Académique Documents

Professionnel Documents

Culture Documents

Chan Robles

Transféré par

ZeaweaCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Chan Robles

Transféré par

ZeaweaDroits d'auteur :

Formats disponibles

ChanRobles Virtual Law Library | chanrobles.

com

PHILIPPINE SUPREME COURT JURISPRUDENCE

THE 2010 PRE-WEEK BAR EXAM NOTES ON LABOR LAW

Search for www.chanrobles.com

Search

Home > ChanRobles Virtual Law Library > Philippine Supreme Court Jurisprudence > G.R.

No. L-21000, 21002-21004, and 21006

EN BANC

G.R. Nos. L-21000, 21002-21004, and 21006 December

20, 1924

In the matter of the involuntary insolvency of Umberto de

Poli. BANK OF THE PHILIPPINE ISLANDS, ET

AL.,claimants-appellees, vs. J.R. HERRIDGE, assignee of

the insolvent estate of U. de Poli, BOWRING and CO.,

C.T. BOWRING and CO., LTD., and T.R.

YANGCO, creditors-appellants.

OSTRAND, J .: chanrobles virtual law library

The present appeals, all of which relate to the Insolvency of U.

de Poli, have been argued together and as the principal

questions involved are the same in all of them, the cases will

be disposed of in one decision.chanroblesvirtualawlibrary chanrobles virtual law library

The insolvent Umberto de Poli was for several years engaged

on an extensive scale in the exportation of Manila hemp,

maguey and other products of the country. He was also a

licensed public warehouseman, though most of the goods

stored in his warehouses appear to have been merchandise

purchased by him for exportation and deposited there by he

himself.chanroblesvirtualawlibrary chanrobles virtual law l ibrary

In order to finance his commercial operations De Poli

established credits with some of the leading banking

institutions doing business in Manila at that time, among them

the Hongkong & Shanghai Banking Corporation, the Bank of

the Philippine Islands, the Asia Banking Corporation, the

Chartered Bank of India, Australia and China, and the

American Foreign Banking Corporation. The methods by

which he carried on his business with the various banks was

practically the same in each case and does not appear to have

differed from the ordinary and well known commercial

practice in handling export business by merchants requiring

bank credits.chanroblesvirtualawlibrary chanrobles virtual law l ibrary

De Poli opened a current account credit with the bank against

which he drew his checks in payment of the products bought

by him for exportation. Upon the purchase, the products were

stored in one of his warehouses and warehouse receipts issued

therefor which were endorsed by him to the bank as security

for the payment of his credit in the account current. When the

goods stored by the warehouse receipts were sold and shipped,

the warehouse receipt was exchanged for shipping papers, a

draft was drawn in favor of the bank and against the foreign

purchaser, with bill of landing attached, and the entire

proceeds of the export sale were received by the bank and

credited to the current account of De Poli.chanroblesvirtualawl ibrary chanrobles virtual law library

On December 8, 1920, De Poli was declared insolvent by the

Court of First Instance of Manila with liabilities to the amount

of several million pesos over and above his assets. An

assignee was elected by the creditors and the election was

confirmed by the court on December 24, 1920. The assignee

qualified on January 4, 1921, and on the same date the clerk of

the court assigned and delivered to him the property of the

estate.chanroblesvirtua lawlibrary chanrobles virtual law library

Among the property taken over the assignee was the

merchandise stored in the various warehouses of the insolvent.

This merchandise consisted principally of hemp, maguey and

tobacco. The various banks holding warehouse receipts issued

by De Poli claim ownership of this merchandise under their

respective receipts, whereas the other creditors of the insolvent

maintain that the warehouse receipts are not negotiable, that

their endorsement to the present holders conveyed no title to

the property, that they cannot be regarded as pledges of the

merchandise inasmuch as they are not public documents and

the possession of the merchandise was not delivered to the

claimants and that the claims of the holders of the receipts

have no preference over those of the ordinary unsecured

creditors.chanroblesvir tualawlibrary chanrobles virtual law li brary

On July 20, 1921, the banks above-mentioned and who claim

preference under the warehouse receipts held by them, entered

into the following stipulation:

It is stipulated by the between the undersigned counsel, for the

Chartered Bank of India, Australia & China, the Hongkong &

Shanghai Banking Corporation, the Asia Banking Corporation

and the Bank of Philippine Islands that:chanrobles virtual law library

Whereas, the parties hereto are preferred creditors of the

insolvent debtor U. de Poli, as evidenced by the following

quedans or warehouse receipts for hemp and maguey stored in

the warehouses of said debtor:

QUEDANS OR WAREHOUSE RECEIPTS OF THE

CHARTERED BANK

No. A-131 for 3,808 bales hemp.

No. A-157 for 250 bales hemp.

No. A-132 for 1,878 bales maguey.

