Académique Documents

Professionnel Documents

Culture Documents

FIN955 - Wollongong

Transféré par

SamFarhaSenior0 évaluation0% ont trouvé ce document utile (0 vote)

63 vues13 pagesfinance 955

Titre original

FIN955 - Wollongong (1)

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentfinance 955

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

63 vues13 pagesFIN955 - Wollongong

Transféré par

SamFarhaSeniorfinance 955

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 13

FIN 955 Subject Outline Trimester 2, 2014 Page 1 of 13

SYDNEY BUSINESS SCHOOL

FIN 955: International Banking

6 credit points

Subject Information

Trimester 2, 2014

Wollongong

On Campus

TEACHING STAFF

Teaching Role Coordinator, Lecturer and Tutor

Name Dr Trenton Milner

Telephone 9266 1315

Email trenton@uow.edu.au

Room 40.312

Consultation Times Wednesday 13:30 - 15:30

Wednesday 20:15 - 21:45

IMPORTANT INFORMATION FOR ALL STUDENTS

This important information must be read together with the Sydney Business School (SBS) Student Handbook

which contains relevant information on University of Wollongong (UOW) and SBS Policies. The handbook is

found at http://business.uow.edu.au/sydney-bschool/current/policiesandrules/UOW100614

It is your responsibility to comply with these policies and processes.

FIN 955 Subject Outline Trimester 2, 2014 Page 2 of 13

Copyright

Commonwealth of Australia

Copyright Regulations 1969

2014 University of Wollongong

The original material prepared for this guide is covered by copyright. Apart from fair dealing for the purposes of

private study, research, criticism or review, as permitted under the Copyright Act, no part may be reproduced by

any process without written permission.

FIN 955 Subject Outline Trimester 2, 2014 Page 3 of 13

Table of Contents

SECTION A: GENERAL INFORMATION ..................................................................................................... 4

SUBJECT DESCRIPTION ........................................................................................................................... 4

STUDENT LEARNING OUTCOMES ........................................................................................................ 4

UPDATES TO THIS SUBJECT ................................................................................................................... 4

GRADUATE QUALITIES ........................................................................................................................... 5

ATTENDANCE REQUIREMENTS ............................................................................................................ 6

REQUIRED TEXT(S) .................................................................................................................................. 6

KEY REFERENCES .................................................................................................................................... 6

LECTURES .................................................................................................................................................. 7

TUTORIALS ................................................................................................................................................ 8

SECTION B: ASSESSMENT ........................................................................................................................... 9

DEFERRED EXAMINATIONS ................................................................................................................ 12

MINIMUM PERFORMANCE REQUIREMENTS ................................................................................... 12

NOTE ON PLAGIARISM .......................................................................................................................... 12

TURNITIN .................................................................................................................................................. 13

FIN 955 Subject Outline Trimester 2, 2014 Page 4 of 13

SECTION A: GENERAL INFORMATION

SUBJECT DESCRIPTION

The global impact of banking is the focus of this subject. The subject incorporates comprehensive discussion of

issues that commonly arise in the international banking environment. These include the development of the

international monetary system, the deregulation of banking, methods of payment in international trade, foreign

exchange markets, international lending and developments of new technology.

STUDENT LEARNING OUTCOMES

Upon successful completion of this subject, student will be able to: 1. Demonstrate an understanding of

importance of international operations of banks for their overall business. 2. Describe mechanisms of various

methods of payments involved in settlement of international transactions, role of banks in facilitating those

transactions and various issues connected with them. 3. Develop knowledge of foreign exchange markets within

banking environment. 4. Assess various risks that banks face in their international operations. 5. Describe

various regulatory regimes in which banks conduct their international operations. 6. Understand impact of

deregulation on international operations of Australian and other global banks. 7. Describe various new

developments taking place in international banking environment. 8. Critically evaluate influence of various

social, political and economic factors on international operations of banks in Australia and overseas.

UPDATES TO THIS SUBJECT

The Faculty of Business is committed to continual improvement in teaching and learning. In assessing teaching

and learning practices in a subject, the Faculty takes into consideration student feedback from many sources.

These sources include direct student feedback to tutors and lecturers, feedback through Business Central,

responses to the Subject and Course Evaluation Surveys. These important student responses are used to make

ongoing changes to subjects and courses. This information is also used to inform systemic comprehensive

reviews of subjects and courses.

