Académique Documents

Professionnel Documents

Culture Documents

Miranda v. PDIC

Transféré par

Sean Galvez0 évaluation0% ont trouvé ce document utile (0 vote)

334 vues2 pages1) Miranda withdrew funds from Prime Savings Bank and opted to receive two cashier's checks totaling over $5 million instead of cash.

2) When Miranda deposited the checks into another bank, Prime Savings Bank had its clearing privileges suspended and was declared insolvent. The checks were returned unpaid.

3) Miranda sued Prime Savings Bank, the Philippine Deposit Insurance Corporation (PDIC), and the Bangko Sentral ng Pilipinas (BSP, the central bank) to recover the funds. The trial court ruled in Miranda's favor but the appellate court reversed.

Description originale:

DIGEST

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce document1) Miranda withdrew funds from Prime Savings Bank and opted to receive two cashier's checks totaling over $5 million instead of cash.

2) When Miranda deposited the checks into another bank, Prime Savings Bank had its clearing privileges suspended and was declared insolvent. The checks were returned unpaid.

3) Miranda sued Prime Savings Bank, the Philippine Deposit Insurance Corporation (PDIC), and the Bangko Sentral ng Pilipinas (BSP, the central bank) to recover the funds. The trial court ruled in Miranda's favor but the appellate court reversed.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

334 vues2 pagesMiranda v. PDIC

Transféré par

Sean Galvez1) Miranda withdrew funds from Prime Savings Bank and opted to receive two cashier's checks totaling over $5 million instead of cash.

2) When Miranda deposited the checks into another bank, Prime Savings Bank had its clearing privileges suspended and was declared insolvent. The checks were returned unpaid.

3) Miranda sued Prime Savings Bank, the Philippine Deposit Insurance Corporation (PDIC), and the Bangko Sentral ng Pilipinas (BSP, the central bank) to recover the funds. The trial court ruled in Miranda's favor but the appellate court reversed.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

"

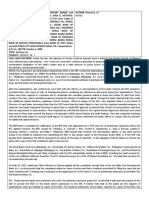

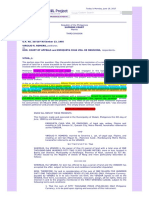

CASE: Miranda v. PDIC

NATURE: Petition for Review on Certiorari under Rule 45

FACTS:

- Miranda was a depositor of Prime Savings Bank. (june 3) She withdrew

substantial amounts but instead of cash she opted to be issued a crossed

cashiers check (cashiers check no. 0000000518) worth 2.5M and worth

3.002M

- Miranda deposited the two checks into her account in another bank

however, Bangko Sentral ng Pilipinas (BSP) suspended the clearing privileges

of Prime Savings Bank effective 2:00 p.m. of June 3, 1999. Prime Savings Bank

declared a bank holiday.

- The two checks of petitioner were returned to her unpaid.

- 2000 the BSP placed Prime Savings Bank under the receivership of the

Philippine Deposit Insurance Corporation (PDIC)

- Miranda filed a civil action for sum of money to recover the funds from her

unpaid checks against Prime Savings Bank, PDIC and the BSP. (TC MIRANDA

WON)

- CA - Reversed the TC and ruled in favor of the PDIC and BSP, dismissing the

case against them,

ISSUE:

(1) Whether the two cashiers checks operate as an assignment of funds in the hands

of the petitioner;

(2) Whether the claim lodged by the petitioner is a disputed claim under Section 30

of Republic Act (R.A.) No. 7653, and therefore, under the jurisdiction of the liquidation

court; and

(3) Whether the respondents are solidarily liable to the petitioner.

HELD: Petition DENIED, CA decision AFFIRMED.

Miranda is entitled to a preference in the assets of Prime Savings Bank in its liquidation

for the amounts of P3,002,000.00 and P2,500,000.00

ARGUMENTS:

MIRANDA

- She is an assignee of the funds of Prime Savings Bank as drawer thereof and

entitled to its immediate payment. (because of checks)

- The disputed claims refer to all claims

- She cannot be placed on the same footing with the ordinary creditors of the

bank because Section 30 of R.A. No. 7653 is for equality among creditors.

PDIC

- the mere issuance of the cashiers checks did not operate as assignment of

funds in favor of the petitioner.

