Académique Documents

Professionnel Documents

Culture Documents

Tax Incentives in Bulgaria PDF

Transféré par

Silvia Daniela RochianuTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Tax Incentives in Bulgaria PDF

Transféré par

Silvia Daniela RochianuDroits d'auteur :

Formats disponibles

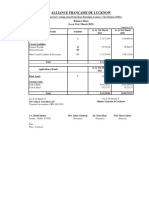

MINISTRY OF FINANCE MINISTRY OF FINANCE MINISTRY OF FINANCE MINISTRY OF FINANCE

TAX INCENTIVES

EVALUATIONS IN BULGARIA

LYUDMILA PETKOVA

DIRECTOR,

TAX POLICY DIRECTORATE

MINISTRY OF FINANCE

DECEMBER, 2011

2

The focus of this presentation is on the system of tax incentives and

preferential tax regimes in Bulgaria.

The presentation includes:

Review of the system of tax incentives - main characteristics;

Effectiveness of the system of tax incentives;

Tax incentives for foreign direct investment.

FOCUS OF PRESENTATION

3

INTRODUCTION

In its essence the tax incentives comprise fiscal measures and instruments,

which are implemented for attraction of foreign direct investment (FDI) to

stimulate the development of particular regional and strategic economic

branches, energy efficiency and innovation, to improve the employment,

etc.

Tax incentives, from legal perspective may, take different forms: low tax

rates, reduced tax rates, tax holidays, investment tax credits, accelerated

depreciation, tax loss carry forward, etc.

GOVERNMENT PRIORITIES IN THE FIELD OF TAXATION

In its Program for European Development of Bulgaria for the period 2009

2013 the Bulgarian Government stipulated seven priorities of its

administration.

The first and main priority of the Bulgarian Government is to stimulate the

investment and innovation activity as well as to develop beneficial business

environment.

One of the measures of this government priority program is to improve the

existing system of tax incentives and to remove tax impediments to

investment.

Taking into account the impact and the leading role of tax incentives for the

economic development of the country, the employment as well as for the

performance of the measures set for implementation among the government

priorities in the field of tax policy for 2011, analysis was made of the

currently implemented system of tax incentives and preferential tax

regimes in Bulgaria.

5

ANALYSIS OF THE SYSTEM OF TAX INCENTIVES

The analysis comprises a detailed survey of the system of national tax

incentives and preferential tax regimes.

With regards to each one of the tax incentives a detailed description of the

characteristics, objectives, terms of use and beneficiaries has been made.

The tax incentives are assessed also in terms of efficiency.

REVIEW OF THE SYSTEM OF TAX INCENTIVES AND

PREFERENTIAL TAX REGIMES IN BULGARIA

MAIN CHARACTERISTICS OF THE SYSTEM OF TAX INCENTIVES

Bulgarian tax system, as the majority of tax systems worldwide, envisages

a number of tax incentives the objective of which is to stimulate the

behavior of taxpayers, support specific types of activity and selected

sectors of the economy, or change progressive features of the tax system.

In the Bulgarian context, tax incentives have been identified as having a

number of objectives including:

- Encouraging foreign direct investment;

- Encouraging innovation such as the accelerated tax depreciation (100%) for

assets formed as a result of research and development activities;

- Encouraging business activities such as the remission of corporate income

tax for registered agricultural producers;

- Encouraging energy efficiency such as reduced tax rates of excise duty;

- Particular social objective.

MAIN CHARACTERISTICS OF THE SYSTEM OF TAX INCENTIVES (2)

The tax incentives in Bulgaria are stipulated mainly in:

- Value Added Tax Act;

- Excise Duties and Tax Warehouses Act;

- Corporate Income Tax Act;

- Personal Income Tax Act.

In the Value Added Tax Act and the Excise Duties and Tax Warehouses

Act a small number of tax incentives are regulated (exemption from

taxation and reduced tax rates).

This is due to the fact that the above said tax laws are harmonized entirely

with the EU legislation which does not provide for as many opportunities at

the choice of Member States in terms of tax incentives.

MAIN CHARACTERISTICS OF THE SYSTEM OF TAX INCENTIVES (3)

The main tax incentives for business activities are stipulated in the

Corporate Income Tax Act.

