Académique Documents

Professionnel Documents

Culture Documents

ACCA Past Paper 2013

Transféré par

FahadDarCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

ACCA Past Paper 2013

Transféré par

FahadDarDroits d'auteur :

Formats disponibles

Fundamentals Level Skills Module

Time allowed

Reading and planning: 15 minutes

Writing: 3 hours

ALL FIVE questions are compulsory and MUST be attempted.

Tax rates and allowances are on pages 23.

Do NOT open this paper until instructed by the supervisor.

During reading and planning time only the question paper may

be annotated. You must NOT write in your answer booklet until

instructed by the supervisor.

This question paper must not be removed from the examination hall.

P

a

p

e

r

F

6

(

P

K

N

)

Taxation

(Pakistan)

Tuesday 3 December 2013

The Association of Chartered Certified Accountants

SUPPLEMENTARY INSTRUCTIONS

1. Calculations and workings need only be made to the nearest rupee.

2. All apportionments should be made to the nearest month except where the exact number of days is given in the

question.

3. All workings should be shown.

TAX RATES AND ALLOWANCES

The following tax rates and allowances for the tax year 2013 are to be used in answering all questions on this

paper.

A. Tax rates for salaried individuals where salary income exceeds 50% of taxable income

Taxable income Rate of tax on taxable income

0 to Rs. 400,000 0%

Rs. 400,001 to Rs. 750,000 5% of the amount exceeding Rs. 400,000

Rs. 750,001 to Rs. 1,500,000 Rs. 17,500 plus 10% of the amount exceeding Rs. 750,000

Rs. 1,500,001 Rs. 2,000,000 Rs. 95,000 plus 15% of the amount exceeding Rs. 1,500,000

Rs. 2,000,001 Rs. 2,500,000 Rs. 175,000 plus 175% of the amount exceeding Rs. 2,000,000

Rs. 2,500,001 and above Rs. 420,000 plus 20% of the amount exceeding Rs. 2,500,000

B. Tax rates for associations of persons and non-salaried individuals to whom the rates given in A are not applicable

Taxable income Rate of tax on taxable income

0 to Rs. 400,000 0%

Rs. 400,001 to Rs. 750,000 10% of the amount exceeding Rs. 400,000

Rs. 750,001 to Rs. 1,500,000 Rs. 35,000 plus 15% of the amount exceeding Rs. 750,000

Rs. 1,500,001 Rs. 2,500,000 Rs. 147,500 plus 20% of the amount exceeding Rs. 1,500,000

Rs. 2,500,001 and above Rs. 347,500 plus 25% of the amount exceeding Rs. 2,500,000

C. Tax rates for companies

Small company 25% of taxable income

Public company/private company 35% of taxable income

D. Tax rates on capital gains on the disposal of securities

Where the holding period of a security is

less than six months 10%

more than six months but less than 12 months 8%

12 months or more 0%

E. Tax rates on capital gains on the disposal of immovable properties

Where the holding period of immovable property is

up to one year 10%

more than one year but not more than two years 5%

2

F. Tax rates for income from property

(i) For individuals and associations of persons

Up to Rs. 150,000 0%

Rs. 150,001 to Rs. 400,000 5% of the gross amount exceeding Rs. 150,000

Rs. 400,001 to Rs. 1,000,000 Rs. 12,500 plus 75% of the gross amount exceeding

Rs. 400,000

Above Rs. 1,000,000 Rs. 57,500 plus 10% of the gross amount exceeding

Rs. 1,000,000

(ii) For companies

Up to Rs. 400,000 5% of the gross amount

Rs. 400,001 to Rs. 1,000,000 Rs. 20,000 plus 75% of the gross amount exceeding

Rs. 400,000

Above Rs. 1,000,000 Rs. 65,000 plus 10% of the gross amount exceeding

Rs. 1,000,000

G. Other tax rates

On dividends received from a company 10%

H. Rates of deduction/collection of tax at source

Sale of goods (general rate) 35%

Sale of immovable property 05%

Services (other than transport) 6%

Contracts 6%

Commission or brokerage 10%

Profit on debt 10%

Import of goods (general rate) 5%

I. Depreciation rates

Buildings (all types) 10%

Furniture and fittings 15%

Plant and machinery (not otherwise specified) 15% of the tax written down value

Motor vehicles (all types) 15%

Computer hardware 30%

}

J. Initial allowance

Eligible depreciable assets other than buildings 50% of cost

Eligible buildings 25% of cost

K. Pre-commencement expenditure

Amortisation rate for pre-commencement expenditure 20%

L. Benchmark rate

Interest free loans to employees 10% per annum

3 [P.T.O.

This is a blank page.

Question 1 begins on page 5.

4

ALL FIVE questions are compulsory and MUST be attempted

1 For the purpose of this question, you should assume that todays date is 15 July 2013.

Faisal Industries Limited (FIL) is an unlisted company incorporated under the Companies Ordinance, 1984. The

company has 1,000 employees. The goods manufactured by FIL are exempt from sales tax. The company prepares

its financial statements to 30 June each year.

The following are the audited financial results for the year ended 30 June 2013:

Note Rs.

Sales 1 110,000,000

Cost of sales 2 (62,000,000)

Gross profit 48,000,000

Administrative expenses 3 (15,000,000)

Distribution and selling costs 4 (13,000,000)

Other operating expenses 5 (10,000,000)

Other operating income 6 5,000,000

(33,000,000)

Profit/(loss) from operations 15,000,000

Finance cost 7 (4,000,000)

Net profit 11,000,000

Unless stated otherwise, FIL paid for all the expenditure through crossed cheques and tax was deducted and deposited

by FIL as required under the law.

Notes

Note 1

Sales include goods, having a fair market value of Rs. 700,000, which were sold for Rs. 500,000 to an associate of

FIL.

Note 2

Cost of sales

Rs.

Stock consumed (i) 52,000,000

Freight inwards (ii) 1,000,000

Depreciation 2,000,000

Other (iii) 7,000,000

62,000,000

Sub-notes to note 2:

(i) Stock consumed has been computed as follows:

Rs.

Opening stock 18,000,000

Purchases 66,000,000

Closing stock (a) (32,000,000)

52,000,000

(a) The net realisable value of the closing stock is Rs. 40,000,000 against its cost of Rs. 35,000,000.

5 [P.T.O.

(ii) The freight inwards was all paid in cash.

(iii) This includes an amount of Rs. 1,500,000 paid to a French company as consideration for a non-exclusive,

non-transferable right for the production of an item for a period of 15 years. Production of the item started on

1 July 2012.

Note 3

Administrative expenses include the following:

Salaries of four employees for six months at Rs. 20,000 per employee per month paid in cash;

Rs. 600,000 paid as wages to a personal servant of a director of the company;

Rs. 500,000 paid for the valuation of the assets of another company which FIL intended to acquire;

Rs. 100,000 depreciation allowance on fixed assets acquired under a finance lease;

Rs. 1,000,000 paid as rent for an office for two years from 1 July 2012;

Rs. 45,000 paid as a penalty imposed by the Commissioner for late filing of the annual return of income for the

tax year 2012; and

Rs. 50,000 donated to a political party which is a staunch supporter of lower taxation for the corporate sector.

Note 4

Distribution and selling costs include the following:

Rs. 500,000 paid to an employee as a reward for achieving his high sales target. As this was a one-off payment,

no tax was withheld by FIL from the reward.

Rs. 700,000 spent on a visitors room for the customers of the company as detailed below:

Rs.