The text book of the subject is changed in order to reflect the current developments in International Banking.

Subject contents are updated and readings revised in accordance with industry developments.

FIN 955 Subject Outline Trimester 2, 2014 Page 5 of 13

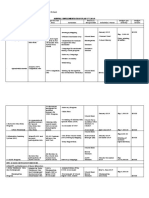

GRADUATE QUALITIES

The Faculty of Business has designated Graduate Qualities which we aim to progressively develop in our

students through learning and teaching. Each subject contributes to these graduate outcomes.

Graduate Quality Our graduates will:

Graduate Qualities Taught,

Practised or Assessed in this

Subject

Informed

have gained appropriate conceptual and applied knowledge

that is research-based

Yes have developed skills for independent thinking and life-

long learning

acknowledge the work and ideas of others

Innovative and

Flexible

be innovative in their thinking and work practices

Yes

be flexible in their approach

be able to apply creativity and logical analysis to solving

business and social issues

Socially

Responsible

appreciate the social and ethical dimensions of business

Yes

be able to make informed choices for the benefit of society

Connected

be able to work and network effectively with others

Yes

appreciate the links between ideas and practice in domestic

and international business, the public sector and

community contexts

Communicators

demonstrate an effective level of interpersonal, written, and

verbal communication skills

Yes

show an understanding of intercultural communication

practices

FIN 955 Subject Outline Trimester 2, 2014 Page 6 of 13

ATTENDANCE REQUIREMENTS

Students are expected to attend all lectures, tutorials, workshops and seminars. Students may fail a subject

unless they attend 80% of lectures, tutorials, workshops and seminars in each subject they take. Students may

apply to have this requirement waived if their circumstances meet those listed in Student Academic

Consideration Policy available at http://www.uow.edu.au/about/policy/UOW060110.html.

REQUIRED TEXT(S)

Custom Book: FIN955 International Banking (2013), Pearson Education, Australia (CB:FIN955) A$119.95.

This textbook(s) is available online from the University Bookshop at http://unicentre.uow.edu.au/unishop/

KEY REFERENCES

The recommended readings below are not intended as an exhaustive list of references. Students should also use

the library catalogue and databases to locate additional resources.

1. De Rosa, L. and A. Fazio,(2003) "International Banking and Financial System: Evolution and Stability."

Aldershot, UK.

2. Eun, C.S. and B. Resnick(2012), "International Financial Management" McGraw Hill Irwin.

3. Hughes, J.E. and S. B. Macdonald (2002) , "International Banking: Text and Cases" Addison Wesley.

4. Malloy, M., P., (1998)"International Banking: Cases, Material and Problems, California Academic Press,

Durham.

5. Mehta, D. and H. Fung(2004), "International Bank Management" Blackwell Publishing.

6. Mullineux, A. and V. Murinde(2003), "Handbook of International Banking" Edward Elgar.

7. Oppenheim, P. (1999), " Global Banking", American Bankers Association.

8. Slager, A. (2006), "The Internationalisation of Banks: Patterns, strategies and performance", Palgrave

Macmillan, New York.

9. Skully, M., (2003)" International Banking and Finance: An Australian Perspective," L.B. Company.

FIN 955 Subject Outline Trimester 2, 2014 Page 7 of 13

LECTURES

Lecture Times

Lectures will be held on:

Day Start Time End Time Room

Wednesday 17:30 19:30 20-1

Trimester 2

Week Date Topics Covered Readings

1 14 May 2014

Emergency Evacuation Procedures

Introduction

Reading CB-FIN955

Chapter 1 and 2

2 21 May 2014 International Monetary System Chapter 3

3 28 May 2014

International Commercial Banking

International Private Banking

Chapter 4 and 5.

4 04 Jun 2014 Payment and Settlement Systems Chapter 7

5 11 Jun 2014 Methods of Payment in International Trade Chapter 8

6 18 Jun 2014 International Lending- Principles & Practice Chapter 8

7 25 Jun 2014 Loan Syndication & Project Finance Chapter 9

8 02 Jul 2014 International Investment Banking Chapter 10 and 11

9 09 Jul 2014 Bank Crashes and Regulatory Issues Chapter 12 and 13

10 16 Jul 2014 Strategy and Organisation Chapter 15

11 23 Jul 2014 Review Nil

FIN 955 Subject Outline Trimester 2, 2014 Page 8 of 13

TUTORIALS

Tutorial/Seminar/Workshop Times

Tutorial times and locations can be found at http://www.uow.edu.au/student/timetables/index.html. Please note

that tutorial times on the timetable are provisional and may change.