The greatest relative share in the corporate tax incentives is for the

incentives aimed at attracting foreign direct investment. To stimulate

innovation the Bulgarian legislation contains one tax incentive.

The tax incentives stipulated in the Personal Income Tax Act have mainly

social objectives - they are oriented towards particular categories of

individuals (people with disabilities, young families, pupils and students,

people with low income, etc.)

9

EFFICIENCY OF THE SYSTEM OF TAX INCENTIVES

The review of the system of national tax incentives is done with the

objective to establish to what extend the currently implemented system is

effective and whether it is advisable to take measures for its improvement.

In terms of each tax incentive a brief assessment is made, including

responses to four main issues, and in particular:

- Is the tax incentive clearly defined;

- Are the provisions stipulated and related to its implementation,

understandable to the taxpayers;

- Is the tax incentive effective and does it achieve the stipulated objective;

- Does it require any future steps (amendment, supplementing, or repealing).

10

EFFICIENCY OF THE SYSTEM OF TAX INCENTIVES (2)

The Bulgarian system of tax incentives includes strictly constrained

number of incentives for stimulating only activities with high national

priority.

The analysis shows that in their greater part the tax incentives are clear and

comprehensive to the taxpayers and do not need any simplification and

clarification.

The tax incentives to a large extend are predictable to the beneficiaries as

their term of use is set in advance (particularly in terms of corporate tax

incentives).

Last but not least, it should be stated out that some part of the tax

incentives approved several years ago have lost their impact on the

taxpayers and are ineffective so that there is no real benefit to the economy

and to the society.

11

12

TAX INCENTIVES STIMULATING FOREIGN DIRECT INVESTMENT

13

The main tax incentives for stimulating foreign direct investment are:

- Low corporate income tax rate 10 %;

- Exemption from corporate income tax;

- Remission of corporate income tax;

- Accelerated depreciation;

- Tax loss carry forward.

VAT incentive for large investment projects.

TAX INCENTIVES FOR FDI

CORPORATE INCOME TAX RATE

Description the tax incentive comprises a tax rate for corporate income

tax of 10%.

Objective of the tax incentive to stimulate foreign direct investment.

Terms of use no preconditions required.

Beneficiaries of the tax incentive the tax rate is applied on equal basis to

all taxpayers regardless of the region, the branch they perform their

economic activity from or the type of activity.

The low tax rate of the corporate income tax is a tax incentive which causes

the least possible deviation to the market.

14

TAX EXEMPTION OF SECURITY TRANSACTIONS ON THE STOCK

MARKET

Description the tax incentive comprises an exemption from taxation with

corporate income tax of the profits gained from transactions concerning

particular financial assets performed on the stock market. Respectively,

such kind of loss is not recognised for tax purposes.

Objective of the tax incentive to develop the secondary market of

securities and to indirectly stimulate economic investments.

Terms of use:

- The transaction has to be executed on a regulated market for securities in

Bulgaria or in another Member State of EU;

- In terms of particular financial assets: shares and interests in collective

investment schemes.

Beneficiaries of the tax incentive local and foreign legal entities.

15

TAX EXEMPTION OF COLLECTIVE INVESTMENT SCHEMES AND

INVESTMENT COMPANIES

Description the tax incentive comprises exemption from taxation from

corporate income tax of collective investment schemes, licensed investment

companies of closed type incorporated under the Act on Public Offering of

Securities as well as companies with special investment purpose set up in

compliance with the Act on Special Investment Purpose Companies. The

collective investment schemes are contractual funds or investment

companies of open type.

Objective of the tax incentive to stimulate the development of the capital

market in Bulgaria and as well as investment in the economy.

Beneficiaries of the tax incentive collective investment schemes, licensed

investment companies and companies with special investment purpose.

16

REMISSION OF CORPORATE INCOME TAX FOR ENTERPRISES,

PERFORMING ACTIVITIES IN MUNICIPALITIES WITH HIGH

UNEMPLOYMENT

Description the tax incentive comprises remission of corporate income

tax up to 100% to the benefit of enterprises with production activities in

municipalities with high unemployment rate.

Objective of the tax incentive stimulate investment in production

activities in municipalities with high unemployment rate.

Terms of use:

- unemployment in the municipalities where the production activity is

performed should be at least by 35% higher than the average for the

country (municipalities with high unemployment). The municipalities with

high unemployment are listed on annual basis in an Order of the Minister

of Finance issued after a proposal by the Minister of Labour and Social

Policy.