Extension of the visitors room 325,000

Installation of new air conditioners 275,000

Decoration items with a useful life of one year 100,000

700,000

Note 5

Other operating expenses include the following:

Rs. 110,000 written off as irrecoverable during the year ended 30 June 2013. The amount had been given to

one of FILs clients as a loan a year earlier.

Rs. 50,000 paid as motor vehicle tax on the companys vehicles.

Rs. 150,000 given as a scholarship to Mr Shafique, a citizen of Pakistan, for his technical training in connection

with a scheme approved by the Federal Board of Revenue under the relevant provision of the law. Shafique is

not an employee of FIL.

Note 6

Other operating income includes a gain of Rs. 200,000 accrued on the sale of some antique furniture.

Note 7

The finance cost includes:

Rs. 50,000 as a provision for bad debts computed at 1% of the trade debtors outstanding on 30 June 2013.

Rs. 700,000 [Rs. 600,000 as the principal cost and Rs. 100,000 as finance charges] paid to an approved

modaraba in respect of plant and machinery taken on a finance lease on 1 January 2013.

6

Note 8

Other information

(i) Schedule of own fixed assets as per tax record

Assets Tax written down Addition at cost

value as on 1 July 2012 during the year

Rs. Rs.

Freehold land 10,000,000

Building on freehold land 5,000,000 1,000,000

Plant, machinery and equipment 12,000,000 200,000 [see note (a)]

Computers 1,825,000 1,000,000 [see note (b)]

Furniture and fittings 6,000,000 [see note (c)]

Motor vehicles 7,000,000 2,400,000 [see note (d)]

Sub-notes to note 8(i):

(a) A machine having a residual value of Rs. 50,000 was transferred from the category of assets taken on

finance lease to own fixed assets on the maturity of the finance lease term. The transfer was made at the

book value of Rs. 200,000.

(b) Includes a new computer purchased for Rs. 300,000 on 20 June 2013 for which installation could not be

made until 15 July 2013.

(c) Within furniture and fittings, antique furniture having a tax written down value (TWDV) of Rs. 300,000 on

1 July 2012 was sold for Rs. 800,000 on 30 June 2013 [refer to note 6].

(d) Represents the cost of an office car.

(e) Plant and machinery of Rs. 2,500,000 taken on a finance lease on 1 January 2013 is not included in the

above schedule of fixed assets [refer to note 7].

(ii) Tax paid by or collected from FIL during the year ended 30 June 2013 was:

Rs.

Income tax deducted from payments received for the supply of goods 45,000

Income tax paid along with electricity bills 800,000

Advance tax paid in cash in four equal instalments on the due dates 4,000,000

(iii) Goodluck Ltd, a public listed company, failed to deduct tax of Rs. 50,000 from payments it made to FIL on

account of a supply of goods made by FIL.

Required:

(a) Compute the taxable income of Faisal Industries Ltd (FIL) for the tax year 2013, giving clear explanations

for the inclusion or exclusion of each of the items listed in the notes.

Note: The reasons/explanations for the items not listed in the computation of taxable income should be shown

separately. Specific marks are allocated for this part of the requirement. (26 marks)

(b) Calculate the tax payable by/refundable to FIL for the tax year 2013 on the basis of taxable income computed

in part (a).

Note: Ignore workers welfare fund and the minimum tax provisions. (2 marks)

(c) (i) State, giving reasons, whether the Commissioner of Inland Revenue (CIR) can recover the tax of

Rs. 50,000 from Goodluck Ltd which it failed to deduct from FIL, after FIL has filed its return of income

and paid the tax due on the declared income. (1 mark)

(ii) State from which company the CIR will recover the default surcharge on account of the non-deduction

of tax referred to in (i) above, together with the period of default.

Note: No calculations are required in this part of the question. (1 mark)

(30 marks)

7 [P.T.O.

2 For the purpose of this question, you should assume that todays date is 15 July 2013.

Dr Ali, aged 48, a citizen of Pakistan, returned to Pakistan on 1 May 2012 after spending ten years in Dubai. He

started his medical practice in Karachi on 1 July 2012. He has adopted accrual based accounting for computing his

taxable income on a regular basis and has calculated his net income for the year ended 30 June 2013 as follows:

Receipts

Note Rs. Rs.

Fees for treatment of patients at the clinic 2,500,000

Fees for treatment of patients at their homes 900,000

3,400,000

Expenses

Rent of clinic 1 120,000

Salaries paid to staff 2 650,000

Purchase of car 1,200,000

Car running expenses 3 180,000

Utility bills paid in cash 75,000

Advance income tax 25,000

Communication expenses 4 80,000

Medicines used 5 850,000

Fees paid to the Pakistan Medical Association (PMA) 6 90,000

Fine paid for violation of Electricity Rules, 1937 50,000

(3,320,000)

Net profit 80,000

All the payments were made through crossed cheques drawn on a scheduled bank unless stated otherwise, but no

tax has been deducted from any of the payments made.

Notes:

Note 1

Of the rent of Rs. 120,000, an amount of Rs. 60,000 was paid in cash in accordance with the terms of the rental

agreement. The expense was otherwise fully verifiable.

Note 2

Salaries paid comprised:

Rs. 575,000 to a nurse; and

Rs. 75,000 to an office boy as advance salary for six months starting from 1 January 2013.

Note 3

It is estimated that one-third of the usage of the car was for personal reasons without any business connection.

Note 4

Communication expenses comprised:

Rs. 40,000 incurred for the purchase of a second-hand mobile phone set, this payment was made in cash; and

Rs. 40,000 paid as mobile phone call bills, inclusive of advance income tax at Rs. 4,000.

It is fairly estimated that half of the calls were made for non-business reasons.

Note 5

Medicines used include the cost of expired medicines of Rs. 50,000, which were destroyed on 30 June 2013.

Note 6

The fees were paid on 1 July 2012 and were for a period of five years.

8

Note 7

Other information:

(i) Dr Ali has received Rs. 250,000 as his 50% share of profit from an association of persons (AOP) in Pakistan.

The AOP is engaged in the business of the import and sale of surgical goods without any value addition. Tax of

Rs. 50,000 deducted at the import stage constituted the AOPs final tax liability.

(ii) During the tax year 2013, Dr Ali also received Rs. 450,000 as salary pertaining to the previous tax year 2012

from his ex-employer in Dubai.

(iii) Dr Alis bank statement shows that a gross amount of Rs. 100,000 was credited to his account on 30 June

2013. The bank deducted Rs. 5,000 as Zakat along with income tax at the specified rate.

(iv) Dr Ali is the owner of two acres of agricultural land situated in the province of Sindh. During the tax year 2013,

he received Rs. 40,000 as rent for this land from his tenant whereas a fair market rent of such land would have

been Rs. 60,000.

(v) Rs. 5,000 was collected as income tax along with the electricity bills paid by Dr Ali.

Required:

(a) Compute Dr Alis taxable income, the income assessable under the final tax regime and his total tax payable

for the tax year 2013. Give reasons for the treatment of any items excluded from the taxable income or for

which no expense/deduction is allowed. (20 marks)

(b) State the type of mistakes found in an assessment order which can be rectified by the Commissioner under

the Income Tax Ordinance, 2001 and the situation(s) in which a taxpayer must be given an opportunity of

being heard by the Commissioner before he can make a rectification order. (2 marks)

(c) State the time limit in which an appeal can be filed before the Commissioner (Appeals) against a rectification

order and the maximum period for which the Commissioner (Appeals) can stay the recovery of a tax demand

contested in the appeal. (3 marks)

(25 marks)

9 [P.T.O.

