates prepared by the JCT.

7

ORA estimated the D.C. portion using two fractions: (1) a ratio

representing the D.C. share of the relevant activity or population, such as D.C. taxable income

divided by national taxable income, and (2) a ratio representing the D.C. average tax rate divided

by the U.S. average tax rate.

Because of the methodological challenges and data issues, it is important to view the revenue

estimates as indicating orders of magnitude rather than providing precise point estimates.

In addition, U.S. Internal Revenue Service rules provide that, No statistical tabulation may be

released outside the agency with cells containing data from fewer than three returns, in order to

protect the confidentiality of individual tax records.

8

Tax expenditures with fewer than three

claimants are therefore listed in this report as no estimate, except in the case of real property tax

expenditures where different rules apply.

9

Key Terms for Summary Tables

too small: refers to a federal conformity tax expenditure with forgone revenue that was

less than $50 million annually, according to the JCT. The revenue loss to the District

from conforming to the federal policy would be very close to zero.

sunset: means that there will be no revenue loss because the provision has expired.

minimal: refers to a local tax expenditure for which precise data are lacking, but the

forgone revenue is estimated to be less than $50,000 per year.

no estimate: refers to a local tax expenditure for which precise data are lacking, but for

which the revenue loss might not be minimal. In addition, no estimate refers to cases

in which calculations cannot be made because of confidentiality rules.

Comments Welcomed

The Office of Revenue Analysis hopes that this report will contribute to a more informed

discussion of budget and tax policy in the District of Columbia by providing clear and concise

information both for policymakers and for the general public. ORA welcomes comments on the

report and will use the feedback to improve future versions.

7

In some cases, ORA used tax expenditure estimates from the U.S. Department of the Treasury when data

from the Joint Committee on Taxation were not available.

8

U.S. Internal Revenue Service, Publication 1075, Tax Information Security Guidelines for Federal, State,

and Local Agencies and Entities (January 2014), p. 116. Even if the taxpayers are not specifically

identified, it might be possible for someone to figure out the confidential information from an estimate of

revenue involving so few people or businesses.

9

D.C. Official Code 47-1001 states that, The Mayor shall publish, by class and by individual property, a

listing of all real property exempt from the real property tax in the District. Such listing shall include the

address, lot and square number, the name of the owner, the assessed value of the land and improvements of

such property, and the amount of the tax exemption in the previous fiscal year. IRS rules do not affect

real property taxation because the federal government does not impose a real property tax.

Office of the Chief Financial Officer

________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page ix

Summary Data on District of Columbia Tax Expenditures

Office of the Chief Financial Officer

________________________________________________________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page x

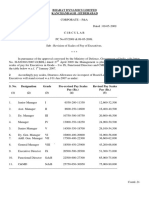

I. Federal Conformity Tax Expenditures

(Individual and Corporate Income Taxes)

# Name of Tax Expenditure Program Area Year Enacted

Internal Revenue

Code Section FY 2014 FY 2015 FY 2016 FY 2017

Federal Exclusions

1 Capital gains on assets transferred at death Economic development 1921

1001, 1014, 1023,

1040, 1221, and

1222 $29,330 $31,270 $33,633 $36,178

2 Capital gains on assets transferred as a gift Economic development 1921 1015 ($1,989) ($5,116) $2,274 $3,126

3 Cash accounting, other than agriculture Economic development 1916 446 and 448 $1,665 $1,804 $1,804 $1,943

4 Credit union income Economic development 1937

501(c)(14) and

12 USC 1768 $405 $463 $521 $579

5

Distribution from redemption of stock to

pay taxes imposed at death Economic development 1950 303 too small too small too small too small

6 Gain on like-kind exchanges Economic development 1921 1031 $4,263 $4,405 $4,690 $4,974

7 Imputed interest Economic development 1964

163(e), 483, 1274,

and 1274A $420 $420 $420 $490

8

Interest on small-issue qualified private-

activity bonds Economic development 1968

103, 141, 144,

and 146 $366 $366 $366 $366

9 Magazine, paperback, and record returns Economic development 1978 458 too small too small too small too small

10 Small business stock gains Economic development 1993 1202 $694 $971 $971 $1,110

11 Discharge of certain student loan debt Education 1984

108(f), 20 USC

1087ee(a)(5) and

42 USC 2541-

1(g)(3) $244 $244 $244 $244

12

Earnings of Coverdell education savings

accounts Education 1998 530 $122 $122 $244 $365

13 Earnings of qualified tuition programs Education 1997 529 $1,096 $1,340 $1,462 $1,583

14 Employer-provided education assistance Education 1978 127 $1,073 $1,073 sunset sunset

15 Employer-provided tuition reduction Education 1984 117(d) $179 $179 $179 $268

16 Interest on education savings bonds Education 1988 135 too small too small too small too small

Revenue Forgone ($ in thousands)

Office of the Chief Financial Officer

________________________________________________________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page xi

# Name of Tax Expenditure Program Area Year Enacted

Internal Revenue

Code Section FY 2014 FY 2015 FY 2016 FY 2017

Federal Exclusions (cont.)

