Académique Documents

Professionnel Documents

Culture Documents

50 Blue Chip Dividend Stocks Q

Transféré par

CaptBB2Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

50 Blue Chip Dividend Stocks Q

Transféré par

CaptBB2Droits d'auteur :

Formats disponibles

50 Blue-Chip Dividend Stocks Increasing Payouts in

Q1 2014

by Kyle Woodley | April 1, 2014 5:58 am

If Q1 2014 felt like a middling quarter well, thats because it was. The S&P 500 entered the final day of first-

quarter trading up fractionally year-to-date, and dividend stocks didnt look much better. Funds focused around

dividend stocks, such as Best Stocks contest[1] entry Vanguard Dividend Appreciation ETF (VIG[2]) and the

SPDR S&P Dividend ETF (SDY[3]), should end the quarter basically flat, too.

[4]Still that doesnt mean Q1 was all bad news for anyone sitting on dividend

stocks.

For one, Wall Street banks just received the results of their most recent federal stress tests[5], and they were

widely positive. That should mean big bumps in the dividend yields of some huge blue-chip financials Bank

of America (BAC[6]) and Morgan Stanley (MS[7]) are forecast to produce some of the best payout

improvements in the coming months.

We also got our regular deluge of paycheck increases from a wide array of dividend stocks, including a host of

S&P 500 stocks, as well as six Dependable Dividend Stocks[8] companies that have upped their regular

dividends for at least 25 consecutive years. And seven of the companies mentioned here have yet to go ex-

dividend, meaning theres still time to invest in these companies before they pay out at their newly improved

dividend rates.

This batch of dividend stocks isnt an end-all list of buy recommendations by any means. Far from it. But, it can

provide you with a great jumping-off point for income investments. After all, companies that are able to increase

their dividends typically are at least demonstrating more stability in their business and, in many cases, youre

looking at some attractive dividend yields here, aswell.

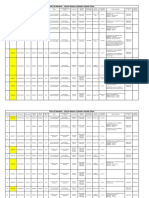

So, lets get to it. Here are 50 of Wall Streets bluest blue-chipstocks that have turned the dividend spigot just a

little more during the past three months. We also list the new payout, percentage increase, yield based on the

closing price on March 31, and payment and record dates:

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.125 25% 1% March 25 March 11

American International Group(AIG)

American International Group (AIG[9]) announced its first dividend increase inmid-February well less

than a year after reinstating its payout! The improved quarterly dividend came alongside a Q4 report that showed

AIG swinging to a profit after a year-ago loss[10], as well as news that the company planned on laying off about

3% of its global workforce.

Page 1of 7 50 Blue-Chip Dividend Stocks Increasing Payouts in Q1 2014 | InvestorPlaceInvestorPlace

5/17/2014 http://investorplace.com/2014/04/50-blue-chip-dividend-stocks-q1/print

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.77 8.5% 2.59% May 12 April 1

Air Products & Checmicals (APD)

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.28 12% 1.98% April 1 March 30

Allstate (ALL)

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.25 25% 1.21% May 22 April 22

* Goes ex-dividend April 17

Apache Corp. (APA)*

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$1.93 15% 2.45% March 24 March 7

BlackRock (BLK)

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.12 9.1% 1.53% March 30 Feb. 14

Broadcom (BRCM)

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.50 13.6% 2.4% April 1 March 14

Chubb (CB)

Dependable Dividend Stock[11] Chubb Corp. (CB[12]) has really taken it on the chin early in 2014 after a fairly

steady 30% ramp-up in 2013. The company is wildly underperforming the market, down more than 8% year-to-

date. However, it offered a slight salve in the form of a roughly 14% bump to its dividend to 50 cents quarterly.

The dividend on CB stock has now been hiked for 32 consecutive years, and it has improved by more than 7%

annually over the past five years.

