Académique Documents

Professionnel Documents

Culture Documents

Answer Scheme Fin542 Apr2011

Transféré par

Janeahmadzack0 évaluation0% ont trouvé ce document utile (0 vote)

1K vues6 pagesANSWER SCHEME FIN542 APR2011.doc

Titre original

ANSWER SCHEME FIN542 APR2011.doc

Copyright

© © All Rights Reserved

Formats disponibles

DOC, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentANSWER SCHEME FIN542 APR2011.doc

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOC, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

1K vues6 pagesAnswer Scheme Fin542 Apr2011

Transféré par

JaneahmadzackANSWER SCHEME FIN542 APR2011.doc

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOC, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 6

INTERNATIONAL FINANCIAL MANAGEMENT (FIN 542)

SEMESTER JANUARY APRIL 2011

Quest!" 1

(a)

It would be useful to examine a countrys BOP for at least two reasons. First, BOP provides

detailed information about te supply and demand of te countrys currency. !econd, BOP data

can be used to evaluate te performance of te country in international economic competition.

For example, if a country is experiencin" perennial BOP deficits, it may si"nal tat te countrys

industries lac# competitiveness.

($ mar#s)

(b)

(i) %otal option premium & (.'$)($''') & (!)*$'. (+)

,ed"in" via call option on !F at exercise rate of )'.-./!F

!ince you are "oin" to buy !F$,''', you expect to spend (!)0,*'' ((!)'.-.x$,''').

(*)

%us, te total expected cost of buyin" !F$,''' will be te sum of (!)0,*'' and

(!)*$' & (!)0,.$' (*)

(ii) ('.-0)($,''') & (!)0,+$' (*)

(iii) (!)0,+$' & $,'''x 1 (!)*$', were x represents te brea#2even future spot rate.

(+)

0+$' & $'''x 1 *$'

0+$' 2*$' & $'''x

*3''/$''' & x & (!)'.$4'' (*)

O5

6lternatively, we can ta#e into consideration for anoter answer

Forward & Options

(!)'.-3 & (!)'.-. 1 (!)'.'$

c) If te ban# 7e"ara switces to an easy monetary policy, te value of rin""it will drop as

fears of inflation rise. !ort term 8alaysia interest rates will fall but ten will rise as

investors see# to protect temselves from i"er anticipated inflation.

9on" term rates will probably rise immediately because of fears of future inflation.

,owever, if te "rowt in te money supply stimulated te economy to "row more rapidly

tan it oterwise would, te value of te 5in""it would rise and so real interest rates.

1

($ mar#s)

Quest!" 2

(a)

+) :ifficult to mana"e economy were 87; ave extensive investment (e". 6ustralia and

;anada). %is is due to 87;s ave external sources of finance tat blunt te local monetary

policy.

*) 8a#e te forei"n excan"e mar#et volatile. %is can be done to te movin" of funds from one

place to anoter by see#in" better yields

0) %ey can defy political direction of teir own "overnment or te forei"n "overnment

.) %ey can concentrate s#ill <ob at ome ot menial <ob abroad

$) 87; can also manipulate prices and spread forei"n culture

(- mar#s)

(b)

!tep +

(ft =e')/e' x 0-'/n x+'' & r2rf

(+.*>33 = +.*$'')/+.*$'' x 0-'/3' x+'' & $.-? 2 $..?

. .

3.$-? @ '.'$?

%erefore ;overed Interest 6rbitra"e exist

(*m)

ii) !tep *

(+1r) & (+1rf)f+/eo

(+ 1 '.'$-/.) & (+ 1 '.'$./.)+.*>33/+.*$''

+.'+. +.'0>>

Borrow from ,; and invest in F;

(*m)

iii)

(!) A mar#s

% & '

Borrow (! B$.-?/.

;onvert to A B(!+.*$

Invest A B $..?/.

