Académique Documents

Professionnel Documents

Culture Documents

Contract Revision

Transféré par

AlizaShah0 évaluation0% ont trouvé ce document utile (0 vote)

1K vues46 pageshelpful notes for llb contract revision

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documenthelpful notes for llb contract revision

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

1K vues46 pagesContract Revision

Transféré par

AlizaShahhelpful notes for llb contract revision

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 46

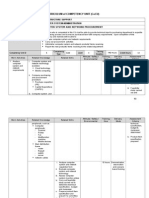

Revision Plan Contract Law 17 topics

1. Themes & Ideas

2. History

a. Classical

b. Neo Classical

3. Contemporary - Relational theory

4. Formation (COVERED FOR MOCKS)

a. Offer&Acceptance

b. Consideration&Estoppel

c. Intention to create legal relations&Capacity, Privity

5. Content

a. Express Terms & Representations

b. Implied Terms

c. Categorisation of terms

d. Exclusion Clauses

6. Vitiating Factors

a. MisRep

b. Undue Influence

c. Duress

7. Discharge of Contract

a. Agreement

b. Performance

c. Breach

Basics of Contract (Lecture 1)

Unilateral: performed by/affecting 1 person/party.t

Bilateral: performed by/affecting both sides

Promises & Agreements

Gratuitous promises (unilateral) - Promise in return for an act (bilateral) - Promise in return for a

promise (bilateral)

Consensus ad idem -the meeting of minds: the two parties are in agreement as to the terms of the

contract.

Standard Forms Some Businesses use standard terms for increased efficiency, reduces negotiation &

introduces certainty

Written in favor of the party presenting them.

Used by large corporations to deal on their terms & exclude or limit liability

Impersonal not open to negotiation

The small print

Special Relationships - Some contracts reflect a special relationship. These are different to routine

contracts. The nature of the agreement imposes different standards on one or more of the parties.

The relationship is based on trust & confidence Rights & Powers must be exercised in good faith.

Extends beyond contract into Trusts.

The historical Context of Contract Law (Lecture 2)

Two views explaining the emergence of contract law

1. Classical Contract Law Develops a results of the social & economic changes in the 18

th

century

informed by political ideas of thinkers like Adam Smith & John Locke.

2. Although there are major changes in society contract law develops over a much longer period &

the beginnings can be seen much earlier. The link in 1 is overstated.

Common law- emerges as court develops common approach (cases) [Common law- individualist

bargain must be upheld]

Statutes- products of parliament

Equity- emerges via Lord Chancellors court .. Courts merge contract & equity in 1873 [Equity-

conscience & fairness]

The Changing Nature of the 18

th

Century

1) The Industrial Revolution

2) Shift from property to trade- Atiyahs view point

3) Classical Economists (Smith, laissez- faire)

4) New political ideas (Hobbes, Locke)

5) Development of Government & the relationship to the people.

Some Theorists views on the emergence of classical contract

Hobbes perceived man to be selfish & presumed that the need for monarchy is simply to have safety

thus establishing an individualistic approach to contract

John Locke the relationship of the government & the people was one of a social contract in which the

citizens surrender their freedom in return for safety

Adam Smith the reason for the emergence of classical contract is due to economic rationale. Mans

desire to become wealthy & happy opened gateways for contracts to be formed. This shows an

individualistic approach to contract as parties enter on their own accounts & for their own purposes.

Max Weber argued thats contractual freedom is based on the economic state in which the contract is

formed in. His view is that freedom of contract is far more dominant than it used to be with one party

being at a bigger advantage than the other even if both parties freely entered the contract.

Atiyah the rise of classical contract law was due to the consequences of the industrial revolution. He

talks about the notion of fairness to bargain it was established at the birth of classical contract that it

should be done so fairly by the Chancery.

Simpson believe that classical contract law existed way before the economic consequence of the

Industrial Revolution & states that it existed during the Tudor period.

Neo-Classical Contract (Lecture 3)

New free-market economy contracting included:

(i) Parties do not owe any duty to each other at the outset.

(ii) Parties bargain or negotiate

(iii) Each party relies on his/her own judgment

(iv) Agreements freely made without duress.

(v) Contents are agreed between the parties

(vi) Each party is bound & must pay for failure to perform

Established what you need for a valid contract; an offer. Something capable of acceptance; Offer =

clear & unambiguous. Acceptance- The offer itself must be accepted. Intention- the parties must

intend it to be a valid agreement. Capacity - for example, certain limitations are placed upon parties

such as minors, mentally disordered persons etc. Consideration - The price paid for the promise

bought. This is probably the most contentious & difficult area in practice

Notion of fair bargains became almost irrelevant. Previously the courts would have taken into account

the fairness of the bargains, however with the new ideas from the notion of free will bargains, the

court sought that the decisions made were individualistic & so the fairness of the consideration

applied became irrelevant.

Attack on Freedom of Contract as there was a rise in standard form contracts. With this came the

inequality of bargaining power, as there was a bigger concentration on economic power. Also there

was the concept of welfarism which meant that there were different political agendas.

Intervention

o Courts & Parliament are prepared to imply terms or redraw the traditional rules.

o Statutory Intervention e.g. Sale of Goods Act 1979, Unfair Contract Terms Act 1977

o Judicial Intervention: Williams v Roffey 1991 1QB 1

Development of areas in Intervention so the court may be able to rescue one party from a bad bargain

Duress /Promissory Estoppel/Mistake/MisRep/Fraud/UI /Restraint of trade

Importance of Consideration as an element of an effective contract

o An essential part of the agreement.

o All contracts require some consideration

o the price for which the promise is bought

o Demonstrates an exchange of promises rather than just evidence of an agreement.

Case Law

Hartley v Ponsonby 1857 119 ER 1471

Lloyds Bank v Bundy 1975 3 All ER 757

Nat West Bank v Morgan 1985 1 All ER 821

Schroeder v Macaulay 1974 3 All E.R. 616

Stilk v Myrick 1809 EWHC KB J58

Williams v Roffey 1991 1QB 1

Relational Ideas/ Relational Contract Theory (lecture 4)

Discrete-relational Spectrum

^ ^

Discrete Relational

Discrete contracts = 1 off transaction, No intent to maintain future relations, Transaction completed

via immediate exchange.

Relational contracts ...Parties treat their contracts more like marriages than like one-night stands.

Obligations grow out of the commitment that theyve made to one another.they are not frozen at the

initial point of commitment, but change as circumstances change; the object of contracting is not

primarily to allocate risks, but to signify a commitment to co-operate.. (Gordon quoted in Macaulay)

Parol Evidence Rule Evidence cannot be admitted..to add to, vary or contradict a written instrument. In

relation to contracts, the rule means that, where a contract has been reduced to writing, neither party

can rely on extrinsic evidence of terms alleged to have been agreed (Treitel)

Avoiding the parol evidence rule, you can use the following

Written agreement not the whole agreement

Implied Terms

Oral warranties

Custom

Rectification

Collateral Agreements

However there is a GAP between the paper deal & the real deal as you cannot predict what the future

holds:

the world changes & surprises us: wars break out in places where we do not expect them.OPEC

drives up energy costs unexpectedly; new technologies, often involving computers change things

so that an older contract no longer makes sense (Macaulay 2003, 46)

If the relationship is a strong one initial terms may be viewed as unimportant.

Those who negotiate may not record the deal there may be different assumptions.

Negotiations may preclude incorporation of some things.