3 For the purpose of this question, you should assume that todays date is 15 July 2013.

Mr Ilyas, aged 50 and resident in Pakistan, disposed of the following assets during the year ended 30 June 2013:

Immovable assets

(1) 5 July 2012: Sold his house in Lahore for Rs. 30,000,000. He had bought the house on 5 December 2011 for

Rs. 20,000,000, incurring the following expenses:

stamp duty at 2% of the purchase price;

capital value tax at 2% of the purchase price;

brokers fee at 2% of the purchase price; and

corporation tax at 1% of the purchase price.

During his ownership of the house, Ilyas incurred the following expenses:

Rs. 300,000 on the modification of the drawing room to give it a modern look; and

Rs. 25,000 as property tax.

Further payments made at the time of the sale of the house were:

brokers fee at 2% of the sale price;

income tax at 05% of the sale price at the time of the transfer of the house to the buyer.

(2) 30 September 2012: The government of Punjab compulsorily acquired his land under the Land Acquisition Act,

1894 and paid him Rs. 30,000,000. He had purchased the land for Rs. 25,000,000 on 1 January 2011. On

7 October 2012, he invested the whole amount of the consideration received in a ten-year fixed term deposit

account with the National Bank of Pakistan. The profit on the deposit will become due to Ilyas at the time of

maturity of the term.

(3) 1 January 2013: Ilyas entered into a contract for the sale of his house in Islamabad with Mr Sohail for a

consideration of Rs. 50,000,000. Sohail paid Rs. 5,000,000 at the time of the contract for sale. However, he

failed to pay the balance of the amount by 30 April 2013 and Ilyas forfeited the Rs. 5,000,000 in accordance

with the terms of the contract. Subsequently, the house was sold for Rs. 49,000,000 to Mr Mumtaz on 30 June

2013. Ilyas had inherited the house on 25 June 2010, on which date the fair market value of the house was

estimated at Rs. 39,000,000.

Movable assets

(1) 15 July 2012: Sold 2,500 shares in Pakistan Petroleum Ltd, a company listed on the Karachi Stock Exchange,

for Rs. 500,000. He had purchased these shares on 15 September 2011 for Rs. 350,000. No tax was withheld

at source on this transaction.

(2) 30 August 2012: Gifted a painting, having a market value of Rs. 1,000,000, to his brother, a citizen of Germany,

and who had lived in Germany for the last ten years. In 2012 the brother visited Pakistan for a period of

180 days, flying back to Germany again on 30 August 2012. Ilyas had bought the painting for Rs. 500,000 on

1 January 1990.

(3) 15 September 2012: Gifted jewellery, having a fair market value of Rs. 1,500,000, to his sister who is an

employee of the Federal Government and has been posted in Saudi Arabia since 1 June 2010. Ilyas had bought

this jewellery on 1 September 2011 for Rs. 500,000.

(4) 14 December 2012: Sold 10,000 shares in Interwood (Pvt) Ltd for Rs. 300,000. He had acquired these shares

as follows:

5,000 shares were purchased at Rs. 18 per share on 5 February 2010.

5,000 bonus shares were allotted to him on 1 July 2010 when the fair market value was Rs. 22 per share.

Incidental charges relating to the purchase and sale of these shares of Rs. 10,000 were paid in cash.

(5) 15 February 2013: Discarded a machine which he had imported from China for Rs. 1,000,000 on 1 January

2013 to start the business. However, the machine was badly damaged during the shipment, rendering it unfit

for use. The shipping company paid him Rs. 850,000 as damages. The scrap value of the machine on the date

it was discarded was estimated to be Rs. 200,000. The documentation charges incurred in connection with the

claim for damages were Rs. 25,000.

10

(6) 15 April 2013: Sold 50,000 shares in Delta (Pvt) Ltd for Rs. 450,000. The shares were originally purchased

for Rs. 550,000 on 15 May 2009. On 30 June 2012, Ilyas had made a provision for diminution in the value

of the shares of Rs. 125,000.

Other information:

(i) Unless stated otherwise, Ilyas paid all the amounts through crossed cheques and tax was deducted and deposited

as required under the law.

(ii) Ilyas has a brought forward capital loss of Rs. 700,000 from the tax year 2011 which had arisen on account of

a sale of shares in Pakistan Petroleum Ltd.

(iii) Advance tax of Rs. 25,000 has been deducted on his cash withdrawals from the bank during the tax year 2013.

(iv) Advance tax of Rs. 50,000 has been paid by Ilyas on the basis of his tax liability for the tax year 2012.

Required:

Compute the tax payable by Mr Ilyas for the tax year 2013 on the taxable income arising from the above

transactions. Give brief reasons for your treatment of each item.

(20 marks)

11 [P.T.O.

4 (a) Mr Muddasir has had an appeal pending before the Appellate Tribunal for a long time. He is thinking about

seeking relief through the alternative dispute resolution (ADR) mechanism provided in the law and seeks your

opinion on some aspects relating to the ADR mechanism.

Required:

Advise Mr Muddasir on the following:

(i) In which two situations a taxpayer CANNOT apply to the Federal Board of Revenue (the Board) for the

appointment of a committee for the resolution of a dispute under the alternative dispute resolution (ADR)

mechanism. (2 marks)

(ii) The persons eligible to be appointed by the Board as members of the resolution committee. (2 marks)

(iii) Whether, if he is not satisfied with the final orders of the Board, he can continue to pursue his remedy

before the Appellate Tribunal. (1 mark)

(b) In the case of each of the following, state the last date of filing of the return of income as provided under

s.118 of the Income Tax Ordinance, 2001:

(i) Bryonia Laboratories (Pvt) Ltd, a manufacturer of medicines, for the tax year ended on 31 March 2012.

(ii) Silk Bank Ltd, a banking company, for the tax year ended on 31 December 2012.

(iii) Ms Mehwish, a salaried person, filing her return through the e-portal for the tax year ended on 30 June

2013.

(iv) Mr Osmani, a property dealer, for the tax year ended on 28 February 2013.

Note: Ignore any extensions given by the Board or the government in any of the above categories of cases.

Note: The total marks will be split equally between each part. (4 marks)

(c) State the grounds on which an individual taxpayer can apply for an extension of time for furnishing his/her

return of income; by when such an application must be made and how many days extension the

Commissioner can grant in normal circumstances. (3 marks)

(d) Mr Adeel purchased a luxury car having a market value of Rs. 3,000,000 on 1 January 2013. The

Commissioner of Inland Revenue (the CIR) served a notice on Adeel requiring him to file his return for the tax

year 2013 but Adeel failed to comply with the terms of the notice.

Required:

Given the circumstances:

(i) State the type of assessment order which the Commissioner of Inland Revenue (CIR) will issue and the

basis on which that assessment order will be framed.

(ii) State after how many days from serving the assessment order in (i) on Adeel, the CIR can take coercive

measures to recover tax from him.

(iii) State the steps Adeel will need to take for the assessment order served on him to be abated without

filing an appeal.

Note: The total marks will be split equally between each part. (3 marks)

(15 marks)

12

5 (a) List the persons who are required to be registered for sales tax under the Sales Tax Act, 1990. (7 marks)

(b) Ms Mehr filed her sales tax return for April 2013 on 15 May 2013. She has now discovered that, due to an error,

taxable supplies of Rs. 500,000 had not been declared in the original return. Although no notice of audit has

yet been received from the Commissioner Inland Revenue, Ms Mehr wishes to revise the return immediately and

pay the due amount of tax.

