Académique Documents

Professionnel Documents

Culture Documents

Asian, Mexican, and Argentine financial crises of the late 1990s

Transféré par

Miggy ZuritaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Asian, Mexican, and Argentine financial crises of the late 1990s

Transféré par

Miggy ZuritaDroits d'auteur :

Formats disponibles

SPECULATION BUBBLE

ASIAN FINANCIAL CRISIS (1997) The Thai government guaranteed that holding

the exchange rate between the Thai baht and

the US dollar at 25 baht per dollar would

encourage trade with and investment from

the United States and other countries in order

to help Thailands economy grow The

government assured that this would work

since interest rates were lower in the US than

they were in Thailand.

Thai finance companies were encouraged by

the promise of the Thai government, thinking

that it will stimulate investment. However,

due to crony capitalism, international

investors became concerned about the health

of the Thai banks and the governments ability

to honor its exchange-rate pledge. This

resulted to the foreign investors immediate

pulling out of funds out of Thailand and

converting them back into dollars. This panic

made it difficult for Thailand to pay because as

the flow of funds out of Thailand increased,

the supply of dollar reserves was drawn down.

MEXICAN FINANCIAL CRISIS (1994) The signing of NAFTA and aggressive

promotion for investment in emerging

markets led lots of people, especially newbie

investors (e.g. grandmothers, authors, and

clergymen) to invest in Mexico. Investor

confidence was high despite the fact that the

recently-signed NAFTA was clearly unstable at

the moment.

Due to the assassination of presidential

candidate Donaldo Colosio which scared

investors on fears of political instability,

Mexico had to choose between international

financial responsibilities and domestic political

chaos as a priority. They chose domestic

issues as a priority then the Mexican peso fell

in value. Peso depreciation, domestic

inflation, and high interest rates plunged

Mexico into a short but deep recession.

ARGENTINE FINANCIAL CRISIS (2001) The Convertibility Plan of Domingo Cavallo,

former head of the Argentine Finance

Ministry) pegged the peso to US dollar at a

rate of 1:1. This policy was aimed at keeping

inflation under control, a problem that had

plagued the Argentine economy in the past.

Further, Cavallo liberalized the economy by

privatizing over 200 state-owned industries.

When the US dollar appreciated dramatically,

Argentina found their currency overvalued.

Due to cheap imports, many businesses closed

down because they could not compete with

low costs of foreign products. With the

selling-off of state-run industries to the

private market, thousands of Argentines were

left without work. Simultaneously, the

government went on a spending spree

financed by debt. When Argentina eventually

decided to abandon the fixed exchange rate, it

gave them domestic and political

consequences.

Vous aimerez peut-être aussi

- INSTRUCTION: Answer The Questions GivenDocument15 pagesINSTRUCTION: Answer The Questions GivendonkhairulPas encore d'évaluation

- Argentina Peso CrisisDocument9 pagesArgentina Peso CrisisastrocritePas encore d'évaluation

- Mexico's rising current account deficit and overvalued peso prior to 1994 crisisDocument2 pagesMexico's rising current account deficit and overvalued peso prior to 1994 crisisKristle Sisles IIPas encore d'évaluation

- SEA Economic Crisis of 1997Document20 pagesSEA Economic Crisis of 1997Vaishali UzzielPas encore d'évaluation

- International Finance AssignmentDocument28 pagesInternational Finance AssignmentWaqar AhmadPas encore d'évaluation

- Mexican Peso Crisis of 1994 ExplainedDocument21 pagesMexican Peso Crisis of 1994 ExplainedAsad ShahPas encore d'évaluation

- The Asian Financial CrisisDocument7 pagesThe Asian Financial CrisisSon IaPas encore d'évaluation

- Asian Financial CrisisDocument13 pagesAsian Financial CrisisMark Roger Huberit IIPas encore d'évaluation

- Eeb20903 Ibei Ib20 Group AssignmentDocument3 pagesEeb20903 Ibei Ib20 Group AssignmentHalima Mohamed ALIPas encore d'évaluation

