Académique Documents

Professionnel Documents

Culture Documents

Abstract

Transféré par

Priye ObomanuCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Abstract

Transféré par

Priye ObomanuDroits d'auteur :

Formats disponibles

Analysis on Credit Card Fraud Detection

Methods

ABSTRACT:

Due to the rise and rapid growth of E-Commerce, use of credit cards for online purchases

has dramatically increased and it caused an explosion in the credit card fraud. As credit

card becomes the most popular mode of payment for both online as well as regular

purchase, cases of fraud associated with it are also rising. In real life, fraudulent

transactions are scattered with genuine transactions and simple pattern matching

techniques are not often sufficient to detect those frauds accurately. Implementation of

efficient fraud detection systems has thus become imperatie for all credit card issuing

ban!s to minimi"e their losses. #any modern techniques based on Artificial Intelligence,

Data mining, $u""y logic, #achine learning, %equence Alignment, &enetic 'rogramming

etc., has eoled in detecting arious credit card fraudulent transactions. A clear

understanding on all these approaches will certainly lead to an efficient credit card fraud

detection system. (his paper presents a surey of arious techniques used in credit card

fraud detection mechanisms and ealuates each methodology based on certain design

criteria.

EXISTING SYSTEM

(he (raditional detection method mainly depends on database system and the

education of customers, which usually are delayed, inaccurate and not in-time.

After that methods based on discriminate analysis and regression analysis are

widely used which can detect fraud by credit rate for cardholders and credit card

transaction.

$or a large amount of data it is not efficient.

R!B"EM REC!GNITI!N

(he high amount of losses due to fraud and the awareness of the relation between

loss and the aailable limit hae to be reduced.

(he fraud has to be deducted in real time and the number of false alert has to be

minimi"ed.

R!!SED SYSTEM

(he proposed system oercomes the aboe mentioned issue in an efficient way.

)sing genetic algorithm the fraud is detected and the false alert is minimi"ed and it

produces an optimi"ed result.

(he fraud is detected based on the customer*s behaior. A new classification

problem which has a ariable misclassification cost is introduced.

+ere the genetic algorithms is made where a set of interal alued parameters are

optimi"ed.

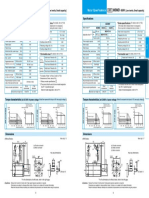

SYSTEM ARC#ITECT$RE

DA(A

,A-E+.)%E

/C)%(.#E-

DA(A0

DA(A

,A-E+.)%E

/C)%(.#E-

DA(A0

-)1E% E2&I2E

-)1E% E2&I2E

&E2E(IC

A1&.-I(+#

&E2E(IC

A1&.-I(+#

$I1(E- 3

'-I.-I(4

$I1(E- 3

'-I.-I(4

$-A)D -)1E

%E(

$-A)D -)1E

%E(

#ARD%ARE RE&$IREMENTS

5 %4%(E# 6 'entium I7 8.9 &+"

5 +A-D DI%: 6 9; &<

5 #.2I(.- 6 => 7&A colour

5 #.)%E 6 1ogitech.

5 -A# 6 8>? #<

5 :E4<.A-D 6 ==; !eys enhanced.

S!FT%ARE RE&$IREMENTS

5 .perating system 6 ,indows @' 'rofessional

5 $ront End 6 AA7A

5 (ool 6 2et<eans IDE

M!D$"ES

)ser &)I

Critical 7alue Identification

$raud Detection using &enetic Algorithm

M!D$"ES DESCRITI!N

$ser G$I

In this module, )ser Interface module is deeloped using Applet 7iewer. (his

module is deeloped to user to identify the credit card fraud using genetic algorithm

technique. %o the user interface must be capable of proiding the user to upload the

dataset and ma!e manipulations and finally must show the user whether fraud has been

detected or not. .nly final output will be in applet screen. All the generation details

/crossoer and mutation0 will b in the console screen of eclipse.