No. A-133 for 1,574 bales maguey. Nos. 131, 132 and 133 all

bear date November 6, 1920, and No. 157, November 19,

1920.

QUEDANS OR WAREHOUSE RECEIPTS OF THE

HONGKONG & SHANGHAI BANKING CORPORATION

No. 130 for 490 bales hemp and 321 bales maguey.

No. 134 for 1,970 bales hemp.

No. 135 for 1,173 bales hemp.

No. 137 for 237 bales hemp.

QUEDANS OR WAREHOUSE RECEIPTS OF THE ASIA

BANKING CORPORATION

No. 57 issued May 22, 1920, 360 bales hemp.

No. 93 issued July 8, 1920 bales hemp.

No. 103 issued August 18, 1920, 544 bales hemp.

No. 112 issued September 15, 1920, 250 bales hemp.

No. 111 issued September 15, 1920, 2,007 bales maguey.

QUEDANS OR WAREHOUSE RECEIPTS OF THE BANK

OF THE PHILIPPINE ISLANDS

No. 147 issued November 13, 1920, 393 bales hemp.

No. 148 issued November 13, 1920, 241 bales hemp.

No. 149 issued November 13, 1920, 116 bales hemp.

No. 150 issued November 13, 1920, 217 bales hemp.

And whereas much of the hemp and maguey covered by the

above mentioned quedans was either non-existent at the time

of the issuance of said quedans or has since been disposed of

by the debtor and of what remains much of the same hemp and

maguey transferred by means of quedans to one of the parties

hereto has also been transferred by means of other quedans to

one or more of the other parties hereto andchanrobles virtual law l ibrary

Whereas, the hemp and maguey covered by said quedans is to

a considerable extent commingled.chanroblesvirtualawl ibrary chanrobles virtual law library

Now, therefore, it is hereby agreed subject to the rights of any

other claimants hereto and to the approval of this Honorable

Court that all that remains of the hemp and maguey covered

by the warehouse receipts of the parties hereto or of any of

them shall be adjudicated to them proportionately by grades in

accordance with the quedans held by each as above set forth in

accordance with the rule laid down in section 23 of the

Warehouse Receipts Law for the disposition of commingled

fungible goods.

Manila, P.I., July 20, 1921.

GIBBS, MCDONOUGH & JOHNSON

By A. D. GIBBS

Attorneys for the Chartered Bank

of India, Australia & China

FISHER & DEWITT

By C.A. DEWITT

Attorneys for the Hongkong & Shanghai

Banking Corporation

WOLFSON, WOLFSON & SCHWARZKOFF

Attorneys for the Asia Banking Corporation

HARTIGAN & WELCH

Attorneys for the Bank of the Philippine Islands

Claims for hemp and maguey covered by the respective

warehouse receipts of the banks mentioned in the foregoing

stipulation were presented by each of said banks. Shortly after

the adjudication of the insolvency of the firm of Wise & Co.,

one of the unsecured creditors of the insolvent on June 25,

1921, presented specific written objections to the claims of the

banks on the ground of the insufficiency of the warehouse

receipts and also to the stipulation above quoted on the ground

that it was entered into for the purpose of avoiding the

necessity of identifying the property covered by each

warehouse receipt. Bowring & Co., C.T. Bowring Co., Ltd.,

and Teodoro R. Yangco, also unsecured creditors of the

insolvent, appeared in the case after the decision of the trial

court was rendered and joined with the assignee in his motion

for a rehearing and in his appeal to this court.chanroblesvirt ualawlibrary chanrobles virtual law librar y

Upon hearing, the court below held that the receipts in

question were valid negotiable warehouse receipts and ordered

the distribution of the hemp and maguey covered by the

receipts among the holders thereof proportionately by grades,

in accordance with the stipulation above quoted, and in a

supplementary decision dated November 2, 1921, the court

adjudged the merchandise covered by warehouse receipts Nos.

A-153 and A-155 to the Asia Banking Corporation. From

these decisions the assignee of the insolvent estate, Bowring &

Co., C.T. Bowring Co., Ltd., and Teodoro R. Yangco appealed

to this court.chanroblesvirtualawlibrary chanrobles virtual law library

The warehouse receipts are identical in form with the receipt

involved in the case of Roman vs. Asia Banking

Corporation (46 Phil., 705), and there held to be a valid

negotiable warehouse receipt which, by endorsement, passed

the title to the merchandise described therein to the Asia

Banking Corporation. That decision is, however, vigorously

attacked by the appellants, counsel asserting, among other

things, that "there was not a single expression in that receipt,

or in any of those now in question, from which the court could

or can say that the parties intended to make them negotiable

receipts. In fact, this is admitted in the decision by the

statement "... and it contains no other direct statement showing

whether the goods received are to be delivered to the bearer, to

a specified person, or to a specified person or his order." There

is nothing whatever in these receipts from which the court can

possibly say that the parties intended to use the phrase "a la

orden" instead of the phrase "por orden," and thus to make

said receipts negotiable. On the contrary, it is very clear from

the circumstances under which they were issued, that they did

not intend to do so. If there was other language in said

receipts, such as would show their intention in some way to

make said receipts negotiable, then there would be some

reason for the construction given by the court. In the absence

of language showing such intention, the court, by substituting

the phrase "a la orden" for the phrase "por orden," is clearly

making a new contract between the parties which, as shown by

the language used by them, they never intended to enter into."chanrobles

virtual law l ibrary

These very positive assertions have, as far as we can see, no

foundation in fact and rest mostly on misconceptions.chanroblesvirtualawlibrary chanrobles virtual law li brary