Required:

(i) State whether Ms Mehr can revise the return without seeking the permission of the Commissioner of

Inland Revenue (CIR).

(ii) State whether Ms Mehr will be liable to pay the full amount of default surcharge or if there is any

concession in this regard.

(iii) State whether the CIR can recover any penalty from Ms Mehr for this default, and if so, of how much.

Note: No computations are required.

Note: The total marks will be split equally between each part. (3 marks)

(10 marks)

End of Question Paper

13

Answers

Fundamentals Level Skills Module, Paper F6 (PKN) December 2013 Answers

Taxation (Pakistan) and Marking Scheme

Notes:

1. The suggested answers provide detailed guidance on the subject for use as a study aid to the question paper. Candidates were

not expected to produce answers with this extensive detail, which would not be possible in a three hour exam.

2. All references to legislation shown in square brackets are for information only and do not form part of the answer expected from

candidates.

Marks

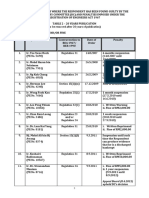

1 Faisal Industries Limited (FIL)

(a) Taxable income for the tax year 2013 (accounting year ended 30 June 2013)

Note Rs. Rs.

Income from business

Net profit as per income statement 11,000,000 05

Add:

Adjustment in the sales value of goods sold to an associate (1) 200,000 10

Adjustment in the value of closing stock (2) 3,000,000 10

Accounting deprecation in the cost of sales (3) 2,000,000 05

Payment made to a French company (4) 1,500,000 05

Salaries paid in cash (5) 480,000 10

Wages of a personal servant of a director (6) 600,000 10

Expenses relating to the acquisition of another company (7) 500,000 10

Depreciation on fixed assets taken under a finance lease (3) 100,000 05

Rent paid in advance (8) 500,000 05

Penalty imposed for late filing of return (9) 45,000 10

Donation to a political party (10) 50,000 05

Payment of reward without tax deduction (11) 500,000 10

Capital expenditure on the visitors room (12) 600,000 10

Loan written off (13) 110,000 10

Taxable profit on the sale of furniture (14) 500,000 05

Provision for bad debts (15) 50,000 10

10,735,000

Less:

Amortisation of intangible (4) 150,000 15

Accounting profit on the sale of furniture (14) 200,000 05

Initial allowance (16) 737,500 15

Tax depreciation (16) 5,353,125 40

(6,440,625)

Income from business/taxable income 15,294,375

Items not included in the computation of taxable income

(i) Freight inwards paid in cash Rs. 1,000,000

Freight charges are not rendered inadmissible merely on the basis that they have been paid in cash.

[2nd proviso to s.21(l)] 10

(ii) Decoration items Rs. 100,000

Since the useful life of the decoration items was estimated to be one year only, it is admissible as

revenue expenditure. [s.20(2)] 10

(iii) Motor vehicle tax Rs. 50,000

Motor vehicle tax is for the purposes of business and revenue in nature. Further, it does not fall in the

list of inadmissible deductions. [s.20(1) read with s.21(a)] 10

(iv) Scholarship granted to a Pakistani citizen Rs. 150,000

Since the scholarship has been granted to a Pakistani citizen for his technical training under a scheme

approved by the Federal Board of Revenue, the expenditure is admissible. The beneficiary of the

scholarship does not need to be an employee of the taxpayer. [s.27(c)] 10

17

Marks

(v) Lease rentals paid to an approved modaraba Rs. 700,000

A lease rental comprises the principal amount and finance charges. Since the plant and machinery were

taken on a finance lease from an approved modaraba, the lease rentals paid are fully admissible.

[s.28(1)(b)] 10

26

Notes

Note 1

The price charged to the associate was below the market value of the goods by Rs. 200,000. The sales are,

therefore, enhanced by this amount to reflect the correct value as if it were an arms length transaction. [ss.68

and 108]

Note 2

The closing value of stock-in-trade for a tax year can be the lower of cost [Rs. 35,000,000] or net realisable

value [Rs. 40,000,000] of the stock-in-trade on hand at the end of the year. It cannot be lower than both

of these values. The amount of Rs. 3,000,000 is, therefore, added back to income to make the value of the

closing stock equal to cost. [s.35(4)]

Note 3

Accounting depreciation is not a deductible charge. Tax depreciation and initial allowance are deductible at

the rates prescribed in the Third Schedule and subject to the conditions mentioned in the relevant provisions

[ss.22 and 23] of the Ordinance.

Note 4

The non-exclusive, non-transferable right for the production of an item is defined as an intangible in the

Income Tax Ordinance, 2001. The full cost of an intangible is not allowed as a deduction in any single tax

year. It is to be amortised over the useful life of the intangible. An intangible asset with a normal useful life

of more than ten years shall be treated as if it had a normal useful life of ten years. [s.24(4)(a)] The amount

to be amortised is computed below:

Cost of the intangible Rs. 1,500,000

Actual useful life 15 years

Deemed to have useful life 10 years

Amortised cost chargeable this year 1,500,000/10 = Rs. 150,000

[s.24(3) and (11)]

Note 5

Since the monthly salary of each employee is above the maximum amount which can be paid in cash [i.e.

Rs. 15,000 per month], the amount is disallowed in full at Rs. 480,000 (20,000 x 6 x 4). [s.21(m)]

Note 6

Wages of Rs. 600,000 paid to a personal servant of a director of FIL are not for the purposes of business

carried on by FIL. It is, therefore, not allowed as an expense. [s.20(1) and s.21(h)]

Note 7

Expenses incurred at Rs. 500,000 relate to the acquisition of another company. The expense, therefore,

being capital in nature, is disallowed. [s.21(n)]

Note 8

Since half the amount of the rent paid relates to the next tax year, it is disallowed at Rs. 500,000. [s.34(1)

and (3)]

Note 9

A penalty of Rs. 45,000 paid for the late filing of a return of income is an inadmissible expense on either of

the following two grounds:

(a) A penalty for the late filing of a return of income is included in tax as defined in the Income Tax

Ordinance, 2001 (the Ordinance). Tax is an inadmissible deduction under the law. [s.21(a)]

(b) It was imposed for violation of the provisions of the Ordinance, hence not admissible. [s.21(g)]

Note 10

Donation of Rs. 50,000 made to a political party is not an allowable expense because it was not for the

purposes of business. The fiscal ideology of a political party is irrelevant in determining the admissibility of

an expense. Further, a donation paid to a political party does not qualify for any tax credit. [s.20(1) and s.61]

18

Marks

Note 11

Any amount paid in connection with employment falls in the definition of salary. Since no tax was deducted

from the taxable salary of the employee, it became an inadmissible expense. [s.21(c)]

Note 12

Expenditure of Rs. 325,000 for an extension of the visitors room and Rs.275,000 for the installation of new

air conditioners are capital expenditure and not allowable as a deduction. However, tax depreciation and

initial allowance will be admissible as per law. [s.21(n)]

Note 13

Since FIL is not a financial institution carrying on a business of lending money, the amount of the loan written

off as a bad debt is not allowable as a deduction. For non-financial institutions, only those amounts which

first had been offered for tax are eligible for deduction as bad debts, when they are written off as irrecoverable.

