Académique Documents

Professionnel Documents

Culture Documents

FTD Companies Research Note 1

Transféré par

api-2494612420 évaluation0% ont trouvé ce document utile (0 vote)

179 vues1 pageTitre original

ftd companies research note 1

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

179 vues1 pageFTD Companies Research Note 1

Transféré par

api-249461242Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

22 April 2014

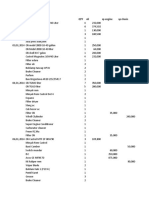

Summary company financials ($m)

Year end December FY2011 FY2012 FY2013* FY2014E

Price $31.97 Revenue 587.2 613.5 627.3 655.0

Market cap ($m) 597.8 5.9% 4.5% 2.3% 4.4%

Enterprise value ($m) 714.0 EBITDA 76.1 80.1 79.0 86.0

13.0% 13.1% 12.6% 13.1%

Free float 100% Net income excl g/w 40.9 46.7 50.5 52.2

Daily val traded ($m) 4.84 Net debt (cash) 214.1 176.7 171.8 166.7

Shares outstanding 18.6 18.6 18.7 17.1

* financials FY2013 exclude $13.4m separation costs and $1.6m litigation expense

EV/Sales 1.14 1.09

EV/EBITDA 9.0 8.3

PE excluding goodwill amortisation 11.8 10.5

FTD Companies, Inc.

Revenue growth

EBITDA margin

FTD Companies Inc is the world's largest floral network service provider, with a $597m market capitalisation and $172m of YE2013 net debt. FTD

has market leadership positions in the US, Canada, and in the UK through its Interflora network. FTD was spun off from United Online in

November 2013. FTD trades on 10.5x PE (ex amortisation, including announced buybacks) for FY2014, and its business model has historically

allowed successful operation with higher levels of financial leverage than current.

Floral network service providers, such as FTD, operate a marketing- and brand-driven business model to generate floral orders from consumers

via the internet and mobile apps. FTD then uses a third party fulfillment model including independent florists and third-party distributors who

ship directly to the customer either by same day and next day delivery selections.

Traditional retail US florist numbers are in decline by about 3% per annum and the remaining businesses are increasingly dependent on floral

network services to provide incoming order volume to offset business lost to the internet and supermarket channels. The result is something of a

winner-take-all dynamic, where the online flower marketplace is dominated by the activities of four corporations: FTD, Teleflora, 1-800-

Flowers, and Proflowers. According to our analysis, FTD maintains a leading position (US revenue $485m) against other US floral network

providers such as Teleflora (US revenue $420m) and the 1-800-Flowers division BloomNet (US revenue $82m). However, direct flowers supplier

ProFlowers.com (US revenue estimate $428m) has grown in excess of the rates achieved by the floral network services, and may present the

greatest threat to their volume of orders. Nevertheless, FTD currently continues to grow orders and revenues, and achieves more than double

ProFlowers' operating margin per customer according to our analysis, suggesting the growth of ProFlowers has come from other market

segments primarily.

FTD's business has delivered steady performance over the last decade, with average organic revenue growth of 5.2% and EBITDA margins

ranging between 10.5% and 14.6%. FTD's total US flower orders were 4.5m in FY2013, relative to a figure of 3.2m orders in FY2003, an annual

growth rate of 3.5%. Order growth for the last two years has averaged 2.1%. FTD throughputs its increasing orders through the decreasing

number of traditional retail florists in the US, an outcome which has tended to enhance the efficiency of FTD's model as well as increasing the

importance of FTD's order stream as a percentage of the traditional florists' overall revenues. The average FTD member florist processed $35.2k

of orders from FTD for FY2013, compared to a FY2003 equivalent of $18.4k. FTD's average revenue per florist is also higher than its competitor

set, with Teleflora revenue per florist at $26.3k and BloomNet at $27.3k. FTD's florist network, perhaps thanks to their above average revenues,

appear to have reasonable financial health, as measured by FTD's own write offs, which currently stand at 0.4% of revenue, relative to a historic

range of 0.2-1.8% of revenue.

In addition to the generation of floral orders, FTD provides its florist network with a broad range of subscription-based retail service products

designed to promote their business efficiency. These products generate c. 25% of FTD's revenue and include services in EPOS, e-commerce,

credit card processing, branding, online marketing, order transmission, and system support services.

FTD utilises a capital-light business model in that it does not own inventory, nor operate retail, warehouse or distribution operations. Despite

this, FTD does receive up front payment from consumers before FTD then pays their floral network members within 4-5 weeks. This allows FTD

to maintain a negative net working capital position which was -6.2% of revenue for FY2013.

FTD currently trades at 10.5x PE (earnings excluding goodwill amortisation, including announced FY2014 share buybacks) for FY2014E. Assuming

continued low single digit revenue growth, with EBITDA margins gradually expanding to 14% (versus consensus 13.1% margin FY2014) on

account of the business' natural operating leverage and pricing power within its network of florists, the shares trade on a prospective FY2016

multiple of 9.2x PE with debt paid down to $40m (0.4x EBITDA).

