Académique Documents

Professionnel Documents

Culture Documents

Investment Alternatives For Tax Savings For Salaried Employees

Transféré par

sanjaymenon94Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Investment Alternatives For Tax Savings For Salaried Employees

Transféré par

sanjaymenon94Droits d'auteur :

Formats disponibles

Investment alternatives for tax savings for salaried

employees:

Often, investment for most individuals begins and ends with tax

planning. Although it is pertinent to avail tax breaks, this should not be

the sole focus. Start by jotting down your key financial objectives, the

tentative time of money requirement and the corpus needed to achieve

those goals. One can use tax saving investments effectively, to achieve

financial goals. or example, one can take a children!s plan that also

provides tax benefit. "onsider the impact of inflation on your needs. After

your first few working years, as income goes up, it is wise to invest

beyond one!s taxsaving investments to achieve your goals. Also,

evaluate the life cover requirement, while planning for your taxes.

As you begin your career, you may not have visibility on your needs. #n

this case, set a target of corpus achievement. or example, how quickly

you can hit a corpus of $s % crore from tax savings investments. &ou

can accelerate this by increasing your contribution yearly, keeping in

mind salary hikes and inflation.

'aving a goal makes the exercise of investing more interesting and

there is always the corpus to look forward to. 'aving clarity will also help

you keep track.

(here are a range of avenues with different levels of risk, return and

liquidity. "hoose an appropriate mix of investments to maintain an

appropriate asset allocation and to help achieve your financial

objectives. )ast returns data may be misleading. *xample, when

markets are at a high and about to fall, equities will give you the best

track record. (oday, when markets are down, it could be a better time to

invest with a three year hori+on. (he maturity should suit the needs you

are planning for. ,eep in mind the tax you need to pay on the returns.

Maximising your tax saving

%. Exemptions/reimbursements #dentify the reimbursements

available from the company and take maximum advantage of the same.

-ormal expenses that one incurs could help save tax. *xample.

(elephone/fuel reimbursements, meal vouchers and company car. A

person in lower tax slabs can reduce his tax liability to nil with

exemptions alone.

Similarly, salaried employees staying in rented apartments can claim

exemption under Section %0123 of the Act in respect of house rent

allowance by making the '$A a component of there salary.

Some of The Popularly Knon Exemptions/!eimbursements

"ouse !ent #lloan$e

4inimum of .

%. Actual '$A

5. $ent )aid 6 %07 of 8asic

9. :0a7 of 8asic 1-on.4etros3 or 207 of 8asic 14etros3

%onveyan$e #lloan$e

$s ;00 / 4onth

&eave Travel #lloan$e

(wo trips in a block of : &rs Amount not exceeding Air *conomy or $ail

A" # are shall be for shortest distance and for a single destination

Medi$al !eimbursement

$s %2,000 / Annum

5. 'edu$tions

Se$tion ()% allows a maximum limit of $s % lakh across

investments ranging from provident fund, )), infrastructure

bonds, fixed deposits 12 years or more3, -S", insurance/pension

plans, unit linked insurance, equity linked savings scheme etc. #t

also includes tuition fees of your children and the repayment of

principal on your housing loan.

(he interest $omponent on your home loan has a separate limit

of $s %.2 lakh.

4edical premia upto a maximum of $s %2,000 qualifies for

deduction, with an additional $s %2,000 for parents. Additional

deduction of 50,000 could be availed in case of a senior

citi+en.&ou can claim a separate deduction for medical premium of

your parents.

A person with disability or those who have spent money on the

maintenance 1including medical treatment3 of dependant persons

with disability, could avail deductions under section ;0< and ;0==

of the Act, respectively.

#ndividuals paying interest on education loan should obtain the

interest payment certificate underse$tion ()E of the Act.

&esser Knon Tax Saving Tips / 'edu$tions

or most of the people >tax savings! brings to mind life insurance, )),

-S", and equity.linked savings scheme, among others, that qualify for

tax deduction under Section ;0 " of the #ncome.(ax Act. An individual

can claim tax deductions of up to $s % lakh under ;0". 'owever, there

are other lesser known avenues that offer additional tax breaks to

individuals. (hey are not widely discussed as they involve special

situations in life such as having a special dependant, paying rent to

parents, owning a house in another city, and so on. 'ere is a small list

you could explore.

