Académique Documents

Professionnel Documents

Culture Documents

Platinum Plans Phils Inc V

Transféré par

Nadine Malaya NadiasanDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Platinum Plans Phils Inc V

Transféré par

Nadine Malaya NadiasanDroits d'auteur :

Formats disponibles

PLATINUM PLANS PHILS INC V.

CUCUECO 488

SCRA 156 (2006)

FACTS: Respondent Cucueco filed a case for

specific performance with damages against

petitioner Platinum Plans pursuant to an alleged

contract of sale executed by them for the purchase

of a condominium unit.

According to the respondent: sometime in July

1993, he offered to buy from petitioner Platinum

Plans Phils a condominium unit he was leasing from

the latter for P 4 million payable in 2 installments of

P2 million with the following terms and conditions:

a. Cucueco will issue a check for P100,00 as

earnest money

b. He will issue a post-dated check for P1.9

million to be encashed on September 30, 1993 on

the condition that he will stop paying rentals for the

said unit after September 30

c. In case Platinum Plans has an outstanding loan

of less than P2 million with the bank as of

December 1993, Cucueco shall assume the same

and pay the difference from the remaining P2

million

Cucueco likewise claimed that Platinum Plans

accepted his offerby encashing the checks he

issued. However, he was surprised to learn that

Platinum Plans had changed the due date of the

installment payment to September 30, 1993.

Respondent argued that there was a perfected sale

between him and Platinum plans and as such, he

may validly demand from the petitioner to execute

the necessary deed of sale transferring ownership

and title over the property in his favor

Platinum Plans denied Cucuecos allegations and

asserted that Cucuecos initial down payment was

forfeited based on the following terms and

conditions:

a. The terms of payment only includes two

installments (August 1993 and September 1993)

b. In case of non-compliance on the part of the

vendee, all installments made shall be forfeited in

favor of the vendor Platinum Plans

c. Ownership over the property shall not pass until

payment of the full purchase price

Petitioners anchor their argument on the claim that

there was no meeting of the minds between the two

parties, as evidenced by their letter of non-

acceptance.

The trial court ruled in favor of Platinum, citing

that since the element of consent was absent there

was no perfected contract. The trial court ordered

Platinum Plans to return the P2 million they had

received from Cucueco, and for Cucueco to pay

Platinum Plans rentals in arrears for the use of the

unit.

Upon appeal, CA held that there was a perfected

contract despite the fact that both parties never

agreed on the date of payment of the remaining

balance. CA ordered Cucueco to pay the remaining

balance of the purchase price and for Platinum

Plans, to execute a deed of sale over the property

ISSUE: WON the contract there is a perfected

contract of sale

HELD: No, it is a contract to sell.

In a contract of sale, the vendor cannot recover

ownership of the thing sold until and unless the

contract itself is resolved and set aside. Art 1592

provides:

In the sale of immovable property, even though it

may have been stipulated that upon failure to pay

the price at the time agreed upon, the rescission of

the contract shall of right take place, the vendee

may pay, even after the expiration of the period, as

long as no demand for rescission of the contract

has been upon him either judicially or by a

notarial act. After the demand, the court may not

grant him a new term.

Based on the above provision, a party who fails to

invoke judicially or by notarial act would be

prevented from blocking the consummation of

the same in light of the precept that mere failure

to fulfill the contract does not by itself have the

effect of rescission.

On the other hand, a contract to sell is bilateral

contract whereby the prospective seller, while

expressly reserving the ownership of the subject

property despite its delivery to the prospective

buyer, commits to sell the property exclusively to

the prospective buyer upon fulfillment of the

condition agreed upon, i.e., full payment of the

purchase price. Full payment here is considered as

a positive suspensive condition.

As a result if the party contracting to sell, because

of non-compliance with the suspensive condition,

seeks to eject the prospective buyer from, the

land, the seller is enforcing the contract and is

not resolving it. The failure to pay is not a

breach of contract but an event which prevent

the obligation to convey title from materializing.

In the present case, neither side was able to produce

any written evidence documenting the actual terms

of their agreement. The trial court was correct in

finding that there was no meeting of minds in this

case considering that the acceptance of the offer

was not absolute and uncondition. In earlier

cases, the SC held that before a valid and binding

contract of sale can exist, the manner of payment of

the purchase price must first be established.

Furthermore, the reservation of the title in the

name of Platinum Plans clearly indicates an

intention of the parties to enter into a contract of

sell. Where the seller promises to execute a deed of

absolute sale upon completion of the payment of

purchase price, the agreement is a contract to sell.

The court cannot, in this case, step in to cure the

deficiency by fixing the period pursuant to:

The relief sought by Cucueco was for specific

performance to compel Platinum Plans to receive

the balance of the purchase price.