Critical 'alue Identi(ication

Based on CC usa)e Fre*uency

float ccfreq B$loat.alue.f/tempCDE0F$loat.alue.f/tempC?E0G

if/ccfreqH;.80

I

if/$loat.alue.f/tempCJE0H/>Kccfreq00

I

resC;EB=G

resC=EB/$loat.alue.f/tempCJE0Kccfreq0G

L

L

if/resC;EM=0

I

resC=EB/float0ccfreqG

L

Ccfreq B (otal number card used /C)0 F CC age

If ccfreq is less than ;.8 , it means this property is not applicable for fraud and

critical alue Bccfreq

.therwise, it chec! for condition of fraud /i.e0 B

$raud condition B number of time Card used (oday /C)(0 H/ > K ccfreq0

If true, there may chance for fraud using this property and its critical alue is C)(Kccfreq

If flase, no fraud occurance and critical alue Bccfreq

Based on CC usa)e "ocation

int locBInteger.alue.f/tempCNE0G

if//locMB >0 33 /Integer.alue.f/tempCOE0H/ 8 K loc000

I

resC;EB=G

resC=EB/$loat.alue.f/loc0F $loat.alue.f/tempCOE00G

L

if/resC;EM=0

I

resC=EB/float0;.;=G

L

2umber of locations CC used so far /loc0 obtained from dataset/loc0

If loc is less than >, it means this property is not applicable for fraud and critical alue

B;.;=

.therwise, it chec! for condition of fraud /i.e0 B

$raud condition B number of locations Card used (oday /C)(0 H/ > K loc0

If true, there may chance for fraud using this property and its critical alue is locFC)(

If flase, no fraud occurance and critical alue B;.;=

Based on CC !+erDra(t

float od B$loat.alue.f/tempC>E0F$loat.alue.f/tempCDE0G

if/odMB;.80

I

if/$loat.alue.f/tempC=;E0HB=0

I

resC;EB=G

resC=EB/$loat.alue.f/tempC=;E0Kod0G

L

L

if/resC;EM=0

I

resC=EB/float0odG

L

2umber of times CC oerdraft w.r.t C) occurred so far /od0 can be found as,

.d w.r.t C) B .DFC)

If .d w.r.t C) is less than ;.;8, it means this property is not applicable for fraud and

critical alue B .d w.r.t C)

.therwise, it chec! for condition of fraud /i.e0 B

$raud condition B chec! whether oerdraft condition occurred today from /.D( dataset0

If true, there may chance for fraud using this property and its critical alue is .D( K .d

w.r.t C)

If flase, no fraud occurance and critical alue B .d w.r.t C)

Based on CC Boo, Balance

float bb B$loat.alue.f/tempC8E0F$loat.alue.f/tempC9E0G

if/bbMB;.8>0

I

resC;EB=G

resC=EB/$loat.alue.f/80Kbb0G

L

if/resC;EM=0

I

resC=EB/float0bbG

L

%tandard <oo! balance can be found as,

<b B current << F Ag. <<

If bb is less or equals than ;.8>, it means this property is not applicable for fraud and

critical alue B bb

.therwise, it chec! for condition of fraud /i.e0 B

If true, there may chance for fraud using this property and its critical alue is curr<< K bb

If flase, no fraud occurance and critical alue B bb

Based on CC A+era)e Daily S-endin)

float monB $loat.alue.f/tempC?E0FD;G

float balB =;;;;; - $loat.alue.f/tempC9E0G

float tot B monKbalG

float ds BtotF$loat.alue.f/tempC?E0G

if//=;Kds0M$loat.alue.f/tempC==E00

I

resC;EB=G

if/$loat.alue.f/tempC==E0H;0

resC=EB/$loat.alue.f/tempC==E0F /=;Kds00G

else

resC=EB/float0 ;.;G

L

if/resC;EM=0

I

resC=EB/float0;.;=G

L

Fraud Detection usin) Genetic Al)orith.

In this module the system must detect whether any fraud has been occurred in the

transaction or not. It must also display the user about the result. It is calculated based on

following6

Age of CC in months can be calculated using CCage /from dataset0 by,

Age of cc by month B CCageFD;

(otal money being spent from the aailable limit /= la!h P =;;;;;0

<al B =;;;;; Q ag <<

%o, total money spent can be found as,

(ot B Age of cc by month K <al

(otal money spent on each month can be calculated as,

DsBtotK Age of cc by month

it chec! for condition of fraud /i.e0 B

$raud condition B /=; K ds0 is amount spent today /Amt( in dataset0

If true, there may chance for fraud using this property and its critical alue is Amt(F

/=;Kds0

If flase, no fraud occurance and critical alue ;.;=

REFERENCE:

%.<enson Edwin -aR, A. Annie 'ortia, SAnalysis on Credit Card $raud Detection

#ethodsT, IEEE International Conference on Computer, Communication and Electrical

(echnology, IEEE March /0112

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Colphenebswh 1816Document2 pagesColphenebswh 1816vinoth kumar SanthanamPas encore d'évaluation