- cashiers checks issued to petitioner were not certified but crossed, hence,

there was no assignment of funds

- instant case involves a disputed claim of sum of money against a closed

financial institution. Sections 30 and 31 of R.A. No. 7653, exclusively vests the

authority to assess, evaluate and determine the condition of any bank with

the BSP, while the PDIC has the primary responsibility of acting as receiver or

liquidator of the closed financial institution.

- it was impleaded in its representative capacity as the receiver/liquidator of

the closed institution, therefore, it has no direct, personal and solidary liability

for the payment of the two cashiers checks.

#

RATIO:

FIRST - Whether the two cashiers checks operate as an assignment of funds in the

hands of the petitioner;

- The two cashiers checks issued by Prime Savings Bank do not constitute an

assignment of funds in the hands of the petitioner as there were no funds to

speak of in the first place.

- The bank was financially insolvent for sometime, even before the issuance of

the checks on June 3, 1999.

SECOND - Whether the claim lodged by the petitioner is a disputed claim under

Section 30 of Republic Act (R.A.) No. 7653, and therefore, under the jurisdiction of the

liquidation court;

- The claim lodged by the petitioner qualifies as a disputed claim subject to the

jurisdiction of the liquidation court.

- Regular courts do not have jurisdiction over actions filed by claimants against

an insolvent bank, unless there is a clear showing that the action taken by the

BSP, through the Monetary Board in the closure of financial institutions was in

excess of jurisdiction, or with grave abuse of discretion.

- The power and authority of the Monetary Board to close banks and liquidate

them thereafter when public interest so requires is an exercise of the police

power of the State.

- Disputed claims refer to all claims, whether they be against the assets of the

insolvent bank, for specific performance, breach of contract, damages, or

whatever.

- Mirandas claim which involved the payment of the two cashiers checks that

were not honored by Prime Savings Bank due to its closure falls within the

ambit of a claim against the assets of the insolvent bank. The issuance of the

cashiers checks by Prime Savings Bank to the petitioner created a

debtor/creditor relationship between them.

- This disputed claim should therefore be lodged in the liquidation proceedings

by the petitioner as creditor, since the closure of Prime Savings Bank has

rendered all claims subsisting at that time moot which can best be threshed

out by the liquidation court and not the regular courts.

- It is well-settled in both law and jurisprudence that the Central Monetary

Authority, through the Monetary Board, is vested with exclusive authority to

assess, evaluate and determine the condition of any bank, and finding such

condition to be one of insolvency, or that its continuance in business would

involve a probable loss to its depositors or creditors, forbid bank or non-bank

financial institution to do business in the Philippines; and shall designate an

official of the BSP or other competent person as receiver to immediately take

charge of its assets and liabilities.

THIRD - Whether the respondents are solidarily liable to the petitioner.

- it is only Prime Savings Bank that is liable to pay for the amount of the two

cashiers checks.

- Solidary liability cannot attach to the BSP, in its capacity as government

regulator of banks, and the PDIC as statutory receiver under R.A. No. 7653,

because they are the principal government agencies mandated by law to

determine the financial viability of banks and quasi-banks, and facilitate

receivership and liquidation of closed financial institutions, upon a factual

determination of the latters insolvency.

Vous aimerez peut-être aussi

- Central Bank vs. CADocument2 pagesCentral Bank vs. CAxx_stripped52Pas encore d'évaluation

- Catuira v. Court of AppealsDocument1 pageCatuira v. Court of AppealsKristine CentinoPas encore d'évaluation

- NERI VDocument15 pagesNERI VVincent CruzPas encore d'évaluation

- CREDIT - PHIL DEPOSIT - Vs BIRDocument3 pagesCREDIT - PHIL DEPOSIT - Vs BIRmichelle zatarainPas encore d'évaluation

- People of The Philippines vs. Danny GodoyDocument7 pagesPeople of The Philippines vs. Danny GodoyDales BatoctoyPas encore d'évaluation

- Leticia Miranda v. PDIC, BSP and Prime Savings BankDocument1 pageLeticia Miranda v. PDIC, BSP and Prime Savings BankCheChePas encore d'évaluation

- PHILIPPINE NATIONAL BANK, PETITIONER, v. FELINA GIRON-ROQUEDocument2 pagesPHILIPPINE NATIONAL BANK, PETITIONER, v. FELINA GIRON-ROQUEabbywinsterPas encore d'évaluation

