Académique Documents

Professionnel Documents

Culture Documents

JKhogges

Transféré par

Degrace NsCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

JKhogges

Transféré par

Degrace NsDroits d'auteur :

Formats disponibles

Cost of Capital = D1/Price + growth = 2.5/25 +.04 =.

14 or 14%

After Annoucement Value of Share = 1.5/(.14-.08)= 25

FV -1000

PMT -40

N 30

Rate 4.40%

PV $934.07

So Price of the Bond should be $934.07

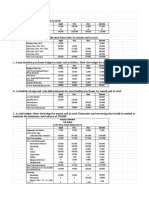

a. Compute the free cash flows for each year of Epiphany's project.

Year 0 Year 1 Year 2 Year 3

Sales 100000 100000 100000

Less: COGS 50000 50000 50000

Less: Dep 30000 30000 30000

EBIT 20000 20000 20000

Less: Taxes 7000 7000 7000

Net Income 13000 13000 13000

Net Income $13,000 $13,000 $13,000

Add: Depriciation $30,000 $30,000 $30,000

Add: Changes in Working Capital ($5,000) ($5,000) $10,000

Investment ($90,000)

Net Cash Flow ($90,000) $38,000 $38,000 $53,000

1. JRN enterprises just announced that it plans to cut its dividend from $2.50 to $1.50 per share and use the extra funds to expand its operations.

Prior to this announcement, JRN's dividends were expected to grow at 4% per year and JRN's stock was trading at $25.00 per share. With the

new expansion, JRN's dividends are expected to grow at 8% per year indefinitely. Assuming that JRN's risk is unchanged by the expansion, the

value of a share of JRN after the announcement is closest to _________. (Note: Compute the cost of capital, r, first then compute the current

price).

2. The Sisyphean Company has a bond outstanding with a face value of $1000 that reaches maturity in 15 years. The bond certificate indicates

that the stated coupon rate for this bond is 8% and that the coupon payments are to be made semi-annually. Assuming the appropriate YTM on

the Sisyphean bond is 8.8%, then at what price should this bond trade for?

3. Epiphany Industries is considering a new capital budgeting project that will last for three years. Epiphany plans on using a cost of capital of

12% to evaluate this project. Based on extensive research, it has prepared the following incremental cash flow projects: Year 0 1 2 3 Sales

(Revenues) 100,000 100,000 100,000 - Cost of Goods Sold (50% of Sales) 50,000 50,000 50,000 - Depreciation 30,000 30,000 30,000 = EBIT

20,000 20,000 20,000 - Taxes (35%) 7000 7000 7000 = unlevered net income 13,000 13,000 13,000 + Depreciation 30,000 30,000 30,000 +

changes to working capital -5,000 -5,000 10,000 - capital expenditures -90,000

b. Compute the NPV

Year Cash Flow PV Factor @12% PV

0 -90000 1 -90000

1 38000 0.892857143 33928.57

2 38000 0.797193878 30293.37

3 53000 0.711780248 37724.35

NPV 11946.29

c. Compute the IRR price

Year Cash Flow

0 -90000

1 38000

2 38000

3 53000

IRR 19.14%

a. For the year ending December 31, 2006 Luther's earnings per share are closest to ______________.

Basic EPS = 10.6/10.2 =$1.04

Diluted EPS= 10.6/(10.2+.3) =$1.01

(If only one needs to be mentioned we will mention Diluted EPS)

b. Luther's Operating Margin for the year ending December 31, 2005 is closest to __________.

Operating Margin = 31.3/578.3=.0541 or 5.41%

c. Luther's return on equity (ROE) for the year ending December 31, 2006 is closest to __________.

