Académique Documents

Professionnel Documents

Culture Documents

Table: 1 Distribution of Companies by Economic Groups. Economic Groups 2010 2011

Transféré par

Ghulam AbbasTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Table: 1 Distribution of Companies by Economic Groups. Economic Groups 2010 2011

Transféré par

Ghulam AbbasDroits d'auteur :

Formats disponibles

Introduction

The analysis and format of this publication was revamped in the year 2011 to incorporate changes in the

regulations and culture of corporate sector. Analysis of last three years (2009, 2010 & 2011) is carried out

on the new format. Also presented in this publication is three years mapped data (2006-2008). All listed

companies on Karachi Stock Exchange (KSE) have been classified in line with new economic categories.

The year-wise distribution of companies by economic group is as under: -

Table: 1 Distribution of companies by economic groups.

Economic Groups 2010 2011

1) Textiles 164 155

i) Spinning, weaving, finishing of textiles 145 137

ii) Made-up textile articles 6 6

iii) Other textiles n.e.s. 13 12

2) Food 54 54

i) Sugar 36 36

ii) Other food products n.e.s 18 18

3) Chemicals, chemical products and Pharmaceuticals 43 43

4) Other manufacturing n.e.s. 33 30

5) Other non-metallic mineral products 29 28

i) Cement 21 20

ii) Mineral products 8 8

6) Motor vehicles, trailers and auto parts 22 22

7) Fuel & Energy 18 18

8) Information, Communication & transport Services 13 13

9) Coke and refined petroleum products 9 9

10) Paper, paperboard and products 9 9

11) Electrical machinery and apparatus 8 8

12)Other services activities 9 10

Total: 411 399

The sum of Assets and Liabilities of a company may exhibit minor differences due to rounding off

separate items. Ratios and percentages have been worked out after rounding off the figures in thousands,

which may, therefore, slightly differ from ratios calculated on the basis of exact numbers in balance sheet.

The symbol appearing in the analytical tables stand for Not applicable or Not available.

iii

I Methodology

Methodology is based on Ratio Analysis, a powerful tool to analyze the financial statements of any company.

Ratio analysis measures inter-relationship between different sections of the financial statements. Ratios are

taken as guides that are useful in evaluating a companys financial position and operation and making

comparison with results in previous years or with others in the same industry. The primary purpose of ratio

analysis is to point out areas needing further investigation. All the ratios are calculated from the following

financial statements and relevant notes to accounts.

Balance Sheet

Profit and Loss accounts

Statement of changes in Equity

Cash Flow Statement

Total shareholders equity is computed as the sum of ordinary share capital plus reserve and surplus plus

unappropriated

profit/ (loss) and the revaluation. Analysis of Non-Financial sector used the following concepts

and definitions as given below.

II Concepts and Definitions

A. Non-Current Assets

1. Capital work in progress:

Work in process consists of the unfinished products in a production process which are not yet complete but

either being fabricated or waiting in a queue or storage. They must be accounted for as funds (capital) that have

been invested for future enhancement in production.

2. Operating fixed assets:

These are owned by an enterprise engaged in production of items (directly or indirectly); which will be

available for sale. These are not readily convertible into cash during the course of normal operations of an

enterprise. These assets are not subject to periodical exchange through sales and purchases. Fixed assets are of

permanent nature and are not normally liquidated or intended to turn into cash except in the form of

depreciation, which is added to the cost of goods sold. The following balance sheet items are included in the

category of fixed assets: -

(a) Real Estate

(i) Freehold and leasehold land

(ii) Factory and office buildings

(iii) Residential buildings

Vous aimerez peut-être aussi

- J SOX ChallengesDocument5 pagesJ SOX ChallengesTapas Bhattacharya100% (1)

- Measurement Assignment EssayDocument31 pagesMeasurement Assignment EssayBihanChathuranga100% (2)

- Acctg 322Document2 pagesAcctg 322Janine Remoroza Ü100% (1)

- Impact of Pantawid Pamilyang Pilipino Program On EducationDocument10 pagesImpact of Pantawid Pamilyang Pilipino Program On EducationEllyssa Erika MabayagPas encore d'évaluation

- Patrick Meyer Reliability Understanding Statistics 2010Document160 pagesPatrick Meyer Reliability Understanding Statistics 2010jcgueinj100% (1)

- 2022 WR Extended VersionDocument71 pages2022 WR Extended Versionpavankawade63Pas encore d'évaluation