How do courts deal with the gap? Implied terms Waiver Estoppel Bending the rules e.g. Williams

v Roffey

FORMAT DEFINITION/NOTES CASES

FACTS/RELAVANCE/PRINCIPLE

OFFER In order to amount to an offer

it must be shown that the

offeror had the intention to be

bound

Carlill v Carbolic Smoke Ball Co [1893] 1 QB 256 CA Carlil

bought product, followed instructions, it didnt work, & she

claimed the 100 reward. D. argued. Held she was entitled:

deposit of 1,000 =intent therefore not a sales puff. Acceptance

through full performance.

Offer leads to binding

contract on acceptance; an

invite to treat cant be

accepted its an invitation for

offers.

o Goods on display are

generally not offers but an

invitation to treat.

Customer makes offer to

purchase goods; trader

decides whether to accept

the offer

Pharmaceutical Society of Great Britain v Boots [1953] 1 QB 401

CA Self-checkout case regarding pharmaceuticals that require a

pharmacist.Ccourts need to determine where the contract came

to play. Goods on the shelf are an invite to treat not an offer.

Fisher v Bell [1961] 1 QB 394 Flick Knife Case - on display in

shop. Not an 'offer' -> an invitation to treat. Court applied the

literal rule of statutory interpretation. Offering / exposing for

sale in the Restriction of Offensive Weapons Act 1959 = only a

true offer would be prohibited by the Act

o Adverts are invites to treat:

o EXCEPTION In some

instances an advert can

amount to an offer Carlill v

Carbolic Smoke Ball

co [1893] 1 QB 256

Partridge v Crittenden (1968) 2 All ER 421 D. put advert in

classified section of a magazine offering bramble finches for

sale. S.6 of the Protection of Birds Act 1954 -> offence to offer

such birds for sale. Charged & convicted, appealed against his

conviction. The Ds conviction was quashed. The advert was an

invitation to treat not an offer. The literal rule of statutory

interpretation was applied.

o Contracts by tenders

represent an invite to treat;

each tender submit,

amounts to an offer. If

request says acceptance of

lowest or highest tender or

specifies any other

condition this will amount

to an offer; unilateral

contract, acceptance takes

place on performance of

the condition

Spencer v Harding Law Rep. 5 C. P. 561 D. advertised sale by

tender of stock in trade belonging Eilbeck & co. Ad specified

goods could be viewed; time of opening for tenders & must pay

in . No reserve. C submitted highest tender but D. refused

sale. Not stated highest tender=acceptance. The ad was invite to

treat, the tender was an offer, D. could choose to accept the

offer or not

Harvela Investments Ltd v Royal Trust of Canada (CI) Ltd (1986)

AC 207 Ds specification that it binds itself to accept the highest

bid meant invites to submit tenders, amounts to an offer. By

submitting highest bid, C accepted offer & unilateral contract

was formed. Outerbridges referential bid deemed invalid,

because other specification of the invite implied no referential

bids.

o Auctions - Where an

auction takes place with

Payne v Cave (1789) 3 TR 148 Old English case, stands for the

proposition that an auctioneer's request for bids is not an offer

reserve, each bid is an

offer which is then

accepted by the auctioneer

(Sales of Goods Act 1979 s

57). Where the auction

takes place without

reserve, the auctioneer

makes a unilateral offer

which is accepted by the

placing of the highest bid

but an invitation to treat. The bidders make the offers which can

be accepted by the auctioneer.

British Car Auctions v Wright [1972] Invitation to treat Attempt

to prosecute the British Car Auction for selling an un-

roadworthy car. At an Auction there was no offer to sell the

vehicle & the prosecution failed.

Barry v Davies [2000] EWCA Civ 235 Offer&unilateral Contract C

submitted highest & only bid at auction, without reserve. Items=

two engine analysers worth 14,000. C submitted bids of 200

each. Auctioneer refused sale. C brought action; breach of

contract claiming damages of 27,600. C entitled to damages.

When auction is without reserve, auctioneer makes unilateral

offer; accepted when submitting highest bid. Binding contract.

TERMINATE Death of Offeror or Offeree Bradbury v Morgan (1862) Judgment was given for the P.,

Bradbury.

Lapse of time. An offer will

terminate after a reasonable

lapse of time. What amounts to

a reasonable period will

depend on the circumstances.

Ramsgate Victoria Hotel v Montefoire (1866) LR 1 Ex 109 D.

offered to purchase shares in the Cs. Company. 6 months later

C. Accepted offer but in time value of shares fell. D. had not

withdrawn the offer but refused to go through with the sale. C.

brought an action for performance of the contract. Offer no

longer open due to the nature of subject matter. Offer lapsed

after a reasonable period of time. no contract & the Cs. action

was unsuccessful.

Revocation (Retraction)

Offeror is free to withdraw at

any time before acceptance

unless a deposit has been paid

Dickinson v Dodds (1876) 2 Ch D 463 D. offers to sell house to

C. promised to keep offer open till Friday. Thursday D. accepts

offer from 3

rd

party for house. D asked a friend to tell the C.

offer was withdrawn. C went round to the Ds house Friday

morning claiming to ac cept the offer. C brought action seeking

performance. Offer revoked. No contract existed between

parties. No obligation to keep the offer open until Friday since C

had provided any consideration in exchange for the promise.

Errington v Errington Woods [1952] 1 KB 290 CA Father-in-law

purchased house for son/daughter-in-law. House was put in the

father's name paying deposit as a wedding gift & promised the

couple if they paid the mortgage instalments=transfer house to

them. Father ill & died. Mother inherits house. After death son

lived with mother but the wife refused & continued to pay

instalments. Mother brought action to remove the wife from the

house. Wife entitled to remain in the house. The father had

made the couple a unilateral offer. The wife was in course of

performing the acceptance of the offer by continuing to meet

the mortgage payments.

Counter Offer

An offeree responds to an

Hyde v Wrench (1840) 49 ER 132 Chancery Division D. offered to

sell farm to C. for 1,000. C. offered 950, D. refused. C. tried

offer by making an offer on

different terms.

to accept original offer of 1,000. D refused to sell to C & C

brought action for specific performance. There was no contract.

Where counter offer is made it destroys the original offer so that

it is no longer open to the offeree to accept.

ACCEPTANCE Communication

The general rule is that the

offeror must receive the

acceptance before it is

effective:

Entorres v Miles Far East [1955] 2 QB 327 CA C. sent telex

message from England offering to purchase 100 tons of

Cathodes from D. in Holland. D. sent back a telex from Holland

to London accepting. Question for court was at what point did

contract came into existence. If acceptance was effective from

the time telex was sent the contract was made in Holland &

Dutch law would apply. If acceptance took place when the telex

was received in London then the contract would be governed by

English law. To amount to an effective acceptance/acceptance

needed to be communicated to the Offeree. Therefore the

contract was made in England.

Felthouse v Bindley [1862] EWHC CP J35 Court of Common Pleas

SILENCE

Nephew discussed buying horse from uncle offering to purchase

horse & said if I don't hear from you by the weekend I will

consider him mine. Horse was sold by mistake at auction.

Auctioneer had been asked not to sell the horse but forgot.

Uncle commenced proceedings against auctioneer for

conversion. Action depended upon whether a valid contract

existed between the nephew & the uncle. There was no contract.

You cannot have silence as acceptance.

Brogden v Metropolitan Railway (1877) 2 App. Cas. 666

PERFORMANCE C. (supplier of coal to D.s railway company)

dealt for some years on informal basis with no written contract.

Parties agreed its wise having formal contract written. D. drew

up a draft contract & sent to C.. C made some amendments &

filled some blanks & sent it back to the D. The D. filed document

but never communicated their acceptance. Throughout this

period Cs. Continued to supply the coal. A dispute arose & it

was questioned whether in fact the written agreement was valid.