The Faculty of Business uses the SMP Online Tutorial System http://www.uow.edu.au/student/tps/index.html.

Trimester 2

Week

Week

Commencing

Topics Covered Readings and Activities

1 12 May 2014 No workshop in week 1

The workshop questions will be available

on eLearning each week.

2 19 May 2014 Introduction

CB: FIN955

Chapter 1 and 2

Group Work

3 27 May 2014 International Monetary System

Chapter 3

Group Work

4 02 Jun 2014

International Commercial Banking

International Private Banking

Chapter 4 and 5

Group Work

5 09 Jun 2014 Payment and Settlement Systems Chapter 7

6 16 Jun 2014 International Lending - Principles & Practice Chapter 8

7 23 Jun 2014 Methods of Payment in International Trade Chapter 8

8 30 Jun 2014 Loan Syndication and Project Finance Chapter 9

9 07 Jul 2014 International Investment Banking

Chapter 10 and 11

Group work

10 14 Jul 2014 Bank Crashes and Regulatory Issues Chapter 12 and 13

11 21 Jul 2014 Strategy and Organisation Chapter 15

FIN 955 Subject Outline Trimester 2, 2014 Page 9 of 13

SECTION B: ASSESSMENT

Assessment Form of Assessment %

Assessment 1 Tutorial/Lab Tasks 10%

Assessment 2 Authentic Tasks 30%

Assessment 3 Final Exam 60%

TOTAL 100%

Assessment 1 Tutorial/Lab Tasks - Tutorial preparations (response to weekly

questions)

Graduate Qualities Assessed Informed

Innovative and Flexible

Socially Responsible

Connected

Communicators

Topic Weekly Tutorial participation

Length Depending on number and complexity of questions. As a guide, tutorial

answers will not exceed 3 typed pages.

Weighting 10%

Due Date To Be Announced

Type of Collaboration Individual Assessment

Marking Criteria Typed answers will be collected at the completion of tutorial at random by the

tutorial facilitator. Each student will have two weekly assignments collected

during the session and a mark out of 10 will be given for participation in class

room discussion and submission of weekly assignments. Please note that

marks are given for participation and will not be given for attendance only.

Style and Format Students are required to prepared typed /written answers to tutorial questions

each week. Students are also required to actively participate in the tutorial

questions.

Assessment Submission Collection of answers will be at the discretion of the tutorial facilitator and

will be collected at the tutorial location.

Assessment Return At the tutorial location.

Detailed Information Refer to the tutorial program of the subject outline. Answers to tutorial

questions will be provided in tutorials.

FIN 955 Subject Outline Trimester 2, 2014 Page 10 of 13

Assessment 2 Authentic Tasks - Case study analysis report

Graduate Qualities Assessed Informed

Innovative and Flexible

Socially Responsible

Connected

Communicators

Topic Group Work

Length Group Report 3000 words.

Weighting 30%

Due Date 07 Jul 2014 (In Your Assigned Tutorial in Trimester 2 Week 9)

Type of Collaboration Group Work

Marking Criteria Based on how the research topic is addressed in terms of its contents,

structure, presentation and references in the report. The marks allocated for

Group Report are 30%.

Style and Format Hard copy, word format.

Assessment Submission In the tutorial in Week 9.

Assessment Return In the tutorial approx. two weeks after submission

Detailed Information The group work will involve preparing a case study on a bank or a banking

system. The groups will be formed in the workshop in week 2 and each group

will be allocated a topic in the tutorial. The maximum number of students in

each group will be 4. The group report will be submitted in tutorial week 9. In

the event of any problems in the group (such as illness, differences between

group members), the Subject Coordinator will be the Final Arbitrator of any

issues arising in the group.

