Académique Documents

Professionnel Documents

Culture Documents

Form 15g Blank1

Transféré par

Rasesh ShahTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Form 15g Blank1

Transféré par

Rasesh ShahDroits d'auteur :

Formats disponibles

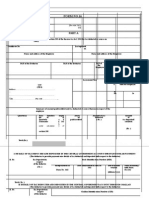

FORM NO.

15G

[See section197A (1), 197A (1A) and rule 29C]

Declaration under section197A (1) and section197A (1A) of the Income-ta Act, 19!1 to "e made "# an indi$idual or a %erson (not "ein& a

com%an# or firm) claimin& certain recei%ts 'ithout deduction of ta(

)A*+ I

1( ,ame of Assessee (Declarant) 2( )A, of the Assessee

-( Assessment .ear

( for 'hich declaration is "ein& made)

/( 0lat1Door12loc3 ,o( 4( ,ame of )remises !(

5

Status

7( Assessed in 'hich 6ard 1

Circle

7( *oad1Street18ane 9( Area18ocalit# 19( A: Code(under 'hom

assessed last time)

Area

Code

A:

+#%e

*an&e

Code

A:

,o(

11( +o'n1Cit#1District 12( State

1-( )I, 1/( 8ast Assessment .ear in

'hich assessed

14( ;mail 1!( +ele%hone ,o( ('ith S+D Code) and

<o"ile ,o(

17( )resent 6ard1Circle

17( *esidential Status ('ithin

the meanin& of Section ! of

the Income +a Act,19!1)

19( ,ame of 2usiness1:ccu%ation

29( )resent A: Code (if not

same as a"o$e)

21( =urisdictional Chief Commissioner of Income-ta or Commissioner of

Income-ta (if not assessed to Income-ta earlier)

Area

Code

A:

+#%e

*an&e

Code

A:

,o(

22( ;stimated total income from the sources mentioned "elo'>

()lease tic3 the rele$ant "o)

Di$idend from shares referred to in Schedule I

Interest on securities referred to in Schedule II

Interest on sums referred to in Schedule III

Income form units referred to in Schedule I?

+he amount of 'ithdra'al referred to in Sec 79CCA(2)(a) from ,ational Sa$in&s Scheme referred to in

Schedule ?

2-( ;stimated total income of the %re$ious #ear in 'hich income mentioned in Column 22 is to "e

included

2/( Details of in$estments in res%ect of 'hich the declaration is "ein& made>

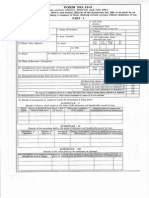

SC@;DA8;-I

(Details of shares, 'hich stand in the name of the declarant and "eneficiall# o'ned "# him)

,o( of

shares

Class of share B face $alue of

each share

+otal $alue of

shares

Distincti$e num"ers

of the shares

Date(s) on 'hich the shares 'ere

acCuired "# the Declarant (dd1mm1####)

SC@;DA8;-II

(Details of the securities held in the name of declarant and "eneficiall# o'ned "# him)

Descri%tion of

Securities

,um"er of

securities

Amount of securities Date(s) of Securities

(dd1mm1####)

Date(s) on 'hich the securities 'ere

acCuired "# the declarant (dd1mm1####)

SC@;DA8;-III

(Details of the sums &i$en "# the declarant on interest)

Name and address of the

person to whom the sums

are given on interest

Amount of

sums given

on interest

Date on which the

sums were given on

interest(dd/mm/yyyy)

Period for which sums

were given on interest

Rate of

Interest

SC@;DA8;-I?

(Details of the mutual fund units held in the name of declarant and "eneficiall# o'ned "# him)

,ame and address of

the mutual fund

,um"er of

units

Class of units and face

$alue of each unit

Distincti$e num"er of units Income in res%ect of units

SC@;DA8;-?

(Details of the 'ithdra'al made from ,ational Sa$in&s Scheme)

)articulars of the )ost : ce 'here the account under the ,ational

Sa$in&s Scheme is maintained and the account num"er

Date on 'hich the account 'as

o%ened (dd1mm1####)

+he Amount of

'ithdra'al from account

DDDDDDDDDDDDDDDDDDDDDDDDDDDD

EE Si&nature of declarant

Info.mpsconsultancygmail.com

Declaration/Verification

EI16e DDDDDDDDDDDDDDDDDDDDDDDDDD DDDD do here"# declare that to the "est of Em#1our 3no'led&e and "elief 'hat is

stated a"o$e is correct, com%lete and is trul# stated( EI16e declare that the incomes referred to in this form are not includi"le in the

total income of an# other %erson u1s !9 to !/ of the Income-ta Act, 19!1( EI16e further, declare that the ta Eon m#1our estimated

total income, includin& Eincome1incomes referred to in Column 22 a"o$e, com%uted in accordance 'ith the %ro$isions of the