The written contract was valid despite no communication of the

acceptance. The acceptance took place by performing the

contract without any objection as to the terms.

Butler Machine Tool v Ex-Cell-O Corporation [1979] 1 WLR 401

CA LAST SHOT DOCTRINE - TERMS OF LAST DOCUMENT

PREVAIL.S

The Postal Rule agreed that

parties will post as a means of

communication rule will apply.

The postal rule states that

where a letter is properly

Adams v Lindsell (1818) 106 ER 250 D wrote to C offering sale

of wool & asking for reply 'in the course of post'. Letter delayed

in post. On receiving letter C posted letter of acceptance the

same day. Due to delay Ds assumed C not interested in the

wool & sold it to a 3

rd

party. C sued for breach of contract. Valid

addressed & stamped the

acceptance takes place when

the letter is placed in the post

box

contract which came in to existence the moment the letter of

acceptance was placed in the post box. This case established

the postal rule. Applies where post is agreed form of

communication between parties & the letter of acceptance is

correctly addressed & carries the right postage stamp. The

acceptance then becomes effective when the letter is posted.

Holwell Securities v Hughes [1974] 1 WLR 155 D granted C

option to purchase his house (45,000). Option was to be

exercisable 'by notice in writing' within 6 months. 5 days before

expiry, C posted a letter exercising the option. This letter never

received by D. C sought to enforce option relying on the postal

rule stating the acceptance took place before the expiry of the

option. By requiring 'notice in writing', D had specified that he

had to actually receive the communication & had therefore

excluded the postal rule.

Postal LOSS/STRIKE Household fire insurance co v grant D

applied for shares in Household Fire & Carriage Accident

Insurance Company. Company allotted the shares to D, &

suitably addressed to him, posting letter containing notice of

shares. Letter was lost in post he never received acceptance.

Later the company went bankrupt, & asked D for the

outstanding payments on the shares, which he refused saying

there was no binding contract. Liquidator sued. The question

was whether D offer for shares had been validly accepted, & was

he legally bound to pay?

Terms of Acceptance must be

same as term of offer terms

differ amounts to offer - no

contract will exist

Hyde v Wrench (1840) 49 ER 132 Chancery Division (Decided by

Lord Langdale MR) no contract. Where counter offer is made it

destroys the original offer so that it is no longer open to the

offeree to accept.

The agreement must be certain

When viewed objectively it

must be possible to determine

exactly what the parties have

agreed to. Compare the

following two cases

Scammell & Nephew v Ouston [1941] AC 251 HL parties entered

agreement, C were to supply a van for 286 on HP terms over 2

years & D was to trade in his old van for 100. There was

disagreement & C refused to supply van. No certainty as to the

terms of the agreement. Whilst there was agreement on price

theres nothing in relation to the HP terms stating whether it

would be weekly or monthly instalments or how much the

instalments would be.

Sudbrook Trading Estate v Eggleton [1983] AC AC 444 HL lease

gave tenant an option to purchase freehold of property at a

price to be agreed by two surveyors 1 appointed by tenant/1

appointed by landlord. Tenant sought to exercise option but

landlord refused to appoint a surveyor. Landlord claimed clause

was vague to be enforceable as it didnt specify a price. Clause

wasnt too vague to be enforceable as theres a mechanism to

ascertain the price.

CONSIDERATION

Bargain of

contract; based

on exchange of

promises. Each

party must be

promisor/promi

se.

Each receives a

benefit/suffers

a loss. This

benefit or loss is

referred to

as consideration

.

Consideration must be

something of value in the eyes

of the law - (Thomas v

Thomas) (1842) 2 QB 851. one

sided promise not supported

by consideration=a gift. Law

doesnt enforce gifts unless

made by deed. Common law

obeys requirement

of Consideration (sometimes

courts go to lengths to invent

consideration eg Ward v

Byham [1956] 1 WLR

496, Williams v Roffey

Bros [1990] 2 WLR 1153)

equity will, in some instances,

uphold promises which are not

supported by consideration

through the doctrine of

promissory estoppel.

MUST NOT BE PAST Re McArdle (1915) Ch 669 CA D carried out

improvements/repairs on a bungalow. Bungalow formed part of

the estate of her husband's father who died leaving the property

to his wife for life then on trust for McArdles husband/four

siblings. After the work had been carried out brothers & sisters

signed a document stating in consideration of you carrying out

the repairs we agree that the executors pay you 480 from the

proceeds of sale. However, the payment was never made.

Promise to make payment came after the consideration had

been performed therefore the promise to make payment was

not binding. Past consideration is not valid.

Past consideration may be valid where it was preceded by a

request: Lampleigh v Braithwaite [1615] EWHC KB J17 D killed a

man & was due to be hung for murder. He asked C to do

everything in his power to obtain a pardon from the King. C

went to great efforts & managed to get the pardon requested. D

then promised to pay him 100 for his efforts but never paid

up. Whilst the promise to make payment came after the

performance & was thus past consideration, the consideration

was proceeded by a request from D which meant the

consideration was valid. D. was obliged to pay C 100.

must be sufficient; need not be adequate Chappel v

Nestle [1960] AC 87 HL

Wrappers did form part of the consideration as the object was to

increase sales & therefore provided value. The fact that the

wrappers were simply to be thrown away did not detract from

this. Chappel were granted the injunction & Nestle could not sell

the records as they had not complied with the notice

requirements under s.8.

must move from the promisee Tweddle v Atkinson [1861] EWHC

QB J57 QB

Couple were getting married; father of bride entered agreement

with father of groom that theyd each pay the couple a sum of

money. The father of the bride died without having paid. The

father of the son also died so was unable to sue on the

agreement. The groom made a claim against the executor of the

will. The claim failed: groom was not party to agreement &

consideration did not move from him. Therefore hes not

entitled to enforce the contract

An existing public duty will not amount to valid consideration

Collins v Godefrey (1831) 1 B & Ad 950 KB C.=Collins was

subpoenaed to court as a witness in separate court case

involving the D.= Godefrey. He had sued his attorney for

malpractice & Collins was required by the court to attend as an

expert witness. Collins never gave evidence but was required to

standby for 6 days in case. After trial Collins gave Godefrey

invoice to cover his time spent at court & demanded payment by

the next day. Without giving him the full day to pay, Collins

commenced an action to enforce payment. Collins was under a

public duty to attend court due to the subpoena. Where there

exists an existing public duty this cant be used as

consideration for a new promise. Godefrey was not required to

pay him.

EXCEPTION Unless it goes beyond their duty.Glasbrook Bros v

Glamorgan County Council [1925] AC 270 HL D. owners of

colliery asked the police to provide protection during a miner's

strike. Police provided protection as requested & provided man

power as directed by D. although they disputed the level of

protection required to keep peace. End of the strike the police

submitted invoice to cover extra costs of providing protection.

D. refused to pay arguing police under an existing public duty to

provide protection & keep peace. Providing additional officers to

that required, the police had gone beyond their duty. They were

therefore entitled to payment

An existing contractual duty will not amount to valid

consideration Stilk v Myrick [1809] EWHC KB J58 King's Bench

Division C. was a seaman on route London to the Baltic & back.

He was to be paid 5 per month. During the voyage 2 of 12

crew left. Captain promised remaining crew that if they worked

ship undermanned back to London hed divide wages due to the

deserters between them. C. agreed. Captain never made extra

payment promised. C. was under existing duty to work ship

back to London & undertook to submit to all the emergencies

that entailed. He hadnt provided consideration for the promise

of extra money. Entitled to nothing.

