Académique Documents

Professionnel Documents

Culture Documents

Performance of Sick Companies Reported To The: and Has

Transféré par

Ali Ahmed0 évaluation0% ont trouvé ce document utile (0 vote)

20 vues39 pagesBIFR - Chapter 5

Titre original

13 Chapter 5

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentBIFR - Chapter 5

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

20 vues39 pagesPerformance of Sick Companies Reported To The: and Has

Transféré par

Ali AhmedBIFR - Chapter 5

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 39

CHAPTER 5

PERFORMANCE OF SICK COMPANIES

REPORTED TO THE BIFR

5.1 Introduction

The BIFR initiates steps to rehabilitate all viable sick industrial

undertakings reported to it. Winding up of a company is considered only as a last

resort. Rehabilitation of a sick unit is carried out by sanctioning and implementing

a rehabilitation scheme. Where the sick unit has already implemented a

rehabilitation scheme, the Board may approve the continuation of the scheme if it

is satisfied that the company would be able to make its networth positive within a

reasonable period.

Where the Board finds that the sick unit has no viable rehabilitation

scheme of its own and it is in 'public interest' to rehabilitate the company, it

appoints an Operating Agency to examine the feasibility of its rehabilitation with

the active participation of all stake holders/participating agencies. The Operating

Agency prepares a rehabilitation scheme after making a detailed techno-economic

viability study incorporating necessary relief and concessions needed to revive the

company.

Chapter 5 119

The rehabilitation scheme is implemented for a period of seven to ten

years. If the company is able to make its networth positive during the period of

implementation of the rehabilitation scheme, it is considered as 'successful' and

the company is taken out of the purview of the BIFR.

The BIFR considers a rehabilitation scheme as successful only if its

implementation helps a company to make its networth positive. A company

reported to the BIFR afier the erosion of its entire networth may not be in a

position to make its networth positive by implementing a rehabilitation scheme.

But the implementation of the rehabilitation schemes might have helped many

companies to improve their operating efficiency and financial position to a great

extent. Hence an evaluation of the effectiveness of the implementation of the

rehabilitation schemes essentially requires an evaluation of the progress made by

the sick companies after implementing the rehabilitation schemes.

To evaluate the effectiveness of the implementation of the rehabilitation

schemes sanctioned by the BIFR, 40 sick companies' were selected and their

profitability, solvency, current assets and over all performance after implementing

the rehabilitation schemes were analysed.

5.2 Evaluation of the Profitability of Companies Reported to the

BIFR

A company should earn profit to survive and grow over a period of time.

The financial health of an enterprise on a long-term basis depends on its

profitability. It is an operational concept and signifies economic efficiency.

Profitability refers to a situation where output exceeds input, that is the value

created by the use of resources is more than the total of the input resources.

1

Data regarding 32 companies were collected from the Bombay Stock Exchange and

fiom 8 companies, by personal visits.

Profit is an outcome of investment. If a company is unable to earn a

satisfactory return on investment its survival is threatened. The return or yield on

capital investment must be satisfactory from the owners' point of view.

Profitability is measured not by the absolute quantum of profits but by

relating profit to a variable to which it depends viz., investment or sales.

Profitability ratios are the best indicators of the overall efficiency of the business

concern because they compare the return of value over and above values put into

business with sale or service carried on by the firm with the help of assets

employed (Srivastava, 1979, 49). It is an indicator of the company's efficiency in

using capital committed by shareholders and lenders. (Srivastava and Yadav,

1986, 3 1) . The operating performance or success of a business can be evaluated

with the help of profitability ratios viz., Gross Profit Margin, Net Profit Margin,

Operating Ratio, Return on Investment, Return on Capital Employed and the like.

Net profit is the net result of the working of a company during a period

and Return on Investment (ROI) relates profitability to investment. Hence the Net

Profit Ratio and the Return on Investment were selected to evaluate the

profitability of sick companies after implementing their rehabilitation schemes.

5.2.1 Net Profit Ratio

The ratio net profit to net sale2 is widely used as a measure of overall

profitability of a business. It indicates the management's efficiency in

manufacturing, administering and selling the products. The higher the ratio, the

better is the operating efficiency of the concern. It provides a search light of its

objectives.

Net Profit Ratio is worked out by dividing net profit by net sales. A figure

of net profit is arrived at after deducting the overall expenses, depreciation charges

' ~ e t Profit Ratio = Net ProfitMet Sales* 100

Chapter 5 121

and provision for development rebate reserve. The net profit is indicative of

management's ability to operate the business with sufficient success not only to

recover from the revenues of the period, the cost of merchandise or services, the

expenses of operating the business (including depreciation) and the cost of the

borrowed funds but also to leave a margin of reasonable compensation to the

owners for providing their capital at risk. The ratio of net profit to sales essentially

expresses the costiprice effectiveness of the operation3.

The profitability of a business concern is regarded as the best measure to

evaluate its operating efficiency. The higher the profitability, the better its

operating eff~ciency. The Net Profit Ratio can be used as a toot to analyse the

profitability of sick units after implementing the rehabilitation schemes. lt also

helps to evaluate the effectiveness of the implementation of the rehabilitation

schemes sanctioned by the BIFR. Any improvement in the profitability of the sick

unit after implementing the rehabilitation scheme can be considered as the success

of the implementation of the rehabilitation scheme. Similarly any decline in the

profitability of the business concern after implementing the rehabilitation scheme

is a sign of the failure of the rehabilitation scheme.

In order to evaluate the effectiveness of the implementation of the

rehabilitation schemes sanctioned by the BIFR the Net Profit Ratios of 40 selected

sick industrial undertakings have been calculated and the trend4 is given in Table

5.1

-

3

Helfert E.A and Richard Irwin - Techniques of Financial Analysis (Homewocd 1 1 1)

1972 P.53 USA as quoted in Banarsi Misra - Monitoring of industrial Sickness, Deep and

Deep Publications: New Delhi.

4

The trend is calculated by using the formula y = a + bx where,

y = Ratio, b = Trend value, x = Year and a = Constant.

Table 5.1:- Net Profit Ratio of Sick Comarmnies

SI.

No.

1

2

3

4

5

6

7

8

9

1990 Name of Companies

AndhraCementsLtd

Binny Ltd

Asian Bearing Ltd

Nirlon Ltd

India Pol$bm Ltd

Priyadarshini Cements Ltd

Modi lndustriesLtd

Munjal Auto Industries Ltd

Shiva Suiting Ltd

I989

i 2

13

14

I 5

16

17

I 8

19

20

I I

1991

S a x p a hdia Ltd

I995

-196.40

16.90

-19.16

-26.46

-3.90

0.61

T

1992

-87. LO

-194.41

-24.42

-22.85

-13.51

-57.06

-34.08

GTC Mustria Ltd

Kings Chemicals & Distillers Ltd

Dynavision Lid

Incab Induhes Ltd

Coromandal Cements Ltd

1996

-3.90

-1.92

Bhoruka Aluminium Ltd

Tmvancore Rayons Ltd

M d Box Ltd

Aluminium Industries Ltd

-14.64

-10.00

1993

-210.60

I

-92.41

66.61

1994

-1365.0

-8.30

1997

-1.30

41.80

2.76

7.00

-16.63

-12.61

-9.22

-382.68

-36.71

0.07

-8.35

0.43

-1 1.32 -1.38

-27.08

-9.93

-5222

-8.17

-33.35

-13.10

-10.58

-152.91

-32.57

-57.94

0.55

-19.45

-104.23

-6.66 1.28

3.41

-38.24

-13.11

1998

4 10

2.82

-11.41

-32. I2

-34.62

(Table

0.62

-2.43

-190.97

2.83

4.48

-13.25

-43.34

-86.12

17.591

-1.3%

-17.545

-1.094

0.308

-3.4221

-5.0452

-2.0069

-214.29 -190.65

9.52

-6.94

-17.55

-23.81

-121.43

1999

-2.40

- 140.80

9.82

,

-12.93

-180.38

0.62

19.04

-3.88

1.61

4. 39

Continued .,.....)

-36.67

-12.76

1.62

-33.02

-138.72

4.12

-3.53

-17.95

4.41

2.35

-12.51

-0.61

0.92

-31.42

3.88

1.10

47.67

12.91

-4.50

-15.61

-91.25

10.49

2000

-31.60

45. 61

4.21

3.25 2.03

-3.68

-0.32

-19.34

2.74

-2.20

3.67

8.04

-0.37

-20.46

-100

10.57

2001

-5.61

-80.92

, -291.84

1.70

2.01

0.98

-15.82

-32.41

Trend

Value

56.8055

-14.2349

----

4.65

1.37

-21.60

-100

5.77

----

-252.52

9.78

-3.68

-18.15

-2.41

3.85

-4.75

0.40

7.01

-33.33

-15.99

-18.33

6.67

5.57 5.26 36.9113

I

-1.41

6.82

40.00

0.6166

0.5606

3.6575

-8.9458

47.11

-10.65

2.37

0.8241

-1.6342

2.6078

Table 5.1 Continued

Source: Annual Reports.