- Transfield vs. Luzon HydroDocument14 pagesTransfield vs. Luzon HydroKayelyn LatPas encore d'évaluation

- Dumo V EspinasDocument2 pagesDumo V EspinasElla B.Pas encore d'évaluation

- Abacus Real Estate Development v. Manila Banking Corporation, G.R. No. 162270, April 6, 2005Document2 pagesAbacus Real Estate Development v. Manila Banking Corporation, G.R. No. 162270, April 6, 2005Metsuyo BaritePas encore d'évaluation

- Singian v. SandiganbayanDocument1 pageSingian v. SandiganbayanIvee OngPas encore d'évaluation

- 11 Ramirez vs. BaltazarDocument2 pages11 Ramirez vs. BaltazarKristie Renz Anne PanesPas encore d'évaluation

- 4.) Fortune Medicare Inc. v. AmorinDocument2 pages4.) Fortune Medicare Inc. v. AmorinJarvin David ResusPas encore d'évaluation

- CIR v. Pascor RealtyDocument1 pageCIR v. Pascor RealtyDaLe AparejadoPas encore d'évaluation

- Facts:: RAMON K. ILUSORIO v. CA, GR No. 139130, 2002-11-27Document3 pagesFacts:: RAMON K. ILUSORIO v. CA, GR No. 139130, 2002-11-27Thoughts and More Thoughts0% (1)

- II. Ownership - Sps Chingkoe Vs Sps ChingkoeDocument2 pagesII. Ownership - Sps Chingkoe Vs Sps ChingkoeSyElfredGPas encore d'évaluation

- Celedonio VS PeopleDocument1 pageCeledonio VS PeopleLeo FelicildaPas encore d'évaluation

- Republic v. Coseteng-MagpayoDocument1 pageRepublic v. Coseteng-Magpayoxsar_xPas encore d'évaluation

- Lim v. Diaz-Millares 18 SCRA 371 (1966)Document50 pagesLim v. Diaz-Millares 18 SCRA 371 (1966)Janz SerranoPas encore d'évaluation

- Calalas v. SungaDocument3 pagesCalalas v. SungaJocel BatagaPas encore d'évaluation

- CIR vs. PNBDocument2 pagesCIR vs. PNBEzi AngelesPas encore d'évaluation

- BANCO FILIPINO SAVINGS AND MORTGAGE BANK vs. HON. FIDEL PURISIMA, Etc., and HON. VICENTE ERICTA and JOSE DEL FIERO, Etc.Document2 pagesBANCO FILIPINO SAVINGS AND MORTGAGE BANK vs. HON. FIDEL PURISIMA, Etc., and HON. VICENTE ERICTA and JOSE DEL FIERO, Etc.Dave Lumasag CanumhayPas encore d'évaluation

- Agency DigestsDocument11 pagesAgency DigestsJil Mei IVPas encore d'évaluation

- Japan Airlines v. SimanganDocument2 pagesJapan Airlines v. SimanganLawrence Y. CapuchinoPas encore d'évaluation

- Kaunlaran Lending Investors V UyDocument4 pagesKaunlaran Lending Investors V UyFrancis Kyle Cagalingan SubidoPas encore d'évaluation

- Tabuada V Hon RuizDocument1 pageTabuada V Hon RuizSuiPas encore d'évaluation

- Far East Bank Vs Pacilan JRDocument2 pagesFar East Bank Vs Pacilan JRJeraldine Tatiana PiñarPas encore d'évaluation

- Bacolod Vs CBDocument2 pagesBacolod Vs CBAnonymous apYVFHnCYPas encore d'évaluation

- BSP MB Vs Antonio-ValenzuelaDocument3 pagesBSP MB Vs Antonio-ValenzuelaCapt. Jack SparrowPas encore d'évaluation

- Ejercito V SandiganbayanDocument2 pagesEjercito V SandiganbayanAnonymous 5MiN6I78I0Pas encore d'évaluation

- BSP Vs ValenzuelaDocument3 pagesBSP Vs ValenzuelaCaroline A. LegaspinoPas encore d'évaluation

- Metrobank vs. Court of AppealsDocument3 pagesMetrobank vs. Court of AppealsAlphaZuluPas encore d'évaluation