17

Interest on state and local private-activity

bonds issued to finance education facilities Education 1986

103, 141, 142(k),

145, 146, and

501(c)(3) $3,192 $3,294 $3,397 $3,500

18

Interest on state and local private-activity

student loan bonds Education 1965

103, 141, 144(b),

and 146 $469 $469 $469 $469

19 Scholarship and fellowship income Education 1954 117 $3,289 $3,411 $3,654 $3,776

20 Cafeteria plan benefits Employment 1974 125 $32,715 $34,950 $36,737 $38,704

21 Employee awards Employment 1986 74(c) and 274(j) $268 $268 $268 $268

22 Employee stock ownership plans Employment 1974

401(a)(28),

404(a)(9), 404(k),

415(c)(6), 1042,

4975(e)(7), 4978,

and 4979A $668 $668 $816 $816

23

Employer-paid meals and lodging (other

than military) Employment 1918 119 and 132(e)(2) $1,698 $1,877 $2,056 $2,235

24 Housing allowance for ministers Employment 1921 107 and 265 $626 $715 $715 $715

25 Miscellaneous fringe benefits Employment 1984 117(d) and 132 $6,704 $6,883 $7,061 $7,330

26

Spread of acquisition of stock under

incentive stock option plans and employee

stock purchase plans Employment 1981 422 and 423 ($719) ($668) ($668) ($668)

27

Voluntary employees' beneficiary

associations Employment 1928

419, 419A, 501(a),

501(c)(9), and

4976 $2,592 $2,771 $2,860 $2,860

28

Interest on state and local private-activity

bonds issued to support energy facilities Energy 1980

103, 141, 142(f),

and 146 $27 $27 $27 $37

29 Accrued interest on savings bonds General fiscal assistance 1951 454(c) $980 $980 $980 $1,050

30

Allocation of interest expenses attributable

to tax-exempt bond interest by financial

institutions General fiscal assistance 2009

141, 265(a),

265(b), and 291(e) $290 $347 $347 $405

31

Interest on public-purpose state and local

bonds General fiscal assistance 1913 103, 141, and 146 $33,543 $35,198 $36,136 $37,074

32

Employer contributions for medical care

and medical insurance premiums Health 1918 105, 106, and 125 $127,821 $136,579 $144,357 $153,027

Revenue Forgone ($ in thousands)

Office of the Chief Financial Officer

________________________________________________________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page xii

# Name of Tax Expenditure Program Area Year Enacted

Internal Revenue

Code Section FY 2014 FY 2015 FY 2016 FY 2017

Federal Exclusions (cont.)

33

Interest on state and local private-activity

bonds issued to finance non-profit hospital

construction Health 1913

103, 141, 145(b),

145(c), 146, and

501(c)(3) $2,093 $2,299 $2,299 $2,459

34

Medical care and TriCare medical

insurance for military dependents, retirees,

retiree dependents, and veterans Health 1986 112 and 134 $2,400 $2,550 $2,600 $2,800

35

Medicare Part A -- hospital insurance

benefits Health 1970 N.A./administrative $15,752 $16,796 $16,995 $18,187

36

Medicare Part B -- supplementary medical

benefits Health 1970 N.A./administrative $13,467 $14,361 $15,405 $17,044

37

Medicare Part D -- prescription drug

benefits Health 2003 N.A./administrative $3,578 $3,926 $4,323 $4,770

38 Capital gain on sale of principal residence Housing 1997 121 $35,243 $36,948 $38,511 $39,790

39

Income from discharge of principal

residence acquisition indebtedness Housing 2007 108 $287 sunset sunset sunset

40

Interest on state and local private-activity

bonds issued to finance housing Housing 1980

103, 141, 142,

143, and 146 $1,990 $2,196 $2,196 $2,196

41

Compensatory damages for physical injury

or sickness Income security 1918

104(a)(2) -

104(a)(5) $1,430 $1,520 $1,520 $1,520

42 Disaster mitigation payments Income security 2005 139 too small too small too small too small

43

Employer contributions for premiums on

accident and disability insurance Income security 1954 105 and 106 $3,397 $3,575 $3,665 $3,844

44

Employer contributions for premiums on

group-term life insurance Income security 1920 79 $2,860 $3,039 $3,218 $3,486

45

Employer pension contributions and

earnings plans Income security 1921

401-407, 410-

418E, and 457 $86,257 $95,731 $108,513 $118,793

46

Income of trusts to finance supplemental

unemployment benefits Income security 1960 501(c)(17) $27 $36 $45 $54

47

Investment income on life insurance and

annuity contracts Income security 1913

72, 101, 7702,

and 7702A $41,353 $42,406 $43,400 $44,595

48 Public assistance cash benefits Income security 1933 N.A./administrative $5,212 $5,420 $5,629 $5,733

Revenue Forgone ($ in thousands)

Office of the Chief Financial Officer

________________________________________________________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page xiii

# Name of Tax Expenditure Program Area Year Enacted

Internal Revenue

Code Section FY 2014 FY 2015 FY 2016 FY 2017

Federal Exclusions (cont.)

49 Roth IRA earnings and distributions Income security 1997 408 $1,993 $2,272 $2,550 $2,874

50

Social Security and Railroad Retirement

benefits Income security 1938 86 $13,029 $13,559 $14,127 $14,809

51

Survivor annuities paid to families of

public safety officers Income security 1997 101(h) too small too small too small too small

52 Workers' compensation benefits Income security 1918 104(a)(1) $8,313 $8,581 $8,939 $9,296

53

Active income of controlled foreign

corporations International commerce 1909

11, 882, and 951-

964 $28,661 $31,208 $33,119 $36,361

54

Allowances for federal employees working

abroad International commerce 1943 912 $8,484 $8,908 $9,332 $9,757

55 Income earned abroad by U.S. citizens International commerce 1926 911 $5,563 $6,583 $7,696 $8,530

56

Inventory property sales source rule

exception International commerce 1921

861, 862, 863,

and 865 $1,969 $2,027 $2,142 $2,200

57

Benefits and allowances for armed forces

personnel National defense 1925 112 and 134 $3,030 $3,272 $3,454 $3,575

58 Combat pay National defense 1918 112 $545 $606 $727 $788

59 Military disability benefits National defense 1942

104(a)(4),

104(a)(5) and

104(b) $121 $121 $182 $182

60

Contributions in aid of construction for

water and sewer utilities Natural resources and environment 1996 118(c) and 118(d) too small too small too small too small

61

Earnings of certain environmental

settlement funds Natural resources and environment 2005 468B too small too small too small too small

62

Energy conservation subsidies provided by

public utilities Natural resources and environment 1992 136 too small too small too small too small

63

Interest on state and local private-activity

bonds issued to finance water, sewer, and

hazardous-waste facilities Natural resources and environment 1968

103, 141, 142,

and 146 $366 $366 $366 $366

64 Employer-provided adoption assistance Social policy 1996 137 $89 $89 $80 $77

Revenue Forgone ($ in thousands)

Office of the Chief Financial Officer

________________________________________________________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page xiv

# Name of Tax Expenditure Program Area Year Enacted

Internal Revenue

Code Section FY 2014 FY 2015 FY 2016 FY 2017

Federal Exclusions (cont.)

