Académique Documents

Professionnel Documents

Culture Documents

Originall Venu

Transféré par

maheshfbCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Originall Venu

Transféré par

maheshfbDroits d'auteur :

Formats disponibles

INTRODUCTION:

The project deals with the different investment decisions made by different people

and focuses on element of risk in detail while investing in securities. It also explains how

portfolio hedges the risk in investment and giving optimum return to a given amount of

risk. It also gives an in depth analysis of portfolio creation, selection, revision and

evaluation. The report also shows different ways of analysis of securities, different

theories of portfolio management for effective and efficient portfolio construction. It also

gives a brief analysis of how to evaluate a portfolio.

The whole reason of the portfolio management service is ensuring that your money goes

that extra mile or earns return, which dramatically improves the returns structure for your

investments.

A portfolio is a collection of investments held by an institution or a private individual. In

building up an investment portfolio a financial institution will typically conduct its own

investment analysis, whilst a private individual may make use of the services of a

financial advisor or a financial institution which offers portfolio management services.

Holding a portfolio is part of an investment and risk-limiting strategy called

diversification. By owning several assets, certain types of risk (in particular specific risk)

can be reduced. The assets in the portfolio could include stocks, bonds, options, warrants,

gold certificates, real estate, futures contracts, production facilities, or any other item that

is expected to retain its value.

Portfolio management involves deciding what assets to include in the portfolio,

given the goals of the portfolio owner and changing economic conditions. Selection

involves deciding what assets to purchase, how many to purchase, when to purchase

them, and what assets to divest. These decisions always involve some sort of

performance measurement, most typically expected returnon the portfolio, and the risk

associated with this return (i.e. the standard deviation of the return). Typically the

expected returns from portfolios, comprised of different asset bundles are compared.

The unique goals and circumstances of the investor must also be considered. Some

investors are more risk averse than others. Mutual funds have developed particular

techniques to optimize their portfolio holdings.

Thus, portfolio management is all about strengths, weaknesses, opportunities and

threats in the choice of debt vs. equity, domestic vs. international, growth vs. safety and

numerous other trade-offs encountered in the attempt to maximize return at a given

appetite for risk.

We all dream of beating the market and being super investors and spend an

inordinate amount of time and resources in this endeavor. Consequently, we are easy prey

for the magic bullets and the secret formulae offered by eager salespeople pushing their

wares. In spite of our best efforts, most of us fail in our attempts to be more than average

investors. Nonetheless, we keep trying, hoping that we can be more like the investing

legends another Warren Buffett or Peter Lynch. We read the words written by and

about successful investors, hoping to find in them the key to their stock-picking abilities,

so that we can replicate them and become wealthy quickly.

In our search, though, we are whipsawed by contradictions and anomalies. In one

corner of the investment town square, stands one advisor, yelling to us to buy businesses

with solid cash flows and liquid assets because thats what worked for Buffett. In another

corner, another investment expert cautions us that this approach worked only in the old

world, and that in the new world of technology, we have to bet on companies with solid

growth prospects. In yet another corner, stands a silver tongued salesperson with vivid

charts and presents you with evidence of his capacity to get you in and out of markets at

exactly the right times. It is not surprising that facing this cacophony of claims and

counterclaims that we end up more confused than ever.

In this introduction, we present the argument that to be successful with any

investment strategy, you have to begin with an investment philosophy that is consistent at

its core and which matches not only the markets you choose to invest in but your

individual characteristics. In other words, the key to success in investing may lie not in

knowing what makes Peter Lynch successful but in finding out more about yourself.

What is an investment philosophy?

An investment philosophy is a coherent way of thinking about markets, how they

work (and sometimes do not) and the types of mistakes that you believe consistently

underlie investor behavior. Why do we need to make assumptions about investor

mistakes? As we will argue, most investment strategies are designed to take advantage of

errors made by some or all investors in pricing stocks. Those mistakes themselves are

driven by far more basic assumptionsabout human behavior. To provide an illustration,

the rational or irrational tendency of human beings to join crowds can result in price

momentum stocks that have gone up the most in the recent past are more likely to go up

in the near future. Let us consider, therefore, the ingredients of an investment philosophy.

Human Frailty

Underlying all investment philosophies is a view about human behavior. In fact,

one weakness of conventional finance and valuation has been the short shrift given to

human behavior. It is not that we (in conventional finance) assume that all investors are

rational, but that we assume that irrationalities are random and cancel out. Thus, for every

investor who tends to follow the crowd too much (a momentum investor), we assume an

investor who goes in the opposite direction (a contrarian), and that their push and pull in

prices will ultimately result in a rational price. While this may, in fact, be a reasonable

assumption for the very long term, it may not be a realistic one for the short term.

Academics and practitioners in finance who have long viewed the rational

investor assumption with skepticism have developed a new branch of finance called

behavioral finance which draws on psychology, sociology and finance to try to explain

both why investors behave the way they do and the consequences for investment

strategies. As we go through this section, examining different investment philosophies,

we will try at the outset of each philosophy to explore the assumptions about human

behavior that represent its base.

Market Efficiency

A closely related second ingredient of an investment philosophy is the view of

market efficiency or its absence that you need for the philosophy to be a successful one.

While all active investment philosophies make the assumption that markets are

inefficient, they differ in their views on what parts of the market the inefficiencies are

most likely to show up and how long they will last. Some investment philosophies

assume that markets are correct most of the time but that they overreact when new and

large pieces of information are released about individual firms they go up too much on

good news and down too much on bad news. Other investment strategies are founded on

the belief that markets can make mistakes in the aggregate the entire market can be

under or overvalued and that some investors (mutual fund managers, for example) are

more likely to make these mistakes than others. Still other investment strategies may be

based on the assumption that while markets do a good job of pricing stocks where there is

a substantial amount of information financial statements, analyst reports and financial

press coverage they systematically misprice stocks on which such information is not

available.