Income-ta Act, 19!1, for the %re$ious #ear endin& on DDDDDDDDDD rele$ant to the assessment #ear DDDDDDDDDD 'ill "e nil(

EI16e also, declare that Em#1ourEincome1incomes referred to in Column 22 for the %re$ious #ear endin& on DDDDDDDDDD rele$ant

to the assessment #ear DDDDDDDDDD 'ill not eceed the maimum amount 'hich is not char&ea"le to income-ta(

)lace > DDDDDDDDDD

Date > DDDDDDDDDD

DDDDDDDDDDDDDDDDDDDDDDDDDDDD

EE Si&nature of declarant

PART II

[0or use "# the %erson to 'hom the declaration is furnished]

1( ,ame of the %erson res%onsi"le for %a#in& the income referred to in

Column 22 of )art I

2( )A, of the %erson indicated in Column

1 of )art II

-( Com%lete Address

/( +A, of the %erson indicated in Column 1

of )art II

4( ;mail !( +ele%hone ,o( ('ith S+D Code) and

<o"ile ,o(

7( Status

7(Date on 'hich Declarations

0urnished (dd1mm1####)

9( )eriod in res%ect of 'hich the di$idend

has "een declared or the income has

"een %aid1credited

19( Amount of income

)aid

11( Date on 'hich the

income

has "een %aid1

credited(dd1mm1####)

12( Date of declaration, distri"ution or %a#ment of di$idend 1

'ithdra'al under the ,ational Sa$in&s Scheme

(dd1mm1####)

1-( Account ,um"er of ,ational Sa$in& Scheme from

'hich 'ithdra'al has "een made

0or'arded to the Chief Commissioner or Commissioner of Income-ta DDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDD

)lace > DDDDDDDDDD

Date > DDDDDDDDDD

DDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDD

Si&nature of the %erson res%onsi"le for %a#in&

the income referred to in Column 22 of )art I

Notes:

1( +he declaration should "e furnished in du%licate(

2( EDelete 'hiche$er is not a%%lica"le(

-(

5

Declaration can "e furnished "# an indi$idual under section197A (1) and a %erson (other than a com%an# or a firm) under

section197A (1A)(

/( EEIndicate the ca%acit# in 'hich the declaration is furnished on "ehalf of a @A0, A:), etc(

4( 2efore si&nin& the declaration1$erification, the declarant should satisf# himself that the information furnished in this form is

true, correct and com%lete in all res%ects( An# %erson ma3in& a false statement in the declaration shall "e lia"le to %rosecution

under 277 of the Income-ta Act, 19!1 and on con$iction "e %unisha"le-

i) In a case 'here ta sou&ht to "e e$aded eceeds t'ent#-fi$e la3h ru%ees, 'ith ri&orous im%risonment

'hich shall not "e less than ! months "ut 'hich ma# etend to se$en #ears and 'ith fineF

ii) In an# other case, 'ith ri&orous im%risonment 'hich shall not "e less than - months "ut 'hich ma# etend

to t'o #ears and 'ith fine(

!( +he %erson res%onsi"le for %a#in& the income referred to in column 22 of )art I shall not acce%t the declaration 'here the

amount of income of the nature referred to in su"-section (1) or su"-section (1A) of section197A or the a&&re&ate of the

amounts of such income credited or %aid or li3el# to "e credited or %aid durin& the %re$ious #ear in 'hich such income is to "e

included eceeds the maimum amount 'hich is not char&ea"le to ta(GF

Info.mpsconsultancygmail.com

Vous aimerez peut-être aussi

- Information Return For Publicly Offered Original Issue Discount InstrumentsDocument4 pagesInformation Return For Publicly Offered Original Issue Discount InstrumentsShawn60% (5)

- Linux For Beginners - Shane BlackDocument165 pagesLinux For Beginners - Shane BlackQuod Antichristus100% (1)

- Walmart, Amazon, EbayDocument2 pagesWalmart, Amazon, EbayRELAKU GMAILPas encore d'évaluation

- Oracle FND User APIsDocument4 pagesOracle FND User APIsBick KyyPas encore d'évaluation

- Reviewer 1, Fundamentals of Accounting 2Document13 pagesReviewer 1, Fundamentals of Accounting 2Hunson Abadeer76% (17)

- Vipin Form 16Document5 pagesVipin Form 16Jagdish Sharma CAPas encore d'évaluation

