Académique Documents

Professionnel Documents

Culture Documents

SCH 3

Transféré par

suniljaithwarDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

SCH 3

Transféré par

suniljaithwarDroits d'auteur :

Formats disponibles

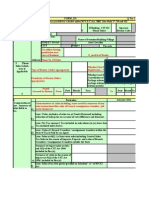

AUDIT REPORT

PART-3

SCHEDULE-III

1. PART-A Computation of Net Turnover of Sales liable to tax:

Sr. As per Return As per Audit

Particulars Difference

No. (Rs.) (Rs.)

1 2 3 4 5

a) Gross turnover of sales including, taxes as

well as turnover of non sales transactions

like value of Branch Transfer, Consignment

Transfers, job work charges etc

b) Less: - Turn-Over of Sales (including taxes

thereon) including inter-state Consignments

and Branch Transfers Covered under

Schedule I, II, IV or V

c) Balance:- Turn-Over Considered under

this Schedule (a-b)

d) Less:-Value of Goods Return (inclusive of

tax), including reduction of sales price on

account of rate difference and discount.

e) Balance: -Turnover of sales including, taxes

as well as turnover of non sales transactions

like value of Branch Transfer, Consignment

Transfers, job work charges etc [(c)-(d)]

f) Less:-Turnover of sales under composition

scheme(s), other than Works Contracts

under composition option (Computation of

turnover of sales liable to tax to be shown

in Part B)

g) Turnover of sales (excluding taxes) relating

to on-going works contracts (Computation

of turnover of sales liable to tax to be

shown in Part C)

h) Turnover of sales (excluding taxes) relating

to on-going leasing contracts (Computation

of turnover of sales liable to tax to be

shown in Part D)

Seal And Signature Of The Auditor 32

i) Balance:- Net turnover of sales including,

taxes, as well as turnover of non sales

transactions like Branch Transfers /

Consignment Transfers and job works

charges, etc [ (e) – (f+g+h)]

j) Less:-Net Tax amount (Tax included in

sales shown in (a) above less Tax included

in (b) and (d) above)

k) Less:-Value of Branch Transfers/

Consignment Transfers within the State if

the tax is to be paid by the Agent.

l) Less:-Sales u/s 8 (1) i.e. Interstate Sales

including Central Sales Tax, Sales in the

course of imports, exports and value of

Branch Transfers/ Consignment transfers

outside the State (Schedule-VI)

m) Less:-Sales of taxable goods fully exempted u/s.

8 other than sales under section 8(1) and covered

in Box 1(l)

n) Non-taxable Labour and other charges / expenses

for Execution of Works Contract

o) Amount paid by way of price for sub-contract

p) Sales of tax-free goods specified in Schedule A

q) Less:- Labour/Job work charges

r) Other allowable reductions/deductions, if any

(Please specify)

s) Total:- Net Turnover of Sales Liable to tax

[(i) - (j+k+l+m+n+o+p+q+r)]

Seal And Signature Of The Auditor 33

2. PART-B Computation of Net Turnover of Sales liable to tax under Composition:

As per Return As per Audit Difference

Sr.

Particulars

No. (Rs.) (Rs.) (Rs.)

1 2 3 4 5

A) Turnover of sales (excluding taxes) under

composition scheme(s) [Same as 1(f)]

B) RETAILER

a) Total Turnover of Sales

b) Less:-Turnover of sales of goods excluded from

the Composition Scheme

c) Less:-Allowable deductions such as Goods

Return etc.

d) Balance: Net turnover of sales liable to tax under

composition option [ (a) – (b+c)]

C) RESTAURANT , CLUB, CATERER ETC.

a) Total turnover of sales

D) BAKER

a) Total turnover of sales

E) SECOND HAND MOTOR VEHICLES

DEALER

a) Total turnover of sales

b) Less: Allowable reductions / deductions

c) Balance: Net turnover of sales liable to tax under

composition option

(a – b)

F) Total net turnover of sales liable to tax under

composition option [2(B)(d)+2(C )

(a)+2(D)(a)+2(E)(c )]

3. PART-C

Computation of net turnover of sales relating to on-going works contracts liable to tax under section

96(1)(g) the MVAT Act, 2002:

Particulars Amount (Rs.)

a) Turnover of sales (excluding tax / composition)

during the period [Same as Box 1(g)]

b) Less:-Turnover of sales exempted from tax

c) Less:-Deductions u/s 6 of the ‘Earlier Law’

d) Less:-Deductions u/s 6(A) of the ‘Earlier Law’

e) Balance: Net turnover of sales liable to tax /

composition [(a)] –[ (b+c+d)]

Seal And Signature Of The Auditor 34

4. PART-D .

Computation of net turnover of sales relating to on-going leasing contracts liable to tax under

Section 96(1) (f) of the MVAT Act, 2002:

Particulars Amount (Rs.)