Chapter 5 124

Among the 40 sick companies selected for the study, only five companies

were able to come out of the ' pwi ew of the BIFR' after making their networth

positive. But the positive trend in the Net Profit Ratio in 19 companies showed

that the implementation of the rehabilitation schemes helped 14 more companies

to improve their profitability after implementing the rehabilitation schemes. The

negative trend in the Net Profit Ratio in 21 companies reflected the failure of the

implementation of the rehabilitation schemes in those cases.

5.2.2. Return on Investment

The efficiency of a business unit can be measured by relating the profit

earned to the investment made for earning it. It measures how well the resources

of a business are being used. The higher the ratio, the better is the result. Return on

Investment (ROI)' relates Earnings Before Interest and Taxes (EBIT) to

investments in fixed assets and current assets. It measures the business

performance not affected by interest charges and tax payments.

The ROI can be effectively used to analyse the operating efficiency of a

sick unit after implementing the rehabilitation scheme sanctioned by the BIFR. A

positive trend6 in ROI during the implementation of the rehabilitation scheme

denotes improvement in the operating efficiency of the business unit and success

in implementing the rehabilitation scheme. The Retum on Investments of 40 sick

companies, which implemented the rehabilitation schemes sanctioned by the

BIFR, have been calculated and the trend is given in Table 5.2.

s

Retum on Investment = EBITl Fixed Assets + Current Assets.

he trend i s calculated by using the formula y = a + bx where,

y = Ratio, b = T m d value, x = Year and a = Constant:

Table 5.2:- Return on Investment of Sick Com~anies - - -

Si.

No.

1

2

Name of Companies

Andhra Cements Ltd

Sinny Ltd

1989

I t

12

13

14

15

16

17

18

19

20

1994

-.24

- . t o

1990

(Table Continued.. ..,)

Saregama India Ltd

GTC Industries Ltd

Kings Chemicals & Distillers Ltd

-

Dynavision Ltd

lncab Industries Ltd

Commandal Cements Ltd

Bhoruka Aluminium Ltd

Travancore Rayons Ltd

M d BOX Ltd

Aluminium Industries t t d

I995

-.20

.I7

1W1

-

- 3

1996

.OS

-.07

1992

-26

- 03

-.I9

1W3

-.20

-.@I

1997

.07

-.M

-.07

.06

1998

0

0

. I 5

.05

-.06

-.01

1W

-.08

-.I6

- 1 1

.21

-.06

-01

2000

-.I7

-07

-12

- . I 3

-.37

.25

- . I 1

- 03

ZOO#

.08

-.03

Tmd

Value

0.0284

-0.0002

-09

-.I3

-.28

-.02

-. 10

-. 10

.14

-.I2

-05

-.06

-.09

-.32

.07

- . I0

.07

0

-.I0

- 02

-.02

. W

- . I6

. I2

-.I9

- 09

-.02

0

-03

.W

-. I3

.I0

-.46

0

-.M

-.08

-.07

-01

.03

-.I5

.09

29

-.w

-.04

-.35

-.07

.06

-.I3

-011

-.97

-.02

-.06

-0.0170

0.0 1

-0.005

-0.00 1

- 0 . 2 ~ ~

0.0165

0.0370

-0.0329

0.0038

0.0007

Table 5.2 Continned

39

40

Dunlop India Ltd

Carona Ltd

-.36

-.43

Source: Annual Repwts.

-.37

-.89

-.59 0.1 I

-.23 -.45 0.06

The table shows that among the 40 companies, only in 18 companies the

ROI showed a positive trend. This shows that the implementation of the

rehabilitst ion schemes were effective in improving the operating efficiency only in

45 percent cases. In the case of 22 companies the ratio showed a negative trend

reflecting the failure of the rehabilitation schemes in improving the operating

eficiency in 55 percent cases.

5.3 Evaluation of the Short-term Solvency of Companies

A firm should be able to meet its financial obligations as and when they

become due. The failure of a firm to meet its fmancial obligations due to lack of

sufficient liquidity, will result in bad credit rating, loss of creditors' confidence or

even in law suits resulting in the closure of the company (Panday, 1980, 428). In

fact, liquidity is a prerequisite for the very survival of a firm. The liquidity ratios

measure the ability of a firm to meet its short-term obligations and reflect the

short-term financial strengthlsolvency of a fm (Khan and Jain, 198 1, 1 18- 1 19). Net

Working Capital representing the excess of current assets over current liabilities is

the best measure to evaluate the short-term solvency of a f m. A good indicator is

the Current ~atio'. It indicates the amount of current assets available for each

rupee of current liability. The higher the ratio, the larger the amount of rupees

available per rupee of current liability; the more the firm's ability to meet current

obligations and greater the safety of funds of short-term creditors (Khan and Jain,

198 1, 12 1). The Current Ratios of 40 sick companies after reporting to the BIFR

and the trend have been calculated and given in Table 5.3.

7~urrent Ratio = Current Assets / Current Liabilities. Current Assets include cash and

bank balance, marketable securities, inventory of raw materials, semi finished and finished goods,

and debtors net of provision for bad and doubtful debts, bill receivables and prepaid expenses.

Current Li~bilities consist of short-term creditors, bills payable, bank credit provision for

taxation, dividends payable and outstanding expenses.

Table 5.3:- Current Ratio of Sick Companies

14

r s

16

1 7

18

19

20

1989 SI-

No.

1

2

3

4

(Table Continued.. ..)

Dynavision Ltd

Incab Industries Ltd

Coromandal Cements Ltd

Bhoruka Aluminium Ltd

TravmcoreRayonsLid

MetalBoxLtd

Aluminium Industries Ltd

1990

0.85

Name of Compmies

Andhm Cements Ltd

Binny Ltd

Asian Beatings Ltd

Nitlon Ltd

1.24

1-57

0.96

1991

0.87

6.29

1993

0.28

2.94

2.95

3.43

5

6

7

8

1.32

1992

0.40

324

9.57

2.28

l%U

0.16

2.15

5.26

5.81

2.43

4.60

1.45

1995

0.40

3. 04

6.448

2.71

India Polyfibres Lid

ki pdmhi ni Cements Ltd

Modi Industries Ltd

Munjal Auto Industries Ltd

9 1.08 0.34 0.48 0.37 0.23 026 0.18

1.84

1.22

2.38

8.46

1.36

2.24

5.49

0.97

I 0

11

12

13

1.99

6.05

1.31

1.78

1.32

1.73

6.33

1.27

1996

0.78

2.72

8.40

3.17

Scooters India Ltd

Smgmna India Ltd

GTC Industries Ltd

Kings Chmicds & Distillem Ltd

1W8

1.04

8.70

2.69

1997

0.94

2.19

7.32

3.25

1.90

4.34

1.24

0.87

.-

1.79

1.21

1.60

1.43

2-12

1.05

0.52

2.01

2.79

1.21

0.73

0.74

1W

0.94

1.19

944

2.14

2.05

1.09

1.39

1.68

2.66

1.04

039

0.80

2000

0.78

1.19

8.97

1.57

135

0.18

2.23

0.99

1.31

5.45

2.21

0.99

0.63

1.01

2001

0.76

1.11

5.49

1.19

2.48

Trend

Value

0.0297

4.278

0.189

-0.2495

2.79

2.01

0.97

0. 7

0.86

1.51

0.1947

-0.5262

4.0334

-0.0572

2.88

0.91

1.31

8.23

2.09

-

1.09

1.7 0.84

O.%

1.27

-- 1.29

0.64

0 56 0.91

1.22

1

8.35

2.87

1.80

0.98

1.42

1.47

0.45

0.80

0.78

8.70

1.85

-

0.2291

4.1 137

0.0657

-0.0325

1.04

1.32

0.63

10.23

1 32

0.60

1.83

135

1.50

22.14

1.92

2.18

1.36

1.76

1.26

2.97

-0.12

-0.1446

2.49

1.41

1.84

1.12

3.11

2.20

1.90

0.86

3.09

2.48

1.33

0.65

0.2879

0.1088

-0.123

4. 21

Table 5.3 Continued

Chapter 5 1 30

The Cument Ratio and the trend can be used to evaluate the effectiveness

of the rehabilitation schemes sanctioned by the BIFR. Any improvement in the

short-term financial strength/solvency of sick industrial undertakings shows the

success in implementing the rehabilitation schemes.

