Académique Documents

Professionnel Documents

Culture Documents

Minimum Representation

Transféré par

Milagros Isabel L. Velasco0 évaluation0% ont trouvé ce document utile (0 vote)

38 vues3 pagesTwo petitions are filed assailing certain provisions of RA 7854, An Act Converting the Municipality of Makati into a Highly Urbanized City to be known as the City of Makati, as unconstitutional.

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentTwo petitions are filed assailing certain provisions of RA 7854, An Act Converting the Municipality of Makati into a Highly Urbanized City to be known as the City of Makati, as unconstitutional.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

38 vues3 pagesMinimum Representation

Transféré par

Milagros Isabel L. VelascoTwo petitions are filed assailing certain provisions of RA 7854, An Act Converting the Municipality of Makati into a Highly Urbanized City to be known as the City of Makati, as unconstitutional.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 3

CONSTITUTIONAL LAW 1

Case Digests Milagros Isabel Velasco

MINIMUM REPRESENTATION:

Mariano v. COMELEC

G.R. No. 118577 March 7, 1995

Puno, J.

PETITIONERS:Juanito Mariano, Jr., Ligaya S. Bautista, Teresita Tibay, Camilo Santos, Frankie

Cruz, Ricardo Pascual, Teresita Abang, Valentina Pitalvero, Rufino Caldoza,

Florante Alba, and Perfecto Alba.

(Of the petitioners, only Mariano, Jr., is a resident of Makati. The others are

residents of Ibayo Ususan, Taguig, Metro Manila, suing as tax payers).

RESPONDENTS: The Commission On Elections, The Municipality Of Makati, Hon. Jejomar

Binay, The Municipal Treasurer, And Sangguniang Bayan Of Makati

FACTS:

G.R. No. 118577 involves a petition for prohibition and declaratory relief.

Two petitions are filed assailing certain provisions of RA 7854, An Act Converting the Municipality of

Makati into a Highly Urbanized City to be known as the City of Makati, as unconstitutional.

Section 52 of RA 7854 is said to be unconstitutional for it increased the legislative district of Makati only

by special law in violation of Art. VI, Sec. 5(4) requiring a general reapportionment law to be passed by

Congress within 3 years following the return of every census. Also, the addition of another

legislative district in Makati is not in accord with Sec. 5(3), Art. VI of the Constitution for as of

the 1990 census, the population of Makati stands at only 450,000.

Issue:

Whether the assailed provision contravenes Section 5, Article VI of the Constitution

Held:

No. Reapportionment of legislative districts may be made through a special law, such as in the

charter of a new city. The Constitution

clearly provides that Congress shall be composed of not

more than two hundred fifty (250) members, unless otherwise fixed by law. As thus worded, the

Constitution did not preclude Congress from increasing its membership by passing a law, other

than a general reapportionment of the law. This is its exactly what was done by Congress in

enacting R.A. No. 7854 and providing for an increase in Makatis legislative district.

Petitioner cannot insist that the addition of another legislative district in Makati is not

in accord with Sec. 5(3), Art. VI of the Constitution for as of the 1990 census, the population

of Makati stands at only 450,000. Said section provides that a city with a population of at least

250,000 shall have at least one representative. Even granting that the population of Makati as of

the 1990 census stood at 450,000, its legislative district may still be increased since it has met

the minimum population requirement of 250,000.

CONSTITUTIONAL LAW 1

Case Digests Milagros Isabel Velasco

AUTOMATIC APPROPRIATION OF DEBT PAYMENTS NEED NOT TO PASS THROUGH CONGRESS

Guingona vs. Carague

G.R. No. 94571 April 22, 1991

GANCAYCO, J.

PETITIONERS: Teofisto Guingona, Jr. and Aquilino Pimentel, Jr., members of the Senate

(as Senators, they may raise the issue of unconstitutionality& as taxpayers, they have personal

interest in restraining unlawful expenditure of public funds)

RESPONDENTS: Guillermo Carague, Secretary of Dept. of Budget and Management; Rozalina

Cajucom, National Treasurer; and Commission on Audit

FACTS:

This is a case of first impression whereby petitioners question the constitutionality of the automatic appropriation

for debt service in the 1990 budget.

Petitioners questioned the constitutionality of Presidential Decree Nos. 81 (which amends RA4860,

Foreign Borrowing Act), 1177 (entitled Revising the Budget Process in Order to Institutionalize the

Budgetary Innovations of the New Society) and 1967 (An Act Strengthening the Guarantee and Payment

Positions of the Rep. of the Phil. On Its Contingent Liabilities Arising out of Relent and Guaranteed Loans

by Appropriating Funds for the Purpose), which provided for the automatic appropriation for the payment of

public debts, on the ground that all appropriation measures must be passed by Congress and approved by

the President.