- Separation PayDocument3 pagesSeparation PayMalen Roque Saludes100% (1)

- Catalogo AWSDocument46 pagesCatalogo AWScesarPas encore d'évaluation

- Dimaampao Tax NotesDocument63 pagesDimaampao Tax NotesMaruSalvatierra100% (1)

- Embedded Systems DesignDocument576 pagesEmbedded Systems Designnad_chadi8816100% (4)

- Form 8-K: Current Report Pursuant To Section 13 OR 15 (D) of The Securities Exchange Act of 1934Document22 pagesForm 8-K: Current Report Pursuant To Section 13 OR 15 (D) of The Securities Exchange Act of 1934Sakan PoolsawatkitikoolPas encore d'évaluation

- Commissioner of Internal Revenue vs. Fortune Tobacco Corporation (July 21, 2008 and September 28, 2011)Document7 pagesCommissioner of Internal Revenue vs. Fortune Tobacco Corporation (July 21, 2008 and September 28, 2011)Vince LeidoPas encore d'évaluation

- POST TEST 3 and POST 4, in ModuleDocument12 pagesPOST TEST 3 and POST 4, in ModuleReggie Alis100% (1)

- Form No 15HDocument2 pagesForm No 15HPrajesh SrivastavaPas encore d'évaluation

- Form No. 15G: Area Code AO Type Range Code Ao NoDocument2 pagesForm No. 15G: Area Code AO Type Range Code Ao NoRanjan ManoPas encore d'évaluation

- Minimum Corporate Income Tax: A Bane or A Boon? by Rosalino G. Fontanosa, Cpa, MbaDocument14 pagesMinimum Corporate Income Tax: A Bane or A Boon? by Rosalino G. Fontanosa, Cpa, MbaanggandakonohPas encore d'évaluation

- Taxation System in IndiaDocument13 pagesTaxation System in IndiaTahsin SanjidaPas encore d'évaluation

- 201455200239Amendments-F.a. 2013 - For UplaodingDocument7 pages201455200239Amendments-F.a. 2013 - For UplaodingvishalniPas encore d'évaluation

- S Vii - F S: Section VII. Security FormsDocument9 pagesS Vii - F S: Section VII. Security FormsiGp2013Pas encore d'évaluation

- Revenue RegulationsDocument13 pagesRevenue RegulationsErika AvedilloPas encore d'évaluation

- Explanation To Commercial CIBIL ReportDocument12 pagesExplanation To Commercial CIBIL ReportManis KmrPas encore d'évaluation

- Pan NoDocument3 pagesPan NokpsmilraviPas encore d'évaluation

- 2013-0694 - EverBank ImprovementsDocument8 pages2013-0694 - EverBank ImprovementsalfiebccPas encore d'évaluation

- Notf.36 2000 CeDocument2 pagesNotf.36 2000 Cepatelpratik1972Pas encore d'évaluation

- Financial Condition Report (FCR) For General Insurance CompaniesDocument28 pagesFinancial Condition Report (FCR) For General Insurance Companiesraheja_ashishPas encore d'évaluation

- Memorandum of Agreement TOV 29072014Document5 pagesMemorandum of Agreement TOV 29072014BobbyConchasPas encore d'évaluation

- 15g MehandiDocument3 pages15g MehandiAjay ParidaPas encore d'évaluation

- Interim Order in The Matter of Progress Cultivation Limited.Document12 pagesInterim Order in The Matter of Progress Cultivation Limited.Shyam SunderPas encore d'évaluation

- Chapter Xxi.cDocument12 pagesChapter Xxi.cdakshbajajPas encore d'évaluation

- IT FormDocument8 pagesIT Formapi-3829020Pas encore d'évaluation

- Form No.16: Part ADocument5 pagesForm No.16: Part APradeep KumarPas encore d'évaluation

- ANF21Document6 pagesANF21Vinod SubramaniamPas encore d'évaluation

- New PBD TemplateDocument198 pagesNew PBD TemplateJeric IsraelPas encore d'évaluation

- Ind AS1Document33 pagesInd AS1SaibhumiPas encore d'évaluation

- IT Return IndividualDocument42 pagesIT Return IndividualAllanPas encore d'évaluation

- VASCO DATA SECURITY INTERNATIONAL INC 8-K (Events or Changes Between Quarterly Reports) 2009-02-23Document28 pagesVASCO DATA SECURITY INTERNATIONAL INC 8-K (Events or Changes Between Quarterly Reports) 2009-02-23http://secwatch.comPas encore d'évaluation

