Académique Documents

Professionnel Documents

Culture Documents

Samsung Electronics: Earnings Release Q2 2013

Transféré par

Alexandru BirneataDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Samsung Electronics: Earnings Release Q2 2013

Transféré par

Alexandru BirneataDroits d'auteur :

Formats disponibles

Earnings Release Q2 2013

Samsung Electronics

July 2013

The financial information in this document are consolidated earnings results based on K-IFRS.

This document is provided for the convenience of investors only, before the external audit on our Q2 2013

financial results is completed. The audit outcomes may cause some parts of this document to change.

This document contains "forward-looking statements" - that is, statements related to future, not past, events.

In this context, "forward-looking statements" often address our expected future business and financial

performance, and often contain words such as "expects, "anticipates, "intends, "plans, "believes, "seeks

or "will ". Forward-looking statements" by their nature address matters that are, to different degrees, uncertain.

For us, particular uncertainties which could adversely or positively affect our future results include:

The behavior of financial markets including fluctuations in exchange rates, interest rates and commodity

prices

Strategic actions including dispositions and acquisitions

Unanticipated dramatic developments in our major businesses including CE (Consumer Electronics),

IM (IT & Mobile communications), DS (Device Solutions)

Numerous other matters at the national and international levels which could affect our future results

These uncertainties may cause our actual results to be materially different from those expressed in this document.

Disclaimer

1

Income Statement

(Unit: KRW Trillion) 2Q 13 % of sales 1Q 13 % of sales 2Q 12

Sales

57.46 100.0% 52.87 100.0% 47.60

Cost of Sales 34.34 59.8% 31.38 59.4% 29.97

Gross Profit

23.12 40.2% 21.49 40.6% 17.63

SG&A expenses 13.59 23.7% 12.71 24.0% 11.16

- R&D expenses 3.54 6.2% 3.33 6.3% 2.87

Operating Profit 9.53 16.6% 8.78 16.6% 6.46

Other non-operating income/expense 0.09 0.2% 0.10 0.2% 0.26

Equity method gain/loss 0.21 0.4% 0.18 0.3% 0.27

Finance income/expense

0.003 - 0.19 0.4% 0.26

Profit Before Income Tax

9.83 17.1% 9.05 17.1% 6.73

Income tax

2.05 3.6% 1.89 3.6% 1.54

Net profit

7.77 13.5% 7.15 13.5% 5.19

2Q 13 1Q 13 2Q 12

ROE

24% 23% 20%

Profitability (Net profit/Sales) 0.14 0.14 0.11

Asset turnover (Sales/Asset) 1.19 1.14 1.18

Leverage (Asset/Equity) 1.48 1.49 1.52

EBITDA Margin

23% 24% 21%

Key Profitability Indicators

2Q 12 1Q 13 2Q 13

20%

23%

24%

21%

24%

23%

ROE EBITDA Margin

(Unit: KRW Trillion)

2Q 13 QoQ 1Q 13 2Q 12

Total 57.46 9% 52.87 47.60

CE

12.78 14% 11.24 12.83

VD 7.94 7% 7.43 8.58

IM 35.54 8% 32.82 23.36

Mobile 34.58 9% 31.77 22.43

DS

17.05 8% 15.81 17.03

Semiconductor 8.68 1% 8.58 8.60

- Memory 5.70 11% 5.12 5.42

DP 8.18 15% 7.11 8.25

(Unit: KRW Trillion)

2Q 13 QoQ 1Q 13 2Q 12

Total 9.53 9% 8.78 6.46

CE

0.43 83% 0.23 0.73

IM

6.28 3% 6.51 4.13

DS

2.92 58% 1.85 1.69

Semiconductor 1.76 64% 1.07 1.03

DP 1.12 46% 0.77 0.71

2

Segment Sales & Operating Profit

Sales

Operating Profit

Note) CE (Consumer Electronics), IM (IT & Mobile communications), DS (Device Solutions), DP (Display Panel)

Sales for each business unit includes intersegment sales.

2012 sales and operating profit of each business stated above reflect the organizational change in 2013.

