Académique Documents

Professionnel Documents

Culture Documents

Senate Banking Submission 2011

Transféré par

Andrew Francis OliverCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Senate Banking Submission 2011

Transféré par

Andrew Francis OliverDroits d'auteur :

Formats disponibles

Sunday 31

st

October 2010

Attention: Senate Economics References Committee

Re: Enquiry Into:- Competition Within The Australian Banking Sector

Dear Mesdames et Messieurs,

I write in support of prudential banking regulation.

I object to unfettered laissez faire most particularly in the area of banking regulation.

Minimal but effective regulation of banks large and small is essential if the second great depression is to be avoided.

Also, bank competition if organised in a regulated way may lead to more valued and appreciated service to customers.

This does not mean self regulation, often merely code for unfettered laissez faire.

Though bank competition may help avoid the prevalence of no value zero service retail banking, leadership by

bankers themselves and sound economic leadership by ministers and regulators is essential. Some matters require

leaders willing to educate and inspire others.

My submission is attached.

I ask that this contribution to this issue be considered by the members of parliament on the Committee.

Yours Sincerely,

Andrew Oliver

0.0 Index

0.0.1 Letter

0.1 Outcomes

0.2 Prudential Banking Regulation

0.3 How To Organise Regulation

0.4 Some Asides On Economic Theory

0.5 Value and Appreciated Customer Service

0.6 Bank Profits

0.7 The Education of Bank Management

0.8 Conclusion

1.0 Outcomes

Competition is a means, not an outcome as this enquirys terms of reference would suggest.

My opinion is that the pursuit of happiness, valued and appreciated service to customers, and consumer

sovereignty are outcomes relevant to banking regulation.

It is important not to put the cart before the horse and posit means as outcomes.

2.0 Prudential Banking Regulation

I remember my Nana telling me her father was almost ruined by bank failures in Australia in the 1890s.

Without prudential banking regulation, the wrong sort of behaviour by bankers can lead to bank failures, the

poor and ordinary people losing their deposits and investments, and even worse, deflation and depressions.

Economics textbooks might imagine the banker as soberly suited, a facilitator who marshals community

savings and organises investment of the same in capital goods for manufacturers, miners, and farmers, and

whose efforts make the wheels of industry go round.

Unfortunately in the roaring 1920s too many bankers behaved like dishevelled riverboat gamblers, stacking

up the chips in casino capitalisms banks and stock exchanges.

Maybe it could also be said that between 1988 and 2008 during the long bull market, too many bankers did

not invest the communitys savings wisely and prudently.

A partial solution to this social problem - of bankers not investing depositors and investors funds prudently -

is prudential banking regulation by government enactments of legislation.

3.0 How To Organise Regulation

Minimal but effective regulation that is well targeted on the likely problem areas with as few questions on as

few forms as prove absolutely necessary, as few regulators as prove absolutely necessary, and as little red

tape for bankers as proves absolutely necessary require proper thought and consideration by legislators.

Technological change does impact on banking regulation. Years ago it might be adequate to protect small

depositors by requiring, say, some percentage of a banks overall deposits to be held in gold in a central bank

so that there is something left if the bank fails. However, with some banks investing in derivatives and

especially computer program trading of derivatives - investments little more than gambling anyway - the

exposure to losses is so much greater that restrictions on where retail high street banks can invest depositors

funds are required.

Nevertheless it is important not to over-regulate lest later governments who have forgotten the lessons of

history try to reintroduce unfettered laissez faire. Not only this, but excessive and badly targeted regulation

make banking inefficient and make the Australian economy less internationally competitive.

Selecting the right people to be the regulators is necessary too. If the banking regulators believe in bank

nationalisation, and have an agenda of regulation by stealth in order to consolidate all banks into one big

peoples bank, they will prove hopeless at minimal but effective regulation.

4.0 Some Asides on Economic Theory

Economics is in part mathematics and statistics, in part commerce and commercial law, in part mass

psychology.

To the extent that economics is mathematical in nature, some analysis of mathematical models and equations

can help explain some things in terms of mathematical models of economic forces and conservation laws.

To the extent that economics is mass psychology, little can be done but to explain that human behaviour in

some situations is often irrational, and that when a bank is known to be about to collapse people behave like

lemmings running off a cliff and by all lining up to withdraw all their funds, make the bank failure happen.

