Académique Documents

Professionnel Documents

Culture Documents

Arce Vs Capital Insurance

Transféré par

thornapple250 évaluation0% ont trouvé ce document utile (0 vote)

558 vues2 pagesArce

Titre original

Arce vs Capital Insurance

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentArce

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

558 vues2 pagesArce Vs Capital Insurance

Transféré par

thornapple25Arce

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

77.

Arce vs Capital Insurance

G.R. No. L-28501, September 30,

1982

Topic: Premium

Ponente: Abad Santos, J.

Author:Jimi Arranchado

Link:

http://www.lawphil.net/judjuris/juri1982/sep1982/gr_l_28501_1982.html

FACTS:

1. The petitioner, the insured, was the owner of a residential house inTondo, Manila, which had been

insured with the Capital insurance since 1961under Fire Policy No. 24204.

2. On November 27, 1965, the COMPANY sent to the petitioner Renewal Certificate No. 47302 to cover

the period December 5, 1965 to December 5, 1966. The respondent also requested payment of the

corresponding premium in the amount of P38.10.

3. Anticipating that the premium could not be paid on time, the petitioner, thru his wife, promised to pay

it on January 4, 1966. The respondent accepted the promise but the premium was not paid on January 4,

1966.

4. When the petitioners house was ravaged with fire, the petitioners wife presented a claim for

indemnity to the respondent. She was told that no indemnity was due because the premium on the

policy was not paid.

5. Nonetheless the respondent tendered a check forP300.00 as financial aid which was received by the

petiotioners daughter. The respondent reiterated that the check was given "not as an obligation, but as

a concession" because the renewal premium had not been paid. The petitioner cashed the check but

then sued the respondent on the policy.

6. CFI: Capital Insurance and Surety Co., Inc. was ordered to pay Pedro Arce the proceeds of a fire

insurance policy.

ISSUE:

Whether or not the petitioners are entitled to claim from their policy despite non-payment of their

premium.

HELD:

No.

RATIO:

1. It is obvious from both the Insurance Act, as amended, and the stipulation of the parties that time is of

the essence in respect of the payment of the insurance premium so that if it is not paid the contract does

not take effect unless there is still another stipulation to the contrary. In the instant case, the petitioner

was given a grace period to pay the premium but the period having expired with no payment made; he

cannot insist that the respondent is nonetheless obligated to him.

2. Moreover, the parties in this case had stipulated:

[T]his insurance will be deemed valid and binding upon the respondent (Capital Assurance) only

when the premium and documentary stamps therefor have actually been paid in full and duly

acknowledged in an official receipt signed by an authorized official/representative of the respondent

(Capital Assurance).

DOCTRINE

An insurer is entitled to payment of premium as soon as the thing insured is exposed to the perils insured

against, unless there is clear agreement to grant credit extension for the premium due. No policy issued by an

insurance company is valid and binding unless and until the premium thereof has been paid.

Vous aimerez peut-être aussi

- Arce vs. The Capital Insurance & Surety Co., Inc.Document2 pagesArce vs. The Capital Insurance & Surety Co., Inc.Man2x SalomonPas encore d'évaluation

- 2 Pacific Banking Corporation V CA and Oriental AssuranceDocument3 pages2 Pacific Banking Corporation V CA and Oriental AssuranceKokoPas encore d'évaluation

- Development Insurance Corporation vs. Intermediate Appellate CourtDocument2 pagesDevelopment Insurance Corporation vs. Intermediate Appellate CourtbrendamanganaanPas encore d'évaluation

- Young vs. Midland Textile Insurance CompanyDocument2 pagesYoung vs. Midland Textile Insurance CompanyMan2x Salomon100% (2)

- ACCFA v. Alpha Insurance DigestDocument2 pagesACCFA v. Alpha Insurance Digestviva_33Pas encore d'évaluation

- 01 Constantino Vs Asia Life Insuracne CompanyDocument2 pages01 Constantino Vs Asia Life Insuracne CompanyRaima Marjian SucorPas encore d'évaluation

- Firemans Fund Insurance vs. Jamila CoDocument2 pagesFiremans Fund Insurance vs. Jamila CoKeangela Louise100% (1)

- Digest of Sun Insurance Office, Ltd. v. CA (G.R. No. 89741)Document2 pagesDigest of Sun Insurance Office, Ltd. v. CA (G.R. No. 89741)Rafael Pangilinan100% (1)

- Makati Tuscany Condo Corp vs AHAC Payment by InstallmentDocument1 pageMakati Tuscany Condo Corp vs AHAC Payment by InstallmentsappPas encore d'évaluation