- Bsa 2005-2010Document518 pagesBsa 2005-2010Abdul KarimPas encore d'évaluation

- Cement Industry of PakistanDocument518 pagesCement Industry of PakistanWaqar HassanPas encore d'évaluation

- FA Unit 2 MaterialDocument58 pagesFA Unit 2 MaterialKeerthanaPas encore d'évaluation

- TCS 2010 AnalysisDocument22 pagesTCS 2010 AnalysisDilip KumarPas encore d'évaluation

- Fsa Part-3Document26 pagesFsa Part-3lakshya jainPas encore d'évaluation

- Financial Performance Appraisal of A Steel Plant: A SD ModelDocument37 pagesFinancial Performance Appraisal of A Steel Plant: A SD ModelShrikant JadhavPas encore d'évaluation

- Q.1: Kind of Data Required To Prepare A Cash Flow StatementDocument6 pagesQ.1: Kind of Data Required To Prepare A Cash Flow StatementShoaib NazarPas encore d'évaluation

- New Toyo International Holdings LTD: Table of ContentDocument15 pagesNew Toyo International Holdings LTD: Table of ContentTr.PhongPas encore d'évaluation

- Identify The IndustriesDocument4 pagesIdentify The IndustriesAarti JPas encore d'évaluation

- SKT2021 YEConsolidatedDocument143 pagesSKT2021 YEConsolidatedBobby SPas encore d'évaluation

- Advanced Accounting 10th Edition Hoyle Solutions ManualDocument29 pagesAdvanced Accounting 10th Edition Hoyle Solutions Manualcliniqueafraidgfk1o100% (22)

- Independent Audit Report (Aud 339)Document7 pagesIndependent Audit Report (Aud 339)ain madihahPas encore d'évaluation

- Operating SegmentDocument15 pagesOperating SegmentSrabon BaruaPas encore d'évaluation

- Case Study - ACI and Marico BDDocument9 pagesCase Study - ACI and Marico BDsadekjakePas encore d'évaluation

- Analysis of Financial Reports: Submitted byDocument17 pagesAnalysis of Financial Reports: Submitted byMalik Muhammad Ali EhsanPas encore d'évaluation

- The ToyotaDocument25 pagesThe ToyotaShahidul Haque PalashPas encore d'évaluation

- 3-6int 2002 Dec QDocument9 pages3-6int 2002 Dec Qadrianlee0107Pas encore d'évaluation

- Segment ReportingDocument45 pagesSegment ReportingNidhi AnandPas encore d'évaluation

- of Revised Schdule Vi1Document43 pagesof Revised Schdule Vi1Jay RoyPas encore d'évaluation

- International Journal of Management (Ijm) : ©iaemeDocument4 pagesInternational Journal of Management (Ijm) : ©iaemeIAEME PublicationPas encore d'évaluation

- Frequently Asked Questions On Companies (Cost Accounting Records) Rules, 2011Document8 pagesFrequently Asked Questions On Companies (Cost Accounting Records) Rules, 2011Srikanth GadepalliPas encore d'évaluation

- Perpetual Inventory Method: Service Lives Discard Patterns and Depreciation MethodsDocument55 pagesPerpetual Inventory Method: Service Lives Discard Patterns and Depreciation MethodsData HandelingPas encore d'évaluation

- Financial Results With Data Sheet & Limited Review For March 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results With Data Sheet & Limited Review For March 31, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Consolidated Financial Statements of Samsung Electronics Co., Ltd. and Its Subsidiaries Index To Financial StatementsDocument103 pagesConsolidated Financial Statements of Samsung Electronics Co., Ltd. and Its Subsidiaries Index To Financial StatementsAlen Vincent JosephPas encore d'évaluation

- Running Head: SEGMENT REPORTINGDocument6 pagesRunning Head: SEGMENT REPORTINGRajshekhar BosePas encore d'évaluation

- RTI AccountingManual PDFDocument459 pagesRTI AccountingManual PDFVanita ValluvanPas encore d'évaluation

- Continous Assignment 2: Mittal School of BusinessDocument8 pagesContinous Assignment 2: Mittal School of BusinessMd UjalePas encore d'évaluation

- Revisionary Test Paper - Final - Syllabus 2012 - Dec2013: Group - IV Paper 19 - Cost and Management Audit Section - ADocument54 pagesRevisionary Test Paper - Final - Syllabus 2012 - Dec2013: Group - IV Paper 19 - Cost and Management Audit Section - ANagendra KrishnamurthyPas encore d'évaluation