- Trust Receipts Remedies (1) ONG Vs CA (1983)Document2 pagesTrust Receipts Remedies (1) ONG Vs CA (1983)Alejandro de LeonPas encore d'évaluation

- Evangelista vs. La ProveedoraDocument5 pagesEvangelista vs. La ProveedoraCarla VirtucioPas encore d'évaluation

- BelmanDocument2 pagesBelmanBethany MangahasPas encore d'évaluation

- BSP and Chuchi Fonacier vs. Hon. Nina G. ValenzuelaDocument2 pagesBSP and Chuchi Fonacier vs. Hon. Nina G. ValenzuelaKelsey Olivar MendozaPas encore d'évaluation

- Rural Bank of Buhi v. CA, G.R. No. L-61689Document2 pagesRural Bank of Buhi v. CA, G.R. No. L-61689xxxaaxxxPas encore d'évaluation

- FULE vs. CADocument6 pagesFULE vs. CAlucky javellanaPas encore d'évaluation

- Ietts Vs CA DigestDocument2 pagesIetts Vs CA DigestoabeljeanmoniquePas encore d'évaluation

- Prudential Bank vs. IACDocument2 pagesPrudential Bank vs. IACVanya Klarika NuquePas encore d'évaluation

- Republic Bank vs. Ebrada-DigestDocument2 pagesRepublic Bank vs. Ebrada-DigestNikolaDaikiBorgiaPas encore d'évaluation

- BALUYOT v. PANO Case DigestDocument2 pagesBALUYOT v. PANO Case DigestSSPas encore d'évaluation

- 20 - General Bank and Trust Company VDocument2 pages20 - General Bank and Trust Company VMokeeCodillaPas encore d'évaluation

- Roberts v. LeonidasDocument5 pagesRoberts v. LeonidasJenPas encore d'évaluation

- Abacus Real Estate Development Center, Inc. v. Manila Banking CorporationDocument1 pageAbacus Real Estate Development Center, Inc. v. Manila Banking CorporationCheChePas encore d'évaluation

- 02 People v. TurcoDocument2 pages02 People v. TurcoTricia MontoyaPas encore d'évaluation

- BPI Vs IACDocument1 pageBPI Vs IACcmv mendozaPas encore d'évaluation

- 01 Metrobank V Junnel's Marketing CorporationDocument4 pages01 Metrobank V Junnel's Marketing CorporationAnonymous bOncqbp8yiPas encore d'évaluation

- GR Nos. 132848-49, June 26, 2001: Philrock, Inc. vs. Construction Industry Arbitration CommissionDocument5 pagesGR Nos. 132848-49, June 26, 2001: Philrock, Inc. vs. Construction Industry Arbitration CommissionJanice F. Cabalag-De VillaPas encore d'évaluation

- Prudential Vs AlviarDocument2 pagesPrudential Vs AlviarKen MarcaidaPas encore d'évaluation

- Catalan V Catalan-Lee - AtienzaDocument2 pagesCatalan V Catalan-Lee - AtienzaKulit_Ako1100% (1)

- Vitug vs. Court of Appeals: GR. No. 82027, March 29, 1990Document2 pagesVitug vs. Court of Appeals: GR. No. 82027, March 29, 1990Lucas Gabriel Johnson67% (3)

- Hilario V Miranda (Sandoval, Maria Tricia Anne C.)Document2 pagesHilario V Miranda (Sandoval, Maria Tricia Anne C.)Tricia SandovalPas encore d'évaluation

- 05 GR NO 224112 Republic v. Bloomberry Resorts and Hotels, Inc.Document1 page05 GR NO 224112 Republic v. Bloomberry Resorts and Hotels, Inc.LawPas encore d'évaluation

- Case B (10) - Relucio v. San JoseDocument1 pageCase B (10) - Relucio v. San JoseArianneParalisanPas encore d'évaluation

- Mico Metals V CADocument2 pagesMico Metals V CAPerry RubioPas encore d'évaluation

- 26 Miranda Vs PDICDocument2 pages26 Miranda Vs PDICJoshua Erik MadriaPas encore d'évaluation

- Miranda vs. PDICDocument2 pagesMiranda vs. PDICsabrina hernandezPas encore d'évaluation

- MIRANDA V PDIC GR NO. 169334, SEPTEMBER 8, 2006Document3 pagesMIRANDA V PDIC GR NO. 169334, SEPTEMBER 8, 2006Kim SabacahanPas encore d'évaluation