ROE=Net Income/(Average Stockholder Equity) = 10.6/((126.6+63.6)/2)=.1115 or 11.15%

d. Luther's price - earnings ration (P/E) for the year ending December 31, 2006 is closest to _________

P/E Ration = Price/Earning Per Share = 16/1.04=15.38

(Note: PE ration is calculated fron Basic EPS)

4.Consider the following income statement and other information: Luther Corporation Consolidated Income Statement Year ended December 31

(in $ millions) 2006 2005 Total sales 610.1 578.3 Cost of sales (500.2) (481.9) Gross profit 109.9 96.4 Selling, general, and administrative

expenses (40.5) (39.0) Research and development (24.6) (22.8) Depreciation and amortization (3.6) (3.3) Operating income 41.2 31.3 Other

income --- --- Earnings before interest and taxes (EBIT) 41.2 31.3 Interest income (expense) (25.1) (15.8) Pretax income 16.1 15.5 Taxes (5.5)

(5.3) Net income 10.6 10.2 Price per share $16 $15 Shares outstanding (millions) 10.2 8.0 Stock options outstanding (millions) 0.3 0.2

Stockholders' Equity 126.6 63.6 Total Liabilities and Stockholders' Equity 533.1 386.7

Money Required for first year of Education(at age of 18) = 12500*(1.04^18) =$25,322.71

Money Required for Second year of Education(at age of 19) = 12500*(1.04^19) =$26,335.61

Money Required for third year of Education(at age of 20) = 12500*(1.04^20) =$27,389.04

Money Required for Fourth year of Education(at age of 21) = 12500*(1.04^21) =$28,484.60

5. Suppose that a young couple has just had their first baby and they wish to ensure that enough money will be available to pay for their child's

college education. Currently, college tuition, books, fees, and other costs, average $12,500 per year. On average, tuition and other costs have

historically increased at a rate of 4% per year. Assume that college costs continue to increase an average of 4% per year. How much money will

she need to have in the future for each of her four years of her undergraduate education when she starts college at age of 18.

1. JRN enterprises just announced that it plans to cut its dividend from $2.50 to $1.50 per share and use the extra funds to expand its operations.

Prior to this announcement, JRN's dividends were expected to grow at 4% per year and JRN's stock was trading at $25.00 per share. With the

new expansion, JRN's dividends are expected to grow at 8% per year indefinitely. Assuming that JRN's risk is unchanged by the expansion, the

value of a share of JRN after the announcement is closest to _________. (Note: Compute the cost of capital, r, first then compute the current

price).

2. The Sisyphean Company has a bond outstanding with a face value of $1000 that reaches maturity in 15 years. The bond certificate indicates

that the stated coupon rate for this bond is 8% and that the coupon payments are to be made semi-annually. Assuming the appropriate YTM on

the Sisyphean bond is 8.8%, then at what price should this bond trade for?

3. Epiphany Industries is considering a new capital budgeting project that will last for three years. Epiphany plans on using a cost of capital of

12% to evaluate this project. Based on extensive research, it has prepared the following incremental cash flow projects: Year 0 1 2 3 Sales

(Revenues) 100,000 100,000 100,000 - Cost of Goods Sold (50% of Sales) 50,000 50,000 50,000 - Depreciation 30,000 30,000 30,000 = EBIT

20,000 20,000 20,000 - Taxes (35%) 7000 7000 7000 = unlevered net income 13,000 13,000 13,000 + Depreciation 30,000 30,000 30,000 +

changes to working capital -5,000 -5,000 10,000 - capital expenditures -90,000

4.Consider the following income statement and other information: Luther Corporation Consolidated Income Statement Year ended December 31

(in $ millions) 2006 2005 Total sales 610.1 578.3 Cost of sales (500.2) (481.9) Gross profit 109.9 96.4 Selling, general, and administrative

expenses (40.5) (39.0) Research and development (24.6) (22.8) Depreciation and amortization (3.6) (3.3) Operating income 41.2 31.3 Other

income --- --- Earnings before interest and taxes (EBIT) 41.2 31.3 Interest income (expense) (25.1) (15.8) Pretax income 16.1 15.5 Taxes (5.5)

(5.3) Net income 10.6 10.2 Price per share $16 $15 Shares outstanding (millions) 10.2 8.0 Stock options outstanding (millions) 0.3 0.2

Stockholders' Equity 126.6 63.6 Total Liabilities and Stockholders' Equity 533.1 386.7

5. Suppose that a young couple has just had their first baby and they wish to ensure that enough money will be available to pay for their child's

college education. Currently, college tuition, books, fees, and other costs, average $12,500 per year. On average, tuition and other costs have

historically increased at a rate of 4% per year. Assume that college costs continue to increase an average of 4% per year. How much money will

she need to have in the future for each of her four years of her undergraduate education when she starts college at age of 18.