- Insular Life v EbradoDocument2 pagesInsular Life v EbradoKath100% (1)

- Summit Guaranty and Insurance Company, Inc. v. de GuzmanDocument2 pagesSummit Guaranty and Insurance Company, Inc. v. de GuzmanRoms RoldanPas encore d'évaluation

- Calanoc v. Court of AppealsDocument1 pageCalanoc v. Court of AppealsRebecca ChanPas encore d'évaluation

- American Home Assurance Company vs. Tantuco Enterprises, Inc., (G.R. No. 138941. October 8, 2001) FactsDocument2 pagesAmerican Home Assurance Company vs. Tantuco Enterprises, Inc., (G.R. No. 138941. October 8, 2001) FactsPatricia Anne GonzalesPas encore d'évaluation

- 67 - Summit Guaranty and Insurance v. de GuzmanDocument1 page67 - Summit Guaranty and Insurance v. de GuzmanperlitainocencioPas encore d'évaluation

- Choa Tiek Seng v. CADocument2 pagesChoa Tiek Seng v. CASoc SaballaPas encore d'évaluation

- Insurance Law - Prudential Guarantee and Assurance v. Trans-Asia Shipping LinesDocument1 pageInsurance Law - Prudential Guarantee and Assurance v. Trans-Asia Shipping LinesMaestro LazaroPas encore d'évaluation

- American Home Assurance vs. ChuaDocument3 pagesAmerican Home Assurance vs. ChuaMan2x SalomonPas encore d'évaluation

- Sps. Cha v. CA (Digest)Document1 pageSps. Cha v. CA (Digest)Tini GuanioPas encore d'évaluation

- 231 Finman Assurance Vs CADocument2 pages231 Finman Assurance Vs CAHarry Dave Ocampo PagaoaPas encore d'évaluation

- TIBAY Vs CA Digest - MungcalDocument2 pagesTIBAY Vs CA Digest - Mungcalc2_charishmungcalPas encore d'évaluation

- Panmalayan Insurance vs. CA on insurer's subrogation rightsDocument2 pagesPanmalayan Insurance vs. CA on insurer's subrogation rightsElerlenne Lim100% (2)

- Manila Mahogany Manufacturing Corp vs. CADocument1 pageManila Mahogany Manufacturing Corp vs. CASamZacharyDumagan100% (1)

- Malayan Insurance Co., Inc. vs. Cruz Arnaldo DigestDocument3 pagesMalayan Insurance Co., Inc. vs. Cruz Arnaldo DigestMan2x SalomonPas encore d'évaluation

- Galarga v. SunlifeDocument3 pagesGalarga v. SunlifeBryce KingPas encore d'évaluation

- Argente v. West Coast Life InsuranceDocument2 pagesArgente v. West Coast Life InsuranceMan2x Salomon100% (1)

- Pioneer V Yap DigestDocument2 pagesPioneer V Yap DigestKath100% (1)

- The Insular Life Assurance Company Vs EbradoDocument2 pagesThe Insular Life Assurance Company Vs Ebradomuyrong100% (4)

- Choa Tiek Seng V Ca DigestDocument2 pagesChoa Tiek Seng V Ca Digestjey_d100% (2)

- Gulf Resorts Inc Vs Philippine Charter Insurance CorpDocument2 pagesGulf Resorts Inc Vs Philippine Charter Insurance CorpJ. LapidPas encore d'évaluation

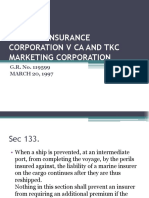

- MALAYAN INSURANCE CORPORATION V CA AND TKC MARKETING CORPORATIONDocument7 pagesMALAYAN INSURANCE CORPORATION V CA AND TKC MARKETING CORPORATIONKristine Garcia100% (2)

- Federal Express Corporation vs. American Home Assurance CompanyDocument2 pagesFederal Express Corporation vs. American Home Assurance Companydelbertcruz50% (2)

- Asssociation of Baptist Vs Fieldman - S Inusrance GR No. L-28772 124 Scra 618Document2 pagesAsssociation of Baptist Vs Fieldman - S Inusrance GR No. L-28772 124 Scra 618Ygh E SargePas encore d'évaluation

- South Sea Surety v. CADocument2 pagesSouth Sea Surety v. CAglecie_co12Pas encore d'évaluation

- Stronghold Insurance Vs Pamana Case DigestDocument7 pagesStronghold Insurance Vs Pamana Case DigestHazelGarciaPas encore d'évaluation

