Académique Documents

Professionnel Documents

Culture Documents

Rehabilitation Under Sick Industrial COMPANIES (Special Provisions) ACT, 1985

Transféré par

Ali Ahmed0 évaluation0% ont trouvé ce document utile (0 vote)

16 vues30 pagesBIFR - Chapter 3

Titre original

11 Chapter 3

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentBIFR - Chapter 3

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

16 vues30 pagesRehabilitation Under Sick Industrial COMPANIES (Special Provisions) ACT, 1985

Transféré par

Ali AhmedBIFR - Chapter 3

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 30

CHAPTER 3

REHABILITATION UNDER SICK INDUSTRIAL

COMPANIES (Special Provisions) ACT, 1985

3.1 Introduction

Industrial sickness in India has been increasing at an alarming rate in

spite of the various remedial measures initiated by the Government of India and

the Reserve Bank of India (RBI). Multiplicity of laws and agencies made the

adoption of a coordinated approach for dealing with sick industrial companies

difficult. Hence the RBI constituted a high power committee of experts in 1981

under the chairmanship of Shri. T. Tiwari, the then Chairman of the Industrial

Reconstruction Corporation of India (IRCI) to examine the legal and other

diff~cuulties faced by Banks and Financial Institutions in rehabilitating sick

industrial undertakings and to suggest remedial measures including changes

required in various laws.

The Committee examined in depth the causes of industrial sickness and

the possible remedies there on. It found that the existing institutional arrangements

and procedures for the revival and rehabilitation of potentially viable sick

Chapter 3 56

industrial units were both inadequate and time consuming. A need has, therefore,

been felt in the public interest that, "a legislation to provide for timely detection of

sickness in industrial companies and for the expeditious determination by a body

of experts of the preventive, ameliorative, remedial and other measures that would

need to be adopted with resped to such companies and for enforcement of the

measures considered appropriate with utmost despatch" (Pahwa and Pulian i, 2000,

176).

Based on the recommendations of the Tiwari Committee the Government

of India promulgated the Sick Industrial Companies (Special Provisions) Act,

1985 popularly known as SICA, 1985. The Board for Industrial and Financial

Reconstruction (BIFR), a quasi judicial body was set up under the Act to

determine the incidence of sickness in industrial companies and to devise suitable

remedial measures for the speedy revival of potentially viable sick units or closure

of non-viable ones. By revival, idle investments in a sick industry can become

productive and by closure, the locked up investments in non-viable units can be

released for productive use elsewhere. An Appellate Authority for Industrial and

Financial Reconstruction (AAIFR) was also set up for hearing appeals against the

orders of the Board.

3.2 Applicability of the Act

SICA applies to medium and large industrial companies both in the

private and public sectors falling under the First Schedule to the Industries

(Development and Regulation) Act, 195 1 (Appendix-2). 'The Act requires 'sick' as

well as 'potentially sick' companies to report to the BIFR.

Section 3 (1) (0) of SICA, 1985 lays down the following criteria to

determine sickness in an industrial company.

Chapter 3 57

i . The accumulated losses of the company should be equal to or more than its

networthi.

ii. The company should have completed five years after incorporation under the

Companies Act, 1 956.

iii. It should have 50 or more workers on any day of the 12 months preceding the

end of the financial year with reference to which sickness is claimed.

iv. It should have a factory licence.

En order to arrest sickness at an early stage, section 23 of SICA requires a

'potentially sick' industrial company to report to the shareholders and the BIFR if

its peak networth in the immediately preceeding four financial years has been

eroded by 50 percent or more.

All sick companies are registered with the BIFR for fbrther process under

the various provisions of the Act while potentially sick companies are not

registered. On a selective basis, they are advised on measures for arresting

sickness.

3.3 Authorities Under the Act

3.3.1 The Board for Industrial and Financial Reconstruction

'fie Government of India has set up a Board for Industrial and Financial

Reconstruction (BIFR) in pursuance of section 4 of SICA, 1985. The principal

objectives of the Board briefly are:

i . to evaluate the techno-economic viability of sick industrial companies with a

view to either rehabilitating them or closing down

ii. to stop continued drain of public as well as private resources and

iii. to safeguard employment as far as possible.

I

According to section 3 ( 1 ) (ga) of SICA, 1 985 'networth' means t he sum total of the

paid up capital and free reserves.

Chapter 3 58

The BIFR became functional w.e.f., 15 May 1987. SICA has given an

unambiguous definition of a 'Sick Industrial Company' and it has been made

mandatory for the management of a sick industrial company to report to the BIFR.

The Board has been given wide-ranging powers for reconstruction, revival or

rehabilitation of sick industrial companies. In cases where rehabilitation is not

Found feasible, the Board is empowered to order it's winding up.

In the process of rehabilitation the Board can change management, order

transfer of shares at prices fixed by it, order financial restructuring, impose on

promoters the quantum of funds that they should bring in, determine changes in

management structure etc. But financial relief and concessions from state and

central governments, banks and financial institutions can be given only with their

concurrence.

The BIFR is deemed to be a civil court and every proceeding before the

Board shall be deemed to be a judicial proceeding. It is a quasi- judicial body

comprising of experts from various disciplines and is empowered to diagnose

sickness in industries. It has adequate powers to summon all those concerned with

the sick unit - promoters, shareholders, banks, financial institutions, governmental

agencies and others having stake in the sick unit, and to prescribe schemes for

revival or winding up of the unit without the interference of any other Acts or

bodies and to punish anybody misrepresenting the Board or not complying with

the orders of the Board.

The orders passed by the BlFR under SICA can only be taken up by an

appeal to the Appellate Authority for Industrial and Financial Reconstruction

(AAIFR). Jurisdiction for any civil court to pass any injunction or stay the orders

of the BIFR or the AAIFR has been barred under section 26 of SICA.

Chapter 3

3.3.1.1 Constitution of the BIFR

Section 4 of SICA provides that the Board shall consist of a Chairman

and not less than two and not more than fourteen other members to be appointed

by the Central ~overnment~. The decision of the Board is taken in Benches, each

of which consists of not less than two members.

3.3.2 Appellate Authority for Industrial and Financial Reconstruction

The Appellate Authority for Industrial and Financial Reconstruction

(AAIFR) has been constituted w.e.f., 1 5 April 1 987. The Appellate Authority was

set up for hearing appeals against the order of the Board. it shall have a chairman

and not more than three other members3.

3.4 BIFR Procedure

3.4.1 Reporting Sickness to the BIFR

STCA makes it mandatory for a sick industrial company to report to the

BIFR. Section 15 (1) places the onus of reporting sickness on the Board of

Directors of the company. The reference is to be made within 60 days from the

date of finalisation of the duly audited accounts of the company for the financial

2

According to section 4(3): The Chairman and other members of the Board shall

be persons who are or have been qualified to be High Court Judges or persons of

ability, integrity and standing who have special knowledge of and professional

experience of not less than 15 years in science, technology, economics, banking, industry,

law, labour matters, industrial finance, industrial management and reconstruction,

investment, accountancy, marketing or any other matter, the special knowledge of or

professional experience which would in the opinion of the Central Government be useful

to the Board.