65 Employer-provided dependent care Social policy 1981 129 $1,511 $1,609 $1,698 $1,804

66 Foster care payments Social policy 1982 131 $536 $536 $536 $536

67

Employer-provided transportation

assistance Transportation 1984 and 1992 132(f) $4,737 $5,095 $5,542 $5,989

68

Interest on state and local private-activity

bonds issued to finance airport, dock and

mass commuting facilities Transportation 1968

103, 141, 142,

and 146 $732 $835 $835 $835

69

Interest on state and local private-activity

bonds issued to finance highway projects

and rail-truck transfer facilities Transportation 2005

103, 141, 142(m),

and 146 too small too small too small too small

70 G.I. Bill education benefits Veterans' benefits 1917 38 USC 5301 $665 $720 $780 $847

71 Veterans' benefits and services Veterans' benefits 1917 38 USC 5301 $3,235 $3,565 $3,930 $4,350

Federal Adjustments

72

Classroom expenses of elementary and

secondary school educators Education 2002 62 $210 sunset sunset sunset

73 Higher education expenses Education 2001 222 $278 sunset sunset sunset

74 Interest on student loans Education 1997 221 $1,705 $1,705 $1,827 $1,827

75 Contributions to health savings accounts Health 2003 223 $1,044 $1,143 $1,242 $1,391

76

Health insurance premiums and long-term

care insurance premiums paid by the self-

employed Health 1986 162(l) $3,818 $4,022 $4,227 $4,500

77

Contributions to self-employment

retirement plans Income security 1962

401-407, 410-

418E, and 457 $33,051 $34,979 $37,458 $39,937

78

Employee contributions to traditional

Individual Retirement Accounts Income security 1974 219 and 408 $6,166 $6,722 $7,371 $7,974

79

Overnight travel expenses of National

Guard and Reserve members National defense 2003

62(a)(2)(E) and

162 $50 $50 $50 $50

Revenue Forgone ($ in thousands)

Office of the Chief Financial Officer

________________________________________________________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page xv

# Name of Tax Expenditure Program Area Year Enacted

Internal Revenue

Code Section FY 2014 FY 2015 FY 2016 FY 2017

Federal Deductions

80

Accelerated depreciation of buildings

other than rental housing Economic development 1954 167 and 168 $345 $345 $403 $403

81 Accelerated depreciation of equipment Economic development 1954 167 and 168 $7,893 $7,893 $7,893 $7,893

82

Small life insurance company taxable

income Economic development 1984 806 too small too small too small too small

83 Amortization of business start-up costs Economic development 1980 195 $139 $139 $139 $139

84 Completed contract rules Economic development 1986 460 $463 $521 $521 $521

85

Exception from passive loss rules for

$25,000 of rental real estate loss Economic development 1986 469(i) $20,125 $22,711 $24,299 $26,813

86

Expensing of depreciable small business

property Economic development 1958 179 $5,505 $5,367 $5,367 $5,644

87

Expensing of magazine circulation

expenditures Economic development 1950 173 too small too small too small too small

88 Film and television production costs Economic development 2004 181 too small too small too small too small

89 Gain on non-dealer installment sales Economic development 1986 453 and 453A(b) $6,809 $6,184 $5,709 $5,338

90 Life insurance company reserves Economic development 1984

803(a)(2),

805(a)(2), and 807 $1,505 $1,563 $1,563 $1,621

91

Loss from sale of small business

corporation stock Economic development 1958 1244 $83 $83 $83 $83

92

Property and casualty insurance company

reserves Economic development 1986 832(b) $232 $232 $290 $290

93 Research and development expenditures Economic development 1954 59(e) and 174 $3,531 $4,052 $4,400 $4,515

94

Amortization of certified pollution control

facilities Energy 2005 169(d)(5) $232 $174 $174 $174

95

Depreciation recovery periods for specific

energy property Energy 1986 168(e) $463 $521 $463 $463

96 Energy-efficient commercial property Energy 2005 179D $173 $173 $173 $173

97 Blue Cross and Blue Shield companies Health 1986 833 $232 $232 $232 $290

98 Medical and dental care expenses Health 1942 213 $10,069 $11,531 $13,155 $14,048

99 Accelerated depreciation of rental housing Housing 1954 167 and 168 $5,045 $4,918 $4,918 $5,021

Revenue Forgone ($ in thousands)

Office of the Chief Financial Officer

________________________________________________________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page xvi

# Name of Tax Expenditure Program Area Year Enacted

Internal Revenue

Code Section FY 2014 FY 2015 FY 2016 FY 2017

Federal Deductions (cont.)

100

Mortgage interest on owner-occupied

residences Housing 1913 163(h) $68,651 $71,811 $75,832 $83,684

101

State and local property taxes on owner-

occupied residences Housing 1913 164 $17,158 $18,238 $19,498 $20,638

102 Casualty and theft losses Income security 1913

165(c)(3), 165(e),

and 165(h) -

165(k) $142 $142 $142 $142

103 Deduction of foreign taxes instead of a credit International commerce 1913 901 $174 $174 $174 $174

104

Financing income of certain controlled

foreign corporations International commerce 1962 953 and 954 $869 sunset sunset sunset