HELD:

The argument of petitioners that the said presidential decrees did not meet the requirement and are therefore

inconsistent with Sections 24 and 27 of Article VI of the Constitution which requires, among others, that "all

appropriations . . . bills authorizing increase of public debt" must be passed by Congress and approved by the

President is untenable. Certainly, the framers of the Constitution did not contemplate that existing laws in the

statute books including existing presidential decrees appropriating public money are reduced to mere "bills" that

must again go through the legislative million. The only reasonable interpretation of said provisions of the

Constitution which refer to "bills" is that they mean appropriation measures still to be passed by Congress. If the

intention of the framers thereof were otherwise they should have expressed their decision in a more direct or

express manner.

-----

W/N PD81, PD1177 and PD1967 are still operative under the Constitution.

YES. Section 3, Article 18 of the Constitution recognizes that all existing decrees not inconsistent with the Constitution shall remain

operative under amended, repealed or revoked. Implied repeal and revocation is frowned upon.

PD 81 amends RA 4860, which authorizes the president to obtain foreign loans and credits and appropriates the necessary funds

therefore, by providing that funds are hereby appropriated from the National Treasury to cover any deficiency for debt servicing

PD1177 provides for the automatic appropriations for expenditures for, inter alia, principal and interests on public debt

PD1967 provides that there is hereby appropriated, out of any funds in the National Treasury, such amounts as may be

necessary to effect payments on foreign or domestic loans

Their purpose is to enable the government to make prompt payment and/or advances for all loans to protect and maintain the credit

standing of the country

Petitioners allege that said decrees became functus officio when Pres. Marcos was ousted because, with the expiration of the one-

man legislature, the legislative power was restored to Congress and that new legislation for automatic appropriations must come from

Congress.

The SC held that it could not have been the intention of the framers of the Constitution to require all existing laws to pass through

Congress again

The requirement of Sections 24 and 27, which requires appropriations and bills to originate from the House of Representatives and be

approved by the President, applies only to bills that are still to be passed by Congress

This is all the more true because of the political wisdom of automatic appropriations, which is to provide flexibility to the government

for effective execution of debt management policies.

CONSTITUTIONAL LAW 1

Case Digests Milagros Isabel Velasco

UNIFORMITY (TAXATION)

CIR v. CA

G.R. No. 119761; August 29, 1996

VITUG, J.

PETITIONER: Commissioner of Internal Revenue

RESPONDENTS: Hon. Court Of Appeals, Hon. Court Of Tax Appeals And Fortune Tobacco

Corporation

FACTS:

Fortune Tobacco Corporation ("Fortune Tobacco"), engaged in the manufacture of different brands of

cigarettes, registered "Champion," "Hope," and "More" cigarettes. BIR classified them as foreign brands

since they were listed in the World Tobacco Directory as belonging to foreign companies. However,

Fortune changed the names of 'Hope' to 'Hope Luxury and 'More' to 'Premium More,' thereby removing

the said brands from the foreign brand category.

A 45% Ad Valorem taxes were imposed on these brands. Then Republic Act ("RA") No. 7654 was

enacted 55% for locally manufactured foreign brand while 45% for locally manufactured brands. 2

days before the effectivity of RA 7654, Revenue Memorandum Circular No. 37-93 ("RMC 37-93"), was

issued by the Commisioner saying since there is no showing who the real owner/s are of Champion,

Hope and More, it follows that the same shall be considered locally manufactured foreign brand for

purposes of determining the ad valorem tax - 55%. BIR sent via telefax a copy of RMC 37-93 to

Fortune Tobacco addressed to no one in particular. Then Fortune Tobacco received, by ordinary mail,

a certified xerox copy of RMC 37-93. CIR assessed Fortune Tobacco for ad valorem tax deficiency

amounting to P9, 598,334.00.

Respondent questioned the validity of RMC 37-93.

HELD:

RMC 37-93 might have likewise infringed on uniformity of taxation.

Article VI, Section 28, paragraph 1, of the 1987 Constitution mandates taxation to be uniform and

equitable. Uniformity requires that all subjects or objects of taxation, similarly situated, are to be treated

alike or put on equal footing both in privileges and liabilities. Thus, all taxable articles or kinds of

property of the same class must be taxed at the same rate and the tax must operate with the same

force and effect in every place where the subject may be found.