Cnter contract to sell A 0 mt forward

B (!+.*>33 / A

+m

(+m) 4'','''

(4'',''')

+

+

% & 0 mont

5eceive A investment proceed

;onvert to (! B (! +.*>33/ A Pay

(! loan D+m x (+ 1 '.'$-/.)E

+,'0>,>.*.3*

+,'+.,'''

4+',4''

(4+',4'')

*

*

*

;I6 Profit *0,>.*.3* *

(+' mar#s)

2

Quest!" #

(a)

,ed"in" transaction exposure by a forward contract is acieved by sellin" or buyin" forei"n

currency receivables or payables forward. On te oter and, money mar#et ed"e is acieved

by borrowin" or lendin" te present value of forei"n currency receivables or payables, tereby

creatin" offsettin" forei"n currency positions. If te interest rate parity is oldin", te two ed"in"

metods are eFuivalent.

(- mar#s)

(b)

6 futures contract is an excan"e2traded instrument wit standardiGed features specifyin"

contract siGe and delivery date. Futures contracts are mar#ed2to2mar#et daily to reflect can"es

in te settlement price. :elivery is seldom made in a futures mar#et. 5ater a reversin" trade is

made to close out a lon" or sort position.

(* mar#s)

(c)

Forward mar#et ,ed"eH

I0$,''' x +...++ & (!)$',.04.$'

(0 mar#s)

8oney 8ar#et ,ed"eH

6cct Payable H Borrow ,;, Invest F;

Invest F; J FKLL

(+ 1 r)

I0$,'''

( + 1 '.'4/.)

I0.,0+0.>0

(0 mar#s)

Borrow ,;J

I0.,0+0.>0 x +..3++ & (!$+,+-$.*'

(* mar#s)

;ost of borrowin" in 0 mont

(!$+,+-$.*' x ( + 1 '.'.*/.) & (!$+,>'*..0

(0 mar#s)

%erefore, sould use forward mar#et to reduce cost of payment

(+ mar#)

Quest!" 4

3

(a)

Cconomic exposure can be mana"ed trou"H

+) Balancin" te sensitivity of revenues and expenses to excan"e rate volatility

*) :iversifyin" te companies operation, sales, and location of te production facilities and te

sources of raw materials.

0) :iversifyin" te companys financin" base. ;ompany can switc its financin" sources wose

costs is lower. %ey also can ta#e advanta"e of unexpected interest differentials by mix of

borrowed currencies wit mix in receivables. %erefore it can reduce its default ris#.

(- mar#s)

(b)

i) e + & *.>4.' ( +1 '.'$$)/(+1'.'4)

& 58 *.>+3-

(0 mar#s)

ii) ; & (e+ =e')/ e'

& (*.>-.' = *.>4.')/ *.>4.'

& 2 '.''>*

(* mar#s)

6fter tax ,; loan

& rc(+2t) 1 (tc)

& '.'$$ (+2'.*$) 1 ('.*$)(2'.''>*)

& '.'03$ or 0.3$?

(0 mar#s)

iii) 6fter tax F; loan

& rfc( +1c)(+2t) 1c

& '.'4 (+2'.''>*)(+2'.*$) 1 (2'.''>*)

& '.'$*. or $.*.?

(. mar#s)

iv) Ocean Bi" sould coose borrowin" in rin""it loan because it is low.

(* mar#s)

Quest!" 5

(a)

%e company as eliminated excan"e rate ris# and credit ris#, but it as not eliminated all. %e

company as converted its (!: receivables into a fixed amount of rin""it to be received in te

future wic is set in nominal terms, but it does not #now wat te purcasin" power of tose

rin""it will be, tereby, incurrin" inflation ris#. 8oreover political ris# is not ta#en into

consideration

($ mar#s)

(b)

i) 6cc 5ec = 6cc Payable

I*$',''' 2 I$',''' & I*'','''

%ransaction exposure (acc receivable) & I*'',''' (* mar#s)

ii) Forward mar#et ed"e

6mount received & *'',''' x ..>$'' & 58 3$','''

(* mar#s)

4

8oney mar#et ed"eH

6cct 5eceivable H Borrow in F; J Invest in ,;

Borrow in F; H

PK & *'',''' /(+1'.+) & I+4+,4+4.+4

(* mar#s)

Invest in 58H

+4+,4+4.+4 x 58 ..4-*+ & 58 44.,'+4.+4

(* mar#s)