- d16 Treatment of Retained EarningsDocument31 pagesd16 Treatment of Retained EarningsNguyên Khánh Dương ThịPas encore d'évaluation

- DR Philip E Dunn RPA (Hon) International Accounting Standards IAS 1: Presentation of Financial StatementsDocument11 pagesDR Philip E Dunn RPA (Hon) International Accounting Standards IAS 1: Presentation of Financial StatementsAkash NCPas encore d'évaluation

- Assignment 1: Accounting Policies For Reporting IncomeDocument9 pagesAssignment 1: Accounting Policies For Reporting IncomesrystalPas encore d'évaluation

- Rfa 2019 en kr7012330007Document106 pagesRfa 2019 en kr7012330007R KathirasanPas encore d'évaluation

- IFRS 8 Operating SegmentsDocument6 pagesIFRS 8 Operating SegmentsPratima SeedheeyanPas encore d'évaluation

- Retail & Consumer Retail & ConsumerDocument3 pagesRetail & Consumer Retail & ConsumerSo LokPas encore d'évaluation

- G 31 Economic Indicator ProtocolsDocument15 pagesG 31 Economic Indicator ProtocolsMario Marcus HyppolitoPas encore d'évaluation

- Analysis of Financial StatementDocument6 pagesAnalysis of Financial StatementABDUL SAMAD SUBHANIPas encore d'évaluation

- Ifrs 8 Operating Segments: BackgroundDocument4 pagesIfrs 8 Operating Segments: Backgroundmusic niPas encore d'évaluation

- Financial Analysis of Telecommunication SectorDocument26 pagesFinancial Analysis of Telecommunication SectorVipul Gupta100% (1)

- 11 IFRS 8, IAS 24 & Ethical IssuesDocument20 pages11 IFRS 8, IAS 24 & Ethical IssuespessePas encore d'évaluation

- Module IIDocument22 pagesModule IIElla Joy B. IgnacioPas encore d'évaluation

- Corporate Financial Reporting: © The Institute of Chartered Accountants of IndiaDocument7 pagesCorporate Financial Reporting: © The Institute of Chartered Accountants of IndiaNmPas encore d'évaluation

- Mutual Recognition Means That National Financial Statements Are Accepted AbroadDocument7 pagesMutual Recognition Means That National Financial Statements Are Accepted Abroadইবনুল মাইজভাণ্ডারীPas encore d'évaluation

- KEPCO - Consolidated - FY 2018 - FinalDocument175 pagesKEPCO - Consolidated - FY 2018 - FinalJenna GanPas encore d'évaluation

- Financial MNGT CH 2Document38 pagesFinancial MNGT CH 2Bikila MalasaPas encore d'évaluation

- Chap 8 - Advanced Issues in ValuationDocument50 pagesChap 8 - Advanced Issues in Valuationrafat.jalladPas encore d'évaluation

- RAR Unit 3 FinalDocument12 pagesRAR Unit 3 Finalraval123690Pas encore d'évaluation

- BASIC FEATURE OF Financial StatementDocument6 pagesBASIC FEATURE OF Financial StatementmahendrabpatelPas encore d'évaluation

- Financial Statement Analysis ControlDocument7 pagesFinancial Statement Analysis ControlTareq MahmoodPas encore d'évaluation

- # 2 Assignment On Financial and Managerial Accounting For MBA StudentsDocument7 pages# 2 Assignment On Financial and Managerial Accounting For MBA Studentsobsa alemayehuPas encore d'évaluation

- Revisionary Test Paper - Final - Syllabus 2012 - Dec2013: Group - IV Paper 19 - Cost and Management Audit Section - ADocument54 pagesRevisionary Test Paper - Final - Syllabus 2012 - Dec2013: Group - IV Paper 19 - Cost and Management Audit Section - ANagendra KrishnamurthyPas encore d'évaluation

- China Coke Oven Products Industry Profile Isic2310Document8 pagesChina Coke Oven Products Industry Profile Isic2310AllChinaReports.comPas encore d'évaluation

- Balance Sheet Analysis by SBPDocument739 pagesBalance Sheet Analysis by SBPhlafsd100% (2)

- Maruti Suzuki Case StudyDocument25 pagesMaruti Suzuki Case StudyShrey KashyapPas encore d'évaluation