- Mayer Steel Pipe Corporation Vs Court of AppealsDocument3 pagesMayer Steel Pipe Corporation Vs Court of AppealsIhon BaldadoPas encore d'évaluation

- Capital Ins. & Surety Co. Vs Plastic Era (Digest)Document2 pagesCapital Ins. & Surety Co. Vs Plastic Era (Digest)Man2x Salomon100% (1)

- American Home Assurance V ChuaDocument1 pageAmerican Home Assurance V ChuaRoxanne AvilaPas encore d'évaluation

- Development Insurance Corp V.S. IACDocument2 pagesDevelopment Insurance Corp V.S. IACMan2x SalomonPas encore d'évaluation

- Insurance Policy Lapsed Due to Unpaid PremiumDocument1 pageInsurance Policy Lapsed Due to Unpaid PremiumApril Gem BalucanagPas encore d'évaluation

- Ang v. Fulton Fire DigestDocument1 pageAng v. Fulton Fire DigestNina100% (2)

- Roque VS Iac DigestDocument2 pagesRoque VS Iac Digestjojo50166Pas encore d'évaluation

- Insurance - Perla Compania V AnchetaDocument1 pageInsurance - Perla Compania V AnchetaAndrea TiuPas encore d'évaluation

- South Sea Surety v. CADocument1 pageSouth Sea Surety v. CAAlec VenturaPas encore d'évaluation

- General Insurance V. NG Hua: GR No. L-14373, Jan 30, 1960Document8 pagesGeneral Insurance V. NG Hua: GR No. L-14373, Jan 30, 1960Reynaldo YuPas encore d'évaluation

- CHOA TIEK SENG v. CADocument2 pagesCHOA TIEK SENG v. CAElden ClairePas encore d'évaluation

- Paz Constantino V Asia Life - GR No l1669Document2 pagesPaz Constantino V Asia Life - GR No l1669Christopher Jan DotimasPas encore d'évaluation

- Insurance Case: Eternal Gardens v. PHILAM LifeDocument1 pageInsurance Case: Eternal Gardens v. PHILAM LifeGR0018100% (1)

- Tan V. Ca GR NO. 48049 June 29, 1989 FactsDocument1 pageTan V. Ca GR NO. 48049 June 29, 1989 FactsFranzesca VinoyaPas encore d'évaluation

- Geagonia vs. Court of Appeals DigestDocument2 pagesGeagonia vs. Court of Appeals DigestKaren Jane Palmiano100% (2)

- Malayan Insurance Not Liable for Accident Involving Driver Without PH LicenseDocument1 pageMalayan Insurance Not Liable for Accident Involving Driver Without PH LicenseperlitainocencioPas encore d'évaluation

- Tan Chuco Vs Yorkshire Fire and Life Insurance CompanyDocument2 pagesTan Chuco Vs Yorkshire Fire and Life Insurance CompanyVern Villarica CastilloPas encore d'évaluation

- Insurance ruling on policy violationsDocument4 pagesInsurance ruling on policy violationsCourtney TirolPas encore d'évaluation

- Florendo v. Philam PlansDocument1 pageFlorendo v. Philam PlansJohney Doe50% (2)

- TAN Vs CADocument3 pagesTAN Vs CAMariz GalangPas encore d'évaluation

- Digest - UCPB Vs Masagana, GR No. 137172Document1 pageDigest - UCPB Vs Masagana, GR No. 137172ladygeorginaPas encore d'évaluation

- Malayan Insurance vs. Pap Co. LTDDocument2 pagesMalayan Insurance vs. Pap Co. LTDKelsey Olivar MendozaPas encore d'évaluation

- FGU Insurance Vs CADocument2 pagesFGU Insurance Vs CAIldefonso HernaezPas encore d'évaluation

- 106 Arce v. Capital InsuranceDocument1 page106 Arce v. Capital InsuranceJovelan V. EscañoPas encore d'évaluation

- Paid at The Time and in The Way and Manner Specified in The Policy, and If Not So Paid, The Policy Will Lapse and BeDocument6 pagesPaid at The Time and in The Way and Manner Specified in The Policy, and If Not So Paid, The Policy Will Lapse and BeGladysAnneMiquePas encore d'évaluation

- Arce v. Capital Insurance & Surety Co., Inc., 117 SCRA 63 (1982Document2 pagesArce v. Capital Insurance & Surety Co., Inc., 117 SCRA 63 (1982Minorka Sushmita Pataunia SantoluisPas encore d'évaluation

- Provisions V.iiDocument2 pagesProvisions V.iithornapple25Pas encore d'évaluation