The relief provide in Art 1592 only applies to

contracts of sale

Because of the differing dates set by both parties,

the court would have no basis for granting Cucueco

an extension of time within which to pay the

outstanding balance

SELLER CANNOT TREAT THE CONTRACT AS

CANCELLED WITHOUT SERVING NOTICE

The act of a party in treating the contract as

cancelled should be made known to the other party

because this act is subject to scrutiny and review by

the courts in cased the alleged defaulter brings the

matter for judicial determination as explained in UP

v. De los Angeles. In the case at bar, there were

repeated written notices sent by Platinum Plans to

Cucueco that failure to pay the balance would result

in the cancellation of the contract and forfeiture of

the down payment already made. Under these

circumstance, the cancellation made by Platinum

Plans is valid and reasonable (except for the

forfeiture of the down payment because Cucueco

never agreed to the same)

EFFECTS OF CONTRACT TO SELL

A contract to sell would be rendered ineffective and

without force and effect by the non-fulfillment of

the buyers obligation to pay since this is a

suspensive condition to the obligation of the seller

to sell and deliver the title of the property. As an

effect, the parties stand as if the conditional

obligation had never existed. There can be no

rescission of an obligation that is still non-existent

as the suspensive condition has not yet occurred.

CAS RELIANCE ON LEVY HERMANOS V.

GERVACIO IS MISPLACED

It was unnecessary for CA to distinguish whether

the transaction between the parties was an

installment sale or a straight sale. In the first place,

there is no valid and enforceable contract to speak

of.

REYNALDO

VILLANUEVA, G.R. NO.

154493

PHILIPPINE NATIONAL BANK

(PNB),

Respondent. Pr

omulgated:

D

ecember 6, 2006

The Petition for Review

on Certiorari under Rule 45 before this

Court assails the January 29, 2002

Decision

[1]

and June 27, 2002 Resolution

[2]

of

the Court of Appeals (CA) in CA-G.R. CV

No. 52008

[3]

which reversed and set aside the

September 14, 1995 Decision

[4]

of the

Regional Trial Court, Branch 22, General

Santos City (RTC) in Civil Case No. 4553.

As culled from the records, the facts are as

follows:

The Special Assets Management

Department (SAMD) of the Philippine

National Bank (PNB) issued an

advertisement for the sale thru bidding of

certain PNB properties

inCalumpang, General Santos City, including

Lot No. 17, covered by TCT No. T-15042,

consisting of 22,780 square meters, with an

advertised floor price of P1,409,000.00, and

Lot No. 19, covered by TCT No. T-15036,

consisting of 41,190 square meters, with an

advertised floor price

of P2,268,000.00.

[5]

Bidding was subject to

the following conditions: 1) that cash bids be

submitted not later than April 27, 1989; 2)

that said bids be accompanied by a 10%

deposit in managers or cashiers check; and

3) that all acceptable bids be subject to

approval by PNB authorities.

In a June 28, 1990 letter

[6]

to the Manager,

PNB-General Santos Branch, Reynaldo

Villanueva (Villanueva) offered to purchase

Lot Nos. 17 and 19 for P3,677,000.00. He

also manifested that he was

depositing P400,000.00 to show his good

faith but with the understanding that said

amount may be treated as part of the

payment of the purchase price only when his

offer is accepted by PNB. At the bottom of

said letter there appears an unsigned

marginal note stating that P400,000.00 was

deposited into Villanuevas account (Savings

Account No. 43612) with PNB-General

Santos Branch.

[7]

PNB-General Santos Branch

forwarded the June 28, 1990 letter of

Villanueva to Ramon Guevara (Guevara),

Vice President, SAMD.

[8]

On July 6, 1990,

Guevara informed Villanueva that only Lot

No. 19 is available and that the asking

price therefor is P2,883,300.00.

[9]

Guevara

further wrote:

If our quoted price is acceptable to you, please

submit a revised offer to purchase. Sale shall

be subject to our Board of Directors approval

and to other terms and conditions imposed by

the Bank on sale of acquired

assets.

[10]

(Emphasis ours)

Instead of submitting a revised offer,

Villanueva merely inserted at the bottom of

Guevaras letter a July 11, 1990 marginal

note, which reads:

C O N F O R M E:PRICE OF P2,883,300.00

(downpayment of P600,000.00 and the balance payable in

two (2) years at quarterly amortizations.)

[11]

Villanueva paid P200,000.00 to PNB

which issued O.R. No. 16997 to

acknowledge receipt of the partial payment

deposit on offer to purchase.

[12]

On the

dorsal portion of Official Receipt No. 16997,

Villanueva signed a typewritten note, stating:

This is a deposit made to show the

sincerity of my purchase offer with the

understanding that it shall be returned without

interest if my offer is not favorably considered

or be forfeited if my offer is approved but I

fail/refuse to push through the purchase.

[13]

Also, on July 24, 1990, P380,000.00 was

debited from Villanuevas Savings Account

No. 43612 and credited to SAMD.

[14]

On October 11, 1990, however, Guevara

wrote Villanueva that, upon orders of the

PNB Board of Directors to conduct another

appraisal and public bidding of Lot No.

19, SAMD is deferring negotiations with him

over said property and returning his deposit

of P580,000.00.

[15]

Undaunted, Villanueva

attempted to deliver postdated checks

covering the balance of the purchase price

but PNB refused the same.

