Académique Documents

Professionnel Documents

Culture Documents

Anti Dumping Duty Notifications (Customs) No.05/2014 Dated 16th January, 2014

Transféré par

stephin k j0 évaluation0% ont trouvé ce document utile (0 vote)

40 vues3 pagesAnti Dumping Duty Notifications (Customs) No.05/2014 "

Seeks to levy definitive anti-dumping duty on imports of ‘Nonyl Phenol’, originating in, or exported from, Chinese Taipei for a further period of five years" Dated 16th January, 2014

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentAnti Dumping Duty Notifications (Customs) No.05/2014 "

Seeks to levy definitive anti-dumping duty on imports of ‘Nonyl Phenol’, originating in, or exported from, Chinese Taipei for a further period of five years" Dated 16th January, 2014

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

40 vues3 pagesAnti Dumping Duty Notifications (Customs) No.05/2014 Dated 16th January, 2014

Transféré par

stephin k jAnti Dumping Duty Notifications (Customs) No.05/2014 "

Seeks to levy definitive anti-dumping duty on imports of ‘Nonyl Phenol’, originating in, or exported from, Chinese Taipei for a further period of five years" Dated 16th January, 2014

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 3

[TO BE PUBLISHED IN PART II, SECTION 3, SUB-SECTION (i) OF THE

GAZETTE OF INDIA, EXTRAORDINARY]

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

(DEPARTMENT OF REVENUE)

Notification No. 05/2014-Customs (ADD)

New Delhi, the 16

th

January, 2014

G.S.R. (E). Whereas, the designated authority, vide notification No. 15/1007/2012-

DGAD, dated the 9

th

August, 2012, published in Part I, Section I of the Gazette of India, Extraordinary

had initiated a review in the matter of continuation of anti-dumping duty on imports of Nonyl Phenol

(hereinafter referred to as the subject goods) falling under Tariff item 2907 13 00 of the First Schedule

to the Customs Tariff Act, 1975 (51 of 1975) (hereinafter referred to as the Customs Tariff Act),

originating in or exported from, Chinese Taipei (hereinafter referred to as the subject country),

imposed vide notification of the Government of India, in the Ministry of Finance (Department of

Revenue), No. 94/2007 dated the 22

nd

August, 2007 published in Part II, Section 3, Sub-section (i) of

the Gazette of India, Extraordinary, vide G.S.R. No. 562 (E), dated the 22

nd

August, 2007.

And whereas, the Central Government had extended the anti-dumping duty on the subject

goods, originating in or exported from the subject country upto and inclusive of the 21

st

August,

2013 vide notification of the Government of India, in the Ministry of Finance (Department of

Revenue), No. 39/2012 Customs (ADD) dated the 24

th

August, 2012, published in Part II, Section 3,

Sub-section (i) of the Gazette of India, Extraordinary, vide G.S.R No. 650 (E), dated the 24

th

August,

2012.

And whereas, in the matter of review of anti-dumping duty on import of the subject goods,

originating in or exported from the subject country, the designated authority vide its final findings, No.

15/1007/2012-DGAD dated the 8

th

November, 2013, published in Part I, Section 1, of the Gazette of

India, Extraordinary, has come to the conclusion that,-

(i) The subject goods from subject country are entering the Indian market at dumped prices;

(ii) The subject goods continue to be exported to India at dumped prices despite the existing anti

dumping duties and there is a likelihood of its continuation should the existing antidumping duties are

allowed to cease;

(iii) The injury to the domestic industry is likely to continue in the event of withdrawal of anti dumping duty

from the subject countries;

(iv) The situation of domestic industry continues to be fragile and therefore should the present anti

dumping duties from the subject country be withdrawn, injury to the domestic industry is likely to

recur; and

(v) The anti dumping duties are required to be extended and modified,

and has recommended continued imposition of the anti-dumping duty on the subject goods,

originating in or exported from the subject country.

Now, therefore, in exercise of the powers conferred by sub-sections (1) and (5) of section 9A

of the Customs Tariff Act, read with rules 18 and 23 of the Customs Tariff (Identification, Assessment

and Collection of Anti-dumping Duty on Dumped Articles and for Determination of Injury) Rules, 1995,

the Central Government, after considering the aforesaid final findings of the designated authority,

hereby imposes on the subject goods, the description of which is specified in column (3) of the Table

below, falling under tariff item of the First Schedule to the Customs Tariff Act as specified in the

corresponding entry in column (2), originating in the countries as specified in the corresponding entry

in column (4), and exported from the countries as specified in the corresponding entry in column (5),

and produced by the producers as specified in the corresponding entry in column (6), and exported

by the exporters as specified in the corresponding entry in column (7), and imported into India, an

anti-dumping duty at the rate equal to the amount as specified in the corresponding entry in column

(8) in the currency as specified in the corresponding entry in column (10) and as per the unit of

measurement as specified in the corresponding entry in column (9) of the said Table.