Tactics and Strategies

Once you have an investment philosophy in place, you develop investment

strategies that build on the core philosophy. Consider, for instance, the views on market

efficiency expounded in the last section. The first investor, who believes that markets

over react to news, may develop a strategy of buying stocks after large negative earnings

surprises (where the announced earnings come in well below expectations) and selling

stocks after positive earnings surprises. The second investor who believes that markets

make mistakes in the aggregate may look at technical indicators (such as mutual fund

cash positions and short sales ratios) to find out whether the market is over bought or

oversold and take a contrary position. The third investor who believes that market

mistakes are more likely when information is absent may look for stocks that are not

followed by analysts or owned by institutional investors.

It is worth noting that the same investment philosophy can spawn multiple

investment strategies. Thus, a belief that investors consistently overestimate the value of

growth and under estimate the value of existing assets can manifest itself in a number of

different strategies ranging from a passive one of buying low PE ratio stocks to a more

active one of buying such companies and attempting to liquidate them for their assets. In

other words, the number of investment strategies will vastly outnumber the number of

investment philosophies.

INDUSTRY PROFILE

INDUSTRY OVERVIEW;

The securities market achieves one of the most important functions of channeling idle

resources to productive resources or from less productive resources to more productive

resources. Hence in the broader context the people who save and investors who invest

focus more towards the economys abilities to invest and save respectively. This

enhances savings and investments in the economy, the two pillars for economic growth.

The Indian Capital Market has come a long way in this process and with a strong

regulator it has been able to usher an era of a modern capital market regime. The past

decade in many ways has been remarkable for securities market in India. It has grown

exponentially as measured in terms of amount raised from the market, the number of

listed stocks, market capitalization, trading volumes and turnover on stock exchanges,

and investor population. The market has witnessed fundamental institutional changes

resulting in drastic reduction in transaction costs and significant improvements in

efficiency, transparency and safety.

Stock market:

When investors think of the stock market, they Nov imagine a specific place -

such as a stock exchange. In fact, the stock market is the abstract idea of stock trading

and stock exchange. All selling of stocks - at stock exchanges and in other ways - affects

the market overall. Following stock market information in the news can help you make

the right decisions about stock market investing.

Need of stock market:

The stock market is simply a term for the overall market or industry that is

concerned with buying and selling company stock, both private and publicly traded

securities. The stock market does many things. It helps to set prices of stocks. The more a

stock is traded on the market and the more in demand the stock, the higher is its value.

Having a stock market that is interconnected with stock markets around the world helps

traders and investors to see how Specific stocks are doing.

Of course, the stock market is mainly present to create money. Through the

market, investors - both companies and individuals - can buy stocks, which effectively

make them own a small part of a company. If the company prospers, investors are

rewarded with dividends and profits. Companies, by becoming public and offering stocks

to the public, can raise money and improve their profile through business expansions

which can help them make great profit.

STOCK MARKETS IN INDIA:

Stock exchanges are the perfect type of market for securities whether of

government and semi-govt bodies or other public bodies as also for shares and debentures

issued by the joint-stock companies. In the stock market, purchases and sales of shares

are affected in conditions of free competition. Government securities are traded outside

the trading ring in the form of over the counter sales or purchase. The bargains that are

struck in the trading ring by the members of the stock exchanges are at the fairest prices

determined by the basic laws of supply and demand.

Definition of a stock exchange:

Stock exchange means anybody or individuals whether incorporated or not,

constituted for the purpose of assisting, regulating or controlling the business of buying,

selling or dealing in securities. The securities include:

Shares of public company.

Government securities.

Bonds

History of Stock Exchanges:

The only stock exchanges operating in the 19

th

century were those of Mumbai

setup in 1875 and Ahmadabad set up in 1894. These were organized as voluntary non-

profit-making associations of brokers to regulate and protect their interests. Before the

control on securities under the constitution in 1950, it was a state subject and the Bombay

securities contracts (control) act of 1925 used to regulate trading in securities. Under this

act, the Mumbai stock exchange was recognized in 1927 and Ahmadabad in 1937.

During the war boom, a number of stock exchanges were organized. Soon after it became

a central subject, central legislation was proposed and a committee headed by

A.D.Gorwala went into the bill for securities regulation. On the basis of the committees

recommendations and public discussion, the securities contract (regulation) act became

law in 1956.

Functions of Stock Exchanges:

Stock exchanges provide liquidity to the listed companies. By giving quotations

to the listed companies, they help trading and raise funds from the market. Over the

hundred and twenty years during which the stock exchanges have existed in this country

and through their medium, the central and state government have raised crores of rupees

by floating public loans. Municipal corporations, trust and local bodies have obtained

from the public their financial requirements, and industry, trade and commerce- the

backbone of the countrys economy-have secured capital of crores or rupees through the

issue of stocks, shares and debentures for financing their day-to-day activities, organizing

new ventures and completing projects of expansion, diversification and modernization.

By obtaining the listing and trading facilities, public investment is increased and

companies were able to raise more funds. The quoted companies with wide public

interest have enjoyed some benefits and assets valuation has become easier for tax and

other purposes.

THE MAJOR STOCK EXCHANGES IN INDIA:

NSE:

NSE's mission is setting the agenda for change in the securities markets in India.

The NSE was set-up with the main objectives of:

Establishing a nation-wide trading facility for equities and debt instruments.

Ensuring equal access to investors all over the country through an appropriate

communication network.

Providing a fair, efficient and transparent securities market to investors using

electronic trading systems.

Enabling shorter settlement cycles and book entry settlements system.

Meeting the current international standards of securities markets.

The standards set by NSE in terms of market practices and technology, have become

industry benchmarks and are being emulated by other market participants

BSE:

The Stock Exchange, Mumbai, popularly known as "BSE" was established in 1875 as

"The Native Share and Stock Brokers Association". It is the oldest one in Asia, even

older than the Tokyo Stock Exchange, which was established in 1878. It is a voluntary

non-profit making Association of Persons (AOP) and is currently engaged in the process

of converting itself into demutualized and corporate entity. It has evolved over the years

into its present status as the premier Stock Exchange in the country. It is the first Stock

Exchange in the Country to have obtained permanent recognition in 1956 from the Govt.

of India under the Securities Contracts (Regulation) Act 1956.The Exchange, while

providing an efficient and transparent market for trading in securities, debt and

derivatives upholds the interests of the investors and ensures redresses of their grievances

whether against the companies or its own member-brokers. It also strives to educate and

enlighten the investors by conducting investor education programmers and making

available to them necessary informative inputs.