- Hilton Vs GuyotDocument34 pagesHilton Vs Guyotthornapple25Pas encore d'évaluation

- 002 Republijjc of The PhilippinesDocument2 pages002 Republijjc of The Philippinesthornapple25Pas encore d'évaluation

- Children 1Document15 pagesChildren 1thornapple25Pas encore d'évaluation

- Class 5 ProvisionsDocument6 pagesClass 5 Provisionsthornapple25Pas encore d'évaluation

- Pioneer Vs TodaroDocument3 pagesPioneer Vs Todarothornapple25Pas encore d'évaluation

- Labor Lise of Cases Parts 3 and 4Document2 pagesLabor Lise of Cases Parts 3 and 4thornapple25Pas encore d'évaluation

- Case 3Document4 pagesCase 3thornapple25Pas encore d'évaluation

- Supreme Court ruling on labor union disputeDocument91 pagesSupreme Court ruling on labor union disputethornapple25Pas encore d'évaluation

- Saudi Airlines Vs CA - Employee Forced to Drop Rape CaseDocument21 pagesSaudi Airlines Vs CA - Employee Forced to Drop Rape Casethornapple25Pas encore d'évaluation

- Estate Taxes CasesDocument34 pagesEstate Taxes Casesthornapple25Pas encore d'évaluation

- Bis 1. To Claim Authorship To Object To Certain Modifications and Other Derogatory Actions 2. After The Author's Death 3. Means of RedressDocument4 pagesBis 1. To Claim Authorship To Object To Certain Modifications and Other Derogatory Actions 2. After The Author's Death 3. Means of Redressthornapple25Pas encore d'évaluation

- Proximate Cause: Concurrent Causes. Where Two Separate Acts ofDocument7 pagesProximate Cause: Concurrent Causes. Where Two Separate Acts ofthornapple25Pas encore d'évaluation

- Saudi Airlines Vs CA - Employee Forced to Drop Rape CaseDocument21 pagesSaudi Airlines Vs CA - Employee Forced to Drop Rape Casethornapple25Pas encore d'évaluation

- What Is Illegal Recruitment?Document22 pagesWhat Is Illegal Recruitment?thornapple25Pas encore d'évaluation

- Patentable Inventions: About PatentsDocument6 pagesPatentable Inventions: About Patentsthornapple25Pas encore d'évaluation

- 160 213Document80 pages160 213thornapple25Pas encore d'évaluation

- Idea Vs ExpressionDocument6 pagesIdea Vs Expressionthornapple25Pas encore d'évaluation

- 049 Pan American World Airways vs. IACDocument2 pages049 Pan American World Airways vs. IACthornapple2567% (3)

- 057 RP v. Manila Electric Co.Document3 pages057 RP v. Manila Electric Co.thornapple25Pas encore d'évaluation

- Transpo 48 - 60 (No 56)Document35 pagesTranspo 48 - 60 (No 56)thornapple25Pas encore d'évaluation

- Cases For XeroxDocument1 pageCases For Xeroxthornapple25Pas encore d'évaluation

- 136 To 188 (Complete)Document116 pages136 To 188 (Complete)thornapple25Pas encore d'évaluation

- 50 China Airlines Vs ChiokDocument3 pages50 China Airlines Vs Chiokthornapple25Pas encore d'évaluation

- 27 Magellan MFG v. CADocument2 pages27 Magellan MFG v. CAthornapple25Pas encore d'évaluation

- LOCGOV 78-116 MISSING 79, 86, 88, 101 and 108Document90 pagesLOCGOV 78-116 MISSING 79, 86, 88, 101 and 108thornapple25Pas encore d'évaluation

- Juntilla v. Fontanar, 136 SCRA 624 (1985)Document2 pagesJuntilla v. Fontanar, 136 SCRA 624 (1985)Faye Cience BoholPas encore d'évaluation

- Lockean Theories of Property Justifications For Unilateral AppropriationDocument24 pagesLockean Theories of Property Justifications For Unilateral Appropriationthornapple25Pas encore d'évaluation

- Martini V MacondrayDocument2 pagesMartini V MacondrayboomonyouPas encore d'évaluation

- 018 Kapalaran v. CoronadoDocument3 pages018 Kapalaran v. Coronadothornapple25Pas encore d'évaluation

- PolicyScheduleDocument1 pagePolicyScheduleProcaeHexdofPas encore d'évaluation

- AsadDocument3 pagesAsadNahidul Islam IUPas encore d'évaluation

- Is It Worth It UAE Qatar Expenses Vs PackageDocument29 pagesIs It Worth It UAE Qatar Expenses Vs Packageandruta1978Pas encore d'évaluation