Next Page[13]

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.19 12% 3.39% April 23 April 3

* Goes ex-dividend April 1

Cisco (CSCO)*

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.47 4% 2.54% March 25 March 10

CME Group (CME)

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.225 15.4% 1.8% April 23 April 2

Comcast (CMCSA)

The big news of the quarter for Comcast (CMCSA[14]) was its proposed merger[15] with Time Warner Cable

(TWC[16]). But the company also made waves for its deal[17] with Netflix (NFLX[18]) in response to net

neutrality rules being hacked away, and is now making headlines again on reported talks[19] with Apple (AAPL

[20]) over streaming TV service.

So, when the company announced it would be upping its quarterly payout to 22.5 cents per share well, one can

understand why that went mostly under the radar. Still, with the latest increase, CMCSAs payout has more than

tripled since 2009, when it was paying 7 cents quarterly. The new Comcast dividend yield sits just above 1.8%.

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.19 12% 1.47% April 1 March 14

Comerica (CMA)

Page 2of 7 50 Blue-Chip Dividend Stocks Increasing Payouts in Q1 2014 | InvestorPlaceInvestorPlace

5/17/2014 http://investorplace.com/2014/04/50-blue-chip-dividend-stocks-q1/print

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.10 300% 0.53% April 28 March 28

Danaher (DHR)

Danaher (DHR[21]) made the biggest splash by far among the dividend stocks on this list, quadrupling its 2.5-

cent quarterly dividend, with a 10-cent payout landing in late April. Granted, this dividend increase is the

companys first since 2011, so investors have been waiting quite a bit plus, DHR still only yields 0.54%, so it

hasnt exactly vaulted Danaher into the ranks of dividend royalty.

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.24 9% 1.43% J une 30 J une 13

* Goes ex-dividend J une 11

Devon Energy (DVN)*

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.37 15% 3.05% April 30 March 31

Dow Chemical (DOW)

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.31 19.2% 2.14% March 12 Feb. 21

Family Dollar (FDO)

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.125 25% 3.21% March 30 J an. 31

Ford (F)

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.62 10.7% 2.28% May 9 April 11

* Goes ex-dividend April 9

General Dynamics (GD)*

General Dynamics (GD[22]) investors cant really ask for much more out of Q1. Holders of the defense

companys stock not only enjoyed a double-digit increase to the dividend, but a market-crushing 13% return

through the final trading day of the quarter. That run was sparked by an excellent earnings report out in late

J anuary that was starkly different from the prior year, when the companys information systems required a major

writedown.

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.41 8% 3.16% May 1 April 10

* Goes ex-dividend April 8

General Mills (GIS)*

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.30 N/A^ 3.49% March 28 March 18

^Resumed dividend

General Motors (GM)

General Motors (GM[23]) saw another financial-crisis scar heal as the company announced in J anuary that it

would be reinstating its dividend. While Charles Sizemore points out that GM might not necessarily have all the

qualities youd normally tether to the moniker dividend stocks,[24] theres no arguing that General Motors is in

a much better place financially. Its 30-cent dividend is enough evidence of that.

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.275 31% 1.65% March 7 Feb. 19

Harley-Davidson (HOG)

Page 3of 7 50 Blue-Chip Dividend Stocks Increasing Payouts in Q1 2014 | InvestorPlaceInvestorPlace

5/17/2014 http://investorplace.com/2014/04/50-blue-chip-dividend-stocks-q1/print

Next Page[25]

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.43 8% 3.09% May 15 May 1

* Goes ex-dividend April 29

Hasbro (HAS)*

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.16 10.2% 1.79% April 2 March 12

Hewlett-Packard (HPQ)

Hewlett-Packard (HPQ[26]) is one of the best performers on this list, up nearly 15% year-to-date after doubling

in 2013. Yes, this is the same Hewlett-Packard that many deemed destined for the meat wagon after HPQ shares

shed about three-quarters of their value from 2010-12. Still, Hewlett-Packard has been slowing its revenue

declines and earnings keep heading higher, making HPQ a much different critter than we thought itd be just a

couple years ago.