Section 2 of the Warehouse Receipts Act (No. 2137)

prescribes the essential terms of such receipts and reads as

follows:

Warehouse receipts needed not be in any particular form, but

every such receipt must embody within its written or printed

terms - chanrobles virtual law library

(a) The location of the warehouse where the goods are stored,chanrobles

virtual law l ibrary

(b) The date of issue of the receipt,chanrobles virtual law library

(c) The consecutive number of the receipt,chanrobles virtual law library

(d) A statement whether the goods received will be delivered

to the bearer, to a specified person, or to a specified person or

his order,chanrobles virt ual law li brary

(e) The rate of storage charges,chanrobles virtual law l ibrary

(f) A description of the goods or of the packages containing

them,chanrobles virtual law l ibrary

(g) The signature of the warehouseman, which may be made

by his authorized agent,chanrobles virtual law library

(h) If the receipt is issued for goods of which the

warehouseman is owner, either solely or jointly or in common

with others, the fact of such ownership, andchanrobles virtual law library

(i) A statement of the amount of advances made and of

liabilities incurred for which the warehouseman claims a lien.

If the precise amount of such advances made or of such

liabilities incurred is, at the time of the issue of the receipt,

unknown to the warehouseman or to his agent who issues it, a

statement of the fact that advances have been made or

liabilities incurred and the purpose thereof is sufficient.chanroblesvirtualawl ibrary chanrobles virtual law library

A warehouseman shall be liable to any person injured thereby,

for all damage caused by the omission from a negotiable

receipt of any of the terms herein required.

Section 7 of the Act reads:

A nonnegotiable receipt shall have plainly placed upon its face

by the warehouseman issuing it "nonnegotiable," or "not

negotiable." In case of the warehouseman's failure so to do, a

holder of the receipt who purchased it for value supposing it to

be negotiable, may, at his option, treat such receipt as

imposing upon the warehouseman the same liabilities he

would have incurred had the receipt been negotiable.

All of the receipts here in question are made out on printed

blanks and are identical in form and terms. As an example, we

may take receipt No. A-112, which reads as follows:

U. DE POLI

209 Estero de Binondo

BODEGAS

QUEDAN No. A-112

Almacen Yangco ----chanrobles virtual law library

Por -------

Marcas

UDP

Bultos

250

Clase de las

mercancias

Fardos

abaca

"Quedan depositados en estos

almacenes por orden del Sr. U. de

Poli la cantidad de doscientos

cincuenta fardos abaca segun

marcas detalladas al margen, y

con arreglo a las condiciones

siguientes:chanrobles vir tual law l ibrary

1.

a

Estan asegurados contra riesgo

de incendios exclusivamente,

segun las condiciones de mis

polizas; quedando los demas por

cuenta de los depositantes.chanroblesvirtualawlibrary chanrobles virtual law li brary

2.

a

No se responde del peso, clase

ni mal estado de la mercancia

depositada.chanroblesvirt ualawlibrary chanrobles virtual law library

3.

a

El almacenaje sera de quince

centimos fardo por mes.

I certify that I am the

sole owner of the

merchandise herein

described.

(Sgd.) "UMBERTO DE

POLI

4.

a

El seguro sera de un octavo

por ciento mensual por el total.

Tanto el almacenaje como el

seguro se cobraran por meses

vencidos, y con arreglo a los dias

devengados siendo el minimo para

los efectos del cobro 10 dias.

5.

a

No seran entregados dichos

efectos ni parte de los mismos sin

la presentacion de

este "quedan" para su

correspondiente deduccion.

6.

a

El valor para el seguro de

estas mercancias es de pesos

filipinos nueve mil

quinientos solamentes.

7.

a

Las operaciones de entrada y

salida, seran de cuenta de los

depositantes, pudiendo hacerlos

con sus trabajadores, o pagando

los que le sean facilitados, con

arreglo a los tipos que tengo

convenido con los mios.

Valor del Seguro

P9,500.

V. B.

(Sgd.) UMBERTO DE

POLI

Manila, 15 de sept. de 1920.