From the standpoint of mathematical economics, the different ways that the conservation of money principle

applies - even if only a first approximation - along different dimensions of the maps of economic equations

can be used to see that the income and expenditure equation, perhaps a simple picture with savings, imports,

exports, taxation, government spending, and investment values included, represents one dimension of the

conservation of money, which imposes economic forces and multiplier effects. Another dimension of the

conservation of money is the volume of money according to some definition, perhaps a simple picture with

only cash and bank deposits and bank loans, which is conserved overnight by regulation and banking practice

and it can be seen that this also imposes economic forces and multiplier effects.

The growth of credit can cause the volume of money to change slightly day to day as the different

components flow into one another. This also is regulated by regulation and banking practice and imposes

economic forces and multiplier effects.

To avoid sub-optimal equilibria in general for these non linear complex systems some regulation will prove

necessary.

Badly designed regulation may prove worse than none at all. And regulation hijacked by economic interest

groups uninterested in good governance of the economy is typical around the world.

It also has to be said that the commercial law favours limited joint stock companies, and disadvantages

worker co-operatives. Proposals for reforming the commercial law were first put forward in the 1800s, but the

right-wingers in that century won then and imposed the limited joint stock company on the world. Now with

derivatives and other strange computerised commercial investment instruments, maybe we need to consider

reforming the basic commercial law to avoid the problems these create ...

5.0 Value and Appreciated Customer Service

Some economists have hypothesised that if there are three or four retail high street banks there will be more

valued and appreciated customer service because a customer can shop around the three closest branches of

the three or four competing banks.

I remember in the 1980s the State Bank of Victoria offered some service to ordinary small customers. One

might get a telephone call from a teller telling one that to avoid some cheques bouncing would one deposit

some amount by 2:45 p.m. that day. Nowadays the typical service most poor and ordinary people receive as

bank customers is more like the computerised no value zero service banking that is spreading everywhere as

bankers optimise their cost structures to maximise shareholder profits.

Bank nationalisation - i.e. creating one large peoples bank - would only make this situation worse.

6.0 Bank Profits

If banks are squeezed too much by regulation, by preventing them charging small fees for service, by setting

interest rates by government decree, then they may become unprofitable and try to gamble internationally

what funds they still have hoping to stave it off. This path leads to depressions ...

Nevertheless banks protected by government insurance of small deposits have some responsibility to return

to the community a level of service and a responsible level of profit-taking. The minimal but effective

regulation of banks should target only known problem spots. Such regulation needs careful consideration

after much public debate and submissions.

7.0 The Education of Bank Management

Bank management, and most particularly local bank managers, have responsibilities to the community. Bank

management are responsible for the poor service most poor and ordinary people receive nowadays. It is

partly a reflection of the value free ethos in the education system that leads to this lack of leadership. And the

solution to this problem lies in the education system too.

8.0 Conclusion

As a jaded former ALP member who resigned from the party in 2005, I am disappointed in both sides of

politics. Demagogues may denounce bankers in the strongest terms, but the major parties must show

leadership!

As a information technology worker - presently between jobs - with a mathematics degree my views on

economics should be taken as not the views of an economist but those of someone interested in politics and

the outcomes that I advocate for Australian banking reflect what I want for both myself and the poor and

ordinary people I sympathise with.

I ask that this contribution be considered by the committee.

Vous aimerez peut-être aussi

- 2021 Submission HoR Enquiry Into Constitutional Reform and ReferendumsDocument10 pages2021 Submission HoR Enquiry Into Constitutional Reform and ReferendumsAndrew Francis OliverPas encore d'évaluation

- My Submission 16 Into 2021 Inquiry Into Victoria's Criminal Justice SystemDocument30 pagesMy Submission 16 Into 2021 Inquiry Into Victoria's Criminal Justice SystemAndrew Francis OliverPas encore d'évaluation

- The Last Judgement God Pronounces On LawyersDocument3 pagesThe Last Judgement God Pronounces On LawyersAndrew Francis OliverPas encore d'évaluation

- Status of The Teaching ProfessionDocument20 pagesStatus of The Teaching ProfessionAndrew Francis OliverPas encore d'évaluation

- MR Proddy and The Stolen Cat FoodDocument9 pagesMR Proddy and The Stolen Cat FoodAndrew Francis OliverPas encore d'évaluation

- Race Criminal Offences Act 2017Document4 pagesRace Criminal Offences Act 2017Andrew Francis OliverPas encore d'évaluation

- Republic of Australia Constitution 2060Document20 pagesRepublic of Australia Constitution 2060Andrew Francis Oliver0% (1)

- My Submission To The Media Diversity in Australia Senate Enquiry.Document10 pagesMy Submission To The Media Diversity in Australia Senate Enquiry.Andrew Francis OliverPas encore d'évaluation

