Académique Documents

Professionnel Documents

Culture Documents

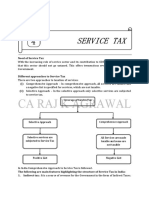

Service Tax On Transportation of Goods

Transféré par

Vijay Dhawle0 évaluation0% ont trouvé ce document utile (0 vote)

270 vues4 pagesTransportation of goods can be through ship / vessel, air, road or rail. Every category has few exemptions from service tax; and some of them also appear in the negative list and abatement scheme. Service Tax is only payable when goods are transported from one port to another in india.

Description originale:

Titre original

Service Tax on Transportation of Goods

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentTransportation of goods can be through ship / vessel, air, road or rail. Every category has few exemptions from service tax; and some of them also appear in the negative list and abatement scheme. Service Tax is only payable when goods are transported from one port to another in india.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

270 vues4 pagesService Tax On Transportation of Goods

Transféré par

Vijay DhawleTransportation of goods can be through ship / vessel, air, road or rail. Every category has few exemptions from service tax; and some of them also appear in the negative list and abatement scheme. Service Tax is only payable when goods are transported from one port to another in india.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 4

Shikha Singhania

Service Tax on Transportation of Goods

Introduction

Transportation of goods can be through ship/vessel, air, road or rail. Every category has few

exemptions from service tax; and some of them also appear in the negative list and abatement scheme.

Let us take a brief look at it.

The following services provided in relation to transportation of goods are specified in the negative list of

services:-

By road except the services of

a) a goods transportation agency; or

b) a courier agency

By aircraft or vessel from a place outside India up to the customs station of clearance in India;

By inland waterways

Transport of goods by vessel - Section 65(105)(zzzp)

Sea freight for goods from outside India to first customs station of clearance in India is not

taxable

Sea freight for goods from going outside the country is not taxable, since as per rule 10 of Place

of Provision of Service Rules, Place of Provision of Service is outside India.

Service Tax is only payable when goods are transported from one port to another in India.

Abatement Service tax is payable on 50% of value. No Cenvat credit should be availed as per

Notification No. 26/2012, Sl.No 10 (w.e.f 01/07/2012)

Exemption - Transportation of petroleum products, agriculture produce, foodstuff, fertilisers,

postal mail, relief material etc. by vessel within India is not taxable

Transport of goods by inland waterways (national waterways or other waterway on any inland

water Indian waterway authority of India act) is not taxable.

Transport of goods by air - Section 65(105)(zzn)

Air freight for transport of goods from outside India to first customs station of clearance in India

is not taxable.

Air freight for transport of goods sent outside from India is not taxable, as per rule 10 of Place of

Provision of Service Rules.

Air transport of goods within India is taxable.

All Rights Reserved Udyog Software Page 1

Shikha Singhania

Transport of goods by rail - Section 65(105)(zzzp)

Presently, only transport of goods in containers is subject to tax

Abatement Service tax is payable on 30% of value on all goods transported by rail w.e.f. 1-

10-2012.

Transportation of petroleum products, agriculture produce, foodstuff, fertilisers, postal mail,

relief material etc. by vessel is not taxable.

Example of transportation of goods which comes under negative list _____________________

A truck owner transporting goods directly without involvement of Goods of a

Goods transport agency.

A manufacturer transporting goods to dealer through own transportation.

Transportation on bullock cart, tonga, rickshaw, thela etc does not attract tax.

Farmers transporting goods of fellow farmers after harvest from farms to sugar mills

Transport of goods by road Goods Transport Agency (GTA) service -

Section 65(105)(zzp)

Service by way of transportation of goods by road, except services of Goods Transport Agency, (GTA)

and Courier Agency is within the ambit of the negative list

Goods transport agency" means any person who provides service in relation to transport of

goods by road and issues consignment note, by whatever name it is called. Sec 65B(26) of

finance Act, 1994.

Courier agency means any person engaged in the door to door transportation of time sensitive

documents, goods or articles utilising the services of a person either directly or indirectly, to carry or

accompany such documents, goods or articles Sec 65B(20) of Finance Act, 1994.

Thus, a Goods transport Agency should meet the following tests

It should be any person

It should provide service in relation to transport of goods

Such transportation should be by road

The Agency should book the goods for transport

It must issue a consignment note (or such document called by any other name) against the goods

so booked and transported.