Hence, Villanueva filed with the RTC a

Complaint

[16]

for specific performance and

damages against PNB. In its September 14,

1995 Decision, the RTC granted the

Complaint, t

WHEREFORE, judgment is rendered

in favor of the plaintiff and against the

defendant directing it to do the following:

1. To execute a deed of sale in

favor of the plaintiff over Lot 19 comprising

41,190 square meters situated

at Calumpang, General Santos City covered by

TCT No. T-15036 after payment of the

balance in cash in the amount

of P2,303,300.00;

2. To pay the plaintiff P1,000,000.00 as

moral damages; P500,000.00 as attorneys fees,

plus litigation expenses and costs of the suit.

SO ORDERED.

[17]

The RTC anchored its judgment on

the finding that there existed a perfected

contract of sale between PNB and

Villanueva. It found:

The following facts are either admitted

or undisputed:

x x x

The defendant through Vice-President

Guevara negotiated with the plaintiff in

connection with the offer of the plaintiff to buy

Lots 17 & 19. The offer of plaintiff to buy,

however, was accepted by the defendant only

insofar as Lot 19 is concerned as exemplified

by its letter dated July 6, 1990 where the

plaintiff signified his concurrence after

conferring with the defendants vice-president.

The conformity of the plaintiff was typewritten

by the defendants own people where the

plaintiff accepted the price of P2,883,300.00.

The defendant also issued a receipt to the

plaintiff on the same day when the plaintiff

paid the amount of P200,000.00 to complete

the downpayment of P600,000.00 (Exhibit F &

Exhibit I). With this development, the

plaintiff was also given the go signal by the

defendant to improve Lot 19 because it was

already in effect sold to him and because of

that the defendant fenced the lot and

completed his two houses on the property.

[18]

The RTC also pointed out that

Villanuevas P580,000.00 downpayment was

actually in the nature of earnest money

acceptance of which by PNB signified that

there was already a sale.

[19]

The RTC further

cited contemporaneous acts of PNB

purportedly indicating that, as early as July

25, 1990, it considered Lot 19 already sold,

as shown by Guevaras July 25, 1990 letter

(Exh. H)

[20]

to another interested buyer.

PNB appealed to the CA which

reversed and set aside the September 14,

1995 RTC Decision, thus:

WHEREFORE, the appealed decision

is REVERSED and SET ASIDE and another

rendered DISMISSING the complaint.

SO ORDERED.

[21]

According to the CA, there was no perfected

contract of sale because the July 6, 1990 letter

of Guevara constituted a qualified acceptance

of the June 28, 1990 offer of Villanueva, and

to which Villanueva replied on July 11,

1990 with a modified offer. The CA held:

In the case at bench, consent, in respect to the

price and manner of its payment, is lacking. The record

shows that appellant, thru Guevaras July 6, 1990 letter,

made a qualified acceptance ofappellees letter-offer

dated June 28, 1990 by imposing an asking price

of P2,883,300.00 in cash for Lot 19. The letter dated July

6, 1990 constituted a counter-offer (Art. 1319, Civil

Code), to whichappellee made a new proposal, i.e., to pay

the amount of P2,883,300.00 in staggered amounts, that

is, P600,000.00 as downpayment and the balance within

two years in quarterly amortizations.

A qualified acceptance, or one that involves a new

proposal, constitutes a counter-offer and a rejection of the

original offer (Art. 1319, id.). Consequently, when

something is desired which is not exactly what is proposed

in the offer, such acceptance is not sufficient to generate

consent because any modification or variation from the

terms of the offer annuls the offer (Tolentino,

Commentaries and Jurisprudence on the Civil Code of

the Philippines, 6

th

ed., 1996, p. 450, cited in ABS-CBN

Broadcasting Corporation v. Court of Appeals, et al., 301

SCRA 572).

Appellees new proposal, which constitutes a

counter-offer, was not accepted by appellant, its board

having decided to have Lot 19 reappraised and sold thru

public bidding.

Moreover, it was clearly stated in Guevaras July 6,

1990 letter that the sale shall be subject to our Board of

Directors approval and to other terms and conditions

imposed by the Bank on sale of acquired assets.

[22]

Villanuevas Motion for

Reconsideration

[23]

was denied by the CA in

its Resolution of June 27, 2002.

Petitioner Villanueva now assails

before this Court the January 29, 2002

Decision and June 27, 2002 Resolution of the

CA. He assigns five issues which may be

condensed into two: first, whether a perfected

contract of sale exists between petitioner and

respondent PNB; and second, whether the

conduct and actuation of respondent

constitutes bad faith as to entitle petitioner to

moral and exemplary damages and attorneys

fees.

The Court sustains the CA on both

issues.

Contracts of sale are perfected by

mutual consent whereby the seller obligates

himself, for a price certain, to deliver and

transfer ownership of a specified thing or

right to the buyer over which the latter

agrees.

[24]

Mutual consent being a state of

mind, its existence may only be inferred

from the confluence of two acts of the

parties: an offer certain as to the object of the

contract and its consideration, and an

acceptance of the offer which is absolute in

that it refers to the exact object and

consideration embodied in said offer.