Paying rent to your parents

=o you live in your parents! house? &ou can pay them rent to claim

'ouse $ent Allowance exemption. (his is possible only if the property is

registered in the name of your parent. (he owner will be taxed for the

rental income after a 907 deduction. So, if you pay your father a rent of

$s 9 lakh a year 1$s 52,000 a month3, he will be taxed for only $s 5.%

lakh. #f your parents are retired and do not derive any significant taxable

income, the amount of rent would be tax free in their hands. #t is

advisable that you enter into an agreement with them and actually make

the payment every month, preferably by cheque.

#t gets better if the property is jointly owned by both parents. (hen you

can divide the rent two.ways so that the tax liability gets split between

the two parents. #f their income exceeds the basic exemption limit, you

can help them save tax by investing in their name under Section

;0" optionssuch as the Senior "iti+ens! Saving Scheme, five.year bank

fixed deposits or tax.saving equity mutual funds.

(ake a look at the example to see the tax implications. @et us assume

your monthly basic salary is $s :0,000 and '$A is $s %A,000. &our

monthly rent is also $s %A,000. #n this case, of the total monthly '$A, $s

%5,000 will be tax exempt. Assuming you are in the 507 tax bracket,

your annual tax saving would be $s 5B,AA:.

)lease note that you will have to submit copies of rent receipts or rent

agreement, depending on what your organisation stipulates. 'owever,

avoid claiming tax benefits on rent payments made to the spouse as the

arrangement can be characterised as a sham transaction, say experts.

!enting and "ome loan in to different lo$ations

#ndividuals today are constantly on the move for better job prospects.

(his could result in a person living in a rented place in the city he is

working while repaying the loan for a home bought in his native city or

any other city. #n such a scenario, the rent that an individual pays is

eligible for '$A exemption. urther, a deduction can be claimed on the

interest paid for the housing loan used to purchase the property at the

native place/any other city.

@et us assume your monthly basic salary is $s :0,000 and '$A is $s

%A,000. &our monthly rent is $s %A,000 and annual interest payment on

your housing loan is $s %.:2 lakh. #n this case, of the total monthly '$A,

$s %5,000 will be tax exempt in your hands. urther, you can claim

deduction under section 5:1b3 of the #ncome.(ax Act, %BA%, on the

interest payable on your housing loan.

or claiming '$A exemption, you need to submit copy of the lease

agreement or rent receipts. or claiming deduction on housing loan

interest, you need to submit a copy of the tax certificate issued by the

housing finance company.

Set off of %apital &oss #gainst %apital *ain

Chile most of us know that we need to pay taxes on short term or long

term capital gains, not many are aware of the fact that capital losses, if

any, can be balanced off against gains. So, for instance, if you have

made a long.term capital gain of $s %2 lakh by selling off your property

and long.term capital loss of $s 9 lakh by selling stocks which are either

not listed or are sold off market , the total taxable amount would $s %5

lakh.

)lease note "apital Dain on Sale of Shares sold through Stock

*xchange can not be set off against other capital gain as profit from sale

of shares of listed companies through stock exchange in exempt.

#t is important to note that short term losses can be balanced off against

both short term as well as long term capital gains. 'owever, long term

capital losses can only be balanced off against long term capital gains.

%harity to noble $auses $ount

"haritable contributions are deductible up to %07 of your income under

Section ;0D. =epending upon the institution to which the donation is

being made, the deduction can be either %007 or 207 of the amount

donated. &ou must *nsure that you obtain a receipt from the institution

and a copy of their income.tax exemption certificate. #nstead of giving

the money directly to the needy and not getting any deduction, you can

make a charitable contribution to an -DO that provides assistance to the

needy. (he individual is then able to get a tax deduction while still

contributing to a noble cause.

%ontributions to a politi$al party

#f you have contributed any amount to a recognised political party, you

are eligible to claim a tax deduction ranging from 20 percent to %00

percent of the amount under Section ;0DD" for individuals and Section

DD8 for corporate organisations. One can contribute up to %0 percent of

one!s gross total income to a political party.