- "Endgame" by Andrew OliverDocument4 pages"Endgame" by Andrew OliverAndrew Francis OliverPas encore d'évaluation

- The Stolen Silk HandkerchiefDocument6 pagesThe Stolen Silk HandkerchiefAndrew Francis OliverPas encore d'évaluation

- Submission On Poor Quality LegislationDocument3 pagesSubmission On Poor Quality LegislationAndrew Francis OliverPas encore d'évaluation

- Additional Remarks Re Poor Quality LegislationDocument1 pageAdditional Remarks Re Poor Quality LegislationAndrew Francis OliverPas encore d'évaluation

- SilverChair DVD ReviewDocument6 pagesSilverChair DVD ReviewAndrew Francis OliverPas encore d'évaluation

- Ruddock Review SubmissionDocument11 pagesRuddock Review SubmissionAndrew Francis OliverPas encore d'évaluation

- Letter 1985 To Channel Two Re CatalystDocument3 pagesLetter 1985 To Channel Two Re CatalystAndrew Francis OliverPas encore d'évaluation

- TPP First Impressions: LabourDocument1 pageTPP First Impressions: LabourAndrew Francis OliverPas encore d'évaluation

- SRC Constitution Review My Meeting Papers 1980Document12 pagesSRC Constitution Review My Meeting Papers 1980Andrew Francis OliverPas encore d'évaluation

- David Bowie Best of DVD #1 ReviewDocument10 pagesDavid Bowie Best of DVD #1 ReviewAndrew Francis OliverPas encore d'évaluation

- My Hundred Favorite CD'sDocument9 pagesMy Hundred Favorite CD'sAndrew Francis OliverPas encore d'évaluation

- 4th Revised Censorship Discussion PaperDocument10 pages4th Revised Censorship Discussion PaperAndrew Francis OliverPas encore d'évaluation

- Dusty Springfield Reflections DVD ReviewDocument5 pagesDusty Springfield Reflections DVD ReviewAndrew Francis OliverPas encore d'évaluation

- My Community Legal Centre Committee Papers 1989-96Document13 pagesMy Community Legal Centre Committee Papers 1989-96Andrew Francis OliverPas encore d'évaluation

- A Panning Critical Review of The Curriculum Review 2014Document16 pagesA Panning Critical Review of The Curriculum Review 2014Andrew Francis OliverPas encore d'évaluation

- Charter Human Rights Responsibilities Payments Remedies Act 2015Document23 pagesCharter Human Rights Responsibilities Payments Remedies Act 2015Andrew Francis OliverPas encore d'évaluation

- My Submission #5 To The Senate Enquiry Into The Hon Christopher Pyne's University ReformsDocument8 pagesMy Submission #5 To The Senate Enquiry Into The Hon Christopher Pyne's University ReformsAndrew Francis OliverPas encore d'évaluation

- My Free Press Agenda 1984Document1 pageMy Free Press Agenda 1984Andrew Francis OliverPas encore d'évaluation

- Marriage Law Liberalisation and Reform Bill 2015Document2 pagesMarriage Law Liberalisation and Reform Bill 2015Andrew Francis OliverPas encore d'évaluation

- East West Contract Dissolution Bill 2015Document2 pagesEast West Contract Dissolution Bill 2015Andrew Francis OliverPas encore d'évaluation

- Critical Review Alanis Morissette's CD Supposed Former Infatuation JunkieDocument4 pagesCritical Review Alanis Morissette's CD Supposed Former Infatuation JunkieAndrew Francis OliverPas encore d'évaluation

- Burwood Heights High School SRC Constitution 1975 - BWDocument4 pagesBurwood Heights High School SRC Constitution 1975 - BWAndrew Francis OliverPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Standard Tendering Document Procurement of Works - Small WorksDocument104 pagesStandard Tendering Document Procurement of Works - Small WorksAccess to Government Procurement Opportunities100% (4)

- Hazina Loan Form Revised March 2021Document4 pagesHazina Loan Form Revised March 2021benson17yatorPas encore d'évaluation

- Four Pillars of Finance and Phil Financial System OverviewDocument29 pagesFour Pillars of Finance and Phil Financial System OverviewGrant Marco Mariano90% (10)

- Managing Distressed AssetsDocument37 pagesManaging Distressed Assetsodumgroup100% (2)

- Cashless Society - The Future of Money or A Utopia?: Nikola FabrisDocument14 pagesCashless Society - The Future of Money or A Utopia?: Nikola FabrisDominika VitárPas encore d'évaluation