- Miranda V. Philippine Deposit Insurance Corp. G.R No. 169334 - September 8, 2006 - J.YNARES-SANTIAGO - MendozaDocument3 pagesMiranda V. Philippine Deposit Insurance Corp. G.R No. 169334 - September 8, 2006 - J.YNARES-SANTIAGO - MendozaKathrine TingPas encore d'évaluation

- Adiong V ComelecDocument3 pagesAdiong V ComelecSean GalvezPas encore d'évaluation

- in Re - Testate Estate of The Late Gregorio VenturaDocument2 pagesin Re - Testate Estate of The Late Gregorio VenturaSean GalvezPas encore d'évaluation

- Adiong v. ComelecDocument2 pagesAdiong v. ComelecSean GalvezPas encore d'évaluation

- Delfin Tan v. BeneliraoDocument5 pagesDelfin Tan v. BeneliraoSean GalvezPas encore d'évaluation

- Heirs of Magdaleno Ypon v. RicaforteDocument2 pagesHeirs of Magdaleno Ypon v. RicaforteSean Galvez100% (1)

- Suntay v. SuntayDocument2 pagesSuntay v. SuntaySean GalvezPas encore d'évaluation

- Dela Cruz v. Dela Cruz PDFDocument3 pagesDela Cruz v. Dela Cruz PDFSean GalvezPas encore d'évaluation

- Vargas v. ChuaDocument2 pagesVargas v. ChuaSean Galvez100% (1)

- Pascual v. CA 2003Document2 pagesPascual v. CA 2003Sean GalvezPas encore d'évaluation

- Benny Sampilo and Honorato Salacup v. CADocument3 pagesBenny Sampilo and Honorato Salacup v. CASean GalvezPas encore d'évaluation

- Franiela v. BanayadDocument1 pageFraniela v. BanayadSean GalvezPas encore d'évaluation

- In Re Palaganas v. PalaganasDocument2 pagesIn Re Palaganas v. PalaganasSean GalvezPas encore d'évaluation

- Rubi V Prov of MindoroDocument3 pagesRubi V Prov of MindoroSean GalvezPas encore d'évaluation

- People v. GesmundoDocument3 pagesPeople v. GesmundoSean GalvezPas encore d'évaluation

- Samson V DawayDocument3 pagesSamson V DawaySean GalvezPas encore d'évaluation

- Creser v. CADocument2 pagesCreser v. CASean GalvezPas encore d'évaluation

- De Los Santos V MontesaDocument3 pagesDe Los Santos V MontesaSean GalvezPas encore d'évaluation

- Nuguid v. Nuguid DDocument2 pagesNuguid v. Nuguid DSean GalvezPas encore d'évaluation

- Samson V CabanosDocument3 pagesSamson V CabanosSean GalvezPas encore d'évaluation

- In The Matter For The Declaration of William GueDocument2 pagesIn The Matter For The Declaration of William GueSean GalvezPas encore d'évaluation

- De Guzman V Angeles PDFDocument3 pagesDe Guzman V Angeles PDFSean GalvezPas encore d'évaluation

- Guzman V NuDocument3 pagesGuzman V NuSean GalvezPas encore d'évaluation

- Ermita Motel Association V Mayor of ManilaDocument5 pagesErmita Motel Association V Mayor of ManilaSean GalvezPas encore d'évaluation

- People V CayananDocument1 pagePeople V CayananSean GalvezPas encore d'évaluation

- Tabuena v. SandiganabayanDocument3 pagesTabuena v. SandiganabayanSean GalvezPas encore d'évaluation

- End of BipolarityDocument9 pagesEnd of Bipolarityekagrata100% (1)

- Unit 1 Indian Contract Act 1872Document48 pagesUnit 1 Indian Contract Act 1872DeborahPas encore d'évaluation

- IGNOU (Help For Students)Document5 pagesIGNOU (Help For Students)ASHISH KUMAR CHOUDHARY-DM 22DM058Pas encore d'évaluation

- Funny Conversation StartersDocument2 pagesFunny Conversation StartersCreed KunPas encore d'évaluation

- G.R. No. L-31831Document3 pagesG.R. No. L-31831Danica GodornesPas encore d'évaluation