"ome loan and +oint home loan

(he principal repayment of the home loan qualifies for deduction under

section ;0"E the interest payable on the home loan is allowed as

deduction under section 5: of the Act. (he deduction in respect of the

interest is available in full for properties that are treated as let out, but in

case of a property treated as self.occupied, the amount cannot exceed

$s %.2 lakh per financial year, subject to certain conditions.

'owever, you cannot claim interest deduction when the flat is under

construction. (he interest paid during the per.construction period can be

claimed as deduction in five equal installments starting from the financial

year in which the construction is completed. Chere the property is jointly

owned, with the share of each owner being definite, the net taxable

annual value of the property is apportioned to each of the joint owners in

the ratio of their share in the property. And, as the shares are definite,

each holder is eligible to claim a separate deduction in case the property

is jointly owned.

Edu$ational expenses of %hildren

#t is well.known that the deduction under section ;0" is available to an

individual in respect of thetuition fees of his/her children with an overall

limit of $s % lakh. (he deduction, however, is not available for capitation

fees/donation collected by the school or college. (here is another

section in the Act 1section ;0*3 which provides for deduction in respect

of interest on loan taken for higher education.

(he educational loan can be taken for any course pursued by the

individual or the spouse or children of the individual post the senior

secondary course or its equivalent. (his deduction is also available for

supporting the education of a relative provided the individual is his/her

legal guardian. #t is allowed for a maximum of eight years starting from

the year in which the interest is first repaid.

"ealth Insuran$e

A deduction of up to $s %2,000 can be claimed in respect of the

health insurance premium which one pays for covering oneself and or

the wife and dependent children. &ou can claim an exemption of $s

%2,000 on premium payments made for parents and a higher deduction

of up to $s 50,000 if one of your parents is a senior citi+en. 'owever, in

case of company insurance, only the organisation can seek tax relief and

not the employee.

"ave an ill dependent to loo, after- Pay loer taxes

(he income tax department understands that chronic illness of a

dependent can empty your life savings, and paying full taxes in such

cases is burdensome for any taxpayer. 'ence, it allows a deduction of

$s :0,000 1$s A0,000 if the dependent is a senior citi+en3 per year,

under Section ;0==8. =ependants include siblings, children, parents

and spouses.

(his deduction is available for specific diseases, which include many

neurological diseases like dystonia musculorum deformans, aphasia and

)arkinson!s disease, hemiballismus, ataxia, motor neuron disease,

chorea, haematological disorders, chronic kidney failure, and a few

more.

#n order to claim this deduction, it is important that the patient should be

dependant on the taxpayer, and should not have filed for such a

deduction separately.

'edu$tion for medi$al expenses in$urred on disability of Spe$ial

dependants . se$tion ()''

#n case any of your dependants suffer from a physical or mental

disability, you can claim a deduction under section ;0== for an amount

of $s 20,000 1if the disability is less than ;073 or $s % lakh 1if the

disability is ;07 or more3.

=ependants for this purpose can include spouse, children, parents,

brothers and sisters, or any of them. (o be eligible to claim the

deduction, you must obtain a certificate in orm %0#A from a doctor with

the prescribed qualification and working in a government hospital.

&ou will have to submit the copy of the certificate in orm %0#A to the

payroll department of your organisation.

Scope of Deduction 6 =eduction can be claimed for dependent parents,

spouse, children and siblings. =ependents must not have claimed any

deduction for their disability.

=eductions are permissible in either of the following cases.

a3 "osts incurred for medical treatment, training or rehabilitation of a

disabled dependent, including amount spent for nursing.

b3 Amount paid towards an insurance scheme for the maintenance of

your disabled dependent in case of your untimely death.

Meaning of Disability- =isability means a person suffering from :07 or

more of any of the below disabilities. A severe disability condition is ;07

or more of the disabilities.

a3 8lindness and Fision problems

b3 @eprosy.cured

c3 'earing impairment

d3 @ocomotor disability

e3 4ental retardation or illness

Please Note -

a3 #ndividuals would need to produce a copy of the disability certificate

as issued by the central or state government medical board to claim

deduction.

b3 #nsurance policy obtained must be in your name and should be a

policy for life. #t could pay either an annuity or a lump sum amount for the

benefit of the dependent on your death.

c3 #f the disabled dependent predeceases you, the policy amount is

returned to you, and treated as income for the year in which you receive

it, thus fully taxable in your hands.