[25]

While

it is impossible to expect the acceptance

to echo every nuance of the offer, it is

imperative that it assents to those points in

the offer which, under the operative facts of

each contract, are not only material but

motivating as well. Anything short of that

level of mutuality produces not a contract but

a mere counter-offer awaiting

acceptance.

[26]

More particularly on the

matter of the consideration of the contract,

the offer and its acceptance must be

unanimous both on the rate of the

payment and on its term. An acceptance of

an offer which agrees to the rate but varies

the term is ineffective.

[27]

To determine whether there was

mutual consent between the parties herein, it

is necessary to retrace each offer and

acceptance they made.

Respondent began with an invitation to bid

issued in April 1989 covering several of its

acquired assets in Calumpang, General

Santos City, including Lot No. 19 for which

the floor price was P2,268,000.00. The offer

was subject to the condition that sealed bids,

accompanied by a 10% deposit in managers

or cashiers check, be submitted not later

than 10 oclock in the morning of April 27,

1989.

On June 28, 1990, petitioner made an offer

to buy Lot No. 17 and Lot No. 19 for an

aggregate price of P3,677,000.00. It is noted

that this offer exactly corresponded to the

April 1989 invitation to bid issued by

respondent in that the proposed aggregate

purchase price for Lot Nos. 17 and 19

matched the advertised floor prices for the

same properties. However, it cannot be said

that the June 28, 1990 letter of petitioner was

an effective acceptance of the April 1989

invitation to bid for, by its express terms, said

invitation lapsed on April 27, 1989.

[28]

More

than that, the April 1989 invitation was

subject to the condition that all sealed bids

submitted and accepted be approved by

respondents higher authorities.

Thus, the June 28, 1990 letter of petitioner

was an offer to buy independent of the April

1989 invitation to bid. It was a definite

offer as it identified with certainty the

properties sought to be purchased and fixed

the contract price.

However, respondent replied to the June 28,

1990 offer with a July 6, 1990 letter that only

Lot No. 19 is available and that the price

therefor is now P2,883,300.00. As the CA

pointed out, this reply was certainly not an

acceptance of the June 28, 1990 offer but a

mere counter-offer. It deviated from the

original offer on three material points: first,

the object of the proposed sale is now only

Lot No. 19 rather than Lot Nos. 17 and 19;

second, the area of the property to be sold is

still 41,190 sq. m but an 8,797-sq. m portion

is now part of a public road; and third, the

consideration is P2,883,300 for one lot rather

than P3,677,000.00 for two lots. More

important, this July 6, 1990 counter-offer

imposed two conditions: one, that petitioner

submit a revised offer to purchase based on

the quoted price; and two, that the sale of

the property be approved by the Board of

Directors and subjected to other terms and

conditions imposed by the Bank on the sale

of acquired assets.

In reply to the July 6, 1990 counter-

offer, petitioner signed his July 11,

1990 conformity to the quoted price

of P2,883,300.00 but inserted the term

downpayment ofP600,000.00 and the

balance payable in two years at quarterly

amortization. The CA viewed this July 11,

1990 conformity not as an acceptance of the

July 6, 1990 counter-offer but a further

counter-offer for, while petitioner accepted

the P2,883,300.00 price for Lot No. 19, he

qualified his acceptance by proposing a two-

year payment term.

Petitioner does not directly impugn such

reasoning of the CA. He merely questions it

for taking up the issue of whether his July 11,

1990 conformity modified the July 6,

1990 counter-offer as this was allegedly never

raised during the trial nor on appeal.

[29]

Such argument is not well taken. From

beginning to end, respondent denied that a

contract of sale with petitioner was ever

perfected.

[30]

Its defense was broad enough to

encompass every issue relating to the

concurrence of the elements of contract,

specifically on whether it consented to the

object of the sale and its

consideration. There was nothing to prevent

the CA from inquiring into the offers and

counter-offers of the parties to determine

whether there was indeed a perfected

contract between them.

Moreover, there is merit in the ruling of the

CA that the July 11, 1990 marginal note was a

further counter-offer which did not lead to

the perfection of a contract of sale between

the parties. Petitioners own June 28,

1990 offer quoted the price of P3,677,000.00

for two lots but was silent on the term of

payment. Respondents July 6, 1990counter-

offer quoted the price of P2,833,300.00 and

was also silent on the term of payment. Up to

that point, the term or schedule of payment

was not on the negotiation table. Thus, when

petitioner suddenly introduced a term of

payment in his July 11, 1990 counter-

offer, he interjected into the negotiations

a new substantial matter on which the

parties had no prior discussion and over

which they must yet agree.

[31]

Petitioners July

11, 1990 counter-offer, therefore, did not

usher the parties beyond the negotiation stage

of contract making towards its perfection. He

made a counter-offer that required

acceptance by respondent.

As it were, respondent, through its Board of

Directors, did not accept this last counter-

offer. As stated in its October 11, 1990 letter

to petitioner, respondent ordered the

reappraisal of the property, in clear

repudiation not only of the proposed price

but also the term of payment thereof.

