Académique Documents

Professionnel Documents

Culture Documents

HowMuchDebt IsTooMuch

Transféré par

iwylDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

HowMuchDebt IsTooMuch

Transféré par

iwylDroits d'auteur :

Formats disponibles

al Man age me n t

Financi

Gayle Rose Martinez, AFC

Clark County Family Living Agent

University of Wisconsin-Extension

How Much Debt is Too Much

“Don’t spend what you don’t will take you 25 years, 7 months to pay the debt

have.” Makes sense, doesn’t off. You will pay $15,432 in interest charges,

it? Then why is it that we (almost twice the balance), bringing your total to

have a 7 trillion dollar gross $23,432.

national debt and the average

balance on a credit card is Time frames can relieve stress, like a 15-year

$7,000? mortgage or a 4-year car loan. Credit cards are

usually not limited by time -- putting a time frame

Each of us must decide if we think debt is an accept- on paying them off could decrease some stress.

able part of our personal money management plan. Often concrete figures decrease stress. For

Some consumers say, “I am going to pay off all my example, I am comfortable with a car loan for 50%

debt," as if this is the goal. They proceed with of the worth of the car, a house loan for 75% the

accomplishing this goal, then turn around and create value of my house and credit card debt that I can

more debt (recycling debt). pay off in six months. Knowing my tolerance for

debt assists me in focusing a clear intent with my

Take time to determine what you consider acceptable spending.

debt and a level of debt in which you are comfort-

able. Debt can be viewed from an emotional or Acceptable Debt from a linear perspective

linear perspective – or both.

Another way to perceive your capacity for debt is

Emotional Tolerance For Debt to calculate your Debt to Income Ratio. Divide

your debt by your gross annual income.

There are many kinds of debt; mortgage loans, credit

cards, and educational loans. You may feel

differently about different kinds of debt. Try to

identify what kind of debt and how much debt

creates stress for you. If debt is causing you stress it

could be attached to: the size of the debt, what it is

costing you to have this debt, or the time it is taking

to pay it off.

(Ex. A person making $20,000 a year gross income

If your credit card balance is $8,000, and you make with $10,000 of outstanding debt has a 50% DTI

the minimum monthly payment at 18% interest, it Ratio.) If your Ratio is .30 (30%) or lower, it

indicates you have enough gross income to make

debt repayments easily and it implies financial

strength. If your debt ratio is 45% or higher, lenders

will perceive you as “over extended” and offered

higher interest rates when applying for loans.

These formulas determine whether debt is acceptable

from a linear perspective for maintaining financial

balance in your life. Once your capacity for debt is

determined, you can set goals for yourself to match

your intent with your spending choices.

Debt is not a simple issue. Being judgmental about

your own or other’s debt, or debt management, is a

simplistic response to a complex issue. It seems

more respectful to decide that debt is a part of this

culture, certainly demonstrated by our government

and our economy. Then discern your own personal

comfort level with the amount and kind of debt you

have in your life, and spend accordingly. Having

debt that is acceptable to you will increase your

personal power around your finances and decrease

money related stress.

Author: Gayle Rose Martinez, AFC, Family Living Agent, University of For more information contact: Gayle Rose Martinez, Clark

Wisconsin-Extension, County Family Living Agent, University Wisconsin-Extension,

Reviewer: Michael Gutter, Asst. Professor UW-Madison, Family Financial 517 Court St., Courthouse Room 104, Neillsville WI 54456 or

Management Specialist, Family Living Program UWEX; Rita

call 715-743-5121, FAX 715-743-5129

Straub, Family Living Agent Marathon Co. UWEX; Brenda

Janke, Family Living Agent Lincoln Co. UWEX, Family Finance Email: gaylerose.martinez@ces.uwex.edu

Management Specialist

Resources: Personal Finances by Jeff Madura, Addison Wesley

"An EEO/AA employer, University of Wisconsin Extension provides equal opportunities in employment and programming, including Title IX and ADA requirements. Please make

requests for reasonable accommodations to ensure equal access to educational programs as early as possible preceding the scheduled program, service or activity."

Vous aimerez peut-être aussi

- Financial Starter Kit: Gain Financial Literacy and Avoid the Pitfalls of the American DreamD'EverandFinancial Starter Kit: Gain Financial Literacy and Avoid the Pitfalls of the American DreamÉvaluation : 4 sur 5 étoiles4/5 (1)

- ADVANCED CREDIT REPAIR SECRETS REVEALED: The Definitive Guide to Repair and Build Your Credit FastD'EverandADVANCED CREDIT REPAIR SECRETS REVEALED: The Definitive Guide to Repair and Build Your Credit FastÉvaluation : 5 sur 5 étoiles5/5 (3)

- INVESTMENT AVENUES BLACK BOOK UpgradedDocument71 pagesINVESTMENT AVENUES BLACK BOOK UpgradedJack DawsonPas encore d'évaluation