- 1997 Asian Financial CrisisDocument13 pages1997 Asian Financial CrisisChirag GoyalPas encore d'évaluation

- Asianfinancialcrisis 160302034438Document58 pagesAsianfinancialcrisis 160302034438soriPas encore d'évaluation

- Unit 10: Study The Financial Crisis of 1994 in Mexico. Describe How The Crisis Manifested Itself and Discuss Its CausesDocument14 pagesUnit 10: Study The Financial Crisis of 1994 in Mexico. Describe How The Crisis Manifested Itself and Discuss Its CausesJaleel KhanPas encore d'évaluation

- Argentina Economic CrisesDocument13 pagesArgentina Economic CrisesfhdkPas encore d'évaluation

- ECON 201 Submitted By: Remar James A. Dollete Submitted To: Sir AmorosoDocument4 pagesECON 201 Submitted By: Remar James A. Dollete Submitted To: Sir AmorosoRemar James DolletePas encore d'évaluation

- Political Science: An IntroductionDocument16 pagesPolitical Science: An IntroductionAbdulphatah Mohamed IbrahimPas encore d'évaluation

- Mexican Peso Currency Crisis of 1994Document15 pagesMexican Peso Currency Crisis of 1994SarikaPas encore d'évaluation

- Finance Project On CrisisDocument14 pagesFinance Project On CrisisAnkit AgarwalPas encore d'évaluation

- East Asian Financial CrisisDocument5 pagesEast Asian Financial CrisisDohaa NadeemPas encore d'évaluation

- Horobet EngDocument8 pagesHorobet EngOana ZamfirPas encore d'évaluation

- Argentina Crisis DRAFT1Document3 pagesArgentina Crisis DRAFT1pranav greyPas encore d'évaluation

- Geithner Is Exactly Wrong On China Trade - 01.26.09 - by Bret SwansonDocument1 pageGeithner Is Exactly Wrong On China Trade - 01.26.09 - by Bret SwansonBret SwansonPas encore d'évaluation

- Adr 3Document23 pagesAdr 3Michael Cano LombardoPas encore d'évaluation

- The Tequila EffectDocument2 pagesThe Tequila EffectShrutakeerti Army blinkPas encore d'évaluation

- If Term Paper Group6Document18 pagesIf Term Paper Group6aksgupta123Pas encore d'évaluation

- South East CrisesDocument6 pagesSouth East CrisesavhadrajuPas encore d'évaluation

- 1997 Asian Financial Crisis: Made byDocument12 pages1997 Asian Financial Crisis: Made byHitesh GuptaPas encore d'évaluation

- Finnacial CrisiDocument5 pagesFinnacial Crisikarima salemPas encore d'évaluation

- Types of Economic CrisisDocument11 pagesTypes of Economic CrisisEira HuynhPas encore d'évaluation

- What Is The Asian Financial Crisis - IB Unit 4Document2 pagesWhat Is The Asian Financial Crisis - IB Unit 4ApurvaPas encore d'évaluation

- Case Study Mexico Peso Crisis 1994Document3 pagesCase Study Mexico Peso Crisis 1994Tushar RastogiPas encore d'évaluation

- Asian Financial CrisisDocument5 pagesAsian Financial Crisisapi-574456094Pas encore d'évaluation

- B23005 Assignment08 AbinashMishraDocument9 pagesB23005 Assignment08 AbinashMishraAbinash MishraPas encore d'évaluation

- Chapter 4 - Economic Development - Asian Financial Crisis 1997Document8 pagesChapter 4 - Economic Development - Asian Financial Crisis 1997Rei PallPas encore d'évaluation

- President Fidel RamosDocument5 pagesPresident Fidel RamosMaria Lucy MendozaPas encore d'évaluation

- Multinational Financial Management 10th Edition Shapiro Solutions ManualDocument36 pagesMultinational Financial Management 10th Edition Shapiro Solutions Manualquadrel.legged.prv1j100% (34)