2Q results

D P

3

Semiconductor

[ LCD ]

Market : Demand increased QoQ led by new SET product

launches and promotion effects

- TV panel : Demand up 6%QoQ led by China due to

Labor Day holidays and subsidy program promotions

- IT panel : Demand increased 9%QoQ

Demand growth continued led by tablet panels

- TV panel ASP improved led by high-end product launches

(60+/UHD); IT panel price remained weak

Samsung : Earnings improved slightly led by

increased high value-added panel shipments

- TV panel : Shipments up high-single digit-% QoQ

but down high-single digit-% YoY

Successfully launched 60+ ultra large-screen TV and UHD

and expanded customer base

- IT panel : High value-added product sales growth continued,

including high-resolution PLS

[ OLED ]

Improved earnings led by OLED panel shipment growth for

premium smartphones

[Memory]

Market : Low PC demand continued, while mobile demand

remained solid, SSD market growth continued

- DRAM : PC DRAM demand remained low, while server/mobile

demand remained solid

- NAND : Smartphone/mass-market tablet demand grew,

broad SSD adoption led solid demand to continue

Samsung: Improved earnings by expanding portion

of high value-added/differentiated products

and enhancing cost competitiveness

- DRAM : Actively addressed growing high value-added specialty

products demand (mobile/server)

and increased shipments

- NAND : Enhanced cost competitiveness through 1xnm

process migration;

Increased portion of high-margin solution products

and 3bit products

[System LSI]

Overall sales declined due to lower Mobile AP shipments

C E

[ T V ]

Market : FPTV market grew slightly QoQ, under

weak seasonality and low demand in EU market

- Market demand up low-single digit-% QoQ and YoY

LED portion growth continued in developed market

(1Q 88% 2Q 90%)

Samsung : Improved product line-ups in strategic markets,

including North America and China

and shipments increased

- High value-added product shipments grew

F7/8000 series : shipments increased 7% QoQ

60 large-size TV sales portion : 9% in 1Q 12% in 2Q

- Enhanced mid to low-end product line-ups in EM,

including China; shipments increased

[ Digital Appliances ]

Market : Under low-growth market condition, seasonal demand

for Air-conditioners improved

Samsung : Earnings grew led by improved key product

line-ups, shipment growth, and seasonal effects

for Air-conditioner

2Q results

I M

[Handset]

Market : Under weak seasonality,

smartphone demand increased slightly

- Smartphone : Demand increased by low single digit-% QoQ

- Tablet : Demand decreased in developed markets

but increased in emerging markets

Samsung : Smartphone sales grew led by solid S4 shipments,

marginal profit decline due to increased costs

of new product launches, R&D and

retail channels investments, etc.

- Smartphone : Shipments increased with Global S4 launch

and regional growth in America (continent)

and China

- Tablet : Expanded product line-ups, including Note 8.0

- P C : Shipments declined due to weak demand

[Network]

Earnings declined QoQ due to delayed investments for LTE

network by some carriers

4

Outlook

I M

C E

Semiconductor

TV

- Expect demand growth under strong seasonality, and

new premium market competition to start, including UHD TV

Expect sales competition to phase-in after new premium

product launches in 3Q

Digital Appliances

- Expect low market growth to continue and demand to increase

led by emerging market

D P

LCD

- Expect strong seasonality despite headwinds, including delayed

EU demand recovery

TV panel : Size increase to continue led by

60+ ultra large screen / UHD market growth

IT panel : Tablet panel demand growth led by

mid to low-price products

OLED : Expect smartphone panel demand growth to continue

Expanding line-ups featuring various sizes and high resolution

Expect smartphone and tablet markets growth to continue

under strong seasonality, while competition to intensify

led by new product launches

- Smartphone : Expect balanced growth in DM and EM

Developed markets : LTE replacement demand to continue,

and expect competition for year-end promotions

Emerging markets : Expect ramp up growth led by

mass-market smartphone, including China

- Tablet : Expect high growth in both DM and EM

Expect competition to intensify as new product offerings

to expand

Memory

- DRAM : Expect steady mobile demand to continue led by

new smartphone launches,

PC demand to grow slightly due to seasonality;

Demand growth led by Server-DRAM for datacenter

and graphic-DRAM for new game consoles

- NAND : Expect demand growth to continue driven by new

mobile product launch and expanded SSD adoption

by PC/Datacenter

S.LSI

- Expect strong drive to improve shipments, including 28nm AP

and high-pixel image sensors

5

[Appendix 1] Statement of Financial Position (K-IFRS)

