Académique Documents

Professionnel Documents

Culture Documents

Bloomberg Open Market Data Whitepaper

Transféré par

markofff100%(1)100% ont trouvé ce document utile (1 vote)

136 vues13 pagesbloomberg open data whitepaper

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentbloomberg open data whitepaper

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

100%(1)100% ont trouvé ce document utile (1 vote)

136 vues13 pagesBloomberg Open Market Data Whitepaper

Transféré par

markofffbloomberg open data whitepaper

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 13

ENTERPRISE

PRODUCTS & SOLUTIONS

February 1, 2012

OPEN

MARKET DATA

INITIATIVE

CONTENTS

02 EXECUTIVE SUMMARY

03 THE MARKET DATA ENVIRONMENT

05 BLOOMBERGS OPEN MARKET DATA INITIATIVE

07 BLOOMBERG BLPAPI

12 THE FUTURE: INDUSTRY STANDARDS FOR MARKET DATA

13 APPENDIX BLPAPI LICENSE TEXT

EXECUTIVE SUMMARY

Todays global nancial markets are fueled by the collection and processing of timely and

accurate market information. To access nancial markets, companies depend on unique security

identiers within reference data and real-time feeds. In large part, both market data symbologies

and programming interfaces are proprietary, which can make data integration a challenge and

limit a rm's ability to migrate between different data providers. Given the high cost and risk of

migration, information consumers and providers often nd themselves locked into a specic

vendors solution. Closed symbologies and restrictions on programming interfaces conne the

use of existing solutions while creating barriers to entry for new marketplace participants.

Bloomberg is responding to these limiting conditions by offering open solutions that are

collectively part of Bloombergs Open Market Data initiative (http://open.bloomberg.com).

In 2009, Bloomberg took the rst step by releasing Bloombergs Open Symbology (BSYM),

a exible and truly open system for identifying securities across all global asset classes. BSYM

represents an alternative to proprietary security identiers that is growing in adoption in

response to investor and institutional demand for unique and non-changing identiers with

no restrictions on usage.

Bloomberg is now addressing the problem of proprietary programming interfaces by opening

the Bloomberg API, or BLPAPI, for free use under a nonrestrictive MIT-style license. BLPAPI is

a proven interface that supports both publish/subscribe and request/response paradigms and

is the common access point to Bloomberg market data distribution products, including Desktop

API, Server API, Managed B-Pipe and Platform service products.

The BLPAPI interface is used today by thousands of applications supporting more than

100,000 daily Bloomberg users accessing both reference and real-time data. Bloomberg

selected a MIT-style license for its BLPAPI because it is accepted in the open community as

the least limiting, allowing for free copying and unrestricted use of the interfaces. Bloomberg

customers, non-Bloomberg users, vendors and third-party application developers can now

adopt the interface for their own use. The new licensing terms will promote BLPAPIs

widespread acceptance, building on its existing application base and broad pool of

development talent.

This release of BLPAPI is part of an ongoing effort that seeks to unlock the value of Bloomberg

services in order to make Bloomberg products more efcient and cost-effective for its

customers. The pursuit of this objective has led Bloomberg to embrace and promote

open solutions.

Furthermore, Bloomberg is evolving its interfaces into candidates for an open standard. Under

this initiative, an independent committee would be formed to manage the future development

of BLPAPI, while ensuring its stability and openness.

Bloomberg is committed to supporting an open strategy and continuing to deliver premier

content, analytics and managed services that leverage these open technologies. This paper

provides a survey of the open market data space and highlights BLPAPIs key technical features.

Open Market Data Initiative

Bloomberg is committed

to supporting an open

strategy and continuing

to deliver premier

content, analytics and

managed services that

leverage these open

technologies.

OPEN MARKET DATA INITIATIVE // 02

OPEN MARKET DATA INITIATIVE // 03

THE MARKET DATA ENVIRONMENT

The market data environment is complex and involved, including programming interfaces,

symbology, and specic behaviors and conventions of the system. Ultimately, the restrictions

created by proprietary interfaces and symbology have limited the contributions of the community

of application developers, vendors, consultants and users, and have stied innovation.