Petitioner insists, however, that the October

11, 1990 repudiation was belated as

respondent had already agreed to his July 11,

1990 counter-offer when it accepted his

downpayment or earnest

money of P580,000.00.

[32]

He cites Article

1482 of the Civil Code where it says that

acceptance of downpayment or earnest

money presupposes the perfection of a

contract.

Not so. Acceptance of petitioners payments

did not amount to an implied acceptance of

his last counter-offer.

To begin with, PNB-General Santos Branch,

which accepted petitioners P380,000.00

payment, and PNB-SAMD, which accepted

his P200,000.00 payment, had no authority to

bind respondent to a contract of sale with

petitioner.

[33]

Petitioner is well aware of this.

To recall, petitioner sent his June 28,

1990 offer to PNB-General Santos

Branch. Said branch did not act on his offer

except to endorse it to Guevarra. Thereafter,

petitioner transacted directly with Guevarra.

Petitioner then cannot pretend that PNB-

General Santos Branch had authority to

accept his July 11, 1990 counter-offer by

merely accepting his P380,000.00 payment.

Neither did SAMD have authority to bind

PNB. In its April 1989 invitation to bid, as

well as its July 6, 1990 counter-offer, SAMD

was always careful to emphasize that whatever

offer is made and entertained will be subject

to the approval of respondents higher

authorities.

This is a reasonable disclaimer

considering the corporate nature of

respondent.

[34]

Moreover, petitioners payment

of P200,000.00 was with the clear

understanding that his July 11, 1990 counter-

offer was still subject to approval by

respondent. This is borne out by

respondents Exhibits 2-a and 2-b, which

petitioner never controverted, where it

appears on the dorsal portion of O.R.

No. 16997 that petitioner acceded that the

amount he paid was a mere x x x deposit

made to show the sincerity of [his] purchase

offer with the understanding that it shall be

returned without interest if [his] offer is not

favorably considered x x x.

[35]

This was a clear

acknowledgment on his part that there was

yet no perfected contract with respondent

and that even with the payments he had

advanced, his July 11, 1990 counter-offer was

still subject to consideration by respondent.

Not only that, in the same Exh. 2-a as

well as in his June 28, 1990 offer, petitioner

referred to his payments as mere

deposits. Even O.R. No. 16997 refers to

petitioners payment as mere deposit. It is

only in the debit notice issued by PNB-

General Santos Branch where petitioners

payment is referred to as downpayment.

But then, as we said, PNB-General Santos

Branch has no authority to bind respondent

by its interpretation of the nature of the

payment made by petitioner.

In sum, the amounts paid by petitioner

were not in the nature of downpayment or

earnest money but were mere deposits or

proof of his interest in the purchase of Lot

No. 19. Acceptance of said amounts by

respondent does not presuppose perfection

of any contract.

[36]

It must be noted that petitioner has

expressly admitted that he had withdrawn the

entire amount of P580,000.00 deposit from

PNB-General Santos Branch.

[37]

With the foregoing disquisition, the

Court foregoes resolution of the second issue

as it is evident that respondent acted well

within its rights when it rejected the last

counter-offer of petitioner.

In fine, petitioners petition lacks merit.

WHEREFORE, the petition

is DENIED. The Decision dated January 29,

2002 and Resolution dated June 27, 2002 of

the Court of Appeals are AFFIRMED.

Vous aimerez peut-être aussi

- 1.9 Platinum Plans Phils Inc VDocument3 pages1.9 Platinum Plans Phils Inc VnathPas encore d'évaluation

- Platinum Plans Phils. Inc Vs Cucueco 488 Scra 156Document4 pagesPlatinum Plans Phils. Inc Vs Cucueco 488 Scra 156Anonymous b7mapUPas encore d'évaluation

- Sales Afos Part 1Document20 pagesSales Afos Part 1Jan Aldrin AfosPas encore d'évaluation

- Platinum v. Cucueco - Contract To SellDocument16 pagesPlatinum v. Cucueco - Contract To SellMarlon TabilismaPas encore d'évaluation

- 30 G.R. No. 147405 April 25, 2006 Platinum Plans Phil. Inc Vs CucuecoDocument6 pages30 G.R. No. 147405 April 25, 2006 Platinum Plans Phil. Inc Vs CucuecorodolfoverdidajrPas encore d'évaluation

- Agustin Vs CADocument3 pagesAgustin Vs CAbebebaaPas encore d'évaluation

- 43 Power Commercial and Industrial Corp. v. CA (Gutierrez)Document4 pages43 Power Commercial and Industrial Corp. v. CA (Gutierrez)Luis MacababbadPas encore d'évaluation

- Olympia Housing Vs Pan-AsiaticDocument2 pagesOlympia Housing Vs Pan-AsiaticLindsay MillsPas encore d'évaluation

- Sales Case Digest by Sulaw Batch 2016 PDFDocument32 pagesSales Case Digest by Sulaw Batch 2016 PDFAlyssa GuevarraPas encore d'évaluation