Exemptions___________________________________________________________________

Goods transport freight for single consignee up to Rs.750 and for single vehicle up to Rs.1500 is

exempt.

Transport by road of fruits, vegetables, eggs, milk, food grains or pulses is exempt (no exemption

to cotton, sugar cane, oil seeds, tobacco or other agricultural produce)

All Rights Reserved Udyog Software Page 2

Shikha Singhania

Abatement___________________________________________________________________

Service tax has to be paid only on 25% of the gross amount paid to the Goods Transport Agency,

provided the service receiver has taken a certificate from GTA that he has not availed Cenvat credit on

inputs, capital goods and input services.

Note : For gross amount, octroi is not taken into account.

Place of Provision of a service of transportation of goods_______________________________

Place of provision of a service of transportation of goods is the place of destination of goods, except in

the case of services provided by a Goods Transportation Agency in respect of transportation of goods

by road, in which case the place of provision is the location of the person liable to pay tax (as

determined in terms of rule 2(1)(d) of Service Tax Rules, 1994 (since amended).

Reverse charge Mechanism

The tax is payable on reverse charge basis by consignor or consignee whoever pays the freight,

whereby the consignor or the consignee is a factory, registered society, co-operative society, registered

dealer under central excise, body corporate, partnership firm, LLP and association of persons.

Thus in a case where an individual, Huf or BOI is liable to pay tax as consigner or consignee, then the

GTA himself will be liable to pay service tax.

However while paying taxes under reverse charge mechanism; it has to be paid in cash only and no

Cenvat credit can be utilized for this purpose. Also, the general exemption of Rs. 10 lakhs available to

small service providers is not applicable in cases where service receiver is liable to pay service tax.

Consigner/consignee will be eligible to take Cenvat credit of GTA services if the service falls under the

definition of input service as defined in Rule 2(l) of CENVAT Credit Rules, 2004.

Other Important points relating to GTA

If the goods transport agency has charged service tax then no service tax is payable by

consignor or consignee.

If the freight is paid by consignor, he is liable to pay service tax. He can recover the freight

amount (including service tax) but it should not be shown separately in his invoice or debit note.

If shown, he may be held liable to pay service tax again.

Registration by GTA is not required if taxable turnover is below exemption limit.

Courier, express cargo and angadia services are subject to service tax.

All Rights Reserved Udyog Software Page 3

Shikha Singhania

If the driver of the goods carriage is self employed either by taking vehicle on rent from others

or as owner of one or two vehicles and does not issue consignment note, then he would not be

liable to pay service tax.

In CCE v. Kanaka Durra Agro oil products P Ltd. 2009 it has been confirmed that there was

no liability on the recipients of the service, to pay service tax, in cases of transportation

undertaken by the individual truck operators/ lorry owners and not by GTA.

All Rights Reserved Udyog Software Page 4

Vous aimerez peut-être aussi

- Social Skills Assessments For Children With Autism Spectrum Disorders 2165 7890.1000122Document9 pagesSocial Skills Assessments For Children With Autism Spectrum Disorders 2165 7890.1000122Shinta SeptiaPas encore d'évaluation

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeD'Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeÉvaluation : 1 sur 5 étoiles1/5 (1)

- 1040 Exam Prep Module X: Small Business Income and ExpensesD'Everand1040 Exam Prep Module X: Small Business Income and ExpensesPas encore d'évaluation

- Ponce vs. Court of AppealsDocument7 pagesPonce vs. Court of AppealsMp CasPas encore d'évaluation

- Chirimuuta, Mazviita - Outside Color - Perceptual Science and The Puzzle of Color in Philosophy-The MIT Press (2017)Document263 pagesChirimuuta, Mazviita - Outside Color - Perceptual Science and The Puzzle of Color in Philosophy-The MIT Press (2017)Karishma borgohainPas encore d'évaluation

- Impact of GST On Logistics Sector: Submitted To - Sebastian DanielDocument11 pagesImpact of GST On Logistics Sector: Submitted To - Sebastian Danielsaurav singh100% (1)