- Kaiser Tax Sheltered Annuity 5500 For 2010Document38 pagesKaiser Tax Sheltered Annuity 5500 For 2010James LindonPas encore d'évaluation

- Executive Order No. 292: DONE in The City of Manila, This 27th Day of September, in The Year of Our Lord, Two ThousandDocument2 pagesExecutive Order No. 292: DONE in The City of Manila, This 27th Day of September, in The Year of Our Lord, Two Thousandkhaye_cee11Pas encore d'évaluation

- Ap Value Added Tax Act - 2005Document90 pagesAp Value Added Tax Act - 2005gantasri8Pas encore d'évaluation

- Financial Accounting 7th EditionDocument6 pagesFinancial Accounting 7th Editiongilli1trPas encore d'évaluation

- Contex Corporation vs. CIR (2004)Document6 pagesContex Corporation vs. CIR (2004)Vince LeidoPas encore d'évaluation

- Key Issues Red 1999 1st EditionDocument27 pagesKey Issues Red 1999 1st EditionNat TikusPas encore d'évaluation

- Compagnie Générale de Géophysique-Veritas Annual Report 2012 Form 20-FDocument218 pagesCompagnie Générale de Géophysique-Veritas Annual Report 2012 Form 20-FsciomakoPas encore d'évaluation

- FAQsDocument10 pagesFAQsrajdeeppawarPas encore d'évaluation

- WWW - Incometaxindia.gov - In: Instructions To Form ITR-7 (A.Y .2018-19)Document26 pagesWWW - Incometaxindia.gov - In: Instructions To Form ITR-7 (A.Y .2018-19)Uttam K SharmaPas encore d'évaluation

- E-TDS Return Preparation SoftwareDocument37 pagesE-TDS Return Preparation Softwareshabs4urosePas encore d'évaluation

- e-TDS: "Electronic Filing of Returns of Tax Deducted at Source Scheme, 2003"Document2 pagese-TDS: "Electronic Filing of Returns of Tax Deducted at Source Scheme, 2003"rajdeeppawarPas encore d'évaluation

- f8281 PDFDocument4 pagesf8281 PDFMARSHA MAINESPas encore d'évaluation

- You're Nearly There! To Ensure That Your Payment Is Received by Your Institution Without Any Delays, Please Follow The Instructions BelowDocument6 pagesYou're Nearly There! To Ensure That Your Payment Is Received by Your Institution Without Any Delays, Please Follow The Instructions BelowJosin JosePas encore d'évaluation

- Form No.15gDocument2 pagesForm No.15gPrakash GowdaPas encore d'évaluation

- Highlights of Annual Supplement 2013-14 Announced by Minister For Commerce, Industry & Textiles Shri Anand SharmaDocument15 pagesHighlights of Annual Supplement 2013-14 Announced by Minister For Commerce, Industry & Textiles Shri Anand Sharmapatelpratik1972Pas encore d'évaluation

- Ch24 Full Disclosure in Financial ReportingDocument31 pagesCh24 Full Disclosure in Financial ReportingAries BautistaPas encore d'évaluation

- Form 3CD NewDocument16 pagesForm 3CD NewRikta KariaPas encore d'évaluation

- 2 (1) - Form 102 - PrintDocument4 pages2 (1) - Form 102 - PrintPraveen SehgalPas encore d'évaluation

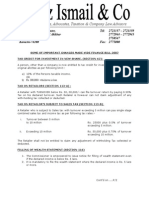

- Auditors, Advocates, Taxation & Company Law AdvisorsDocument3 pagesAuditors, Advocates, Taxation & Company Law AdvisorsHussain MehmoodPas encore d'évaluation

- Flat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovDocument3 pagesFlat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovVishwini ViswanathanPas encore d'évaluation

- 15G FormDocument2 pages15G Formgrover.jatinPas encore d'évaluation

- Audit Programe For Statutory AuditDocument20 pagesAudit Programe For Statutory AuditTekumani Naveen KumarPas encore d'évaluation

- Act 51862 804Document6 pagesAct 51862 804Parvathi Devi VaranasiPas encore d'évaluation

- Concept of IncomeDocument12 pagesConcept of IncomeCara HenaresPas encore d'évaluation

- Form 15GDocument3 pagesForm 15GRahul DattoPas encore d'évaluation

- Ans Key IMO Class 1 To 10 01 12 16Document10 pagesAns Key IMO Class 1 To 10 01 12 16DaisyQueenPas encore d'évaluation