A Governing Board having 20 directors is the apex body, which decides the policies and

regulates the affairs of the Exchange. The Governing Board consists of 9 elected

directors, who are from the broking community (one third of them retire ever year by

rotation), three SEBI nominees, six public representatives and an Executive Director &

Chief Executive Officer and a Chief-Operating-Officer.

The Executive Director as the Chief Executive Officer is responsible for the

day-to-day administration of the Exchange and the Chief Operating Officer and other

Heads of Department assist him. The Exchange has inserted new Rule No.126 A in its

Rules, Byelaws pertaining to constitution of the Executive Committee of the Exchange.

Accordingly, an Executive Committee, consisting of three elected directors, three SEBI

nominees or public representatives, Executive Director & CEO and Chief Operating

Officer has been constituted. The Committee considers judicial & quasi matters in which

the Governing Board has powers as an Appellate Authority, matters regarding annulment

of transactions, admission, continuance and suspension of member-brokers, declaration

of a member-broker as defaulter, norms, procedures and other matters relating to

arbitration, fees, deposits, margins and other monies payable by the member-brokers to

the Exchange, etc.

REGULATORY FRAME WORK OF STOCK EXCHANGE:

A comprehensive legal framework was provided by the Securities

Contract Regulation Act, 1956 and Securities Exchange Board of India 1952. Three

tier regulatory structure comprising

Ministry of finance

The Securities And Exchange Board of India

Governing body

Members of the stock exchange:

The securities contract regulation act 1956 has provided uniform regulation for

the admission of members in the stock exchanges. The qualifications for becoming a

member of a recognized stock exchange are given below:

The minimum age prescribed for the members is 21 years.

He should be an Indian citizen.

He should be neither a bankrupt nor compound with the creditors.

He should not be convicted for fraud or dishonesty.

He should not be engaged in any other business connected with a company.

He should not be a defaulter of any other stock exchange.

The minimum required education is a pass in 12

th

standard examination.

SEBI (Securities and exchange board of India) :

The securities and exchange board of India was constituted in 1988 under a resolution of

government of India. It was later made statutory body by the SEBI act 1992.according to

this act, the SEBI shall With the coming into effect of the securities and exchange board

of India act, 1992 some of the powers and functions exercised by the central government,

in respect of the regulation of stock exchange were transferred to the SEBIconstitute of a

chairman and four other members appointed by the central government..

DEPENDENCE OF SECURITIES MARKET:

Three main sets of entities depend on securities market- the corporate, the

government & households. While the corporate and governments raise resources from the

securities market to meet their obligations, the households invest their savings in

securities.

Primary market & secondary market:

The securities market comprises two segments- primary market (new

issues, offer for sale) & secondary market (trading of stocks). There are two major types

of issuers who issue securities. The corporate entities issue mainly debt and equity

instruments (shares, debentures, etc.), while the governments (central and state

governments) issue debt securities (dated Securities, treasury bills). The two major

exchanges, namely the NSE and the BSE provide trading of securities.

Laws governing capital market:

The four main legislations governing the securities market are:

(a) The SEBI Act, 1992 which establishes SEBI to protect investors and develop and

regulate securities market.

(b) The Companies Act, 1956, which sets out the code of conduct for the corporate

sector in relation to issue, allotment and transfer of securities, and disclosures to be made

in public issues.

(c) The Securities Contracts (Regulation) Act, 1956, read with the Securities Contracts

(Regulation) Rules, 1957 which provide for regulation of transactions in securities

through control over stock exchanges; and

(d) The Depositories Act, 1996 which provides for electronic maintenance

And transfers of ownership of d-mat securities.

Regulators:

SEBI is the primary regulator of the Securities Market and the entities operating

therein. The SEBI Act and the Depositories Act are mostly administered by SEBI.

Government and regulations by SEBI frame the rules under the securities laws. All these

are administered by SEBI. The powers under the Companies Act relating to issue and

transfer of securities and non-payment of dividend are administered by SEBI in case of

listed public companies and public companies proposing to get their securities listed.

STOCK MARKET DEFINITIONS:

1. A place where stocks, bonds, or other securities are bought and sold.

2. An association of stockbrokers who meet to buy and sell stocks and bonds according

to fixed regulations.

3. Stock exchange: an exchange where professional stockbrokers conduct security

trading.

4. A stock market is a market for the trading of company stock, and derivatives of it;

both of these are securities listed on a stock exchange as well as those only traded

privately.

5. The organized trading of stocks, bonds, or other securities, or the place where such

trading occurs.

6. Where stocks (shares) are bought and sold. A share is a portion of the total ownership

of a corporation. The more shares you own in a corporation, the more ownership you

have in that corporation.

7. The set of institutions that facilitate the exchange of stocks between buyers and

sellers. A stock market can be an actual place, but with the growth of electronic

transactions a large fraction of stock market transactions are not centrally located in a

particular location.

8. Stock market Nov is a physical place, sometimes known as a stock exchange, where

brokers gather to buy and sell stocks and other securities. The term is also used more

broadly to include electronic trading that takes place over computer and telephone

lines.

9. Is a market for the trading of publicly held company stocks or shares and associated

financial instruments (including stock options, convertibles and stock index futures).

10. Where stocks (shares) are bought and sold. A share is a portion of the total ownership

of a corporation. The more shares you own in a corporation, the more ownership you

have in that corporation

COMPANY PROFILE

Introduction

India bulls are Indias leading Financial, Real Estate and Power Company with a wide

presence throughout India. They ensure convenience and reliability in all their products

and services. India bulls have over 640 branches all over India. The customers of

Indiabulls are more than 4,50,000 which covers from a wide range of financial services

and products from securities, derivatives trading, depositary services, research &

advisory services, consumer secured & unsecured credit, loan against shares and

mortgage & housing finance. The company employs around 4000 Relationship managers

who help the clients to satisfy their customized financial goals. Indiabulls entered the

Real Estate business in the year 2005 with its group of companies. Large scale projects

worth several hundred million dollars are evaluated by them.

India bulls Financial Services Ltd is listed on the National Stock Exchange (NSE),

Bombay Stock Exchange (BSE) and Luxembourg Stock Exchange. The market

capitalization of India bulls is around USD 2500 million (29

th

December, 2006).