Table 5.3 shows that the Current Ratio showed a positive trend only in 1 1

companies whereas the trend is negative in 29 cases. It indicated that the

rehabilitation schemes were effective in improving the short-term solvency

position only in 27.5 percent companies whereas in 72.5 percent cases the short-

term solvency position continued to decline even after implementing the

rehabilitation schemes.

5.4 Evaluation of the Long Term Solvency Position of Companies

The use of borrowed funds to improve the earnings to equity shareholders

is considered a prudent financial policy. Healthy companies borrow out of choice;

weak units borrow out of necessity to tide over drain in financial resources. The

extent of the use of funds provided by the owners as well as creditors in the total

1

assets is a significant factor affecting the long-term solvency position of a firm.

Excessive external equity tends to cause insolvency (Gupta, 1990,87). The long-term

financial strength of a company can be judged in terms of its ability to repay the

instalments of principal on due dates or in one lump sum at maturity (Khan and

Jain, 198 1, 123).

Sick industrial undertakings reported to the BIFR after the erosion of their

total networth faces a threat to their solvency due to huge accumulation of debt,

Increase in debt increases the debt-servicing obligation, which adversely affects

the operating efficiency of the units. Hence the rehabilitation schemes give

emphasis to improve the fmancial strength of the units by reducing debt by One

Time Settlement (OTS) of dues with own funds or m&hg arrangements for the

Chapter 5 131

easy repayment of debt by rescheduling them at concessional rate of interest

waiving aH penal charges and penal interest.

The implementation of the rehabilitation scheme aims to bring back the

sick units to normal. health by improving their operating efficiency and financial

position. The Debt-Equity Ratio and the Interest Service Ratio can be effectively

used to evaluate whether the implementation of the rehabilitation schemes helped

the companies to improve their long-term solvency position.

5.4.1 Debt-Equity Ratio

The total assets of a business concern are financed by the owner's equity

as well as outside debt. There should be an ideal relationship between total assets,

owners' equity and outside debt to ensure long-term solvency of a firm. The

Debt-Equity ~at i o' shows this relationship. This ratio reflects the relative claims

of creditors and shareholders against the assets of the firm. The higher the ratio,

the greater is the possibility of increasing the rate of return to the equity so tong as

the cost of debt is lower than the rate of return on investment.

The Debt-Equity Ratio c,an be used to evaluate the effectiveness of the

implementation af the rehabilitation schemes sanctioned by the BIFR. The decline

in the ratio shows decline in debt financing and improvement in the financial

position of the unit. To evaluate whether the implementation of the rehabilitation

schemes sanctioned by the BIFR were effective in improving the financial position

of the sick units, the Debt-Equity Ratios of 40 sick units have been calculated and

the trend is given in Table 5.4.

Debt-Equity Ratio = Long Tern Debt / Shareholders' Equity.

(Table Continued.. .. . ,)

1997

14.05

7.96

480

2.13

6.25

9.17

4.95

6.01

2.37

12.34

3.34

9.94

7.35

3.45

3.26

1.82

4.44

1.39

1998

8.74

5.38

1.86

0.87

I 1. M

5.42

6.73

2.82

9.17

3.59

9.65

7.08

3.33

3.30

2.44

2.12

6.00

1.49

2001

11.28

1.99

1.95

9.57

7.18

3.32

1695

12.48

1.80

7.84

2.27

3.71

7.68

5.78

7.37

3.67

6.95

1.26

Continued

1994

11.M

2.88

4.51

1.69

6.88

5.79

5.88

7.1 1

Trend

Value

0.2813

-1.575

0.661

0.542

-0.4971

4.1769

0.292

0.628

0.0807

-0.173

4.7154

0.014

0.9154

-0.024

4.3068

0.007

-1.2068

0.344

1.305

0.085

1999

9.37

5.96

2.18

0.81

12.73

6.00

7.41

1.90

I 56

3.38

9.65

7.13

3.16

3 51

2.52

5

1.56

1996

13.20

0.04

7.13

4.47

2.75

3.84

11.60

3.72

7.68

16.22

3.10

3.51

4.08

5.32

1.54

2000

9.73

6.60

12.73

8.13

1.85

1.83

3.15

9.66

7.18

3.09

3.99

1.14

3.02

8.62

Table

1992

9.83

7.1 1

5.4

1593

10.6%

4.93

4.15

6.34

5.53

1990

12.81

1989

11.32

-

S1.

No.

21

22

B

24

25

26

27

28

29

30

31

31

33

34

35

36

37

38

39

40

Source:

1991

10.97

13.26

Name of Cornpwk

South India Wire ropes Ltd

Kerala Minerals & Metals Ltd

Pigmen& India Ltd

Elecra Substrates Ltd

Steel and Industrial ForRings Ltd

The Tramme Sugm and

chemi ds ~t d

Tmsfwmers and Ekctricds

Kaala Ltd

Hindustani Cylinder Co. Ltd

Raj Prakash Chemicals Ltd

ModemDairiwLtd

Zenith Ltd

Mahmhtra Explosives Ltd

Bhoruka Stds Ltd

MardiaSteel Lid

hapuma Foils Ltd

Gujarat Steel Tubes Ltd

Ipi Steel Ltd

Shree Karthik Papers Ltd

Dunlop India Ltd

(hOlltlLtd

Annual Reports.

Chapter 5 134

Among the 40 companies, the Debt-Equity Ratio showed a negative trend9

in 20 companies, including four companies declared successful by the BIFR. It

showed that the reduction in debt helped to improve the financial position of 50

percent companies. The ratio showed a positive trend in 20 companies indicating

the increased use of debt and the decline in their long-term solvency position due

to the failure of the rehabilitation schemes in generating adequate internal

surpluses.

5.4.2 Interest Service Ratio

The soundness of a firm from the viewpoint of long-term creditors lies in

its ability to service their claims. Interest Service ~ati o' ' is used to measure the

debt servicing ability of a fm in so far as the fixed interest on long-term debt is

concerned. The ratio shows how many times the interest charges are covered by

Earnings Before Interest and Taxes (EBIT). The higher the ratio, the better it is for

the organisation. A lower ratio is a danger signal that the firm is using excessive

debt and does not have the ability to offer assured payment of interest to creditors

due to poor operating performance. The inability of a sick unit to mobilise own

resources to recoup the cash losses incurred results in increased use of borrowed

funds. The more the amount of borrowed funds, the more their service cost. The

increase in the debt-servicing obligation, adversely affects the profitability of the

unit. The Interest Service Ratio can be used to evaluate the effectiveness of the

rehabilitation schemes in reducing the debt and interest charges thereon in

improving the operating efficiency of companies. The Interest Service Ratios of

40 sick companies selected for the study have been calculated and the trend is

given in Table 5.5.

9

The trend is calculated by using the formda y = a + bx. where,

y = Ratio, b = Trend value, x = Year and a = Consw.

'O~nterests Service Ratio = Earnings Before Interest and Taxesllnterest Charges.

51.

No.

I

6

8

9

I 0

I I

12

14

I 5

I 6

17

18

19

20

Nme of Companies

hdhm Cements Ltd

Binny Ltd

Asian Bearings Ltd

NirIon Ltd

India Polyfibres Ltd

PriyadaFshini Cements Ltd

Modi Industries Ltd

Munjal Auto Industries Ltd

Shiva Suitings Ltd

Scooters India Ltd

Sarepma India Ltd

GTC Industries Ltd

Kings Chemicals and

Distillers Ltd

Dynavision Ltd

Incab Industries Ltd

Coromrtndal Cements Ltd

Bhoruka Aluminium Ltd

Travanmre Rayons Lid

Metal Box Ltd

Aluminium Industries Lid

1989

-1.08

-1.12

Table 5.5:- Interest Service Ratio of Sick Companies

1W 1991

0.09

1992

0.78

0.39

0.39

1.18

0.08

0.97

1993

-.0.43

0.30

0.30

4.12

1.14

0.47

-1.14

4.27

1.07

1.33

-0.21

-0.09

1W4

4.39

-8.29

0.41

0.41

1.04

-0.07

-0.45

0.01

0.33

4.06

102

1.01

-0.66

1.78

-10.01

2 5

1995

-1.02

2.79

-0.34

137

0.76

-0.23

-0.11

-019

-0.19

0.98

2.04

-0.09

-0.03

1-04

0.89

-0.57

4.16

-31.37

-0.55

1996

0.48

1997

0.67

-3.89

-3.89

4.27

3.19

-0.66.

-1.62

-8.00

0.93

4.93

-0.22

3.62

0.31

- I . %

-7.00

0.76

0.76

-0.08

4.17

0.36

-1.61

-0.33

- 0. 01.

