Académique Documents

Professionnel Documents

Culture Documents

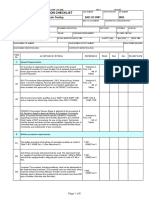

Report b2b

Transféré par

anon_7940804810 évaluation0% ont trouvé ce document utile (0 vote)

62 vues6 pagesbusiness to business report

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentbusiness to business report

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

62 vues6 pagesReport b2b

Transféré par

anon_794080481business to business report

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 6

Literature Review

According to Sandhusen and Richard (2008), Business-to-business (B2B)

describes commerce transactions between businesses, such as between

amanufacturer and a wholesaler, or between a wholesaler and a retailer in marketing

perspective.B2B branding is a term used in marketing. The overall volume of B2B

transactions is much higher than the volume of B2C transactions. The primary

reason for this is that in a typical supply chain there will be many B2B transactions

involving sub components or raw materials, and only one B2C transaction,

specifically sale of the finished product to the end customer. The final transaction, a

finished vehicle sold to the consumer, is a single (B2C) transaction. B2B is also used

in the context of communication and collaboration. Many businesses are now using

social media to connect with their consumers (B2C), however, they are now using

similar tools within the business so employees can connect with one another. When

communication is taking place amongst employees, this can be referred to as "B2B"

communication. (Sandhusen Richard, 2008).

According to Joel York, the todays trend business buyers are awash in a

deluge of online information. B2B buyer behavior has evolved in adaptation to the

Internet. A new species of B2B buyer has arisen that is more connected, more

impatient, more elusive, more impulsive, and more informed than its pre-millennium

ancestors. The Internet has changed the B2B buying process so radically that its

difficult to recollect exactly how the pre-Internet B2B buyer used to go about the

business of making a purchase: paper, phone and people mostly. The process went

something like this: ask the analysts about the next big thing, collect requirements

into and RFP, get a list of vendors from a roundup in an industry magazine, go to a

trade show and collect collateral, solicit and evaluate RFP responses by mail or fax,

call in a short list of vendors to do a dog and pony show, follow up with a technical

drill down meeting, maybe do a bake-off or a pilot, select a vendor, call a reference

account, negotiate final pricing and contract terms, and wrap it all up by planning out

phase 2 of the project: a complex and expensive implementation. It was a slow,

arduous and expensive process for which consultants charged exorbitant fees that

B2B buyers were happy to pay, because it wasnt easy.

With such a treasure trove of information available online, the Internet is the

21st century B2B buyers first stop for researching products and services. It wont be

the only source of information for the savvy prospect, but the Internet now is a

significant and recurring influence throughout the B2B buying process. The new

species of B2B buyer is connected to the Internet physically, functionally, socially

and frequently.

Moreover, the B2B buying process neither starts nor stops at your website. It

is more likely to start at a major search engine, industry portal or social network. If

you want your product or service to be considered, its critical that your content

appear wherever the new B2B buyer goes online at every point in the decision

making process. It isnt enough to just write a blog or make a white paper available

for download on your website, because your prospects may never find your website

if you dont show up in search and social media.

In the pre-millennium B2B buying process, the salesperson was the

gatekeeper of information. That meant that the pre-millennium B2B buyer had to

engage with the salesperson early on and stay engaged throughout every stage of

the B2B buying process. A prospect might go dark or a sale might be lost, but a

purchase could not move forward without engaging with the salesperson. Not so

today. Unfortunately for the B2B salesperson, the new B2B buying process tips the

information imbalance in the prospects favor. The new breed of B2B buyer can find

your product or service, learn about it, evaluate it, see what others think about it, and

in many cases try it and buy it, all without engaging with a salesperson.

The new breed of B2B buyer is more agile than its pre-millennium ancestor.

Cheap and easy access to online information about products and services enables

flexibility in the new B2B buying process the same way the elimination of setup costs

enable flexibility in manufacturing. When the up-front cost of purchase-related

information was high, the pre-millennium B2B buyer was forced to orchestrate a

rigid, deterministic B2B buying process that ensured the investment required to

execute the process itself was not wasted and produced a positive result, i.e., a

considered purchase with high ROI. Purchase decisions were made up frontonly

the vendor was unknown, budgets were established before the buying process

began, requirements were collected and communicated, vendors were evaluated in

tandem, and a clean vendor selection was made.

The new breed of B2B buyer does not face this constraint. Today, window

shopping is cheap. In the case of most SaaS and cloud applications, the entire B2B

buying process is cheap: trial is free and purchase amounts to a monthly

subscription that can be canceled at any time. Instead of orchestrating a structured

B2B buying process with a certain outcome, the new B2B buyer can start, stop, start

again, turn around, go slow, go fast, whatever. The new B2B buying process carries

no internal momentum. Purchases are motivated by near term organizational

priorities and the relative urgency to solve a pressing business problem, which can

turn on a dime.