3 ~ s per section 5(2), the Chairman shall be a person who is or has been a judge

of the Supreme Court or who is or has been a judge of a High Court for not less than five

years and according to section 5(3), a member of the Appellate Authority shall be a

person who is or has been a judge of a High Court or who is or has been an officer not

below the rank of a secretary to the Government of India or who i s or has been a member

of the Board for not less than three years.

year at the end of which the company would have become a 'Sick Industrial

Company'.

Section 15 ( 2) empowers the central government, state governments, the

RBI, a public financial institution, a state level institution or a scheduled bank to

make a reference to the Board if it has suff~cient reason to believe that an

industrial company has become 'sick'.

The Board is also empowered to make a 'suo motu ' enquiry, as it may

deem appropriate for determining whether any industrial company has become

sick upon receiving information from a shareholder, creditor or employee or from

any other source with respect to any such company or upon its own knowledge as

to the financial condition of the company.

3.4.2 Registration of Reference and Enquiry by the BIFR

All 'sick' and 'potentially sick' industrial companies are obliged to make

a report to the BIFR in the prescribed form. The preliminary scrutiny of all

references made is done at the Ofice of the Registrar and after confirmation that

the case would come under the purview of the BIFR, it would register the case and

issue a 'certificate of registration' to the concerned party.

The registered references are allotted to different Benches by the

Chairman for an enquiry (under section 16) to determine whether the company has

become sick within the meaning of SICA. The Bench hears the promoters,

representatives of financial institutions and banks and labour to provide them an

opportunity to conf m or deny the facts reported to the Board and make their

submissions in this regard about the affairs of the company. In this process the

Board can appoint an Operating Agency to enquire and make a report to it

ordinarily within a period of 60 days. The Board may appoint one or more Special

Director(s) on the Board of any company regarding which an enquiry is going to

Chapter 3 6 1

be made with a view to safeguard the financial and other interests of the company

or in public interest.

3.4.3 Result of Enquiry

The Bench either on its own or on the basis of the enquiry reports of the

Operating Agency is satisfied that no case exists and the conclusion is that the

company has not become a 'sick industrial company' within the meaning of

section 3 (1) (o) of SICA, the reference is dismissed as non-maintainable. This

could arise when the industrial undertaking -

is not a scheduled industry under the Industries (Development and

Regulation) Act, 195 1 or does not employ more than 50 persons

has started making cash profits

has not completed five years of incorporation

its networth is more than the accumulated losses as per the definition accepted

in the Act.

If the Bench i s satisfied that the company meets all the

requirements as per SICA of a 'sick industrial company' it declares as such and

makes an order in writing that whether it is possible for the company to make its

networth positive within a reasonable period and proceeds to consider its

rehabilitation either under section 1712) or section 17(3) of SICA. The Board is

also empowered to recommend the winding up of the company to the High Court

under section 20 ( I) , in those cases where there are no chances for revival.

3.4.3.1 Opportunity for Self-revival: Section 17(2)

Well-managed companies take various steps to cure sickness as soon as it

becomes evident. The management of such companies tries to overcame sickness

by implementing schemes of rehabilitation with the support of financing

institutions and banks. If a company after implementing such a rehabilitation

Chapter 3 62

scheme is reported to the BIFR, it may approve the scheme subject to such

modifications and conditions as may be necessary, if it is satisfied that the scheme

would help the company to make its networth positive within a reasonable period.

The Board may also appoint Special Director(s) on the Board of the sick company

to monitor the implementation of the rehabilitation scheme.

3-4.3.2 Rehabilitation under an Operating Agency: Section 17(3)

Where the Board finds that the company reported to it is 'sick' within the

meaning of SICA, 1985 and there is no viable rehabilitation scheme supported by

financial institutions and it is in the public interest such as employment, utilisation

of public h d s etc., to rehabilitate the company, the Board appoints an Operating

Agency under Section 17(3) to prepare a scheme for the rehabilitation of the

company.

The Board may direct the Operating Agency about the measures required

to be taken for the revival of the company and give guidelines for the preparation of

the rehabilitation scheme. Tbese are set out under sections 18 (1) and 18 (2), and

are briefly explained below.

a) Restructuring of capital in view of the total erosion of networth and

heavy losses suffered.

h) Possibility of sale of surplus assets including machinery, land and building, if

any.

c) Proper management of sick industrial company by changeltakeover or

strengthening of management. h the case of change over or takeover, the

new promoters should have adequate capabilities to bring in

sufficientlrequired stake.

d) Mergedamalgamation of sick industrial companies with any other company.

e ) Sale/lease of a part or whole of any industrial undertaking of the sick

company, to bring in sufficient funds to revive the unit.

Chapter 3 63

fi Examine the possibility of a workers co-operative society being entrusted to

run the unit by transfaring the shares of the management.

The rehabilitation scheme prepared by the Operating Agency should

ensure the techno-economic viability of the company. The Operating Agency

should examine the demand and supply position of the product, sources and prices

of raw materials, market for the products, pricing and contribution. In cases where

marketing has been the cause of sickness, an overall industry profile should be

malysed. The rehabilitation scheme should envisage the revival of the company

with the co-operation of all concerned. The promoters should bring in fresh

contribution towards the cost of the scheme, the financial institutionshanks should

provide additional funds and relief and concessions in the farm of waiving of

interest, reduction in rates of interest etc.

Normally the Operating Agency is given a period of 90 days to compile

the data, hold inter-institutional meetings and submit its report to the Board on the

proposal for the revival of the company.

3.4.3.2.1 Publication of Draft Scheme and Sanction thereof

The BIFR shall publish the particulars of the draft rehabilitation scheme

in newspapers for inviting suggestions and objections from shareholders, creditors,

and employees of the sick company as also from the transferee company in the case

of amalgamation. After having considered the suggestions and objections, if any

received, the Board calls all parties concerned who have to provide relief and

concessions under section 19 for their consensus on the proposal and circulates the

draft scheme for their consideration. If there is a consensus based on the draft

scheme the Board sanctions the scheme for rehabilitation of the company under

section 18 (4). In the event of there being no consent for the draft scheme the

Board may either consider revival as 'not feasible' and recommend the winding up

of the company under section 20 (1) or a revised scheme to be submitted by the

Chapter 3 64

Operating Agency and follow the same course of action to arrive at the stage of

sanctioning a scheme for rehabilitation.

3.4.3.3 Recommending Winding-up: Section 20

Winding up of an industrial unit is by no means a pleasant prospect. It

entails loss of productive assets, loss of investment, loss of resources provided by

banks and financial institutions and ultimately the loss of jobs to the labourer.