- Tender Input Form: (A) Basic DetailsDocument4 pagesTender Input Form: (A) Basic DetailsSanjay MahatoPas encore d'évaluation

- Promotion March2016 Final Updated Upto 24-02-2016Document147 pagesPromotion March2016 Final Updated Upto 24-02-2016pankaj gargPas encore d'évaluation

- Sonia Stevenson Resume 2018Document2 pagesSonia Stevenson Resume 2018api-404951725Pas encore d'évaluation

- I AnnexureDocument4 pagesI AnnexureRiSHI KeSH GawaIPas encore d'évaluation

- Internship-Report-on-General-Banking-of-Janata-Bank-Limited 2Document35 pagesInternship-Report-on-General-Banking-of-Janata-Bank-Limited 2Bronson CastroPas encore d'évaluation

- Determinants Of Household Access To Formal Credit In Rural VietnamDocument33 pagesDeterminants Of Household Access To Formal Credit In Rural VietnamGunk Alit Part IIPas encore d'évaluation

- Reliance Money Project ReportDocument12 pagesReliance Money Project Reportmysterio666Pas encore d'évaluation

- Statement 16-MAR-23 AC 63755886 18042921Document6 pagesStatement 16-MAR-23 AC 63755886 18042921Shauna DunnPas encore d'évaluation

- Brosur CPM 2017Document12 pagesBrosur CPM 2017Y TjiaPas encore d'évaluation

- Project Plan & Charter - MotlatsiDocument5 pagesProject Plan & Charter - MotlatsiMotlatsi MokoenaPas encore d'évaluation

- Itc Classic StoryDocument6 pagesItc Classic StoryNeelu BajajPas encore d'évaluation

- Syllabus in Business Organization II UpdatedDocument11 pagesSyllabus in Business Organization II UpdatedJel LyPas encore d'évaluation

- ABM Annual Report 2014Document80 pagesABM Annual Report 2014Tan Gim GimPas encore d'évaluation

- Brazilian Sovereign Bonds in DollarsDocument6 pagesBrazilian Sovereign Bonds in DollarsquiquemoPas encore d'évaluation

- Exam DiscussionDocument4 pagesExam DiscussionChelliah SelvavishnuPas encore d'évaluation

- Directory of The Business Correspondents in IndiaDocument36 pagesDirectory of The Business Correspondents in IndiaParvez SheikhPas encore d'évaluation

- #BWNLLSV #000000Q4T6WXX2A6#000AMP90F Champeil D Lewis 18026 Valley BLVD Apt 96 BLOOMINGTON CA 92316-2083Document4 pages#BWNLLSV #000000Q4T6WXX2A6#000AMP90F Champeil D Lewis 18026 Valley BLVD Apt 96 BLOOMINGTON CA 92316-2083Popo Lewis67% (3)

- Rekap Data Permohonan Buka Rekening Bni PuskesmasDocument8 pagesRekap Data Permohonan Buka Rekening Bni PuskesmasmsrepetPas encore d'évaluation

- Microfinance Provision in Ethiopia: September 2020Document11 pagesMicrofinance Provision in Ethiopia: September 2020yeshitilaPas encore d'évaluation

- ch21 SolDocument21 pagesch21 SolJohn Nigz PayeePas encore d'évaluation

- 29th July 2022Document2 pages29th July 2022Morena hartnettPas encore d'évaluation

- The Greatest Texas Bank Job: Felonious Balonias - ToxiczombiedevelopmentsDocument4 pagesThe Greatest Texas Bank Job: Felonious Balonias - ToxiczombiedevelopmentsBaqi-Khaliq BeyPas encore d'évaluation

- AEGON RELIGARE Premium Payment Receipt 2013Document1 pageAEGON RELIGARE Premium Payment Receipt 2013tusharmithaiPas encore d'évaluation

- H Theory of Money SupplyDocument3 pagesH Theory of Money SupplyShofi R Krishna100% (17)

- Sample - Death Care & Funeral Service Market - Trends & Opportunities (2016-2020) PDFDocument6 pagesSample - Death Care & Funeral Service Market - Trends & Opportunities (2016-2020) PDFDiarany SucahyatiPas encore d'évaluation

- Senior Auditor MCQsDocument118 pagesSenior Auditor MCQsZia Ud Din81% (32)

- DocumenteDocument5 pagesDocumentemaxim caldarasanPas encore d'évaluation