Medi$al expenses for spe$ified diseases li,e #I'S/ %an$er 0Se$tion

() ''1 3

(he actual expenditure incurred on treatment of specified disease such

as A#=S, cancer, neurological diseases, etc., is deductable to the extent

of :0,000 or the actual expense whichever is lower. (he limit is

increased to A0,000 in case of expense incurred for a senior citi+en.

Scope of Deduction 6 =eduction is applicable for treatment of self,

spouse, children, siblings, and parents, wholly dependent on you.

Diseases covered

a3 -eurological =iseases 1where the disability level has been certified as

:07 or more3.

b3 )arkinson!s =isease

c3 4alignant "ancers

d3 Acquired #mmune =eficiency Syndrome 1A#=S3

e3 "hronic $enal failure

f3 'emophilia

g3 (halassaemia

Point to Note-

%. #f you are already receiving any reimbursement for the treatment from

your insurance company or employer, deductions cannot be claimed. #f

you are receiving partial reimbursement, the balance amount can be

used for a deduction.

5. A certificate would be required from a specialist working in a

government hospital, as proof for the specified ailment.

'edu$tion for rent paid if you are not availing "!#

&ou can claim a deduction for rent paid to the extent of 5,000 per month

even if you don!t receive '$A from your employer or you are self.

employed. (his deduction, available under Section ;0DD, is subject to

some conditions.

(o "laim the deduction -either the taxpayer nor the spouse should own

a house at the place of employment. (hey cannot be self employed,

which includes businessmen or professionals. @astly, the tax payer

should not self.occupy his/her house at any other place.

#mount paid under 2ational Pension System

G(he contributions made by an employee to the -)S qualify for a

deduction under ;0""= and the upper limit of %,00,000 under Section

;0" of the Act. 'owever, effective April 50%%, employer contributions to

-)S up to %07 of the employee!s salary would qualify for an additional

deduction.

3oreign taxes

4any individuals take up overseas assignments and as a result earn

income both in #ndia and abroad. #n the event they face taxation in both

countries, they may avail credit of taxes paid overseas while filing their

tax returns in #ndia. (he #ndian tax laws as well as tax treaties signed by

#ndia with other countries prescribe provisions for claiming credit of

foreign taxes.

!epairs and maintenan$e of house property

&ou will never forget to claim deduction of interest on repayment of your

home loan, but not many people know that any interest paid on home

loan for reconstruction or repair of the Ghouse propertyH qualifies for

deduction of up to 90,000, subject to the overall limit of %,20,000.

Exemption from $apital gains

#f you have made any capital gains on the sale of residential house

property, such capital gains shall be exempt from tax, provided you

purchase a new residential house one year before or within two years

after the date of transferE or you incur expenditure on construction of

house property within three years from the date of transfer. Alternatively,

to avail exemption, a tax payer may also invest the gains in $*" / -'A#

bonds, subject to specified conditions.

4ith most $ompanies $losing investment de$laration by +anuary

end/ you still have some time to iden your tax relief5 Thin,/

exe$ute and file your investment de$laration and see, optimal tax

benefits5 These dedu$tions/ along ith the $ommon ones li,e

medi$al benefits/ "!#/ home loan EMIs/ et$5 $an help you save a

$onsiderable amount of tax every year5

&itle Knon S$hemes u/s ()% of In$ome Tax #$t

#f an individual falls in the 907 tax bracket and has exhausted the

maximum limit of Sec ;0", one can save $s 90,B00 in taxes. Ce runs

you through the provisions of Section ;0". 'owever, we highlight those

schemes that are little known and which many investors avail of

sparingly.

Stamp duty and registration $harges

(he first and foremost provision that many taxpayers are not aware of

isstamp duty and registration $harges. According to the law, >the

amount paid towards stamp duty, registration fees and other expenses

for the purpose of transfer of house property to the owner also qualifies

for tax exemption!. (his is over and above the principal payment that

qualifies under Section ;0". 8ut deduction u/s. ;0" for total amount

including )rincipal @oan $epayment and stamp duty and registration

$harges can not exceed $s. One @akh.

*xemption for interest payment towards home loan is permissible under

another section hence the above limit of $s % lakh does not apply to it.