Therefore SICA makes a stress on rehabilitation and the question of winding up is

considered only as the last step. Before coming to a prima facie conclusion that an

industrial company should be wound up, the Board is required to consider whether

the promoters have any scheme of their own which can make the sick company

viable. I f such a viable scheme is not available, the Board appoints an Operating

Agency to carry out a detailed economic-cum-commercial study to revive the

company through fresh infusion of funds with old or new promoters and with relief

from banks and financial institutions or explores the possibility of merger with a

cash rich company. Another alternative is the workers co-operative coming in to run

the company. If all these measures fail the Board comes to a prima facie conclusion

to wind up the company. Section 20 ( 1 ) of SI CA~ contains provisions in this regard.

Once the Board records its opinion for winding up, the concerned High Court has no

choice but to confirm the position unless there is a writ petition against the order of

the Board.

.

Section 20 ( I ) of SICA, 1 985 provides that

" where the Board after making an enquiry under section 16 and after considering all the

relevant facts and circumstances and after giving an opportunity of being heard to all

concerned parties, is of the opinion that the sick industrial company is not likely to make

its networth exceed the accumulated losses within a reasonable time while meeting all its

financial obligations and that the company as a result there of i s not likely to become

viable in future and that it i s just and equitable that the company should be.wound up, it

may record and forward its opinion to the concerned High Court".

Chapter 3

3,5 Monitoring the Implementation of the Rehabilitation Scheme

The BIFR does not get itself absolved of its responsibility once a

rehabilitation scheme is sanctioned. Section 18 (12) stipulates that the Board shall

monitor periodically the implementation of the sanctioned revival scheme. In this

exercise the Operating Agency and the Special Director(s) of the company assist

the Board. Any delay in complying with the provisions of the scheme is reported

to the Board by the Operating Agency and the Special Director(s). On receipt of

such a report a review meeting is called by the secretary in which the

representatives of financial institutions, banks, governments and promoters

identify and try to remove the general constraints and bottlenecks in the

implementation of the rehabilitation scheme. However, if such dificulties persist,

the Bench conducts review hearings and directions are given including those for

modification of the same. The diagrammatic representation of the procedure with

the BIFR is given in Fig. 3. 1.

Chapter 3

,Fig: 3.1:- Procedure in the Board

received

i 4

Source: BIFR Performance Review 1997-98, P8.

t

*Rehabilita f ion Scheme

* *Non Maintainable

Registration

declined

Registered

Inquiry

UIS 16

On appeal

UI S 15

1

I

1 Remanded 1

4

I

'

4

Rch.Scheme4

U/S 17(2) or

17(3)

Recommended

for closure

U/S ZO(1)

+

A

Dismissed

asNM**

U/S 17(1)

Discharged

on Revival

Monitoring

U/S 18 (12)

Modification

A

of Scheme

I 1

Chapter 3

3.6 Operational Performance of the BIFR

The Government of India enacted the Sick Industriai Companies (Special

Provisions) Act, 1985 and the Board for Industrial and Financial Reconstruction

(BIFR) was constituted under the Act to oversee the rehabilitation of sick

industrial units in the medium and large sector. The task before the Board has

undoubtedly been a daunting one in the face of fast changing economic scenario in

the wake of economic reforms initiated by the Government of India in the early

nineties and further accelerated during the latter part of the decade. The Board has

been in existence for more than one and a half decades now. The time therefore is

appropriate for a review of the functioning of the BIFR and to appraise to what

extent it has been a success in curbing industrial sickness in India. The overall

performance of the BIFR can be evaluated only in a quantitative angle by

comparing the number of companies turned successhl/failed after implementing

the rehabilitation schemes with the total number of companies registered by it.

Up to 3 1-7-2000 the BIFR had registered 3 1 10 references and among

them rehabilitation schemes were sanctioned only in 708 references. The Board

rejected 1532 references, recommending winding up in 960 cases and dismissing

572 references as non-maintainable. Among the companies for which

rehabilitation schemes were sanctioned only 277 companies came out of the

purview of the BIFR after making their networth positive. There were 870

references pending with the BIFR at various stages. This represents 28 percent of

the total number of registered references.

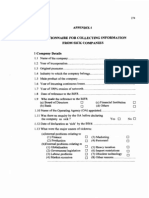

The present status of companies registered by the BIFR is given in Table

3.1. Figures 3.2 and 3.3 are the diagrammatic representation of the status of

companies and the rehabilitation schemes sanctioned.

Chupter 3

Table 3.1:- Status of Companies Registered by the BIFR

(as on 3 1-7-2000)

References pending at various stages

Status of Companies

References declared successful

References declared failed:

Winding up recommended 960

Dismissed as non maintainable 572

Percentage

to total

Number of

companies

277

Revival schemes in Operation

I

I

Fig: 3.2:- Status of Companies Registered by the BIFR

Total

1 532

-. - - -

/leclared no longer sick Not declared no longer sick 1

References rejected - References pending

Source: BI FR Records.

' 3110 100.0

Chapter 3

Fig: 3.3:- Status of Rehabilitation Schemes

Sanctioned

Declared no longer sick W Not declared no longer sick

Table 3.1 shows that the performance of the BIFR in rehabilitating sick

industrial units was not at all encouraging. Only 8.9 percent of the total number of

companies registered by the BIFR was declared successful. l'he low success rate

was justified on the ground that "the cases that came before the BlFR were almost

mortuary cases" (Ganapathi, 1999, 9). The success rate is only 39 percent even

among the companies for which rehabilitation schemes were sanctioned after a

proper viability study. Figure 3.3 exhibits the status of rehabilitation schemes

sanctioned. Nearly 28 percent of the total number of references registered by the

BIFR remained at various stages. It reflects the delay with the BIFR in disposing

the cases registered by it.

Chapter 3

3.7 Role of Operatiug Agencies in Rehabilitating Sick Units

Operating Agencies play a pivotal role in rehabilitating sick industrial

units. Section 17(3) of SICA empowers the BIFR to take the services of an

Operating Agency where it finds that it is not practicable for a sick industrial

company to make its networth positive on its own and it is expedient in the public

interest to adopt measures for the rehabilitation of the company. An Operating

Agency acts as an arm of the BIFR in rehabilitating a sick industrial unit by

performing the foliowing functions.

i. To enquire into and make a report with respect to the working of a sick

industrial company reported to the BIFR to establish whether the company is

sick or not and to suggest various steps and measures for making its networth

positive.

ii. To prepare technically and economically viable rehabilitation measures

specified under section 18 of the ~ c t ~ .

iii. To recommend to the Board various steps to be taken for the smooth

implementation of the rehabilitation scheme.

To perform these multifarious functions, Operating Agencies should have

expertise in the preparation of rehabilitation schemes, monitoring their

implementation and coordinating various institutions for getting the package of

relief and concessions sanctioned. Four All India Financial Institutions (AIFIs),

eight Public Sector Banks and two State Financial Corporations (SFCs) have been

5

Section 18 provides for any one or more of the following measures viz.,

i. financial reconstruction of the sick company,

i i . proper management of the sick company by change in or takeover of the

management of sick industrial company,

i i i . the amalgamation of the sick industrial company with any other company or any

other company with the sick company and

iv. the sale or lease of a part or whole of any industrial undertaking of the sick industrial

company and

v. such other preventive, ameliorative and remedial measures as may be

appropriate.