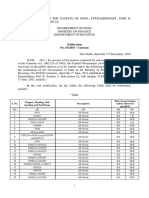

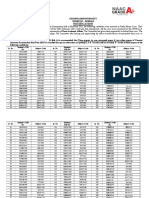

Table

Sl.No. Tariff

Item

Description

of goods

Country

of origin

Country

of

export

Producer Exporter Amount Unit of

measurement

Currency

(1) (2) (3) (4) (5) (6) (7) (8) (9) (10)

1 2907

13

00

Nonyl

Phenol

Chinese

Taipei

Chinese

Taipei

M/s China

Man-made

Fibre

Corporation

M/s China

Man-made

Fibre

Corporation

163.62 MT US

Dollar

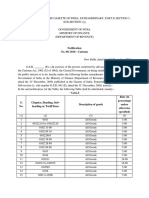

2 2907

13

00

Nonyl

Phenol

Chinese

Taipei

Chinese

Taipei

M/s

Formosan

Union

Chemical

Corporation

M/s

Formosan

Union

Chemical

Corporation

207.18 MT US Dollar

3 2907

13

00

Nonyl

Phenol

Chinese

Taipei

Chinese

Taipei

Any combination of

producer / exporter (other

than in Sl. No. 1 and 2

above)

364.48 MT US

Dollar

4 2907

13

00

Nonyl

Phenol

Chinese

Taipei

Any

country

other

Any Any 364.48 MT US

Dollar

than

Chinese

Taipei

5 2907

13

00

Nonyl

Phenol

Any

Any

country

other

than

Chinese

Taipei

Chinese

Taipei

Any Any 364.48 MT US Dollar

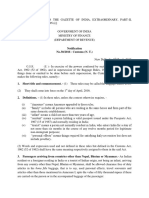

2. The anti-dumping duty imposed under this notification shall be effective for a period of

five years (unless revoked, superseded or amended earlier) from the date of publication of this

notification in the Official Gazette.

3. The anti-dumping duty imposed under this notification shall be paid in Indian currency.

Explanation.- For the purposes of this notification, rate of exchange applicable for the

purposes of calculation of such anti-dumping duty shall be the rate which is specified in the

notification of the Government of India, in the Ministry of Finance (Department of Revenue), issued

from time to time, in exercise of the powers conferred by section 14 of the Customs Act, 1962 (52 of

1962), and the relevant date for the determination of the rate of exchange shall be the date of

presentation of the bill of entry under section 46 of the said Customs Act.

[F.No.354/117 /2007-TRU]

(Akshay Joshi)

Under Secretary to the Government of India

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Customs Circular No.10/2016 Dated 15th March, 2016Document4 pagesCustoms Circular No.10/2016 Dated 15th March, 2016stephin k jPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Customs Circular No. 25/2015 Dated 15th October, 2015Document10 pagesCustoms Circular No. 25/2015 Dated 15th October, 2015stephin k jPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Customs Circular No.05/2015 Dated 9th February, 2016Document21 pagesCustoms Circular No.05/2015 Dated 9th February, 2016stephin k jPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Customs Circular No.04/2015 Dated 9th February, 2016Document5 pagesCustoms Circular No.04/2015 Dated 9th February, 2016stephin k jPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Customs Circular No. 27/2015 Dated 23rd October, 2015Document13 pagesCustoms Circular No. 27/2015 Dated 23rd October, 2015stephin k jPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Customs Circular No. 20/2015 Dated 31st July 2015Document15 pagesCustoms Circular No. 20/2015 Dated 31st July 2015stephin k jPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Customs Circular No.03/2015 Dated 3rd February, 2016Document4 pagesCustoms Circular No.03/2015 Dated 3rd February, 2016stephin k jPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Customs Circular No. 28/2015 Dated 23rd October, 2015Document3 pagesCustoms Circular No. 28/2015 Dated 23rd October, 2015stephin k jPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Customs Circular No. 03/2015 Dated 16th January, 2015Document2 pagesCustoms Circular No. 03/2015 Dated 16th January, 2015stephin k jPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Customs Circular No. 06/2015 Dated 11th February, 2015Document1 pageCustoms Circular No. 06/2015 Dated 11th February, 2015stephin k jPas encore d'évaluation