- KEPCO Consolidated FY20 4Q Final Clean (Eng)Document206 pagesKEPCO Consolidated FY20 4Q Final Clean (Eng)Darryl Farhan WidyawanPas encore d'évaluation

- Guide to Management Accounting CCC (Cash Conversion Cycle) for ManagersD'EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for ManagersPas encore d'évaluation

- Guide to Management Accounting CCC (Cash Conversion Cycle) for Managers 2020 EditionD'EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for Managers 2020 EditionPas encore d'évaluation

- Guide to Management Accounting CCC for managers 2020 EditionD'EverandGuide to Management Accounting CCC for managers 2020 EditionPas encore d'évaluation

- Offices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryD'EverandOffices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Form 45: Please Complete in Typescript or in Bold Block CapitalsDocument2 pagesForm 45: Please Complete in Typescript or in Bold Block CapitalsGhulam AbbasPas encore d'évaluation

- FGEI Job AdvertisementDocument2 pagesFGEI Job AdvertisementGhulam AbbasPas encore d'évaluation

- Pakistan Water and Power Development Authority Revised Prescribed Form For Free Electricity Supply To Wapda Employees Deptt: Code 01641Document1 pagePakistan Water and Power Development Authority Revised Prescribed Form For Free Electricity Supply To Wapda Employees Deptt: Code 01641Ghulam AbbasPas encore d'évaluation

- AT & C Losses 1Document3 pagesAT & C Losses 1Ghulam AbbasPas encore d'évaluation

- TagsDocument2 pagesTagsGhulam AbbasPas encore d'évaluation

- Subject: Service Profile/Transfer/PostingDocument4 pagesSubject: Service Profile/Transfer/PostingGhulam AbbasPas encore d'évaluation

- Auditing McqsDocument27 pagesAuditing McqsGhulam Abbas100% (5)

- Nitish India Banking 00923009001533Document68 pagesNitish India Banking 00923009001533Ghulam AbbasPas encore d'évaluation

- Accountancy and Auditing-IIDocument3 pagesAccountancy and Auditing-IIamindherPas encore d'évaluation

- Annual Report 2013 067Document1 pageAnnual Report 2013 067Ghulam AbbasPas encore d'évaluation

- Profit and Loss Account: For The Year Ended June 30, 2013Document1 pageProfit and Loss Account: For The Year Ended June 30, 2013Ghulam AbbasPas encore d'évaluation

- Annual Parking Report 201213Document20 pagesAnnual Parking Report 201213Ghulam AbbasPas encore d'évaluation

- (Rupees in Thousand) Note 2012 2011: (Re-Stated) (Re-Stated)Document1 page(Rupees in Thousand) Note 2012 2011: (Re-Stated) (Re-Stated)Ghulam AbbasPas encore d'évaluation

- Final SKMH ReportDocument44 pagesFinal SKMH ReportGhulam Abbas0% (1)

- Historical Background of The CompanyDocument3 pagesHistorical Background of The CompanyGhulam AbbasPas encore d'évaluation

- Annual Report 2013 066Document1 pageAnnual Report 2013 066Ghulam AbbasPas encore d'évaluation

- ContentsDocument3 pagesContentsGhulam AbbasPas encore d'évaluation

- Purification ProcessDocument3 pagesPurification ProcessGhulam AbbasPas encore d'évaluation

- 9704 enDocument86 pages9704 enGhulam AbbasPas encore d'évaluation

- Internship Report: "Assessment of Customer Loyalty For Banglalink"Document103 pagesInternship Report: "Assessment of Customer Loyalty For Banglalink"Ghulam AbbasPas encore d'évaluation

- EPS Before Tax: 2013 2012 2013 2012 Ratio RatioDocument12 pagesEPS Before Tax: 2013 2012 2013 2012 Ratio RatioGhulam AbbasPas encore d'évaluation

- InternshipDocument6 pagesInternshipGhulam AbbasPas encore d'évaluation

- Viyellatex GroupDocument62 pagesViyellatex GroupGhulam AbbasPas encore d'évaluation

- UltimateBeginnerHandbookPigeonRacing PDFDocument21 pagesUltimateBeginnerHandbookPigeonRacing PDFMartinPalmPas encore d'évaluation

- How To Block HTTP DDoS Attack With Cisco ASA FirewallDocument4 pagesHow To Block HTTP DDoS Attack With Cisco ASA Firewallabdel taibPas encore d'évaluation