- GSTDocument40 pagesGSTdurairajPas encore d'évaluation

- Safe Use of Power Tools Rev0Document92 pagesSafe Use of Power Tools Rev0mohapatrarajPas encore d'évaluation

- Import DutyDocument10 pagesImport DutyFuadPas encore d'évaluation

- Customs DutyDocument17 pagesCustoms DutyBabasab Patil (Karrisatte)100% (1)

- Jean-Louis Cohen - Exhibitionist Revisionism - Exposing Architectural History (September 1999)Document10 pagesJean-Louis Cohen - Exhibitionist Revisionism - Exposing Architectural History (September 1999)Javier PerezPas encore d'évaluation

- Goods Transport AgencyDocument5 pagesGoods Transport Agencygourab999Pas encore d'évaluation

- Service Tax AmendmentDocument3 pagesService Tax AmendmentChethan VenkateshPas encore d'évaluation

- Service TaxDocument12 pagesService TaxdeepikaPas encore d'évaluation

- Service Tax Under Reverse Charge Mechanism On Goods Transport Agency (GTA) - Taxguru - inDocument1 pageService Tax Under Reverse Charge Mechanism On Goods Transport Agency (GTA) - Taxguru - inIshwarchandra KolhePas encore d'évaluation

- GST On TransportDocument10 pagesGST On TransportShakti SharmaPas encore d'évaluation

- GST Handout - E-WaybillDocument4 pagesGST Handout - E-WaybilldebPas encore d'évaluation

- Service TaxDocument55 pagesService Taxtushar vatsPas encore d'évaluation

- Custom DutyDocument40 pagesCustom DutyVijayasarathi VenugopalPas encore d'évaluation

- Supply and Its TypesDocument30 pagesSupply and Its TypesAmit GuptaPas encore d'évaluation

- Day2session3 4Document60 pagesDay2session3 4Kuwar RaiPas encore d'évaluation

- Introduction HellyDocument14 pagesIntroduction HellyDeep ShahPas encore d'évaluation

- GST On Road Transportation & LogisticsDocument14 pagesGST On Road Transportation & LogisticsBhavesh PasrichaPas encore d'évaluation

- Presentation On Payment Under Reverse Charge in GSTDocument21 pagesPresentation On Payment Under Reverse Charge in GSTApurv Shaurya SrivastavaPas encore d'évaluation

- 29324budget Idt2013Document5 pages29324budget Idt2013sridharramansPas encore d'évaluation

- CUSTOMS LAW MANUAL - NotesDocument10 pagesCUSTOMS LAW MANUAL - NotesChetanya KapoorPas encore d'évaluation

- Thomas Thomas PoovathingalDocument5 pagesThomas Thomas PoovathingalvedisreePas encore d'évaluation

- Reverse Charge Under Service TaxDocument2 pagesReverse Charge Under Service TaxMohit GabaPas encore d'évaluation

- Service Tax On Goods Transport Agency (GTADocument11 pagesService Tax On Goods Transport Agency (GTARaveendran P MPas encore d'évaluation

- Customs Revision Notes PDFDocument10 pagesCustoms Revision Notes PDFShaan AmanPas encore d'évaluation

- GST Unit 2Document30 pagesGST Unit 2SANSKRITI YADAV 22DM236Pas encore d'évaluation

- Servicetaxandvat 130420194223 Phpapp01Document65 pagesServicetaxandvat 130420194223 Phpapp01Ram ShiralkarPas encore d'évaluation

- Service Tax Qick RevisionDocument91 pagesService Tax Qick RevisiongouthamPas encore d'évaluation

- Export Assmnt and ExamnDocument33 pagesExport Assmnt and Examnpavan kumar gothwalPas encore d'évaluation

- Ca Gaurav Gupta: 507 B, D-Mall, Netaji Subhash Place, Pitampura, Delhi - 110034 P: 011 - 32962487, 9811013940Document5 pagesCa Gaurav Gupta: 507 B, D-Mall, Netaji Subhash Place, Pitampura, Delhi - 110034 P: 011 - 32962487, 9811013940Gaurav GuptaPas encore d'évaluation

- Indian Taxation and Corporate Laws: Home Service TaxDocument8 pagesIndian Taxation and Corporate Laws: Home Service TaxRahul TankPas encore d'évaluation