17

REMISSION OF CORPORATE INCOME TAX FOR ENTERPRISES,

PERFORMING ACTIVITIES IN MUNICIPALITIES WITH HIGH

UNEMPLOYMENT

- the remitted tax shall be invested back in municipalities with high

unemployment rate within 4 years of the beginning of the fiscal year in

which the tax is remitted.

- the enterprise shall select whether or not to use the incentive as:

- de minimis state aid, or

- regional state aid,

and at its discretion it may comply with particular requirements stipulated

by CITA and based on the regulations of EU in the field of state aids.

Beneficiaries of the tax incentive local legal entities and permanent

establishments of foreign legal entities in Bulgaria, forming profit in

compliance with Corporate Income Tax Act.

18

REMISSION OF CORPORATE INCOME TAX FOR REGISTERED

AGRICULTURAL PRODUCERS

Description the tax incentive comprises remission of up to 60% of the

corporate income tax to registered agricultural producers in terms of their

profit from production activities employing unprocessed agricultural

products and/or unprocessed animal products.

Objective of the tax incentive to stimulate the development of agriculture

and to attract investment in this sector of the economy.

Terms of use:

- the remitted tax shall be invested in new buildings and new agricultural

machinery and equipment until the end of the year following the year of the

remission;

- the acquisition of the assets (newly built buildings and brand new

agricultural machinery and equipment) shall be done in compliance with

the market conditions corresponding to the ones of unrelated parties.

19

REMISSION OF CORPORATE INCOME TAX TO REGISTERED

AGRICULTURAL PRODUCERS

- the activities on the production of unprocessed agricultural and animal

products should continue to be carried out for a period of at least three

years after the year of remission;

- the remitted tax shall not exceed 50% of the value of the acquired buildings

and agricultural machinery and equipment;

- the acquired buildings and agricultural machinery and equipment shall not

replace existing agricultural machinery and equipment;

- in terms of acquired buildings, agricultural machinery and equipment the

agricultural producer should not have received another state aid from the

national budget or from the budget of EU.

Beneficiaries of the tax incentive legal entities or sole proprietors,

registered as agricultural producers.

20

ACCELERATED DEPRECIATION

Description for tax purposes, a depreciation rate of 50% may be applied

with regards to machinery, production equipment and apparatuses which

are part of the initial investment (while, in general, the annual depreciation

rate for these assets is 30%).

Initial investment is the investment in new tangible and intangible assets,

related to:

- establishment of new business activities;

- extension of existing business activities;

- diversification of the produced items through the development of new

products;

- major change in the existing production process.

The investment in assets replacing existing assets IS NOT an initial

investment.

21

ACCELERATED DEPRECIATION

Objective of the tax incentive to stimulate the acquisition of new assets,

forming part of an investment project.

Terms of use:

- the assets should be part of the initial investment;

- the assets should be brand new, could not be second hand upon acquisition.

Beneficiaries of the tax incentive local legal entities, sole proprietors and

permanent establishments of foreign legal entities in Bulgaria, forming

profit in compliance with Corporate Income Tax Act.

22

TAX LOSS CARRY FORWARD

Description the tax incentive comprises the right of the taxpayers,

subjected to taxation with corporate income tax to carry forward tax loss

accrued in compliance with CITA. The right of carry forward of tax loss

could be exercised by the companies during the first year in which they

have formed tax profit prior deduction of tax loss.

Tax loss is a negative financial result.

Objective of the tax incentive to stimulate the investment in high-risk

branches with uncertain rate of return and generating loss in the first years

of the investment.

23

TAX LOSS CARRY FORWARD (2)

Terms of use:

1. Tax loss from source in the country

The tax loss is carried forward:

- successively in the next 5 years until exhausting;

- up to the value of the tax profit (positive tax financial result).

In case the tax loss is lower than the tax profit, the complete value of the

tax loss is to be deducted.

The newly occurred losses are carried forward in the following way:

- successively in the next 5 years;

- for each occurred loss the 5-year term starts on the fiscal year right after the

fiscal year of their occurrence.