- Reinsurance Carrier Revenues World Summary: Market Values & Financials by CountryD'EverandReinsurance Carrier Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Aircraft Engines & Parts World Summary: Market Sector Values & Financials by CountryD'EverandAircraft Engines & Parts World Summary: Market Sector Values & Financials by CountryPas encore d'évaluation

- Air & Gas Compressors World Summary: Market Values & Financials by CountryD'EverandAir & Gas Compressors World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Priority Sector Lendings by Commercial Banks in India: Dr. Sandeep KaurDocument7 pagesPriority Sector Lendings by Commercial Banks in India: Dr. Sandeep KaurRasesh ShahPas encore d'évaluation

- Report 1Document14 pagesReport 1Rasesh ShahPas encore d'évaluation

- A. Contents of Memorandum of AssociationDocument3 pagesA. Contents of Memorandum of AssociationRasesh ShahPas encore d'évaluation

- Kinds of Companies: 1. Private Company-S. 3 (1) (Iii)Document2 pagesKinds of Companies: 1. Private Company-S. 3 (1) (Iii)Rasesh ShahPas encore d'évaluation

- Sample Annual BudgetDocument4 pagesSample Annual BudgetMary Ann B. GabucanPas encore d'évaluation

- 90FF1DC58987 PDFDocument9 pages90FF1DC58987 PDFfanta tasfayePas encore d'évaluation

- Sky ChemicalsDocument1 pageSky ChemicalsfishPas encore d'évaluation

- Forecasting of Nonlinear Time Series Using Artificial Neural NetworkDocument9 pagesForecasting of Nonlinear Time Series Using Artificial Neural NetworkranaPas encore d'évaluation

- Gender Ratio of TeachersDocument80 pagesGender Ratio of TeachersT SiddharthPas encore d'évaluation

- Environmental Auditing For Building Construction: Energy and Air Pollution Indices For Building MaterialsDocument8 pagesEnvironmental Auditing For Building Construction: Energy and Air Pollution Indices For Building MaterialsAhmad Zubair Hj YahayaPas encore d'évaluation

- Introduction To Motor DrivesDocument24 pagesIntroduction To Motor Drivessukhbat sodnomdorjPas encore d'évaluation

- MMC Pipe Inspection RobotDocument2 pagesMMC Pipe Inspection RobotSharad Agrawal0% (1)

- Are Groups and Teams The Same Thing? An Evaluation From The Point of Organizational PerformanceDocument6 pagesAre Groups and Teams The Same Thing? An Evaluation From The Point of Organizational PerformanceNely Noer SofwatiPas encore d'évaluation

- Google App EngineDocument5 pagesGoogle App EngineDinesh MudirajPas encore d'évaluation

- Amare Yalew: Work Authorization: Green Card HolderDocument3 pagesAmare Yalew: Work Authorization: Green Card HolderrecruiterkkPas encore d'évaluation

- Tivoli Performance ViewerDocument4 pagesTivoli Performance ViewernaveedshakurPas encore d'évaluation

- Efs151 Parts ManualDocument78 pagesEfs151 Parts ManualRafael VanegasPas encore d'évaluation

- 30 Creative Activities For KidsDocument4 pages30 Creative Activities For KidsLaloGomezPas encore d'évaluation

- Expense Tracking - How Do I Spend My MoneyDocument2 pagesExpense Tracking - How Do I Spend My MoneyRenata SánchezPas encore d'évaluation

- Draft Contract Agreement 08032018Document6 pagesDraft Contract Agreement 08032018Xylo SolisPas encore d'évaluation

- T1500Z / T2500Z: Coated Cermet Grades With Brilliant Coat For Steel TurningDocument16 pagesT1500Z / T2500Z: Coated Cermet Grades With Brilliant Coat For Steel TurninghosseinPas encore d'évaluation

- Ludwig Van Beethoven: Für EliseDocument4 pagesLudwig Van Beethoven: Für Eliseelio torrezPas encore d'évaluation

- Internship ReportDocument46 pagesInternship ReportBilal Ahmad100% (1)

- Instructions For Microsoft Teams Live Events: Plan and Schedule A Live Event in TeamsDocument9 pagesInstructions For Microsoft Teams Live Events: Plan and Schedule A Live Event in TeamsAnders LaursenPas encore d'évaluation

- Water Hookup Kit User Manual (For L20 Ultra - General (Except EU&US)Document160 pagesWater Hookup Kit User Manual (For L20 Ultra - General (Except EU&US)Aldrian PradanaPas encore d'évaluation

- Lab 6 PicoblazeDocument6 pagesLab 6 PicoblazeMadalin NeaguPas encore d'évaluation

- Cryo EnginesDocument6 pagesCryo EnginesgdoninaPas encore d'évaluation