Apparently, RMC 37-93 would only apply to "Hope Luxury," "Premium More" and "Champion" cigarettes

and, unless petitioner would be willing to concede to the submission of private respondent that the

circular should, as in fact my esteemed colleague Mr. Justice Bellosillo so expresses in his separate

opinion, be considered adjudicatory in nature and thus violative of due process following the Ang Tibay

doctrine, the measure suffers from lack of uniformity of taxation. In its decision, the CTA has keenly

noted that other cigarettes bearing foreign brands have not been similarly included within the scope of

the circular.

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- RULE 130, D.testimonial Evidence, 8. CHAVEZ vs. PCGGDocument2 pagesRULE 130, D.testimonial Evidence, 8. CHAVEZ vs. PCGGMilagros Isabel L. VelascoPas encore d'évaluation

- Pallada vs. PeopleDocument2 pagesPallada vs. PeopleMilagros Isabel L. Velasco100% (3)

- Alcatraz WikiDocument43 pagesAlcatraz WikiMilagros Isabel L. VelascoPas encore d'évaluation

- Akbayan InfoDocument43 pagesAkbayan InfoMilagros Isabel L. VelascoPas encore d'évaluation

- Roberts V CADocument61 pagesRoberts V CAMilagros Isabel L. VelascoPas encore d'évaluation

- Toyota Motor Philippines Corporation Vs CADocument6 pagesToyota Motor Philippines Corporation Vs CAMilagros Isabel L. VelascoPas encore d'évaluation

- Title Viii RemediesDocument8 pagesTitle Viii RemediesMilagros Isabel L. VelascoPas encore d'évaluation

- People Vs GoDocument19 pagesPeople Vs GoMilagros Isabel L. VelascoPas encore d'évaluation

- Partnership Duty To ContributeDocument2 pagesPartnership Duty To ContributeMilagros Isabel L. VelascoPas encore d'évaluation

- Gold Creek CaseDocument3 pagesGold Creek CaseMilagros Isabel L. VelascoPas encore d'évaluation

- Cod WarsDocument11 pagesCod WarsMilagros Isabel L. VelascoPas encore d'évaluation

- NeptuneDocument5 pagesNeptuneMilagros Isabel L. VelascoPas encore d'évaluation

- Geogonia Vs CADocument4 pagesGeogonia Vs CAJasper PelayoPas encore d'évaluation

- Adr ActDocument8 pagesAdr ActMilagros Isabel L. VelascoPas encore d'évaluation

- National Housing Authority Vs BasaDocument2 pagesNational Housing Authority Vs BasaMilagros Isabel L. VelascoPas encore d'évaluation

- HEIRS of TIRO Vs PESDocument1 pageHEIRS of TIRO Vs PESMilagros Isabel L. VelascoPas encore d'évaluation

- Decs Vs San DiegoDocument2 pagesDecs Vs San DiegoMPas encore d'évaluation

- Give Love On Christmas DayDocument1 pageGive Love On Christmas DayMilagros Isabel L. VelascoPas encore d'évaluation

- Ra 7279Document19 pagesRa 7279Babang100% (1)

- Microbiological Analysis Water Samples Flow Chart ProcedureDocument1 pageMicrobiological Analysis Water Samples Flow Chart ProcedureMilagros Isabel L. VelascoPas encore d'évaluation

- Ilocano PhrasesDocument4 pagesIlocano PhrasesMilagros Isabel L. Velasco100% (1)

- To Make The TreeDocument1 pageTo Make The TreeMilagros Isabel L. VelascoPas encore d'évaluation

- Ormoc Sugar Company Tax Ordinance Violates Equal Protection ClauseDocument10 pagesOrmoc Sugar Company Tax Ordinance Violates Equal Protection ClauseMilagros Isabel L. VelascoPas encore d'évaluation

- QDocument1 pageQMilagros Isabel L. VelascoPas encore d'évaluation

- Part 2Document135 pagesPart 2Milagros Isabel L. VelascoPas encore d'évaluation

- Phi 19097Document4 pagesPhi 19097Milagros Isabel L. VelascoPas encore d'évaluation

- LaugaDocument1 pageLaugaMilagros Isabel L. Velasco50% (2)

- Memory Aid - Obli ConDocument6 pagesMemory Aid - Obli ConMilagros Isabel L. VelascoPas encore d'évaluation

- In His Third Assignment of ErrorDocument1 pageIn His Third Assignment of ErrorMilagros Isabel L. VelascoPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Philippines laws on referendum and initiativeDocument17 pagesPhilippines laws on referendum and initiativeGeorge Carmona100% (1)

- Statcon - Week2 Readings 2Document142 pagesStatcon - Week2 Readings 2Kê MilanPas encore d'évaluation