However, given the subscription element to FTD's business model, low capex requirement, and negative working capital allowing cashflows to

exceed earnings, FTD may attract the sort of investor who will look for the company to take on leverage, as it has in its private equity past with

Leonard Green & Partners in 2003.

At last quarter's end, FTD authorized a $50m share repurchase (included in our estimates). However, FY2014 debt levels at 1.9x EBITDA still

remain low relative to the 5.8x senior debt to EBITDA placed on the company for the 2003 Leondard Green & Partners buyout. If FTD today took

debt to 5.8x EBITDA then the share repurchase could be increased from a $50m buyback to a $380m tender offer representing more than half

the company's outstanding stock. Such an offer, assuming successfully carried out at a 20% premium to today's equity price, would leave the

remaining equity trading on 6.7x PE.

As ancilliary points we'd note that the Leonard Green & Partners buyout additionally secured junior debt on the company, at 8.5x EBITDA, a

higher rating that FTD's current EV/EBITDA of 8.3x. FTD's CEO Robert Apatoff also possesses a history with private equity firm Patriarch Partners,

as well as being a FTD board member during the Leonard Green & Partners buyout.

Vous aimerez peut-être aussi

- Its Activists Not Buffett Who Can Change Corporate America - NytimesDocument4 pagesIts Activists Not Buffett Who Can Change Corporate America - Nytimesapi-249461242Pas encore d'évaluation

- Carl Icahn What I Do Is Good For AmericaDocument3 pagesCarl Icahn What I Do Is Good For Americaapi-249461242Pas encore d'évaluation

- Somnomed Research NoteDocument2 pagesSomnomed Research Noteapi-249461242Pas encore d'évaluation

- Viasat Research NoteDocument1 pageViasat Research Noteapi-249461242Pas encore d'évaluation

- SbryDocument60 pagesSbryapi-249461242Pas encore d'évaluation

- Theravance Research NoteDocument1 pageTheravance Research Noteapi-249461242Pas encore d'évaluation

- Songbird Estates Research NoteDocument1 pageSongbird Estates Research Noteapi-249461242Pas encore d'évaluation

- What Ive Learned About InvestingDocument5 pagesWhat Ive Learned About Investingapi-249461242Pas encore d'évaluation

- Coca Cola HellenicDocument2 pagesCoca Cola Hellenicapi-249461242Pas encore d'évaluation

- Collins Foods Research NoteDocument1 pageCollins Foods Research Noteapi-249461242Pas encore d'évaluation

- Zooplus Research NoteDocument1 pageZooplus Research Noteapi-249461242Pas encore d'évaluation

- Lands EndDocument1 pageLands Endapi-249461242Pas encore d'évaluation

- Miko Research NoteDocument1 pageMiko Research Noteapi-249461242Pas encore d'évaluation

- Proto Corp Research NoteDocument1 pageProto Corp Research Noteapi-249461242Pas encore d'évaluation

- Athens Water Supply and Sewerage Research NoteDocument1 pageAthens Water Supply and Sewerage Research Noteapi-249461242Pas encore d'évaluation

- Dart Group Research NoteDocument1 pageDart Group Research Noteapi-249461242Pas encore d'évaluation

- Thorntons Research NoteDocument2 pagesThorntons Research Noteapi-249461242Pas encore d'évaluation

- Ebay Research NoteDocument1 pageEbay Research Noteapi-249461242Pas encore d'évaluation

- Aegean Airlines Research NoteDocument2 pagesAegean Airlines Research Noteapi-249461242Pas encore d'évaluation

- Fujitec Research Note 3Document2 pagesFujitec Research Note 3api-249461242Pas encore d'évaluation

- Rocketfuel Research NoteDocument2 pagesRocketfuel Research Noteapi-249461242Pas encore d'évaluation

- Mondelez Research Note 1Document1 pageMondelez Research Note 1api-249461242Pas encore d'évaluation

- Crossrail The Impact On Londons Property MarketDocument20 pagesCrossrail The Impact On Londons Property Marketapi-249461242Pas encore d'évaluation

- Stef Research Note 1Document1 pageStef Research Note 1api-249461242Pas encore d'évaluation

- Good Energy Research NoteDocument2 pagesGood Energy Research Noteapi-249461242Pas encore d'évaluation

- Notice of Revisions To Mid-Term Management PlanDocument1 pageNotice of Revisions To Mid-Term Management Planapi-249461242Pas encore d'évaluation

- Global Brass and Copper Holdings Research Note 1Document2 pagesGlobal Brass and Copper Holdings Research Note 1api-249461242Pas encore d'évaluation

- Crossrail Property Impact StudyDocument224 pagesCrossrail Property Impact Studyapi-249461242Pas encore d'évaluation