Chapter 3

71

notified as Operating Agencies by the BIFR. The financial institution or bank

having the highest stake in the sick company is normally appointed as the

Operating Agency. Up to 3 1-7-2000, the BIFR had appointed Operating Agencies

in 1 855 references and its break up is given in Table 3.2.

IFCI

1 : I ICICI

Table 3.2:- References Allotted to the Operating Agencies

(as on 3 1 -7-2000)

%

27.3

17.6

5

6

7

8

( 11 1 Indian Bank 1

27

1 1.5 1

No. of

References

507

326

S 1.

No.

1

2

SBI

CanaraBank

Punjab National Bank

Bank of India

9

10

1 :1 1 t J n ~ ~ n l mk ; f India 1: 1 ::: 1

1855 100.0

Source: BIFR Records.

Name of Operating Agency

lDBt

IIBI

Central Bank of India

BankofBaroda

Table 3.2 shows that out of 1 855 companies for which Operating Agencies

were appointed, 1407 companies were allotted to AIFIs. It was 75.8 percent of the

total. Public sector b d s were allotted 444 companies and only four cases were

allotted to the two SFCs. The IDBI, being the largest financial institution in the

country was allotted the largest number of sick companies and among the banks;

the State Bank of India was allotted the largest number of cases. They were given

507 cases (27.3%) and 158 cases (8.5%) respectively of the total number of cases

allotted to the Operating Agencies.

Chapter 3

3.7.1 Performance-of the Operating Agencies

The Operating Agencies have specialised expertise in rehabilitating sick

industrial units. Hence their appointment should accelerate the rate of success of

sick companies reported to the BIFR. To evaluate the performance of Operating

Agencies the present status of sick companies for which Operating Agencies were

appointed has been analysed and given in Table 3.3.

Table 3.3:- Status of Operating Agency Appointed Companies

References rejected

(as on 3 1.07.2000)

Revival schemes sanctioned:

Declared no longer sick 205

Not declared no longer sick 396

Status of Companies

References pending at various stages

Total

Source: BIFR Records.

No. of

companies

As an 31.07.2000 the BIFR had registered 31 10 references of which

Operating Agencies were appointed in the case of 1855 companies. Among them

only 205 companies were able to come out of the purview of the BIFR after

making their networth positive and 892 cases were rejected. This shows that the

success rate was only 11 percent. In spite of the active support extended by the

Operating Agencies the increase in success rate was only marginal. Similarly 362

references representing 19.5 percent of the total remained at the preliminary stage

of enquiry. This clearly points out the delay brought about by the Operating

Agencies in disposing the cases allotted to them. Figures 3.4 and 3.5 are the

Percentage

to total

Chapter 3

diagrammatic representation of the status of companies and the rehabilitation

schemes sanctioned.

Fig: 3.4:- Status of Conpanies

A 91 \

892

B Schemes sanctioned References rejected References pending

Fig: 3.6:- Status of Schemes Sanctioned

Declared no longer sick IN Not declared no longer sick

Chapter 3 74

In order to evaluate the performance of the Operating Agencies

individually in rehabilitating sick industrial units, the present status of companies

allotted to various Operating Agencies has been analysed on the basis of Operating

Agency, state, industry and year.

3.7.2 Status of Companies: Operating Agency-wbe

As on 31 July 2000, Operating Agencies were appointed in 1855

references. Among them 1407 cases were allotted to the All India Financial

Institutions (AIFIs) like the IDBI, IIBI, IFCI and the ICICI and 448 cases were

shared by the State Bank of India, seven Public Sector Banks and two State

Financial Corporations (SFCs). The IDBI being the largest financial institution in

the country was given the first priority and was allotted 507 references. The IIBI

(the erstwhile IRBI) which was established as the specialised reconstruction and

rehabilitation agency in the country was allotted 326 cases.

Among 1407 cases allotted to AIFIs, 158 companies were declared no

longer sick after making their networth positive. This shows that the success rate is

only 11.2 percent. Seven hundred and one cases were rejected. Rehabilitation

schemes were in operation in 298 cases and 250 references remained at the

preliminary stage of enquiry. The present status of companies allotted to various

Operating Agencies has been analysed and given in Table 3.4. Figure 3.6 is its

diagrammatic represent ation,

Chapter 3

Total

Fig: 3.6:- Status of Companies: Operating Agency-wise

250

200

I

*-

e

g I 50

E

8

5 100

P

50

0

z

- -

2

o(l

P

- g 2 i! 8

i "

Declared no longer sick Not declared no longer sick

Cl Referancas rejected References pending

Table 3.4:- Status of Sick Companies: Operating Agency-wise

Operating

Agency

IDBI

IlBI

IFCI

1 CICl

Banks and

SFCs

Total

Source: BIFR

Schemes sanctioned

References

rejected

220

(43.4%)

209

(64. I %)

165

(53%)

107

(40.66/0)

191

(42.6%)

892

(48.1%)

Declared

no longer

sick

4 8

(9.5%)

3 1

(9.5%)

27

(8.7%)

52

(19.8%)

47

(10.5%)

205

(I 1%)

records.

Not

declared no

longer sick

101

(19.Yh)

74

(22.7%)

6 1

(19.6%)

62

(23.6%)

98

(2 1 .9%)

396

(21.4%)

(as on 3 1.07.2000)

References

under

enquiry

138

(2 7.2?h)

12

(3.7%)

5 8

(18.7%)

42

(1 6%)

112

(25%)

362

(19.5%)

507

( 1 OPh)

326

(10%)

31 1

( 100%)

263

(100%)

448

( I ooo?)

1 885

(1000/'o)

Chapter 3 76

Among the AIFIs, the ICICI topped with a success rate of 19.8 percent

followed by the Banks and SFCs with 10.5 percent. Out of the 263 cases allotted

to the ICTCI, 52 companies were declared no longer sick. The IDBI and the IIBI

each reported a success rate of 9.5 percent while in the case of the IFCI; the

success rate was only 8.7 percent.

Out of the 1855 companies allotted to different Operating Agencies

rehabilitation schemes were sanctioned only in 601 cases. Among them ICICI

reported the highest success rate of 45.6% percent, followed by Banks and SFCs

(32.4%), lDBI (32.2%) and IFCT (30.7%). The lowest success rate, 29.5 percent

was reported by IIBI. This shows that the success rates varied among dlerent

Operating Agencies.

To test whether there is any significant difference in the success rates

among different Operating Agencies a chi-square6 test was conducted taking the

null hypothesis that there is no significant dzference in the success rates among

the difere~t Operating Agencies. It was found that at 5 percent significance level

the calculated value (8.554) was lower than the table value (9.488) at four degrees

of freedom. This result leads to the acceptance of the null hypothesis and it can be

concluded that the dlference in the success rates among the various Operating

Agencies is statistically not signif cant.

3.7.3 Status of Companies: Industry-wise

The industrial sickness in India has affected industries across all states.