EXCEPTIONS Unless the party goes beyond their existing duty

Hartley v Ponsonby [1857] 7 EB 872 Half of a ship's crew

deserted on a voyage. The captain promised the remaining crew

members extra money if they worked the ship & completed the

voyage. The captain then refused to pay up. crew entitled to

extra payment promised on grounds that they had gone beyond

existing contractual duty or the voyage had become too

dangerous frustrating original contract & leaving crew free to

negotiate a new contract.

or if they confer a practical advantage: Williams v Roffey

Bros [1990] 2 WLR 1153 The D.s= building contractors who

entered agreement with Shepherds Bush Housing Association to

refurbish block of 27 flats. Contract subject to a liquidated

damages clause if they did not complete the contract on time. D

engaged C to do the carpentry work for an agreed price of

20,000. 6 months after commencing the work, C realised he

had priced the job too low & would be unable to complete at

originally agreed price. He approached the D who had

recognised that the price was particularly low & was concerned

about completing contract on time. D agreed to pay C an

additional 575 per flat. C continued work on the flats for a

further 6 weeks but only received additional 500. C ran out of

money & refused to continue unless payment was made. The D

engaged another carpenter to complete the contract & refused

to pay C the further sums promised arguing C had not

provided consideration as he was already under an existing

contractual duty to complete the work. Consideration was

provided by C conferring a benefit on D by helping them to

avoid the penalty clause. Therefore the D was liable to make the

extra payments promised.

If the existing contractual duty is owed to a 3rd party this may

be used as valid consideration for a new promise: Scotson v

Pegg [1861] EWHC Exch J2 Purchaser of coal paid the D to carry

& to unload coal. C was the supplier of the coal who had also

paid the D to carry & unload coal. C brought an action to recover

the money paid arguing the D was already under an existing

duty to carry & unload the coal & thus provided no

consideration. An existing contractual duty owed to a 3rd party

to the contract amounts to valid consideration for new promise.

Consequently C could not recover the sums paid & the D was

entitled to get paid twice for doing the same thing.

Part payment of a Debt Part payment of a debt is not valid

consideration for a promise to release the debt in full Pinnel's

Case 1602 5 Rep, 117 Court of Common Pleas C was owed 8

10 shillings. D paid 5 2 shillings & 2p. C sued for amount

outstanding. C entitled to full amount even if agreed to accept

less. Part payment of debt isnt valid consideration for a promise

to forebear the balance unless at the promisor's request part

payment is made either:

a) before the due date or

b) with a chattel or

c) to a different destination

exceptions to rule in Pinnel's case: Hirachand Punamchand v

Temple [1911] 2 KB 330 CA C= money lenders in India. Lent

money to D Lieutenant Temple who was army officer serving in

India. C sought money from D but unable to get response, they

contacted his father. Talk occurred between C & father's

solicitors. C asked how much the father would be prepared to

pay to settle son's accounts. Amount agreed which was

substantial amount though not full amount. C promised to send

promissory note relating to the son's debt to the father when

payment received. Father paid, but C retained promissory note /

sued son to enforce balance. Payment made by father =

sufficient to discharge balance. Where person making payment

in return for discharging the debt owed by another this will

amount to good consideration as the existing duty to make

payment was not owed by them but a third party

ESTOPPEL Promissory estoppel- an

equitable doctrine which can

stop a person going back on a

promise which isnt supported

by consideration; developed by

an obiter statement by

Denning in Central London

Property Trust Ltd v High Trees

Ltd [1947] KB 130 basing the

doctrine on the decision

in Hughes v Metropolitan

Railway (1876-77) L.R. 2 App.

Cas. 439 . The HL affirmed

existence of promissory

estoppel in contract law

in Tool Metal Manufacturing v

Tungsten [1955] 1 WLR 761

Requirements: pre-existing

contract or legal obligation

which is then modified. There

must be a clear/unambiguous

promise. Change of position. It

must be inequitable to allow

the promisor to go back on

their promise

Pre-existing contract/legal obligation -> modified Combe v

Combe [1951] 2 KB 215 CA Husband promised to make

maintenance payments to his estranged wife but failed. Wife

brought an action to enforce the promise invoking promissory

estoppel. Action failed. There was no pre-existing agreement

which was later modified by a promise. Wife sought to use

promissory estoppel as sword & not a shield.

There must be a clear an unambiguous promise Woodhouse

A.C. Israel Cocoa Ltd v Nigerian Product Marketing Co Ltd [1972]

AC 741 A contract for the sale of some coffee beans was agreed

to be payable in pound sterling. The sellers mistakenly sent

invoice stating price was payable in Kenyan Shillings. At the time

the value of pound sterling & Kenyan shillings was equal. The

buyers accepted the delivery & invoice without objection.

Subsequently the value of pound fell dramatically in relation to

Kenyan shillings. Buyers sought to revert to pound sterling as

stated in the contract. The buyers conduct in accepting the

invoice unquestionably amounted to an implied clear&

unambiguous promise to accept on those terms.

Change of position Alan v El Nasr [1972] 2 WLR 800 By contract,

sellers agreed to sell 250 tons of coffee beans at 262 Kenyan

shillings per cwt to El Nasr payable on credit. At the time of the

contract the value of Kenyan shillings & pound sterling were of

equal value. Whilst the contract specified the price payable in

Kenyan shillings, the credit account referred payment in pound

sterling. There were a number of other discrepancies between

credit agreement & contract such as date of shipping & the

quantity to be shipped these were rectified in revised agreement

however, new agreement still referred to payment in pound

sterling. Sellers accepted the first instalment of 57K in pound

sterling without objection, however, the value of the pound

dropped dramatically resulting in loss of 165,530.45 shillings.

Sellers then sought to revert to Kenyan shillings & demanded

further payment. Buyers raised promissory estoppel in defence;

in accepting the instalment in pound sterling & redrafting the

credit agreement without changing the currency there was an

implied promise that theyd not revert to Kenyan Shillings. The

sellers argued the buyers hadnt acted to their detriment in

reliance of this promise as theyd gained a benefit Detrimental

reliance=not a requirement of promissory estoppel. It only

needs to be established that the promisor has changed their

position.

It must be inequitable to allow the promisor to go back on their

promise D & C Builders v Rees [1966] 2 WLR 28 CA D instructed

C to do building work at his home to the value of 746. D paid

250 on account & C reduced the bill by 14 & there was a sum

owing of 482. C wrote to D several times pressing payment but

unsuccessful; there had been no complaints as to the

workmanship at this time. C at the time was in financial need &

the business was verging bankruptcy a fact D was aware of. C

telephoned the home & D answered & said she would give them

300 in satisfaction of the whole debt. C refused & said he

would take the 300 & give her a year to clear the balance. He

called at the house to collect the money but D remained firm

that she would only pay 300 & demanded that C wrote on the

receipt 'in completion of the account' otherwise shed pay

nothing. C needed the money immediately so reluctantly agreed

to write this but stated he fully intended to pursue the balance

as the money paid did not cover the costs he had incurred. He

brought an action to recover the balance. D sought to rely on

estoppel relying on the written receipt as demonstrating a

promise to accept the lesser sum. Cs were successful. D could

not rely on estoppel as there was no true agreement to accept

less & because D had taken advantage of the builder's position

& mislead them as to her financial position.

INTENT TO

CREAT LEGAL

RELATIONSHIP

Intent to create legal

relations is aimed at sifting

cases that arent appropriate

for court. Not every agreement

= binding contract which can

be enforced through courts. Eg

agreement to meet a friend at

pub. Moral duty, not a legal

duty.. In order to determine

which agreements are legally

binding & have an intention to

create legal relations, law

draws distinction between

social/domestic

agreements & agreements

made in a commercial context.