1 2 3 4 5

a) Turnover of sales (excluding taxes) Relating

to On-going Leasing Contract [same as Box

1(h)]

b) Less: Turnover of sales exempted from tax

c) Balance: Net turnover of sales liable to tax

(a –b)

5) Computation of tax payable under the MVAT Act

Rate of As per Returns As per Audit Difference in

Tax Tax Amount Tax Amount Tax Amount

Turnover of Sales Turnover of Sales

(%) (Rs.) (Rs.) (Rs.)

liable to tax (Rs.) liable to tax (Rs.)

a) 12.50

b) 8.00

c) 4.00

d)

e)

TOTAL

5A) Sales Tax collected in Excess of the As per Returns As per Audit Difference

Amount of Tax payable

6) Computation of Purchases Eligible for Set-off

Particulars As per Returns As per Audit Difference

(Rs.) (Rs.) (Rs.)

a) Total Turn-Over of Purchases

including taxes, value of Branch

Transfers / consignment transfers

received and Labour/ job work

charges.

b) Less:- Turn-Over of Purchases

Covered under Schedule I, II, IV or V

c) Balance:- Turn-Over of Purchases

Considered under this Schedule

(a-b)

d) Less:-Value of Goods Return

(inclusive of tax), including reduction

of purchase price on account of rate

difference and discount.

Seal And Signature Of The Auditor 35

e) Less:-Imports (High seas purchases)

f) Less:-Imports (Direct imports)

g) Less:-Inter-State purchases

h) Less:-Inter-State Branch Transfers/

Consignment Transfers received

i) Less:-Within the State Branch

Transfers / Consignment Transfers

received where tax is to be paid by an

Agent

j) Less:-Within the State purchases of

taxable goods from un-registered

dealers

k) Less:-Purchases of the taxable goods

from registered dealers under MVAT

Act, 2002 and which are not eligible

for set-off

l) Less:-Within the State purchases of

taxable goods which are fully

exempted from tax u/s 8 but not

covered under section 8(1)

m) Less:- Within the State purchases of

tax-free goods specified in Schedule A

n) Less:-Other allowable deductions

/reductions, if any. (Please Specify)

o) Balance: Within the State purchases

of taxable goods from registered

dealers eligible for set-off

(c) – (d+e+f+g+h+i+j+k+l+m+n)

7) Tax rate wise break-up of Purchases from registered dealers eligible for set-off as per Box

6(o) above

As per Returns As per Audit

Rate of

Sr. Tax

Net Turnover of Net Turnover Difference in

Tax Amount

No. Purchases Tax Amount of Purchases

(%) Tax (Rs.)

Eligible for Set (Rs.) Eligible for (Rs.)

–Off (Rs.) Set –Off (Rs.)

a) 12.50

b) 8.00

c) 4.00

d)

Seal And Signature Of The Auditor 36

e)

TOTAL

8) Computation of set-off claim.

Difference

As per Return As per Audit

Sr. in Tax

Particulars

No. Amount

Purchase Tax Purchase Tax

(Rs.)

Value Rs. Amount Value Rs. Amount

a) Within the State

purchases of taxable

goods from registered

dealers eligible for set-

off as per Box 7 above

b) Less: - Reduction in the

amount of set off u/r 53

(1) of the corresponding

purchase price of

(Schedule C, D & E) the

goods

Less: - Reduction in the

amount of set off u/r 53

(2) of the of the

corresponding purchase

price of (Schedule B, C,

D & E) the goods

c) Less: - Reduction in the

amount of set off under

any other Sub-rule of

rule 53

d) Amount of Set-off

available (a) – (c+b)

Seal And Signature Of The Auditor 37

9) Computation of Tax Payable

Sr. Particulars As per Return As per Audit Difference

No. (Rs.) (Rs.)