24

TAX LOSS CARRY FORWARD (3)

2. Tax loss from sources abroad

Tax loss from source abroad by implementing the method exemption with

progression

Tax loss formed in the current fiscal year in a state with which Bulgaria has

concluded a Double Tax Treaty, the applicable method for avoiding double

taxation in terms of the profits is exemption with progression and is not

deducted from the tax profits gained from source in the country or from the

tax profits from other states during the current or the subsequent years.

The tax profit is deducted:

- Only from the tax profits, gained from the source abroad;

- Successively in the next 5 years.

25

TAX LOSS CARRY FORWARD (4)

Tax loss from source abroad by implementing the method of tax credit

Tax loss formed from source abroad and the applicable method for

avoiding double taxation is the tax credit, the non-deducted loss during the

current fiscal year is deducted as follows:

- successively in the next 5 years;

- it is deducted only from the tax profits at the source abroad where it

originates.

In the event when the loss is accrued from a source in a Member State of

EU the loss is deducted from the profit gained from a source in Bulgaria.

Beneficiaries of the tax incentive local legal entities and permanent

establishments of foreign legal entities in Bulgaria, forming profit in

compliance with Corporate Income Tax Act.

26

VAT INCENTIVE FOR LARGE INVESTMENT PROJECTS

Description Entities VAT-registered in Bulgaria investing in a large

investment project can upon receiving authorization by the Ministry of

Finance:

Self-charge the VAT on importation of certain goods (i.e., the reverse

charge mechanism will apply and the VAT on importation will not be

related to a cash outflow for the entity). The goods should not be subject to

excise duty and should be included in a list agreed with the Ministry of

Finance;

Refund VAT under a faster procedure within 30 days of filing the VAT

return.

Terms of use authorization may be granted if the following conditions are

fulfilled:

- the entity should have no pending tax or social security contribution

liabilities;

VAT INCENTIVE FOR LARGE INVESTMENT PROJECTS (2)

- the investment project is approved by the Minister of Finance;

- the entity should meet the conditions and requirements for de minimis state

aid.

The investment project should meet certain requirements, including:

- it should be finished within two years;

- it should create at least 50 new jobs;

- the investment should exceed BGN 10 million (approximately EUR 5

million);

- the entity should be able to finance the project on its own or through

outside financing.

Procedure - In order to receive authorization the entity should apply before

the Ministry of Finance. The application must be supported with business

plans, feasibility studies, etc.

Beneficiaries of the tax incentive legal entities.

MINISTRY OF FINANCE MINISTRY OF FINANCE MINISTRY OF FINANCE MINISTRY OF FINANCE

l.petkova@minfin.bg

Vous aimerez peut-être aussi

- SyllabusDocument6 pagesSyllabusSilvia Daniela RochianuPas encore d'évaluation

- SyllabusDocument5 pagesSyllabusSilvia Daniela RochianuPas encore d'évaluation

- 7Document6 pages7Silvia Daniela RochianuPas encore d'évaluation

- Scanned by CamscannerDocument6 pagesScanned by CamscannerSilvia Daniela RochianuPas encore d'évaluation

- 6sem 1Document5 pages6sem 1Silvia Daniela RochianuPas encore d'évaluation

- 0Document6 pages0Silvia Daniela RochianuPas encore d'évaluation

- 0Document6 pages0Silvia Daniela RochianuPas encore d'évaluation

- Structura AFADocument6 pagesStructura AFASilvia Daniela RochianuPas encore d'évaluation

- Top TV Shows by EpisodeDocument1 pageTop TV Shows by EpisodeSilvia Daniela RochianuPas encore d'évaluation

- Structura BIDocument6 pagesStructura BISilvia Daniela RochianuPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Accounts Nitin SirDocument11 pagesAccounts Nitin Sirpuneet.sharma1493Pas encore d'évaluation

- Tamilnadu Govt 6 Pay Commission 3 RD Instalment Arrear Letter No 16697 Date 18.03.2011Document2 pagesTamilnadu Govt 6 Pay Commission 3 RD Instalment Arrear Letter No 16697 Date 18.03.2011Mohankumar P KPas encore d'évaluation

- CIMB-Principal Australian Equity Fund (Ex)Document2 pagesCIMB-Principal Australian Equity Fund (Ex)Pei ChinPas encore d'évaluation