Consolidated net worth of the group is around USD 700 million. India bulls and its

group companies have attracted USD 500 million of equity capital in Foreign Direct

Investment (FDI) since March 2000. Some of the large shareholders of India bulls are the

largest financial institutions of the world such as Fidelity Funds, Goldman Sachs, Merrill

Lynch, Morgan Stanley and Carillon Capital.

Growth of India bulls

Year 2000-01:

One of Indias first trading platforms was set up by India bulls Financial Services Ltd.

with the development of an in-house team.

Year 2001-03:

The service offered by India bulls was increased to include Equity, F&O, Wholesale

Debt, Mutual fund, IPO Financing/Distribution and Equity Research.

Year 2003-04:

In this particular year India bulls ventured into Distribution and Commodities Trading

business.

Year 2004-05:

This was one of the most important years in the history of India bulls. In this year:

India bulls came out with its initial public offer (IPO) in September 2004.

India bulls started its Consumer Finance business.

India bulls entered the Indian Real Estate market and became the first company to

bring FDI in Indian Real Estate.

India bulls won bids for landmark properties in Mumbai.

Year 2005-06:

In this year the company acquired over 115 acres of land in Sonepat for

residential home site development. The world renowned investment banks like Merrill

Lynch and Goldman Sachs increased their shareholding in India bulls. It also became a

market leader in securities brokerage industry, with around 31% share in Online Trading.

The worlds largest hedge fund, Farallon Capital and its affiliates committed Rs. 2000

million for India bulls subsidiaries Viz. India bulls Credit Services Ltd. and India bulls

Housing Finance Ltd. In the same year, the Steel Tycoon Mr. L N Mittal promoted LNM

India Internet venture Ltd. acquired 8.2% stake in India bulls Credit Services Ltd.

Year 2006-07:

In this year, India bulls Financial Services Ltd. was included in the prestigious

Morgan Stanley Capital International Index (MSCI). India bulls Financial Services Ltd.

was benefited with the Farallon Capital agreeing to invest Rs. 6,440 million in it. The

company also received an in principle approval from Government of India for

development of multi product SEZ in the state of Maharashtra. India bulls Financial

Services Ltd acquired 100% of the equity share capital of Noble Realtors Pvt. Ltd. Noble

Realtors is a Company engaged in the business of construction and development of real

estate projects. India bulls Real Estate Business was demerged to become a separate

entity called India bulls Real Estate Ltd. The Board of India bulls Financial Services Ltd.,

Resolved to Amalgamate Indiabulls Credit Services Ltd and demerge India bulls

Securities Limited.

India bulls Financial Services Ltd: In Year 2008-09Several developments across its

group companies have propelled India bulls forward and are expected to continue to

power the rise of this conglomerate. India bulls financial services limited has recently

signed a joint venture agreement with sogecap, the insurance arm of Society General

(SocGen) for its upcoming life insurance venture. At the same time it has also signed a

Memorandum of understanding with MMTC.On the asset management front, the

company has received formal approval uhby7hbfrom SEBI and is expected to shortly

launch its first NFO. India bulls enter in to Public issue for his India bulls power Ltd.

Promoters for Indiabulls :

Sameer Gehlaut, Rajiv Rattan and Saurabh Mittal are the promoters of India bulls

Financial Services Limited WhileSameer Gehlaut will have a 23.0% stake in the

company post the IPORajiv Rattan and Saurabh Mittal will have a post issue holding of

11.5% and 10.1% respectively. All the three promoters of the company are engineering

graduates while Saurabh Mittal is a management graduate as well

The Team:

India bulls Securities Ltd, main strength lies in its formidable team. This team

comprising highly qualified and experienced personnel has been responsible for the

overall management of the company and has provided direction in diverse areas of

business strategy, operating management, regulatory reporting, human resources

development and product development.

Vision statement: To become the preferred long term financial partner to a wide base of

customers whilst optimizing stake holders value

Mission statement: To establish a base of 1 million satisfied customers by 2010. We will

create this by being a responsible and trustworthy partner

Corporate action: An Approach to Business that reflects Responsibility, Transparency

and Ethical Behavior. Respect for Employees, Clients & Stakeholder groups

Indiabulls Group entities in India

India bulls Capital Services Ltd.

India bulls Commodities Pvt. Ltd.

India bulls Credit Services Ltd.

India bulls Finance Co. Pvt. Ltd

India bulls Housing Finance Ltd.

India bulls Insurance Advisors Pvt. Ltd.

India bulls Resources Ltd.

India bulls Securities Ltd.

India bulls Power Ltd.

India bulls Securities Ltd is listed on the National Stock Exchange (NSE) and the

Bombay Stock Exchange (BSE) and its global depository shares are listed on the

Luxembourg Stock Exchange

Reasons to choose India bulls Securities Ltd:

The India bulls Financial Services stock is the best performing stock in the MSCI Index

the global benchmark for equity investments

A person who bought India bulls shares in the IPO at Rs. 19 (US$ 0.48) in September

2004 has been rewarded almost 100 times in three and a half years a feat unparalleled

in the history of Indian capital markets

India bulls Real Estate Limited partnered Farallon Capital Management LLC of the US to

bring the first Foreign Direct Investment into real estate

Seven Reasons why investing with India bulls Securities Limited is smarter

1) Customization: Formulates investment plans based on customer individual

requirements

2) Expertise: Brings within customer reach, about institutional expertise and companies

valuable understanding of the financial markets

3) One-stop shop: Caters to all customers investment needs under one roof.

4) Trust: Enjoys the pedigree of India bulls Securities Ltd and share its expertise in

financial services.

5) Personalized service: Helps customer through the entire investment process, step by

step, with innovative and efficient services.

6) Unbiased & Objective advice: We partner you in your investment process, with our

team of expert investment advisors

Online trading potential is huge: Online trading accounted for 5% of overall market in

FY04 as compared to an estimated 3% in FY03. India bulls currently has almost 20%

market share of volumes in the Internet trading space. The table below indicates the

growth in volumes of the Internet trading segment on the NSE over the last few years.

The growth is indicative of the potential of this segment, which we believe is likely to be

robust going forward as well.