The ever-changing economic scenario coupled with economic reforms initiated in

early 90's caused a large number of industrial units without comparative

advantages and competitiveness to become non-viable and sick. But its magnitude

varied from industry to industry and from state to state. In order to evaluate the

4

For the test only those companies, which were 'declared no longer sick' and 'not

declared no longer sick' after implementing the rehabilitation schemes, were taken.

Chapter 3

77

impact of industrial sickness in various industries and to evaluate the industry-

wise performance of Operating Agencies, the present status of sick industrial

companies reported to the BIFR for which Operating Agencies were appointed has

been classified industry-wise and given in Table 3.5. Figure 3.7 is its

diagrammatic representation.

Table 3.5:- Status of Sick Companies: Industry-wise

Total

3 96

(1 00%)

328

( 1 00%)

306

100%

202

(100%)

I61

( I 00%)

155

(100%)

119

(100%)

86

( 1 000/0)

67

(100%)

35

( 1 00%)

1855

(100%)

(as on 3 1-7-2000)

References

under

enquiry

79

120%)

79

(24.1 %)

62

(20.3%)

3 1

(15.4%)

38

(23.6V0)

2 1

(13.6%)

16

(13.4%)

14

I 6.2%)

17

(25.4%)

.-- -.

5

( 14.3%)

362

(19.5%)

rejected References

20 1

(50.8%)

153

(46.6%)

149

(48.7%)

92

(45.5%)

---

7 5

(46.6%)

74

(47.7%)

68

(57.2%)

44

(5 I .2%)

25

(37.3Y0)

I I

( 3 1.4%)

892

(48.1%)

industry

Metallurgical

*

Miscellaneous

Textiles

Chemicals

-- -

Food Products

& Processing

Electronic &

Electrical

Equipment

Paper

Cement

Drugs &

Pharmaceuticals

-A-

Jute

Total

Source: BIFR

Schemes

Declared no

longer sick

39

(9.8%)

3 1

(9.5%)

26

(8.5%)

27

( I3 -4%)

i 8

( 1 1. 2~0)

3 1

(20%)

13

( I 0 .9"/o)

9

(10.5?4)

7

( 1 0.4%)

---

4

( 1 1.4%)

205

( I 1 %)

records.

sanctioned

Not declared

no longer

sick

77

( 19.4%)

65

( 19.8%)

69

(22.5%)

52

125.7%)

P

30

( 1 8.fi0/o)

29

(1 8.7%)

22

( I 8.5%)

19

(22. l %)

18

(26.9%)

-- -

15

(42.5%)

-

3 96

( 2 1.4%)

Chapter 3

Fig: 3.7;- Status of Companies: Industty-wise

450

400

350

300

' 250

E

0 200

'B

d 150

Z

100

50

0

Q Rejected B Under enquiry C1 Not declared no longer sick . lhclarsd rwr longer sick

The largest number of sick industrial units was reported in the

Metallurgical industry. There were 396 reported cases in the Metallurgical

industry, which accounted for 21.3 percent of the total number of cases reported.

There were 328 reported cases in Miscellaneous, 306 cases in Textiles and 202

cases in Chemical industries. They represented 17.7 percent, 16.5 percent and

I 0.9 percent respectively of the total number of cases reported.

An evaluation of the performance of various industries revealed that the

highest success rate was reported in the Electronic and Electrical Equipment

industry followed by the Chemical industry. There were 155 reported cases in

Electronic and Electrical Equipments industry in which 31 companies were

Chapter 3 79

declared no longer sick, the success rate being 20 percent. The zoom in the Indian

Info-tech industry from a mere Rs.560 crores ten years ago to a whopping

Rs.25000 crores in 1998-99 helped many companies in this sector to diversify

their activities into software development and to make their operations successful

(Mehta 2000,321). In the Chemical industry 27 companies from 202 cases reported

were declared no longer sick, the success rate being 13.4 percent.

The BIFR initiates rehabilitation measures only in viable sick units and all

non-viable references are rejected. The highest rejection rate was reported in the

Paper industry. There were 1 I9 reported cases in the Paper industry, of which 68

companies were rejected, the rejection rate being 57.2 percent. The crash in the

international prices of papa on account of the global economic recession and the

dumping of products from Canada, Russia, and ASEAN countried made a large

number of units in the Paper industry sick and non-viable. The second largest

rejection rate of 51.2 percent was reported in the Cement industry. There were 44

failed cases from 88 companies reported in the Cement industry. The total

decontrol of cement in 1984 and the increase in production capacity from 50

million tomes in 1988-89 to 107 million tomes in 1998-99 by large cement

manufacturers made it difficult for the mini cement manufacturers to compete and

survive in the market (Srinivasan, 2000,232).

3.7.4 Status of Companies: State-wise

Industrial sickness in India has affected industries across all states.

Maharashtra being the most industrialised state in the country was the worst

affected by industrial sickness8. There were 3 1 1 cases reported to the BlFR in

Maharashtra followed by 2 12 cases in Andhra Pradesh (AP), 172 cases in Tamil

'Prabhu N. P., as quoted by Sanyal, B., (2000), 9.

R

There were 114851 companies in Maharashtra which accounted for 21.6% of 532580

companies at work in India as on 1-1 -2000.

Chapter 3 8 1

The highest success rate was reported in Maharashtra. From the 3 11

cases reported in Maharashtra, 52 companies were declared no longer sick, the

success rate being 16.7 percent. This includes 10 companies declared successful

from the 23 companies reported in Electronic and Electrical Equipments industry.

This shows that the high success rate in Maharashtra was mainly due to the high

success rate associated with the Electronic and Electrical Equipments industry.

The highest rejection rate was reported in Himachal Pradesh (HP). From

the 30 companies reported in Himachal Pradesh, 21 cases were rejected, the

rejection rate being 70 percent. This was mainly due to the non-viability of the

units in the Paper industry. In Hirnachal Pradesh nine companies from 10 cases

reported in the Paper industry were rejected. This showed that the success and

rejection rates of the companies reported to the BIFR depended on [he type of

industiy.

3.7.5 Efficiency of the Operating Agencies in Handling Cases

Timely implementation of a rehabilitation scheme is a precondition for

the revival of the sick unit. Timely implementation of the scheme depends much

on the efficiency of the Operating Agency in determining the sickness of the

company and in finalising the rehabilitation scheme. In order to evaluate the

efficiency of the Operating Agencies in dealing with the cases allotted to them, the

present status of the total number of cases allotted to various Operating Agencies

has been analysed year-wise.

Among the 1 855 companies allotted to different Operating Agencies, 892

references were rejected, revival schemes were sanctioned in 601 cases and 362

cases remained at the preliminary stage of enquiry. A year-wise analysis of the

present status of Operating Agency appointed companies are given in Table 3.7.