- Credit Repair Secrets - Learn Fast The Basic Strategies To Repair Bad Credit and Fix Your Bad Debt To Improve Your Score, Business, and Personal Finance. 609 Letter Template Included.Document91 pagesCredit Repair Secrets - Learn Fast The Basic Strategies To Repair Bad Credit and Fix Your Bad Debt To Improve Your Score, Business, and Personal Finance. 609 Letter Template Included.Lohji “LowiYT” Koenig50% (2)

- Samoa Session2 Sagar Sarbhai PDFDocument30 pagesSamoa Session2 Sagar Sarbhai PDFAnonymous 4ThfhDBajPas encore d'évaluation

- The Debt Master Detox. A Comprehensive Guide to Getting out of Debt and Building Wealth.: 1, #1D'EverandThe Debt Master Detox. A Comprehensive Guide to Getting out of Debt and Building Wealth.: 1, #1Pas encore d'évaluation

- The Credit Score Blueprint: Strategies and Secrets to Raising Your Credit Score: Strategies and Secrets to Raising Your Credit ScoreD'EverandThe Credit Score Blueprint: Strategies and Secrets to Raising Your Credit Score: Strategies and Secrets to Raising Your Credit ScorePas encore d'évaluation

- Credit Score: The Beginners Guide for Building, Repairing, Raising and Maintaining a Good Credit Score. Includes a Step-by-Step Program to Improve and Boost Your Bank Rating.D'EverandCredit Score: The Beginners Guide for Building, Repairing, Raising and Maintaining a Good Credit Score. Includes a Step-by-Step Program to Improve and Boost Your Bank Rating.Pas encore d'évaluation

- Steps towards Financial Freedom: From Debt to Savings and Smart InvestmentsD'EverandSteps towards Financial Freedom: From Debt to Savings and Smart InvestmentsPas encore d'évaluation

- 3 The Nature of DefaultDocument10 pages3 The Nature of DefaultDesara_GJoka123Pas encore d'évaluation

- Literature On Personal Debt ManagementDocument16 pagesLiterature On Personal Debt ManagementANNKPas encore d'évaluation

- Chapter 2 2 IntlDocument3 pagesChapter 2 2 IntlChris FloresPas encore d'évaluation

- Hidden Credit Repair Secrets: How to Fix Your Credit Score and Boost it to 720+ with Credit Repair Secrets: Change Your Financial Life. Protect and Manage Your Business, Your Money and Enjoy FreedomD'EverandHidden Credit Repair Secrets: How to Fix Your Credit Score and Boost it to 720+ with Credit Repair Secrets: Change Your Financial Life. Protect and Manage Your Business, Your Money and Enjoy FreedomPas encore d'évaluation

- Stop the Insanity: Success Strategies for Credit RepairD'EverandStop the Insanity: Success Strategies for Credit RepairPas encore d'évaluation

- Research Papers On Reverse Mortgage LoanDocument5 pagesResearch Papers On Reverse Mortgage Loanafmcuafnh100% (1)

- Mastering Your Finances: A Comprehensive Guide to Understanding, Managing, and Leveraging Good vs Bad DebtD'EverandMastering Your Finances: A Comprehensive Guide to Understanding, Managing, and Leveraging Good vs Bad DebtPas encore d'évaluation

- The Importance of Good CreditDocument17 pagesThe Importance of Good CreditAllan BPas encore d'évaluation

- No Debt Zone: Your 9 Step Guide To a Debt Free LifeD'EverandNo Debt Zone: Your 9 Step Guide To a Debt Free LifeÉvaluation : 5 sur 5 étoiles5/5 (1)

- Household Debt ThesisDocument6 pagesHousehold Debt Thesismoz1selajuk2100% (2)

- Are You: Credit WiseDocument32 pagesAre You: Credit Wisebesis111Pas encore d'évaluation

- Your Road Map To Financial Freedom 101Document14 pagesYour Road Map To Financial Freedom 101Samuel TeddyPas encore d'évaluation

- Thesis Statement For Credit Card DebtDocument4 pagesThesis Statement For Credit Card DebtPayToWritePaperCanada100% (2)

- Repair and Boost Your Credit Score in 30 Days: How Anyone Can Fix, Repair, and Boost Their Credit Ratings in Less Than 30 DaysD'EverandRepair and Boost Your Credit Score in 30 Days: How Anyone Can Fix, Repair, and Boost Their Credit Ratings in Less Than 30 DaysPas encore d'évaluation

- How To Get Great CreditDocument16 pagesHow To Get Great Creditduckey08Pas encore d'évaluation

- How to Get Out of Debt and Achieve Financial FreedomD'EverandHow to Get Out of Debt and Achieve Financial FreedomPas encore d'évaluation