El Encargado,

(Sgd.) I. MAGPANTAY

The receipt is not marked "nonnegotiable" or "not negotiable,"

and is endorsed "Umberto de Poli."chanrobles virtual law library

As will be seen, the receipt is styled "Quedan" (warehouse

receipt) and contains all the requisites of a warehouse receipt

as prescribed by section 2, supra, except that it does not, in

express terms, state whether the goods received are to be

delivered to bearer, to a specified person or to his order. The

intention to make it a negotiable warehouse receipt appears,

nevertheless, quite clearly from the document itself: De Poli

deposited the goods in his own warehouse; the warehouse

receipt states that he is the owner of the goods deposited; there

is no statement that the goods are to be delivered to the bearer

of the receipt or to a specified person and the presumption

must therefore necessarily be that the goods are in the

warehouse subject to the orders of their owner De Poli. As the

owner of the goods he had, of course, full control over them

while the title remained in him; we certainly cannot assume

that it was the intention to have the goods in the warehouse

subject to no one's orders. That the receipts were intended to

be negotiable is further shown by the fact that they were not

marked "nonnegotiable" and that they were transferred by the

endorsement of the original holder, who was also the

warehouseman. In his dual capacity of warehouseman and the

original holder of the receipt, De Poli was the only party to the

instrument at the time of its execution and the interpretation he

gave it at that time must therefore be considered controlling as

to its intent.chanroblesvirtualawlibrary chanrobles virtual law l ibrary

In these circumstances, it is hardly necessary to enter into any

discussion of the intended meaning of the phrase "por orden"

occurring in the receipts, but for the satisfaction of counsel, we

shall briefly state some of our reasons for the interpretation

placed upon that phrase in the Felisa Roman case:chanrobles virtual law library

The rule is well-known that wherever possible writings must

be so construed as to give effect to their general intent and so

as to avoid absurdities. Applying this rule, it is difficult to see

how the phrase in question can be given any other rational

meaning than that suggested in the case mentioned. It is true

that the meaning would have been more grammatically

expressed by the word "a la orden"; the world "por preceding

the word "orden" is generally translated into the English

language as "by" but "por" also means "for" or "for the

account of" (see Velazquez Dictionary) and it is often used in

the latter sense. The grammatical error of using it in

connection with "orden" in the present case is one which

might reasonably be expected from a person insufficiently

acquainted with the Spanish language.chanroblesvirt ualawlibrary chanrobles virtual law library

If the receipt had been prepared in the English language and

had stated that the goods were deposited "for order" of U. de

Poli, the expression would not have been in accordance with

good usage, but nevertheless in the light of the context and

that circumstances would be quite intelligible and no one

would hesitate to regard "for order" as the equivalent of "to the

order." Why may not similar latitude be allowed in the

construction of a warehouse receipt in the Spanish language?chanrobles virtual law

library

If we were to give the phrase the meaning contended for by

counsel, it would reveal no rational purpose. To say that a

warehouseman deposited his own goods with himself by his

own order seems superfluous and means nothing. The

appellants' suggestion that the receipt was issued by Ireneo

Magpantay loses its force when it is considered that

Magpantay was De Poli's agent and that his words and acts

within the scope of his agency were, in legal effect, those of

De Poli himself. De Poli was the warehouseman and not

Magpantay.chanroblesvir tualawlibrary chanrobles virtual law li brary

Counsel for the appellants also assail the dictum in our

decision in the Felisa Roman case that section 7 of the

Warehouse Receipts Act "appears to give any warehouse

receipt not marked "nonnegotiable" or "not negotiable"

practically the same effect as a receipt which by its terms is

negotiable provided the holder of such unmarked receipt

acquired it for value supposing it to be negotiable." The

statement is, perhaps, too broad but it certainly applies in the

present case as against the appellants, all of whom are

ordinary unsecured creditors and none of them is in position to

urge any preferential rights.chanroblesvirtualawlibrary chanrobles virtual law library

As instruments of credit, warehouse receipts play a very

important role in modern commerce and the present day

tendency of the courts is towards a liberal construction of the

law in favor of a bona fide holder of such receipts. Under the

Uniform Warehouse Receipts Act, the Supreme Court of New

York in the case of Joseph vs. P. Viane, Inc.

( [1922], 194 N.Y. Supp., 235), held the following writing a

valid warehouse receipt:

"Original. Lot No. 9. New York, November 19, 1918. P.

Viane, Inc., Warehouse, 511 West 40th Street, New York

City. For account of Alpha Litho. Co., 261 9th Avenue.

Marks: Fox Film Co. 557 Bdles 835- R. 41 x 54-116. Car

Number: 561133. Paul Viane, Inc. E.A. Thompson. P. Viane,

Inc., Warehouse."

In the case of Manufacturers' Mercantile Co vs. Monarch

Refrigerating Co.