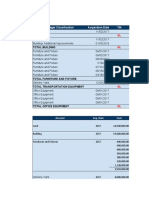

T $ 0 % RM

Borrow B +'? +4+,4+4.+4 (+)

;onvert to 58 B 58..4-*+ (+4+,4+4.+4) 44.,'+4.+4 (+)

Invest B +*? (44.,'+4.+4)

'

'

T $ 1&'

5eturn from investment B +*? 33',+''.0- (+)

(44.,'+4.+4 x +.'+*)

5eceive payment from buyer *'',''' (+)

Pay borrowin"s B +'? (*'',''') ((((((((

%otal amount received ' ))0*100+#, (*)

;oose ed"in" te 6ccount 5eceivable in 8oney mar#et since it "ives i"er return .

(+ mar#)

(%otal & +$ mar#s)

Quest!" ,

(a)

i. 584'','''/$..+>$ & I+.>,--3.$3

(* mar#s)

ii. 0.$44$ 1 '.''.' & 0.$3*$

58*.$m/0.$3*$ & (!)-3$,43..**

(. mar#s)

iii. $..+.$ = '.''** & $..+*0

I>$''' x $..+*0 & 58.'$,3**.$'

(. mar#s)

iv. bid & $..+.$/0.$44$ & +.$'44

6s# & $..+>$/0.$4>0 & +.$+'*

(* mar#s)

(b)

;ountertrade is wen "oods and services are excan"e for "oods and services between two

parties were part or no monetary payment is involved.

5

(* mar#s)

6dvanta"es of ;ountertradeH

+) ;ountertrade enables members of cartels to undercut an a"reed on price witout formally

doin" so

*) It reduces te ris# face by country tat contracts for a new manufacturin" facility

:isadvanta"esH

+) Moods ta#en in countertrade are usually undesirable

*) %radin" details are difficult to wor# out

(+.$ mar#s x . & - mar#s)

(*' mar#s)

6

Vous aimerez peut-être aussi

- FIN 542 - Answer Scheme OCT 2009Document8 pagesFIN 542 - Answer Scheme OCT 2009Rafiedah OmarPas encore d'évaluation

- Assignment Fin544Document12 pagesAssignment Fin544Yumi MayPas encore d'évaluation

- Fin544 TUTORIAL and FormulaDocument9 pagesFin544 TUTORIAL and FormulaYumi MayPas encore d'évaluation

- Answer All: TEST 2 FIN 542 International Financial Management 2012Document5 pagesAnswer All: TEST 2 FIN 542 International Financial Management 2012Janeahmadzack100% (1)

- Fin 548 Answer SchemeDocument23 pagesFin 548 Answer SchemeDayah Angelofluv100% (1)

- Public Prosecutor V Mohamed Ezam Bin Mohd NoDocument14 pagesPublic Prosecutor V Mohamed Ezam Bin Mohd Nomykoda-10% (1)

- Final Assessment Fin546 (Template Answer)Document6 pagesFinal Assessment Fin546 (Template Answer)NOR IZZATI BINTI SAZALI100% (1)

- FIN658 Degree Session 1 2012Document8 pagesFIN658 Degree Session 1 2012Amirah RahmanPas encore d'évaluation

- Mgt646 Research IntroDocument5 pagesMgt646 Research IntroSaufi RazaliPas encore d'évaluation

- FIN 542 - Answer Scheme APR2010Document8 pagesFIN 542 - Answer Scheme APR2010Rafiedah Omar100% (2)

- Fin430 - Dec2019Document6 pagesFin430 - Dec2019nurinsabyhahPas encore d'évaluation

- Fin 533 Chapter 6 Past Year QuestionDocument2 pagesFin 533 Chapter 6 Past Year QuestionWAN NORSYAMILAPas encore d'évaluation

- Ads 465 Individual AssignmentDocument13 pagesAds 465 Individual Assignmentliyana nazifaPas encore d'évaluation

- Group Project: Gabungan Aqrs Vs Crest Builder HoldingsDocument43 pagesGroup Project: Gabungan Aqrs Vs Crest Builder HoldingsNURUL SYAFIQAH MOHD IDRISPas encore d'évaluation