@et us take an example, 4r A purchases a house property of $s 95 lakh

and takes a home loan of $s 52 lakh at %07. 'is stamp duty and

registration charges on this work out to approximately $s %.I2 lakh. (he

interest for the first year comes to $s 5.:; lakh and principal payment

comes to $s :%,9IA.

(hus, 4r A can claim maximum tax exemption of $s %.2 lakh on his

interest payment under Sec 5:. (he entire principal payment 1not more

than $s % lakh3 of $s :%,9IA can be claimed under Sec ;0".

-onetheless, it still leaves $s 2;,A5: to be invested in other tax.saving

instruments to reduce overall tax liability. #n reality, buying a house is

quite often an expensive affair, leaving little cash with the homebuyer.

On top of it, if one has to make additional investment to save on tax, it

becomes difficult.

8ut with the inclusion of registration and stamp duty fees under Section

;0", it not only reduces tax liability but also saves the property buyer

from further cash outgo.

3ixed.deposit ith "6'%7 or any housing board

Another provision that would be eligible for exemption under Section

;0" is >any sum paid towards fixed.deposit schemes of '<="O or to

any housing board, which is constituted in #ndia for the purpose of

planning, development or improvement of cities or towns!.

(ypically, these schemes are promoted by state housing boards to

promote long.term social sector objectives, or for infrastructure

development of city. #n fact, principal payment towards home loans

taken from 'ousing and <rban =evelopment "orporation 1'<="O3 also

qualifies for exemption under Sec ;0".

*ven subscription to a home loan account scheme of the -ational

'ousing 8ank 1-'83 or contribution to any notified pension fund set up

by the -'8 also meet the requirements. 'ence, if these two offer home

loans at competitive rates, one can avail loan from them as well.

%ontribution to a non.$ommutable deferred annuity plan

urther, $ontribution to a non.$ommutable deferred annuity plan is

also an option to avail tax exemption. #n normal parlance, this is nothing

but a standard pension plan eligible for tax exemption under Section

;0".

(his includes schemes such as Jeevan Suraksha by @#" or )ension

)lus plan by '=" Standard @ife. "ontribution to an approved

superannuation fund is also a way to claim tax benefit.

(ypically, large organisations maintain superannuation funds and

contribute to them. #n case employees want to make a higher

contributionE they can do so to the extent of %27 of basic plus dearness

allowance. 8esides these lesser.known options, the other commonly

used options are contribution to employee provident fund, life insurance

premium, or payment of tuition fees. ive.year tax saving fixed deposits

issued by banks can also be bought.

Cith a A.I .I27 quarterly compounding interest rate, these =!s have

an edge over -S" with a one.year lesser lock.in period. 'owever, the

-S" has an edge because of the fact that interest accrued is also

eligible for ;0 " limit for the first five years that is not the case with =s.

E8uity.lin,ed savings s$heme M3 or 6lips

8esides, these low risk options, one can go for high.risk return schemes

such as equity.linked savings scheme 4 or even <lips. *@SS usually

provides a higher return in the long run than small savings schemes and

carries a lower lock.in period of three years.

Small savings schemes offer a lower return of around ; to ;.27. urther,

there is a relatively long lock.in period .%2 years for the )) and six

years for -S". (he advantage with these schemes is that they offer a

guaranteed return unlike equity.based products where there is no

guaranteed return and one can lose money like when the markets

tumbled in 500;.

$isk profile and investment strategy are the key determinants for

allocating funds to any scheme. Also, one must consider inflation.

adjusted returns before taking a decision.

Vous aimerez peut-être aussi

- 2020 Proteus Offshore, LLC Form 1065 Partnerships Tax Return - FilingDocument17 pages2020 Proteus Offshore, LLC Form 1065 Partnerships Tax Return - FilingPeter Kitchen100% (2)

- 22 Wealth MultipliersDocument19 pages22 Wealth MultipliersShantrece MarshallPas encore d'évaluation

- FINRA Investor Alert - 10 TipsDocument2 pagesFINRA Investor Alert - 10 TipslizjutilaPas encore d'évaluation

- Auditing International Approach NotesDocument29 pagesAuditing International Approach NotesRayz100% (1)

- Tax I R K FINAL AS AT 20 2 06Document315 pagesTax I R K FINAL AS AT 20 2 06Adarsh. UdayanPas encore d'évaluation