105 Charitable contributions Social policy 1917 and 1935 170 and 642(c) $55,257 $57,684 $60,209 $63,107

106

Costs of removing architectural and

transportation barriers to the disabled and

elderly Social policy 1976 190 too small too small too small too small

Federal Special Rules

107

60-40 rule for gain or loss from section 1256

contracts Economic development 1981 1256 $142 $200 $200 $200

108

Interest rate and discounting period

assumptions for reserves of property and

casualty insurance companies Economic development 1986

831, 832(b), and

846 $463 $463 $463 $463

109 Inventory accounting Economic development 1938 475, 491-492 $3,753 $3,927 $4,042 $4,216

110

Special alternative tax on small property and

casualty insurance companies Economic development 1954

321(a),

501(c)(15), 832,

and 834 $58 $58 $58 $58

111

Apportionment of research and development

expenses for determining foreign tax credits International commerce 1977 861-863 and 904 $290 $290 $232 $174

112

Interest-charge domestic international sales

corporations International commerce 1986 991-997 $232 $232 $232 $232

Revenue Forgone ($ in thousands)

Office of the Chief Financial Officer

________________________________________________________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page xvii

II. Local Tax Expenditures

(D.C. Individual and Corporate Income Taxes)

# Name of Tax Expenditure Program Area Year Enacted D.C. Code Section FY 2014 FY 2015 FY 2016 FY 2017

D.C. Income Tax Exemptions

113

Additional personal exemption for the

blind Income security 1987 47-1806.02(d) $90 $92 $95 $95

114

Additional personal exemption for the

elderly Income security 1987 47-1806.02(e) $4,652 $4,787 $4,922 $4,922

D.C. Income Tax Subtractions

115

Qualified high-technology companies:

depreciable business assets Economic development 2001 47.1803.3(a)(18) no estimate no estimate no estimate no estimate

116 College savings plan contributions Education 2001

47-4501 - 47-

4512 $1,066 $1,066 $1,066 $1,066

117 Public school teacher expenses Education 2007 47-1803.03(b-2) $112 $112 $112 $112

118

Health insurance premiums paid for a

domestic partner (business income tax) Health 1992

47-

1803.02(a)(2)(W) $170 $178 $188 $198

119

Health insurance premiums paid for a

domestic partner (personal income tax) Health 2006

47-

1803.03(a)(15) and

46-401(b) $24 $24 $25 $26

120 Health professional loan repayments Health 2006 7-751.11 $70 $70 $70 $70

121 Long-term care insurance premiums Health 2005 47-1803.03(b-1) $225 $225 $225 $225

122 Housing relocation assistance Housing 1980

42-2851.05, 42-

3403.05, and 47-

1803.02(a)(2)(R) minimal minimal minimal minimal

123

D.C. and federal government pension

income Income security 1987

47-

1803.02(a)(2)(N) $4,124 $4,228 $4,378 $4,542

124

D.C. and federal government survivor

benefits Income security 1987

47-

1803.02(a)(2)(N) $3,934 $4,033 $4,176 $4,332

Revenue Forgone ($ in thousands)

Office of the Chief Financial Officer

________________________________________________________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page xviii

# Name of Tax Expenditure Program Area Year Enacted D.C. Code Section FY 2014 FY 2015 FY 2016 FY 2017

D.C. Income Tax Subtractions (cont.)

125

Disability payments for the permanently

and totally disabled Income security 1985

47-

1803.02(a)(2)(M) $87 $89 $93 $96

126

Income of persons with a permanent and

total disability Income security 2005

47-

1803.02(a)(2)(V) $553 $567 $587 $609

127 Railroad retirement system benefits Income security 1985

47-

1803.02(a)(2)(L) $93 $95 $99 $103

128

Social Security benefits for retired

workers Income security 1985

47-

1803.02(a)(2)(L) $16,877 $17,304 $17,918 $18,587

129

Social Security benefits for survivors and

dependents Income security 1985

47-

1803.02(a)(2)(L) $2,142 $2,196 $2,274 $2,359

130 Social Security benefits for the disabled Income security 1985

47-

1803.02(a)(2)(L) $4,190 $4,296 $4,449 $4,615

131

Environmental savings account

contributions and earnings Natural resources and environment 2001 8-637.03 minimal minimal minimal minimal

132 Rental assistance to police officers Public safety 1993 42-2902 minimal minimal minimal minimal

133

Compensatory damages awarded in a

discrimination case Social policy 2002

47-

1803.02(a)(2)(U) $31 $32 $33 $34

134 Poverty lawyer loan assistance Social policy 2007

47-

1803.02(a)(2)(X) $40 $40 $40 $40

D.C. Income Tax Credits

135

Economic development zone incentives for

businesses Economic development 1988

6-1501, 6-

1502, 6-1504,

and 47-1807.06 $0 $0 $0 $0

136

Qualified high-technology companies:

business income tax exemption and

reduction Economic development 2001 47-1817.06 $15,983 $16,777 $17,491 $18,310

137

Qualified high-technology companies:

employee relocation incentives Economic development 2001 47-1817.02

included in

#136

included in

#136

included in

#136

included in

#136

Revenue Forgone ($ in thousands)

Office of the Chief Financial Officer

________________________________________________________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page xix

# Name of Tax Expenditure Program Area Year Enacted D.C. Code Section FY 2014 FY 2015 FY 2016 FY 2017

D.C. Income Tax Credits (cont.)

138

Qualified high-technology companies:

employment incentives Economic development 2001 47-1817.03

included in

#136

included in

#136

included in

#136

included in

#136

139

Qualified high-technology companies:

incentives to employ disadvantaged

workers Economic development 2001 47-1817.05

included in

#136

included in

#136

included in

#136

included in

#136

140

Qualified high-technology companies:

incentives to retrain disadvantaged workers Economic development 2001 47-1817.04

included in

#136

included in

#136

included in

#136

included in

#136

141

Qualified social electronic commerce

companies Economic development 2012

47-1818.01 -

47-1818.08 $0 $0 $1,440 $1,500

142

First-time home purchase for D.C.