9A) Aggregate of credit available

a)

Set off available as per Box 8 (d)

b) Amount already paid (Details as

Per ANNEXURE-A)

c) Excess Credit if any, as per

Schedule I, II, IV, or V to be

adjusted against the liability as per

this Schedule

d) Adjustment of ET paid under

Maharashtra Tax on Entry of Goods

into Local Areas Act, 2002/ Motor

Vehicle Entry Tax Act, 1987

e) Amount Credited as per Refund

adjustment order (Details as Per

ANNEXURE-A)

f) Works Contract TDS

g) Any other (Please Specify)

h) Total Available Credit

(a+b+c+d+e+f+g)

B) Sales tax payable and adjustment of CST / ET payable against available credit

1 2 3 4 5

a) Sales Tax Payable as per Box 5

b) Excess Credit as per this Schedule

adjusted on account of M.VAT

payable, if any, as per Schedule I, II,

IV or V

c) Adjustment on account of CST

payable as per Schedule VI for the

period under Audit

d) Adjustment on account of ET

payable under the Maharashtra Tax

on Entry of Goods into Local Areas

Act, 2002/Motor Vehicle Entry Tax

Seal And Signature Of The Auditor 38

Act, 1987

e) Amount of Sales Tax Collected in

Excess of the amount of Sales Tax

payable, if any (As per Box 5A)

f) Interest Payable under Section 30 (2)

g) Total Amount.(a+b+c+d+e+f)

9C) Tax payable or Amount of Refund Available

a) Total Amount payable as per Box

9B(g)

b) Aggregate of Credit Available as

per Box 9A(h)

c) Total Amount Payable (a-b)

d) Total Amount Refundable (b-a)

Seal And Signature Of The Auditor 39

Vous aimerez peut-être aussi

- Audit Report PART-3 Schedule-Iv: Eligibility Certificate (EC) No. Certificate of Entitlement (COE) NoDocument12 pagesAudit Report PART-3 Schedule-Iv: Eligibility Certificate (EC) No. Certificate of Entitlement (COE) NosuniljaithwarPas encore d'évaluation

- Audit Report PART-3 Schedule-IDocument6 pagesAudit Report PART-3 Schedule-IsuniljaithwarPas encore d'évaluation

- Form 231Document14 pagesForm 231Jignesh Dinesh MewadaPas encore d'évaluation

- Form 231Document9 pagesForm 231Pushkar JoshiPas encore d'évaluation

- Form 231 Sharp EnterprisesDocument8 pagesForm 231 Sharp Enterprisesqaid_duraiyaPas encore d'évaluation

- Form 231 Errors Sno Error Line No Error BOX No Error Box DescriptionDocument9 pagesForm 231 Errors Sno Error Line No Error BOX No Error Box DescriptionnitinnawarPas encore d'évaluation

- Vat R2 2016 - 2017Document4 pagesVat R2 2016 - 2017Hotel sapphirePas encore d'évaluation

- Form 231Document9 pagesForm 231sanjay jadhav100% (5)

- CST AppealDocument3 pagesCST AppealvnbanjanPas encore d'évaluation

- New VAT Audit FormatDocument12 pagesNew VAT Audit FormatTarifPas encore d'évaluation

- Mvat f231Document5 pagesMvat f231pgotaphoePas encore d'évaluation

- Form 231 Errors Sno Error Line No Error BOX No Error Box DescriptionDocument9 pagesForm 231 Errors Sno Error Line No Error BOX No Error Box DescriptionNishant GoyalPas encore d'évaluation

- 27860151571V 27860151571C Venktesh Trading CompanyDocument7 pages27860151571V 27860151571C Venktesh Trading CompanyAdesh NaharPas encore d'évaluation

- Form VAT R2Document10 pagesForm VAT R2murarirahul80% (5)

- Form VAT-R2: (See Rule 16 (2) ) DdmmyyDocument7 pagesForm VAT-R2: (See Rule 16 (2) ) Ddmmyygovind_2363Pas encore d'évaluation

- Form Vat - IiiDocument4 pagesForm Vat - IiihrsolutionPas encore d'évaluation

- Please Enable Macro To Use This Form As Per The Instructions Given BelowDocument12 pagesPlease Enable Macro To Use This Form As Per The Instructions Given Belowanilshukla1969Pas encore d'évaluation