1.39

1.34

0.38

-0.37

-209

-1.25

7.90

0.46

3.30

4.91

4.58

0.16

1.36

0.15

-0.16

1998

0. 01

5.20

0.95

4 . 4 2

2.40

4. 77

-1.87

-0.11

0

-0.92 - 1. 85

-0.84

4.84

-0.66

2.22

0.03

-2.29

-2.00

-1 1 1

-0.17

-0.50

0.08

-10.36

4.07

-5.61

0.47 _.

4. 26

0

(Table

1999

-0.51

-1.02

-0.32

4. 32

1-19

2000

-0.95

327

0.40

0.55

-1 129

5-05

-2.66

0.48

4. 88

0

-0.35

-1.57

-1.57

1.97

0.4149

-0.0472

-0.1564

0.102

2001

0.44

Continued.. ..)

0.65

-0.43

3.15

-2.00

0.98

1.43

-4.12

5.23

2.75

0.41

Trend

Value

0 . m

0.3946

-0.0844

0.125

-1.778

0.613

-0.42

-0.W80

0.1789

-0.1475

-19.5526

0.0038

1-05

0.49

3.65

-2.00

0.0425

-0.0533

0.7171

-0.3882

2001

1.68

9. 27

1.68

-2.33

-322.5

-0.65

-2.23

2000

0.30

-0.39

3.59

-1.46

4.28

1.07

-0.6%

1.07

-113.50

- 1. 77,

4.76

-2.97

1.35

0. 56

-1 -37

Trend

Vdue

-0.0258

2.865

0 2 7 7

-0.036

0.8321

0.1 14

0.491

0.289

-0.0768

0.267

0.0026

0.303

-9.0871

-57.947

0. 1137 -

0.401

-0.001 1

0.035

4.301

-2.64

1W

0.0%

-0.22

5.17

4. 21

-1.12

-1.57

1.45

0.66

1.45

-23.26

-70.50

-0.53

-7.74

0.68

-2.38

-10.79

1998

-0.09

0.16

3.62

4.44

0.57

-0.70

0.99

0.70

1.56

0.70

-7.65

44.40

0 1

-13.01

-0.63

-9.76

19%

0.06

9.26

0.01

4.22

1.67

4. 55

0.57

0. 47

0.37

0.27

1.05

0.69

1995

0.79

4.61

-0.29

1.03

4.87

0.31

-1.13

-0.12

-0.73

0.61

0.66

1997

0.80

-0.25

-0.20

3.62

-3.55

-

0.64

4.36

-1.22

0.53

0.93

0.35

0.62

-1.44

0.79

-2.55

4. 07

-1.41

-5.51

5.5

1993

-0.42

0.60

0. 12

0.16

0.17

-0.M

Table

1992

0.26

0.16

Continued

1994

4.70

2.03

0.11

-0.04

-5.35

-0.31

-0.25

-0.10

0.69

1991

0.45

1990

4. 33

1989

4.19

9.

No -

21

22

23

24

25

26

''

28

29

30

31

32

33

34

35

36

37

38

39

40

Name of Compan~es

South India Wire ropes Ltd

Kerala Minerals & Metals Ltd

Pigments lndia Ltd

Elecra Submates Ltd

Steel & Induseial Forgin~s Ltd

The Tmmcote Sugars &

Chemicals Ltd

Transfornets and Eledcals

KeralaLtd

Hindustani Cylinder Co. Ltd

Raj Prakash Chemicals Ltd

Modern Dairies Ltd

ZenithLtd

Maharashha Explosives Lld

B h o d Steels Ltd

Mardi astd Ltd

Annapurna Foils Ltd

Gujarat Steel Tubes Ltd

Ipi Steel Ltd

Shree Karthik Papers Lld

Dunlop India Ltd

Carona Ltd

Source: Annual Reports.

Chaprer 5 137

In 19 companies the Interest Service Ratio showed a positive trend. It is

an indication that the implementation of the rehabilitation schemes helped them to

reduce their debt and interest cost. In 21 companies the ratio indicated a negative

trend reflecting the increase in borrowed funds and interest cost thereon. It showed

that the rehabilitation schemes were effective in reducing the debt and interest cost

only in 47.5 percent companies.

5.5 Evaluation of the Performance of Current Assets

The performance of a firm can be evaluated by analysing the use of

assets, both fixed assets and current assets for the generation of income. The

greater is the rotation of assets to generate sales, the better it is for the business. It

measures the efficiency with which the assets are used in the business. In other

words, the more efficient the operation of an asset, the quicker and more number

of times the rotation is.

An evaluation of the performance of assets of sick industrial undertakings

after implementing the rehabilitation schemes sanctioned by the BIFR can be used

to analyse the effectiveness of the implementation of the rehabilitation schemes.

Hence the performance of current assets like stock and sundry debtors and

working capital after implementing the rehabilitation schemes were analysed with

the help of Inventory Turnover Ratio, Debtors Turnover Ratio and Working

Capital Turnover Ratio.

5S.1 Inventory Turnover Ratio

Every firm has to maintain a certain level of inventory of finished goods

to meet the requirement of business. But the level of inventory should neither be

too high nor too low. Holding more inventory than what is required is harmful to

the business. It unnecessarily blocks capital which can otherwise be profitably

used somewhere else. Slow disposal of stocks will mean slow recovery of cash;

Chapter 5 138

which will adversely affect the liquidity of the firm. On the other hand, a too low

in;entory may mean loss of business opportunities.

The efficiency of a firm's inventory management can be evaluated with

the help of Inventory Turnover ~at i o". It measures the velocity of conversion of

stock into sales. Inventory Turnover Ratio can be calculated by dividing cost of

goods sold by average inventory.

A high Inventory Tumover Ratio reflects the efficiency in inventory

management because more frequently the stocks are sold, the lesser amount of

money is required to finance inventory. A low inventory turnover suggests an

inefficient inventory management. It implies excessive inventory levels than

warranted by production and sales activities, or slow moving or obsolete

inventory. A high level of sluggish inventory amounts to unnecessary tie-up of

funds, impairment of profit, and increased costs. I f obsolete inventories are to be

written off, this will adversely affect the working capital position and the liquidity

of the firm.

The Inventory Turnover Ratio can be successfully used to evaluate the

efficiency of the inventory management in sick industrial units after implementing

the rehabilitation schemes sanctioned by the BIFR. Accordingly the Inventory

Turnover Ratios of selected sick companies have been calculated and the trend l 2

is given in Table 5.6.

I1lnventory Turnover Ratio = Cost of Gods Sold I Average Inventory.

he trend is calculated by using the formula y = a + bi . where,

y = Ratio, b = Trend value, x = Year and a = Constant.

1992

94.4

5.6

11.6

3 3 2

6.9

18.1

5. 9

6.3

28.5

6.91

Sick

1995

213

9.8

4.3

9.7

43.7

56.7

0

18.0

0

28.2

9.5

126.9

0

8.8

5.9

6.42

1998

34.3

0

2.6

8.9

20.7

62.4

2.4

251

1.7

12.8

10.2

28.1

4.4

4 6

7.9

263.7

23.5

118

0

5.6:-

1990

6.83

Table

1989

6.81

SI.

No.

1

2

5

6

,

9

1

12

13

14

15

16

17

18

20

Companies

1696

33.7

11.2

4.4

15.8

21.6

53.2

2. 9

14.7

0

24.0

11.3

138.5

0

10.1

6.3

5,21

Inventory

1991

6.2

3 4

21.5

8 8 5

Turnover

1993

24.9

3.6

11.0

24.2

43.2

4.4

8 9

6 4

-

17.7

17.3

7.03

Name of Companies

AndhCmml t ~ Ltd

Binny Ud

Asian m g s Ltd

NirlonUd

lndia Polyfibrts Ltd

Riyadarshini Cements Ltd

M d i IndustFies Ltd

Munjal Auto Indusbies Ltd

Shiva Suitings Ud

Scooten India Ltd

Saregama India Ltd

GTC Industries Ltd

Kings Chemicals & Distillers b d

Dynavision Lid

lncab Industries Ltd

Coromdal Cements Ltd

B h k a Aluminium Ltd

Travancore Rayons Ltd

Metal Box Ltd

Aluminium Industries Ltd

1997

30.2

4.6

4.2

11.9

15.1

51.4

2.8

17.4

14.0

17.9

10.1

4.5

4.4

9 7

0

0

116

5.5

Ratio of

1994

H. 2

8.6

3.4

8.9

36.9

50.9

0

15.2

6.8

8.3

0

11.2

10.8

8.32

Trend

Value

4. 31

-0.1071 -

-0.1709

-2.7833

0,2206

-0.1527

g6,1785

-0.357 1

-0.7121

4.6078

-

-4.85

0.15

0.1

-2.73

0,2523

3,2w

-

2.3718

-2.479

-0.1752

....)