Chapter 3

Table 3.7:- Status of Sick Companies: Year-wise

registered by the BIFR remained at various stages of enquiry. They included six

cases reported in 1987, 241 cases reported between 1988 and 1998 and 101 cases

Year

1987

1988

1989

1 990

199 1

1 992

1993

1 994

1995

1 996

1 997

1998

1999

2000

Total

Source: BIFR

registered in 1999. In order to evaluate the efficiency of the Operating Agencies in

disposing the cases allotted to them, the references pending with the various

Table 3.7 shows that nearly 20 percent of the total number of cases

References

re~ejecred

131

116

78

63

69

63

46

10 1

54

48

7 1

46

5

I

892

records

Schemes

Declared

no longer

sick

53

43

24

23

2 1

9

9

14

1

1

4

2

I

0

205

References

Under enquiry

6

1

3

3

1

4

I

6

2

8

62

150

I01

14

362

sanctioned

-

Not declared

no longer sick

49

35

34

22

20

5 0

22

48

20

15

4 1

3 3

7

0

396

--

Total

239

195

139

I l l

1 1 1

126

78

1 69

77

72

178

23 1

114

15

1855

Operating Agencies at the enquiry stage have been classified and given in Table

Source: Bl FR Records

Table 3.8 shows that among the 362 pending references with various

Operating Agencies, 139 cases were with the IDBI. That was 38.4 percent of the

total number of pending references and 27.4 percent of the total number of cases

allotted to the IDBI. There were 75 pending ref'erences with the Banks and SFCs,

Table

Year

1987

1988

1989

1990

199 1

1992

1993

1994

1995

1996

1997

1998

1999

2000

Total

Total

References

which constituted 20.7 percent of the total pending references and 25.9 percent of

Cases:

IIBI

1

0

0

0

0

0

1

1

0

0

3

3

2

1

12

(3.4%)

326

(3.7%)

3.8:- Pending

IDBl

1

1

0

1

0

0

0

1

0

4

1 1

58

53

9

139

(38.4%)

507

(27.4%)

Operating

IFCI

2

0

I

1

1

0

0

2

2

0

16

20

12

I

58

(16.0D/o)

31 1

(1 8.6%)

Agency-

ICICI

1

0

0

I

0

3

0

0

0

0

10

23

4

0

42

1 % )

263

( 1 6.0%)

wise

SBI

0

0

1

0

0

0

0

1

0

I

7

I5

1 1

0

36

(9.9%)

158

(22.8%)

(as on 3 I

Banks &

SFCs

1

0

1

0

0

0

0

I

0

3

15

3 1

19

4

75

(20.7%)

290

(25.9%)

-7-2000)

Total

6

I

3

3

1

3

I

6

2

8

62

150

10 1

15

362

(100%)

1855

( 1 9.5%)

Chapter 3 84

the total number of cases allotted. Among the various Operating Agencies, IIBI

was the most efficient in disposing the cases allotted to it. There were only 12

pending cases with the IIBI. That was only 3.4 percent of the total pending

references and 3.7 percent of the total cases allotted to the IIBI. Among the 97

pending references registered between 1987 and 1997, twenty-five cases were

with the IFCI, 19 cases with the IDBI and 15 cases with the ICICI.

The 81FR in its performance review 1998 acknowledged that despite the

best efforts of the Board to expedite the disposal of cases, considerable delays

were c a ~ s e d. ~ The quasi judicial nature of the constitution of the BIFR, the

consensus approach in finalising the rehabilitation schemes and the delay caused

by the Operating Agencies in disposing the cases allotted to them often made the

BIFR process time consuming. Here it is apt to quote the words of Richa Mishra,

deluys in the disposal of cases is inherent in every system established under the

law where the BIFR as a quasi judicial tribunal is required to follow the principles

of natural justice, providing opportunities to all interested parties to participate in

the proceedings and its orders are also subject to appeals to the AAIFR and higher

courts lo.

'BIFR Performance Review ( 1 998), 27.

' O~i shra (200 I ) , 4.

Vous aimerez peut-être aussi

- Unit 1 Challenge 1: D.) Unethical Behavior by Major Companies Prompted The Government To Create The Sarbanes-Oxley ActDocument16 pagesUnit 1 Challenge 1: D.) Unethical Behavior by Major Companies Prompted The Government To Create The Sarbanes-Oxley ActMeredith Eckard100% (1)

- Case Study Assessment (Event 3 of 3) : CriteriaDocument26 pagesCase Study Assessment (Event 3 of 3) : CriteriaFiona AzgardPas encore d'évaluation

- The Socionomic Theory of FinanceDocument93 pagesThe Socionomic Theory of FinanceTHE TRADING SECTPas encore d'évaluation

- Singer India No Longer Sick Company Under BIFRDocument3 pagesSinger India No Longer Sick Company Under BIFRRahul KhoslaPas encore d'évaluation

- BIFRDocument3 pagesBIFRkanchan_khadilkarPas encore d'évaluation

- Project On Sick Industrial Company Act, 1985 (SICA) : G.Srihitha 11FLUHH010212Document25 pagesProject On Sick Industrial Company Act, 1985 (SICA) : G.Srihitha 11FLUHH010212pravinsankalpPas encore d'évaluation

- Module 1 - Unit 4Document26 pagesModule 1 - Unit 4AlishaPas encore d'évaluation

- Sick Industries - Causes, Symptoms, Consequences and SICADocument5 pagesSick Industries - Causes, Symptoms, Consequences and SICAAshish BharadwajPas encore d'évaluation

- Unit 12 Sick Industrial UnitDocument17 pagesUnit 12 Sick Industrial UnitGinu George VarghesePas encore d'évaluation

- Sick Industrial CompaniesDocument9 pagesSick Industrial CompaniesyagnilPas encore d'évaluation

- Industrial LicensingDocument26 pagesIndustrial LicensingJuiÇý ßitëPas encore d'évaluation

- Brief Introduction of BIFR and Its FunctioningDocument3 pagesBrief Introduction of BIFR and Its FunctioningChowdhury HussainPas encore d'évaluation

- Board For Industrial and Financial Reconstruction (BIFR)Document3 pagesBoard For Industrial and Financial Reconstruction (BIFR)Rahul RajagopalanPas encore d'évaluation

- 4 - Sick Undertaking ActDocument8 pages4 - Sick Undertaking ActRajveer ParmarPas encore d'évaluation

- 8a2d3sick Industrial Companies ActDocument8 pages8a2d3sick Industrial Companies ActSimar SinghPas encore d'évaluation

- Brief Introduction of BIFR and Its FunctioningDocument14 pagesBrief Introduction of BIFR and Its FunctioningAbhimanyu SoniPas encore d'évaluation

- Company Regulatory Legislations in IndiaDocument57 pagesCompany Regulatory Legislations in IndiaAmit verma100% (1)

- Brief Introduction of BIFR and Its Functioning PDFDocument5 pagesBrief Introduction of BIFR and Its Functioning PDFranjan703Pas encore d'évaluation

- 20 (Twenty) or More PersonsDocument12 pages20 (Twenty) or More PersonsakashPas encore d'évaluation