This is primarily driven by increasing penetration of computers, significant

decline in Internet charges, convenience of usage and cost advantage. To put things in

perspective, the offline brokerage on equities is around 1.0% as compared to 0.5% in the

online trading space

Advisory services:

An India bull is also into mutual fund and insurance advisory businesses. Though

this field is extremely competitive and requires significant research skills, these are

highly profitable business segments. Though these businesses currently account for an

insignificant portion of overall revenues, considering the penetration levels of mutual

funds and insurance in the country, prospects are promising.

Aggressive growth plans:

India bulls have set aggressive targets to expand its business in the offline space.

This includes investments in up gradation of branch network and opening another 75

branches by the end of calendar year 2009 (150 in total). The company has also indicated

its intent to acquire strategic stake in other companies towards growing the business

inorganically

Products provided Power India bulls: An online trading system designed for the high-

volume trader. The platform provides enhanced trade information and executes orders on

an integrated software based trading platform.

India bulls financial service offers:

? SME finance

? Mortgage loans

? Commercial vehicle loans

? Farm equipment loans

? Commercial credit loans

? Loan against shares and

? Third part distribution of insurance products.

Broking: Equity, Derivatives, Commodities, Currency Derivatives.

Distribution: Mutual funds, IPOs, Home loans, Insurance.

Divisions:

Investment Advisory and Broking? Division

Project Syndication Division? Institutional Equity Broking? Division

Institutional Debt Broking? Division

Retail Offerings:

? Wealth Management Services

? Portfolio Management Services

? Securities Broking-Equities and derivatives

? Depository & Custodial Service & Distribution of financial products. .

Services:

Indiabulls securities provide a wide range of services that include Power Indiabulls:

An online trading system designed for the high-volume trader. The platform provides

enhanced trade information and executes orders on an integrated software based trading

platform.

1) Equities

2) Commodities

3) Wholesale debts

4) Futures and options

5) Depository services

6) Equity research services

7) Post Trade -Custodial,

8) Depository Services

9) Payment Gateway

10) Other back office support

Online Banks Tie-ups for trading: Company having online transaction tie-ups with

banks like.

HDFC BANK,

ICICI BANK,

IDBI BANK,

CITI BANK.

Company Achievements:

The Indiabulls Group is one of the top fifteen conglomerates in the country with

businesses in several significant sectors.

The India bulls Financial Services stock is the best performing stock in the MSCI Index

the global benchmark for equity investments.

Indiabulls Real Estate Limited partnered Carillon Capital Management LLC of the US to

bring the first Foreign Direct Investment into real estate.

Indiabulls Financial Services Limited was accorded the highest rating P1+ for short term

debt and the highest rating of AAA (SO) by CRISIL for loan receivables securitization

while Indiabulls Securities Limited is the only broker in India to be assigned CRISILs

highest broker quality grading of BQ1.

In December 2007, Indiabulls acquired Pyramid Retail including Pyramid Megastores

and Trumart, their chain of lifestyle and convenience outlets

Company competitors

Kotak Securities Ltd,

ICICI Securities Ltd,

HDFC Securities Ltd,

Religare Securities Ltd,

Birla Money,

Indiainfoline Ltd.

ABOUT INDIABULLS GROUP

The Indiabulls Group is one of the top fifteen conglomerates in the country with

businesses in several significant sectors.

The group companies have a market capitalization of over Rs. 25,000 crore (US$

6.25 billion) while group revenues have grown at a cumulative annual rate of over 100%

to now reach Rs. 3100 crore (US$ 775 million) and the group profit has surged to over

Rs. 1200 crore (US$ 300 million). Its companies, listed in important Indian and overseas

markets, have Distributed over Rs. 700 crore (US$ 175 million) as dividend in the year

2008.

Indiabulls Financial Services Limited was accorded the highest rating P1+ for short term

debt and the highest rating of AAA (SO) by CRISIL for loan receivables securitisation

while India bulls Securities Limited is the only broker in India to be assigned CRISILs

highest broker quality grading of BQ1.

In December 2007, Indiabulls acquired Pyramid Retail including Pyramid Megastores

and Trumart, their chain of lifestyle and convenience outlets

Indiabulls growth has been nothing short of stupendous. In less than eight years since the

company was first registered, it has grown from just five employees to 21,000 and from

one Office to 600 across the country.

The Indiabulls Financial Services stock is the best performing stock in the MSCI Index

the global benchmark for equity investments.

A person who bought Indiabulls shares in the IPO at Rs. 19 (US$ 0.48) in September

2004 has been rewarded almost 100 times in three and a half years a feat unparalleled

in the history of Indian capital markets

Indiabulls Real Estate Limited partnered Farallon Capital Management LLC of the US to

bring the first Foreign Direct Investment into real estate.

Companies History in India

In 1999, three IIT-Delhi alumni Sameer Gehlaut, Rajiv Rattan and Saurabh Mittal

acquired Orbis,a Delhi based stock broking company. Young entrepreneur Sameer

Gehlaut established India bulls in 2000, after acquiring orbis Securities, a stock brokerage

company in Delhi. The group started its operations from a small office near Hauz Khas

bus terminal in Delhi.The office had a tin roof and two computers. The idea of leveraging

technology for trading stocks led to the creation of Indiabulls Incorporated on 10th

January 2000, it was converted into a public limited company on 27th February 2004.

Its original idea of leveraging technology bore fruit when Indiabulls was accorded

permission to conduct online trading on Indian stock exchanges.

The company had achieved the distinction of becoming only the second brokerage firm in

India to be granted this consent. The challenges facing it were immense not least of all

the mind set of investors who were called to make the big leap from traditional stock

trading to a completely online interface. Having overcome this resistance, the company

later expanded its service portfolio to include equity, F&O, wholesale debt, mutual fund

distribution and equity research.

In 2003/04, Indiabulls ventured into insurance distribution and commodity trading. It

successfully floated its IPO in September 2004 and in the same year entered the

consumer finance segment. Real estate, the new sunrise industry, was the next frontier for

Indiabulls. In 2004/05, it entered this sector. But it wasnt just real estate that was

booming.