1W

31.4

9.5

3.6

8.3

36.2

68.7

3.5

44.5

0.8

12.3

t 0.2

21.7

5.3

-

4.4

8.9

0

15.9

-

10.1

4.1

2000

40.2

8.4

3.4

10.3

O

47.0

4.6

576.6

1 6

11.9

105

14.4

5.7

4.4

0

129.3

1 . 7

10.5

2.6

(Table

2001

37.2

9.7 -

3- 1

11.3

1 4 - '

22.7

3,7

438.7

11.7

4.6

5.0

0

151.3

18.1

13.5

0

Continued

Table 5.6 Continued

38 Shree Kanhik Papers Ltd 16.5 19.9

39 Dunlop India Ltd

.. 4.1 1 2.39 0.98

40 Car~naLtd 5.57 3.80 3.84

Source: Annual Reports.

Trend

4.3236

Chapter 5 141

The Inventory Turnover Ratio showed a positive trend in 17 companies.

It showed that the implementation of the rehabilitation schemes were effective in

improving the efficiency of the inventory management in 42.5 percent cases. The

ratio showed a declining trend only in 23 companies and it accounted for 57.5

percent cases.

5.5.2 Debtors Turnover Ratio

A firm sells goods on credit and cash basis. Credit is one of the important

elements of sales promotion. Following a liberal credit policy can increase the

volume of sales. But a liberal credit policy may result in tying up of substantial

funds of a firm in the form of trade debtors. Conversion of trade debtors into cash

within a reasonably short period i s essential to keep the liquidity position of the

firm intact. Hence the liquidity position of the firm depends on the quality of its

trade debtors.

The efficiency of the debtor's management of a fm can be evaluated

with the help of the Debtors Turnover Ratio (DTR). It indicates the velocity of the

debt collection of a firm. It shows the number of times average debtors are turned

over during a year. It is generally observed that the higher the value of the debtors'

turnover, the more efficient is the management of debtors or more liquid is the

debtors. A low Debtors Turnover Ratio implies inefficient management of

debtodsales. DTR can be used to evaluate the effectiveness of the implementation

of the rehabilitation schemes in sick companies reported to the BIFR. An

improvement in the efficiency of debtors' management in a unit after

implementing the rehabilitation scheme shows the effectiveness of the

rehabilitation scheme and vice versa. Hence to evaluate the efficiency of debtors'

management in sick units after implementing their rehabilitation schemes the

Debtors Turnover Ratios of selected sick companies have been calculated and the

trend is given in Table 5.7.

Table 5.7:- Debtors Turnover Ratio of Sick Companies

SI .

No.

I

2

3

4

5 .

6

7

g

9

10

1 1

12

13

14

1 5

16

17

18

19

20

Name of Cornpanics

Andhra Cements Ltd

Binny Ltd

Asian Bearifigs Ltd

Nirlon Ltd

India Polfibres Ltd

Priyad&mi Cements Ltd

Modi lndustriesLtd

Munjal Auto Indus~~i es Ltd

Shiva Suitings Lrd

Smt ers India Ltd

Sarcgma Mia Ud

GTC lndustnts Ltd

Ki ng Chemicals and Dist~llers Ltd

Dynavision Ltd

lncab Indwies Ltd

Cwornandal Cements Ltd

Bhoruka Atminim Ltd

Travancore Rayons Ltd

Metal Box Ltd

AIum~mum Industries Ltd

1989 1 W l IN1

3.4

4.2

6.3

6.5

12.9

I

4.8

5.6

6.7

4.4

2.7

1992

9.6

3. 8

2.5

5.0

7.4

6.9

10.0

4.1

6.1

5.8

3.6

3.6

10.8

9.7

4 7

3 -2

1993

4.2

2.3

5. 5

9.4

6.1

9.1

1994

1.3

2.2

5.7

10.0

8.0

7.7

1995

2.9

8.6

2.7

6.7

7.0

9.7

7.2

1 3.6 4.4

1996

7.8

3.5

4.9

13.11

0

4.7

2.2

3.5

3.4

2.8

5.5

5.8

11.7

7.8

3.3

3.9

4.7

10.7

0

4.2

1.1

2.3

6.6

1997

6.1

0

2.2

4.9

6.3

11.2

6.3

1998

5.3

0.2

5.9

5.3

11.1

2.1

5.4

7.6

8.5

6.2

7.2

2.7

6.5

5.3

1999

3. 3

4.4 6.9

0.7

13.3

6.8

3.8

2.4

1.1

3.1

12.9

15.9

6.8

0

2.0

3.3

4.2

2.9

1.9

.9

9.4

7.5

4.9

3

(Table

7 -6

2.0

6.6

4.6

9.1

7.8

0.4

5.9

5.3

2.7

2.5

1.3

2.3

0

8.7

8.7

.4

9.6

0

6.4

1.0

1.6

2000

4.3

2.4

5.2

.8

3.3

0

0

7. 3

.8

0. 1 178

1.7

3.0

4.9

3.0

.9

9.2

7.2 .

10. 0~

0

7.8

1.8

7.7

4 7

10.7

7.7

0. 125

0.1151

4.06%4

-0.45

-0.49

-1.4551

-0.5

-0.65

1.5464

0.0972

-0.4927

-0.2 178

Continued.. .)

0.0476

0. 1575

0.0769

-0.5116

0. 654

4.48

2001

5.9

Trend

Value

-0.1036

SI ,

No.

2 1

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

Source:

Name of Companies

South India Wire ropes Ltd

K d a M i n d s and Metals Ltd

Pigments India Ltd

Elwra Substrates Ltd

Steel & Industrial Forgings Ltd

The Travancore Sugars and

Chemicals Ltd

Transformers and ElBctricals

Kerala Ltd

HindustaniCylinderCo.Ltd

Raj P r Wh Chemicals Ltd

Modem Dairies Ltd

Zenith Ltd

Maharashka Explosives Ltd

Bhoruka Steels Lki

Mardia Steel Lid

Annapuma Foils Ltd

Gujarat Steel Tubes Ltd

Ipi Steel Ltd

Shree Karthik Papm Ltd

Dunlop lndia Ltd

CmnaLtd

Annual Reports.

1989

6.1

1990

18

I WI

5.8

Table 5.7

1992

5.2

24.4

Continued

1993

3.5

17.2

4.8

3.1

28.8

5.4

1%

2.2

39.8

5. 2

3 5

13.8

12 2

18.3

5. 7

13.1

1995

4.8

235.1

5. 5

4.6

20.2

21.4

9 4

14.4

8.0

5. 8

13.5

1996

3.6

413.7

5.3

3.9

4.7

90.4

2.1

19.4

68.7

10.6

3.8

0

4.7

14.0

12.4

1997

3 7

3.0

2.3

4.3

32.3

1.9

8.5

37.6

16.9

11.2

3.9

10.3

2 1

4.2

154

9.1

4 3

11.7

1998

4.2

4.0

4.5

58.5

1 .b

17.8

17.0

31.1

16.7

4.0

2 I

I . I

4.3

2.2

o

7. 2

0 7

6.7

1999

4.4

2.5

4.2

113.0

13

15.0

86.0

111.5

22.3

3.7

2.4

6.4

3. 7

0

0

5. 5

0. I

3.7

2000

6.1

2.0

149.0

130

25.5

40

57.9

18.7

3.2

14.6

3.8

0

12.3

9.4

2.6

2001

0

0

0

25.6

46.31

0

5. 2

26.4

7.7

0

0

Trend

Value

-0.2472

138.48

-0.0131

-0.36

0.1785

19.975

4.36

- 1.44

0.3142

2.63

2.5963

0.7171

4.3535

6.2 1

-0.01833

.3.3828

-1.7142

1. I

-0.57

4

Chapter 5 144

Among the 40 companies selected for the study, only in 15 companies did

the Debtors Tmover Ratio show a positive trend1) whereas in other 25

companies, the ratio indicated a negative trend, This showed that the

implementation of the rehabilitation schemes could not improve the efficiency of

the debtors' management in 62.5 percent companies.

5.5.3 Working Capital Turnover Ratio

The Working Capital Turnover R.atio14 (WCTR) measures the

effectiveness of the utilisation of net current assets or working capital. It is the

ratio between cost of sales and the average working capital employed. It shows the

number of times the working capital is turned over in the course of a business

during a year. The ratio highlights the efficiency with which the working capital is

being used or the state of over-investment or under-investment in current assets. A

higher ratio indicates efficient utilisation of working capital whereas the decline in

the ratio indicates that the working capital is either in excess of requirements or

that there has been an operational ineffectiveness.

The Working Capital Turnover Ratio can be best utilised for comparative

and trend analysis of different firms in the same industry and for various periods.