- Otis - FujitecDocument2 pagesOtis - Fujitecapi-249461242Pas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Triblender Wet Savoury F3218Document32 pagesTriblender Wet Savoury F3218danielagomezga_45545100% (1)

- Master StationDocument138 pagesMaster StationWilmer Quishpe AndradePas encore d'évaluation

- Vallance - Sistema Do VolvoDocument15 pagesVallance - Sistema Do VolvoNuno PachecoPas encore d'évaluation

- 1 N 2Document327 pages1 N 2Muhammad MunifPas encore d'évaluation

- ITIL - Release and Deployment Roles and Resps PDFDocument3 pagesITIL - Release and Deployment Roles and Resps PDFAju N G100% (1)

- JIS K 6250: Rubber - General Procedures For Preparing and Conditioning Test Pieces For Physical Test MethodsDocument43 pagesJIS K 6250: Rubber - General Procedures For Preparing and Conditioning Test Pieces For Physical Test Methodsbignose93gmail.com0% (1)

- ДСТУ EN ISO 2400-2016 - Калибровочный блок V1Document11 pagesДСТУ EN ISO 2400-2016 - Калибровочный блок V1Игорь ВадешкинPas encore d'évaluation

- S0231689H02-B01-0001 Rev 02 Code 1 General Arrangement Drawing For 44 Kva Diesel Generator PDFDocument6 pagesS0231689H02-B01-0001 Rev 02 Code 1 General Arrangement Drawing For 44 Kva Diesel Generator PDFAnonymous AfjzJdnPas encore d'évaluation

- Superior University: 5Mwp Solar Power Plant ProjectDocument3 pagesSuperior University: 5Mwp Solar Power Plant ProjectdaniyalPas encore d'évaluation

- BC Specialty Foods DirectoryDocument249 pagesBC Specialty Foods Directoryjcl_da_costa6894Pas encore d'évaluation

- LNGC Q-Flex Al Rekayyat - Imo 9397339 - Machinery Operating ManualDocument581 pagesLNGC Q-Flex Al Rekayyat - Imo 9397339 - Machinery Operating Manualseawolf50Pas encore d'évaluation

- User-Centered Website Development: A Human-Computer Interaction ApproachDocument24 pagesUser-Centered Website Development: A Human-Computer Interaction ApproachKulis KreuznachPas encore d'évaluation

- NVH Analysis in AutomobilesDocument30 pagesNVH Analysis in AutomobilesTrishti RastogiPas encore d'évaluation

- A Dream Takes FlightDocument3 pagesA Dream Takes FlightHafiq AmsyarPas encore d'évaluation

- Method StatementDocument11 pagesMethod StatementMohammad Fazal Khan100% (1)

- Dubai Healthcare Providers DirectoryDocument30 pagesDubai Healthcare Providers DirectoryBrave Ali KhatriPas encore d'évaluation

- The Causes of Cyber Crime PDFDocument3 pagesThe Causes of Cyber Crime PDFInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- Renewable and Sustainable Energy ReviewsDocument13 pagesRenewable and Sustainable Energy ReviewsMohammadreza MalekMohamadiPas encore d'évaluation

- 59 - 1006 - CTP-Final - 20200718 PDFDocument11 pages59 - 1006 - CTP-Final - 20200718 PDFshubh.icai0090Pas encore d'évaluation

- Lea 201 Coverage Topics in Midterm ExamDocument40 pagesLea 201 Coverage Topics in Midterm Examshielladelarosa26Pas encore d'évaluation

- Checklist PBL 2Document3 pagesChecklist PBL 2Hazrina AwangPas encore d'évaluation

- Book Two - 2da. EdiciónDocument216 pagesBook Two - 2da. EdiciónJhoselainys PachecoPas encore d'évaluation

- Nuxeo Platform 5.6 UserGuideDocument255 pagesNuxeo Platform 5.6 UserGuidePatrick McCourtPas encore d'évaluation

- Business PlanDocument9 pagesBusiness PlanRico DejesusPas encore d'évaluation

- Javascript: What You Should Already KnowDocument6 pagesJavascript: What You Should Already KnowKannan ParthasarathiPas encore d'évaluation

- Enhancing reliability of CRA piping welds with PAUTDocument10 pagesEnhancing reliability of CRA piping welds with PAUTMohsin IamPas encore d'évaluation

- A Research About The Canteen SatisfactioDocument50 pagesA Research About The Canteen SatisfactioJakeny Pearl Sibugan VaronaPas encore d'évaluation

- Itec 3100 Student Response Lesson PlanDocument3 pagesItec 3100 Student Response Lesson Planapi-346174835Pas encore d'évaluation

- EE3331C Feedback Control Systems L1: Overview: Arthur TAYDocument28 pagesEE3331C Feedback Control Systems L1: Overview: Arthur TAYpremsanjith subramani0% (1)

- Siyaram S AR 18-19 With Notice CompressedDocument128 pagesSiyaram S AR 18-19 With Notice Compressedkhushboo rajputPas encore d'évaluation