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.47 21% 2.38% March 27 March 13

Home Depot (HD)

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.25 19% 1.75% March 31 March 14

Ingersoll-Rand (IR)

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.34 13% 2.4% March 7 Feb. 21

L Brands (LB)

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.30 7.1% 1.57% March 12 Feb. 26

McGraw-Hill Financial (MHFI)

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.37 16% 2.51% March 17 Feb. 28

Molson Coors Brewing (TAP)

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.375 50% 4.58% Feb. 20 Feb. 10

Noble Corp. (NE)

Noble Corp. (NE[27]) is another company that announced a big dividend increase in the midst of a pretty poor

quarter. NE shares enjoyed a 50% hike to the dividend as of February, and at current prices, the dividend yield is

a healthy 4.7%. Of course, that has come after a rather unhealthy Q1 in which the stock dipped 13%.

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.33 10% 2.11% March 25 March 10

Nordstrom (J WN)

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.54 3.8% 2.22% March 10 Feb. 7

Norfolk Southern (NSC)

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.40 5% 2.7% Feb. 18 Feb. 10

Oneok (OKE)

PPL Corp. (PPL)

Page 4of 7 50 Blue-Chip Dividend Stocks Increasing Payouts in Q1 2014 | InvestorPlaceInvestorPlace

5/17/2014 http://investorplace.com/2014/04/50-blue-chip-dividend-stocks-q1/print

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.3725 1% 4.5% April 1 March 10

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.65 8% 1.99% March 17 March 7

Praxair (PX)

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.42 20% 1.78% TBD TBD

Qualcomm (QCOM)

Qualcomms (QCOM[28]) enjoyable 2014 was made even better thanks to an announced 20% hike to its

dividend, effective as of its next payout sometime in J une. Qualcomm, most known for its communications

technologies and chipsets, also released a smartwatch the Toq[29] in late December, and is increasingly

trying to become a part of the connected home. So far, optimism in Qualcomm has resulted in 7% gains for

QCOM for the year-to-date.

New Payout** % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.1825 0.17% 5.36% April 15 April 1

** Monthly payout

Realty Income (O)

Realty Income (O[30]), affectionately known as the Monthly Dividend Company, notched yet another uptick

in its monthly income check with a 0.17% increase to 18.25 cents per share. The company currently boasts 66

consecutive quarterly increases to its payout, and at 5%-plus in dividend yield and 9% in gains so far this year,

Realty Income has to be among Wall Streets favorite dividend stocks this year.

Next Page[31]

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.20 18% 1.12% March 31 March 10

Ross Stores (ROST)

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.66 5% 2.73% March 31 March 10

Sempra Energy (SRE)

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.55 10% 1.12% March 14 March 3

Sherwin-Williams (SHW)

Sherwin-Williams (SHW[32]) hit another milestone, celebrating its 35th consecutive year of increased dividend

payouts thanks to its 10% hike in March. That announcement will keep SHW on the Dependable Dividend Stocks

[8] list for another year.

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.335 9.8% 3.63% March 10 Feb. 14

Spectra Energy (SE)

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.27 8% 1.65% April 30 March 31

St. J ude Medical (STJ )

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.23 15% 2.37% March 25 March 4

Suncor Energy (SU)

Time Warner Cable (TWC)

Page 5of 7 50 Blue-Chip Dividend Stocks Increasing Payouts in Q1 2014 | InvestorPlaceInvestorPlace

5/17/2014 http://investorplace.com/2014/04/50-blue-chip-dividend-stocks-q1/print

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.75 15% 2.19% March 17 Feb. 28

The other half of the Comcast merger party, Time Warner Cable (TWC[16]), also bumped up its dividend this

past quarter. With its latest increase to 75 cents quarterly) Time Warners payout has now grown by 88%

since establishing regular dividends in 2010.

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.47 9.3% 3.6% April 30 April 3

* Goes ex-dividend April 1

Toronto-Dominion Bank (TD)*

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.44 16% 2.14% March 28 March 14

T. Rowe Price (TROW)

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.67 8.1% 2.75% March 11 Feb. 24

UPS (UPS)

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.25 11.1% 1.88% March 12 Feb. 12

Valero Energy (VLO)

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.48 2% 2.51% April 1 March 11

Walmart (WMT)

Walmart (WMT[33]) has not had itself a good 2014. The company suffered a substantial fourth-quarter sales and

profit decline that it blamed heavily on lousy weather, and has been in the crosshairs of the minimum wage

debate. WMT has declined 3.4% so far this year underperforming the market but considering any lack of

positive spark, one could reasonably expect it to have done worse. Investors did receive an increase in Walmarts

quarterly dividend, but it was a token one at just 2%, this is one of its weakest improvements ever.