Intention to create legal relations in social & domestic

agreements In social & domestic agreements the law raises

a presumption that the parties do not intend to create legal

relations: Jones v Padavatton [1969] 1 WLR 328 CA mother

promised to pay daughter $200 per month if she gave up her

job in US & went to London to study the bar. Daughter was

reluctant at first, she had a well-paid job with Indian embassy in

Washington & was happy & settled however her mother

persuaded her that itd be in her interest go. The mother's idea

was that the daughter could join her in Trinidad as a lawyer.

Initial agreement wasn't working out as the daughter believed

the $200 was US whereas the mother meant Trinidad dollars

which was less than half what was expected. This meant the

daughter could only afford to rent 1 room for her & her son to

live in. Mother then agreed to purchase a house for the daughter

to live in. She purchased a large house so the daughter could

rent out other rooms & use the income as maintenance. The

daughter married & did not complete her studies. The mother

sought possession of the house. Question for the court was

whether there existed a legally binding agreement between the

mother & daughter or whether the agreement was merely a

family agreement not intended to be binding. The agreement

was purely a domestic agreement which raises a presumption

that the parties do not intend to be legally bound by the

agreement. There was no evidence to rebut this presumption.

This presumption may be rebutted by evidence to the contrary.

This evidence may consist of:

A written agreement: Errington v Errington Woods [1952] 1 KB

290

Where the parties have separated: Merritt v Merritt [1970] 1 WLR

1211

Where theres 3rd party to agreement: Simpkins v Pays [1955] 1

WLR 975

Intention to create legal relations in commercial agreements

Where an agreement is made in a commercial context, the law

raises a presumption that the parties do intend to create legal

relations by the agreement: Esso Petroleum v Customs &

Excise [1976] 1 WLR 1 HL Esso ran a promotion whereby any

person purchasing four gallons of petrol would get a free coin

from their World Cup Coins Collection. The question for the

court was whether these coins were 'produced in quantity for

general resale' if so they would be subject to tax & Esso would

be liable to pay 200,000. Esso argued that the coins were

simply a free gift & the promotion was not intended to have

legal effect & also that there was no resale. There was an

intention to create legal relations. The coins were offered in a

commercial context which raised a presumption that they did

intend to be bound. However, the coins were not exchanged for

a money consideration & therefore the coins were not for resale.

Again this presumption can be rebutted by evidence to the

contrary-Binding in honour only clauses: Jones v Vernon Pools

(1938) C claimed to have won the football pools. The coupon

stated that the transaction was "binding in honour only". It was

held that C was not entitled to recover because agreement was

based on honour of the parties (and thus not legally binding).

(DECISION BOUND Ferrera v Littlewoods Pools [1998] EWCA Civ

618 CA)

CAPACITTY Minors

Contracts For Necessaries

Sale of Goods Act 1979

s.3(3) defines

necessaries as: goods

suitable to the

condition of life of the

minor & to his actual

requirements at the

time of sale & delivery

Minors Benefit (Minors

Contract Act 1987)

Contracts of employment.

Nash v Inman C entered into a contract to supply D (a

Cambridge undergraduate student) with, amongst other things,

11 waistcoats. D was a minor who was already adequately

supplied with clothes by his father. When C claimed the cost of

these clothes D sought to rely on lack of capacity & succeeded

at first instance. C was unsuccessful; he couldnt show the

minor was adequately supplied with clothes.

Clements v London & NW Railway Co-contract young railway

porter agreed to join an insurance scheme & to forgo any claims

he might have under the Employers' Liability Act. He had

forfeited his rights under the Act, the contract as a whole being

for his benefit. It was held that the contract was for the minor's

benefit & that he should be able to obtain employment which

wou1d be difficult if he could not make a binding contract

De Francesco v Barnum 14 yr old girl apprenticed for 7 years to

learn stage dancing. Terms restrained her from several acts eg

not being maintained by Barnum; not able to accept other work

& being deemed to have resigned if wishing to marry. beneficial

contracts of service require that the beneficial terms outweigh

the onerous terms. In this case they did not - the restrictions on

her were too harsh so the contract was not considered binding.

Mental Incapacity Section

7 of the Mental Capacity

Act 2005

Drunken persons Section 3

of the Sale of Goods Act

1979

Individuals will be bound by their contracts unless:

disordered or drunk that they did not understand the nature

of what they were doing

The other party was aware of this

PRIVITY

2 rules 1

st

that

a 3

rd

party may

not have

obligations

imposed by

terms of a

contract, & 2

nd

,

that a 3

rd

party

may not benefit

from terms of a

contract.

consideration must move from

the promisee

Tweddle v Atkinson 1861The fathers of a husband & wife agreed

in writing that both should pay money to the husband, adding

that the husband should have the power to sue them for the

respective sums. The husband's claim against his wife's fathers'

estate was dismissed, the court justifying the decision largely

because no consideration moved from the husband.

Only a promisee may enforce

the promise meaning if 3

rd

party is not a promisee hes

not privy to contract.

Dunlop Tyre Co v Selfridge [1915] AC 847

C sold tyres to Dew & Co, wholesale distributors, on terms that

Dew would obtain an undertaking from retailers that they

shouldnt sell below C list price. Dew sold some of the tyres to

the D, who retailed them below list price. C sought injunction &

damages. The action failed because although there was a

contract between D & Dew, C were not a party to it & "only a

person who is a party to a contract can sue on it," (per Lord

Haldane).

EXCEPTIONS

COLLATERAL CONTRACT

Shanklin Pier Ltd v Detel Products Ltd[1951] 2 KB 854 Shanklin

Pier Ltd hired a contractor to paint Shanklin Pier. They spoke to

Detel Products Ltd about whether a particular paint was suitable

to be used, & Detel assured them that it was, & that it would last

for at least seven years.

[1]

On the basis of this conversation

Shanklin Pier Ltd instructed the contractors to use a particular

paint, which they did. The paint started to peel after three

months, & Shanklin Pier attempted to claim compensation from

Detel Products A collateral contract existed. Shanklin Could not

sue for the contract for sale of paint.

CONTENT DEFINITION/NOTES CASES FACTS/RELAVANCE/

PRINCIPLES

Contents of

a contract are

known

as terms or

clauses.

Contract

terms may

be express or

implied & they

may be classed

as; conditions,

warranties or

innominate

terms.

EXPRESS TERMS

1. An express term - if not

fulfilled the innocent party may

bring an action for breach of

contract.

2. A representation - if not

fulfilled the innocent party may

bring an action for MisRep.

3. As part of a collateral

contract - the innocent party

may sue on the collateral

contract. The main contract

remains intact:

4. A sales puff - not intended

to be binding. Has no legal

effect. eg Red Ball gives you

wings. N/A

Esso Petroleum v Mardon [1976] QB 801 CA D entered tenancy

agreement with C in respect of a new Petrol station. Cs experts

estimated the petrol station would sell 200k gallons of petrol.

Estimate was based on figures prepared prior to planning

application. Planning permission changed the prominence of the

petrol station which would have an adverse effect on the sales

rate. C made no amendments to the estimate. The rent under

the tenancy was also based on the erroneous estimate.

Consequently it became impossible for D to run the petrol

station profitably. In fact, despite his best endeavours the petrol

station only sold 78,000 gallons in the first year & made a loss

of 5,800. The CA held that there was no action for MisRep as

the statement was an estimate of future sales rather than a

statement of fact. However, C was entitled to damages based on

either negligent misstatement at common law or breach of

warranty of a collateral contract.

those agreed

between parties

themselves

1. The parole evidence rule:

where contract is in writing

only the terms included in the

written document are terms

any verbal statements will be

representations

2. Relative expertise: If the

representor has the greater

knowledge, it is more likely to

be a contractual term.