- 2020 113 Taxmann Com 36 SAT Mumbai 10 10 2019Document23 pages2020 113 Taxmann Com 36 SAT Mumbai 10 10 2019Sejal LahotiPas encore d'évaluation

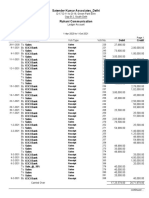

- Satender Kumar Associates - DelhiDocument7 pagesSatender Kumar Associates - DelhiAVS & AssociatesPas encore d'évaluation

- PLM Business School Credit Management Module on Credit DecisionsDocument29 pagesPLM Business School Credit Management Module on Credit DecisionsHarlene BulaongPas encore d'évaluation

- ALL Banks PL Policy OglDocument18 pagesALL Banks PL Policy OglmadirajunaveenPas encore d'évaluation

- Exim Bank of India: A Comprehensive Guide to Products and ServicesDocument21 pagesExim Bank of India: A Comprehensive Guide to Products and ServicesPrathap AnPas encore d'évaluation

- Self PPT On Money and CreditDocument15 pagesSelf PPT On Money and CreditTripti SinghaPas encore d'évaluation

- FRM Practice Exam Part 2 NOVDocument139 pagesFRM Practice Exam Part 2 NOVkennethngai100% (2)

- A PROJECT REPORT ON HDFC BANK Submiited by Ankita SinghDocument29 pagesA PROJECT REPORT ON HDFC BANK Submiited by Ankita SinghBHRIGURASHAN 16588% (94)

- AssignmentDocument8 pagesAssignmentNawaz ShaikhPas encore d'évaluation

- VILLANTE, Stephen U. Bachelor in Public Administration 3-1 Case Study (Midterm Exam) (Open Format)Document6 pagesVILLANTE, Stephen U. Bachelor in Public Administration 3-1 Case Study (Midterm Exam) (Open Format)Stephen VillantePas encore d'évaluation

- Assistant Investigation Officer (BS-14)Document3 pagesAssistant Investigation Officer (BS-14)Yasir BalochPas encore d'évaluation

- BM 4 Commercial BankingDocument17 pagesBM 4 Commercial BankingKawsar Ahmed BadhonPas encore d'évaluation

- Cheque Issue & MGMTDocument51 pagesCheque Issue & MGMTVincent100% (1)

- Financial Policies & Accounting Procedures Manual - PAD ...Document60 pagesFinancial Policies & Accounting Procedures Manual - PAD ...JamalPas encore d'évaluation

- Dep LiabDocument6 pagesDep LiabMary Ann PacariemPas encore d'évaluation

- 17 Soriano v. BSPDocument6 pages17 Soriano v. BSPChester BryanPas encore d'évaluation

- Commercial Bank Lending AnalysisDocument27 pagesCommercial Bank Lending Analysisashish664Pas encore d'évaluation

- The Legal Framework of The Philippine Banking System: Atty. Elmore O. CapuleDocument114 pagesThe Legal Framework of The Philippine Banking System: Atty. Elmore O. CapuleMakoy BixenmanPas encore d'évaluation

- Reading 7 Economics of Regulation - AnswersDocument15 pagesReading 7 Economics of Regulation - Answerstristan.riolsPas encore d'évaluation

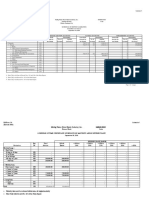

- Form 3CBDocument12 pagesForm 3CBpriya sharmaPas encore d'évaluation

- A Study On Credit Management of Sahayogi Bikas Bank LTDDocument31 pagesA Study On Credit Management of Sahayogi Bikas Bank LTDShivam KarnPas encore d'évaluation

- Procedure On Financing of Two-Wheeler Loan at Centurian Bank by Sneha SalgaonkarDocument57 pagesProcedure On Financing of Two-Wheeler Loan at Centurian Bank by Sneha SalgaonkarAarti Kulkarni0% (2)

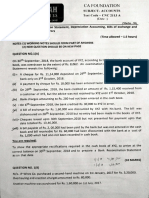

- K - J.K. Shah: TOPICS: Bank ReconclatlonDocument3 pagesK - J.K. Shah: TOPICS: Bank ReconclatlonJpPas encore d'évaluation

- Refining Business Plans for Specific AudiencesDocument4 pagesRefining Business Plans for Specific Audiencesali haiderPas encore d'évaluation

- CASE - The Great Bangladesh Bank HeistDocument12 pagesCASE - The Great Bangladesh Bank HeistFrancis VirayPas encore d'évaluation