- Customs Circular No. 16/2015 Dated 19th May, 2015Document6 pagesCustoms Circular No. 16/2015 Dated 19th May, 2015stephin k jPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Customs Circular No. 18/2015 Dated 9th Jun, 2015Document2 pagesCustoms Circular No. 18/2015 Dated 9th Jun, 2015stephin k jPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Customs Circular No. 10/2014 Dated 17th October, 2014Document3 pagesCustoms Circular No. 10/2014 Dated 17th October, 2014stephin k jPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Customs Circular No. 13/2014 Dated 18th November, 2014Document3 pagesCustoms Circular No. 13/2014 Dated 18th November, 2014stephin k jPas encore d'évaluation

- Customs Tariff Notifications No.63/2016 Dated 31st December, 2016Document38 pagesCustoms Tariff Notifications No.63/2016 Dated 31st December, 2016stephin k jPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Customs Tariff Notifications No.54/2016 Dated 3rd October, 2016Document6 pagesCustoms Tariff Notifications No.54/2016 Dated 3rd October, 2016stephin k jPas encore d'évaluation

- Customs Tariff Notifications No.37/2014 Dated 29th December, 2014Document60 pagesCustoms Tariff Notifications No.37/2014 Dated 29th December, 2014stephin k jPas encore d'évaluation

- Customs Tariff Notifications No.67/2016 Dated 31st December, 2016Document34 pagesCustoms Tariff Notifications No.67/2016 Dated 31st December, 2016stephin k j100% (2)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Customs Tariff Notifications No.66/2016 Dated 31st December, 2016Document26 pagesCustoms Tariff Notifications No.66/2016 Dated 31st December, 2016stephin k jPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Customs Tariff Notifications No.64/2016 Dated 31st December, 2016Document22 pagesCustoms Tariff Notifications No.64/2016 Dated 31st December, 2016stephin k jPas encore d'évaluation

- Customs Non Tariff Notifications No.30/2016 Dated 1st March, 2016Document6 pagesCustoms Non Tariff Notifications No.30/2016 Dated 1st March, 2016stephin k jPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Customs Non Tariff Notifications No.34/2016 Dated 29th February, 2016Document2 pagesCustoms Non Tariff Notifications No.34/2016 Dated 29th February, 2016stephin k jPas encore d'évaluation

- Customs Non Tariff Notifications No.32/2016 Dated 1st March, 2016Document5 pagesCustoms Non Tariff Notifications No.32/2016 Dated 1st March, 2016stephin k jPas encore d'évaluation

- Customs Non Tariff Notifications No.26/2016 Dated 16th February, 2016Document11 pagesCustoms Non Tariff Notifications No.26/2016 Dated 16th February, 2016stephin k jPas encore d'évaluation

- Customs Non Tariff Notifications No.11/2016 Dated 12th January, 2016Document3 pagesCustoms Non Tariff Notifications No.11/2016 Dated 12th January, 2016stephin k jPas encore d'évaluation

- Customs Non Tariff Notifications No.31/2016 Dated 1st March, 2016Document2 pagesCustoms Non Tariff Notifications No.31/2016 Dated 1st March, 2016stephin k jPas encore d'évaluation

- Customs Non Tariff Notifications No.20/2016 Dated 8th February, 2016Document4 pagesCustoms Non Tariff Notifications No.20/2016 Dated 8th February, 2016stephin k jPas encore d'évaluation

- Customs Non Tariff Notifications No.22/2016 Dated 8th February, 2016Document9 pagesCustoms Non Tariff Notifications No.22/2016 Dated 8th February, 2016stephin k jPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Customs Tariff Notifications No.37/2014 Dated 29th December, 2014Document60 pagesCustoms Tariff Notifications No.37/2014 Dated 29th December, 2014stephin k jPas encore d'évaluation

- The Atlas Series: Thank You!Document8 pagesThe Atlas Series: Thank You!Leicel cuevasPas encore d'évaluation

- Dominion Insurance Vs CADocument3 pagesDominion Insurance Vs CAJMF1234Pas encore d'évaluation

- EPG Construction Co. vs. Vigilar, 354 SCRA 566, G.R. No. 131544 March 16, 2001Document12 pagesEPG Construction Co. vs. Vigilar, 354 SCRA 566, G.R. No. 131544 March 16, 2001Marl Dela ROsaPas encore d'évaluation