- 16 Don'T-Miss Tax DeductionsDocument4 pages16 Don'T-Miss Tax DeductionsGon FloPas encore d'évaluation

- Landlord Tax Planning StrategiesD'EverandLandlord Tax Planning StrategiesPas encore d'évaluation

- Tax Tips 2022Document26 pagesTax Tips 2022Mary Juvy Ramao100% (1)

- Self-Help Guidebook for Retirement Planning For Couples and Seniors: Ultimate Retirement Planning Book for Life after Paid EmploymentD'EverandSelf-Help Guidebook for Retirement Planning For Couples and Seniors: Ultimate Retirement Planning Book for Life after Paid EmploymentPas encore d'évaluation

- How To Convert A Traditional IRA To A Roth IRA: Key TakeawaysDocument2 pagesHow To Convert A Traditional IRA To A Roth IRA: Key Takeawayssaivijay2018Pas encore d'évaluation

- International TaxationDocument33 pagesInternational TaxationKaran VohraPas encore d'évaluation

- Provident Fund: How Should Provident Fund Trust Deed and Rules Consist ofDocument3 pagesProvident Fund: How Should Provident Fund Trust Deed and Rules Consist ofAzhar Rana100% (1)

- Sole Proprietorship Vs Partnership Vs Limited Liability Company (LLC) Vs Corporation Vs S CorporationDocument8 pagesSole Proprietorship Vs Partnership Vs Limited Liability Company (LLC) Vs Corporation Vs S CorporationAlex TranPas encore d'évaluation

- Sample Engagement Letter - PartnershipsDocument12 pagesSample Engagement Letter - PartnershipsSRIVASTAV17Pas encore d'évaluation

- Chapter#act 34 Small Business, Entrepreneurship, and General PartnershipsDocument57 pagesChapter#act 34 Small Business, Entrepreneurship, and General PartnershipsAhsan AliPas encore d'évaluation

- Income TaxDocument71 pagesIncome TaxMahrukh MalikPas encore d'évaluation

- Gather Data LO1Document8 pagesGather Data LO1Samson GirmaPas encore d'évaluation

- Tax PlanningDocument12 pagesTax PlanningPrince RajputPas encore d'évaluation

- Starting A Small Scale BusinessDocument26 pagesStarting A Small Scale BusinessMariam Oluwatoyin CampbellPas encore d'évaluation

- The Issue On Jurisdiction Regarding Double Taxation Avoidance Agreements: An OverviewDocument6 pagesThe Issue On Jurisdiction Regarding Double Taxation Avoidance Agreements: An Overviewrushi sreedharPas encore d'évaluation

- Credit For The Elderly or The Disabled: Publication 524Document16 pagesCredit For The Elderly or The Disabled: Publication 524api-115350234Pas encore d'évaluation

- Contractual Mechanisms of Investor Protection in Non-Listed Limited Liability Companies PDFDocument58 pagesContractual Mechanisms of Investor Protection in Non-Listed Limited Liability Companies PDFmariam machaidzePas encore d'évaluation

- A Sole ProprietorshipDocument2 pagesA Sole Proprietorshipkishorepatil8887100% (1)

- Employee Provident FundDocument7 pagesEmployee Provident FundAkm Ashraf Uddin0% (1)

- Tax Terminologies - W2 + C2C + 1099Document3 pagesTax Terminologies - W2 + C2C + 1099Chintan PatelPas encore d'évaluation

- COVID-19 Federal Assistance Summary of Benefits For Churches and IndividualsDocument4 pagesCOVID-19 Federal Assistance Summary of Benefits For Churches and IndividualsKirk PetersenPas encore d'évaluation

- Tax Deduction ChecklistDocument2 pagesTax Deduction ChecklistlunwenPas encore d'évaluation

- Risk ManagementDocument15 pagesRisk ManagementanupkallatPas encore d'évaluation

- 15 Tax Deductions You Should Know - E-Filing GuidanceDocument32 pages15 Tax Deductions You Should Know - E-Filing GuidanceErin LamPas encore d'évaluation

- Choosing A Business Structure For AaronDocument7 pagesChoosing A Business Structure For AaronJoshua GikuhiPas encore d'évaluation