Conversely if the representee

has the greater knowledge it is

more likely to be a

representation:

Oscar Chess Ltd v Williams [1957] 1 WLR 370 CA D purchased

second hand Morris car on basis it was a 1948 model. The

registration document stated it was first registered in 1948. The

following year her son used the car as a trade in for a brand new

Hillman Minx which he was purchasing from C. The son stated

car was a 1948 model & on that basis C offered 290 off the

purchase price of the D. Without this discount D wouldnt have

been able to go through with the purchase. 8 months later C

found the car was in fact a 1939 model & worth less. They

brought action for breach of contract arguing the date of the

vehicle was a fundamental term of the contract thus giving

grounds to repudiate the contract & claim damages. The

statement relating to the age of the car was not a term but a

representation. The representee, Oscar Chess ltd as a car dealer,

had the greater knowledge & would be in a better position to

know the age of the manufacture than D.

Dick Bentley Productions v Harold Smith Motors [1965] 1 WLR

623 CA C knew the D, who was a car trader specialising in the

prestige market, for some time. C asked D to look out for a well

vetted Bentley car. D obtained a Bentley & recommended it to C.

D told him the car had been owned by German Baron & had

been fitted with replacement engine & gearbox & only done 20k

miles since replacement. C Purchased the car but it developed

faults. D had done some work under the warranty but then more

faults developed. It transpired the car did 100k miles since the

refit. The question for the court was whether the statement

amounted to a term in which case damages would payable for

breach of contract, or whether the statement was a

representation, in which case no damages would be payable

since it was an innocent MisRep & C has also lost his right to

rescind due to lapse of time. The statement was a term. The D

as a car dealer had greater expertise & C relied upon that

expertise

3. The importance of the

statement & reliance: Where

the representee indicates to

the representor the importance

of the statement, this is likely

to be held to be a term:

Bannerman v White (1861) 10 CBNS 844 C agreed by contract to

purchase some hops to be used for making beer. He asked the

seller if the hops had been treated with sulphur & told him if

they had he wouldn't buy them as he would not be able to use

them for making beer if they had. The seller assured him that

the hops had not been treated with sulphur. In fact they had

been treated with sulphur. The statement that the hops had not

been treated with sulphur was a term of the contract rather than

a representation as C had communicated the importance of the

term & relied on the statement. His action for breach of contract

was successful.

4. Timing The longer the time

lapse between making the

statement & entering the

contract the more likely it will

be a representation

Routledge v Mackay [1954] 1 WLR 615 CA C acquired a Douglas

BSA motorcycle & sidecar by exchanging another motorcycle &

paying 30. The registration documents stated that it was a

1942 model & this is what the D stated the year of the

motorcycle to be when C came to look at it. The motorcycle was

in fact a 1936 model but had been modified & re-registered by

a previous owner. The purchaser went away to think about it &

then returned a few days later a written agreement was

produced to the effect of the exchange which ended with the

words "It is understood that when the 30 is paid over that this

transaction is closed". Statement was representation & not

contractual term. Registration document was not prima facie

evidence of a contractual term. Neither party was expert, &

there was a lapse of time between the making of the statement

& entering the contract giving C the opportunity to check the

statement. Furthermore there was no mention of the date in the

written agreement & the words of the agreement stating the

transaction is considered closed excluded any possible collateral

warranty.

IMPLIED TERMS

Not expressly

stated, but

courts are

willing, or

required by

statute to

imply.

Statutory implied terms - The

Sale of Goods Act 1979 & the

Supply of Goods & Services Act

1982

Terms implied by common law

Implied through custom

(particular term is prevalent in

a trade the courts may imply a

term in a contract of the same

type in that trade)

Hutton v Warren [1836] EWHC Exch J61 C was a farmer who had

a tenancy on the D fields. C had planted corn & Barley on the

fields & worked the fields to ensure the crops would grow.

Before the field was due to be harvested the tenancy was

terminated. C then submitted a bill to the D for the work & cost

of seed spent on the field as was customary in farming

tenancies. D refused to pay stating there was nothing in the

tenancy agreement stating that such compensation was payable.

The court implied a term into the tenancy providing for

compensation for the work & expenses undertaken in growing

the crops. The term was implied as it was common practice for

farming tenancies to contain such a clause.

Terms implied in fact

1) The business efficacy test:

This asks whether the term

was necessary to give the

contract business efficacy ie

would the contract make

business sense without it? -

The courts will only imply a

term where it is necessary to

do so.

The Moorcock (1889) 14 PD 64 C tied his ship at the D wharf

on Thames. Thames is a tidal river & at times when the tide

went out the ship would come into contact with river bed. Ship

became damaged due to uneven surfaces & rocks on the river

bed. C sought to claim damages from the D & the D argued that

there was no provision in the contract warranting the condition

of the river bed. The court implied a term in fact, that the river

bed would be safe for mooring. The court introduced the

business efficacy test ie the term must be necessary to give the

contract business effect. If the contract makes business sense

without the term, the courts will not imply a term.

2) The officious bystander

test:

Had an officious bystander

been present at the time the

contract was made & had

suggested that such a term

should be included, it must be

obvious that both parties

would have agreed to it.

Shirlaw v Southern Foundries [1939] 2 KB 20 C had been

employed as a managing director of Southern Foundries the

office of employment was to last for 10 years. Federated

Foundries then purchased controlling share in the company &

altered the company's Articles of Association giving them power

to remove directors. They then dismissed C as a director who

brought an action for wrongful dismissal. There was no breach

of contract for his dismissal based on the employment contract

as they had not dismissed him from being a managing director

but only as a director. However, if he was not a director he was

not able to be a managing director. C asked the court to imply a

term the D would not act in a way making it incapable for him to

perform his contract. CA applied the officious bystander test &

did imply the term.

The officious bystander test: If a third party was with the parties

at the time the contract was made & had they suggested the

term should be implied it would be obvious that both parties

would reply with a hearty 'oh of course'. It must be obvious that

both parties would agree to the term at the time the contract

was made.

Terms implied at law

The courts may imply a term in

law in contracts of a defined

type eg Landlord/tenant,

retailer/customer where the

law generally offers some

protection to the weaker party

Liverpool City Council v Irwin [1977] AC 239 Liverpool council

owned a block of flats in which the D was a tenant. The common

parts of the flats, the lifts, stair cases, rubbish chutes etc, had

fallen into disrepair. A rent strike was implemented by many of

the tenants including the D. The council sought to evict the D

for non-payment of rent & she counter claimed for breach of an

obligation to repair. However, the tenancy agreement did not

mention any obligation to repair. In fact the tenancy agreement

only imposed obligations on the tenant with no mention of the

obligations of the landlord. The D asked the court to imply a

term that the council had an obligation to repair the common

parts of the block of flats. Courts did imply a term. The term

arose as a legal incident in contracts of a defined type between

landlord & tenant that the landlord was to take reasonable care

to maintain the common parts. However, there was no breach of

this duty

In addition to being a contract

of a defined type, the term

must be a reasonable one to

include:

Wilson v Best Travel [1993] 1 All ER 353 C injured when he fell

through glass patio doors whilst on holiday in Greece. The glass

conformed to Greek safety standards but not to British safety

standards. C brought an action against the travel agent asking

for a term to be implied as a matter of law, that all

accommodation offered by the D should conform to British

standards. Courts did not imply a term. Whilst this was a

contract of a defined type, it was reasonable for the travel

agency to ensure that all accommodation offered, no matter

where in the world, conformed to British safety standards.