- 03FM SM Ch3 1LPDocument6 pages03FM SM Ch3 1LPjoebloggs18880% (1)

- FINANCE MANAGEMENT FIN 420 CHP 4Document24 pagesFINANCE MANAGEMENT FIN 420 CHP 4Yanty Ibrahim25% (4)

- 4C Abdul Syareez Aiman Bin Abd Rashid (22 July 2021)Document9 pages4C Abdul Syareez Aiman Bin Abd Rashid (22 July 2021)Rey QuincePas encore d'évaluation

- Maf603-Test 2-Jan 2021-QDocument2 pagesMaf603-Test 2-Jan 2021-QPutri Naajihah 4GPas encore d'évaluation

- Law Report Ques 41Document15 pagesLaw Report Ques 41Syahirah AliPas encore d'évaluation

- MKT542 ARTICLE REVIEW REPORT Sample 1Document14 pagesMKT542 ARTICLE REVIEW REPORT Sample 1kyaissah100% (1)

- Topic: Effect of Covid19 Toward Bank Islam Malaysia Berhad (BIMB) ProfitabilityDocument7 pagesTopic: Effect of Covid19 Toward Bank Islam Malaysia Berhad (BIMB) ProfitabilityLuqmanulhakim JohariPas encore d'évaluation

- Ins510 Group Project ReportDocument17 pagesIns510 Group Project Reportradia amalin99Pas encore d'évaluation

- Fin645 Final AssessmentDocument3 pagesFin645 Final Assessmentmark50% (2)

- Group Assignment FIN658Document60 pagesGroup Assignment FIN658PiqsamPas encore d'évaluation

- Guidelines To Article Analysis Elc501Document10 pagesGuidelines To Article Analysis Elc501Akmal RahimPas encore d'évaluation

- Maf 603 Suggested Solutions Solution 1Document5 pagesMaf 603 Suggested Solutions Solution 1anis izzatiPas encore d'évaluation

- Presentation MGT430Document13 pagesPresentation MGT430Esther MPas encore d'évaluation

- Elc231 Mid Sem Test June2020 Set1 PDFDocument6 pagesElc231 Mid Sem Test June2020 Set1 PDFNURUL AIN IZZATI BINTI MUHAMAD ZAILAN SOVILINUSPas encore d'évaluation

- Sta404 QuestionnaireDocument8 pagesSta404 QuestionnaireNur Amirah Abdullah100% (1)

- Asm453 2Document10 pagesAsm453 2Megan Sikajat100% (1)

- Assignment 1 (Ethic Case)Document8 pagesAssignment 1 (Ethic Case)Mohamad SaniyPas encore d'évaluation

- (Question) Mat 491 Final Assessment 6aug2021 3PM-5PMDocument4 pages(Question) Mat 491 Final Assessment 6aug2021 3PM-5PMfirdausPas encore d'évaluation

- Upload 8Document3 pagesUpload 8Meghna CmPas encore d'évaluation

- Forum Portfolio Panel 1 LATESTDocument11 pagesForum Portfolio Panel 1 LATESTIrdina Mahrose100% (1)

- Tutorial 5 Eco 415Document7 pagesTutorial 5 Eco 415ZhiXPas encore d'évaluation

- TMC501 Written ExerciseDocument4 pagesTMC501 Written ExerciseHaziq Aris SaruPas encore d'évaluation

- Assigment Prob. N Stat.Document34 pagesAssigment Prob. N Stat.Syuaib Supani100% (1)

- HR Case StudiedDocument2 pagesHR Case StudiedSafuan Saad100% (2)

- Jarvis University Ju Is A Private Multiprogram U S University WithDocument2 pagesJarvis University Ju Is A Private Multiprogram U S University Withtrilocksp SinghPas encore d'évaluation

- Questionnaire Result On How UiTM Seri Iskandar Students Spend Their WeekendDocument9 pagesQuestionnaire Result On How UiTM Seri Iskandar Students Spend Their WeekendIkmal Ahmad100% (1)

- Group Assignment Report Fin658Document94 pagesGroup Assignment Report Fin658Muhammad FaizPas encore d'évaluation