- Tybcom Tax Theory Sem 6Document4 pagesTybcom Tax Theory Sem 6y.zadanePas encore d'évaluation

- BGM ST Trans SecDocument235 pagesBGM ST Trans SecrajuwithualwaysPas encore d'évaluation

- Final Project On Service Tax 2017Document21 pagesFinal Project On Service Tax 2017ansh patelPas encore d'évaluation

- Single Customs TerritoryDocument4 pagesSingle Customs TerritoryURAugandaPas encore d'évaluation

- Export of ServicesDocument9 pagesExport of ServicesshantX100% (1)

- Goods and Services Tax (GST) in India: Input Tax Credit (ITC)Document24 pagesGoods and Services Tax (GST) in India: Input Tax Credit (ITC)Noman AreebPas encore d'évaluation

- Variant 3 REVISED Jan13 LDocument96 pagesVariant 3 REVISED Jan13 LGopakumar PPas encore d'évaluation

- UntitledDocument9 pagesUntitledsuyash dugarPas encore d'évaluation

- Valuation - : Concepts and CasesDocument3 pagesValuation - : Concepts and Casesjonnajon92Pas encore d'évaluation

- Basics of GSTDocument28 pagesBasics of GSTSandip JadavPas encore d'évaluation

- Service Tax: Aiaims Mms-ADocument31 pagesService Tax: Aiaims Mms-AAbbas Haider NaqviPas encore d'évaluation

- Goods and Service Tax (GST)Document29 pagesGoods and Service Tax (GST)Prince Digital ComputersPas encore d'évaluation

- Taxes Relevant To TransportationDocument15 pagesTaxes Relevant To TransportationPrateek AggarwalPas encore d'évaluation

- UNIT - 2custom and Central ExciseDocument25 pagesUNIT - 2custom and Central ExciseShishir Bharti StudentPas encore d'évaluation

- 9347 Single CustomsDocument8 pages9347 Single CustomsKalpesh RathodPas encore d'évaluation

- Transport of Goods by Road ServicesDocument9 pagesTransport of Goods by Road ServicesgoelmukeshPas encore d'évaluation

- Workshop On Finance For Non-Finance Executives: Mining & BeneficiationDocument36 pagesWorkshop On Finance For Non-Finance Executives: Mining & BeneficiationSaikumar SelaPas encore d'évaluation

- Mamta BhushanDocument26 pagesMamta BhushanDinesh HegdePas encore d'évaluation

- Chapter 3 - Charge of GST - NotesDocument17 pagesChapter 3 - Charge of GST - NotesHarsh SawantPas encore d'évaluation

- Custom DutyDocument17 pagesCustom DutyMubbashir Khan RanaPas encore d'évaluation

- Tax Mod 3Document7 pagesTax Mod 3Ayushi TiwariPas encore d'évaluation

- Input Tax CreditDocument16 pagesInput Tax CreditPreeti SapkalPas encore d'évaluation

- Answer 4: Custom DutyDocument3 pagesAnswer 4: Custom DutyAshlee RobertsPas encore d'évaluation

- VAT SlidesDocument137 pagesVAT SlidesLebogang MashigoPas encore d'évaluation

- Notes RCM 66F Reimbursement 29-5-15Document22 pagesNotes RCM 66F Reimbursement 29-5-15Prabhat BhatPas encore d'évaluation

- Payment of Service Tax Under Reverse Charge - A Comprehensive StudyDocument13 pagesPayment of Service Tax Under Reverse Charge - A Comprehensive Studyav_meshramPas encore d'évaluation

- Remaning TopicsDocument7 pagesRemaning TopicsAbhishekPas encore d'évaluation

- Carriage by Road ActDocument22 pagesCarriage by Road ActPRADEEP MK100% (1)

- CDL Study Guide: Guide on hazardous materials, chamber vehicles and basic vehicle control skillsD'EverandCDL Study Guide: Guide on hazardous materials, chamber vehicles and basic vehicle control skillsPas encore d'évaluation

- Logical Database Design ModelingDocument2 pagesLogical Database Design ModelingGio Agudo100% (1)

- Vững vàng nền tảng, Khai sáng tương lai: Trang - 1Document11 pagesVững vàng nền tảng, Khai sáng tương lai: Trang - 1An AnPas encore d'évaluation