government employees Employment 2000 42-2506 $124 $124 $124 $124

143 Job growth tax credit Employment 2010

47-1807.09 and

47-1807.51 -

47-1807.56 $0 $0 $0 $0

144

Paid leave for organ or bone marrow

donors Health 2006

47-1807.08 and

47-1808.08 no estimate no estimate no estimate no estimate

145 Employer-assisted home purchases Housing 2002

47-1807.07 and

47-1808.07 minimal minimal minimal minimal

146 Lower-income, long-term homeownership Housing 2002

47-1806.09 -

47-1806.09f $4 $4 $4 $4

147 Property tax circuit-breaker Housing 1977 47-1806.06 $16,354 $16,853 $18,110 $19,088

148 Earned income tax credit Income security 2000 47-1806.04(f) $54,262 $54,967 $55,737 $56,461

149 Low-income credit Income security 1987 47-1806.04(e) $1,789 $1,789 $1,789 $1,789

150 Brownfield revitalization and cleanup Natural resources and environment 2001 8-637.01 $0 $0 $0 $0

151 Child and dependent care Social policy 1977 47-1806.04(c) $3,575 $3,575 $3,575 $3,575

Revenue Forgone ($ in thousands)

Office of the Chief Financial Officer

________________________________________________________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page xx

# Name of Tax Expenditure Program Area Year Enacted D.C. Code Section FY 2014 FY 2015 FY 2016 FY 2017

D.C. Real Property Tax Abatements

152

New or improved buildings used by high-

technology companies Economic development 2001 47-811.03 $35 $36 $37 $38

153

Non-profit organizations locating in

designated neighborhoods Economic development 2010

47-857.11 -

47-857.16 $153 $153 $153 $153

154 Improvements to low-income housing Housing 2002 47-866 $0 $0 $0 $0

155 New residential developments Housing 2002

47-857.01 -

47-857.10 $3,771 $2,105 $1,540 $1,346

156 NoMA residential developments Housing 2009

47-859.01 -

47-859.05 $1,002 $4,212 $4,212 $4,212

157

Preservation of section 8 housing in

qualified areas Housing 2002 47-865 $0 $0 $0 $0

158 Single-room-occupancy housing Housing 1994 42-3508.06 $0 $0 $0 $0

159 Vacant rental housing Housing 1985 42-3508.02 $0 $0 $0 $0

D.C. Real Property Tax Exemptions

160

Development of a qualified supermarket,

restaurant, or retail store Economic development 1988 47-1002(23) $2,383 $2,948 $2,958 $3,684

161

High-technology commercial real estate

database and service providers Economic development 2010 47-4630 $700 $700 $700 $700

162 Educational institutions Education 1942 47-1002(10) $104,195 $104,455 $104,716 $104,978

163 Libraries Education 1942 47-1002(7) $426 $427 $428 $429

164

Embassies, chanceries, and associated

properties of foreign governments General law 1942 47-1002(3) $43,825 $43,935 $44,045 $44,155

165 Federal government property General law 1942 47-1002(1) $839,900 $841,999 $844,904 $846,215

166 Miscellaneous exemptions General law multiple years

Title 47, Chapters

10 and 46 $118,784 $119,081 $119,379 $119,677

167 Hospital buildings Health 1942 47-1002(9) $13,352 $13,386 $13,419 $13,453

Revenue Forgone ($ in thousands)

Office of the Chief Financial Officer

________________________________________________________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page xxi

# Name of Tax Expenditure Program Area Year Enacted D.C. Code Section FY 2014 FY 2015 FY 2016 FY 2017

D.C. Real Property Tax Exemptions (cont.)

168 Historic property Housing 1974

47-842 -

47-844 $9 $10 $10 $10

169 Homestead deduction Housing 1978 47-850 $57,264 $58,982 $60,751 $62,574

170

Lower-income homeownership households

and cooperative housing associations Housing 1983 47-3503 $9,711 $9,735 $9,760 $9,784

171

Multi-family and single-family rental and

cooperative housing for low- and moderate-

income persons Housing 1978 47-1002(20) $1,080 $1,082 $1,085 $1,088

172 Nonprofit housing associations Housing 1983 47-3505 $10,791 $10,818 $10,845 $10,872

173 Nonprofit affordable housing developers Housing 2012 47-1005.02 $200 $300 $400 $500

174 Resident management corporations Housing 1992 47-1002(24) $0 $0 $0 $0

175 Correctional Treatment Facility Public safety 1997 47-1002(25) $3,422 $3,487 $3,602 $3,721

176 Art galleries Social policy 1942 47-1002(6) $2,374 $2,380 $2,386 $2,392

177 Cemeteries Social policy 1942 47-1002(12) $5,723 $5,728 $5,734 $5,740

178 Charitable organizations Social policy 1942 47-1002(8) $14,534 $14,571 $14,607 $14,644

179 Churches, synagogues, and mosques Social policy 1942 47-1002(13) $60,626 $60,778 $60,930 $61,082

180

Washington Metropolitan Area Transit

Authority properties Transportation 1966 9-1107.01 $9,408 $9,432 $9,456 $9,479

D.C. Real Property Tax Credits

181

Qualified social electronic commerce

companies Economic development 2012

47-1818.01 -

47-1818.08 $0 $0 $1,510 $1,580

182

First-time homebuyer credit for D.C.

government employees Employment 2000 42-2506 $313 $318 $329 $340

183 Assessment increase cap Housing 2001 47-864 $17,177 $18,310 $18,859 $19,425

184

Senior citizens and persons with

disabilities Housing 1986 47-863 $21,520 $21,574 $21,628 $21,682

185 Brownfield revitalization and cleanup Natural resources and environment 2001 8-637.01 $0 $0 $0 $0

186

Condominium and cooperative trash

collection Natural resources and environment 1990

47-872 and

47-873 $5,327 $5,460 $5,597 $5,737

Revenue Forgone ($ in thousands)