- Module 6 DrillingDocument18 pagesModule 6 DrillingdejanflojdPas encore d'évaluation

- Self-Regulated Learning - Where We Are TodayDocument13 pagesSelf-Regulated Learning - Where We Are Todayvzzvnumb100% (1)

- Realizing Higher Productivity by Implementing Air Drilling Tech For Drilling Hard Top Hole Sections in Vindhyan FieldsDocument7 pagesRealizing Higher Productivity by Implementing Air Drilling Tech For Drilling Hard Top Hole Sections in Vindhyan FieldsLok Bahadur RanaPas encore d'évaluation

- Kirsten Koyle Grade 5 Science and Technology Understanding Matter and EnergyDocument10 pagesKirsten Koyle Grade 5 Science and Technology Understanding Matter and Energyapi-311535995Pas encore d'évaluation

- Selected Books For Electronic Hobby Center (EHC) : A. Books (Available in The Resource Centre)Document9 pagesSelected Books For Electronic Hobby Center (EHC) : A. Books (Available in The Resource Centre)Rajalakshmi BashyamPas encore d'évaluation

- Mobile Crane Inspector & CertificationDocument3 pagesMobile Crane Inspector & CertificationgptothPas encore d'évaluation

- 50 Practice Questions With Topics For IELTS Speaking Part 3Document5 pages50 Practice Questions With Topics For IELTS Speaking Part 3Adeel Raza SyedPas encore d'évaluation

- 15 Oil Fired Crucible FurnaceDocument2 pages15 Oil Fired Crucible Furnaceudaya kumarPas encore d'évaluation

- A5 MSMD 400WDocument1 pageA5 MSMD 400WInfo PLSPas encore d'évaluation

- Project Goals/ ObjectivesDocument51 pagesProject Goals/ ObjectivesJoyce Abegail De PedroPas encore d'évaluation

- Fingerstyle Guitar - Fingerpicking Patterns and ExercisesDocument42 pagesFingerstyle Guitar - Fingerpicking Patterns and ExercisesSeminario Lipa100% (6)

- PresentationDocument67 pagesPresentationNagarjuna Reddy MPas encore d'évaluation

- Xpulse200t Manual de PartesDocument92 pagesXpulse200t Manual de PartesAthiq Nehman100% (2)

- Swot Analysis of PTCLDocument5 pagesSwot Analysis of PTCLM Aqeel Akhtar JajjaPas encore d'évaluation

- Firewall Geometric Design-SaiTejaDocument9 pagesFirewall Geometric Design-SaiTejanaveenPas encore d'évaluation

- Parallel Processing:: Multiple Processor OrganizationDocument24 pagesParallel Processing:: Multiple Processor OrganizationKrishnaPas encore d'évaluation

- Scan 1111111111Document1 pageScan 1111111111angela1178Pas encore d'évaluation

- DIN 3900 1984 04 Compression CouplingsDocument3 pagesDIN 3900 1984 04 Compression Couplingsjangaswathi0% (1)

- Using Spreadsheets For Steel DesignDocument4 pagesUsing Spreadsheets For Steel DesignAmro Ahmad AliPas encore d'évaluation

- DSCDocument7 pagesDSCthanhnguyenhhvnPas encore d'évaluation

- IV-series-monitor Monitor Um 440gb GB WW 1027-3Document360 pagesIV-series-monitor Monitor Um 440gb GB WW 1027-3Quang DuyPas encore d'évaluation

- Clan Survey Pa 297Document16 pagesClan Survey Pa 297Sahara Yusoph SanggacalaPas encore d'évaluation

- SSMT Solution ManualDocument12 pagesSSMT Solution ManualPraahas Amin0% (1)

- Physics 2Document2 pagesPhysics 2MarcusKlahnTokoeJr.Pas encore d'évaluation

- Surveyor C.VDocument2 pagesSurveyor C.VMasood Shabbir Khan Niazi100% (1)

- Waterjet CutterDocument4 pagesWaterjet CutterCarlos RamirezPas encore d'évaluation

- Running Head: Digital Storytelling As An Assessment Tool 1Document9 pagesRunning Head: Digital Storytelling As An Assessment Tool 1vifongiPas encore d'évaluation

- Hatch Cover Maintenance PlanDocument5 pagesHatch Cover Maintenance Planvinay3972Pas encore d'évaluation

- FacebookDocument13 pagesFacebookDivya SharmaPas encore d'évaluation