( [1915], 266 III., 584), the Supreme Court of Illinois said:

The provisions of Uniform Warehouse Receipts Act, sec. 2

(Hurd's Rev. St. 1913, c. 114, sec. 242), as to the contents of

the receipt, are for the benefit of the holder and of purchasers

from him, and failure to observe these requirements does not

render the receipt void in the hands of the holder.

In the case of Hoffman vs. Schoyer ( [1892], 143 III., 598), the

court held that the failure to comply with Act III, April 25,

1871, which requires all warehouse receipts for property

stored in Class C to "distinctly state on their face the brands or

distinguishing marks upon such property," for which no

consequences, penal or otherwise, are imposed, does not

render such receipts void as against an assignee for value.chanroblesvir tualawlibrary chanrobles virtual law

library

The appellants argue that the receipts were transferred merely

as security for advances or debts and that such transfer was of

no effect without a chattel mortgage or a contract of pledge

under articles 1867 and 1863 of the Civil Code. This question

was decided adversely to the appellants' contention in the case

of Roman vs. Asia Banking Corporation, supra. The

Warehouse Receipts Act is complete in itself and is not

affected by previous legislation in conflict with its provisions

or incompatible with its spirit or purpose. Section 58 provides

that within the meaning of the Act "to "purchase" includes to

take as mortgagee or pledgee" and "purchaser" includes

mortgagee and pledgee." It therefore seems clear that, as to the

legal title to the property covered by a warehouse receipt, a

pledgee is on the same footing as a vendee except that the

former is under the obligation of surrendering his title upon

the payment of the debt secured. To hold otherwise would

defeat one of the principal purposes of the Act, i. e., to furnish

a basis for commercial credit.chanroblesvirtualawlibrary chanrobles virtual law l ibrary

The appellants also maintain that baled hemp cannot be

regarded as fungible goods and that the respective warehouse

receipts are only good for the identical bales of hemp for

which they were issued. This would be true if the hemp were

ungraded, but we can see no reason why bales of the same

government grade of hemp may not, in certain circumstances,

be regarded as fungible goods. Section 58 of the Warehouse

Receipts Act defines fungible goods as follows:

"Fungible goods" means goods of which any unit is, from its

nature or by mercantile custom, treated as the equivalent of

any other unit.

In the present case the warehouse receipts show how many

bales of each grade were deposited; the Government grade of

each bale was clearly and permanently marked thereon and

there can therefore be no confusion of one grade with another;

it is not disputed that the bales within the same grade were of

equal value and were sold by the assignee for the same price

and upon the strength of the Government grading marks.

Moreover, it does not appear that any of the claimant creditors,

except the appellees, hold warehouse receipts for the goods

here in question. Under these circumstances, we do not think

that the court below erred in treating the bales within each

grade as fungible goods under the definition given by the

statute. It is true that sections 22 and 23 provide that the goods

must be kept separated and that the warehouseman may not

commingle goods except when authorized by agreement or

custom, but these provisions are clearly intended for the

benefit of the warehouseman. It would, indeed, be strange if

the warehouseman could escape his liability to the owners of

the goods by the simple process of commingling them without

authorization. In the present case the holders of the receipts

have impliedly ratified the acts of the warehouseman through

the pooling agreement hereinbefore quoted.chanroblesvirtualawlibrary chanrobles virtual law l ibrary

The questions so far considered are common to all of the

claims now before us, but each claim has also its separate

features which we shall now briefly discuss:

R.G. Nos. 21000 AND 21004

CLAIMS OF THE BANK OF THE PHILIPPINE ISLANDS

AND THE GUARANTY TRUST COMPANY OF NEW

YORKchanrobles virtual law library

The claim of the Bank of the Philippine Islands is supported

by four warehouse receipts, No. 147 for 393 bales of hemp,

No. 148 for 241 bales of hemp, No. 149 for 116 bales of hemp

and No. 150 for 217 bales of hemp. Subsequent to the pooling

agreement these warehouse receipts were signed, endorsed and

delivered to the Guaranty Trust Company of New York, which

company, under a stipulation of October 18, 1921, was

allowed to intervene as a party claiming the goods covered by

said receipts, and which claim forms the subject matter of the

appeal R.G. No. 21004. All of the warehouse receipts involved

in these appeals were issued on November 13, 1920, and

endorsed over the Bank of the Philippine Islands.chanroblesvirtualawli brary chanrobles virtual law li brary

On November 16, 1920, De Poli executed and delivered to

said bank a chattel mortgage on the same property described in

the receipts, in which chattel mortgage no mention was made

of the warehouse receipts. This mortgage was registered in the

Office of the Register of Deeds of Manila on November 18,

1920.chanroblesvirtualawlibrary chanrobles virtual law l ibrary

The appellants argue that the obligations created by the

warehouse receipts were extinguished by the chattel mortgage

and that the validity of the claim must be determined by the

provisions of the Chattel Mortgage Law and not by those of

the Warehouse Receipts Act, or, in other words, that the

chattel mortgage constituted a novation of the contract

between the parties.chanroblesvirtualawlibrary chanrobles virtual law li brary

Novations are never presumed and must be clearly proven.