Office of the Chief Financial Officer

________________________________________________________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page xxii

# Name of Tax Expenditure Program Area Year Enacted D.C. Code Section FY 2014 FY 2015 FY 2016 FY 2017

D.C. Real Property Tax Deferrals, Rebates, and Multiple Categories

187

Economic development zone incentives for

real property owners Economic development 1988

6-1501 -

6-1503 $0 $0 $0 $0

188 Public charter school tax rebate Education 2005 47-867 $1,296 $1,321 $1,364 $1,409

189 Homeowners in enterprise zones Housing 2002

47-858.01 -

47-858.05 $0 $0 $0 $0

190 Low-income homeowners Housing 2005 47-845.02 $0 $0 $0 $0

191 Low-income, senior-citizen homeowners Housing 2005 47-845.03 $3 $4 $4 $4

D.C. DEED RECORDATION AND TRANSFER TAX

Deed Recordation and Transfer Tax Exemptions

192 Educational institutions Education 1962 and 1980

42-1102(3) and

47-902(3) $516 $518 $519 $520

193 Bona-fide gifts to the District of Columbia General law 2011 47-902(24) $0 $0 $0 $0

194

Embassies, chanceries, and associated

properties of foreign governments General law 1962 and 1980

42-1102(3) and

47-902(3) $1,064 $1,067 $1,069 $1,072

195 Federal government General law 1962 and 1980

42-1102(2) and

47-902(2) $52 $53 $53 $54

196

Other properties exempt from real

property taxation General law 1962 and 1980

42-1102(3) and

47-902(3) $687 $689 $689 $690

197

Special act of Congress (recordation tax

only) General law 1962 42-1102(4) $375 $376 $376 $377

198 Cooperative housing associations Housing 1983

42-1102(14),

47-3503(a)(2),

47-3503(a)(3),

47-902(11), and

47-3503(b)(2) $267 $272 $278 $283

Revenue Forgone ($ in thousands)

Office of the Chief Financial Officer

________________________________________________________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page xxiii

# Name of Tax Expenditure Program Area Year Enacted D.C. Code Section FY 2014 FY 2015 FY 2016 FY 2017

D.C. Deed Recordation and Transfer Tax Exemptions (cont.)

199

Inclusionary zoning program (transfer tax

only) Housing 2007 47-902(23) $7 $30 $30 $30

200 Lower-income homeownership households Housing 1983

42-1102(12),

47-3503(a)(1),

47-3503(a)(3),

47-902(9), and

47-3503(b)(1) $107 $107 $107 $108

201 Nonprofit housing associations Housing 1983

42-1102(13),

47-3505(c),

47-902(10), and

47-3505(b) $160 $160 $160 $161

202 Nonprofit affordable housing developers Housing 2012 42-1102(32) $155 $155 $156 $156

203 Resident management corporations Housing 1992

42-1102(20),

47-

3505.01(b)(1),

47-902(15), and

47-

3506.01(b)(2) $0 $0 $0 $0

204 Charitable organizations Social policy 1962 and 1980

42-1102(3) and

47-902(3) $2,004 $2,009 $2,014 $2,019

205 Churches, synagogues, and mosques Social policy 1962 and 1980

42-1102(3) and

47-902(3) $129 $129 $130 $130

206

Tax-exempt entities subject to a long-term

lease Tax administration and equity 2003

42-1102(27) and

47-902(21) no estimate no estimate no estimate no estimate

Revenue Forgone ($ in thousands)

Office of the Chief Financial Officer

________________________________________________________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page xxiv

# Name of Tax Expenditure Program Area Year Enacted D.C. Code Section FY 2014 FY 2015 FY 2016 FY 2017

D.C. SALES TAX

Sales Tax Exemptions

207 Energy products used in manufacturing Economic development 1949

47-2005(11) and

(11A) $4,388 $4,563 $4,728 $4,889

208 Internet access service Economic development 1999 47-2001(n)(2)(F) $5,691 $5,885 $6,103 $6,341

209

Materials used in development of a

qualified supermarket Economic development 2000 47-2005(28) $817 $845 $876 $908

210 Professional and personal services Economic development 1949

47-

2001(n)(2)(B) $261,782 $272,353 $282,054 $291,644

211

Qualified high-technology companies:

certain sales Economic development 2001

47-

2001(n)(2)(G) $672 $695 $721 $749

212

Qualified high-technology companies:

technology purchases Economic development 2001 47-2005(31) $179 $187 $194 $203

213

Transportation and communication

services Economic development 1949

47-

2001(n)(2)(A) $46,974 $48,571 $50,368 $52,332

214 Federal and D.C. governments General law 1949 47-2005(1) $194,110 $200,710 $208,136 $216,253

215 Medicine, drugs, and medical devices Health 1949

47-2005(14) and

(15) $16,294 $16,848 $17,471 $18,153

216 Groceries Social policy 1949

47-

2001(n)(2)(E) $54,382 $56,231 $58,312 $60,586

217 Materials used in war memorials Social policy 1957 47-2005(16) $0 $0 $0 $0

218 Nonprofit (501(c)(4)) organizations Social policy 1987 47-2005(22) $33,171 $34,299 $35,568 $36,955

219 Semi-public institutions Social policy 1949 47-2005(3) $49,377 $51,056 $52,945 $55,010

220 Miscellaneous Tax administration and equity multiple years 47-2005 no estimate no estimate no estimate no estimate

221 Public utility companies Tax administration and equity 1949 47-2005(5) $81,699 $84,477 $87,602 $91,019

222 State and local governments Tax administration and equity 1949 47-2005(2) minimal minimal minimal minimal

223 Valet parking services Transportation 2002

47-

2001(n)(1)(L)(iv-I)

and 47-

2001(n)(2)(H) $143 $148 $153 $159

Revenue Forgone ($ in thousands)

Office of the Chief Financial Officer

________________________________________________________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page xxv

# Name of Tax Expenditure Program Area Year Enacted D.C. Code Section FY 2014 FY 2015 FY 2016 FY 2017

D.C. INSURANCE PREMIUMS TAX

Insurance Premiums Tax Credit

224

Certified capital investment by insurance

companies Economic development 2004 31-5233 $8,804 $2,859 $0 $0

D.C. PERSONAL PROPERTY TAX

Personal Property Tax Exemptions

225 Digital audio radio satellite companies Economic development 2000 47-1508(a)(8) no estimate no estimate no estimate no estimate