- The cardioprotective effect of astaxanthin against isoprenaline-induced myocardial injury in rats: involvement of TLR4/NF-κB signaling pathwayDocument7 pagesThe cardioprotective effect of astaxanthin against isoprenaline-induced myocardial injury in rats: involvement of TLR4/NF-κB signaling pathwayMennatallah AliPas encore d'évaluation

- What Are The Spacer Bars in RC Beams - QuoraDocument3 pagesWhat Are The Spacer Bars in RC Beams - QuoradesignPas encore d'évaluation

- Export Management EconomicsDocument30 pagesExport Management EconomicsYash SampatPas encore d'évaluation

- Applied Economics 2Document8 pagesApplied Economics 2Sayra HidalgoPas encore d'évaluation

- My Mother at 66Document6 pagesMy Mother at 66AnjanaPas encore d'évaluation

- Kyle Pape - Between Queer Theory and Native Studies, A Potential For CollaborationDocument16 pagesKyle Pape - Between Queer Theory and Native Studies, A Potential For CollaborationRafael Alarcón Vidal100% (1)

- Kiritsis SolutionsDocument200 pagesKiritsis SolutionsSagnik MisraPas encore d'évaluation

- SOL LogicDocument21 pagesSOL LogicJa RiveraPas encore d'évaluation

- Hướng Dẫn Chấm: Ngày thi: 27 tháng 7 năm 2019 Thời gian làm bài: 180 phút (không kể thời gian giao đề) HDC gồm có 4 trangDocument4 pagesHướng Dẫn Chấm: Ngày thi: 27 tháng 7 năm 2019 Thời gian làm bài: 180 phút (không kể thời gian giao đề) HDC gồm có 4 trangHưng Quân VõPas encore d'évaluation

- What's New in CAESAR II: Piping and Equipment CodesDocument1 pageWhat's New in CAESAR II: Piping and Equipment CodeslnacerPas encore d'évaluation

- FuzzingBluetooth Paul ShenDocument8 pagesFuzzingBluetooth Paul Shen许昆Pas encore d'évaluation

- Week-3-Q1-Gen Chem-Sep-11-15-DllDocument12 pagesWeek-3-Q1-Gen Chem-Sep-11-15-DllJennette BelliotPas encore d'évaluation

- 22 Khan S.Document7 pages22 Khan S.scholarlyreseachjPas encore d'évaluation

- Design of Penstock: Reference Code:IS 11639 (Part 2)Document4 pagesDesign of Penstock: Reference Code:IS 11639 (Part 2)sunchitk100% (3)

- Canon Powershot S50 Repair Manual (CHAPTER 4. PARTS CATALOG) PDFDocument13 pagesCanon Powershot S50 Repair Manual (CHAPTER 4. PARTS CATALOG) PDFRita CaselliPas encore d'évaluation

- Literatura Tecnica 3Document10 pagesLiteratura Tecnica 3Christian PerezPas encore d'évaluation

- Dermatology Skin in Systemic DiseaseDocument47 pagesDermatology Skin in Systemic DiseaseNariska CooperPas encore d'évaluation

- Summary of Bill of Quantities ChurchDocument52 pagesSummary of Bill of Quantities ChurchBiniamPas encore d'évaluation

- Radon-222 Exhalation From Danish Building Material PDFDocument63 pagesRadon-222 Exhalation From Danish Building Material PDFdanpalaciosPas encore d'évaluation

- Subject Manual Tle 7-8Document11 pagesSubject Manual Tle 7-8Rhayan Dela Cruz DaquizPas encore d'évaluation

- Student Exploration: Inclined Plane - Simple MachineDocument9 pagesStudent Exploration: Inclined Plane - Simple MachineLuka MkrtichyanPas encore d'évaluation

- Disassembly Procedures: 1 DELL U2422HB - U2422HXBDocument6 pagesDisassembly Procedures: 1 DELL U2422HB - U2422HXBIonela CristinaPas encore d'évaluation

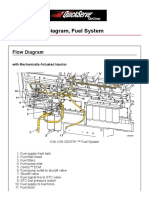

- Cummin C1100 Fuel System Flow DiagramDocument8 pagesCummin C1100 Fuel System Flow DiagramDaniel KrismantoroPas encore d'évaluation

- Out PDFDocument211 pagesOut PDFAbraham RojasPas encore d'évaluation