(Unit : KRW Billion)

2Q '13 1Q '13 2Q '12

Current Assets 104,791 95,198 73,460

- Cash * 46,986 43,559 23,804

- A/R 27,108 23,398 24,117

- Inventories 21,562 19,502 17,443

- Other Current Assets 9,135 8,739 8,096

Non Current Assets 98,971 95,645 92,840

- Investments 15,725 14,630 13,078

- PP&E 70,398 68,766 68,840

- Intangible Assets 4,062 4,077 3,673

- Other Non Current Assets 8,786 8,172 7,249

203,762 190,843 166,300

Liabilities 65,382 62,037 56,036

- Debts 13,825 12,356 14,472

- Trade Accounts and N/P 10,527 10,478 10,516

- Other Accounts and N/P

& Accrued Expenses

18,043 16,690 14,267

- Income Tax Payables 3,066 4,291 2,327

- Unearned Revenue

& Other Advances

2,884 3,053 2,769

- Other Liabilities 17,037 15,169 11,685

Shareholders' Equity 138,380 128,806 110,264

- Capital Stock 898 898 898

203,762 190,843 166,300

Cash * =Cash and Cash equivalents +Short-term financial instruments +Short-term available-for-sale securities

2Q '13 1Q '13 2Q '12

Current ratio * 197% 189% 165%

Liability/Equity 47% 48% 51%

Debt/Equity 10% 10% 13%

Net debt/Equity -24% -24% -8%

Current ratio * =Current assets/Current liabilities

Total Liabilities &

Shareholder's Equity

Total Assets

[Appendix 2] Cash Flow Statement (K-IFRS)

(Unit : KRW Trillion)

Cash flows from operating activities

Net profit

Depreciation

Others

Cash flows from investing activities

Increase in tangible assets

Cash flows from financing activities

Increase in debts

Increase in cash

Cash * =Cash and Cash equivalents +Short-term financial instruments +Short-term available-for-sale securities

Current State of Net Cash (Net Cash =Cash* - Debts)

(Unit : KRW Trillion)

Cash * =Cash and Cash equivalents +Short-term financial instruments +Short-term available-for-sale securities

[ '13 CAPEX Plan ]

- Total 24 trillion won (Semiconductor 13 trillion won, DP 6.5 trillion won, etc.)

33.16 31.20 9.33

2Q '12

8.60 12.82 5.93

7.77 7.15 5.19

-5.47 -3.40 -6.18

46.99 43.56 23.80

0.42 -2.62 -0.78

1.33 -2.69 0.27

-1.59

2Q '13 1Q '13 2Q '12

43.56 37.45 25.39

-6.00 -4.45 -6.48

3.81 3.78 3.74

-2.98 1.89 -3.00

3.43 6.11

2Q '13 1Q '13

Cash (Beginning of period)*

Cash (End of period)*

Net Cash

For 2013, our capital investment is planned for 24 trillion won, an increase of more than

one trillion won from the record-high amount we reported last year.

It is possible for the budgeted amount to increase based on the market conditions of

the second half and the next year.

Vous aimerez peut-être aussi

- S Elt I Samsung Electronics: Earnings Release Q1 2013Document9 pagesS Elt I Samsung Electronics: Earnings Release Q1 2013sim0cyzPas encore d'évaluation

- S Elt I Samsung Electronics: Earnings Release Q4 2012Document10 pagesS Elt I Samsung Electronics: Earnings Release Q4 2012Cristi IvanPas encore d'évaluation

- S Elt I Samsung Electronics: Earnings Release Q2 2012Document11 pagesS Elt I Samsung Electronics: Earnings Release Q2 2012anon_248928013Pas encore d'évaluation

- Samsung Electronics: Earnings Release Q4 2015Document8 pagesSamsung Electronics: Earnings Release Q4 2015Radovanovic.95Pas encore d'évaluation

- Samsung Electronics: Earnings Release Q2 2015Document8 pagesSamsung Electronics: Earnings Release Q2 2015carmen4621Pas encore d'évaluation

- Samsung Electronics: Earnings Release Q1 2015Document8 pagesSamsung Electronics: Earnings Release Q1 2015Radovanovic.95Pas encore d'évaluation