Vous aimerez peut-être aussi

- Mini Case Chapter 3 Final VersionDocument14 pagesMini Case Chapter 3 Final VersionAlberto MariñoPas encore d'évaluation

- Business Economics ICFAIDocument20 pagesBusiness Economics ICFAIDaniel VincentPas encore d'évaluation

- Investment Decision MethodDocument44 pagesInvestment Decision MethodashwathPas encore d'évaluation

- CFROIDocument15 pagesCFROImakrantjiPas encore d'évaluation

- Valuation Final PPT 2015Document48 pagesValuation Final PPT 2015roopesh gowdaPas encore d'évaluation

- Fitch RatingsDocument7 pagesFitch RatingsTareqPas encore d'évaluation

- Beta Management QuestionsDocument1 pageBeta Management QuestionsbjhhjPas encore d'évaluation

- Segment AnalysisDocument53 pagesSegment AnalysisamanPas encore d'évaluation

- Case 3 - Starbucks - Assignment QuestionsDocument3 pagesCase 3 - Starbucks - Assignment QuestionsShaarang BeganiPas encore d'évaluation

- Company AnalysisDocument11 pagesCompany AnalysisRamesh Chandra DasPas encore d'évaluation

- Investment BKM 5th EditonDocument21 pagesInvestment BKM 5th EditonKonstantin BezuhanovPas encore d'évaluation

- Leverage Buyout - LBO Analysis: Investment Banking TutorialsDocument26 pagesLeverage Buyout - LBO Analysis: Investment Banking Tutorialskarthik sPas encore d'évaluation

- Numericals On Stock Swap - SolutionDocument15 pagesNumericals On Stock Swap - SolutionAnimesh Singh GautamPas encore d'évaluation

- Acc 255 Final Exam Review Packet (New Material)Document6 pagesAcc 255 Final Exam Review Packet (New Material)Tajalli FatimaPas encore d'évaluation

- IPO UnderpricingDocument9 pagesIPO UnderpricingHendra Gun DulPas encore d'évaluation

- Three Stage Dividend Discount ModelDocument6 pagesThree Stage Dividend Discount ModeljibranqqPas encore d'évaluation

- Nvda Vs Google Final ADocument6 pagesNvda Vs Google Final AAnonymous Ht0MIJPas encore d'évaluation

- F Wall Street 4-JNJ-Analysis (2009)Document1 pageF Wall Street 4-JNJ-Analysis (2009)smith_raPas encore d'évaluation

- 2.3 Fra and Swap ExercisesDocument5 pages2.3 Fra and Swap ExercisesrandomcuriPas encore d'évaluation

- Elasticity EconomicsDocument14 pagesElasticity EconomicsYiwen LiuPas encore d'évaluation

- Asset Schedule Corality ModelOff Worked Solution Asset ScheduleDocument23 pagesAsset Schedule Corality ModelOff Worked Solution Asset ScheduleFelicia Shan SugataPas encore d'évaluation

- Technical Analysis of The Size PremiumDocument4 pagesTechnical Analysis of The Size PremiumRamiro Gamen0% (1)

- Assumptions: DCF ModelDocument3 pagesAssumptions: DCF Modelniraj kumarPas encore d'évaluation

- SMCH 12Document101 pagesSMCH 12FratFool33% (3)

- Test 01 21 - Tri3 - FINA309Document9 pagesTest 01 21 - Tri3 - FINA309Kateryna Ternova100% (1)

- Finance Case Study SolutionDocument4 pagesFinance Case Study SolutionOmar MosalamPas encore d'évaluation

- Alta Fox JYNT Long - Final Version PDFDocument38 pagesAlta Fox JYNT Long - Final Version PDFJerry HsiangPas encore d'évaluation

- Completed Chapter 5 Mini Case Working Papers FA14Document12 pagesCompleted Chapter 5 Mini Case Working Papers FA14ZachLoving75% (4)

- Axis Bank ValuvationDocument26 pagesAxis Bank ValuvationGermiya K JosePas encore d'évaluation