- Full Download Multinational Financial Management 10th Edition Shapiro Solutions Manual PDF Full ChapterDocument36 pagesFull Download Multinational Financial Management 10th Edition Shapiro Solutions Manual PDF Full Chaptertightlybeak.xwf5100% (16)

- The Mexican Peso Collapse of 1994Document17 pagesThe Mexican Peso Collapse of 1994Alejandro Lopez RangelPas encore d'évaluation

- Global FinancesDocument31 pagesGlobal Financesdtq1953401010044Pas encore d'évaluation

- The Asian Crisis of 1997Document4 pagesThe Asian Crisis of 1997MaricrisPas encore d'évaluation

- "These Headwinds Have Really Concentrated On LatinDocument4 pages"These Headwinds Have Really Concentrated On Latinapi-308666826Pas encore d'évaluation

- Mexico Peso Crisis Causes and Preventative PoliciesDocument6 pagesMexico Peso Crisis Causes and Preventative PoliciesRahat Ali KhanPas encore d'évaluation

- Chille A Changed JungleDocument15 pagesChille A Changed JunglepechorinsPas encore d'évaluation

- 1997 Asian Financial CrisisDocument13 pages1997 Asian Financial CrisisMyloginoPas encore d'évaluation

- LCWU's Asian Financial Crises AssignmentDocument3 pagesLCWU's Asian Financial Crises AssignmentAisha WaqarPas encore d'évaluation

- Group 1 Report in ConwoDocument3 pagesGroup 1 Report in ConwoLina ArevaloPas encore d'évaluation

- Business in Canada ComsatsDocument17 pagesBusiness in Canada Comsatsfarhan harcho100% (1)

- The Globalization of World EconomicsDocument31 pagesThe Globalization of World EconomicsLiane Francesita Mendoza100% (1)

- Case Study On International BusinessDocument6 pagesCase Study On International BusinessChetan BagriPas encore d'évaluation

- Peso (Currency) : Argentine Economic Crisis (1999-2002)Document8 pagesPeso (Currency) : Argentine Economic Crisis (1999-2002)raghavan001Pas encore d'évaluation

- Asian Financial Crisis ReportDocument12 pagesAsian Financial Crisis ReportNeha KumariPas encore d'évaluation

- Asian Financial CrisisDocument4 pagesAsian Financial Crisisramsha aliPas encore d'évaluation

- MSM-RITI Report on Causes of Argentina's 2001 Financial CrisisDocument35 pagesMSM-RITI Report on Causes of Argentina's 2001 Financial CrisisMiral MouradPas encore d'évaluation

- Tequila Crisis 1994Document21 pagesTequila Crisis 1994John Anthony ViceraPas encore d'évaluation

- The Mexican Peso CrisisDocument5 pagesThe Mexican Peso CrisisRodrigoTorresPas encore d'évaluation

- Case StudyDocument6 pagesCase StudyChetan BagriPas encore d'évaluation

- Reaction or Essay On The Asian Crisis VideoDocument4 pagesReaction or Essay On The Asian Crisis VideoK.A.Pas encore d'évaluation

- Mexican Peso Crisis Final 0-)Document18 pagesMexican Peso Crisis Final 0-)Bharati RamaiyaPas encore d'évaluation

- Financial Crisis, Contagion, and Containment: From Asia to ArgentinaD'EverandFinancial Crisis, Contagion, and Containment: From Asia to ArgentinaÉvaluation : 5 sur 5 étoiles5/5 (1)

- When Credit Money (Far) Eclipses the Money Supply: A Money-Supply View of 21St Century Economic DisastersD'EverandWhen Credit Money (Far) Eclipses the Money Supply: A Money-Supply View of 21St Century Economic DisastersPas encore d'évaluation

- Treaties in The 1500sDocument10 pagesTreaties in The 1500sMiggy ZuritaPas encore d'évaluation

- BROKERAGE Quiz PDFDocument2 pagesBROKERAGE Quiz PDFMiggy Zurita100% (1)