[s.29(1)(a)]

Note 14

An accounting loss or profit resulting from the disposal of an asset is tax neutral. Therefore, to nullify its effect,

the amount of the accounting profit of Rs. 200,000 is reduced from the total income and the excess of the

sale proceeds over the tax written down value of the furniture is added back at Rs. 500,000. [s.22(8)(a)]

Note 15

Provision for bad debts at Rs. 50,000 has been made on an estimated basis and does not satisfy the

conditions of:

written off in the accounts; and

existence of reasonable grounds for believing that the debt is irrecoverable.

The provision is, therefore, added back to the total income of the taxpayer. [s.29(1)(b) and (c)]

Note 16

Initial allowance and tax depreciation:

Asset TWDV on Addition/ Initial TWDV Rate of Depreciation

1 July 2012 (deletion) allowance for depreciation

during the depreciation

year

(1) (2) (3) (4) 5 = (2 + 3) (6) (7)

(4)

Rs. Rs. Rs. Rs.

Freehold land 10,000,000

Building on

freehold land 5,000,000 1,000,000 250,000 5,750,000 10% 575,000

(see (a))

325,000 325,000 10% 32,500

(see (b))

Plant, machinery

and equipment 12,000,000 50,000 12,050,000 15% 1,807,500

(see (c))

275,000 137,500 137,500 15% 20,625

(see (d))

Computers 1,825,000 700,000 350,000 2,175,000 30% 652,500

(see (e))

Furniture and fittings 6,000,000 (300,000) 5,700,000 15% 855,000

Motor vehicles 7,000,000 2,400,000 9,400,000 15% 1,410,000

Total 737,500 5,353,125

[s.22 and 23 read with 3rd Sch]

Sub-notes to note 16

(a) The rate of initial allowance on new buildings used for business during the tax year is 25%.

(b) The addition represents an extension of an existing room for visitors. Hence no initial allowance is

admissible. However, depreciation is admissible on such an addition.

(c) The machine already in use by the taxpayer under the finance lease was transferred at its residual value

[Rs. 50,000] at the maturity of the finance lease term. Tax depreciation is allowable at 15% of the

residual value and not on the book value of Rs. 200,000. [s.22 read with ss.76 and 77(4)]

19

Marks

(d) The amount represents new air conditioners installed and used during the tax year and eligible for

depreciation and initial allowance at 50% of the cost. [s.23]

(e) Although computers of Rs. 1,000,000 were purchased during the year, a computer costing

Rs. 300,000 was not put to use during the year ended 30 June 2013, hence is not entitled to any

capital allowance.

(b) Tax liability for the tax year 2013

Rs. Rs.

Taxable income for the tax year 2013 (from (a)) 15,294,375

Since the company does not fall within the definition of small company,

tax is charged at 35% 5,353,031 05

Less: Tax already paid

Tax deducted on payments received for the supply of goods

[Proviso to s.153(3)] 45,000 05

Tax collected along with electricity bills [ss.168 and 235] 800,000 05

Advance tax paid in cash [s.147] 4,000,000 05

(4,845,000)

Tax payable with return [s.137] 508,031

20

(c) (i) The Commissioner of Inland Revenue (CIR) cannot recover the principal amount of tax from the

withholding agent, if in the meanwhile it has been paid by the person from whom it was originally

deductible. Hence, the CIR cannot recover the amount in question from Goodluck Ltd. 10

(ii) The CIR can only recover the amount of default surcharge from Goodluck Ltd and not from FIL. The

period of default starts from the date the deducted tax amount was payable to the date it was paid

by FIL. 10

30

20

Marks

2 (a) Dr Ali

Taxable income and tax payable for the tax year 2013 (accounting year ended 30 June 2013)

Note Rs. Rs.

Income under normal law

Net income as per income statement 80,000 05

Add:

Rent of the clinic (1) 60,000 10

Salary paid to nurse (2) 575,000 10

Purchase of car (3) 1,200,000 05

Expenses relating to personal use car (4) 60,000 10

Advance income tax paid (5) 25,000 05

Communication expenses (6) 62,000 15

Pre-paid fees to PMA (7) 72,000 10

Fine for violation of electricity rules (8) 50,000 10

2,104,000

Less:

Depreciation on car (3) 120,000 10

Depreciation on cell phone (6(i)) 3,000 10

(123,000)

Income from business 2,061,000

Tax on taxable income under the normal law

Tax on income from business

On first Rs. 1,500,000 147,500

On remainder of Rs. 561,000 at 20% 112,200 259,700 05

Tax on income under the final tax regime (FTR)

Tax on profit on debt (9) 9,500 15

Total tax payable 269,200

Less: Tax paid or deducted/collected by withholding agents

Tax deducted on profit for debt (9) 9,500 05

Tax collected with electricity bills [s.235] 5,000 05

Tax collected with mobile phone bills [s.236] 4,000 05

Advance tax paid by Ali [s.147] 25,000 05

(43,500)

Tax payable with return [s.137] 225,700

Explanation of items not included in the computation of taxable income

(i) Salary paid to office boy Rs. 75,000

If the monthly salary of an employee does not exceed Rs. 15,000, its payment in cash does not render

it inadmissible. Since the monthly salary of the office boy was Rs. 12,500 (75,000/6), the full amount

is admissible. [s.21(m)] 10

(ii) Utility bills paid in cash Rs. 75,000

When otherwise admissible, the utility bills do not become inadmissible on account of being paid in

cash. [para (b)(i) of proviso to s.21(l)] 10

(iii) Destruction of expired medicines Rs. 50,000

Destruction of expired medicines is incidental to the medical practice and allowable as a deduction.

[s.20 and general principles of taxation] 10

(iv) Share from association of persons (AOP) Rs. 250,000

Where income from an AOP is assessable under the normal law, the share of profit from such an AOP

is added to the income of the individual member when determining the rate of tax to be applied to his

other taxable income. However, where the income from the AOP is taxable under the final tax regime

(FTR), the share of profit is neither liable to be further taxed nor added when determining the rate of

tax for other taxable income. Since the total income of the AOP is covered under the FTR, it does not

need to be further added to the income of Ali. [s.169(2)(a)] 10

21

Marks

(v) Income from ex-employer in Dubai Rs. 450,000

Dr Ali was not resident in Pakistan in any of the four tax years preceding the tax year 2013. Therefore,

his foreign-source income during the tax years 2013 and 2014 will be exempt from tax in Pakistan.

[s.51(1)] 10

(vi) Agricultural income Rs. 40,000

Rent received from land which is situated in Pakistan and is used for agricultural purposes is treated as

agricultural income and exempt from income tax under the Ordinance. [s.41(1) and (2)(a)] In such a

situation there is no need to determine the fair market rent of the land. 10

20

Notes

Note 1

Rent paid in cash Rs. 60,000

Where any expenditure under a single head of account exceeds Rs. 50,000 and the individual payment is

more than Rs. 10,000, to be admissible as a deduction, it has to be paid through the prescribed modes like

a crossed pay order, crossed bank draft, etc. Verifiability of the expense does not mitigate the inadmissibility

of the expense, therefore it is disallowed. [s.21(l)]

Note 2

Dr Ali, being an employer, was required to deduct income tax from the taxable salaries paid to his employees.

Since the salary of the nurse was above Rs. 400,000, his failure to deduct tax at source and deposit it in

the government treasury renders the whole salary of Rs. 575,000 paid to the nurse as inadmissible.

[s.21(m)]

Note 3

The car is a capital asset and any costs incurred in acquiring a capital asset are not admissible. [s.21(n)].

However, depreciation on the car is admissible at 15% of the value of car. Since one-third of the usage of

the car was not for the purposes of business, the admissible tax depreciation is restricted accordingly as

below:

Rs.