- Idra 1951Document23 pagesIdra 1951Jermaine MaysPas encore d'évaluation

- 33-Merger&acquisition-Amalgamation of Sick Company-Sem 3 Div A - Aditi SrivastavaDocument7 pages33-Merger&acquisition-Amalgamation of Sick Company-Sem 3 Div A - Aditi SrivastavaaditiPas encore d'évaluation

- Industrial Sickness of IndiaDocument24 pagesIndustrial Sickness of IndiaMukesh Patel67% (6)

- Acquisition & Merger of Sick Companies Through BIFRDocument3 pagesAcquisition & Merger of Sick Companies Through BIFRaygaikwadPas encore d'évaluation

- Company Regulatory Legislations in IndiaDocument42 pagesCompany Regulatory Legislations in IndiaAngad SinghPas encore d'évaluation

- Company NotesDocument102 pagesCompany NotesSuraj ShahPas encore d'évaluation

- Business Laws Vol 1Document27 pagesBusiness Laws Vol 1Sriram_VPas encore d'évaluation

- 12-03-2020Document42 pages12-03-2020AlishaPas encore d'évaluation

- Industrial Sickness A Project123Document21 pagesIndustrial Sickness A Project123Sandeep Kaur SraPas encore d'évaluation

- Industrial Development and Regulation ActDocument20 pagesIndustrial Development and Regulation ActRajesh Dey100% (1)

- 8/april / Lecture Notes Historical Background and Structure of Insolvency and Bankruptcy Code, 2016Document10 pages8/april / Lecture Notes Historical Background and Structure of Insolvency and Bankruptcy Code, 2016Mishika PanditaPas encore d'évaluation

- Industrial Sickness: Business EnvironmentDocument28 pagesIndustrial Sickness: Business EnvironmentAmar SarafPas encore d'évaluation

- Company LawDocument5 pagesCompany LawvibhajainPas encore d'évaluation

- RTP Nov 2020Document30 pagesRTP Nov 2020Syamala GadupudiPas encore d'évaluation

- November, 2017 - Company LawDocument16 pagesNovember, 2017 - Company LawHarshvardhan MelantaPas encore d'évaluation

- Chapter - 5 Revival and Rehabilitation of Sick Units: The Companies Act, 1956Document44 pagesChapter - 5 Revival and Rehabilitation of Sick Units: The Companies Act, 1956paulPas encore d'évaluation

- Rtpfinalnew Nov20 p3Document30 pagesRtpfinalnew Nov20 p3cdPas encore d'évaluation

- Five Crore Rupees : Dormant CompanyDocument13 pagesFive Crore Rupees : Dormant CompanySaranyaPas encore d'évaluation

- ID Act Simplified by ChawDocument25 pagesID Act Simplified by ChawSaurabhChoudharyPas encore d'évaluation

- 60829bos49465 PDFDocument11 pages60829bos49465 PDFHari KiranPas encore d'évaluation

- Indian Trade Union Act 1926Document5 pagesIndian Trade Union Act 1926Mohit BansalPas encore d'évaluation

- Insurance Regulatory & Development Authority of India (IRDAI)Document10 pagesInsurance Regulatory & Development Authority of India (IRDAI)Deeptangshu KarPas encore d'évaluation

- Edited Audit Manual PDFDocument234 pagesEdited Audit Manual PDFXYZ123Pas encore d'évaluation

- CCI, 'Provisions Relating To Combinations', Accessed 15 MAY 2020. IbidDocument7 pagesCCI, 'Provisions Relating To Combinations', Accessed 15 MAY 2020. IbidAyushPas encore d'évaluation

- Understanding Company Act 2017Document2 pagesUnderstanding Company Act 2017Raja RizwanPas encore d'évaluation

- Industrial Disputes ActDocument92 pagesIndustrial Disputes ActSanjana SonkarPas encore d'évaluation

- CHAPTER-III Industrial Relations Laws in India - An Analytical StudyDocument41 pagesCHAPTER-III Industrial Relations Laws in India - An Analytical StudyPankaj TiwariPas encore d'évaluation

- Employee Provident Funds and Miscellaneous Provision Act 1952Document5 pagesEmployee Provident Funds and Miscellaneous Provision Act 1952Tanver ShaikhPas encore d'évaluation

- GN-2 General MeetingsDocument183 pagesGN-2 General MeetingsAkash SharmaPas encore d'évaluation

- Industrial SicknessDocument10 pagesIndustrial SicknessAditya0% (1)

- Corporate Law-II Revival of Sick IndustriesDocument27 pagesCorporate Law-II Revival of Sick IndustriesLanka VenkatPas encore d'évaluation

- Industrial Disputes Act 1947Document25 pagesIndustrial Disputes Act 1947Kalpesh Surve67% (3)

- COMMISSION ON AUDIT Final PaperDocument32 pagesCOMMISSION ON AUDIT Final PaperZeline MariePas encore d'évaluation

- IRDA ACTppt1Document33 pagesIRDA ACTppt1rajisumaPas encore d'évaluation

- Unit 5 ConsuDocument2 pagesUnit 5 ConsuMukul KumarPas encore d'évaluation

- Trade Union - Functions and Regulations. IRPMDocument17 pagesTrade Union - Functions and Regulations. IRPMSHUBHAM JAISWALPas encore d'évaluation

- Omnibus Investment CodeDocument31 pagesOmnibus Investment CodeAllen PoncePas encore d'évaluation

- Act No 53 of 1976Document10 pagesAct No 53 of 1976anwarpasha313Pas encore d'évaluation

- Labour Law. SECTION 2Document19 pagesLabour Law. SECTION 2manishwaghePas encore d'évaluation

- Labour Law AssignmentDocument9 pagesLabour Law Assignmentshivam tiwariPas encore d'évaluation

- Duties & Powers: Role, Independence and Powers of The Comptroller & Auditor GeneralDocument11 pagesDuties & Powers: Role, Independence and Powers of The Comptroller & Auditor GeneralJaswant RanaPas encore d'évaluation

- CG in NepalDocument39 pagesCG in NepalStuti AryalPas encore d'évaluation

- National Financial Reporting Authority RulesDocument2 pagesNational Financial Reporting Authority Rulesakshali ranePas encore d'évaluation

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisD'EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisPas encore d'évaluation

- SpeechesDocument2 pagesSpeechesAli AhmedPas encore d'évaluation

- Cab o Sil M 5p MsdsDocument8 pagesCab o Sil M 5p MsdsAli AhmedPas encore d'évaluation

- COA ClonazepamDocument1 pageCOA ClonazepamAli AhmedPas encore d'évaluation

- 5 DR Farhat MoazamDocument9 pages5 DR Farhat MoazamAjit Govind SonnaPas encore d'évaluation

- Heparin Sodium USPDocument1 pageHeparin Sodium USPAli AhmedPas encore d'évaluation

- Outlook 2007 ShortcutDocument4 pagesOutlook 2007 ShortcutAli AhmedPas encore d'évaluation

- History of Cabot-SanmarDocument1 pageHistory of Cabot-SanmarAli AhmedPas encore d'évaluation