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.375 2.7% 3.57% March 21 March 10

Waste Management (WM)

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.4375 17% 1.76% March 25 March 10

WellPoint (WLP)

New Payout % increaseDIVIDEND Yield as of 3/31Payment DateRecord date

$0.0625 8.7% 2.21% April 30 March 31

Xerox (XRX)

Kyle Woodley[34] is the Deputy Managing Editor of InvestorPlace.com[35]. As of this writing, he did not hold a

position in any of the aforementioned securities. Follow him on Twitter at @KyleWoodley[36].

Endnotes:

Best Stocks contest: http://investorplace.com/best-stocks-for-2014 1.

VIG: http://studio-5.financialcontent.com/investplace/quote?Symbol=VIG 2.

SDY: http://studio-5.financialcontent.com/investplace/quote?Symbol=SDY 3.

[Image]: http://investorplace.com/hot-topics/companies-increasing-dividends/ 4.

results of their most recent federal stress tests: http://investorplace.com/2014/03/dividend-stocks-bank-

stocks/

5.

BAC: http://studio-5.financialcontent.com/investplace/quote?Symbol=BAC 6.

Page 6of 7 50 Blue-Chip Dividend Stocks Increasing Payouts in Q1 2014 | InvestorPlaceInvestorPlace

5/17/2014 http://investorplace.com/2014/04/50-blue-chip-dividend-stocks-q1/print

MS: http://studio-5.financialcontent.com/investplace/quote?Symbol=MS 7.

Dependable Dividend Stocks: http://investorplace.com/dividend-paying-stocks/ 8.

AIG: http://studio-5.financialcontent.com/investplace/quote?Symbol=AIG 9.

AIG swinging to a profit after a year-ago loss: http://www.reuters.com/article/2014/02/13/us-aig-results-

idUSBREA1C1VR20140213

10.

Dependable Dividend Stock: http://investorplace.com/dividend-paying-stocks/ 11.

CB: http://studio-5.financialcontent.com/investplace/quote?Symbol=CB 12.

Next Page: http://investorplace.com/2014/03/50-blue-chip-dividend-stocks-q1/2/ 13.

CMCSA: http://studio-5.financialcontent.com/investplace/quote?Symbol=CMCSA 14.

proposed merger: http://investorplace.com/2014/02/will-comcast-cmcsa-time-warner-cable-twc-kill-tv/ 15.

TWC: http://studio-5.financialcontent.com/investplace/quote?Symbol=TWC 16.

its deal: http://slant.investorplace.com/2014/02/netflix-comcast-nflx-stock/ 17.

NFLX: http://studio-5.financialcontent.com/investplace/quote?Symbol=NFLX 18.

reported talks: http://www.usatoday.com/story/money/2014/03/23/apple-comcast-talks/6806363/ 19.

AAPL: http://studio-5.financialcontent.com/investplace/quote?Symbol=AAPL 20.

DHR: http://studio-5.financialcontent.com/investplace/quote?Symbol=DHR 21.

GD: http://studio-5.financialcontent.com/investplace/quote?Symbol=GD 22.

GM: http://studio-5.financialcontent.com/investplace/quote?Symbol=GM 23.

GM might not necessarily have all the qualities youd normally tether to the moniker dividend stocks,:

http://investorplace.com/2014/01/gm-stock-dividend-stocks/

24.

Next Page: http://investorplace.com/2014/03/50-blue-chip-dividend-stocks-q1/3/ 25.

HPQ: http://studio-5.financialcontent.com/investplace/quote?Symbol=HPQ 26.

NE: http://studio-5.financialcontent.com/investplace/quote?Symbol=NE 27.

QCOM: http://studio-5.financialcontent.com/investplace/quote?Symbol=QCOM 28.

the Toq: http://investorplace.com/2014/03/toq-smartwatch-review-qcom/ 29.