CATEGORISE

Conditions,

warranties &

innominate

terms

Traditionally,

contractual

terms=conditio

ns

or warranties.

The category

of innominate

terms was

created in Hong

Kong Fir

Shipping;

important for

parties to

identify which

terms=conditio

ns & which are

warranties. Brea

ch of contract =

it is important

to determine

which type of

term has been

breached in

order to

establish the

remedy

available.

Conditions Major term of the

contract which goes to the root

of the contract. If a condition

is breached the innocent party

is entitled to repudiate (end)

the contract & claim damages:

Poussard v Spiers (1876)1 QBD 410 Madame Poussard entered a

contract to perform as an opera singer for three months. She

became ill five days before the opening night & was not able to

perform the first four nights. Spiers then replaced her with

another opera singer. Madame Poussard breached condition &

Spiers were entitled to end the contract. She missed the opening

night which was the most important performance as all the

critics & publicity would be based on this night.

Warranties Minor terms of

contract which arent central to

existence of contract. If a

warranty is breached the

innocent party may claim

damages but cant end the

contract:

Bettini v Gye (1876) QBD 183 Bettini agreed to perform as an

opera singer for a three month period. He became ill & missed 6

days of rehearsals. The employer sacked him & replaced him

with another opera singer. Bettini was in breach of warranty &

therefore the employer was not entitled to end the contract.

Missing the rehearsals did not go to the root of the contract.

Innominate terms Established

in the case of Hong Kong Fir

Shipping. Rather than

classifying the terms

themselves as conditions or

warranties, the innominate

term approach looks to the

effect of the breach &

questions whether the

innocent party to the breach

was deprived of substantially

the whole benefit of the

contract. Only where the

innocent party was

substantially deprived of the

whole benefit, will they be able

to treat the contract as at an

end

Hong Kong Fir Shipping v Kawasaki Kisen Kaisha [1962] 2 QB 26

CA A ship was chartered to the D for a 2 year period. Agreement

included a term that the ship would be seaworthy throughout

the period of hire. Problems developed with ship engine & the

engine crew were incompetent. Consequently the ship was out

of service for a 5 week period & then a further 15 week period.

D treated this as a breach of condition & ended the contract.

The Cs brought an action for wrongful repudiation arguing the

term relating to seaworthiness was not a condition of the

contract. Ds were liable for wrongful repudiation. Court

introduced the innominate term approach. Rather than seeking

to classify the term itself as a condition or warranty, the court

should look to the effect of the breach & ask if the breach has

substantially deprived the innocent party of the whole benefit of

the contract. Only where this is answered affirmatively is it to be

a breach of condition. 20 weeks out of a 2 year contract period

did not substantially deprive the D of whole benefit & therefore

they were not entitled to repudiate the contract

Schuler v Wickman Tools [1974] AC 235 HL C=manufacturers of

tools & D=sales company granted the sole right to sell certain

tools manufactured by C. Term of contract between parties was

described as being a condition & provided that D would send a

sales person to each named company once a week to solicit

sales. This imposed an obligation to make 1,400 visits in total.

D failed to make some of the visits & C terminated the contract

for breach of condition. Despite the fact the contract had

expressly stated the term was a condition, the HL held that it

was only a warranty.

Lombard North Central v Butterworth [1987] QB 527 D leased a

computer from the C. C was to pay 584 by 20 instalments

every 3 months. A term of the lease agreement provided that

punctual payment was required & breach of this term would

entitle the lessor to terminate the agreement. The D got into

arrears with the instalments & C took possession of the

computer & sold it on for 175. C sued the D claiming arrears &

all future payments amounting to 6,869 in total. The term

relating to prompt payment was a condition. The parties by their

agreement had demonstrated that prompt payment was an

essential term & the consequence of breach was clearly set out.

Nicholls LJ stated that even one late payment would entitle the

lessor to terminate irrespective of the effect of the breach.

NEED FOR COMMERCIAL

CERTAINTY

Bunge Corporation v Tradax [1981] 1 WLR 711 HLA contract for

the sale 5,000 tons of soya beans required the buyers to give

the sellers 15 days notice of readiness of loading. This term

was stated as a condition. The buyers gave a shorter notice

period & the sellers treated this as terminating the contract &

claimed damages. The price of soya beans had dropped by over

$60 per ton. The initial hearing was decide by arbitration where

it was held that the sellers were entitled to end the contract &

awarded $317.500 representing the decrease in value of the

soya beans. The buyers appealed to the High court who reversed

this decision applying the innominate term approach from Hong

Kong Fir. CA reversed the decision & the buyers appealed to the

HL. The term was stated as a condition & should be treated as

such. The need for certainty in commercial contracts & the fact

that the innominate term approach had caused much litigation

meant that it should only be used where it was impossible to

classify the term as a condition or warranty by reference to the

term itself.

EXEMPTION/EXC

LUSION CLAUSES

excludes liability

or limits liability

Incorporation clause

amounts to a term of contract

Working through either:

a. Signature

LEstrange v Graucob (1934) C purchased cigarette vending

machine for cafe. She signed order form stating in small print

'Any express or implied, condition, statement of warranty,

statutory or otherwise is expressly excluded'. Vending machine

Limitation

clause = Limits

liability (more

favourable

courts

understand

business need

to limit liability,

if businesses

didnt limit

liability they

would be

initially screwed.

b. Notice

c. Course of Dealing

SIGNATURE

Once signed = BOUND!!

(courts are strict)

didnt work & C sought to reject it under the Sale of Goods Act

for not being of merchantable quality. In signing the order form

she was bound by all the terms contained in the form

irrespective of whether she had read the form or not.

Consequently her claim was unsuccessful.

Curtis v Chemical Dry Cleaning (1951) C took wedding dress to

cleaners. She was asked to sign a form. She asked the assistant

what she was signing & assistant told her it excluded liability for

damage to beads. Form in fact contained clause excluding all

liability for all damage howsoever caused. Dress returned badly

stained. Assistant had MisRep the effect of the clause & thus

could not rely on the clause in the form even though C had

signed it.

NOTICE

Timing=CRUTIAL

Term must be brought to the

attention of a party at the time

of contracting or prior

anything post contractual

would be ineffective

HOWEVER, because of UCTA

1977 this would be invalid

because you cannot exclude

liability for death or personal

injury

Olley v Marlborough Court [1949] 1 KB 532 C booked into a

hotel. In the hotel room on the back of the door a notice sought

to exclude liability of the hotel proprietors for any lost, stolen or

damaged property. C had her fur coat stolen. The notice was

ineffective. The contract had already been made by the time C

had seen the notice. It did not therefore form part of the

contract.

Thornton v Shoe Lane Parking [1971] 2 WLR 585 CA C was

injured in a car park partly due to the D negligence. C was given

a ticket on entering the car park after putting money into a

machine. The ticket stated the contract of parking was subject

to terms & conditions which were displayed on the inside of the

car park. One of the terms excluded liability for personal injuries

arising through negligence. The question for the court was

whether the term was incorporated into the contract ie had the

D brought it to the attention of C before or at the time the

contract was made. This question depended upon where the

offer & acceptance took place in relation to the machine. The

machine itself constituted the offer. The acceptance was by

putting the money into the machine. The ticket was dispensed

after the acceptance took place & therefore the clause was not

incorporated into the contract.

Receipts/tickets

Ticket showed only a proof of

purchase so courts did not

include exclusion causes here.

a. TYPE OF DOCUMENT IS

IMPORTANT!!!