FIN 955 Subject Outline Trimester 2, 2014 Page 11 of 13

Assessment 3 Final Exam - Other

Graduate Qualities Assessed Informed

Connected

Communicators

Topic Final Exam

Length 3 hours

Weighting 60%

Due Date To Be Announced

Type of Collaboration Individual Assessment

Marking Criteria Marks awarded for correct technical knowledge and understanding of

theoretical concepts

Style and Format To Be Advised

Assessment Submission Examination Hall

Assessment Return

Detailed Information The examination will be held during university examination period

FIN 955 Subject Outline Trimester 2, 2014 Page 12 of 13

DEFERRED EXAMINATIONS

Students who suffer illness or other circumstances beyond their control which are likely to affect their academic

performance on the day of an examination should not attend the exam. These students should obtain a Medical

Certificate or other approved supporting documentation and follow the University's Academic Consideration

application process to apply for a deferred exam. The School will not approve students to re-sit an examination.

See Section C, Student Academic Consideration Policy for further details.

Students approved for a deferred examination will receive at least five (5) days notice via SOLSMail, regarding

the examination date, time and location. SBS Deferred exam period dates can be found at

http://business.uow.edu.au/sydney-bschool/current/importantdates/index.html

MINIMUM PERFORMANCE REQUIREMENTS

To be eligible to pass this subject, students must achieve an overall mark of at least 50%, submit all assessment

tasks for the subject and achieve at least 50% in the final examination.

NOTE ON PLAGIARISM

The use of information provided on websites established for the purpose of providing assessment task solutions

can constitute plagiarism. Similarly, the provision of information to such sites can be regarded as aiding the

commitment of plagiarism. Requesting information about assessment solutions from current or previously

enrolled students may also be interpreted as intent to commit plagiarism. Such activities should be avoided as

they can potentially represent student academic misconduct and be subject to penalty.

FIN 955 Subject Outline Trimester 2, 2014 Page 13 of 13

TURNITIN

Turnitin is a web-based site found at www.turnitin.com used by UOW as a tool for detecting plagiarism, along

with educating students about the importance of correct referencing techniques. The Turnitin system checks

each student's written assessment against electronic text;

on the publicly accessible Internet,

in published works (including ABI/Inform, Periodical Abstracts, Business dateline, and electronic

books),

on the ProQuest and Gale commercial databases, and

in every assignment previously submitted to Turnitin

When a student submits his/ her written assessment, the system generates an 'originality report' that highlights

the similarity found between the assessment and all the sources checked by Turnitin. Turnitin does not check

that references are in the correct Harvard format. It is the student's responsibility to check that all references

follow the Harvard format detailed on http://www.library.uow.edu.au/referencing/

It will be compulsory for all SBS students to submit all written assignments (final version) into the Turnitin

system from Trimester 2 2014 before submitting the hard copy to the lecturer. A printed copy of the 'originality

report' obtained from the Turnitin system must be attached to the assignment. Any assignment received which

does not have an attached report will not be marked and therefore be awarded a 0 for this assessment task.

Students are encouraged to submit drafts of their assignment to Turnitin before the due date, thus enabling

students to check their referencing and rectify any issues before submission of the final version.

The first time a UOW student uses the Turnitin system, they must register using a functioning UOW email

address as their user name and adhere to the following guidelines:

1. Use one sign in name only

2. Use one document name only for each assignment that includes your UOW student number

3. Any resubmissions must use the same document name as the original submission

4. References must be included in your Turnitin submission

5. Do not include the assignment topic question at the beginning of your submission

6. The originality report provided with the assignment submission must be consistent with your last

submission to Turnitin

Failure to comply with these requirements may result in penalties being applied.

Please access the Moodle site for this subject for further Turnitin details.

Detailed instructions on how to use and obtain access to the Turnitin system can be found at the website:

http://www.uow.edu.au/student/services/ld/students/UOW021315.html

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- (Sue Lloyd) Phonics HandbookDocument135 pages(Sue Lloyd) Phonics Handbooksujit21in43760% (1)

- Teaching Experiments Lesson Plan TemplateDocument2 pagesTeaching Experiments Lesson Plan Templateapi-282906321Pas encore d'évaluation

- Stern Math Theory and PracticeDocument24 pagesStern Math Theory and PracticeSamar HamadyPas encore d'évaluation