There is no evidence whatever in the record to show that a

novation was intended. The chattel mortgage was evidently

taken as additional security for the funds advanced by the bank

and the transaction was probably brought about through a

misconception of the relative values of warehouse receipts and

chattel mortgages. As the warehouse receipts transferred the

title to the goods to the bank, the chattel mortgage was both

unnecessary and inefficatious and may be properly

disregarded.chanroblesvirtualawl ibrary chanrobles virtual law library

Under the seventh assignment of error the appellants argue

that as De Poli was declared insolvent by the Court of First

Instance of Manila on December 8, 1920, only twenty-five

days after the warehouse receipts were issued, the latter

constituted illegal preferences under section 70 of the

Insolvency Act. In our opinion the evidence shows clearly that

the receipts were issued in due and ordinary course of business

for a valuable pecuniary consideration in good faith and are

not illegal preferences.

R.G. No. 21002

CLAIM OF THE HONGKONG & SHANGHAI BANKING

CORPORATIONchanrobles virtual law library

The warehouse receipts held by this claimant-appellee are

numbered A-130 for 490 bales of hemp and 321 bales of

maguey, No. A-134 for 1,970 bales of hemp, No. A-135 for

1,173 bales of hemp and No. A-137 for 237 bales of hemp,

were issued by De Poli and were endorsed and delivered to the

bank on or about November 8, 1920. The appellants maintain

that the bank at the time of the delivery to it of the warehouse

receipts had reasonable cause to believe that De Poli was

insolvent, and that the receipts therefore constituted illegal

preferences under the Insolvency Law and are null and void.

There is nothing in the record to support this contention.chanroblesvirtualawlibrary chanrobles virtual law library

The other assignments of error relate to questions which we

have already discussed and determined adversely to the

appellants.

R.G. No. 21003

CLAIM OF THE CHARTERED BANK OF INDIA,

AUSTRALIA & CHINAcha nrobles virtual law library

This claimant holds warehouse receipts Nos. 131 for 3,808

bales of hemp, A-157 for 250 bales of hemp, A-132 for 1,878

bales of maguey and A-133 for 1,574 bales of maguey. Nos.

A-131, A-132 and A-133 bear the date of November 6, 1920,

and A-157 is dated November 19, 1920.chanroblesvirtualawl ibrary chanrobles virtual law library

Under the fourth assignment of error, the appellants contend

that the court erred in permitting counsel for the claimant bank

to retract a withdrawal of its claim under warehouse receipt

No. A-157. It appears from the evidence that during the

examination of the witness Fairnie, who was the local manager

of the claimant bank, counsel for the bank, after an answer

made by Mr. Fairnie to one of his questions, withdrew the

claim under the warehouse receipt mentioned, being under the

impression that Mr. Fairnie's answer indicated that the bank

had knowledge of De Poli's pending insolvency at the time the

receipt was delivered to the bank. Later on in the proceedings

the court, on motion of counsel, reinstated the claim. Counsel

explains that by reason of Mr. Fairnie's Scoth accent and rapid

style of delivery, he misunderstood his answer and did not

discover his mistake until he read the transcript of the

testimony.chanroblesvirtualawl ibrary chanrobles virtual law library

The allowance of the reinstatement of the claim rested in the

sound discretion of the trial court and there is nothing in the

record to show that this discretion was abused in the present

instance.chanroblesvirt ualawlibrary chanrobles virtual law library

Under the fifth assignment of error appellants argue that the

manager of the claimant bank was informed of De Poli's

difficulties on November 19, 1920, when he received

warehouse receipt No. A-157 and had reasonable cause to

believe that De Poli was insolvent and that the transaction

therefore constituted an illegal preference.chanroblesvirtualawlibrary chanrobles virtual law l ibrary

Mr. Fairnie, who was the manager of the claimant bank at the

time the receipt in the question was delivered to the bank,

testifies that he had no knowledge of the impending

insolvency and Mr. De Poli, testifying as a witness for the

assignee-appellee, stated that he furnished the bank no

information as to his failing financial condition at any time

prior to the filing of the petition for his insolvency, but that on

the contrary he advised the bank that his financial condition

was sound.chanroblesvirtualawl ibrary chanrobles virtual law library

The testimony of the same witnesses also shows that the bank

advanced the sum of P20,000 to De Poli at Cebu against the

same hemp covered by warehouse receipt No. A-157 as early

as October, 1920, and that upon shipment thereof to Manila

the bill of lading, or shipping documents, were made out in

favor of the Chartered Bank and forwarded to it at Manila; that

upon the arrival of the hemp at Manila, Mr. De Poli, by giving

a trust receipt to the bank for the bill of lading, obtained

possession of the hemp with the understanding that the

warehouse receipt should be issued to the bank therefor, and it

was in compliance with that agreement previously made that

the receipt was issued on November 19, 1920. Upon the facts

stated we cannot hold that the bank was given an illegal

preference by the endorsement to it of the warehouse receipt in

question. (Mitsui Bussan Kaisha vs. Hongkong & Shanghai

Banking Corporation, 36 Phil., 27.)