- Entity Formation Checklist DHZ Rev 20140701Document15 pagesEntity Formation Checklist DHZ Rev 20140701KevinPas encore d'évaluation

- An Overview of Itemized DeductionsDocument19 pagesAn Overview of Itemized DeductionsRock Rose100% (1)

- Personal Financial StatementDocument3 pagesPersonal Financial StatementIra Hilado BelicenaPas encore d'évaluation

- Tax Assignment 7Document2 pagesTax Assignment 7Monis KhanPas encore d'évaluation

- Steps Followed in Establishing A Home Furnishing Unit/ Design StudioDocument5 pagesSteps Followed in Establishing A Home Furnishing Unit/ Design StudioshashikantshankerPas encore d'évaluation

- MBATaxDocument24 pagesMBATaxFilsufGorontaloPas encore d'évaluation

- Impact Accounting, LLCDocument6 pagesImpact Accounting, LLCbarber bobPas encore d'évaluation

- Partnership July 7 FinalDocument26 pagesPartnership July 7 FinalPaoPas encore d'évaluation

- Trust - Not A Separate Legal EntityDocument2 pagesTrust - Not A Separate Legal EntityNeha ShahPas encore d'évaluation

- US Internal Revenue Service: p4 - 1994Document16 pagesUS Internal Revenue Service: p4 - 1994IRSPas encore d'évaluation

- Self-Employed PersonDocument3 pagesSelf-Employed PersonqwertyPas encore d'évaluation

- Buckwold12e Solutions Ch11Document40 pagesBuckwold12e Solutions Ch11Fang YanPas encore d'évaluation

- Partnerships: Save $ and Experience The DifferenceDocument2 pagesPartnerships: Save $ and Experience The DifferenceFinn KevinPas encore d'évaluation

- Entrepreneurship Workbook (2 Ed) - LeggeDocument78 pagesEntrepreneurship Workbook (2 Ed) - LeggeTroy M. FowlerPas encore d'évaluation

- Chapter Two SolutionsDocument9 pagesChapter Two Solutionsapi-3705855Pas encore d'évaluation

- Tax Research AssignmentDocument8 pagesTax Research Assignmentanon_768972800100% (1)

- Estate Tax SyllabusDocument7 pagesEstate Tax SyllabuscuteangelchenPas encore d'évaluation

- CHAP 13 Partnerships and Limited Liability CorporationsDocument89 pagesCHAP 13 Partnerships and Limited Liability Corporationspriyankagrawal7100% (1)

- Tax Cuts and Jobs Act Individuals 2018Document4 pagesTax Cuts and Jobs Act Individuals 2018godardsfanPas encore d'évaluation

- Insurance LawsDocument158 pagesInsurance LawsmattiepPas encore d'évaluation

- Right Business GuideDocument24 pagesRight Business GuideAhmed KhanPas encore d'évaluation

- USD Tax Clinics: Dan Kimmons Reference Librarian USD Legal Research Center 619.260.6846 Dkimmons@sandiego - EduDocument36 pagesUSD Tax Clinics: Dan Kimmons Reference Librarian USD Legal Research Center 619.260.6846 Dkimmons@sandiego - EducglaskoPas encore d'évaluation

- Mortgagescreening ChecklistDocument14 pagesMortgagescreening Checklistحمود المريتعPas encore d'évaluation

- Appendix C - GlossaryDocument27 pagesAppendix C - GlossarySoriano GabbyPas encore d'évaluation

- IG CH 03Document20 pagesIG CH 03Basa TanyPas encore d'évaluation

- Money Matters: A Simple Guide To Help You Make Ends MeetD'EverandMoney Matters: A Simple Guide To Help You Make Ends MeetPas encore d'évaluation

- Fit Chap012Document56 pagesFit Chap012djkfhadskjfhksd100% (2)

- Hours and ProceduresDocument4 pagesHours and ProceduresttawniaPas encore d'évaluation

- Cruz16e Chap09 IMDocument10 pagesCruz16e Chap09 IMJosef Galileo SibalaPas encore d'évaluation

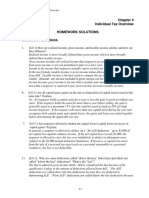

- Homework Chapter 4Document10 pagesHomework Chapter 4ChaituPas encore d'évaluation