- Form Jvat 409Document2 pagesForm Jvat 409Suzanne BradyPas encore d'évaluation

- GSTR-9C 09awdpk5848f1zb 29122023Document8 pagesGSTR-9C 09awdpk5848f1zb 29122023suraj888999Pas encore d'évaluation

- Form VAT-R2: (See Rule 16 (2) ) DdmmyyDocument4 pagesForm VAT-R2: (See Rule 16 (2) ) DdmmyyPRAHLAD_KUMAR8424Pas encore d'évaluation

- 18-19 - CT - Annual - 19dec19 - 05.35PM - SEE & Financial InstitutionDocument2 pages18-19 - CT - Annual - 19dec19 - 05.35PM - SEE & Financial InstitutionWUTYI THINNPas encore d'évaluation

- Revised Quarterly Return Under Section 24 of The Bihar Value Added Tax Act, 2005Document20 pagesRevised Quarterly Return Under Section 24 of The Bihar Value Added Tax Act, 2005gurudev21Pas encore d'évaluation

- 1 67 8 (A) Tax Amount in Box 8 (A) 2 68 8 (A) Tax Amount in Box 8 (A) 3 67,68 8 Duplicate Tax Rates in Line Nos 67,68Document12 pages1 67 8 (A) Tax Amount in Box 8 (A) 2 68 8 (A) Tax Amount in Box 8 (A) 3 67,68 8 Duplicate Tax Rates in Line Nos 67,68Ganesh ChavanPas encore d'évaluation

- GSTR-9C 09absfa5984a1z3 29122023Document8 pagesGSTR-9C 09absfa5984a1z3 29122023suraj888999Pas encore d'évaluation

- Monthly VAT Return SampleDocument35 pagesMonthly VAT Return SampleJohnHKyeyunePas encore d'évaluation

- Monthly VAT ReturnDocument34 pagesMonthly VAT ReturnEdris MatovuPas encore d'évaluation

- 27201451249V M1 1703 Hist PDFDocument6 pages27201451249V M1 1703 Hist PDFPriyanka AgrawalPas encore d'évaluation

- Creditable Tax Withheld: Goods ManufacturedDocument12 pagesCreditable Tax Withheld: Goods ManufacturedNino FrondozoPas encore d'évaluation

- Useful Life or 60 Mos. (Whichever Is Shorter) : (Attach Additional Sheet, If Necessary)Document6 pagesUseful Life or 60 Mos. (Whichever Is Shorter) : (Attach Additional Sheet, If Necessary)Katherine OlidanPas encore d'évaluation

- Form CST Errors Sno Error Box Description Error Line No Error Box NoDocument12 pagesForm CST Errors Sno Error Box Description Error Line No Error Box NoVivek PatilPas encore d'évaluation

- Kanya KarungalDocument13 pagesKanya KarungalramPas encore d'évaluation

- Form 23ACDocument6 pagesForm 23ACNikkhil GuptaaPas encore d'évaluation

- FIN AL: Form GSTR-9CDocument12 pagesFIN AL: Form GSTR-9CShrishti enterprisesPas encore d'évaluation

- GSTR9 18acvpa7546a1zk 032022Document8 pagesGSTR9 18acvpa7546a1zk 032022SUBHASH MOURPas encore d'évaluation

- Income Statement and Balance SheetDocument20 pagesIncome Statement and Balance Sheetpankaj tiwariPas encore d'évaluation

- 201 Oct To Dec 2011Document4 pages201 Oct To Dec 2011Ishan KhandelwalPas encore d'évaluation

- Egypt VAT Return Configurations Note 2538979Document6 pagesEgypt VAT Return Configurations Note 2538979IkramPas encore d'évaluation

- GSTR9 08aaafu3205h1zh 032022Document8 pagesGSTR9 08aaafu3205h1zh 032022Deepanshu AgarwalPas encore d'évaluation

- Useful Life or 60 Mos. (Whichever Is Shorter) : (Attach Additional Sheet, If Necessary)Document3 pagesUseful Life or 60 Mos. (Whichever Is Shorter) : (Attach Additional Sheet, If Necessary)Mark Alvin Tallongon100% (2)

- GSTR9 19GCBPS5582Q1ZH 032023Document8 pagesGSTR9 19GCBPS5582Q1ZH 032023nirmalku2061Pas encore d'évaluation