R.G. No. 21006

CLAIM OF THE ASIA BANKING CORPORATIONchanrobles vir tual law l ibrary

Claimant holds warehouse receipts Nos. A-153, dated

November 18, 1920, for 139 bales of tobacco, A-154, dated

November 18, 1920, for 211 bales of tobacco, A-155, dated

November 18, 1920, for 576 bales of tobacco, A-57, dated

May 22, 1920, for 360 bales of hemp, A-93, dated July 8,

1920, for 382 bales of hemp, A-103, dated August 18, 1920,

for 544 bales of hemp, A-112, dated September 15, 1920, for

250 bales of hemp and A-111, dated September 15, 1920, for

207 bales of maguey.chanroblesvirtualawl ibrary chanrobles virtual law library

The assignments of error in connection with this appeal are,

with the exception of the fourth, similar to those in the other

cases and need not be further discussed.chanroblesvirt ualawlibrary chanrobles virtual law li brary

Under the fourth assignment, the appellants contend that

warehouse receipts Nos. A-153, A-154 and A-155 were illegal

preferences on the assumption that the claimant bank must

have had reasonable reasons to believe that De Poli was

insolvent on November 18, 1920, when the three receipts in

question were received. In our opinion, the practically

undisputed evidence of the claimant bank sufficiently refutes

this contention.chanroblesvirtualawlibrary chanrobles virtual law library

For the reasons hereinbefore stated the judgments appealed

from are hereby affirmed, without costs. So ordered.chanroblesvirtualawlibrary chanrobles virtual law l ibrary

Street, Malcolm, Avancea, Villamor, and Romualdez, JJ.,

concur.

FEATURED

DECISIONScralaw

Search for www.chanrobles.com

Search

QUICK SEARCH

1901 1902 1903 1904 1905 1906 1907 1908 1909 1910 1911 1912 1913 1914 1915 1916 1917 1918 1919 1920

1921 1922 1923 1924 1925 1926 1927 1928 1929 1930 1931 1932 1933 1934 1935 1936 1937 1938 1939 1940

1941 1942 1943 1944 1945 1946 1947 1948 1949 1950 1951 1952 1953 1954 1955 1956 1957 1958 1959 1960

1961 1962 1963 1964 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980

1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Copyright1998-2010 ChanRobles Publishing Company | Disclaimer | E-mail Restrictions ChanRobles Virtual Law Library | chanrobles.com

RED

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Permanently End Premature EjaculationDocument198 pagesPermanently End Premature EjaculationZachary Leow100% (5)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Definition of CultureDocument14 pagesDefinition of CultureRenee Louise CoPas encore d'évaluation

- PIL Q&A (Quiz#1)Document5 pagesPIL Q&A (Quiz#1)ZeaweaPas encore d'évaluation

- Land Titles and Deeds Case DigestDocument6 pagesLand Titles and Deeds Case DigestZeawea100% (1)

- Preview-90187 Pno H UnlockedDocument5 pagesPreview-90187 Pno H UnlockedFilip SuciuPas encore d'évaluation

- Sec NS-97-01Document13 pagesSec NS-97-01ZeaweaPas encore d'évaluation

- Pros and Cons of AbortionDocument14 pagesPros and Cons of AbortionSuman SarekukkaPas encore d'évaluation

- Director of Lands v. CA and Bisnar, October 26, 1989Document3 pagesDirector of Lands v. CA and Bisnar, October 26, 1989ZeaweaPas encore d'évaluation

- Student IDDocument1 pageStudent IDZeaweaPas encore d'évaluation

- The Life Story of Engr. Arturo Francisco EustaquioDocument38 pagesThe Life Story of Engr. Arturo Francisco EustaquioZeaweaPas encore d'évaluation

- Republic of The Philippines v. Intermediate Appellate Court, November 29, 1988Document12 pagesRepublic of The Philippines v. Intermediate Appellate Court, November 29, 1988ZeaweaPas encore d'évaluation

- Cases For BAIL - CrimprocDocument10 pagesCases For BAIL - CrimprocZeaweaPas encore d'évaluation

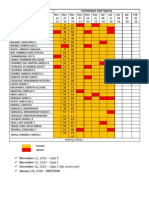

- Attendance Sheet With ScoresDocument1 pageAttendance Sheet With ScoresZeaweaPas encore d'évaluation

- SaturdayDocument1 pageSaturdayZeaweaPas encore d'évaluation

- Jeddah Declaration: OIC/41-CFM/2014/JEDDAH-DEC/FINALDocument9 pagesJeddah Declaration: OIC/41-CFM/2014/JEDDAH-DEC/FINALZeaweaPas encore d'évaluation