- Year-End Adjustment NewDocument27 pagesYear-End Adjustment NewKyrzen Novilla0% (1)

- 國際快捷託運單Document3 pages國際快捷託運單Broundo ChungPas encore d'évaluation

- OD426681185912189100Document1 pageOD426681185912189100SethuPas encore d'évaluation

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 409150350210720 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 409150350210720 Assessment Year: 2020-21Vasanth Kumar AllaPas encore d'évaluation

- Screen Control TablesDocument19 pagesScreen Control TablesCarlos ConcencoPas encore d'évaluation

- Offer LetterDocument3 pagesOffer LetterAditya GadgilPas encore d'évaluation

- Assignment 1 Outline and Guideline UpdateDocument3 pagesAssignment 1 Outline and Guideline UpdateĐan Nguyễn PhươngPas encore d'évaluation

- WFH#3 OnegoDocument4 pagesWFH#3 OnegoJoselito OñegoPas encore d'évaluation

- Strictly Private & Confidential: Steria (India) LimitedDocument2 pagesStrictly Private & Confidential: Steria (India) LimitedAnant AhujaPas encore d'évaluation

- Instructions For Form CT-1: Department of The TreasuryDocument4 pagesInstructions For Form CT-1: Department of The TreasuryIRSPas encore d'évaluation

- SalamatDocument132 pagesSalamatCaila Chin DinoyPas encore d'évaluation

- Respuesta de La Comisión Europea A La Consulta de España Sobre El IVA de Las MascarillasDocument2 pagesRespuesta de La Comisión Europea A La Consulta de España Sobre El IVA de Las MascarillasMaldita.esPas encore d'évaluation

- Payroll January 15, 2024Document5 pagesPayroll January 15, 2024Joan Mendez RosalePas encore d'évaluation

- FBR Tax FilingDocument48 pagesFBR Tax FilingMuhammad Waqas Hanif100% (1)

- Liddell & Co DigestDocument2 pagesLiddell & Co DigestJoey PastranaPas encore d'évaluation

- Invoice 1694664392Document1 pageInvoice 1694664392Saurabh SinhaPas encore d'évaluation

- Socialight: H-No:8-2-703/4/1, 1st Floor, Sai Enclave, Bhola Nagar, Road No:12, Banjarahills, Hyderabad-500034Document4 pagesSocialight: H-No:8-2-703/4/1, 1st Floor, Sai Enclave, Bhola Nagar, Road No:12, Banjarahills, Hyderabad-500034subba reddyPas encore d'évaluation

- IRN: D26305b0b65f1f587ebdDocument3 pagesIRN: D26305b0b65f1f587ebdDeependraAgarwalPas encore d'évaluation

- Philippine Income Taxation - Supplemental Quizzes Part 1 (CHAPTERS 1-6)Document9 pagesPhilippine Income Taxation - Supplemental Quizzes Part 1 (CHAPTERS 1-6)Wag mong ikalatPas encore d'évaluation

- Tax Invoice: SEN/CBE/0007 9-Jul-2022 100% Adv PaymentDocument1 pageTax Invoice: SEN/CBE/0007 9-Jul-2022 100% Adv PaymentMPM SENTHILPas encore d'évaluation

- Entity Tax ExamDocument7 pagesEntity Tax ExamWesley JacksonPas encore d'évaluation

- Week 4 Day 2: Salient Features of GST ObjectivesDocument2 pagesWeek 4 Day 2: Salient Features of GST Objectivestina tanwarPas encore d'évaluation

- Pims PDF in Stream WriterDocument3 pagesPims PDF in Stream WriterBrianPas encore d'évaluation

- Deacc506 23241 2Document2 pagesDeacc506 23241 2Sants ShadyPas encore d'évaluation

- GSTDocument14 pagesGSTsatwikaPas encore d'évaluation

- COPA FTMO Apr-21Document794 pagesCOPA FTMO Apr-21kashif aliPas encore d'évaluation

- VAT and Other TopicsDocument14 pagesVAT and Other TopicsJanePas encore d'évaluation

- Profit & Loss (Standard) : Resa Harisma 195154024Document1 pageProfit & Loss (Standard) : Resa Harisma 195154024Bikin OrtubanggaPas encore d'évaluation