- Nature of CreditDocument6 pagesNature of CreditMikk Mae GaldonesPas encore d'évaluation

- Debt ManagementDocument11 pagesDebt ManagementRijah WeiweiPas encore d'évaluation

- Financial Literacy-Lesson 2 - Managing Expenses and DebtsDocument23 pagesFinancial Literacy-Lesson 2 - Managing Expenses and DebtsKielloggsPas encore d'évaluation

- Research Essay - Final DraftDocument11 pagesResearch Essay - Final Draftapi-509696889Pas encore d'évaluation

- Planning, Persisting and Prospering: Liberate Youself From Debt (Expanded Version)D'EverandPlanning, Persisting and Prospering: Liberate Youself From Debt (Expanded Version)Pas encore d'évaluation

- Recession-Proof: Debt Management Strategies for Financial StabilityD'EverandRecession-Proof: Debt Management Strategies for Financial StabilityPas encore d'évaluation

- Credit Score Mastery: A Step-by-Step Guide to Financial FreedomD'EverandCredit Score Mastery: A Step-by-Step Guide to Financial FreedomPas encore d'évaluation

- Credit Repair Book: The Official Guide to Increase Your Credit ScoreD'EverandCredit Repair Book: The Official Guide to Increase Your Credit ScorePas encore d'évaluation

- Release Your Bad Credit Now: The Professional Do It Yourself Guide For Improving Your CreditD'EverandRelease Your Bad Credit Now: The Professional Do It Yourself Guide For Improving Your CreditPas encore d'évaluation

- Fixing Your Credit: Simple Solutions for a Better ScoreD'EverandFixing Your Credit: Simple Solutions for a Better ScorePas encore d'évaluation

- How to Raise your Credit Score: Proven Strategies to Repair Your Credit Score, Increase Your Credit Score, Overcome Credit Card Debt and Increase Your Credit Limit Volume 2D'EverandHow to Raise your Credit Score: Proven Strategies to Repair Your Credit Score, Increase Your Credit Score, Overcome Credit Card Debt and Increase Your Credit Limit Volume 2Pas encore d'évaluation

- GoodbyeE BookDocument15 pagesGoodbyeE BookTSPas encore d'évaluation

- How To Evaluate Your Personal Finances - SoFiDocument10 pagesHow To Evaluate Your Personal Finances - SoFiJerry liuPas encore d'évaluation

- Balance To Limit RatioDocument2 pagesBalance To Limit RatioNiño Rey LopezPas encore d'évaluation

- Student Loans Thesis ServicingDocument4 pagesStudent Loans Thesis Servicingcheriekingtulsa100% (1)

- Solving Financial Problems: Know How. KnowDocument2 pagesSolving Financial Problems: Know How. KnowJerry TurtlePas encore d'évaluation

- Guide To Understanding Different Personal Finance Ratios - SoFiDocument11 pagesGuide To Understanding Different Personal Finance Ratios - SoFiJerry liuPas encore d'évaluation

- Preparing To Be Debt FreeDocument17 pagesPreparing To Be Debt Freechelseahoward2021Pas encore d'évaluation

- The Ultimate Credit Score Guide and Debt Reduction Value Pack - How to Get Out of Debt + The Credit Score Blueprint - The #1 Beginners Box Set for Improving Your FinancesD'EverandThe Ultimate Credit Score Guide and Debt Reduction Value Pack - How to Get Out of Debt + The Credit Score Blueprint - The #1 Beginners Box Set for Improving Your FinancesPas encore d'évaluation

- Credit Score SecretsDocument73 pagesCredit Score SecretsVijaya Bhasker100% (1)

- Credit Repair Secrets Learn Proven Steps To Fix And Boost Your Credit Score To 100 Points in 30 days Or LessD'EverandCredit Repair Secrets Learn Proven Steps To Fix And Boost Your Credit Score To 100 Points in 30 days Or LessPas encore d'évaluation

- BUSN1200 - Final Term Paper - Catherine Lau PDFDocument12 pagesBUSN1200 - Final Term Paper - Catherine Lau PDFCatherine LauPas encore d'évaluation

- The Most Common Chinese Characters in Order of FrequencyDocument132 pagesThe Most Common Chinese Characters in Order of FrequencyiwylPas encore d'évaluation

- CRPWind Integration Study Final ReportDocument14 pagesCRPWind Integration Study Final ReportiwylPas encore d'évaluation

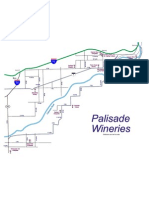

- Wineries Map PalisadesDocument1 pageWineries Map PalisadesiwylPas encore d'évaluation

- Coca Cola Report June 2008Document13 pagesCoca Cola Report June 2008iwylPas encore d'évaluation