- Godrej AgrovetDocument37 pagesGodrej AgrovetBandaru NarendrababuPas encore d'évaluation

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisD'EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisPas encore d'évaluation

- Valuation Models: Aswath DamodaranDocument47 pagesValuation Models: Aswath DamodaranSumit Kumar BundelaPas encore d'évaluation

- 09 JAZZ Equity Research ReportDocument9 pages09 JAZZ Equity Research ReportAfiq KhidhirPas encore d'évaluation

- Buffett CaseDocument15 pagesBuffett CaseElizabeth MillerPas encore d'évaluation

- Chapter 6 Review in ClassDocument32 pagesChapter 6 Review in Classjimmy_chou1314Pas encore d'évaluation

- CM FinanceforUndergradsDocument5 pagesCM FinanceforUndergradsChaucer19Pas encore d'évaluation

- ENG 111 Final SolutionsDocument12 pagesENG 111 Final SolutionsDerek EstrellaPas encore d'évaluation

- Reverse Discounted Cash FlowDocument11 pagesReverse Discounted Cash FlowSiddharthaPas encore d'évaluation

- Q&aDocument70 pagesQ&apaulosejgPas encore d'évaluation

- China Distilled Spirits Manufacturing Industry ReportDocument9 pagesChina Distilled Spirits Manufacturing Industry ReportDrink SectorPas encore d'évaluation

- Tax TileDocument4 pagesTax TileDrYogesh MehtaPas encore d'évaluation

- Chapter 7 SolutionsDocument8 pagesChapter 7 SolutionsAustin LeePas encore d'évaluation

- Sonny Tunnel SystemsDocument28 pagesSonny Tunnel SystemsRudy ZydelPas encore d'évaluation

- CoorsDocument2 pagesCoorsdizenz07Pas encore d'évaluation

- Particulars Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Trailing Best CaseDocument31 pagesParticulars Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Trailing Best CasePranay Singh Raghuvanshi100% (1)

- Adventures in Debentures GibbonsDocument144 pagesAdventures in Debentures GibbonsRimpy SondhPas encore d'évaluation

- Example: What Is The Value at Risk (VAR) of ADocument10 pagesExample: What Is The Value at Risk (VAR) of Afogobr8469Pas encore d'évaluation

- Exer 10 1Document14 pagesExer 10 1AbhishekKumar0% (2)

- Valuation Errors - HBSDocument13 pagesValuation Errors - HBSlaliaisondangereusePas encore d'évaluation

- Quality of Earnings Thornton L o PDF 1413879Document2 pagesQuality of Earnings Thornton L o PDF 1413879Ashutosh GuptaPas encore d'évaluation

- Tax Equity Financing and Asset RotationDocument18 pagesTax Equity Financing and Asset RotationShofiul HasanPas encore d'évaluation

- Yacktman PresentationDocument34 pagesYacktman PresentationVijay MalikPas encore d'évaluation

- Seminar 3 Discount Rates & Yield Curves (Lecture Notes Recap)Document6 pagesSeminar 3 Discount Rates & Yield Curves (Lecture Notes Recap)api-3695734100% (1)

- Company Valuation MultiplesDocument7 pagesCompany Valuation Multiplessebastianflyte77Pas encore d'évaluation

- Accounting For ValueDocument15 pagesAccounting For Valueolst100% (5)

- Jun18l1-Ep04 QDocument18 pagesJun18l1-Ep04 QjuanPas encore d'évaluation

- Financial Soundness Indicators for Financial Sector Stability in Viet NamD'EverandFinancial Soundness Indicators for Financial Sector Stability in Viet NamPas encore d'évaluation

- Sample Event Management PlanDocument5 pagesSample Event Management PlanAndile NtuliPas encore d'évaluation

- Answer and 642-832 - Strategy-Recipie 3612 PDFDocument16 pagesAnswer and 642-832 - Strategy-Recipie 3612 PDFDegrace NsPas encore d'évaluation

- CaliforniainvestigationpostsexualassaultvictimandincidentinformationDocument3 pagesCaliforniainvestigationpostsexualassaultvictimandincidentinformationDegrace NsPas encore d'évaluation