- Tutorial 3 Answer SegmentalDocument6 pagesTutorial 3 Answer Segmental--bolabolaPas encore d'évaluation

- PBL GroupingDocument20 pagesPBL GroupingJihah RazakPas encore d'évaluation

- Sources and Uses of Funds Islamic BankDocument2 pagesSources and Uses of Funds Islamic BankAkma AseriPas encore d'évaluation

- Internship Log Book Template LATESTDocument29 pagesInternship Log Book Template LATESTNabila HusnaPas encore d'évaluation

- MGT657 - Group Wind - Company Business ReviewDocument27 pagesMGT657 - Group Wind - Company Business Reviewizzat asriPas encore d'évaluation

- Assignment - Eco (1) Dah SiapppDocument11 pagesAssignment - Eco (1) Dah SiapppMUHAMMAD ZIKRY ADAM TAJUL ARAFATPas encore d'évaluation

- Test 1 Name: Nurul Shafirah Binti Norwadi STUDENT ID: 2019802212 GROUP: BA2425BDocument2 pagesTest 1 Name: Nurul Shafirah Binti Norwadi STUDENT ID: 2019802212 GROUP: BA2425BNurul Shafirah0% (1)

- Fakulty of Computer and Mathematical Sciences Bachelor of Science (Hons.) Management MathematicsDocument13 pagesFakulty of Computer and Mathematical Sciences Bachelor of Science (Hons.) Management MathematicsFatihah SyukorPas encore d'évaluation

- Semester 1-6 Complete ReferenceDocument17 pagesSemester 1-6 Complete ReferenceNaturalEvan100% (1)

- ADS465 SEMESTER OCT2020-FEB2021 Individual Assignment: Situational Based-AnalysisDocument8 pagesADS465 SEMESTER OCT2020-FEB2021 Individual Assignment: Situational Based-AnalysisFADZLIN SYAFIQAHPas encore d'évaluation

- Accounting Tutorial 2 Part 2Document18 pagesAccounting Tutorial 2 Part 2Sim Pei Ying100% (1)

- Group Assignment 1 Risk Assessment Guidelines - UBM588 Introduction To Risk and InsuranceDocument1 pageGroup Assignment 1 Risk Assessment Guidelines - UBM588 Introduction To Risk and InsuranceIqmal AhmadPas encore d'évaluation

- Field Report Pac671 Template (New) - Cover Page - TocDocument2 pagesField Report Pac671 Template (New) - Cover Page - TocAiman FaezPas encore d'évaluation

- Nuratiqah Binti Kubak (2020899576) - Individual Assignment 1Document10 pagesNuratiqah Binti Kubak (2020899576) - Individual Assignment 1NuratiqahPas encore d'évaluation

- 474 07 Exchange Rate DeterminationDocument15 pages474 07 Exchange Rate Determinationjordi92500Pas encore d'évaluation

- Order in The Matter of Greentouch Projects Ltd.Document15 pagesOrder in The Matter of Greentouch Projects Ltd.Shyam Sunder0% (1)

- Order in The Matter of Amrit Projects (N. E.) LimitedDocument13 pagesOrder in The Matter of Amrit Projects (N. E.) LimitedShyam SunderPas encore d'évaluation

- International Financial MarketsDocument10 pagesInternational Financial MarketsFurqan AhmedPas encore d'évaluation

- Interim Order Against Falkon Industries India Limited.Document11 pagesInterim Order Against Falkon Industries India Limited.Shyam SunderPas encore d'évaluation

- Classifications of Business ProposalDocument3 pagesClassifications of Business ProposalMariah Janey VicentePas encore d'évaluation

- Commercial BPO - CreatedDocument4 pagesCommercial BPO - CreatedBPO Forms33% (3)

- Brealey. Myers. Allen Chapter 32 SolutionDocument5 pagesBrealey. Myers. Allen Chapter 32 SolutionHassanSheikhPas encore d'évaluation

- David Nassar - Day Trading SmartDocument33 pagesDavid Nassar - Day Trading SmartLinneu BuenoPas encore d'évaluation