Opportunities were opening up in retail and infrastructure as well. To cement its position

in the Indian business and industry firmament,

Indiabulls acquired Pyramid Retail In 2007 and marked its presence in the power sector

by launching Indiabulls Power.

Brand Values

Indiabulls is amongst the largest non-banking financial services companies in India and

enjoys strong brand recognition and customer acceptance.

The company attributes its dominant position in the brokerage industry to the preferential

status it enjoys with investors Coupled with its forays into various segments; the Group

believes that the bulk of its brand story is yet to be written.

Indeed, when a case study on Indias youngest brands which have had a profound impact

on the economy is crafted, Indiabulls will feature prominently in it.

Recent Developments

Several developments across its group companies have propelled Indiabulls forward and

are expected to continue to power the rise of this conglomerate.

Indiabulls Financial Services Limited has recently signed a joint venture agreement with

Sogecap, the insurance arm of Society Generale (SocGen) for its upcoming life insurance

venture.

At the same time it has also signed a Memorandum of Understanding with MMTC, the

largest commodity trading house in India, to establish a Commodities Exchange with

26% Ownership held by MMTC.

On the asset management front, the company has received formal approval from SEBI

and is expected to shortly launch its first NFO.

DATA ANALYSIS

The collected data is sorted out an analyses to prepare the final report

the tools and techniques is in the analysis are

Tables

Graphs

Formulas are

Return = (close price-previous close)/previous close*100.

Risk= D

2

/ (n-1).

D

2

= Total Sum of the D

2

.

Return of portfolio=w1 R1+w2 R2

Where: R1= return on the first company

R2= return on the second company

W1, W2= investment on 50%

Risk of portfolio= w1

2

1

2

+ w2

2

2

2

+2w1, w2 1 2, R1&R2.

1= Risk of company 1.

2= Risk of company 2.

R1&R2= Correlation coefficient of companies 1 & 2.

Coefficient of Correlation = R1 & R2.

RESEARCH METHODOLOGY:

Research methodology is a way to find out the result of a given problem on a

specific matter or problem that is also referred as research problem. In methodology uses

different criteria for solving searching the given research problem. Different sources use

different type of methods for solving the problem. If we think about the world

methodology, it is the way of searching or solving the research problem. (Industrial

research institute 2010)

According to Goddard & Melville (2004), answering unanswered questions exploring

which currently not exit is a research. The advanced learners dictionary current English

lays down the meaning of research as careful investigation or inquiry especial through

search for new facts in any branch of knowledge.Redmen &Mory (2009) define research

as a systemized effort to gain new knowledge.

In research methodology, research always tries search the given questions

systematically in our own way and out all the answered tell conclusion. If research does

not work systematically on problem three worlds be less possibility.

METHODOLOGY

The data collected is basically confined to secondary sources,

There is a constraint with regard to time allocated for the research study.

The availability of information about different& price fluctuations of the

companies is a big constraint to the study.

SECONDARY DATA:

Data collected from various books and sites.

Data collected from internet.

The Price of stocks from national stock exchange is totally secondary data

SAMPLE

Different companies from different sector randomly list of company

1: APOLLO TYRES

2: RELIANCE INDUSTRIES LTD

3: MOTILAL OSWAL

4: HDFC

5: HERO MOTORS

6: MRF TYRES

7: KOTAK MAHINDRA

8: ICICI

9: ASIAN PAINTS

10: KINGFISHER AIRLINES

.DATA ANALYSIS FORMULA:

In this study the statistical tools used are risk, return, average, variance,

correlation coefficient etc.

Return calculation: [p1-p0]/p0*100

Average return: [p1-p0]/p0*100/5

Standard deviation: variance

Variance=1/n-1(d2)

NEED FOR THE STUDY

Portfolio management is a process encompassing many activities of investment in

assets and securities .it is a dynamic and flexible concept and involves regular and

systematic analysis judgments and actions .the objectives of the service is to help the un

known investors which the expertise of professionals in investment portfolio management

. it involves construction of a portfolio basis up on the investors objectives , constraints

,preferences for risk and return and tax ability . The portfolio is reviewed and adjusted

from time to time in tune with the market conditions the evaluation of portfolio is to be

done in terms of targets set for a risk and return .the changes in the portfolio or to be

effected to meet the changing conditions.

Portfolio construction refers to the allocation of surplus funds in hand among a

verity of financial assets open for investments .portfolio theory concerns itself with the

principles governing such allocations .the modern view of investments is oriented more

towards the assembly of proper combinations of individuals securities to from investment

portfolios .the combination of individual securities to from investments portfolios .the

combination of securities held together will give a beneficial results if they are grouped

in a manner to secure higher return after taking into policy consideration the risk

elements.

OBJECTIVES OF THE STUDY

To make detailed study on the overall concepts of the portfolio management in india

bulls

To do an analysis of the risk and return characteristics of stocks related to different

companies

To help the investors to decide the effective portfolio of securities in india bulls

To identify the best securities out of which a portfolio can be constructed by the india

bulls

SCOPE OF THE STUDY

This study covers the Markowitz model. the study covers the calculation of

correlation between the different securities in order to find out at what percentage of

funds should be invested among the companies in the portfolio .also the study includes

the calculation of weights of individual securities involve in the portfolio .this percentage

help in allocation of the funds available for investments base d on the risky portfolios.

DATA SOURECES:

Use Data Warehouse Manager to combine your data from SimCorp Dimension

with data from other sources and systems and eliminate the need for costly ETL and

data consolidation tools. Data Warehouse Manager leverages best practice gained from

decades of experience with SimCorp Dimension installations. You get a reporting

database that is constantly developed, maintained, and enhanced by SimCorp. With

highly automated data quality checks and validations, you are confident that your data

warehouse solution is optimized for your reporting and analysis requirements.

Central repository for all data sources

Data Warehouse Manager serves as the central repository for all reporting and analytics

data, whether sourced directly from SimCorp Dimension or alternate sources. Simplify

your reporting process with this single source in place to meet your reporting and analysis

requirement. Whats more, youll have a stable and consistent application over time as

Data Warehouse Manager is updated along with the rest of SemCorp Dimension.

Compatible with any data warehouse environment

Data Warehouse Manager adapts to virtually all existing data warehouse infrastructures.