226 Qualified high-technology companies Economic development 2001 47-1508(a)(10) $100 $104 $108 $113

227 Qualified supermarkets Economic development 2000 47-1508(a)(9) $312 $316 $319 $322

228 Solar energy systems Natural resources and environment 2013 47-1508(a)(11) $124 $125 $126 $127

229 Cogeneration systems Natural resources and environment 2013 47-1508(a)(12) $0 $0 $0 $1,370

230 Non-profit organizations Social policy 1902 47-1508(a)(1) $4 $4 $4 $4

231

Public utility and toll telecommunications

providers Tax administration and equity 2001 47-1508(a)(3A) $6 $6 $6 $6

232 Wireless telecommunication companies Tax administration and equity 1998 47-1508(a)(7) minimal minimal minimal minimal

233

Works of art lent to the National Gallery

by non-residents Tax administration and equity 1950 47-1508(a)(2) $0 $0 $0 $0

234 Motor vehicles and trailers Transportation 1954 47-1508(a)(3) $2,437 $2,461 $2,486 $2,511

Revenue Forgone ($ in thousands)

Office of the Chief Financial Officer

________________________________________________________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page xxvi

(this page intentionally left blank)

Part II: Local Tax Expenditures

________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page 27

PART I: FEDERAL CONFORMITY TAX EXPENDITURES

Part II: Local Tax Expenditures

________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page 28

Income Tax

Exclusions

1. Capital gains on assets transferred at death

Internal Revenue Code Sections: 1001, 1014, 1023, 1040, 1221, and 1222

Federal Law Sunset Date: None

Year Enacted in Federal Law: 1921

Total

(Dollars in thousands) FY 2014 FY 2015 FY 2016 FY 2017

Corporate Income Tax Loss $0 $0 $0 $0

Personal Income Tax Loss $29,330 $31,270 $33,633 $36,178

Total $29,330 $31,270 $33,633 $36,178

DESCRIPTION: When property is transferred upon an owners death, unrealized capital gains

on the property are excluded from taxable income. The new basis of taxation for the heir is the

market value of the property when the owner died, rather than the original cost of the asset (this is

sometimes called a step-up in basis). This policy departs from the usual rules for capital gains,

which are taxed on the difference between the current price and the original cost of the asset.

PURPOSE: Although the original rationale for the exclusion is not clear, a justification currently

used is that death should not trigger a recognition of income.

10

One author notes that, Part of the

rationale for step-up in basis was that the gains were subject to the estate tax.

11

In addition, there

would be an administrative burden both for taxpayers and the IRS to determine the original price

of assets that were purchased long ago.

IMPACT: The Congressional Research Service states that, The exclusion of capital gains at

death is most advantageous to individuals who need not dispose of their assets to achieve

financial liquidity. Generally speaking, these individuals tend to be wealthier. The deferral of tax

on the appreciation involved, combined with the exemption for the appreciation before death, is a

significant benefit for those investors and their heirs.

12

With regard to efficiency, the failure to tax capital gains transferred at death encourages lock-in

of assets (holding the same assets even though portfolio change might otherwise be more

beneficial).

13

CRS points out that, Lower capital gains taxes may disproportionately benefit real

estate investments and may cause corporations to retain more earnings than would otherwise be

10

U.S. Senate, Committee on the Budget, Tax Expenditures: Compendium of Background Material on

Individual Provisions, Senate Print 112-45, prepared by the Congressional Research Service (December

2012), p. 431.

11

Gerald Auten, Capital Gains Taxation, in The Encyclopedia of Taxation and Tax Policy, Joseph

Cordes, Robert Ebel, and Jane Gravelle, eds. (Washington, D.C.: The Urban Institute Press, 2005), p. 47.

12

U.S. Senate, Committee on the Budget, p. 430.

13

U.S. Senate, Committee on the Budget, p. 431.

Part II: Local Tax Expenditures

________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page 29

the case, causing efficiency losses. At the same time, lower capital gains taxes reduce the

distortion that favors corporate debt over equity, which produces an efficiency gain.

14

14

U.S. Senate, Committee on the Budget, p. 431.

Part II: Local Tax Expenditures

________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page 30

Income Tax

Exclusions

2. Capital gains on assets transferred as a gift

Internal Revenue Code Sections: 1015

Federal Law Sunset Date: None

Year Enacted in Federal Law: 1921

Total

(Dollars in thousands) FY 2014 FY 2015 FY 2016 FY 2017

Corporate Income Tax Loss $0 $0 $0 $0

Personal Income Tax Loss -$1,989 -$5,116 $2,274 $3,126

Total -$1,989 -$5,116 $2,274 $3,126

DESCRIPTION: When property is transferred as a gift during the lifetime of the owner,

unrealized capital gains on the property are excluded from taxable income. The new basis of

taxation is the original cost of the asset paid by the donor, but the tax is not imposed upon the

transfer. In addition, tax can be avoided entirely if the recipient holds the asset until death, when

it can be transferred to an heir without triggering capital gains taxation.

PURPOSE: Although the original rationale for the exclusion is not clear, a justification currently

used is that a gift should not trigger a recognition of income.

15

In addition, another rationale

might be that the transfer is subject to the gift tax.

IMPACT: The impact of the capital gains tax exclusion for gifts is somewhat similar to the

exclusion for assets transferred at death (see Tax Expenditure #1, described on the previous

pages). The exclusion of capital gains on gifts will be most advantageous to individuals who do

not need to dispose of their assets to achieve financial liquidity, and to those who have more

valuable assets. These individuals tend to be wealthier. In addition, the exclusion for capital

gains on gifts encourages the lock-in of assets (maintaining the same assets even though

portfolio change might otherwise be more beneficial).

15

U.S. Senate, Committee on the Budget, p. 431.