- SerraDocument9 pagesSerraανατολή και πετύχετεPas encore d'évaluation

- Ayala Life Corporation V Burton Development CorporationDocument7 pagesAyala Life Corporation V Burton Development Corporationjagabriel616Pas encore d'évaluation

- Sales Case Digest by SULAW Batch 2016Document32 pagesSales Case Digest by SULAW Batch 2016Mousy GamalloPas encore d'évaluation

- Group 5 Case DigestsDocument22 pagesGroup 5 Case Digestsnaomi_mateo_4Pas encore d'évaluation

- Ayala Life Assurance vs. Ray Burton Devt, 2006 - Contract To Sell vs. Contract of SaleDocument8 pagesAyala Life Assurance vs. Ray Burton Devt, 2006 - Contract To Sell vs. Contract of SalehenzencameroPas encore d'évaluation

- Spouses Serrano vs. Caguiat G.R. No. 139173Document10 pagesSpouses Serrano vs. Caguiat G.R. No. 139173ペラルタ ヴィンセントスティーブPas encore d'évaluation

- Petitioners Vs Vs Respondents Salonga, Hernandez & Mendoza Ermitaño, Sangco, Manzano & AssociatesDocument8 pagesPetitioners Vs Vs Respondents Salonga, Hernandez & Mendoza Ermitaño, Sangco, Manzano & AssociatesKimberly GangoPas encore d'évaluation

- 2006 - Villanueva v. PNBDocument7 pages2006 - Villanueva v. PNBiaton77Pas encore d'évaluation

- LEANO Vs CADocument3 pagesLEANO Vs CAshambiruarPas encore d'évaluation

- 73 - Iringan V Court of AppealsDocument4 pages73 - Iringan V Court of AppealsRomy Ian LimPas encore d'évaluation

- Refund Under Maceda Law-1Document2 pagesRefund Under Maceda Law-1lamadridrafael100% (2)

- Refund Under The Maceda Law (R.a. 6552)Document2 pagesRefund Under The Maceda Law (R.a. 6552)daybarba100% (2)

- Sale Cases (Object)Document71 pagesSale Cases (Object)Wilfredo Guerrero IIIPas encore d'évaluation

- 28 Vda. de Mistica V NaguiatDocument9 pages28 Vda. de Mistica V NaguiatAisa CastilloPas encore d'évaluation

- Vda. de Mistica v. Naguiat, 418 SCRA 73 (Sales)Document10 pagesVda. de Mistica v. Naguiat, 418 SCRA 73 (Sales)rezeile morandartePas encore d'évaluation

- Legal Research On Contracts To Sell June 4 - 2020Document3 pagesLegal Research On Contracts To Sell June 4 - 2020MAVPas encore d'évaluation

- Second Division: Central Bank of The Philippines, Petitioner, vs. Spouses ALFONSO and ANACLETA BICHARA, RespondentsDocument13 pagesSecond Division: Central Bank of The Philippines, Petitioner, vs. Spouses ALFONSO and ANACLETA BICHARA, RespondentsMichael Angelo VictorianoPas encore d'évaluation

- 16 Cavite Development Bank Vs LimDocument9 pages16 Cavite Development Bank Vs LimEMPas encore d'évaluation

- Sales Assignment 5Document13 pagesSales Assignment 5Bruce Wait For It MendozaPas encore d'évaluation

- Shemberg Vs CitibankDocument4 pagesShemberg Vs CitibankIheart DxcPas encore d'évaluation

- Cruz Vs FernandoDocument3 pagesCruz Vs FernandoJoel G. AyonPas encore d'évaluation

- Laforteza v. Machuca G.R. No. 137552 June 16, 2000 FactsDocument3 pagesLaforteza v. Machuca G.R. No. 137552 June 16, 2000 FactsJanWacnang100% (1)

- Cruz V Fernando DIGESTDocument4 pagesCruz V Fernando DIGESTStephanie Reyes GoPas encore d'évaluation

- Sales Nov 2ND WeekDocument16 pagesSales Nov 2ND WeekLeyy De GuzmanPas encore d'évaluation

- 89 - Yuvienco v. Dacuycuy - SALESDocument3 pages89 - Yuvienco v. Dacuycuy - SALESCarlyle Esquivias ChuaPas encore d'évaluation

- Petitioner Vs Vs Respondents: Second DivisionDocument10 pagesPetitioner Vs Vs Respondents: Second DivisionKit ChampPas encore d'évaluation

- Ayala Life Insurance v. Ray Burton Dev't, 23 January 2006Document7 pagesAyala Life Insurance v. Ray Burton Dev't, 23 January 2006Rodel Cadorniga Jr.Pas encore d'évaluation

- HLURB Case (Carl Bation)Document7 pagesHLURB Case (Carl Bation)Marcus-Ruchelle MacadangdangPas encore d'évaluation

- Laforteza V MachucaDocument2 pagesLaforteza V MachucaABPas encore d'évaluation

- Leano Vs CA, 369 SCRA 36 (2001)Document1 pageLeano Vs CA, 369 SCRA 36 (2001)Rebuild BoholPas encore d'évaluation

- Tan vs. BenoliraoDocument8 pagesTan vs. BenoliraoAngel UrbanoPas encore d'évaluation