It can also be used for evaluating the performance of sick companies aRer

implementing the rehabilitation schemes. The Working Capital Turnover Ratios of

selected companies reported to the BlFR have been calculated and trend1' is given

in Table 5.8.

'' The trend is calculated by using the formula y = a + bx where,

y = Ratio, b =Trend Value, x = Year and a = Constant.

14

Working Capital Turnover Ratio = Cost of Sales I Working Capital.

'' The trend is calculated by using the formula y = a + bx where,

y = Ratio, b = Trend value, x = Year and a = Constant.

5.07 8.54 15.01 -121.3 4. 0 -1.53

-.5 1 0 I - . I l l

19 W BOX Ltd

20 Aluminium Industries t t d -37.41 21-80 5. 55 3.35

3 . 5.94 7.38 -98.54

-7.4653

(Table Continued.. .)

Table 5.8 Continued

Source: Annual Reports.

Chapter 5 147

A positive trend in the WCTR was found only in 16 companies whereas

in 24 companies the ratio showed a negative trend. It showed that the

implementation of the rehabilitation schemes were not effective in improving the

eficiency in the working capital management in 60 percent cases.

5.6 Evaluation of Ratios

The implementation of a rehabilitation scheme is considered effective

only when it helps to improve the operating efficiency and the financial position of

the sick company. Profitability is the best measure of evaluation of the operating

efficiency of a company. Financial position of a company can be evaluated by

analysing its short-term as well as long-term solvency position.

In order to evaluate the effectiveness of the implementation of the

rehabilitation schemes sanctioned by the BIFR, the profitability and fmancial

position of 40 sick companies after implementing the rehabilitation schemes were

analysed with the help of relevant financial ratios.

Net Profit Ratio and Return on Investment are used to evaluate the

profitability of companies. The long-term solvency position of the companies are

analysed with the help of Debt-Equity Ratio (DER) and Interest Service Ratio.

Current Ratio is used to evaluate the short-term financial position and the

performance of current assets are analysed with the help of Inventory Turnover

Ratio (ITR), Debtors Turnover Ratio (DTR) and Working Capital Turnover Ratio

(WCTR).

In order to make a meaningful evaluation, the trend in various ratios has

been calculated and is given in Table 5.9.

Table 5.9 Continued

35

36

37

38

39

40

-0.2433

-0.37

-0.2139

-0.0295

-0.039

-0.135

ha puma Foils Ltd

Gujarat Steel Tubes Ltd

Ipi Steel Ltd

Shree Karthik Papers Ltd

Dunlop lndia Ltd

Carona Ltd

-0.3068

0.007

-1.2068

0.344

1.305

0.085

-1.3753

-164.335

1.665

-35.865

-161.942

-0.1 137

0.401

-0.001 1

0.035

-0.301

-2.64

-0.0293

-0.101

0.01 1

-0.02

0.06

I

-32.28 0.1 1

1.4016

0.6742

0.5833

9.2

0.489

-0.865

4. 01833

-3.3828

-1.7142

1.1

4.57

-4

-0.1316

0.0765

- 1.0903

0.399

0.31

0.38

Chapter 5

Among the 40 companies analysed only five companies were able to

come out of the purview of the BIFR after making their networth positive during

the implementation of the rehabilitation scheme. But the implementation of the

rehabilitation schemes helped many other companies to improve their operating

efficiency and fmancial position.

An evaluation of the profitability of sick companies made by analysing

the trend in the Net Profit Ratio showed a positive trend in 19 cases and Return on

Investment in 18 cases. They were 47.5 percent and 45 percent respectively of the

total number of cases.

The Current Ratio showed a positive trend in 1 1 companies indicating

improvement in the short-term fmancial position in 27.5 percent cases. The long

term financial position of the companies was evaluated with the help of Debt-

Equity Ratio (DER) and Interest Service Ratio (ISR). DER showed a negative

trend in 20 companies (50% cases) indicating decline in debt. ISR showed a

positive trend in 19 companies (47.5% cases) reflecting the reduction in the

interest cost.

An evaluation of the performance of current assets, showed a positive

trend in Inventory Turnover Ratio in 17 companies, Debtors Turnover Ratio in 15

cases and the. Working Capital Turnover Ratio in 16 companies. They were 42.5

percent, 37.5 percent and 40 percent respectively of the total number of cases

evaluated.

5.7 Evaluation of Overall Performance of Companies

The BIFR regards the implementation of rehabilitation successful only if

the company is able to make its networth positive during the implementation of

the rehabilitation scheme. The number of companies declared no longer sick is the

Chapter 5 15 1

only criterion to evaluate the effectiveness of the rehabilitation schemes

sanctioned by the BIFR.

A sick industrial undertaking reported to the BIFR after the erosion of its

total networth by accumulated loss, is at the stage of imminent insolvency, and

making its networth positive by implementing a rehabilitation scheme for a

specified period may not be possible in many cases. But the implementation of

the rehabilitation scheme might have improved the operating efficiency and

financial position of the company to a great extent. The SICA does not provide

any criterion to evaluate the overall performance of the sick unit, which

implemented the rehabilitation scheme, except declaring the unit as 'no longer

sick' after making its networth positive. Hence it is essential to evaluate the

overall progress made by the sick unit after implementing the rehabilitation

scheme in order to judge its effectiveness in improving the operating efficiency

and financial position of the unit.

5.7.1. Application of Altman's Model

The Multiple Discriminant Analysis (MDA) technique developed by

Edward I ~l t r na n' ~, with certain modifications can be conveniently employed to

evaluate the overall progress made by the sick industrial companies after

implementing the rehabilitation schemes sanctioned by the BIFR

Altrnan had developed a criterion for predicting the insolvency of the firm

on the basis of financial ratios. He calculated an overall index, '2' score with the

help of following ratios.

i. Working capital to total assets

ii. Retained earnings to total assets

16

Edward 1 Altman, Financial Ratios, Discriminant Analysis and Prediction of

Corporate Bankruptcy. ( 1968) Journal of Finance, (September): 5 89-609.

Chapter 5

iii. Earnings before interest and taxes to total assets

iv. Market value of equity to book value of debt and

v. Sales to total assets

He has assigned weights to these ratios and the sum value of weighted

ratios is the value of 'Z', which if more than 2.99, signifies insolvency; if the value

is between 1.81 and 2.99, it denotes danger and if it is less than 1.81, it is a sign of

imminent insolvency. The formula has been expressed thus:

Z = -0 12x1 + .O 14x2 + -033x3 + -006x4 -t .999X5

Where,

XI, X2, X3, X4 and X5 refer to ratios mentioned in (i) to (v) above.

The ratio of working capital to total assets indicates the firm's liquidity-

smaller the ratio means lack of liquid funds to enable the fum to carry on routine

operations. As a matter of fact, those firms, which are insolvent or likely to be so,

have a very meagre working capital or negative working capital. The future cash

flow is generally eaten away by past commitment in such cases.

The ratio of retained earnings to total assets is indicative of the

management's wisdom in appropriating profits. Retention of earnings is desired

for having a buffer in the event of anticipated losses. If the retained earnings

cushion is weak naturally it poses a threat to the solvency of the firm in the event

of heavy losses, particularly in case of insolvent firms retained earnings are absent.

The ratio of earnings before interest and taxes to total assets, which is a

measure of return on capital employed, indicates the earning power of an

enterprise and the capacity to have cash inflows. The insolvent firms usually run

into losses, therefore, generally there is no question of regular cash inflows in

future.

Chapter 5

The ratio of market value of equity shares" to book value of total

liabilities shows the extent to which liabilities of the fm are covered by the value

of equity. The extent to which asset values may decline and the possibility of a

balance left to cover the liabilities is provided by this ratio.

The sales to total assets ratio is crucial in the sense that the turnover of

total assets to generate sales, if higher, is indicative of a sound position of the firm

and vice versa. It is the sales, which produce profits, and low turnover leads to

insolvency of the firm in due course of time.

Altman's model was developed to predict the insolvency of a fm.

However, it can be used with certain modifications to evaluate the overall progress

made by sick units after implementing the rehabilitation schemes since the ratios

represent liquidity, profitability, leverage, solvency and activity. The trend in the

'2' score can be taken as the best indicator of the progress achieved by sick

industrial units through the implementation of the rehabilitation schemes. A

positive trend shows an overall improved performance while a negative trend

denotes poor operating efficiency.

To evaluate the effectiveness of the implementation of the rehabilitation

schemes sanctioned by the BIFR in improving the overall performance of

companies, their '2' score has been calculated and the trend is shown in Table

5.10.

" Instead of market value of shares book value of shares are considered since the shares

of most of the companies are not traded in the BSE/NSE.

SI.

No.