Chapelton v Barry UDC (1940) DECK CHAIR HIRE CASE - pile of

chairs & a nearby notice stating "hire of chairs 2d per session of

3 hours - Public requested to obtain ticket from attendant". C

took a chair & obtained a ticket. He then went to sit down & fell

through the canvas. Judge would have found for C, but said that

the wording on the ticket, "The council will not be liable for any

accident or damage arising from hire of the chair" obliged him

to find for D." On appeal it was decided there was no restriction

on the notice because the ticket (which might not be obtained at

the same time as the hiring of the chair), could not modify the

terms of the contract

Parker v south Eastern train (1877) Bag left in railway station &

ticket said see back & on the ticket it limited liability to 10 C

lost his bag & had not read the back of the ticket. Courts said

INVALID Handing over a ticket with an exclusion clause is

INSUFFICIENT!!! Ticket doesnt have contractual force

Thompson v L M & S Railway Co (1930) Ticket said subject to

timetable. Its not contractual but Being directed to Other info

makes it VALID & CONTRACTUAL

Nature of clauses Onerous

Terms? (burdenous)

Onerous terms MUST be

specifically drawn to the

attention of the party

(THORNTON CASE ^)

Interfoto Picture Library v Stiletto Visual Programmes ltd. (1988)

C delivered 47 photographic transparencies to D in jiffy bag. D

was planning to use them for a presentation, but did not. It

never opened the transparency bag or read Interfoto's standard

terms & conditions, which were inside the bag. Condition 2 said

there was a holding fee of 5 for each day over fourteen days.

After around a month, Interfoto sent a bill for 3,783.50.

Because the amount was exorbitant & it was an onerous term

it should have been brought to the attention of the parties.

DENNING: Some clauses (ONEROUS) should be printed in RED

INK with a red pointed hand indicating it!

Course of dealing

Exemption clause may become

part of a contract if there have

been previous dealings!

Course of dealings CASES

illustrating regular &

inconsistent dealings & where

courts will incorporate this in

cases.

Spurling v Bradshaw [1956] 1 WLR 461 D used services of a

warehouse to store goods on regular basis. Each time he

delivered goods to the warehouse he was asked to sign invoice

which contained an exclusion clause. Invoice came after contract

had been agreed. On one occasion he stored some barrels of

orange juice & signed the invoice. When he went to pick them

up, however, some of the barrels were empty & one contained

dirty water. Consequently he refused to pay for the storage. C

warehouse owners brought an action for the agreed price of

storage relying on the exclusion clause to demonstrate that they

were not liable for the damage to the goods. D argued the

clause had not been incorporated into the contract as he signed

the document after the contract was made. The clause was

incorporated through previous dealings. D would have been

aware of the term from the previous contracts & therefore it did

form part of the contract. C was entitled to payment & D had no

right to claim compensation for the damage to the orange juice.

Hollier v Rambler Motors [1972] 2 WLR 401 CA C had used

services of D garage on 3-4 occasions over five year period.

Each time he was asked to sign a document excluding liability

for damage. On this occasion the contract was made over the

phone & no reference to the exclusion clause was made. The

garage damaged the car during the repair work & sought to

invoke the exclusion clause through previous dealings. There

was not a sufficient number of or regularity of transactions to

amount to a previous course of dealings capable of

incorporating the exclusion clause. It was not reasonable to

expect C to remember the clause from one transaction to the

next. Consequently the garage was liable to pay for the damage.

Construction Must be clear &

not ambiguous

Contra proferentem rule

ambiguity will be construed

against party relying on the

clause!

Houghton v Trafalgar Insurance [1953] 2 All ER 1409 CA C, the

assured, claimed against the Trafalgar Insurance under an

insurance policy in respect of a car accident which resulted in

his car becoming a total loss. At the time of the accident the

five seater car contained six people - the driver & one

passenger in the front seats, & four passengers in the back of

the car, three being seated on the back seat & one on the

knees of another. The policy contained a clause which

excluded Trafalgar Insurance's liability for 'Loss, damage, &/or

liability caused or arising whilst any such car is... conveying

any load in excess of that for which it was constructed.'

Meaning of LOAD ambiguous in case & therefore clause

ineffective

Ailsa Craig Fishing v Malvern Fishing [1983] 1 WLR 964 HL A

contract between existed between Securicor & Aberdeen Fishing

Vessel Owners Association whereby Securicor were to provide

security cover in the harbour where the Cs vessels were

moored. As a result of negligence & breach of contract the Cs

vessels sunk. The contract contained a clause which provided

that in the event of negligence or breach, Securicor would not

be liable for any amount exceeding 1,000 in any one claim &

that it would not be liable for more than 10,000 in any twelve

month period. HL held that where the clause limits liability

rather than excludes liability altogether the courts should apply

the natural meaning of the clause & not be too eager to find

ambiguity. Lord Wilberforce stated relevant words must be

given, if possible, their natural, plain meaning. Clauses of

limitation are not regarded by the courts with the same hostility

as clauses of exclusion.

EXCLUDING NEGLIGENCE

Canada Steamships v R Appeal was allowed against the SCC

judgment. It was said: clause 7 did not exclude negligence

liability in clear enough terms & clause 17 was ambiguous &

would be construed against the Crown. If a clause expressly

excludes liability for negligence (or an appropriate synonym)

then effect is given to that.

[3]

If not, one should ask whether the

words are wide enough to exclude negligence & if there is doubt

that is resolved against the one relying on the clause. If that is

satisfied, then one should ask whether the clause could cover

some alternative liability other than for negligence, & if it can, it

covers that.

Another form of liability for damage was strict

liability, & so the exclusion clause did not work to cover

negligence.

Excluding negligence usually

covering strict liability only

needs careful wording to

exclude liability for negligence

1) To be effective must

include terms such as

a. HOWSOEVER CAUSED

b. No liability

WHATSOEVER

c. SOLE RISK

Hollier v Rambler Motors [1972] 2 WLR 401 CA no reference to

the exclusion clause was made. The garage damaged the car

during the repair work & sought to invoke the exclusion clause

through previous dealings. not a sufficient number of or

regularity of transactions to amount to a previous course of

dealings capable of incorporating the exclusion clause.

Alderslade v Hendon Laundry (1945) 1 KB 189 C took laundry to

be cleaned - when he picked it up it was gone. On Cs receipt it

stated that the launderer was not responsible for loss of

damage; & that this was limited to 20 times the cost of cleaning.

The laundry had duty to take reasonable care & any excluding

clause indicated that there was some liability - the clause did

not include negligence of the launderer.

Even where an exclusion

clause has been incorporated

into a contract, it may not have

been incorporated in a

collateral contract.

Photo Production v Securicor [1980] AC 827 HL A contract for

provision of security services by Securicor at the Cs factory. The

security guards negligence caused the destruction of the Cs

factory by fire. The contract contained a clause excluded liability

for negligence of Securicors workers. Where the parties are

negotiating at arms-length, & have set out who should bear the

risks, the courts should be unwilling to interfere

Andrews v Hopkinson [1957] 1 QB 229 C saw a car in the Ds

garage, which the D described as follows: "It's a good little bus. I

would stake my life on it". C agreed to take it on hire-purchase

& D sold it to a finance company that made a h-p agreement

with C. When the car was delivered C signed a note saying he

was satisfied about its condition. Shortly afterwards, due to a

defect in the steering, the car crashed. C was stopped from

suing the finance company because of the delivery note but he

sued the D. It was held that there was a collateral contract with

the D who promised the car was in good condition & in return

the plaintiff promised to make the h-p agreement. D was liable.

Effectiveness

UCTA/regulations

The Act does not apply to

insurance contracts; the sale of

land; contracts relating to

companies; the sale of shares; &

the carriage of goods by sea

(Schedule 1); or to international

supply contracts (s26).

REASONABLENESS