Online marketers lament the waning effectiveness of email. Some even claim

that email marketing is dead and spam killed it. Email may be waning for marketing

communications, but it is central to the internal communications of the new impulsive

B2B buyer and acts as a powerful catalyst in the new B2B buying process. The new

impulsive B2B buyer can research your product online, coordinate an email

conversation among all decision makers, get a basic consensus without a single

meeting, and then stop dead because something else came up. Then, six months

later the VP of Such-and-Such decides: This needs to get done yesterday! And

shoots off an email that reignites the urgency around the purchase. Next thing you

know, a previously dead or unknown deal is suddenly very hot, and a purchase is

made almost on first contact. Or, at least first contact to the unprepared who are not

measuring, modeling and moving the new B2B buying process throughout its

lifecycle. (Joel York, 2013).

According to finding from Ann Handley and Joe Pulizzi last years survey

showed, nine out of 10 B2B marketers are using content marketing to grow their

businesses, and on average, marketers use eight content marketing tactics to

achieve their marketing goals. The most popular tactics are article posting (79%),

social media (excluding blogs) (74%), blogs (65%), eNewsletters (63%), case

studies (58%), and in-person events (56%). While marketers are confident about the

value of content marketing, they are challenged to demonstrate the effectiveness

and impact of individual tactics and distribution channels. That said, the confidence

gap we discovered last year is shrinking when it comes to the rates of adoption of

specific content marketing tactics and the perceived effectiveness of those tactics.

Content marketing uptake is high across industries, with no single industry reporting

below 70% adoption. The professional services industry reports the highest level of

adoption, just nudging out computing/software, which ranked number one last year.

Companies still struggle to integrate digital tactics deep into broader

marketing campaigns, but there are a few key points of leverage (such as pushing to

mandate an objective Channel Consideration Review early in the process) that can

help weed out reflexive channel bias, opening the door for digital influence.

Armed with past performance data and evidence from external best

practices, a growing number of marketers are pushing to develop standardized

campaign architectures, which offer a strong platform for promoting the best

applications and integration points for digital tactics.

Increased digital marketing efforts demand continuous and collective

management, something few companies are designed to support. The value

destroyed by this misfit approachalthough hard to quantifyis potentially very

large. Several companies are taking steps to restructure as a result. Review your

campaign planning process and look for opportunities to apply the practices outlined

on in particular, seek ways to hardwire a consideration of digital tactics earlier in the

planning process. Evaluate several campaigns with similar objectives and identify a

reasonable opportunity to develop a standard architecture for your teams to align to.

As noted be sure to look not only inside your own organizations past campaigns and

performance data, but seek out industry and outside of industry campaigns as a

reference for new ideas and best practices.

Take a few hours to exhaustively sketch out the various activities shaping

your digital footprint and compare that back to the organizational structure and

processes accountable for managing those activities. Then identify all of the specific

areas where you could be potentially leaking or losing potential value by not

executing in a more coordinated way. Chances are there are several low-hanging

fruits for improving integration (e.g., a more frequent or intense coordinating

mechanism between SEO and social media) as well as some larger battles (e.g.,

relocating paid search from the media team to an integration search performance

team). Consider tackling a small one and pushing a large one this year.

As the trend emerging, the need of the advertising and branding increases

parallel. The advertising become a must in the internet perspective. This because it

give the advantages to them in branding their product and services. Potential

customers are readily turning to their personal networks and publicly available

informationincreasingly via digital and social media channelsto self-diagnose

their problems and form opinions about solutions. To understand the scope of this

issue in the B2B context, CEBs Marketing Leadership Council (MLC) surveyed more

than 1,500 customer contacts (decision makers and influencers in a recent major

business purchase) for 22 large B2B organizations (spanning all major NAICS

categories and 10 industries). In a striking finding, the survey revealed that the

average customer had completed more than one-half of the purchase decision-

making process prior to engaging a supplier sales rep directly (Figure 1). At the

upper limit, that number ran as high as 70% (Figure 2). The fundamental implication

is clear: companies that fail to show up strong in this context are underserving

potential customers and at risk of losing mindshare and, ultimately, sales

opportunities.

References

Aaker D. A. (1991), Managing Brand Equity Capitalizing on the Value of A Brand

Name , Canada, Maxwell Macmillan, Inc.

Aaker D. A. (1997), Should You Take Your Brand to Where the Action Is? Harvard

Business Review , Sept-Oct 1997.

Abimbola, T. (2005) Branding as a Competitive strategy for Demand Management

in SMEs, Journal of Research in Marketing and Entrepreneurship , Vol 3 Issue 2, pp

97-106

Garbade, Michael (2011). Differences in Venture Capital Financing of U.S., UK,

German and French Information Technology Start-ups A Comparative Empirical

Research of the Investment Process on the Venture Capital Firm Level. Mnchen:

GRIN Verlag GmbH. p. 31. ISBN 3-640-89316-6.