- Samsung Electronics: Earnings Release Q3 2014Document8 pagesSamsung Electronics: Earnings Release Q3 2014Joel Eljo Enciso SaraviaPas encore d'évaluation

- S Elt I Samsung Electronics: Earnings Release Q4 2011Document11 pagesS Elt I Samsung Electronics: Earnings Release Q4 2011Dark BlackPas encore d'évaluation

- Samsung Annual Report 2011Document16 pagesSamsung Annual Report 2011Nishant KhattwaniPas encore d'évaluation

- APQ3FY12Document19 pagesAPQ3FY12Abhigupta24Pas encore d'évaluation

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryD'EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- 4Q15 Earnings Eng FinalDocument15 pages4Q15 Earnings Eng FinalsupportPas encore d'évaluation

- Samsung Electronics: September, 2001Document26 pagesSamsung Electronics: September, 2001Udhaya KrishnaPas encore d'évaluation

- Sun Microsystems Q107 Quarterly Results Release: Investor RelationsDocument39 pagesSun Microsystems Q107 Quarterly Results Release: Investor RelationsjohnachanPas encore d'évaluation

- Samsung Market Share and CompetitorsDocument19 pagesSamsung Market Share and CompetitorsVikramPas encore d'évaluation

- Analyst Presentation - Aptech LTD Q3FY13Document31 pagesAnalyst Presentation - Aptech LTD Q3FY13ashishkrishPas encore d'évaluation

- LG Electronics.2Q2012 Earnings PresentationDocument22 pagesLG Electronics.2Q2012 Earnings PresentationSam_Ha_Pas encore d'évaluation

- Technical & Trade School Revenues World Summary: Market Values & Financials by CountryD'EverandTechnical & Trade School Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Sales Financing Revenues World Summary: Market Values & Financials by CountryD'EverandSales Financing Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryD'EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- 2013 2q Presentation EngDocument38 pages2013 2q Presentation EngRockiPas encore d'évaluation

- Martin Engegren ST Ericsson q3 2012Document4 pagesMartin Engegren ST Ericsson q3 2012martin_engegrenPas encore d'évaluation

- Traveler Accommodation Revenues World Summary: Market Values & Financials by CountryD'EverandTraveler Accommodation Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryD'EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Telephone Answering Service Revenues World Summary: Market Values & Financials by CountryD'EverandTelephone Answering Service Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- LGE.2Q11 Earnings PresentationDocument22 pagesLGE.2Q11 Earnings PresentationSam_Ha_Pas encore d'évaluation

- Business Service Center Revenues World Summary: Market Values & Financials by CountryD'EverandBusiness Service Center Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- FY12 - Analyst (Main Deck) - FINALDocument27 pagesFY12 - Analyst (Main Deck) - FINALoumichiePas encore d'évaluation

- Global Invacom Group Corporate Presentation 1H FY2013Document15 pagesGlobal Invacom Group Corporate Presentation 1H FY2013WeR1 Consultants Pte LtdPas encore d'évaluation

- 4Q13 LG Earnings Summarized Financial StatementsDocument20 pages4Q13 LG Earnings Summarized Financial Statementsbobloblaw0Pas encore d'évaluation

- Credit Union Revenues World Summary: Market Values & Financials by CountryD'EverandCredit Union Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- 9M 2013 Unaudited ResultsDocument2 pages9M 2013 Unaudited ResultsOladipupo Mayowa PaulPas encore d'évaluation

- Commercial Banking Revenues World Summary: Market Values & Financials by CountryD'EverandCommercial Banking Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Miscellaneous Nondepository Credit Intermediation Revenues World Summary: Market Values & Financials by CountryD'EverandMiscellaneous Nondepository Credit Intermediation Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- P Halfyear2013Document124 pagesP Halfyear2013Stancu Andreea CarmenPas encore d'évaluation

- Siemens 2020 VisionDocument46 pagesSiemens 2020 VisionSudeep KeshriPas encore d'évaluation

- TCS Financial Results: Quarter I FY 2014 - 15Document28 pagesTCS Financial Results: Quarter I FY 2014 - 15Bethany CaseyPas encore d'évaluation