O: http://studio-5.financialcontent.com/investplace/quote?Symbol=O 30.

Next Page: http://investorplace.com/2014/03/50-blue-chip-dividend-stocks-q1/4/ 31.

SHW: http://studio-5.financialcontent.com/investplace/quote?Symbol=SHW 32.

WMT: http://studio-5.financialcontent.com/investplace/quote?Symbol=WMT 33.

Kyle Woodley: http://www.investorplace.com/author/kyle-woodley/ 34.

InvestorPlace.com: http://investorplace.com/ 35.

@KyleWoodley: https://twitter.com/KyleWoodley 36.

Source URL: http://investorplace.com/2014/04/50-blue-chip-dividend-stocks-q1/

Short URL: http://invstplc.com/1hrzito

Copyright 2014 InvestorPlace Media, LLC. All rights reserved. 700 Indian Springs Drive, Lancaster, PA

17601.

Page 7of 7 50 Blue-Chip Dividend Stocks Increasing Payouts in Q1 2014 | InvestorPlaceInvestorPlace

5/17/2014 http://investorplace.com/2014/04/50-blue-chip-dividend-stocks-q1/print

Vous aimerez peut-être aussi

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- 9 Little Known Strategies ThatDocument4 pages9 Little Known Strategies ThatCaptBB250% (2)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Biology Mapping GuideDocument28 pagesBiology Mapping GuideGazar100% (1)

- Origins and Rise of the Elite Janissary CorpsDocument11 pagesOrigins and Rise of the Elite Janissary CorpsScottie GreenPas encore d'évaluation

- Insider Threat ManagementDocument48 pagesInsider Threat ManagementPatricia LehmanPas encore d'évaluation

- Pub - Essentials of Nuclear Medicine Imaging 5th Edition PDFDocument584 pagesPub - Essentials of Nuclear Medicine Imaging 5th Edition PDFNick Lariccia100% (1)

- Exp 8 - GPG - D12B - 74 PDFDocument4 pagesExp 8 - GPG - D12B - 74 PDFPRATIKSHA WADIBHASMEPas encore d'évaluation

- 40 Years After Embargo, OPEC Is Over A BarrelDocument4 pages40 Years After Embargo, OPEC Is Over A BarrelCaptBB2Pas encore d'évaluation

- 10 Resources For Code ReviewDocument3 pages10 Resources For Code ReviewCaptBB2Pas encore d'évaluation

- 10 Great Mutual Funds That Deliver High IncomeDocument6 pages10 Great Mutual Funds That Deliver High IncomeCaptBB2Pas encore d'évaluation

- Senior Manager-Energy Utilities & Mining (Upstream Energy Consultant)Document3 pagesSenior Manager-Energy Utilities & Mining (Upstream Energy Consultant)CaptBB2Pas encore d'évaluation

- Senior Manager/Director - Strategy - Government - Consulting - RiyadhDocument2 pagesSenior Manager/Director - Strategy - Government - Consulting - RiyadhCaptBB2Pas encore d'évaluation

- 09 Reliability ExcelDocument5 pages09 Reliability ExcelCaptBB2Pas encore d'évaluation

- Emerging Markets: Think Local For Global Expansion: To Receive 8 Free Articles Per MonthDocument3 pagesEmerging Markets: Think Local For Global Expansion: To Receive 8 Free Articles Per MonthCaptBB2Pas encore d'évaluation

- 4 Contrarian Income FundsDocument3 pages4 Contrarian Income FundsCaptBB2Pas encore d'évaluation

- Hindustan Motors Case StudyDocument50 pagesHindustan Motors Case Studyashitshekhar100% (4)

- DIN Flange Dimensions PDFDocument1 pageDIN Flange Dimensions PDFrasel.sheikh5000158Pas encore d'évaluation

- The European Journal of Applied Economics - Vol. 16 #2Document180 pagesThe European Journal of Applied Economics - Vol. 16 #2Aleksandar MihajlovićPas encore d'évaluation