- Overhead Rate Calculation Instructions. SpreadsheetDocument15 pagesOverhead Rate Calculation Instructions. Spreadsheetanon_366970884Pas encore d'évaluation

- TAXATION OF CAPITAL GAINS AND PASSIVE INCOMEDocument12 pagesTAXATION OF CAPITAL GAINS AND PASSIVE INCOMELiyana ChuaPas encore d'évaluation

- BatraDocument18 pagesBatraapi-390239645Pas encore d'évaluation

- Survey Questionnier For Startup BarriersDocument5 pagesSurvey Questionnier For Startup BarriersSarhangTahir100% (4)

- Sabeco FS 2018 PDFDocument67 pagesSabeco FS 2018 PDFLưu Tố UyênPas encore d'évaluation

- College of St. John - Roxas: Flexible Learning Plan Course Syllabus A.Y 2020-2021Document6 pagesCollege of St. John - Roxas: Flexible Learning Plan Course Syllabus A.Y 2020-2021Miles Santos100% (1)

- CF Final Group 3Document8 pagesCF Final Group 3Armyboy 1804Pas encore d'évaluation

- Analisis Stock Split Terhadap Harga Saham Dan Volume Perdagangan PT Telekomunikasi Indonesia Dan PT Jaya Real PropertyDocument12 pagesAnalisis Stock Split Terhadap Harga Saham Dan Volume Perdagangan PT Telekomunikasi Indonesia Dan PT Jaya Real PropertyIlham MaulanaPas encore d'évaluation

- 9706 s10 Ms 43Document6 pages9706 s10 Ms 43cherylllimclPas encore d'évaluation

- Financial Statement 2020-21Document7 pagesFinancial Statement 2020-21celiaPas encore d'évaluation

- Wire Reciept For DaveDocument9 pagesWire Reciept For DaveNicolePas encore d'évaluation

- Test Bank Econ 212 1p12 PDFDocument11 pagesTest Bank Econ 212 1p12 PDFamer moussalliPas encore d'évaluation

- On January 1 2014 Palmer Company Acquired A 90 InterestDocument1 pageOn January 1 2014 Palmer Company Acquired A 90 InterestCharlottePas encore d'évaluation

- School of Advanced Studies: Principles and Processes For Enterprise DevelopmentDocument70 pagesSchool of Advanced Studies: Principles and Processes For Enterprise DevelopmentRaymond Wagas GamboaPas encore d'évaluation

- Fair Practice Code-Valid Upto 31032024Document6 pagesFair Practice Code-Valid Upto 31032024Tejas JoshiPas encore d'évaluation

- PRACTICAL ACCOUNTING 1 - ReviewDocument21 pagesPRACTICAL ACCOUNTING 1 - ReviewMaria BeatricePas encore d'évaluation

- The Future of MoneyDocument104 pagesThe Future of MoneyKhiêm TrầnPas encore d'évaluation

- Compendium of PNB Products & ServicesDocument125 pagesCompendium of PNB Products & ServicesRomanshu PorwalPas encore d'évaluation

- Olympic Industries LimitedDocument18 pagesOlympic Industries LimitedRakib HasanPas encore d'évaluation

- Analysis of Financial Statements Of: Presented by AyeshaDocument30 pagesAnalysis of Financial Statements Of: Presented by AyeshaaaaaPas encore d'évaluation

- Global Depository ReceiptsDocument4 pagesGlobal Depository ReceiptsSaiyam ChaturvediPas encore d'évaluation

- ALLEN Career Institute fee receiptDocument1 pageALLEN Career Institute fee receipthaleyPas encore d'évaluation

- McKinsey ReportDocument58 pagesMcKinsey ReportSetiady MaruliPas encore d'évaluation

- Horizontal Analysis Interpretation PDFDocument2 pagesHorizontal Analysis Interpretation PDFAlison JcPas encore d'évaluation

- Chapter1 5importance JRJDocument45 pagesChapter1 5importance JRJJames R JunioPas encore d'évaluation

- Advance Accounting - Dayag 2015. Chapter 7 Problem IIIDocument1 pageAdvance Accounting - Dayag 2015. Chapter 7 Problem IIIJohn Carlos DoringoPas encore d'évaluation

- Corporate Governance in Terms With SEC GuidelinesDocument13 pagesCorporate Governance in Terms With SEC Guidelinesasif29mPas encore d'évaluation