- Sales Cases Atty. SualogDocument329 pagesSales Cases Atty. SualogMariline Lee100% (1)

- Power Commercial Industrial V CaDocument2 pagesPower Commercial Industrial V CaAnnHopeLove100% (2)

- Platinum Plans vs. CucuecoDocument8 pagesPlatinum Plans vs. CucuecoSherwin Anoba CabutijaPas encore d'évaluation

- 118059-2000-Heirs of San Andres v. RodriguezDocument11 pages118059-2000-Heirs of San Andres v. RodriguezJuanaPas encore d'évaluation

- San Miguel Properties vs. Sps. HuangDocument2 pagesSan Miguel Properties vs. Sps. HuangRoberts Sam100% (1)

- Iringan Vs CADocument6 pagesIringan Vs CAMabelle ArellanoPas encore d'évaluation

- Cavite Development Bank v. Spouses Lim Et. Al.Document8 pagesCavite Development Bank v. Spouses Lim Et. Al.jagabriel616Pas encore d'évaluation

- Vda de Mistica vs. Sps NaguiatDocument7 pagesVda de Mistica vs. Sps NaguiatDeric MacalinaoPas encore d'évaluation

- Case Digests For Pacto de Retro Sale / Equitable Mortgage By: Vaneza D. LopezDocument21 pagesCase Digests For Pacto de Retro Sale / Equitable Mortgage By: Vaneza D. LopezVaneza LopezPas encore d'évaluation

- Tan vs. Benolirao G.R. No. 153820 October 16, 2009 FactsDocument4 pagesTan vs. Benolirao G.R. No. 153820 October 16, 2009 FactsRalph232323Pas encore d'évaluation

- Law On Sales Digested CasesDocument130 pagesLaw On Sales Digested Casesmanol_salaPas encore d'évaluation

- Article 1182 Catungal Vs RodriguezDocument5 pagesArticle 1182 Catungal Vs RodriguezPrincess Rosshien HortalPas encore d'évaluation

- Civ Rev CasesDocument76 pagesCiv Rev CaseseenahPas encore d'évaluation

- Sales GR Last 2 MeetingsDocument62 pagesSales GR Last 2 MeetingsJhudith De Julio BuhayPas encore d'évaluation

- Sales Digested Case of LeanoDocument4 pagesSales Digested Case of Leanokelela_12018554Pas encore d'évaluation

- Alta Vitas Research 2Document5 pagesAlta Vitas Research 2Queng ArroyoPas encore d'évaluation

- SPS Beltran vs. SPS CangaydaDocument3 pagesSPS Beltran vs. SPS CangaydaDkNarciso100% (2)

- Iringan Vs CA, Palao (2001)Document11 pagesIringan Vs CA, Palao (2001)Joshua DulcePas encore d'évaluation

- Cape Law: Texts and Cases - Contract Law, Tort Law, and Real PropertyD'EverandCape Law: Texts and Cases - Contract Law, Tort Law, and Real PropertyPas encore d'évaluation

- Amor Vs GonzalesDocument2 pagesAmor Vs GonzalesNadine Malaya NadiasanPas encore d'évaluation

- BBBBDocument14 pagesBBBBNadine Malaya NadiasanPas encore d'évaluation

- Motion To Quash Unjust VexationDocument10 pagesMotion To Quash Unjust VexationDana HernandezPas encore d'évaluation

- MurderDocument1 pageMurderNadine Malaya NadiasanPas encore d'évaluation

- Teodoro Almirol V. Register of Deeds of Agusan FactsDocument42 pagesTeodoro Almirol V. Register of Deeds of Agusan FactsNadine Malaya NadiasanPas encore d'évaluation

- Page 11 of 25 E. B. Effects of Registration VIllaluz Vs Neme and Alarcon Vs BidinDocument4 pagesPage 11 of 25 E. B. Effects of Registration VIllaluz Vs Neme and Alarcon Vs BidinNadine Malaya NadiasanPas encore d'évaluation

- C. A. IV. Vda. de Barroga Vs Albano Page 2 of 25Document3 pagesC. A. IV. Vda. de Barroga Vs Albano Page 2 of 25Nadine Malaya NadiasanPas encore d'évaluation

- B. A. II. Talavera Vs Mangoba Page 7 of 25Document2 pagesB. A. II. Talavera Vs Mangoba Page 7 of 25Nadine Malaya NadiasanPas encore d'évaluation

- Apprenticeship Agreement, Validity: G.R. No. 187320, January 26, 2011 Brion, J.Document2 pagesApprenticeship Agreement, Validity: G.R. No. 187320, January 26, 2011 Brion, J.Nadine Malaya NadiasanPas encore d'évaluation

- B. A. III. Antonio Vs Ramos Page 7 of 25Document2 pagesB. A. III. Antonio Vs Ramos Page 7 of 25Nadine Malaya NadiasanPas encore d'évaluation