- 2010 - Impact of Open Spaces On Health & WellbeingDocument24 pages2010 - Impact of Open Spaces On Health & WellbeingmonsPas encore d'évaluation

- Antenna VisualizationDocument4 pagesAntenna Visualizationashok_patil_1Pas encore d'évaluation

- Three-D Failure Criteria Based on Hoek-BrownDocument5 pagesThree-D Failure Criteria Based on Hoek-BrownLuis Alonso SAPas encore d'évaluation

- CMC Ready ReckonerxlsxDocument3 pagesCMC Ready ReckonerxlsxShalaniPas encore d'évaluation

- House Rules For Jforce: Penalties (First Offence/Minor Offense) Penalties (First Offence/Major Offence)Document4 pagesHouse Rules For Jforce: Penalties (First Offence/Minor Offense) Penalties (First Offence/Major Offence)Raphael Eyitayor TyPas encore d'évaluation

- Malware Reverse Engineering Part 1 Static AnalysisDocument27 pagesMalware Reverse Engineering Part 1 Static AnalysisBik AshPas encore d'évaluation

- Memo Roll Out Workplace and Monitoring Apps Monitoring Apps 1Document6 pagesMemo Roll Out Workplace and Monitoring Apps Monitoring Apps 1MigaeaPas encore d'évaluation

- PLC Networking with Profibus and TCP/IP for Industrial ControlDocument12 pagesPLC Networking with Profibus and TCP/IP for Industrial Controltolasa lamessaPas encore d'évaluation

- ITU SURVEY ON RADIO SPECTRUM MANAGEMENT 17 01 07 Final PDFDocument280 pagesITU SURVEY ON RADIO SPECTRUM MANAGEMENT 17 01 07 Final PDFMohamed AliPas encore d'évaluation

- Prof Ram Charan Awards Brochure2020 PDFDocument5 pagesProf Ram Charan Awards Brochure2020 PDFSubindu HalderPas encore d'évaluation

- 2014 mlc703 AssignmentDocument6 pages2014 mlc703 AssignmentToral ShahPas encore d'évaluation

- Pradhan Mantri Gramin Digital Saksharta Abhiyan (PMGDISHA) Digital Literacy Programme For Rural CitizensDocument2 pagesPradhan Mantri Gramin Digital Saksharta Abhiyan (PMGDISHA) Digital Literacy Programme For Rural Citizenssairam namakkalPas encore d'évaluation

- Chennai Metro Rail BoQ for Tunnel WorksDocument6 pagesChennai Metro Rail BoQ for Tunnel WorksDEBASIS BARMANPas encore d'évaluation

- TWP10Document100 pagesTWP10ed9481Pas encore d'évaluation

- ERP Complete Cycle of ERP From Order To DispatchDocument316 pagesERP Complete Cycle of ERP From Order To DispatchgynxPas encore d'évaluation

- Clark DietrichDocument110 pagesClark Dietrichikirby77Pas encore d'évaluation

- Algorithms For Image Processing and Computer Vision: J.R. ParkerDocument8 pagesAlgorithms For Image Processing and Computer Vision: J.R. ParkerJiaqian NingPas encore d'évaluation

- Unit 3 Computer ScienceDocument3 pagesUnit 3 Computer ScienceradPas encore d'évaluation

- DMDW Mod3@AzDOCUMENTS - inDocument56 pagesDMDW Mod3@AzDOCUMENTS - inRakesh JainPas encore d'évaluation

- Reflection Homophone 2Document3 pagesReflection Homophone 2api-356065858Pas encore d'évaluation

- Nama: Yetri Muliza Nim: 180101152 Bahasa Inggris V Reading Comprehension A. Read The Text Carefully and Answer The Questions! (40 Points)Document3 pagesNama: Yetri Muliza Nim: 180101152 Bahasa Inggris V Reading Comprehension A. Read The Text Carefully and Answer The Questions! (40 Points)Yetri MulizaPas encore d'évaluation

- Controle de Abastecimento e ManutençãoDocument409 pagesControle de Abastecimento e ManutençãoHAROLDO LAGE VIEIRAPas encore d'évaluation