I

2

3

4

5

6

7

g

9

10

I I

12

Table 5.10:- Overall Performance of Sick Companies

Name of Companies

Andhra Cements Ltd

Bimy Ltd

Asian Bearings Ltd

Nirlon Ltd

India Polyf~bres Ltd

Priyadarshini Cements Ltd

Modi Industries Ltd

Munjal Auto Industries Lid

Scooters India Ltd

Saregma India Ltd

GTC Indumies Ltd

1989

,5505

-6944

,7766 4437

l 3

14

15

16 .

17

18

19

20

1990

1.3200

,6427

,8096

-6173

Kings Chemicals and Distillers

Ltd

Dynavision Ltd

Incab Industries Ltd

Comrnandal Cements Ltd

Bhoruka Aluminium Lid

Travancore Rayons Ltd

Metal Box Ltd

Aluminium Indubpies Ltd

tW1

.282(3

1.4260

-------

,0461

,87611

-------

,9038

-6182

,5930

1W2

-3041

----

,3622

,6878

. 83M

(Table Continued.. ..)

_ -6879

-.0142

,9364

,4068

,7047

1993

1.0541 ,7121

,8445

-.0124

,7715

,1582

-3139

1994

,0433

,9673

,9675 ,7688

1.0035

7.1128

,7976

,1398

,1598

1995

,0590

,0746

1.0337

,7442

-2171

,4066

,5865

-6137

,6245

1.6390

,8197

,9994

,7288

0

-.MI1

,6095

,0923

1996

-.W7

-0.0544

,5195

,5089

-0689

1.2488

,7827

,2146

,1923

-4936

,5537

,3018

,7347

,2378

-6493

,4721

,9582

,6599

1.3890

,7944

,7015

2.6266

,5194

0 .

1997

,0214

-3966

-0118

,0981

1.7165.

,2960.

,1777

,4596

,6270

,7650

-9236

,4399

,6934

,5503

,9347

,1344

,8488 .

0

1.4423

.52M

,0225

,3159

1998

0.0209

-0.1507

0.0201

4.0093

-0.0007

0.0216

,5027

,0799

.5375

,6943

,7177

1.3644

,5115 -4503 ,5616 .W 0.0533

,0021

,1383

1.2729

1.4399

,4020

,0092

,4218

I999

,71148 13148 1.2059 1.3186 ,9055 0.1617

12488 1.2781 1.1092 ,5127 ,7027 -0.0288-

,7672 ,5117 ,5283

,4171

,5936

,8722

,6106

1.6382

,1410

1.2671

1.4293

,2803

2000

-0.296%

0.06

0.0463

0.0355

0.0413 .

4.0953

-0.0207

0

2001

,6340

,9394

-4564

1.7012

Trend

Value

,4953

,6982.

,3269

1.6172

Table 5.10 Continued

I

SI- I NmofCompanicr

No.

I

2 1

22

23

24

1989

25

26

,,

South India Wire ropes Ltd

Ketala Minerals and Metals Ltd

Pigments India Ltd

Elma Subseates Ltd

L I

2~

1W

Steel and Industrial Forgings Ltd

The Travancore Sugars and

Chemicals Ltd

Transformers and Electricals

29

30

3 1

32

33

M

35

36

3 7

38

39

40

,510

Kerala Ltd

Hindustani Cylinder Co. Ltd

1991

-2965

-6652

Source: A M U ~ Reports.

Raj Prakasb Chemicals Ltd

Modem Dairies Lid

Zenith Ltd

Maharashtra Explosives Ltd

Bhoruka Steels Ltd

Mardia Steel Ltd

Annapurna Foils Ltd

Gujarat Steel Tubes Ltd

Ipi Steel Ltd

Shree Karhik Papms Ltd

Dunlop India Ltd

Carona Ltd

,4653

1992

,3038

,5251

1

3889

,4580

,4686

1993

-7926

-6165

1994

8091

,3144

1995 19%

-3911

,6169

,6696

,7636

,2122

,8012

,2606

,8592

1.4308

,5314 ,4177

1.2786 1.9014

,4445

,2066

,3318

2.0936

-5.536

2.4799

Chapter 5 IS6

Table 5.10 shows that among the 40 sick companies selected for the

study, only in 12 companies, including four companies declared by the BIFR as

'no longer sick' the implementation of the rehabilitation schemes helped to

improve their overall performance. In 28 cases, the performance deteriorated after

implementing the rehabilitation schemes. This makes it clear that in 70 percent

companies the implementation of the rehabilitation schemes was not effective in

improving their overall performance whereas only in 30 percent cases the schemes

produced encouraging results.

Vous aimerez peut-être aussi

- Profitability AnalysisDocument23 pagesProfitability AnalysisAmit PandiaPas encore d'évaluation

- General Insurance Final PrintDocument32 pagesGeneral Insurance Final PrintMohsin TamboliPas encore d'évaluation

- Profitability Ratio PDFDocument37 pagesProfitability Ratio PDFSiddharth Arora100% (2)

- A Study On Profitability Analysis atDocument13 pagesA Study On Profitability Analysis atAsishPas encore d'évaluation

- Running Head: Income Statement Ford Motor Company 1Document3 pagesRunning Head: Income Statement Ford Motor Company 1Moses MachariaPas encore d'évaluation

- Internship Report - 03 June 22Document12 pagesInternship Report - 03 June 22Alina KujurPas encore d'évaluation

- Chapter - 4: Analysis and Interpretation OF DataDocument62 pagesChapter - 4: Analysis and Interpretation OF Dataprashanraj123Pas encore d'évaluation

- Dmp3e Ch05 Solutions 02.28.10 FinalDocument37 pagesDmp3e Ch05 Solutions 02.28.10 Finalmichaelkwok1Pas encore d'évaluation

- 11. Operating SegmentsDocument39 pages11. Operating Segmentslascona.christinerheaPas encore d'évaluation

- Solutions - Chapter 5Document21 pagesSolutions - Chapter 5Dre ThathipPas encore d'évaluation

- Performance-Measurement (1)Document6 pagesPerformance-Measurement (1)cherrymia canomayPas encore d'évaluation

- Sabir Auto Parts Working CapitalDocument88 pagesSabir Auto Parts Working CapitalGopi NathPas encore d'évaluation

- Textual Learning Material - Module 5Document62 pagesTextual Learning Material - Module 5Jerry JohnPas encore d'évaluation

- Q1 Explain Briefly Features of An IDEAL Management Control System. Ans. IntroductionDocument18 pagesQ1 Explain Briefly Features of An IDEAL Management Control System. Ans. IntroductionDhaval LagwankarPas encore d'évaluation

- Course: Financial Accounting & Analysis A1Document10 pagesCourse: Financial Accounting & Analysis A1Pallavi PandeyPas encore d'évaluation

- FIN420Document55 pagesFIN420suhadajajuli21Pas encore d'évaluation

- Presentation On Financial ManagementDocument18 pagesPresentation On Financial Managementguptasoniya247Pas encore d'évaluation

- GDF AssignmentDocument11 pagesGDF AssignmentZalwie JoePas encore d'évaluation

- JK Tyre Industries LTDDocument15 pagesJK Tyre Industries LTDAlex KuruvillaPas encore d'évaluation

- Analyzing Profitability Ratios of Two CompaniesDocument6 pagesAnalyzing Profitability Ratios of Two Companiescarl vonPas encore d'évaluation

- Faca ShristiDocument11 pagesFaca Shristishristi BaglaPas encore d'évaluation

- FINA2004 Unit 5Document11 pagesFINA2004 Unit 5Taedia HibbertPas encore d'évaluation

- Submitted To: Ms. Faria AkterDocument11 pagesSubmitted To: Ms. Faria Akterfarzana mahmudPas encore d'évaluation

- Financial Reporting Analysis and Valuation Course: Post Graduate Programme in ManagementDocument13 pagesFinancial Reporting Analysis and Valuation Course: Post Graduate Programme in ManagementSivabalanDhanabalPas encore d'évaluation

- Alekya - Profit AnaDocument17 pagesAlekya - Profit AnaMOHAMMED KHAYYUMPas encore d'évaluation

- 213 - F - Hdfc-A Study On Profitability and Operating Efficiency of Banking in India at HDFC BankDocument68 pages213 - F - Hdfc-A Study On Profitability and Operating Efficiency of Banking in India at HDFC BankPeacock Live ProjectsPas encore d'évaluation

- Financial Performance MeasuresDocument5 pagesFinancial Performance Measurescattiger123Pas encore d'évaluation

- Cpar MAS: Decentralization and Performance EvaluationDocument15 pagesCpar MAS: Decentralization and Performance EvaluationAlliah Gianne Jacela100% (1)

- MAS Responsibility Acctg.Document6 pagesMAS Responsibility Acctg.Rosalie Solomon BocalaPas encore d'évaluation