- Go ToDocument3 pagesGo ToNadine Malaya NadiasanPas encore d'évaluation

- Six Sigma PDFDocument62 pagesSix Sigma PDFssno1Pas encore d'évaluation

- Harry Potter and The Prisoner of Azkaban: Chapter 3-1 Owl PostDocument20 pagesHarry Potter and The Prisoner of Azkaban: Chapter 3-1 Owl PostodfasdPas encore d'évaluation

- Model Control System in Triforma: Mcs GuideDocument183 pagesModel Control System in Triforma: Mcs GuideFabio SchiaffinoPas encore d'évaluation

- Technical Analysis CourseDocument51 pagesTechnical Analysis CourseAkshay Chordiya100% (1)

- Aluminium, Metal and The SeaDocument186 pagesAluminium, Metal and The SeaMehdi GhasemiPas encore d'évaluation

- Nutrition Science by B Srilakshmi PDFDocument6 pagesNutrition Science by B Srilakshmi PDFRohan Rewatkar46% (35)

- Rubrics On Video Analysis - 2022Document2 pagesRubrics On Video Analysis - 2022jovenil BacatanPas encore d'évaluation

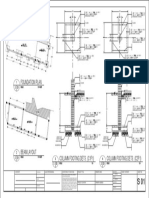

- Foundation Plan: Scale 1:100 MTSDocument1 pageFoundation Plan: Scale 1:100 MTSJayson Ayon MendozaPas encore d'évaluation

- SerpılDocument82 pagesSerpılNurhayat KaripPas encore d'évaluation

- Top German AcesDocument24 pagesTop German AcesKlaus Richter100% (1)

- Forum Discussion #7 UtilitarianismDocument3 pagesForum Discussion #7 UtilitarianismLisel SalibioPas encore d'évaluation

- Brock CoursesDocument4 pagesBrock Coursesapi-339025646Pas encore d'évaluation

- The Anti Cancer Essential Oil ReferenceDocument9 pagesThe Anti Cancer Essential Oil ReferenceΡαφαέλα ΠηλείδηPas encore d'évaluation

- Dwnload Full Practicing Statistics Guided Investigations For The Second Course 1st Edition Kuiper Solutions Manual PDFDocument36 pagesDwnload Full Practicing Statistics Guided Investigations For The Second Course 1st Edition Kuiper Solutions Manual PDFdavidkrhmdavis100% (11)

- Holidays Homework 12Document26 pagesHolidays Homework 12richa agarwalPas encore d'évaluation

- Unit 4 Classical and Keynesian Systems: 4.0 ObjectivesDocument28 pagesUnit 4 Classical and Keynesian Systems: 4.0 ObjectivesHemant KumarPas encore d'évaluation

- Sergei Soloviov - Jose Raul Capablanca Games 1901-1924 (Chess Stars 2004) - EditableDocument368 pagesSergei Soloviov - Jose Raul Capablanca Games 1901-1924 (Chess Stars 2004) - EditableHernanArrondoPas encore d'évaluation

- Sol2e Printables Unit 5ADocument2 pagesSol2e Printables Unit 5AGeorgio SentialiPas encore d'évaluation

- Rule 110 CasesDocument102 pagesRule 110 Casesアブドゥルカリム エミールPas encore d'évaluation

- ReferencesDocument12 pagesReferencesBilal RazzaqPas encore d'évaluation

- Partnership Liquidation May 13 C PDFDocument3 pagesPartnership Liquidation May 13 C PDFElla AlmazanPas encore d'évaluation

- Warcraft III ManualDocument47 pagesWarcraft III Manualtrevorbourget78486100% (6)

- Hibike Euphonium - Crescent Moon DanceDocument22 pagesHibike Euphonium - Crescent Moon Dancelezhi zhangPas encore d'évaluation

- New Action Plan Launched To Enhance Somali Women's Role in Somalia's Maritime SectorDocument5 pagesNew Action Plan Launched To Enhance Somali Women's Role in Somalia's Maritime SectorUNSOM (The United Nations Assistance Mission in Somalia)Pas encore d'évaluation

- Nava V Artuz AC No. 7253Document7 pagesNava V Artuz AC No. 7253MACASERO JACQUILOUPas encore d'évaluation

- Micro Analysis Report - Int1Document3 pagesMicro Analysis Report - Int1kousikkumaarPas encore d'évaluation

- Kenneth Dean Austin v. Howard Ray, Warden, Jackie Brannon Correctional Center and Attorney General of The State of Oklahoma, 124 F.3d 216, 10th Cir. (1997)Document8 pagesKenneth Dean Austin v. Howard Ray, Warden, Jackie Brannon Correctional Center and Attorney General of The State of Oklahoma, 124 F.3d 216, 10th Cir. (1997)Scribd Government DocsPas encore d'évaluation

- Individual Assignment 1 (TPT630)Document7 pagesIndividual Assignment 1 (TPT630)MUHAMMAD HABIB HARRAZ ABDUL RAHMANPas encore d'évaluation

- Amazon PrimeDocument27 pagesAmazon PrimeMohamedPas encore d'évaluation

- GRP 15 Property Law Final DDocument15 pagesGRP 15 Property Law Final DBruno OsananPas encore d'évaluation