- ASM8-M07-L02 8c39a336Document4 pagesASM8-M07-L02 8c39a336Degrace NsPas encore d'évaluation

- Heads Up: Urricane Vacuation Nalysis and Ecision Upport Tility RogramDocument46 pagesHeads Up: Urricane Vacuation Nalysis and Ecision Upport Tility RogramDegrace NsPas encore d'évaluation

- The 100 Days Challenge - 100 Ways in 100 DaysDocument15 pagesThe 100 Days Challenge - 100 Ways in 100 DaysSlaavo100% (2)

- NLP For RookiesDocument193 pagesNLP For Rookiesimiloje100% (4)

- CCNP Network Engineer Resume Free Word DownloadDocument9 pagesCCNP Network Engineer Resume Free Word DownloadbilllPas encore d'évaluation

- Vsphere 5 Cheat SheetDocument3 pagesVsphere 5 Cheat SheetDegrace NsPas encore d'évaluation

- LAN Design: LAN Switching and Wireless - Chapter 1Document30 pagesLAN Design: LAN Switching and Wireless - Chapter 1Degrace Ns100% (1)

- Heads Up: Urricane Vacuation Nalysis and Ecision Upport Tility RogramDocument46 pagesHeads Up: Urricane Vacuation Nalysis and Ecision Upport Tility RogramDegrace NsPas encore d'évaluation

- CCNP Network Engineer Resume Free Word DownloadDocument9 pagesCCNP Network Engineer Resume Free Word DownloadbilllPas encore d'évaluation

- Final AmendementDocument82 pagesFinal AmendementDegrace NsPas encore d'évaluation

- Switch 10 LGDocument394 pagesSwitch 10 LGDegrace NsPas encore d'évaluation

- Music Salary Guide PDFDocument24 pagesMusic Salary Guide PDFSusan JonesPas encore d'évaluation

- PDF For PrintDocument86 pagesPDF For PrintDegrace NsPas encore d'évaluation

- Parting in Yangguan 2Document3 pagesParting in Yangguan 2Degrace NsPas encore d'évaluation

- Health Grant List For Two PreparDocument5 pagesHealth Grant List For Two PreparDegrace NsPas encore d'évaluation

- Parting inDocument3 pagesParting inDegrace NsPas encore d'évaluation

- Music Merrit BadgeDocument6 pagesMusic Merrit BadgeDegrace NsPas encore d'évaluation

- Digital Booklet - Life Is GoodDocument15 pagesDigital Booklet - Life Is GoodChristian CamposPas encore d'évaluation

- PDF For PrintDocument86 pagesPDF For PrintDegrace NsPas encore d'évaluation

- Multi PDFDocument3 pagesMulti PDFDegrace NsPas encore d'évaluation

- Autumn Moon Over The Han PalaceDocument3 pagesAutumn Moon Over The Han PalaceDegrace NsPas encore d'évaluation

- The Essence of Success - Earl NightingaleDocument2 pagesThe Essence of Success - Earl NightingaleDegrace Ns44% (16)

- Ambush From All SidesDocument3 pagesAmbush From All SidesDegrace NsPas encore d'évaluation

- CD 4 - Autumn RecollectionsDocument3 pagesCD 4 - Autumn RecollectionsDegrace NsPas encore d'évaluation

- Orientation - POFT 1328 - 4-Week Classes - SP2012Document5 pagesOrientation - POFT 1328 - 4-Week Classes - SP2012Degrace NsPas encore d'évaluation

- Rogerian Model 2Document2 pagesRogerian Model 2Degrace NsPas encore d'évaluation

- AnswersDocument9 pagesAnswersSandip AgarwalPas encore d'évaluation

- Entrepreneurial Finance and Private Equity: (GBUS 844, Fall 2002)Document19 pagesEntrepreneurial Finance and Private Equity: (GBUS 844, Fall 2002)KARTHIK145Pas encore d'évaluation

- Special Production IssuesDocument43 pagesSpecial Production IssuesMonique VillaPas encore d'évaluation

- Fees Hit Private-EquityCos - Dechert StudyDocument3 pagesFees Hit Private-EquityCos - Dechert StudyputigersPas encore d'évaluation