- Cebu Provincial Candidates for Governor, Vice-Governor and Sangguniang Panlalawigan MembersDocument76 pagesCebu Provincial Candidates for Governor, Vice-Governor and Sangguniang Panlalawigan MembersGinner Havel Sanaani Cañeda100% (1)

- PIL NotesDocument19 pagesPIL NotesGoldie-goldAyomaPas encore d'évaluation

- SASI ADAT: A Study of the Implementation of Customary Sasi and Its ImplicationsDocument14 pagesSASI ADAT: A Study of the Implementation of Customary Sasi and Its Implicationsberthy koupunPas encore d'évaluation

- 13 Feb 2021 Daily DoseDocument13 pages13 Feb 2021 Daily DoseShehzad khanPas encore d'évaluation

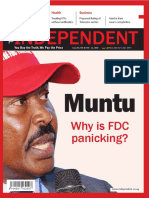

- THE INDEPENDENT Issue 541Document44 pagesTHE INDEPENDENT Issue 541The Independent MagazinePas encore d'évaluation

- Spain PH Visas 2014Document1 pageSpain PH Visas 2014Eightch PeasPas encore d'évaluation

- Annotated BibliographyDocument3 pagesAnnotated Bibliographyapi-272929479Pas encore d'évaluation

- Castro vs. Gregorio (2014)Document1 pageCastro vs. Gregorio (2014)Xavier BataanPas encore d'évaluation

- Chapter 2: Evolution of Urban Local Governments in IndiaDocument26 pagesChapter 2: Evolution of Urban Local Governments in IndiaNatasha GuptaPas encore d'évaluation

- America Counts On... : Scholarship Scam Spreads To Bihar, Ropes in School From Punjab TooDocument16 pagesAmerica Counts On... : Scholarship Scam Spreads To Bihar, Ropes in School From Punjab TooAnshu kumarPas encore d'évaluation

- SPG BallotDocument4 pagesSPG BallotLeonorBagnison55% (11)

- Words: BrazenDocument16 pagesWords: BrazenRohit ChoudharyPas encore d'évaluation

- Jawarhalal Nehru Speeches - Vol 2Document637 pagesJawarhalal Nehru Speeches - Vol 2GautamPas encore d'évaluation

- Draft Environmental Impact Report Volume 1 For The Alon Bakersfield Refinery Crude Flexibility ProjectDocument660 pagesDraft Environmental Impact Report Volume 1 For The Alon Bakersfield Refinery Crude Flexibility ProjectenviroswPas encore d'évaluation

- Conclusion To A Research Paper About The HolocaustDocument5 pagesConclusion To A Research Paper About The HolocaustgudzdfbkfPas encore d'évaluation

- Broward Sheriffs Office Voting Trespass AgreementDocument20 pagesBroward Sheriffs Office Voting Trespass AgreementMichelle SolomonPas encore d'évaluation

- MPU 2163 - ExerciseDocument7 pagesMPU 2163 - ExerciseReen Zaza ZareenPas encore d'évaluation

- FC - FVDocument88 pagesFC - FVandrea higueraPas encore d'évaluation

- Mil Reflection PaperDocument2 pagesMil Reflection PaperCamelo Plaza PalingPas encore d'évaluation

- Republic of Kosovo - Facts and FiguresDocument100 pagesRepublic of Kosovo - Facts and FiguresTahirPas encore d'évaluation

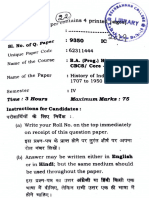

- B.A (Prog) History 4th Semester 2019Document22 pagesB.A (Prog) History 4th Semester 2019lakshyadeep2232004Pas encore d'évaluation

- Quilt of A Country Worksheet-QuestionsDocument2 pagesQuilt of A Country Worksheet-QuestionsPanther / بانثرPas encore d'évaluation

- Lens AssignmentDocument14 pagesLens Assignmentraunak chawlaPas encore d'évaluation

- Argumentative EssayDocument1 pageArgumentative EssaySophia CassandraPas encore d'évaluation

- Literary Theory & Practice: Topic: FeminismDocument19 pagesLiterary Theory & Practice: Topic: Feminismatiq ur rehmanPas encore d'évaluation

- Warren Harding Error - Shreyas InputsDocument2 pagesWarren Harding Error - Shreyas InputsShreyPas encore d'évaluation

- Nine Lessons For NegotiatorsDocument6 pagesNine Lessons For NegotiatorsTabula RasaPas encore d'évaluation

- Providing Culturally Appropriate Care: A Literature ReviewDocument9 pagesProviding Culturally Appropriate Care: A Literature ReviewLynette Pearce100% (1)