Security Identication

A variety of contractually restricted methodologies for identifying nancial instruments exist.

These proprietary symbologies are deeply embedded in spreadsheets and applications.

Migrating to another market data product requires a high-cost migration to a different symbology.

To remove such restrictions on its clients, Bloomberg has placed its symbology in the public

domain. The Bloomberg Open Symbology (BSYM) is a family of security identiers available

as a nonproprietary and open security identication system:

Full descriptions of its methodology are freely available to the entire fnancial community,

offering any company involved in securities trading a number of advantages over closed

and limited systems.

BSYM offers a simplifed symbology mapping that supports most characters, including blank

spaces and periods.

A Web-based instrument lookup service is publically available (http://bsym.bloomberg.com).

Proprietary Interfaces

>>Emergence of Proprietary Interfaces

The demanding requirements of the market data space have forced vendors to be trailblazers

relative to their information technology peers. The early days of digital market data saw the quick

adoption of innovations in the areas of software messaging, networking and systemsa trend

that is accelerating with requirements for reliable delivery of increasing volumes of data at

ever-lower latencies.

Critical to the success of these early systems was the development of programming interfaces

that supported publish/subscribe and request/response paradigms, clearly identied

messaging streams (e.g., tick-by-tick market data per instrument per exchange or data source),

and handled high data rates, often requiring asynchronous processing. To protect their tenuous

positions in this emerging market, vendors maintained strong proprietary rights over their

technologies and interfaces.

Due to this demanding environment as well as innovation driven by technology, the market data

space remains dominated by proprietary interfaces. Application developers at nancial rms as

well as third-party vendors nd themselves tightly coupled with these interfaces.

Open Market Data Initiative

Due to this demanding

environment as well as

innovation driven by

technology, the market

data space remains

dominated by proprietary

interfaces.

>>Limits of Proprietary Interfaces

A programming interface that is proprietary severely limits the options for rms that use them.

Typically, a proprietary interface is contractually tied to the associated product. If the client

decides to stop using the product, any references to the interface must be removed from the

clients applications. Further, the proprietary interface may not be copied and used for any other

purpose, even if the rm remains a customer of that vendor for other uses. Together, these

restrictions prevent the creation of adapters that could mitigate the costs and risks of migration.

Given such restrictions, attempts to introduce products from alternative vendors or from internal

sources require that existing applications migrate to a separate interface. Such migrations are

rare in this industry because of the risks and costs involved. Essentially, a rms investment in

proprietary interfaces imposes a barrier to entry for other vendors.

A proprietary interface may become the de facto standard. Such de facto standards create a

semblance of community by encouraging third-party vendors to offer complementary products,

but the proprietary interface does not allow a third-party vendor to adopt it for their own

products, thus severely restricting the community.

Vendor-Independent Interfaces

>>User Efforts

Financial rms embraced new technologies because of competitive pressures, despite

the drawbacks of proprietary solutions. Very early they recognized that they were binding

themselves to a particular vendor, so various attempts were made throughout the industry

to mitigate the problem. Many of the early-adopting rms committed signicant resources to

creating their own interfaces and developed adapters to hide the underlying vendors API.

Theoretically, these adapters (sometimes known as Vendor Independent API or Abstraction

Layer) would support multiple existing vendors and could be extended to support new vendor

APIs as they emerged. The goal was to separate applications from the details of any vendors

interfaces, thereby providing an easy migration path between vendors. At best, these efforts

had limited success.

In the rapidly moving environment of an investment bank, extraordinary discipline is required to

strictly enforce the use of a vendor-independent adapter. As vendors expand their interfaces to

support new features, temptation is strong within application groups not to wait for the adapter

to cover that feature. Support issues create more opportunity for conict with an additional

software layer inserted in the mix. Since nothing prevents an application group from using a

vendors interface directly, many applications avoid the adapter out of ignorance or expediency.

Over time, many rms end up with a signicant number of their applications using the vendors

proprietary interface directly instead of the adapter, thus undermining the original purpose of the

vendor-independent interface.