- E Corporate Manager June 2022 - FINALDocument90 pagesE Corporate Manager June 2022 - FINALlegal shuruPas encore d'évaluation

- Home Office, Branch and Agency Accounting: Acctg 8d 8:30-9:30Document35 pagesHome Office, Branch and Agency Accounting: Acctg 8d 8:30-9:30Danica100% (1)

- Quiz 3 Fin II - Parte 2Document3 pagesQuiz 3 Fin II - Parte 2RicardoPas encore d'évaluation

- JBMA Unclaimed Dividend FY 2014 2021Document27 pagesJBMA Unclaimed Dividend FY 2014 2021equalseriousPas encore d'évaluation

- The Common Forms of Debt Restructuring: Asset SwapDocument5 pagesThe Common Forms of Debt Restructuring: Asset SwapJonathan VidarPas encore d'évaluation

- 2 Past Year Q'sDocument7 pages2 Past Year Q'sJhagantini PalaniveluPas encore d'évaluation

- CHAPTER 1,2 and 3 GodspowerDocument40 pagesCHAPTER 1,2 and 3 GodspowerprincealaseiworimaPas encore d'évaluation

- WorldCom and SatyamDocument17 pagesWorldCom and SatyamM Tanzeel Rahman KhanPas encore d'évaluation

- Summery of California Pizza Kitchen CaseDocument1 pageSummery of California Pizza Kitchen CaseAbid Ullah67% (3)

- Module 5A CBO Corporate Banking Topic 1Document17 pagesModule 5A CBO Corporate Banking Topic 1RajabPas encore d'évaluation

- CH 14 Country and Political RiskDocument32 pagesCH 14 Country and Political Riskklm klmPas encore d'évaluation

- CAPM and Alpha - Practice Problems - SOLUTIONSDocument2 pagesCAPM and Alpha - Practice Problems - SOLUTIONSAlexa WilcoxPas encore d'évaluation

- Incorporation Questionnaire For Startups From Orrick, Herrington & Sutcliffe LLPDocument9 pagesIncorporation Questionnaire For Startups From Orrick, Herrington & Sutcliffe LLPthedundiesPas encore d'évaluation

- Mergers and Acquisitions Country Report PhilippinesDocument12 pagesMergers and Acquisitions Country Report PhilippinesErika PinedaPas encore d'évaluation

- Case 8-31: April May June QuarterDocument2 pagesCase 8-31: April May June QuarterileviejoiePas encore d'évaluation

- 4356062Document5 pages4356062mohitgaba19Pas encore d'évaluation

- The Following Information For CLH Company Is Available On June 30, 2018, The End of A MonthlyDocument5 pagesThe Following Information For CLH Company Is Available On June 30, 2018, The End of A MonthlyJel SanPas encore d'évaluation

- Paper FinanceeeeeeeeeeDocument7 pagesPaper FinanceeeeeeeeeertPas encore d'évaluation

- محاسبة مالية 1 PDFDocument147 pagesمحاسبة مالية 1 PDFRowis E. AzizPas encore d'évaluation

- Business Studies ProjectDocument10 pagesBusiness Studies Projectabarajitha sureshkumarPas encore d'évaluation

- T2 Corporation Income Tax Return (2019 and Later Tax Years) : IdentificationDocument9 pagesT2 Corporation Income Tax Return (2019 and Later Tax Years) : IdentificationBryan WilleyPas encore d'évaluation

- Mas Theories 2018Document18 pagesMas Theories 2018Suzette VillalinoPas encore d'évaluation

- Syndicat 1 - NIKE Financial ManagementDocument12 pagesSyndicat 1 - NIKE Financial ManagementAndhitiawarman NugrahaPas encore d'évaluation

- Chapter Four: Mcgraw-Hill/Irwin 4-1Document18 pagesChapter Four: Mcgraw-Hill/Irwin 4-1John SnowPas encore d'évaluation

- Accounting 3 Investment in AssociatesDocument2 pagesAccounting 3 Investment in AssociatesMina ChouPas encore d'évaluation

- Tesla SolarCity Case AnalysisDocument2 pagesTesla SolarCity Case AnalysisSofia LimaPas encore d'évaluation