If you already have a data warehouse solution in place, its easy to read the layout and

map the data of your existing data warehouse into Data Warehouse Manager.

TOOLS FOR PORTFOLIO MANAGEMENT:

Portfolio management (PM) tools assist the portfolio managers in achieving the

optimum balance between attractions and drawbacks, stability and growth, and risks and

returns by making the good use of limited resources available. They provide the

organized and systematic ways for analyzing the set of projects or activities.

Common Aspects of PM tools

There are certain common aspects of various Portfolio management tools.

The results obtained by the assessment of individual projects in a portfolio are balanced

with PM tools.

Portfolio Management can be combined with suitable evaluation techniques of single

project.

PM utilizes the results of the analysis (partially or completely) done for evaluating the

individual projects when used for selecting or assessing the projects.

The projects do not occur during the same period of time when PM tools are applied

therefore there are some discontinuities.

One of the main tasks of PM tools is to balancing the projects on time in terms of costs

and returns over time.

In order to ensure the uniformity and validity of the input data, it is imperative to

examine every project in a similar way. It is necessary for the balancing of the projects.

Popular Portfolio Management tools

There are many project evaluation tools that can be applied to portfolio evaluation

techniques

by making direct comparison of the assessment results of individual projects. In addition

to these, there are certain techniques that are designed specifically for PM.

Others Tools

Others tools are used primarily for project evaluation such as decision tress and others

2D and 3D matrices

The 2D and 3D matrices are used for the analysis and representation of business units,

projects or activities on the basis of 2 or 3 meaningful variables. All these matrices need a

similar process for taking decisions and analyzing the data. They are considered to be

complementary and hence they are grouped together.

The portfolio is analyzed by business and RTD managers by examining each individual

project. It is followed by placing each project within portfolio matrices that incorporates

the strategic elements that are critical to the particular company and its industry.

The2D and 3D matrices techniques are suitable for any company and context and

therefore they are very popular and interesting. They are easy to implement and

compared with other techniques.

These matrices offer a framework for assessment of various parameters, and company

should do some experiments for applying these tools for finding the suitable

combinations. These matrices require the judgment and these judgements are supported

by using these PM tools.

PORTFOLIO MANAGEMENT FORMULAS:

In this study the statistical tools used are risk, return, average, variance, correlation

coefficient etc.

Return calculation: [p1-p0]/p0*100

Average return: [p1-p0]/p0*100/5

Standard deviation: variance

Variance=1/n-1(d2)

Return = (close price-previous close)/previous close*100.

Risk= D

2

/ (n-1).

D

2

= Total Sum of the D

2

.

Return of portfolio=w1 R1+w2 R2

Where: R1= return on the first company

R2= return on the second company

W1, W2= investment on 50%

Risk of portfolio= w1

2

1

2

+ w2

2

2

2

+2w1, w2 1 2, R1&R2.

1= Risk of company 1.

2= Risk of company 2.

R1&R2= Correlation coefficient of companies 1 & 2.

Coefficient of Correlation = R1 & R2

LIMITATIONS OF THE STUDY

Time constraint is major factor.

Construction of portfolio is restricted to assets.

Limited industries are covered in the study.

Constrained to a small number of investors

Large scope for long term investments

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Chaitanya Chemicals - Capital Structure - 2018Document82 pagesChaitanya Chemicals - Capital Structure - 2018maheshfbPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- "Adaptive Cruise Control": Electronics & Communication EngineeringDocument2 pages"Adaptive Cruise Control": Electronics & Communication EngineeringmaheshfbPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- ZUARIDocument46 pagesZUARImaheshfbPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Running RaceDocument2 pagesRunning RacemaheshfbPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Networks Are Privately Owned Networks: Wireless NetworkingDocument12 pagesNetworks Are Privately Owned Networks: Wireless NetworkingmaheshfbPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- CONTENTSDocument2 pagesCONTENTSmaheshfbPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Rts ContentsDocument1 pageRts ContentsmaheshfbPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Objective: C Baba Fakruddin Masapet, Rayachoty MD, Kadapa (DT), Phone: +91-9703104942 Andhra PradeshDocument2 pagesObjective: C Baba Fakruddin Masapet, Rayachoty MD, Kadapa (DT), Phone: +91-9703104942 Andhra PradeshmaheshfbPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Adaptive CruiseDocument15 pagesAdaptive CruisemaheshfbPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Solar Power Satelite Seminar ReportDocument21 pagesSolar Power Satelite Seminar ReportmaheshfbPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Adaptive Missiles Guidance Using GpsDocument1 pageAdaptive Missiles Guidance Using GpsmaheshfbPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Kotak Mahindra Bank: Presented by Navya.CDocument29 pagesKotak Mahindra Bank: Presented by Navya.CmaheshfbPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- DispatchedDocument5 pagesDispatchedmaheshfbPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Department of Electronics and Communication Engineering Annamacharya Institute of Technology and Sciences (An Autonomous Institution)Document15 pagesDepartment of Electronics and Communication Engineering Annamacharya Institute of Technology and Sciences (An Autonomous Institution)maheshfbPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Presented by L.Anusha 17700E00AADocument16 pagesPresented by L.Anusha 17700E00AAmaheshfbPas encore d'évaluation

- NARAYANADocument24 pagesNARAYANAmaheshfbPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Spare 32W SPD & Driver Dispatched From Noida Office As On 14.08.2018 Ap Gram Panchayat Raj & Rural DevelopmentDocument2 pagesSpare 32W SPD & Driver Dispatched From Noida Office As On 14.08.2018 Ap Gram Panchayat Raj & Rural DevelopmentmaheshfbPas encore d'évaluation

- Market Startegies of Maruti Udyog: Presented byDocument51 pagesMarket Startegies of Maruti Udyog: Presented bymaheshfbPas encore d'évaluation

- YeshDocument3 pagesYeshmaheshfbPas encore d'évaluation

- Flexible Electronic Skin (Modified)Document18 pagesFlexible Electronic Skin (Modified)maheshfbPas encore d'évaluation

- JNVST 2018 Offline Application Form WWW - Jnvstentrancetest2017.in PDFDocument1 pageJNVST 2018 Offline Application Form WWW - Jnvstentrancetest2017.in PDFmaheshfbPas encore d'évaluation