- GATT and WTO Trade Roundtable DiscussionDocument8 pagesGATT and WTO Trade Roundtable DiscussionMiggy ZuritaPas encore d'évaluation

- Significant Treaties of The 14th CenturyDocument2 pagesSignificant Treaties of The 14th CenturyMiggy ZuritaPas encore d'évaluation

- Fundamentals of Land Ownership - Notes 2013Document10 pagesFundamentals of Land Ownership - Notes 2013Miggy Zurita100% (1)

- 11th Century TreatiesDocument4 pages11th Century TreatiesMiggy ZuritaPas encore d'évaluation

- Written 1300 SDocument3 pagesWritten 1300 SMiggy ZuritaPas encore d'évaluation

- 17th Century Treaties CompiledDocument5 pages17th Century Treaties CompiledMiggy ZuritaPas encore d'évaluation

- 1900 1999Document3 pages1900 1999Miggy ZuritaPas encore d'évaluation

- 1800s TreatiesDocument2 pages1800s TreatiesMiggy ZuritaPas encore d'évaluation

- 20th Century TreatiesDocument2 pages20th Century TreatiesMiggy ZuritaPas encore d'évaluation

- BROKERAGE Quiz PDFDocument2 pagesBROKERAGE Quiz PDFMiggy Zurita100% (1)

- 12th Century Int - L TreatiesDocument5 pages12th Century Int - L TreatiesMiggy ZuritaPas encore d'évaluation

- Art. 11. Justifying Circumstances. - The Following Do Not Incur Any Criminal LiabilityDocument1 pageArt. 11. Justifying Circumstances. - The Following Do Not Incur Any Criminal LiabilityMiggy ZuritaPas encore d'évaluation

- Real Property Assessment ExamDocument2 pagesReal Property Assessment ExamMiggy Zurita100% (1)

- 10 Good Reasons To Invest in Davao CityDocument14 pages10 Good Reasons To Invest in Davao CityMiggy ZuritaPas encore d'évaluation

- 11.16&17.13 MOCK EXAM Real Estate Economics No AnswerDocument2 pages11.16&17.13 MOCK EXAM Real Estate Economics No AnswerMiggy Zurita100% (1)

- 12 01 13 Mock Board Exam II With AnswerDocument16 pages12 01 13 Mock Board Exam II With Answercherry lyn calama-anPas encore d'évaluation

- 11.09.13AM Family Code (Atty. Raymond B. Batu)Document18 pages11.09.13AM Family Code (Atty. Raymond B. Batu)Miggy Zurita100% (1)

- 12.01.13 Mock Board Exam 1.with AnswerDocument13 pages12.01.13 Mock Board Exam 1.with AnswerMiggy Zurita83% (6)

- 12.01.13 Mock Board Exam 1.with AnswerDocument13 pages12.01.13 Mock Board Exam 1.with AnswerMiggy Zurita83% (6)

- Real Estate Exam Part 2Document16 pagesReal Estate Exam Part 2Miggy Zurita100% (1)

- 11.30.13 BP220 and PD957 StandardsDocument1 page11.30.13 BP220 and PD957 StandardsMiggy Zurita100% (3)

- Real Estate Taxation SolutionsDocument4 pagesReal Estate Taxation SolutionsMiggy Zurita100% (5)

- Thesis BangsamoroDocument3 pagesThesis BangsamoroMiggy Zurita100% (1)

- SERPDocument2 pagesSERPBill BlackPas encore d'évaluation

- Topic 4 AnnuityDocument22 pagesTopic 4 AnnuityNanteni GanesanPas encore d'évaluation

- Assessment of OMT TollCollection-RoadsDocument158 pagesAssessment of OMT TollCollection-Roadsmitu100% (1)

- Bank Management Financial Services Rose 9th Edition Solutions ManualDocument23 pagesBank Management Financial Services Rose 9th Edition Solutions Manualkevahuynh4vn8d100% (27)