Sandhusen, Richard (2008). Marketing. Hauppauge, N.Y: Barron's Educational

Series. p. 520. ISBN 0-7641-3932-0.

Shelly, Gary (2011). Systems analysis and design. Boston, MA: Course Technology,

Cengage Learning. p. 10. ISBN 0-538-47443-2.

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5782)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- TÜV SÜD Report UG8Document19 pagesTÜV SÜD Report UG8Антон ФроловPas encore d'évaluation

- Wartsila O E W 50DF PG Product GuideDocument180 pagesWartsila O E W 50DF PG Product GuideFábio Almeida100% (1)

- Lion - dr.K.S.rangasamy, MJF Founder & PresidentDocument36 pagesLion - dr.K.S.rangasamy, MJF Founder & PresidentpradeepPas encore d'évaluation

- (Customer) 04 DX75-5B Control Valve (BCV-65) (To Print)Document8 pages(Customer) 04 DX75-5B Control Valve (BCV-65) (To Print)AimHighPas encore d'évaluation

- HSBC Placement Paper Aptitude ReasoningDocument6 pagesHSBC Placement Paper Aptitude ReasoningRatnadeep Mitra67% (3)

- Experiment 3Document18 pagesExperiment 3Simyeen LeongPas encore d'évaluation

- Shading Devices VaishaliDocument12 pagesShading Devices VaishalivaishaliPas encore d'évaluation

- Annual Report Nutek 2008 09Document92 pagesAnnual Report Nutek 2008 09avneesh99Pas encore d'évaluation

- Final PPT BpoDocument21 pagesFinal PPT BpoPradeepPas encore d'évaluation

- ANSI E1.50-1 2017 Entertainment Technology - Requirements For The Structural Support of Temporary LED, Video & Display SystemsDocument19 pagesANSI E1.50-1 2017 Entertainment Technology - Requirements For The Structural Support of Temporary LED, Video & Display SystemsGabriel neagaPas encore d'évaluation

- A&E Price List - EditedDocument5 pagesA&E Price List - EditedMostafa MohamedPas encore d'évaluation

- ARAMCO UT Inspection Checklist - SAIC-UT-2001Document6 pagesARAMCO UT Inspection Checklist - SAIC-UT-2001Anonymous hBBam1n100% (1)

- Impressionism and Its CanonsDocument303 pagesImpressionism and Its CanonsAni Thomas100% (4)

- BUSINESS RESEARCH CHALLENGESDocument12 pagesBUSINESS RESEARCH CHALLENGESShilpa JadhavPas encore d'évaluation

- Introduction To Computing ReviewerDocument2 pagesIntroduction To Computing ReviewerKyle AbiogPas encore d'évaluation

- Fiber Internet ONU AgreementDocument2 pagesFiber Internet ONU AgreementShazama Abdul WajidPas encore d'évaluation

- Flight 60T Turbine Operating ManualDocument128 pagesFlight 60T Turbine Operating Manualtravieso112Pas encore d'évaluation

- Instrument TubingDocument11 pagesInstrument Tubingbab_ooPas encore d'évaluation

- The Three Main Forms of Energy Used in Non-Conventional Machining Processes Are As FollowsDocument3 pagesThe Three Main Forms of Energy Used in Non-Conventional Machining Processes Are As FollowsNVPas encore d'évaluation

- Wind Load AnalysisDocument4 pagesWind Load AnalysisNiraj ShindePas encore d'évaluation

- 20TPH Dump Condenser Datasheet 12-1-2022Document4 pages20TPH Dump Condenser Datasheet 12-1-2022Manoj BPas encore d'évaluation

- Sullair AWFDocument4 pagesSullair AWFOscar BedregalPas encore d'évaluation

- Housing AffordabilityDocument13 pagesHousing Affordabilityjeanette narioPas encore d'évaluation

- QCAI476 LfiltersDocument11 pagesQCAI476 LfilterscivodulPas encore d'évaluation

- SST CrossguideDocument39 pagesSST Crossguideardacho1968Pas encore d'évaluation

- EMI and ACDocument14 pagesEMI and ACbharathPas encore d'évaluation

- SiemensDocument9 pagesSiemensGhassen Khalil100% (2)

- Centrifugal Vs Reciprocating Compressor - Turbomachinery Magazine PDFDocument2 pagesCentrifugal Vs Reciprocating Compressor - Turbomachinery Magazine PDFReyes SanchezPas encore d'évaluation

- Reviewed BOQ For Shallow Borehole DrillingDocument4 pagesReviewed BOQ For Shallow Borehole DrillingAdonis AlabiPas encore d'évaluation

- Ficha Tecnica Lishide Escavadora Lishide SC220-8 - 1081Document3 pagesFicha Tecnica Lishide Escavadora Lishide SC220-8 - 1081PABLO HERNAN PRADA MONCADAPas encore d'évaluation