- Mike Mahler's Aggressive Strength Kettle Bell Workshop ManualDocument55 pagesMike Mahler's Aggressive Strength Kettle Bell Workshop ManualAlen_D80% (5)

- Midterm ExamDocument14 pagesMidterm ExamDrew BanlutaPas encore d'évaluation

- Analisis Tingkat Kesehatan Bank Dengan Menggunakan Metode Camel Pada PT - Bank Syariah Mandiri (PERIODE 2001-2010) SkripsiDocument98 pagesAnalisis Tingkat Kesehatan Bank Dengan Menggunakan Metode Camel Pada PT - Bank Syariah Mandiri (PERIODE 2001-2010) SkripsiARYA AZHARI -Pas encore d'évaluation

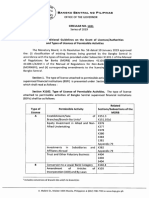

- Banoxo SerurReL Ne PrLrPrNAsDocument27 pagesBanoxo SerurReL Ne PrLrPrNAsJohnmill EgranesPas encore d'évaluation

- 4ac1 01 Que 20231103Document20 pages4ac1 01 Que 20231103Sadat RahmanPas encore d'évaluation

- Winter Internship Report Presentation at Chittorgarh Central Cooperative Bank LTDDocument13 pagesWinter Internship Report Presentation at Chittorgarh Central Cooperative Bank LTDayushiPas encore d'évaluation

- 1-SECP - Saboohi IsrarDocument15 pages1-SECP - Saboohi Israranum naeemPas encore d'évaluation

- Richard W Ellson ResumeDocument2 pagesRichard W Ellson Resumenrhuron13Pas encore d'évaluation

- Request Letter For Bank DraftDocument8 pagesRequest Letter For Bank Draftc2nwx0f3100% (1)

- Financial Services: Mutual Fund and Hedge Fund Companies: True / False QuestionsDocument32 pagesFinancial Services: Mutual Fund and Hedge Fund Companies: True / False Questionslatifa hnPas encore d'évaluation

- Octoberbulletin 2016Document76 pagesOctoberbulletin 2016Doctor planet global institutePas encore d'évaluation

- Free Cash Flow Valuation ModelsDocument46 pagesFree Cash Flow Valuation ModelsTahir GadehiPas encore d'évaluation

- Your Adv Plus Banking: Account SummaryDocument8 pagesYour Adv Plus Banking: Account SummaryFrancy MartinezPas encore d'évaluation

- INDIV - UnionBank PHP Fixed Income FundDocument6 pagesINDIV - UnionBank PHP Fixed Income FundBiggsterPas encore d'évaluation

- 08 - Ishares Barclays Capital Emerging Market Local Govt Bond enDocument2 pages08 - Ishares Barclays Capital Emerging Market Local Govt Bond enRoberto PerezPas encore d'évaluation

- Paid Client Sample Data CRM HackerDocument12 pagesPaid Client Sample Data CRM HackerUpendraPas encore d'évaluation

- A. Present Value PMT/iDocument2 pagesA. Present Value PMT/iABDUL WAHABPas encore d'évaluation

- Accounting Cycle Journal Entries With Chart of AccountsDocument4 pagesAccounting Cycle Journal Entries With Chart of Accountskutsara0300Pas encore d'évaluation

- Assignment 1Document21 pagesAssignment 1siddhant jainPas encore d'évaluation

- Appendix 31 - DVDocument2 pagesAppendix 31 - DVhehehedontmind me100% (1)

- Auditing and Assurance Services: Seventeenth Edition, Global EditionDocument37 pagesAuditing and Assurance Services: Seventeenth Edition, Global Edition賴宥禎100% (1)

- Example 1: SolutionDocument7 pagesExample 1: SolutionalemayehuPas encore d'évaluation

- Specialised Accouning Ques BankDocument31 pagesSpecialised Accouning Ques BankMayra AzharPas encore d'évaluation

- Solved Wayne Angell A Former Fed Governor Stated in An EditorialDocument1 pageSolved Wayne Angell A Former Fed Governor Stated in An EditorialM Bilal SaleemPas encore d'évaluation

- HDB Enterprise Business Loans - HDBDocument4 pagesHDB Enterprise Business Loans - HDBhermandeep5Pas encore d'évaluation

- STMKB CorporateProfile - 120123Document22 pagesSTMKB CorporateProfile - 120123SharpbanPas encore d'évaluation

- IandF CT5 201604 ExamDocument7 pagesIandF CT5 201604 ExamPatrick MugoPas encore d'évaluation

- Financial Institutions, Functions and Importance.: Prepared By: Dr. Albert C. RocesDocument12 pagesFinancial Institutions, Functions and Importance.: Prepared By: Dr. Albert C. RocesAMPas encore d'évaluation

- Purchases Day BookDocument8 pagesPurchases Day Bookdrishti.singh0609Pas encore d'évaluation