Académique Documents

Professionnel Documents

Culture Documents

Auto Insurers Charge (Some) Safe Drivers Higher Rates

Transféré par

shockingjam9109Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Auto Insurers Charge (Some) Safe Drivers Higher Rates

Transféré par

shockingjam9109Droits d'auteur :

Formats disponibles

Auto insurers charge (some) safe drivers higher rates

$1,394

$760

State Farm

$1,486

To conduct the survey, CFA used the websites for five major insurers -- Geico (BRKA), Progressive

(PGR), State Farm, Allstate (ALL) and Farmers -- to solicit rates for two hypothetical customers in 12

cities, generating 60 sets of rate quotes.

Los Angeles

$1,344

Industry officials countered that insurance is widely available, and drivers are always able to shop

around for the best price.

Up to a third of low-income drivers do not have insurance even though it is required by law in 49

states, according to CFA studies.

"Is there any question why so many of them drive uninsured when what is being asked for auto

insurance is so much of their income?" said Robert Hunter, CFA's director of insurance.

$770

$2,074

Farmers

GEICO

$678

Progressive

$832

$1,622

$812

$1,334

Allstate

$790

NEW YORK (CNNMoney)

$1,210

$546

State Farm

$1,274

Farmers

$1,248

Progressive

$678

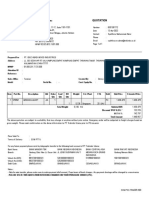

A sampling from the CFA report

State Farm

In the most extreme example, Allstate in Baltimore quoted the receptionist an annual premium of

$3,292, compared to $1,248 for the executive -- a difference of 164%. Of the five companies

surveyed, only State Farm consistently quoted lower rates for the receptionist -- the safer driver.

$942

Progressive

Allstate

$1,218

Related: Cheapest cars to fuel

First Published: January 28, 2013: 4:34 PM ET

Washington D.C.

$1,224

$888

Geico, State Farm, Allstate and Farmers all declined to comment. Progressive noted it has a

voluntary program that installs a device on a customer's vehicle to track actual driving behavior, and

provide rates based on that information.

Allstate

$1,126

$554

$578

For each company and city, CFA entered information for two 30-year-old women who drove the same

car, had the same annual mileage and were both seeking minimum liability insurance as required by

state law. In each city, the women lived on the same street in a zip code with a median income of

about $50,000. No credit score was entered.

Insurers say that they use a wide variety of factors to determine the likelihood a customer will be in

an accident, in accordance with state regulations.

$1,090

Insurers are barred from basing rates on race or income, but the CFA says that their rate-setting

practices tend to result in higher rates for low and moderate-income drivers.

"If [State Farm] can be a successful company without using highly discriminatory factors, other

large companies should be able to do so as well," Brobeck said.

Farmers

GEICO

$624

"The use of factors such as credit-based insurance scoring, location of the vehicle, driver experience,

traffic citations, continuity of coverage and education helps insurers to more accurately price risk,"

Willem O. Rijksen, vice president of public affairs for the American Insurance Association, said in a

statement.

Auto insurance quotes by city

In a case study of five major insurers in 12 cities, the Consumer Federation of America found that

major insurers charged a safer driver with less education and a lower-paying job higher premiums

two-thirds of the time. In a majority of those cases, the premiums were at least 25% higher. In some

cases, the rates were more than double what was quoted for a driver who had recently had an

accident but had a higher-paying job.

$950

$1,386

GEICO

Atlanta

That's because most of the insurers surveyed put more weight on income-related factors, like

education or occupation, than driving-related factors including miles on the road and driving history,

said CFA Executive Director Stephen Brobeck.

When

setting rates, insurers often put more weight on income-related factors, like education or

occupation, than factors like driving history, according to a consumer watchdog report.

$694

The difference: One woman was a high-school educated single receptionist who rented her home and

had been without insurance coverage for 45 days. The other was a married executive with a masters

degree who owned her own home and had no lapse in coverage. The receptionist had a perfect 10-

year driving record, while the executive had recently caused a car accident.