- 2020 4 1501 43489 Judgement 13-Apr-2023Document15 pages2020 4 1501 43489 Judgement 13-Apr-2023ckd84Pas encore d'évaluation

- Broker Carrier Agreement 2Document13 pagesBroker Carrier Agreement 2vizroadgroupPas encore d'évaluation

- NOTIFICATION - UMC Decision Exam May-2021Document7 pagesNOTIFICATION - UMC Decision Exam May-2021Ak HilPas encore d'évaluation

- Vector Calculus Colley 4th Edition Solutions ManualDocument24 pagesVector Calculus Colley 4th Edition Solutions ManualJenniferDownsqzes100% (33)

- II.C.5.a, B, I - APQ Ship Management V Casenas (Full Text)Document7 pagesII.C.5.a, B, I - APQ Ship Management V Casenas (Full Text)Andrew Mercado NavarretePas encore d'évaluation

- Magellan Capital Management Corporation vs. Zosa, 355 SCRA 157 (2001)Document5 pagesMagellan Capital Management Corporation vs. Zosa, 355 SCRA 157 (2001)DNAA100% (1)

- Fourth Judicial Region Regional Trial Court Branch 46 San Jose, Occidental Mindoro Hon. Ulysses D. DelgadoDocument3 pagesFourth Judicial Region Regional Trial Court Branch 46 San Jose, Occidental Mindoro Hon. Ulysses D. DelgadoVILLAMAR LAW OFFICEPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Module 1 EthicsDocument16 pagesModule 1 EthicsRadha ChaudharyPas encore d'évaluation

- Case DigestDocument7 pagesCase DigestTeddyboy AgnisebPas encore d'évaluation

- United States v. Ticchiarelli, 171 F.3d 24, 1st Cir. (1999)Document16 pagesUnited States v. Ticchiarelli, 171 F.3d 24, 1st Cir. (1999)Scribd Government DocsPas encore d'évaluation

- Free Speech FlowchartDocument1 pageFree Speech FlowchartAlexandra SashaPas encore d'évaluation

- ROPA 2009 For West Bengal Teachers Modification)Document4 pagesROPA 2009 For West Bengal Teachers Modification)arup_maiti424190% (10)

- Go 84 DT 17.09.2012-Sanction of Maternity LeaveDocument2 pagesGo 84 DT 17.09.2012-Sanction of Maternity LeaveNarasimha SastryPas encore d'évaluation

- WUT: Dario Navarro Letter To St. Louis #3Document5 pagesWUT: Dario Navarro Letter To St. Louis #3collegetimesPas encore d'évaluation

- Beachwood Police LawsuitDocument13 pagesBeachwood Police LawsuitWKYC.comPas encore d'évaluation

- Royal Decree 53 - 2023 Promulgating The Labour Law - Decree NEWDocument30 pagesRoyal Decree 53 - 2023 Promulgating The Labour Law - Decree NEWafrahPas encore d'évaluation

- Chapter 25 DerivativesDocument4 pagesChapter 25 DerivativesThomasPas encore d'évaluation

- Canada Korea Foundation Court FileDocument45 pagesCanada Korea Foundation Court FileBob MackinPas encore d'évaluation

- Fadd "Trap Queen" Motion To DismissDocument18 pagesFadd "Trap Queen" Motion To DismissTHROnlinePas encore d'évaluation

- Short NotesDocument3 pagesShort NotesGautamPariharPas encore d'évaluation

- Republic vs. Lao, G.R. No. 205218Document2 pagesRepublic vs. Lao, G.R. No. 205218DanielMatsunagaPas encore d'évaluation

- US Shrimp DS58Document2 pagesUS Shrimp DS58dorudascPas encore d'évaluation

- Lawsuit Against SubdivisionDocument17 pagesLawsuit Against SubdivisionAnonymous Pb39klJ100% (2)

- Marriage Equality TestimonyDocument3 pagesMarriage Equality TestimonyKris CoffieldPas encore d'évaluation

- The Merger Doctrine: by Lewis R. ClaytonDocument2 pagesThe Merger Doctrine: by Lewis R. ClaytonPriya RaviPas encore d'évaluation

- Chapter 11-CRIMINAL Law-UoLDocument5 pagesChapter 11-CRIMINAL Law-UoLVikash HingooPas encore d'évaluation

- Horizons Employee HandbookDocument7 pagesHorizons Employee Handbookapi-434171191Pas encore d'évaluation