- Office of The SK Chairperson: ReceivedDocument1 pageOffice of The SK Chairperson: ReceivedMark Joseph San DiegoPas encore d'évaluation

- Kilosbayan V MoratoDocument5 pagesKilosbayan V Moratolehsem20006985Pas encore d'évaluation

- Application of The County of Monterey For Rehearing of Decision No. 12-10-030 11-30-12Document13 pagesApplication of The County of Monterey For Rehearing of Decision No. 12-10-030 11-30-12L. A. PatersonPas encore d'évaluation

- IPC All QuestionsDocument16 pagesIPC All QuestionsaswinecebePas encore d'évaluation

- Posttraumatic Stress DisorderDocument1 pagePosttraumatic Stress DisorderStephanie R. S. HsuPas encore d'évaluation

- Alabama AMBER Alert: Christian PerkinsDocument2 pagesAlabama AMBER Alert: Christian PerkinsBen CulpepperPas encore d'évaluation

- Tataruka Usul-Adab HadorohDocument23 pagesTataruka Usul-Adab HadorohWasta SupirPas encore d'évaluation

- The Odyssey Vs o BrotherDocument2 pagesThe Odyssey Vs o Brotherapi-361517795Pas encore d'évaluation

- Year 12 English Invictus and Ransom Aarushi Kaul ADocument3 pagesYear 12 English Invictus and Ransom Aarushi Kaul ALevi LiuPas encore d'évaluation

- The Lucis Trust - Satanism and The New World OrderDocument5 pagesThe Lucis Trust - Satanism and The New World OrderPedro Pablo Idrovo Herrera100% (1)

- Pay Cost of Rs 25000 To ExHusband For False 498ADocument17 pagesPay Cost of Rs 25000 To ExHusband For False 498ADipankar Dey100% (1)

- English Test 1 Xi SuggestionDocument3 pagesEnglish Test 1 Xi SuggestionRabiah An Nikmah0% (1)

- Securing Children's Rights: Childreach International Strategy 2013-16Document13 pagesSecuring Children's Rights: Childreach International Strategy 2013-16Childreach InternationalPas encore d'évaluation

- Broadcast Music, Inc. v. Columbia Broadcasting System, Inc. Analysis of The 1979 Supreme Court CaseDocument19 pagesBroadcast Music, Inc. v. Columbia Broadcasting System, Inc. Analysis of The 1979 Supreme Court CaseCharles ChariyaPas encore d'évaluation

- Famine in Bengal 1943Document6 pagesFamine in Bengal 1943Elma KhalilPas encore d'évaluation

- Book2 (CLJ4)Document65 pagesBook2 (CLJ4)Christopher PerazPas encore d'évaluation

- Romero v. Court of Appeals 250 SCRA 223Document5 pagesRomero v. Court of Appeals 250 SCRA 223Krisleen Abrenica0% (1)

- Medieval Indian History - The Rise of The VIJAYANAGARA Empire in South India and The Establishment of The PORTUGUESE - SADASHIV ARAYA AND RAMARA YA 1543-1571 A.D PDFDocument325 pagesMedieval Indian History - The Rise of The VIJAYANAGARA Empire in South India and The Establishment of The PORTUGUESE - SADASHIV ARAYA AND RAMARA YA 1543-1571 A.D PDFmarbeth sobranaPas encore d'évaluation

- Ang Ladlad LGBT Party Vs ComelecDocument3 pagesAng Ladlad LGBT Party Vs ComelecrmelizagaPas encore d'évaluation

- Learning Activity Sheets (LAS) : TITLE: Determining Social, Moral and Economic Issues in TextsDocument4 pagesLearning Activity Sheets (LAS) : TITLE: Determining Social, Moral and Economic Issues in TextsJhanzel Cordero67% (3)

- Non FiniteverbsDocument5 pagesNon FiniteverbsSuraj KumarPas encore d'évaluation

- Dis ProstuDocument36 pagesDis ProstuAswathy MenonPas encore d'évaluation

- 3.4 Reading Questions Electoral CollegeDocument2 pages3.4 Reading Questions Electoral CollegeIvy HoPas encore d'évaluation

- 04.08.2022 S.no.116Document2 pages04.08.2022 S.no.116RUSHIK ZINZUVADIAPas encore d'évaluation

- Ocampo v. EnriquezDocument128 pagesOcampo v. EnriquezNicole APas encore d'évaluation