Value of the car 1,200,000

Tax depreciation at 15% [s.22 read with Part I of the 3rd Sch] 180,000

Admissible depreciation restricted to 2/3rd (180,000 x 2/3) [s.22(3)] 120,000

Further, no initial allowance is admissible on a car. [s.22(5)(a)]

Note 4

One-third usage of the car was for non-business purposes, therefore, Rs. 60,000, being one-third of total

expenses, are added back as inadmissible. [s.21(h)]

Note 5

Income tax paid is an inadmissible expense under the relevant provision [s.21(a)] of the Ordinance. However,

it is included when computing the tax payable/refundable with the return.

Note 6

(i) Communication expenses include inadmissible capital expenditure of Rs. 40,000 incurred on the

purchase of a mobile phone. The expenditure is inadmissible as a straight deduction [s.21(n)];

however, it is eligible for depreciation as computed below:

Rs.

Value of the mobile phone 40,000

Tax depreciation at 15% [s.22 read with Part I of the 3rd Sch] 6,000

Since only half the usage was for the purposes of business, the amount of allowable depreciation is

reduced by 50% to Rs. 3,000.

Further, no initial allowance is admissible on a used mobile phone. [s.22(1)]

(ii) The total mobile phone calls bill at Rs. 40,000 includes advance income tax collected at source which

is not admissible as a deduction. [s.21(a)] However, it is adjustable against the tax liability of the

taxpayer.

Since half of the calls were made for non-business purposes, half the bill is to be disallowed on a

pro-rata basis. [s.20(1)]

22

Marks

The inadmissible amount is, consequently, computed as below:

Rs.

Total mobile phone bill 40,000

Less: Inadmissible advance income tax (4,000)

(a) 36,000

Less: Expenditure relating to non-business use (36,000 x 1/2) (18,000)

Admissible expenditure (b) 18,000

Inadmissible phone call expenditure (a) (b) 18,000

Inadmissible advanced income tax 4,000

22,000

Total inadmissible communication expenses at (i) and (ii) [40,000 + 22,000] 62,000

Note 7

Rs. 90,000 paid to the Pakistan Medical Association (PMA) was for five years. Since only Rs. 18,000

relates to the tax year 2013, the balance amount of Rs. 72,000 is added back to the total income. [s.34(1)]

However, the disallowed amount will be available for deduction in the next four tax years in accordance with

the law.

Note 8

A fine paid for the violation of the Electricity Rules, 1937 is an inadmissible deduction under the law.

[s.21(g)]

Note 9

Profit on debt

Tax deducted on the profit on debt is the final discharge of the tax liability. [s.151(3)]

Tax is deductible on the gross amount of the profit on debt as reduced by the amount of Zakat deducted at

source/paid under the Zakat and Ushr Ordinance, 1980. [s.151(1)]

Rs.

Gross profit credited to the account 100,000

Less: Zakat deducted (5,000)

Income liable to tax deduction 95,000

Tax at 10% 9,500

(b) Rectifiable mistakes

Any mistake, whether of the law or of fact, which is apparent from the record and which does not require

further investigation/inquiry can be rectified by the Commissioner. 10

A rectification order which has the effect of increasing an assessment, reducing a refund or otherwise being

adverse to the taxpayer can only be passed after giving the taxpayer a reasonable opportunity of being heard. 10

20

(c) An appeal can be filed within 30 days of the service of the demand notice based on the rectification order

or where no demand notice is served, the date on which the rectification order is served. 15

The Commissioner (Appeals) can stay the recovery of the tax demanded in appeal for a maximum period of

30 days, in aggregate, after affording an opportunity of being heard before the Commissioner against whose

order the appeal has been filed by the taxpayer. 15

30

25

23

Marks

3 Mr Ilyas

Tax payable for the tax year 2013 (accounting year ended 30 June 2013)

Transaction Note Capital gain/(loss) Tax

Rs. Rs.

Capital gains and tax on the disposal of immovable properties

taxable as a separate block

On the sale of a house in Lahore (1) 7,700,000 770,000 35

On the compulsory acquisition of land (2) 5,000,000 250,000 20

On the sale of a house in Islamabad (3) 10,000,000 0 10

Capital gains on securities taxable as a separate block

On the sale of shares in Pakistan Petroleum Ltd (4) 150,000 12,000 15

Income under the head Capital gains assessable to tax along

with other heads of income

On the gift of a painting (5) 375,000 10

On the sale of shares in Interwood (Pvt) Ltd (6) 150,000 20

On the disposal of an imported machine (7) 25,000 20

550,000

Less:

Capital loss on the disposal of shares in Delta (Pvt) Ltd (8) (100,000) 15

Capital loss brought forward from the tax year 2011 on

account of disposal of shares in Pakistan Petroleum Ltd (9) 0 10

(100,000)

Taxable income 450,000

Tax at 10% of the amount exceeding

Rs. 400,000 (450,000 400,000) x 10% 5,000 05

[Para (1) of Div I, Pt I of the 1st Sch]

Tax payable under the fixed tax regime

Tax under the head Income from property (3) 457,500 15

[s.15 read with Div VI of Pt I of the 1st Sch]

Total tax 1,494,500

Less: tax already paid

on the sale proceeds of house in Lahore at 05% of total

proceeds Rs. 30,000,000 (30,000,000 x 05%) [s.236C] 150,000 05

on cash withdrawals from bank [s.231A] 25,000 05

advance tax paid [s.147] 50,000 05

(225,000)

Tax payable with return 1,269,500

Items not included in the computation of capital gain

Ilyas gifted the jewellery to his sister who, although she had been in Saudi Arabia for the last two years on account

of being an employee of the Federal Government posted abroad, is treated as resident in Pakistan. [s.82(c)] A gift

to a resident person is not a taxable event. [s.79(1)(c)] 10

20

Notes:

Note 1

Sale of house in Lahore

Through an amendment in the Finance Act, 2012, a gain on the disposal of an immovable property held not

beyond two years has been made chargeable to tax according to the rates prescribed for such capital gains in the

First Schedule to the Income Tax Ordinance, 2001. The capital gain on the disposal of the house in Lahore is

computed as:

24

Marks

Rs. Rs.

Consideration received 30,000,000

Less:

Cost of acquisition

Purchase price [s.76(2)(a)] 20,000,000

Stamp duty (20,000,000 x 2%) [s.76(2)(b)] 400,000

Capital value tax (20,000,000 x 2%) [s.76(2)(b)] 400,000

Brokers fee on the purchase of the house (20,000,000 x 2%) [s.76(2)(b)] 400,000

Corporation tax (20,000,000 x 1%) [s.76(2)(b)] 200,000

Modification of the drawing room [s.76(2)(c)] 300,000

Brokerage to real estate agent on the sale of the property

(30,000,000 x 2%) [s.76(2)(b)] 600,000

(22,300,000)

Capital gain 7,700,000

Tax at 10% as the holding period of the house was less than one year

(7,700,000 x 10%) [Div VIII of Pt I of 1st Sch] 770,000

The property tax paid at Rs. 25,000 did not form part of the cost nor did it increase the value of the house, hence

it is not deducted from the consideration received.

Note 2

Land acquired by the Government of Punjab under the Land Acquisition Act, 1894

In the case of an asset compulsorily acquired under any law where the consideration received by the person for

the disposal of the asset is reinvested by the recipient in an asset of a similar kind within one year of the disposal,

no capital gain is to be recognised. [s.79(1)(d)] In the given case, the amount of consideration received was not

reinvested in an asset of the same kind, hence the capital gain is taxable as computed below:

Rs.