- Cybercrime Law Constructive SpeechDocument3 pagesCybercrime Law Constructive SpeechZeaweaPas encore d'évaluation

- Latin Legal MaximsDocument34 pagesLatin Legal MaximsZeaweaPas encore d'évaluation

- Table of Contents: A. The ConstitutionDocument7 pagesTable of Contents: A. The ConstitutionZeaweaPas encore d'évaluation

- Lpm2.1theoryDocument85 pagesLpm2.1theoryvetprabu34Pas encore d'évaluation

- 2019 National Innovation PoliciesDocument98 pages2019 National Innovation PoliciesRashmi SinghPas encore d'évaluation

- Roger Fidler DeclarationDocument6 pagesRoger Fidler Declarationnphillips0304Pas encore d'évaluation

- BM - GoPro Case - Group 6Document4 pagesBM - GoPro Case - Group 6Sandeep NayakPas encore d'évaluation

- Short Question: Computer Science For 9 Class (Unit # 3)Document5 pagesShort Question: Computer Science For 9 Class (Unit # 3)Yasir MehmoodPas encore d'évaluation

- CLASSIFICATION OF COSTS: Manufacturing: Subhash Sahu (Cs Executive Student of Jaipur Chapter)Document85 pagesCLASSIFICATION OF COSTS: Manufacturing: Subhash Sahu (Cs Executive Student of Jaipur Chapter)shubhamPas encore d'évaluation

- Aci - The Financial Markets Association: Examination FormulaeDocument8 pagesAci - The Financial Markets Association: Examination FormulaeJovan SsenkandwaPas encore d'évaluation

- Modelling The Relationship Between Hotel Perceived Value, CustomerDocument11 pagesModelling The Relationship Between Hotel Perceived Value, Customerzoe_zoePas encore d'évaluation

- The Mystery of The Secret RoomDocument3 pagesThe Mystery of The Secret RoomNur Farhana100% (2)

- Cropanzano, Mitchell - Social Exchange Theory PDFDocument28 pagesCropanzano, Mitchell - Social Exchange Theory PDFNikolina B.Pas encore d'évaluation

- Medico Legal CaseDocument2 pagesMedico Legal CaseskcllbPas encore d'évaluation

- Republic of The Philippines: Paulene V. Silvestre Personal DevelopmentDocument3 pagesRepublic of The Philippines: Paulene V. Silvestre Personal DevelopmentPau SilvestrePas encore d'évaluation

- Essay 1 John WatsonDocument4 pagesEssay 1 John Watsonapi-259502356Pas encore d'évaluation

- Nonfiction Reading Test The Coliseum: Directions: Read The Following Passage and Answer The Questions That Follow. ReferDocument3 pagesNonfiction Reading Test The Coliseum: Directions: Read The Following Passage and Answer The Questions That Follow. ReferYamile CruzPas encore d'évaluation

- Brochure Selector Guide EN-web-protectedDocument16 pagesBrochure Selector Guide EN-web-protectedPierre-Olivier MouthuyPas encore d'évaluation

- All This Comand Use To Type in NotepadDocument9 pagesAll This Comand Use To Type in NotepadBiloul ShirazPas encore d'évaluation

- Trabajos de InglésDocument6 pagesTrabajos de Inglésliztmmm35Pas encore d'évaluation

- CS101 Solved File For Final Term MCQS 1 To 45 LecturesDocument130 pagesCS101 Solved File For Final Term MCQS 1 To 45 LecturesHisan Mehmood64% (28)

- Karbohidrat: Gula, Pati & SeratDocument20 pagesKarbohidrat: Gula, Pati & SeratAlfi Syahrin SiregarPas encore d'évaluation

- Lecture 1. Introducing Second Language AcquisitionDocument18 pagesLecture 1. Introducing Second Language AcquisitionДиляра КаримоваPas encore d'évaluation

- Introduction To Motor DrivesDocument24 pagesIntroduction To Motor Drivessukhbat sodnomdorjPas encore d'évaluation

- Tucker CarlsonDocument4 pagesTucker CarlsonDai ZPas encore d'évaluation

- Artikel Andi Nurindah SariDocument14 pagesArtikel Andi Nurindah Sariapril yansenPas encore d'évaluation

- Activity 1 Which Is WhichDocument1 pageActivity 1 Which Is WhichRhanna Lei SiaPas encore d'évaluation

- Farewell Address WorksheetDocument3 pagesFarewell Address Worksheetapi-261464658Pas encore d'évaluation

- (Promotion Policy of APDCL) by Debasish Choudhury: RecommendationDocument1 page(Promotion Policy of APDCL) by Debasish Choudhury: RecommendationDebasish ChoudhuryPas encore d'évaluation