- Submitted By: Moeez Ul Hassan FA19-BAF-068 Submitted To: Sir Hashim Khan Financial Statement Analysis Final ProjectDocument16 pagesSubmitted By: Moeez Ul Hassan FA19-BAF-068 Submitted To: Sir Hashim Khan Financial Statement Analysis Final ProjectMoeez KhanPas encore d'évaluation

- Financial Performance AnalysisDocument30 pagesFinancial Performance AnalysisSairam AlluPas encore d'évaluation

- Return on Invested Capital Analysis and InterpretationDocument33 pagesReturn on Invested Capital Analysis and InterpretationMega KemilauPas encore d'évaluation

- International Journal of Management (Ijm) : ©iaemeDocument4 pagesInternational Journal of Management (Ijm) : ©iaemeIAEME PublicationPas encore d'évaluation

- Chapter 8 - Divisional Perfomance and BudgetingDocument34 pagesChapter 8 - Divisional Perfomance and BudgetingJeremiah NcubePas encore d'évaluation

- IFC-analysis-ratiosDocument6 pagesIFC-analysis-ratiosKumar RajeshPas encore d'évaluation

- Analyzing and Interpreting Financial Statements: Learning Objectives - Coverage by QuestionDocument37 pagesAnalyzing and Interpreting Financial Statements: Learning Objectives - Coverage by QuestionpoollookPas encore d'évaluation

- Module VII Profit Mgmt.Document15 pagesModule VII Profit Mgmt.Apoorv BPas encore d'évaluation

- 3.1 Financial Statements Firms Financial OperationDocument13 pages3.1 Financial Statements Firms Financial Operationnahu a dinPas encore d'évaluation

- Auditing Assignment 03Document12 pagesAuditing Assignment 03Akash KumarPas encore d'évaluation

- MANAGERIAL ACCOUNTING Assignment (Ratio Analysis)Document14 pagesMANAGERIAL ACCOUNTING Assignment (Ratio Analysis)Agniv BasuPas encore d'évaluation

- Profit Center: Group 2: Charesareig Farrajean Freolo Justine Arboleda Jecellebuere Jeyjavier Nathalie OcanaDocument34 pagesProfit Center: Group 2: Charesareig Farrajean Freolo Justine Arboleda Jecellebuere Jeyjavier Nathalie OcanaShelvanPas encore d'évaluation

- (I) Introduction To Investment CentreDocument28 pages(I) Introduction To Investment CentreBook wormPas encore d'évaluation

- Module 010 Week004-Finacct3 Statement of Comprehensive IncomeDocument6 pagesModule 010 Week004-Finacct3 Statement of Comprehensive Incomeman ibePas encore d'évaluation

- Profitabulity Analysis - PDF IntroductionDocument87 pagesProfitabulity Analysis - PDF IntroductionUsha Rani Vajroj100% (1)

- Responsibility AccountingDocument20 pagesResponsibility AccountingaddityarajPas encore d'évaluation

- Intro PDFDocument30 pagesIntro PDFArt KingPas encore d'évaluation

- Guidebook Productivity GainsharingDocument12 pagesGuidebook Productivity GainsharingSujatman SaputraPas encore d'évaluation

- Difference Between EVA and ROIDocument6 pagesDifference Between EVA and ROINik PatelPas encore d'évaluation

- Analysis of Profitability in Indian Life InsuranceDocument30 pagesAnalysis of Profitability in Indian Life InsuranceJenni PennyworthPas encore d'évaluation

- Chapter 1 Introduction - Chapter 2 Industrial ProfileDocument74 pagesChapter 1 Introduction - Chapter 2 Industrial Profilebalki123Pas encore d'évaluation

- Team RawhaDocument27 pagesTeam RawhaNishat Anjum HaquePas encore d'évaluation

- MB0045 - Financial Management: Q.1 Write The Short Notes OnDocument5 pagesMB0045 - Financial Management: Q.1 Write The Short Notes OnAnil Kumar ThapliyalPas encore d'évaluation

- 3Document26 pages3JDPas encore d'évaluation

- AAA - Unit 1 PPT QuestionDocument5 pagesAAA - Unit 1 PPT QuestionAlicia AbsolamPas encore d'évaluation

- ACC51112 Responsibility Accounting WITH ANSWERSDocument8 pagesACC51112 Responsibility Accounting WITH ANSWERSjasPas encore d'évaluation

- Balangoda Plantations PLC and Madulsima Planrtations PLC (1193)Document21 pagesBalangoda Plantations PLC and Madulsima Planrtations PLC (1193)Bajalock VirusPas encore d'évaluation

- Task 1: Financial Analysis: Financial Health of Unilever PLCDocument4 pagesTask 1: Financial Analysis: Financial Health of Unilever PLCperelapelPas encore d'évaluation

- Introduction Business Account and FinanceDocument45 pagesIntroduction Business Account and FinanceLuthfi Bin LokmanPas encore d'évaluation

- Benchmarking Best Practices for Maintenance, Reliability and Asset ManagementD'EverandBenchmarking Best Practices for Maintenance, Reliability and Asset ManagementPas encore d'évaluation

- Material Requirement PlanningDocument2 pagesMaterial Requirement PlanningAli AhmedPas encore d'évaluation

- 5 DR Farhat MoazamDocument9 pages5 DR Farhat MoazamAjit Govind SonnaPas encore d'évaluation

- 25 Ways To Lower Supply Chain Inventory CostsDocument8 pages25 Ways To Lower Supply Chain Inventory CostsAli AhmedPas encore d'évaluation

- Outlook 2010 ShortcutDocument3 pagesOutlook 2010 ShortcutAli AhmedPas encore d'évaluation

- Heparin Sodium PH - Eur. DRAFTDocument1 pageHeparin Sodium PH - Eur. DRAFTAli AhmedPas encore d'évaluation

- Vadodara - Chennai - Train - ScheduleDocument1 pageVadodara - Chennai - Train - ScheduleAli AhmedPas encore d'évaluation

- COA ClonazepamDocument1 pageCOA ClonazepamAli AhmedPas encore d'évaluation

- Outlook 2007 ShortcutDocument4 pagesOutlook 2007 ShortcutAli AhmedPas encore d'évaluation

- Heparin Sodium USPDocument1 pageHeparin Sodium USPAli AhmedPas encore d'évaluation

- SpeechesDocument2 pagesSpeechesAli AhmedPas encore d'évaluation

- History of Cabot-SanmarDocument1 pageHistory of Cabot-SanmarAli AhmedPas encore d'évaluation

- Cab o Sil M 5p MsdsDocument8 pagesCab o Sil M 5p MsdsAli AhmedPas encore d'évaluation

- 12 Chapter 4Document33 pages12 Chapter 4Ali AhmedPas encore d'évaluation

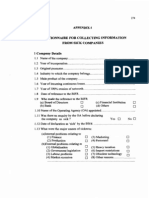

- Questionnaire Information From Sick Companies: For CollectingDocument6 pagesQuestionnaire Information From Sick Companies: For CollectingAli AhmedPas encore d'évaluation

- Ramadan The Month of Fasting (Tamil) : For More Information, ContactDocument2 pagesRamadan The Month of Fasting (Tamil) : For More Information, ContactAli AhmedPas encore d'évaluation

- Table of Contents AnalysisDocument6 pagesTable of Contents AnalysisAli AhmedPas encore d'évaluation

- List of Halal and HaramDocument14 pagesList of Halal and HaramMohd AliPas encore d'évaluation

- 16 BibliographyDocument7 pages16 BibliographyAli AhmedPas encore d'évaluation

- Of Diagrams And: List ChartsDocument1 pageOf Diagrams And: List ChartsAli AhmedPas encore d'évaluation

- 14 Chapter 6Document88 pages14 Chapter 6Ali AhmedPas encore d'évaluation

- Rehabilitation Under Sick Industrial COMPANIES (Special Provisions) ACT, 1985Document30 pagesRehabilitation Under Sick Industrial COMPANIES (Special Provisions) ACT, 1985Ali AhmedPas encore d'évaluation

- 15 Chapter 7Document22 pages15 Chapter 7Ali AhmedPas encore d'évaluation

- 10 Chapter 2Document36 pages10 Chapter 2Ali AhmedPas encore d'évaluation

- List of Tables: Description No India Details Companies byDocument3 pagesList of Tables: Description No India Details Companies byAli AhmedPas encore d'évaluation

- 09 Chapter 1Document18 pages09 Chapter 1Ali AhmedPas encore d'évaluation

- Acknowledgements: I Take Sincere in SuccessfulDocument2 pagesAcknowledgements: I Take Sincere in SuccessfulAli AhmedPas encore d'évaluation

- List Abbreviations: AAI Appellate FinancialDocument1 pageList Abbreviations: AAI Appellate FinancialAli AhmedPas encore d'évaluation