Source: Consumer Federation of America

$782

Related: Protect your home

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- R1508D933901 - PS4S26-V1 Assessment PointDocument31 pagesR1508D933901 - PS4S26-V1 Assessment PointRue Spargo Chikwakwata100% (3)

- CH 21 TBDocument18 pagesCH 21 TBJessica Garcia100% (1)

- Mays Mba Resume - Korbin King v8Document1 pageMays Mba Resume - Korbin King v8api-478389721Pas encore d'évaluation

- 35 Financial Management FM 71 Imp Questions With Solution For CA Ipcc MsDocument90 pages35 Financial Management FM 71 Imp Questions With Solution For CA Ipcc Msmysorevishnu75% (8)

- Merchandising Reviewer 2Document5 pagesMerchandising Reviewer 2Sandro Marie N. ObraPas encore d'évaluation

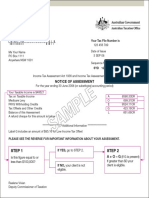

- Step 1 Step 2: Notice of AssessmentDocument1 pageStep 1 Step 2: Notice of Assessmentabinash manandharPas encore d'évaluation

- Transcription Doc Foreign Trade: Speaker: Chris OatesDocument9 pagesTranscription Doc Foreign Trade: Speaker: Chris OatesAnirban BhattacharyaPas encore d'évaluation

- 06 MaterialityDocument2 pages06 MaterialityMan Cheng100% (1)

- Accounting For Manufacturing FirmDocument13 pagesAccounting For Manufacturing Firmnadwa dariahPas encore d'évaluation

- Answers To End of Chapter QuestionsDocument59 pagesAnswers To End of Chapter QuestionsBruce_scribed90% (10)

- Contribution Reciept (1) CyungoDocument1 pageContribution Reciept (1) CyungoBizimenyera Zenza TheonestePas encore d'évaluation

- Mergent Residences Sample ComputationDocument1 pageMergent Residences Sample Computationrx5426.homerouterPas encore d'évaluation

- Assign 2 Cash Flow Basic Sem 1 13 14Document2 pagesAssign 2 Cash Flow Basic Sem 1 13 14Sumaiya AbedinPas encore d'évaluation

- Abjamesola Tailoring Services Case StudyDocument17 pagesAbjamesola Tailoring Services Case StudyTintin Tao-onPas encore d'évaluation

- Financial Accounting Steel SectorDocument36 pagesFinancial Accounting Steel SectorashishPas encore d'évaluation

- Act 282 Lembaga Kemajuan Wilayah Pulau Pinang Act 1983Document34 pagesAct 282 Lembaga Kemajuan Wilayah Pulau Pinang Act 1983Adam Haida & CoPas encore d'évaluation

- 3.2 Accounting For Corporation Reviewer With Sample ProblemDocument82 pages3.2 Accounting For Corporation Reviewer With Sample Problemlavender hazePas encore d'évaluation

- Additional Bank Recon QuestionsDocument4 pagesAdditional Bank Recon QuestionsDebbie DebzPas encore d'évaluation

- Idec 8301381772Document1 pageIdec 8301381772denny palimbungaPas encore d'évaluation

- Lecture3 Sem2 2023Document35 pagesLecture3 Sem2 2023gregPas encore d'évaluation

- What Is A BCG Growth-Share Matrix?: Minglana, Mitch T. BSA 201Document3 pagesWhat Is A BCG Growth-Share Matrix?: Minglana, Mitch T. BSA 201Mitch Tokong MinglanaPas encore d'évaluation

- Tata Corus DealDocument39 pagesTata Corus DealdhavalkurveyPas encore d'évaluation

- Management Hierarchy: Askari Bank LimitedDocument14 pagesManagement Hierarchy: Askari Bank LimitedEeshaa MalikPas encore d'évaluation

- InflationDocument40 pagesInflationmaanyaagrawal65Pas encore d'évaluation

- Satia Industry Training Report.Document57 pagesSatia Industry Training Report.Deep zaildarPas encore d'évaluation

- ARTI Annual Report 2019 PDFDocument139 pagesARTI Annual Report 2019 PDFS Gevanry SagalaPas encore d'évaluation

- Merger and Acquisition of BanksDocument1 pageMerger and Acquisition of Banksstithi aggarwalPas encore d'évaluation

- Issues and Challenges of Insurance Industry in IndiaDocument3 pagesIssues and Challenges of Insurance Industry in Indianishant b100% (1)

- CAPE 2003 AccountingDocument13 pagesCAPE 2003 AccountingStephen WhiteKnight BuchananPas encore d'évaluation

- Financing Strategy at Tata SteelDocument23 pagesFinancing Strategy at Tata SteelSarangPas encore d'évaluation