Part II: Local Tax Expenditures

________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page 31

Income Tax

Exclusions

3. Cash accounting, other than agriculture

Internal Revenue Code Sections: 446 and 448

Federal Law Sunset Date: None

Year Enacted in Federal Law: 1916

Corporation Personal Total

(Dollars in thousands) FY 2014 FY 2015 FY 2016 FY 2017

Corporate Income Tax Loss too small too small too small too small

Personal Income Tax Loss $1,665 $1,804 $1,804 $1,943

Total $1,665 $1,804 $1,804 $1,943

Note: Too small means that the nationwide federal revenue impact was estimated as $50 million or less.

DESCRIPTION: Employee-owned personal service businesses

16

and other small businesses with

average annual gross receipts of less than $5 million for the last three years have the option of

using the cash method of accounting instead of the accrual method. Using the cash method for tax

purposes effectively defers corporation and personal income taxes by allowing qualified

businesses to record income when it is received rather than when it is earned (the accrual

method).

PURPOSE: The purpose of the exclusion is to simplify record keeping and eliminate an

additional drain on the working capital of small businesses.

IMPACT: Small businesses and personal service corporations benefit from this provision. The

Congressional Research Service states that cash accounting allows businesses to exercise greater

control over the timing of receipts and payments for expenses. By shifting income or deductions

from the current tax year to a future year, taxpayers can defer the payment of income taxes or

take advantage of expected or enacted reductions in tax rates. In addition, the cash method of

accounting has the advantage of lower compliance costs and greater familiarity for individuals

and small firms that are permitted to use it for tax purposes.

17

16

This category includes businesses in the fields of health, law, accounting, engineering, architecture,

actuarial science, performing arts, or consulting.

17

U.S. Senate, Committee on the Budget, p. 497.

Part II: Local Tax Expenditures

________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page 32

Income Tax

Exclusions

4. Credit union income

Internal Revenue and U.S. Code Sections: 501(c)(14) and 12 USC 1768

Federal Law Sunset Date: None

Year Enacted in Federal Law: 1937

CTotal

(Dollars in thousands) FY 2014 FY 2015 FY 2016 FY 2017

Corporate Income Tax Loss $405 $463 $521 $579

Personal Income Tax Loss $0 $0 $0 $0

Total $405 $463 $521 $579

DESCRIPTION: The income of a credit union is exempt from corporate income tax. Credit

unions are non-profit cooperatives organized by people with a common bond (such as

membership in the same profession) that distinguishes them from the general public. Members of

the credit union pool their funds to make loans to one another. The earnings that the credit union

distributes to its depositors (as opposed to earnings that it retains) are subject to taxation.

Credit unions initially gained tax-exempt status in 1937 when they were included in a broader

exemption for domestic building and loan associations. In 1951, a specific tax exemption for

credit unions was enacted.

PURPOSE: According to the U.S. Government Accountability Office (GAO), credit unions

continue to be exempt because of their cooperative, not-for-profit structure, which is distinct

from other depository institutions, and because credit unions have historically emphasized serving

people of modest means.

18

IMPACT: Credit unions and their members benefit from this provision. The Congressional

Research Service states that, For a given addition to retained earnings, this tax exemption

permits credit unions to pay members higher dividends and charge members lower interest rates

on loans. Over the past 25 years, this tax exemption may have contributed to the more rapid

growth of credit unions compared to other depository institutions.

19

Proponents of the exemption emphasize that credit unions are directed by volunteers for the

purpose of serving their members, rather than maximizing profits. CRS also points out that,

[S]upporters argue that credit unions are subject to certain regulatory constraints not required of

other depository institutions and that these constraints reduce the competitiveness of credit

unions. For example, credit unions may only accept deposits of members and lend only to

members, other credit unions, or credit union organizations.

20

18

U.S. Government Accountability Office, Financial Institutions: Issues Regarding the Tax-Exempt Status

of Credit Unions, Highlights of GAO-06-220T, Testimony before the Committee on Ways and Means,

House of Representatives, November 3, 2005.

19

U.S. Senate, Committee on the Budget, pp. 317-318.

20

U.S. Senate, Committee on the Budget, p. 319.

Part II: Local Tax Expenditures

________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page 33

On the other hand, Proponents of taxation argue that deregulation has caused extensive

competition among all depository institutions, including credit unions, and that the tax exemption

gives credit unions an unwarranted advantage over other depository institutions. They argue that

depository institutions should have a level playing field in order for market forces to allocate

resources efficiently.

21

The U.S. Treasury Departments 1984 tax reform report to President

Reagan proposed repealing the exclusion of credit union income on precisely those grounds.

22

It is also not clear to what extent credit unions serve people of low or moderate incomes and pass

on the savings from the tax exclusion to credit union members. In testimony to the U.S. House

Committee on Ways and Means in November 2005, a GAO official stated that, [S]ome studies,

including one of our own, indicate that credit unions serve a slightly lower proportion of

households with low and moderate incomes than banks.

23

21

U.S. Senate, Committee on the Budget, p. 319.

22

U.S. Treasury Department, Tax Reform for Fairness, Simplicity, and Economic Growth, The Treasury

Department Report to the President, Volume 1, Overview (November 1984), p. 133.

23

U.S. Government Accountability Office, Financial Institutions: Issues Regarding the Tax-Exempt Status

of Credit Unions, Statement of Richard Hillman, Managing Director, Financial Markets and Community

Investments, before the Committee on Ways and Means, House of Representatives (GAO-06-220T),

November 3, 2005, p. 9.

Part II: Local Tax Expenditures

________________________________________________________________________________________________

District of Columbia Tax Expenditure Report

Page 34

Income Tax

Exclusions

5. Distribution from redemption of stock to pay taxes imposed at

death

Internal Revenue Code Sections: 303

Federal Law Sunset Date: None

Year Enacted in Federal Law: 1950

CTotal

(Dollars in thousands) FY 2014 FY 2015 FY 2016 FY 2017