- Igcse AccountingDocument3 pagesIgcse AccountingbonolomphaPas encore d'évaluation

- Income Tax Test BankDocument65 pagesIncome Tax Test Bankwalsonsanaani3rdPas encore d'évaluation

- Cash Transfer Methods: Berito, Quennie Bernal, Jessamie Cacho, CarminaDocument26 pagesCash Transfer Methods: Berito, Quennie Bernal, Jessamie Cacho, CarminaJewelyn CioconPas encore d'évaluation

- Fund Flow StatementDocument16 pagesFund Flow StatementRavi RajputPas encore d'évaluation

- Chapter 10 - SolutionsDocument25 pagesChapter 10 - SolutionsGerald SusanteoPas encore d'évaluation

- Quiz Cash FlowDocument3 pagesQuiz Cash FlowMumbo Jumbo100% (1)

- OECD Economic Outlook - June 2023Document253 pagesOECD Economic Outlook - June 2023Sanjaya AriyawansaPas encore d'évaluation

- Doa Borges MT 103 One Way 500m 5bDocument19 pagesDoa Borges MT 103 One Way 500m 5bMorris Rubio100% (1)

- IFRS9Document218 pagesIFRS9Hamza AmiriPas encore d'évaluation

- Insurance Black BookDocument44 pagesInsurance Black Booksupport NamoPas encore d'évaluation

- MPKJDocument36 pagesMPKJJoshua Capa FrondaPas encore d'évaluation

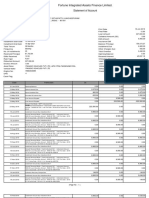

- Statement of Account for Mohansri ADocument2 pagesStatement of Account for Mohansri ASanthosh SehwagPas encore d'évaluation

- Atlantic City Recovery Plan in Brief 10.24.2016 - FINALDocument23 pagesAtlantic City Recovery Plan in Brief 10.24.2016 - FINALPress of Atlantic CityPas encore d'évaluation

- Cash Flow StatementDocument16 pagesCash Flow Statementrajesh337masssPas encore d'évaluation

- Forex Trading by Money Market, BNGDocument69 pagesForex Trading by Money Market, BNGsachinmehta1978Pas encore d'évaluation

- Vamsi Krishna Velaga - ITDocument1 pageVamsi Krishna Velaga - ITvamsiPas encore d'évaluation

- 1.a. PPT1 CR COLL Nature and Functions of CreditDocument41 pages1.a. PPT1 CR COLL Nature and Functions of CreditRoi Martin A. De VeyraPas encore d'évaluation

- Project Report On Market Survey On Brand EquityDocument44 pagesProject Report On Market Survey On Brand EquityCh Shrikanth80% (5)

- Leuthold Group - From August 2015Document10 pagesLeuthold Group - From August 2015ZerohedgePas encore d'évaluation

- My Report Internal AssessmentDocument18 pagesMy Report Internal AssessmentGlenn John BalongagPas encore d'évaluation

- Executive Order 1035 Streamlines Gov't Land AcquisitionDocument5 pagesExecutive Order 1035 Streamlines Gov't Land Acquisitionahsiri22Pas encore d'évaluation

- Program Management Office (Pgmo) : Keane White PaperDocument19 pagesProgram Management Office (Pgmo) : Keane White PaperOsama A. AliPas encore d'évaluation

- Exim PolicyDocument11 pagesExim PolicyRohit Kumar100% (1)

- 2 Re Calculation of SSD For HDB Sale Under 2 Years of OwnershipDocument17 pages2 Re Calculation of SSD For HDB Sale Under 2 Years of Ownershipapi-308324145Pas encore d'évaluation

- BBVA OpenMind Libro El Proximo Paso Vida Exponencial2Document59 pagesBBVA OpenMind Libro El Proximo Paso Vida Exponencial2giovanniPas encore d'évaluation

- Adidas Anual Report 2011Document242 pagesAdidas Anual Report 2011EricNyoniPas encore d'évaluation