- Presented by O.Subramanyam 13701A04C2Document15 pagesPresented by O.Subramanyam 13701A04C2maheshfbPas encore d'évaluation

- Paper Battery: Keywords: Paper Batteries, FlexibleDocument12 pagesPaper Battery: Keywords: Paper Batteries, FlexiblemaheshfbPas encore d'évaluation

- PawanDocument3 pagesPawanmaheshfbPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Resume UjjayiniDocument3 pagesResume UjjayinimaheshfbPas encore d'évaluation

- Assets (Meaning) .: 1 8 BCF 412 (Asset Management) - NotesDocument8 pagesAssets (Meaning) .: 1 8 BCF 412 (Asset Management) - NotessamPas encore d'évaluation

- Introduction To Financial MarketsDocument109 pagesIntroduction To Financial Marketssadhana100% (1)

- An Analytical Study of Derivatives in Futures Mba ProjectDocument70 pagesAn Analytical Study of Derivatives in Futures Mba ProjectAbhinandan Chougule100% (2)

- Capital Market in TanzaniaDocument11 pagesCapital Market in TanzaniaJohnBenardPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Risk ManagementDocument6 pagesRisk ManagementsaurabhPas encore d'évaluation

- (BNP Paribas) DivDax. Trade 2009-2010 Dividend SwapDocument10 pages(BNP Paribas) DivDax. Trade 2009-2010 Dividend SwapaacmasterblasterPas encore d'évaluation

- Financial Instruments: Classification, Recognition and MeasurementDocument105 pagesFinancial Instruments: Classification, Recognition and MeasurementĐỗ Thụy Minh ThưPas encore d'évaluation

- Abs CDSDocument16 pagesAbs CDSSilverio J. VasquezPas encore d'évaluation

- Ch12 Beams10e TBDocument22 pagesCh12 Beams10e TBSteven Andrian GunawanPas encore d'évaluation

- Alternative Investments: FIN 423 Fall 2019 Page Exam 1-1/16: Francisco - Delgado@Miami - EduDocument16 pagesAlternative Investments: FIN 423 Fall 2019 Page Exam 1-1/16: Francisco - Delgado@Miami - EduAyman Fatima100% (1)

- Cryptocurrencies and The Definition ofDocument10 pagesCryptocurrencies and The Definition ofAvik BarmanPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Guerrero Leon F 201308 MS PDFDocument68 pagesGuerrero Leon F 201308 MS PDFganPas encore d'évaluation

- The Tenuous Case For Derivataves ClearinghousesDocument24 pagesThe Tenuous Case For Derivataves ClearinghousesRicharnellia-RichieRichBattiest-CollinsPas encore d'évaluation

- Caso Toy World IncDocument18 pagesCaso Toy World IncLuis Fernando MoraPas encore d'évaluation

- Professional EthicsDocument93 pagesProfessional EthicsSrishti MohanPas encore d'évaluation

- Guidance Note On Accounting For Equity Index and Equity Stock Futures and OptionsDocument22 pagesGuidance Note On Accounting For Equity Index and Equity Stock Futures and Optionsshyamsunder bajajPas encore d'évaluation

- Financial System of IndiaDocument3 pagesFinancial System of IndiaAshutosh GuptaPas encore d'évaluation

- INDIAN Derivatives MarketDocument14 pagesINDIAN Derivatives Marketnarasimha narasimhaPas encore d'évaluation

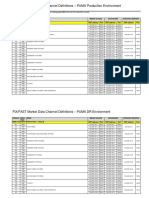

- FIX/FAST Market Data Channel Definitions - PUMA Production EnvironmentDocument3 pagesFIX/FAST Market Data Channel Definitions - PUMA Production EnvironmentVaibhav PoddarPas encore d'évaluation

- Types of Financial MarketsDocument2 pagesTypes of Financial MarketsMher Edrolyn Cristine LlamasPas encore d'évaluation

- NISM Series XIII - Common Derivatives Examination PDFDocument4 pagesNISM Series XIII - Common Derivatives Examination PDFBhushan LokmitraPas encore d'évaluation

- Lecture Notes Forwards and Futures ContractsDocument4 pagesLecture Notes Forwards and Futures ContractsPetey K. NdichuPas encore d'évaluation

- House Hearing, 110TH Congress - Hearing To Review Reauthorization of The Commodity Exchange ActDocument106 pagesHouse Hearing, 110TH Congress - Hearing To Review Reauthorization of The Commodity Exchange ActScribd Government DocsPas encore d'évaluation

- Pedersen - Wall Street Primer (2009)Document262 pagesPedersen - Wall Street Primer (2009)Cosmin VintilăPas encore d'évaluation

- Credit Risk Analyst Interview Questions and Answers 1904Document13 pagesCredit Risk Analyst Interview Questions and Answers 1904MD ABDULLAH AL BAQUIPas encore d'évaluation

- Wealth Management Asia: ParsimonyDocument3 pagesWealth Management Asia: ParsimonyJohn RockefellerPas encore d'évaluation

- Goldman Sachs Report That Asks, "Will The Kids Move Out of The Basement?"Document10 pagesGoldman Sachs Report That Asks, "Will The Kids Move Out of The Basement?"MarketplacePas encore d'évaluation

- Chapter 17 Hybrid and Derivative Securities: Principles of Managerial Finance, 13e, Global Edition (Gitman)Document44 pagesChapter 17 Hybrid and Derivative Securities: Principles of Managerial Finance, 13e, Global Edition (Gitman)Ariel Dimalanta100% (2)

- Fundamental and Technical Analysis of Banking StocksDocument118 pagesFundamental and Technical Analysis of Banking StocksFranklin Aleyamma Jose89% (9)

- MQ - Ifrs 9Document11 pagesMQ - Ifrs 9Huỳnh Minh Gia HàoPas encore d'évaluation

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSND'Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNÉvaluation : 4.5 sur 5 étoiles4.5/5 (3)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 3.5 sur 5 étoiles3.5/5 (8)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthD'EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthÉvaluation : 4 sur 5 étoiles4/5 (20)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (14)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialD'EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialPas encore d'évaluation