- Tennessee Comprehensive Assessment Program: Achievement Test Grade 6 Practice TestDocument172 pagesTennessee Comprehensive Assessment Program: Achievement Test Grade 6 Practice Testquarz11Pas encore d'évaluation

- Evaluating TexbooksDocument9 pagesEvaluating TexbooksMaeDeSestoIIPas encore d'évaluation

- Narrative, Dan Analytical Exposition in Daily Life."Document7 pagesNarrative, Dan Analytical Exposition in Daily Life."Aninda Ree PanjaitanPas encore d'évaluation

- Lesson Plan Flipbook Autosaved Autosaved2Document5 pagesLesson Plan Flipbook Autosaved Autosaved2api-227755377Pas encore d'évaluation

- Sample Questions: Annexure - IDocument3 pagesSample Questions: Annexure - Isakthiceg100% (1)

- Chemistry 111 - SYLLABUS Summer 2017 - GrayDocument4 pagesChemistry 111 - SYLLABUS Summer 2017 - GrayRashid AliPas encore d'évaluation

- Professional Development AssignmentDocument3 pagesProfessional Development Assignmentapi-509036585Pas encore d'évaluation

- Oz HowtopassthegamsatDocument48 pagesOz HowtopassthegamsatD SchoPas encore d'évaluation

- Science HighDocument3 pagesScience HighDonna Sheena SaberdoPas encore d'évaluation

- Know About E-CTLT Digital DiaryDocument19 pagesKnow About E-CTLT Digital DiarydimbeswarrajbongshiPas encore d'évaluation

- Self Confidence IndiaDocument5 pagesSelf Confidence IndiajosekinPas encore d'évaluation

- Table of Specifications: Melisa F. Mendoza Evangeline D. CasasDocument55 pagesTable of Specifications: Melisa F. Mendoza Evangeline D. Casasangelica levita100% (1)

- Content Area Reading: Literacy and Learning Across The CurriculumDocument9 pagesContent Area Reading: Literacy and Learning Across The CurriculumAlin RathorePas encore d'évaluation

- Chris Peck CV Hard Copy VersionDocument6 pagesChris Peck CV Hard Copy VersionChris PeckPas encore d'évaluation

- Intervention For Bridging Learners Gap and Intensifying Learners - GinaDocument22 pagesIntervention For Bridging Learners Gap and Intensifying Learners - Ginagina b. habilPas encore d'évaluation

- Cross-Cultural Differences in Risk Perception: A Model-Based ApproachDocument10 pagesCross-Cultural Differences in Risk Perception: A Model-Based ApproachBianca RadutaPas encore d'évaluation

- Starbucks, Polaroid, and Organizational ChangeDocument29 pagesStarbucks, Polaroid, and Organizational ChangeRamesh HiragappanavarPas encore d'évaluation

- Daniyal Amjad Butt: Career HighlightsDocument3 pagesDaniyal Amjad Butt: Career Highlightsdbutt15Pas encore d'évaluation

- Proceedings 2013 PDFDocument104 pagesProceedings 2013 PDFrubenmena1Pas encore d'évaluation

- Doña Juana Actub Lluch Memorial Central School Pala-O, Iligan CityDocument19 pagesDoña Juana Actub Lluch Memorial Central School Pala-O, Iligan CityRowena Malugao Malinao-TeofiloPas encore d'évaluation

- KG2-Grade12 New Applicants InstructionsDocument6 pagesKG2-Grade12 New Applicants Instructionsadnandilawaiz6380Pas encore d'évaluation

- Whitney Trinh: ProfileDocument2 pagesWhitney Trinh: Profileapi-273424668Pas encore d'évaluation

- PECFASDocument2 pagesPECFASNunik KhoirunnisaPas encore d'évaluation

- Resume and Cover LetterDocument4 pagesResume and Cover Letterapi-404378566Pas encore d'évaluation

- True 3 Little Pigs LPDocument4 pagesTrue 3 Little Pigs LPapi-384512330Pas encore d'évaluation

- Six Instructional StrategiesDocument1 pageSix Instructional Strategiesapi-268779824Pas encore d'évaluation

- English4 q3 Mod7 AnalyzeaStoryintermsofitsElementsDocument16 pagesEnglish4 q3 Mod7 AnalyzeaStoryintermsofitsElementsJeana Rick GallanoPas encore d'évaluation