- Fulltext PDFDocument454 pagesFulltext PDFVirmantas JuoceviciusPas encore d'évaluation

- Richard Dennis Sonterra Capital Vs Cba Nab Anz Macquarie Gov - Uscourts.nysd.461685.1.0-1Document87 pagesRichard Dennis Sonterra Capital Vs Cba Nab Anz Macquarie Gov - Uscourts.nysd.461685.1.0-1Maverick MinitriesPas encore d'évaluation

- The Normal DistributionDocument9 pagesThe Normal DistributionElfren BulongPas encore d'évaluation

- D2 1 PDFDocument148 pagesD2 1 PDFsubas khanalPas encore d'évaluation

- CH 6 - Performance AppraisalDocument50 pagesCH 6 - Performance AppraisalMark SullivanPas encore d'évaluation

- December 2022 Issue: More Transparency, P S An R T e R o M, y C en Ar P P, y PDocument24 pagesDecember 2022 Issue: More Transparency, P S An R T e R o M, y C en Ar P P, y Pwpp8284Pas encore d'évaluation

- Essay Writing TipsDocument4 pagesEssay Writing TipsSubhasish MitraPas encore d'évaluation

- Level 2 Online BPDocument98 pagesLevel 2 Online BProbertduvallPas encore d'évaluation

- BVP651 Led530-4s 830 Psu DX10 Alu SRG10 PDFDocument3 pagesBVP651 Led530-4s 830 Psu DX10 Alu SRG10 PDFRiska Putri AmirPas encore d'évaluation

- Fabrication Techniques of A PN Junction DiodeDocument5 pagesFabrication Techniques of A PN Junction DiodeNida Amber100% (3)

- DEP 33641012 Electrical Supply and Generation - Design and OperationDocument51 pagesDEP 33641012 Electrical Supply and Generation - Design and Operationpeter wiltjerPas encore d'évaluation

- Usp3 ComDocument5 pagesUsp3 ComMike MelgaPas encore d'évaluation

- GE2410 Student Booklet (UpdatedDec27)Document88 pagesGE2410 Student Booklet (UpdatedDec27)markhoPas encore d'évaluation

- Growth Performance of Papaya Plants As Influenced by Organic MulchesDocument9 pagesGrowth Performance of Papaya Plants As Influenced by Organic MulchesMa. Christine Lyn AustriaPas encore d'évaluation

- Ebook Essentials of Kumar Clarks Clinical Medicine PDF Full Chapter PDFDocument67 pagesEbook Essentials of Kumar Clarks Clinical Medicine PDF Full Chapter PDFjanet.cochran431100% (19)

- Experiment Number - 1.2 Student Name: Kumar Harsh UID: 21BCS11423 Branch: CSE Section/Group: 508-A Semester: 2 Date of Performance:03/03/2022Document4 pagesExperiment Number - 1.2 Student Name: Kumar Harsh UID: 21BCS11423 Branch: CSE Section/Group: 508-A Semester: 2 Date of Performance:03/03/2022Kartik AgarwalPas encore d'évaluation

- NTCC Project - Fake News and Its Impact On Indian Social Media UsersDocument41 pagesNTCC Project - Fake News and Its Impact On Indian Social Media UsersManan TrivediPas encore d'évaluation

- Paper Cutting 6Document71 pagesPaper Cutting 6Vidya AdsulePas encore d'évaluation

- Chapter 04 - Motion and Force - DynamicsDocument24 pagesChapter 04 - Motion and Force - DynamicsMohamad SyazwanPas encore d'évaluation

- Principles of Public ExpenditureDocument1 pagePrinciples of Public ExpenditureNikhil Shenai100% (1)

- RHEL 9.0 - Configuring Device Mapper MultipathDocument59 pagesRHEL 9.0 - Configuring Device Mapper MultipathITTeamPas encore d'évaluation

- 4th - STD - MM - Kerala Reader Malayalam Vol 1Document79 pages4th - STD - MM - Kerala Reader Malayalam Vol 1Rajsekhar GPas encore d'évaluation

- A. in What Way Is Khatri A Surplus Unit?Document5 pagesA. in What Way Is Khatri A Surplus Unit?Aakriti SanjelPas encore d'évaluation