- Packing & Crating Revenues World Summary: Market Values & Financials by CountryD'EverandPacking & Crating Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Miscellaneous Publisher Revenues World Summary: Market Values & Financials by CountryD'EverandMiscellaneous Publisher Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- 2013 2q Presentation WN EngDocument38 pages2013 2q Presentation WN EngRockiPas encore d'évaluation

- Business Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryD'EverandBusiness Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- BSBFIM601 Task 1Document10 pagesBSBFIM601 Task 1Kitpipoj PornnongsaenPas encore d'évaluation

- 2013 3 BDavidson Roth FinalDocument31 pages2013 3 BDavidson Roth FinalMitsuo SakamotoPas encore d'évaluation

- Interim Report: Nokia Corporation Interim Report For Q2 2013 and January-June 2013 Financial and Operating HighlightsDocument44 pagesInterim Report: Nokia Corporation Interim Report For Q2 2013 and January-June 2013 Financial and Operating HighlightsSushil GhadgePas encore d'évaluation

- FullYear2014 ResultsPresentationDocument31 pagesFullYear2014 ResultsPresentationkaze_no_taniPas encore d'évaluation

- Miscellaneous Investment Pools & Funds Revenues World Summary: Market Values & Financials by CountryD'EverandMiscellaneous Investment Pools & Funds Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Sound Recording Studio Revenues World Summary: Market Values & Financials by CountryD'EverandSound Recording Studio Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Estados Financieros ComcastDocument90 pagesEstados Financieros ComcastGustavo Florez100% (1)

- Q2 FY23 Financial Results Press ReleaseDocument16 pagesQ2 FY23 Financial Results Press ReleaseDennis AngPas encore d'évaluation

- FXCM Q1 2014 Earnings PresentationDocument21 pagesFXCM Q1 2014 Earnings PresentationRon FinbergPas encore d'évaluation

- Sales Presentation - Consumer DurablesDocument50 pagesSales Presentation - Consumer DurablesdrifterdriverPas encore d'évaluation

- Investor Presentation: Q2FY13 & H1FY13 UpdateDocument18 pagesInvestor Presentation: Q2FY13 & H1FY13 UpdategirishdrjPas encore d'évaluation

- Objectives of The StudyDocument1 pageObjectives of The StudyDanya JainPas encore d'évaluation

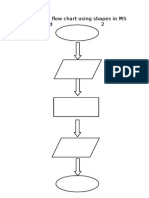

- 1) Draw A Flow Chart Using Shapes in MS Word To Add 2 NumbersDocument4 pages1) Draw A Flow Chart Using Shapes in MS Word To Add 2 NumbersDanya JainPas encore d'évaluation

- Type The Company NameDocument6 pagesType The Company NameDanya JainPas encore d'évaluation

- Seminar Project Report Submittedtowards The Partial Fulfillment of Under Graduate Degree in Business AdministrationDocument13 pagesSeminar Project Report Submittedtowards The Partial Fulfillment of Under Graduate Degree in Business AdministrationDanya Jain40% (5)

- Query 1Document21 pagesQuery 1Danya JainPas encore d'évaluation

- Chart in Microsoft Office WordDocument1 pageChart in Microsoft Office WordDanya JainPas encore d'évaluation

- Guidelines BBA-II YearDocument6 pagesGuidelines BBA-II YearDanya JainPas encore d'évaluation

- Staffing The Sales Force: Recruitment and Selection: Module FiveDocument23 pagesStaffing The Sales Force: Recruitment and Selection: Module FiveDanya JainPas encore d'évaluation

- MyntraDocument17 pagesMyntraDanya Jain100% (1)

- E Businessstrategiesof 140323144605 Phpapp02Document42 pagesE Businessstrategiesof 140323144605 Phpapp02Srujan ChPas encore d'évaluation

- McdfpomDocument4 pagesMcdfpomDanya JainPas encore d'évaluation

- Application of FayolDocument4 pagesApplication of FayolAnshita Garg87% (15)

- CO PY: Camera User GuideDocument132 pagesCO PY: Camera User GuideDanya JainPas encore d'évaluation

- Study of Customer Satisfaction For The Loan Product Avaqilable at IIFLDocument70 pagesStudy of Customer Satisfaction For The Loan Product Avaqilable at IIFLDanya JainPas encore d'évaluation