- PPE Investments Working PaperDocument15 pagesPPE Investments Working PaperMarriel Fate CullanoPas encore d'évaluation

- The Influence of Price On Customer's Purchase DecisionDocument6 pagesThe Influence of Price On Customer's Purchase DecisionSiti Nur JannahPas encore d'évaluation

- Yelp Inc (Yelp-N) : Average ScoreDocument12 pagesYelp Inc (Yelp-N) : Average ScoreInvest StockPas encore d'évaluation

- John J Murphy - Technical Analysis of The Financial MarketsDocument547 pagesJohn J Murphy - Technical Analysis of The Financial MarketsJaime González100% (1)

- Chocopizza! Business Plan & New InnovationDocument51 pagesChocopizza! Business Plan & New InnovationHuba ZehraPas encore d'évaluation

- Submitted By: Bhakti Shelar SMBA - 2, Roll No - 08 ITM, ThaneDocument7 pagesSubmitted By: Bhakti Shelar SMBA - 2, Roll No - 08 ITM, ThaneBhakti ShelarPas encore d'évaluation

- Business Report - Pham Thuy Linh - 11196343Document14 pagesBusiness Report - Pham Thuy Linh - 11196343Thuy Linh PhamPas encore d'évaluation

- Dam, Land Law and Economic DevelopmentDocument36 pagesDam, Land Law and Economic DevelopmentSaima RodeuPas encore d'évaluation

- 2016 Policy Topicality FileDocument164 pages2016 Policy Topicality FileSeed Rock ZooPas encore d'évaluation

- Innovation of DAISO - Focused in Economies of Scale, Economies of Scope, DiversificationDocument3 pagesInnovation of DAISO - Focused in Economies of Scale, Economies of Scope, DiversificationShiv KothariPas encore d'évaluation

- Advertising and Sales ManagementDocument123 pagesAdvertising and Sales ManagementNidhisha P MPas encore d'évaluation

- Problem Set 4 - Capital Structure and Cost of CapitalDocument7 pagesProblem Set 4 - Capital Structure and Cost of Capitalmattgodftey1Pas encore d'évaluation

- JioMart - Anamika, Anamta, Anjali, Bhawna, Mukund and Vaishnavi. MFM Sem III Assignment 1 PDFDocument34 pagesJioMart - Anamika, Anamta, Anjali, Bhawna, Mukund and Vaishnavi. MFM Sem III Assignment 1 PDFAnamikaPas encore d'évaluation

- Managerial Economics An Analysis of Business IssuesDocument25 pagesManagerial Economics An Analysis of Business Issueslinda zyongwePas encore d'évaluation

- Marketing MCQs 1Document29 pagesMarketing MCQs 1Manish SoniPas encore d'évaluation

- The Startup Canvas by Startup ExperienceDocument1 pageThe Startup Canvas by Startup ExperienceYasser AbdesselamPas encore d'évaluation

- Inventory Management and Control: Chapter-05Document5 pagesInventory Management and Control: Chapter-05Bijoy SalahuddinPas encore d'évaluation

- 03 - Management AccountingDocument7 pages03 - Management AccountingRigner ArandiaPas encore d'évaluation

- Goldiam Share - Google SearchDocument5 pagesGoldiam Share - Google SearchDudheshwar SinghPas encore d'évaluation

- Chapter 1Document39 pagesChapter 1Haaromsaa Taayyee TolasaaPas encore d'évaluation

- Drill Exercises 2Document4 pagesDrill Exercises 2Enerel TumenbayarPas encore d'évaluation

- Problem SolvingDocument9 pagesProblem Solvingmax p0% (2)

- Unit Trust Products-1 PDFDocument2 pagesUnit Trust Products-1 PDFgatimupPas encore d'évaluation

- 3 1 Gavin HolmesDocument38 pages3 1 Gavin HolmesjokoPas encore d'évaluation

- Money Management PlannerDocument4 pagesMoney Management PlannerlaxmiccPas encore d'évaluation

- LIBOR - Its End & The Transition To SOFR - Morgan StanleyDocument7 pagesLIBOR - Its End & The Transition To SOFR - Morgan StanleyKhalilBenlahccen100% (1)