- Quarterly Tax Value-Added Return: Kawanihan NG Rentas InternasDocument5 pagesQuarterly Tax Value-Added Return: Kawanihan NG Rentas InternasStephanie LayloPas encore d'évaluation

- Mushak-9.1 VAT Return On 11.JAN.2023Document6 pagesMushak-9.1 VAT Return On 11.JAN.2023Mac TanzinPas encore d'évaluation

- Mushak-9.1 VAT Return On 11.JAN.2023Document6 pagesMushak-9.1 VAT Return On 11.JAN.2023Mac TanzinPas encore d'évaluation

- (Attach Additional Sheet, If Necessary) : Useful Life or 60 Mos. (Whichever Is Shorter)Document2 pages(Attach Additional Sheet, If Necessary) : Useful Life or 60 Mos. (Whichever Is Shorter)Bianca LizardoPas encore d'évaluation

- GST Audit Report PDFDocument12 pagesGST Audit Report PDFSagar BadaniPas encore d'évaluation

- US Internal Revenue Service: f1065sm3 AccessibleDocument3 pagesUS Internal Revenue Service: f1065sm3 AccessibleIRSPas encore d'évaluation

- PART1 (Details of Turnover/transfers) Deductions:: Form Rt3Document4 pagesPART1 (Details of Turnover/transfers) Deductions:: Form Rt3balaramPas encore d'évaluation

- PART1 (Details of Turnover/transfers) Deductions:: Form Rt3Document4 pagesPART1 (Details of Turnover/transfers) Deductions:: Form Rt3balaramPas encore d'évaluation

- New VAT Audit FormatDocument12 pagesNew VAT Audit FormatparulshinyPas encore d'évaluation

- GSTR-9C 04aaefk7065p3zu 032022 PDFDocument9 pagesGSTR-9C 04aaefk7065p3zu 032022 PDFVineet KhuranaPas encore d'évaluation

- TallyHelp - Official Online Help Channel of Tally SolutionsDocument7 pagesTallyHelp - Official Online Help Channel of Tally Solutionswww.TdsTaxIndia.comPas encore d'évaluation

- GSTR-9C 27aadcb2230m1zt 032018Document12 pagesGSTR-9C 27aadcb2230m1zt 032018deepika pandeyPas encore d'évaluation

- Sub. Code 205415/ 205515/ 205615/ 205715/ 205815Document10 pagesSub. Code 205415/ 205515/ 205615/ 205715/ 205815qaqc marineryPas encore d'évaluation

- Tnvat Form WW Fy 15-16Document30 pagesTnvat Form WW Fy 15-16samaadhuPas encore d'évaluation

- Mushak-9.1 VAT Return On 17.DEC.2023Document7 pagesMushak-9.1 VAT Return On 17.DEC.2023Md. Abu NaserPas encore d'évaluation

- GSTR9 23apjps3159l1zg 032022Document8 pagesGSTR9 23apjps3159l1zg 032022sales candoPas encore d'évaluation

- (Attach Additional Sheet, If Necessary) : Useful Life or 60 Mos. (Whichever Is Shorter)Document3 pages(Attach Additional Sheet, If Necessary) : Useful Life or 60 Mos. (Whichever Is Shorter)commoPas encore d'évaluation

- Schaum's Outline of Principles of Accounting I, Fifth EditionD'EverandSchaum's Outline of Principles of Accounting I, Fifth EditionÉvaluation : 5 sur 5 étoiles5/5 (3)

- SCH 5Document6 pagesSCH 5suniljaithwarPas encore d'évaluation

- SCH 2Document5 pagesSCH 2suniljaithwarPas encore d'évaluation

- AnnexureDocument16 pagesAnnexuresuniljaithwarPas encore d'évaluation

- 704 - VatDocument20 pages704 - VatsuniljaithwarPas encore d'évaluation

- SCH 6Document4 pagesSCH 6suniljaithwarPas encore d'évaluation

- Quiz in ObligationDocument8 pagesQuiz in ObligationSherilyn BunagPas encore d'évaluation

- Report of Checks Issued 2023Document1 pageReport of Checks Issued 2023Jahzeel RubioPas encore d'évaluation

- Unit II Methods of Valuing Material IssuesDocument21 pagesUnit II Methods of Valuing Material IssuesLeemaRosaline Simon0% (1)