Consideration received on the disposal on 30 September 2012 30,000,000

Less:

Cost of the land on 1 January 2011 (25,000,000)

Capital gain 5,000,000

Tax at 5% as the holding period of the land was more than one year but less than two years

(5,000,000 x 5%) [Div VIII of Pt I of 1st Sch] 250,000

Note: The profit on the fixed term account did not accrue during the tax year 2013, hence, no taxation during

the year.

Note 3

Sale of house in Islamabad

(i) Transaction with Mr Sohail

The amount of Rs. 5,000,000 forfeited by Ilyas in accordance with the terms of the contract for the sale of

his house to Sohail is to be treated as rent received [s.15(2)] and taxed as below as a separate block of

income:

Rs.

Rent received 5,000,000

Tax payable on Rs. 5,000,000

[Rs. 57,500 plus 10% of the gross amount exceeding Rs. 1,000,000]

(57,500+ 10% x (5,000,000 1,000,000)) 457,500

[s.15 read with Div VI of Pt I of the 1st Sch]

(ii) Transaction with Mr Mumtaz

Rs.

Consideration received for the sale of the house on 30 June 2013 49,000,000

Market value on 25 June 2010, the date of inheritance by Ilyas [s.37(4A)(b)] (39,000,000)

Capital gain 10,000,000

Since the disposal was made after holding the house for more than two years, no gain is taxable under the

law. [s.37(1A)]

25

Marks

Note 4

Sale of shares in Pakistan Petroleum Ltd

Since the company is listed on the Karachi Stock Exchange, it is to be treated as a public limited company. Shares

of a public company are included in the definition of a security. Any gain or loss on the disposal of a security is

treated as a separate block of income. [s.37A] The capital gain is computed as:

Rs.

Consideration received on the sale of 2,500 shares on 15 July 2012 500,000

Purchase price on 15 September 2011 (350,000)

Capital gain 150,000

Tax at 8% of the capital gain as the holding period is more than six months but less than

12 months (150,000 x 8%) [Div VII of Pt I of 1st Sch] 12,000

Note 5

Gift of painting

Gift of a capital asset, chargeable to tax, to a non-resident is a taxable event. Since his brother did not stay in

Pakistan for 183 days during the tax year 2013, he remained a non-resident and the gift of the painting to him

does not fall in the non-recognition clause and so is taxable. [s.79(2) read with s.82(a)]

The capital gain is computed as:

Rs.

Fair market value of the painting to be treated as consideration received on 30 August 2012 1,000,000

Cost of the painting purchased on 1 January 1990 (500,000)

Capital gain 500,000

Since the disposal of the painting was made after holding it for more than a year, only 75% of the capital gain is

taxable at Rs. 375,000. [s.37(3)]

Note 6

Sale of shares in Interwood (Pvt) Ltd

Rs. Rs.

Consideration received on the sale of 10,000 shares on 14 December 2012 300,000

Less:

Purchase price of 5,000 shares at Rs. 18 per share on 5 February 2010

(5,000 x 18) 90,000

Allotment of 5,000 bonus shares on 1 July 2010 0

(Fair market value is not relevant in this case)

Incidental charges [s.76(2)(b)] 10,000

(100,000)

Capital gain 200,000

Since the disposal of the shares was made after holding them for more than a year, only 75% of the capital gain

is taxable at Rs. 150,000. [s.37(3)]

Note 7

Disposal of machine

Since Ilyas was not entitled to claim depreciation on this machine, the machine falls within the definition of a

capital asset. [s.37(5)(b)] Discarding an asset is also treated as a disposal of the asset. [s.75(3A)] The capital

gain is determined as:

Rs. Rs.

Consideration received 15 February 2013

Damages from the shipping company 850,000

Scrap value of the machine 200,000

1,050,000

Cost of the machine on 1 January 2013

Purchase price of the machine 1,000,000

Documentation charges incurred 25,000

(1,025,000)

Capital gain 25,000

26

Marks

Since the disposal was made within one year of acquiring the asset, the full amount of capital gain is taxable.

[s.37 (3)]

Note 8

Sale of shares in Delta (Pvt) Ltd

Rs.

Consideration received on 15 April 2013 for the sale of shares 450,000

Purchase price on 15 May 2009 (550,000)

Capital loss (100,000)

The provision for diminution in the value of shares made on 30 June 2012 is to be ignored as the same, being

a notional loss, was not deductible in the tax year 2012. A capital loss on the sale of shares of a private limited

company can be set off, subject to certain exceptions, against the capital gains arising from the disposal of other

assets. [s.38(1)]

Note 9

The capital loss on the sale of shares in Pakistan Petroleum Ltd, being a loss suffered from the sale of securities

during a tax year, is not eligible to be carried forward to the subsequent tax year. [s.37A(5)]

4 (a) Mr Muddasir

Subject to the fulfilment of certain conditions, a taxpayer whose case is pending before an appellate authority

can avail of the alternative dispute resolution (ADR) mechanism provided in the law for the resolution of their

tax disputes. The points raised in the question are answered as follows:

(i) There are two exceptions where a taxpayer cannot apply to the Federal Board of Revenue (the Board)

for the appointment of a committee for the resolution of their dispute. These are where:

either the prosecution proceedings have already been initiated against the taxpayer; or

the dispute involves interpretation of a question of law having effect on identical other cases. 20

(ii) The committee shall consist of an officer of the Inland Revenue and two other persons from a panel.

The panel comprises chartered or cost accountants, advocates, income tax practitioners and reputable

taxpayers. 20

(iii) Yes, if Muddasir is not satisfied with the orders of the Board, he may continue to pursue his remedy

before the Appellate Tribunal as if no order had been made by the Board. [s.134A] 10

(b) The last date for the filing of returns of income by taxpayers is determined with reference to the date on which

their tax year ends, and the category of persons to which they fall. In the given situations, the last dates

for filing of the returns are as below:

(i) Bryonia Laboratories (Pvt) Ltd

For the tax year ended 31 March 2012, the last date for filing of the return of income in the case of

a company is 31 December 2012. [s.118(2)(a)] 10

(ii) Silk Bank Ltd

For the tax year ended 31 December 2012, the last date for filing of the return of income in the case

of a company is 30 September 2013. [s.118(2)(b)] 10

(iii) Ms Mehwish

For the tax year ended 30 June 2013, the last date for e-filing of the return of income in the case of a

salaried person is 31 August 2013. [s.118(3)(a)] 10

(iv) Mr Osmani

For the tax year ended 28 February 2013, the last date for filing of the return of income in the case of

a person is 30 September 2013. [s.118(3)(b)] 10

40

(c) Application for an extension of time to file a return of income

A person who is required to file a return of income may, by the due date for the furnishing of that return,

apply for an extension of time to file the return. Valid reasons for seeking an extension are:

27

Marks

(i) absence of the person from Pakistan;

(ii) sickness or other misadventure; or

(iii) any other reasonable cause. 20

In normal circumstances, an extension of time for furnishing a return shall not exceed 15 days from the due

date of furnishing of the return. [s.119(2) and (3)] 10

30

(d) Mr Adeel

Since Adeel has not complied with the notice served on him for the filing of the return of income, the

Commissioner of Inland Revenue (CIR) can frame an assessment in the manner provided in the Ordinance,

without waiting for the filing of the return by Adeel. Under the given circumstances in the question, different

aspects relating to such assessment of income are explained as follows:

(i) In the given circumstances, the CIR may issue a provisional assessment order by framing an

assessment based on any available information or material and to the best of his judgement. 10

(ii) The provisional assessment order will become a final assessment order after the expiry of 60 days from

the date of service of the provisional assessment order. Once the assessment order becomes a final

assessment order, the CIR can take coercive measures to recover the amount of tax assessed against

Mr Adeel in accordance with the provisions of the Ordinance. 10

(iii) For the provisional assessment order served on him to be abated without the filing of an appeal, Adeel

should, within 60 days of the service of the provisional assessment order, file his return of income for

the tax year 2013 along with other relevant documents/information, namely:

a wealth statement;

a wealth reconciliation statement; and

an explanation of the source of the funds used for the acquisition of the car. [s.122C and 116(2A)] 10

30

15

5 (a) Persons required to be registered for sales tax

The following persons, who are making taxable supplies in Pakistan in the course or furtherance of any

taxable activity carried on by them, are required to be registered for sales tax under the Sales Tax Act, 1990:

(i) a manufacturer, not being a cottage industry; 10

(ii) a retailer whose value of supplies, in any period during the last 12 months exceeds Rs. 5 million; 15

(iii) an importer; 10

(iv) a wholesaler (including dealer) and distributor; 10

(v) a person required, under any other Federal law or Provincial law, to be registered for the purpose of any

duty or tax collected or paid as if it were a levy of sales tax to be collected under the Act; and 15

(vi) a commercial exporter, who intends to obtain a sales tax refund against his zero-rated supplies. 10

[s.14 of the Sales Tax Act, 1990 read with rule 4 of the Sales Tax Rules, 2006] 7

(b) Ms Mehr

In the given circumstances, Ms Mehr can revise her sales tax return, on her own, without waiting for any

notice of audit from the Commissioner of Inland Revenue (CIR).

The points raised in the question are answered as follows:

(i) Ms Mehr can revise her return to declare the correct amount of taxable supplies made without seeking

any permission from the CIR and pay the shortfall of tax. 10

(ii) Ms Mehr will be liable to pay the full amount of the default surcharge on the amount of the tax shortfall

caused by the non-declaration of taxable supplies of Rs. 500,000 in the original return. 10

(iii) No. If both the tax due and the full amount of the default surcharge are paid by Ms Mehr along with

her revised return, the CIR cannot recover any penalty from her on account of the shortfall of tax paid

with the original return. 10

[First proviso to s.26(4)] 30

10

28

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Natural Law Legal PositivismDocument5 pagesNatural Law Legal PositivismlotuscasPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- ELECTION LAW Case Doctrines PDFDocument24 pagesELECTION LAW Case Doctrines PDFRio SanchezPas encore d'évaluation

- Othello Character Analysis and General NotesDocument8 pagesOthello Character Analysis and General Notesjoshuabonello50% (2)

- Iso 16750 4 2010 en PDFDocument8 pagesIso 16750 4 2010 en PDFvignesh100% (1)

- Training Design SKMTDocument4 pagesTraining Design SKMTKelvin Jay Cabreros Lapada67% (9)

- CRIMINAL LAW 1 REVIEWER Padilla Cases and Notes Ortega NotesDocument110 pagesCRIMINAL LAW 1 REVIEWER Padilla Cases and Notes Ortega NotesrockaholicnepsPas encore d'évaluation

- Caballes V CADocument2 pagesCaballes V CATintin CoPas encore d'évaluation

- City of Columbus Reaches Settlement Agreement With Plaintiffs in Alsaada v. ColumbusDocument2 pagesCity of Columbus Reaches Settlement Agreement With Plaintiffs in Alsaada v. ColumbusABC6/FOX28Pas encore d'évaluation

- Safety Data Sheet: Zetpol 1020Document8 pagesSafety Data Sheet: Zetpol 1020henrychtPas encore d'évaluation

- Botoys FormDocument3 pagesBotoys FormJurey Page Mondejar100% (1)

- Guidelines For The Writing of An M.Phil/Ph.D. ThesisDocument2 pagesGuidelines For The Writing of An M.Phil/Ph.D. ThesisMuneer MemonPas encore d'évaluation

- Tutang Sinampay:: Jerzon Senador Probably Wants To Be Famous and Show The World How Naughty He Is by Hanging HisDocument2 pagesTutang Sinampay:: Jerzon Senador Probably Wants To Be Famous and Show The World How Naughty He Is by Hanging HisClaire Anne BernardoPas encore d'évaluation

- Petitioners: La Bugal-B'Laan Tribal Association Inc, Rep. Chariman F'Long Miguel Lumayong Etc Respondent: Secretary Victor O. Ramos, DENR EtcDocument2 pagesPetitioners: La Bugal-B'Laan Tribal Association Inc, Rep. Chariman F'Long Miguel Lumayong Etc Respondent: Secretary Victor O. Ramos, DENR EtcApple Gee Libo-onPas encore d'évaluation

- A&M Plastics v. OPSol - ComplaintDocument35 pagesA&M Plastics v. OPSol - ComplaintSarah BursteinPas encore d'évaluation

- A Chronology of Key Events of US HistoryDocument5 pagesA Chronology of Key Events of US Historyanon_930849151Pas encore d'évaluation

- Itlp Question BankDocument4 pagesItlp Question BankHimanshu SethiPas encore d'évaluation

- CSRF 1 (CPF) FormDocument4 pagesCSRF 1 (CPF) FormJack Lee100% (1)

- TOR Custom Clearance in Ethiopia SCIDocument12 pagesTOR Custom Clearance in Ethiopia SCIDaniel GemechuPas encore d'évaluation

- COC 2021 - ROY - Finance OfficerDocument2 pagesCOC 2021 - ROY - Finance OfficerJillian V. RoyPas encore d'évaluation

- CEILLI Trial Ques EnglishDocument15 pagesCEILLI Trial Ques EnglishUSCPas encore d'évaluation

- The Following Information Is Available For Bott Company Additional Information ForDocument1 pageThe Following Information Is Available For Bott Company Additional Information ForTaimur TechnologistPas encore d'évaluation

- LIST OF HEARING CASES WHERE THE RESPONDENT HAS BEEN FOUND GUILTYDocument1 pageLIST OF HEARING CASES WHERE THE RESPONDENT HAS BEEN FOUND GUILTYDarrenPas encore d'évaluation

- United States Bankruptcy Court Southern District of New YorkDocument21 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsPas encore d'évaluation

- NC LiabilitiesDocument12 pagesNC LiabilitiesErin LumogdangPas encore d'évaluation

- Case StudyDocument6 pagesCase StudyGreen Tree0% (1)

- Bulletin No 18 August 16 2019 - PassDocument770 pagesBulletin No 18 August 16 2019 - PassNithyashree T100% (1)

- Test 3 - Part 5Document4 pagesTest 3 - Part 5hiếu võ100% (1)

- AKD Daily Mar 20 202sDocument3 pagesAKD Daily Mar 20 202sShujaat AhmadPas encore d'évaluation

- Riverscape Fact SheetDocument5 pagesRiverscape Fact SheetSharmaine FalcisPas encore d'évaluation

- CAGAYAN STATE UNIVERSITY TECHNOLOGY LIVELIHOOD EDUCATION CLUB CONSTITUTIONDocument7 pagesCAGAYAN STATE UNIVERSITY TECHNOLOGY LIVELIHOOD EDUCATION CLUB CONSTITUTIONjohnlloyd delarosaPas encore d'évaluation