- Heparin Sodium PH - Eur. DRAFTDocument1 pageHeparin Sodium PH - Eur. DRAFTAli AhmedPas encore d'évaluation

- Outlook 2010 ShortcutDocument3 pagesOutlook 2010 ShortcutAli AhmedPas encore d'évaluation

- List of Halal and HaramDocument14 pagesList of Halal and HaramMohd AliPas encore d'évaluation

- 16 BibliographyDocument7 pages16 BibliographyAli AhmedPas encore d'évaluation

- List of Tables: Description No India Details Companies byDocument3 pagesList of Tables: Description No India Details Companies byAli AhmedPas encore d'évaluation

- Questionnaire Information From Sick Companies: For CollectingDocument6 pagesQuestionnaire Information From Sick Companies: For CollectingAli AhmedPas encore d'évaluation

- 12 Chapter 4Document33 pages12 Chapter 4Ali AhmedPas encore d'évaluation

- 09 Chapter 1Document18 pages09 Chapter 1Ali AhmedPas encore d'évaluation

- Ramadan The Month of Fasting (Tamil) : For More Information, ContactDocument2 pagesRamadan The Month of Fasting (Tamil) : For More Information, ContactAli AhmedPas encore d'évaluation

- Performance of Sick Companies Reported To The: and HasDocument39 pagesPerformance of Sick Companies Reported To The: and HasAli AhmedPas encore d'évaluation

- Of Diagrams And: List ChartsDocument1 pageOf Diagrams And: List ChartsAli AhmedPas encore d'évaluation

- List Abbreviations: AAI Appellate FinancialDocument1 pageList Abbreviations: AAI Appellate FinancialAli AhmedPas encore d'évaluation

- Fffectivenes.s Of: The Rehabilitation SchemesDocument1 pageFffectivenes.s Of: The Rehabilitation SchemesAli AhmedPas encore d'évaluation

- Acknowledgements: I Take Sincere in SuccessfulDocument2 pagesAcknowledgements: I Take Sincere in SuccessfulAli AhmedPas encore d'évaluation

- 05 - Table of ContentsDocument6 pages05 - Table of ContentsAli AhmedPas encore d'évaluation

- Shampooing & Cond. DrapingDocument22 pagesShampooing & Cond. DrapingAli Ahmed100% (3)

- AN Evaluation of The Effectiveness of The Rehabilitation Schemes of The BifrDocument1 pageAN Evaluation of The Effectiveness of The Rehabilitation Schemes of The BifrAli AhmedPas encore d'évaluation

- Caste and Social Hierarchy Among Indian MuslimsDocument16 pagesCaste and Social Hierarchy Among Indian MuslimsAli Ahmed100% (1)

- Islamic ArtDocument8 pagesIslamic ArtAli AhmedPas encore d'évaluation

- Scanning A Document & and Making A PDF in Adobe AcrobatDocument2 pagesScanning A Document & and Making A PDF in Adobe AcrobatAli AhmedPas encore d'évaluation

- 225,226, Msds Isolan Gi 34 eDocument8 pages225,226, Msds Isolan Gi 34 eAli AhmedPas encore d'évaluation

- Corrosion EconomicsDocument9 pagesCorrosion EconomicsEmmanuel EkongPas encore d'évaluation

- Indas 2Document28 pagesIndas 2Ranjan DasguptaPas encore d'évaluation

- Corporate Finance Asia Global 1st Edition Ross Test BankDocument25 pagesCorporate Finance Asia Global 1st Edition Ross Test BankDonnaNguyengpij100% (60)

- Mastering Financial Modelling File ListDocument1 pageMastering Financial Modelling File ListNamo Nishant M PatilPas encore d'évaluation

- Social Money and CreditDocument6 pagesSocial Money and CreditKM Gaming100% (1)

- ROGEN AssignmentDocument9 pagesROGEN AssignmentRogen Paul GeromoPas encore d'évaluation

- Study Guide 10-17Document22 pagesStudy Guide 10-17minisizekevPas encore d'évaluation

- Internship Report (Rida)Document46 pagesInternship Report (Rida)Tania AliPas encore d'évaluation

- Exercise 4 AccountingDocument4 pagesExercise 4 AccountingnimnimPas encore d'évaluation

- Estate Tax-Handout 2Document4 pagesEstate Tax-Handout 2Xerez SingsonPas encore d'évaluation

- The Perfomance of Mutual FundDocument125 pagesThe Perfomance of Mutual Fundavinash singh50% (2)

- Advantages of Each Source of Finance and Their DisadvantagesDocument8 pagesAdvantages of Each Source of Finance and Their DisadvantagesfelixPas encore d'évaluation

- Caam RM1000Document2 pagesCaam RM1000NinerMike MysPas encore d'évaluation

- Module-1 Introduction To Finanaical ManagementDocument79 pagesModule-1 Introduction To Finanaical ManagementRevathi RevathiPas encore d'évaluation

- ZPPF Loan Recoverable ApplicationDocument3 pagesZPPF Loan Recoverable ApplicationNaga ManoharababuPas encore d'évaluation

- 5 Must Have Clauses in Property Sale AgreementDocument3 pages5 Must Have Clauses in Property Sale AgreementRajat KatyalPas encore d'évaluation

- NHDE - TRAC NGHIEM - B02050 - B02080 - B02082 - B03027 - CUOI KY - G I L PDocument30 pagesNHDE - TRAC NGHIEM - B02050 - B02080 - B02082 - B03027 - CUOI KY - G I L PTrân LêPas encore d'évaluation

- Micro Financing and Rural India: With Reference To Lijat PapadDocument20 pagesMicro Financing and Rural India: With Reference To Lijat PapadAmisha PrakashPas encore d'évaluation

- INVESTMENT JOURNEY - Kiran Dhanawada - VP CHINTAN BAITHAK - GOA 2015Document11 pagesINVESTMENT JOURNEY - Kiran Dhanawada - VP CHINTAN BAITHAK - GOA 2015sureshvadPas encore d'évaluation

- 07 Chapter Seven - Buy Side M&A (By Masood Aijazi)Document51 pages07 Chapter Seven - Buy Side M&A (By Masood Aijazi)Ahmed El KhateebPas encore d'évaluation

- Gold Export GhanaDocument3 pagesGold Export Ghanamusu35100% (4)

- Income Tax Case List Exam Related PurposeDocument9 pagesIncome Tax Case List Exam Related PurposeShubham PhophaliaPas encore d'évaluation

- Taxi Business PlanDocument31 pagesTaxi Business PlanHarry H Gaiya100% (2)

- Pramerica Life Rakshak SmartDocument10 pagesPramerica Life Rakshak SmartTraditional SamayalPas encore d'évaluation

- Bank Management P 52Document62 pagesBank Management P 52revathykchettyPas encore d'évaluation

- Ratio Analysis ItcDocument41 pagesRatio Analysis ItcPrit Ranjan Jha86% (7)

- Tally Era Conti...Document5 pagesTally Era Conti...Olivia OwenPas encore d'évaluation