- Ratio Analysis at Amararaja Batteries Limited (Arbl) A Project ReportDocument79 pagesRatio Analysis at Amararaja Batteries Limited (Arbl) A Project Reportfahim zamanPas encore d'évaluation

- Skanray Technologies Pvt. LTD: Company ProfileDocument33 pagesSkanray Technologies Pvt. LTD: Company ProfileMars NaspekovPas encore d'évaluation

- Securities Regulation OutlineDocument55 pagesSecurities Regulation OutlineJosh Sawyer100% (1)

- Salary Slip-Format 547Document2 pagesSalary Slip-Format 547dinescPas encore d'évaluation

- INCOME TAX OF INDIVIDUALS Part 1Document3 pagesINCOME TAX OF INDIVIDUALS Part 1Abby TañafrancaPas encore d'évaluation

- Entrepreneurial Finance - Luisa AlemanyDocument648 pagesEntrepreneurial Finance - Luisa Alemanytea.liuyudanPas encore d'évaluation

- Slide Commission SecuritiesDocument4 pagesSlide Commission SecuritiesNADHIRAH DIYANA BINTI AHMAD LATFIPas encore d'évaluation

- Personal Loan Application Form Borang Permohonan Pinjaman PeribadiDocument6 pagesPersonal Loan Application Form Borang Permohonan Pinjaman PeribadiMohd AzhariPas encore d'évaluation

- VPS Form SampleDocument7 pagesVPS Form SampleMuhammad ShariqPas encore d'évaluation

- 3.1.projected Balance SheetDocument1 page3.1.projected Balance Sheetdhimanbasu1975Pas encore d'évaluation

- Chapter 21 The Influence of Monetary and Fiscal Policy On Aggregate DemandDocument50 pagesChapter 21 The Influence of Monetary and Fiscal Policy On Aggregate DemandRafiathsPas encore d'évaluation

- Books of Accounts Double Entry System With Answers by AlagangwencyDocument4 pagesBooks of Accounts Double Entry System With Answers by AlagangwencyHello KittyPas encore d'évaluation

- Industrial Analysis-Financial Services: Presented To - Prof. Tarun Agarwal SirDocument19 pagesIndustrial Analysis-Financial Services: Presented To - Prof. Tarun Agarwal SirGEETESH KUMAR JAINPas encore d'évaluation

- Dfi 501 Course OutlineDocument3 pagesDfi 501 Course OutlineblackshizoPas encore d'évaluation

- Strategic Financial ManagementDocument96 pagesStrategic Financial Managementansary75Pas encore d'évaluation

- PA Sample MCQs 2Document15 pagesPA Sample MCQs 2ANH PHẠM QUỲNHPas encore d'évaluation

- GDP and gnp1Document18 pagesGDP and gnp1AakanshasoniPas encore d'évaluation

- DrewDocument2 pagesDrewmusunna galibPas encore d'évaluation

- UntitledDocument2 pagesUntitledarmando González100% (2)

- Research ReportDocument69 pagesResearch ReportSuraj DubeyPas encore d'évaluation

- Lembar Jawaban 2-BUKU BESARDocument13 pagesLembar Jawaban 2-BUKU BESAREnrico Jovian S SPas encore d'évaluation

- Basic Details: Indian Oil Corporation Eprocurement PortalDocument3 pagesBasic Details: Indian Oil Corporation Eprocurement PortalamitjustamitPas encore d'évaluation

- READS S Worksheet 1Document3 pagesREADS S Worksheet 1Auguste Anthony SisperezPas encore d'évaluation

- Ch. 5 Financial AnalysisDocument34 pagesCh. 5 Financial AnalysisfauziyahPas encore d'évaluation

- Time Value of MoneyDocument22 pagesTime Value of Moneyshubham abrolPas encore d'évaluation

- Technical Indicators: - Stochastic Oscillator - Relative Strength Index - Moving Average Convergence-DivergenceDocument32 pagesTechnical Indicators: - Stochastic Oscillator - Relative Strength Index - Moving Average Convergence-DivergenceChartSniperPas encore d'évaluation

- Foreign Exchange Market: Unit HighlightsDocument29 pagesForeign Exchange Market: Unit HighlightsBivas MukherjeePas encore d'évaluation