Successfully implementing and supporting these vendor-independent APIs proved onerous

and costly. Covering all current and future features of multiple vendors publish/subscribe APIs

became impractical, especially in the face of vendor resistance. Further, these adapter efforts

were still proprietary to the rms creating them, limiting their usefulness and impact.

>>Partnership Attempts

Companies found maintaining their in-house vendor-independent adapters an expensive choice.

Vendors, understandably, did not cooperate in these efforts, leading nancial rms to form

partnerships on their own to create a common interface. The most visible early effort (circa

1992) was undertaken by Electronic Joint Venture Partners (EJV), a consortium made up of

large investment banks. This attempt failed because the major vendors would not participate

and also because of the competing interests of the partners. More recent efforts have been

made to create adapter layershowever, none have been supported by a vendor with a proven

interface and a large established client base.

Open Market Data Initiative

OPEN MARKET DATA INITIATIVE // 04

Proprietary interfaces

imposes a barrier to

entry for other vendors.

OPEN MARKET DATA INITIATIVE // 05

BLOOMBERGS OPEN MARKET DATA INITIATIVE

Bloomberg is pursuing an Open Market Data Initiative with its Enterprise Products and Services

offerings, which include Desktop API, Server API, Managed B-Pipe and Platform. Bloombergs

focus is on providing premium data and compelling services to customers without imposing

articial restrictions on client applications. The Bloomberg Open Market Data Initiative places

what are now considered commodity technologiessymbology and open market data

programming interfacesrmly into the open domain. The initiative will create a dynamic

community around market data systems, encouraging new innovation and cooperation

between vendors and clients.

In 2009, Bloomberg released its nancial instrument symbology into the public domain with

BSYM. Bloomberg is now making the BLPAPI interface free-use by distributing its header

les, documentation and programming examples under a MIT-style license. Specically,

Bloomberg is allowing clients and other parties to freely use interfaces for C, C++, Java, .NET,

COM and Perl. The new license also allows header and library les needed to compile client

applications to be copied to facilitate testing and evaluation.

The BLPAPI interface is widely used among Bloombergs clientswith thousands of BLPAPI

applications already written that support more than 100,000 regular users. Free-use licensing

allows clients, consultants and other third-party vendors to adopt BLPAPIs comprehensive and

highly regarded interfaces for their own market data service implementations, as well as use

them in applications and adapters. Bloomberg sees this release as the rst step in creating a

compelling programming interface that is based on open standards.

BLPAPIs future direction is to evolve into a candidate for an open standardization process.

This effort is beginning as Bloomberg starts working with vendors and clients to review and

update the interface for open use. An independent standards committee made up of vendors

and end-user rms, will be formed, with a mandate to promote the interface to the community

and to provide a stable forum for an open and deliberative process for the ongoing evolution of

the interface standard. This process will take into consideration both the community of existing

users and the potential needs of future users. The committee will set the stage for open source

implementations of the interface, as well as the creation of standards-compliance tests.

With BSYM and free use of its interfaces, Bloomberg is making a clear commitment to

providing applications with an unfettered access to market data distribution platforms

through open systems.

Open Market Data Initiative

The Bloomberg Open

Market Data Initiative

places what are now

considered commodity

technologiessymbology

and open market

data programming

interfacesrmly into

the open domain.

OPEN MARKET DATA INITIATIVE // 06

Open Market Data Initiative

BLOOMBERG BLPAPI

BLPAPI is the programming interface for Bloombergs Desktop and Server API, Managed B-Pipe and Platform service

products. The interface is designed to have maximum exibility. An explicit requirement was to serve both customers market

data applications as well as Bloombergs own Desktop suite, including the Microsoft Excel

plug-in. From the outset, this

required supporting diverse types of data: subscription data for pricing, historical and intraday tick data, and reference data

(both scalar and tabular). With interfaces for publishing pricing data and bindings for additional programming languages,

BLPAPI is a comprehensive market data interface. The rest of this section describes its key technical features.

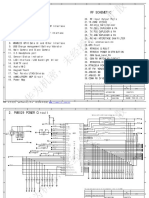

BLPAPI Overview

AUTHENTICATION

SCHEMA/

METADATA

REQUEST/

RESPONSE

PUBLISH

TOPIC RESOLUTION

SERVICE

SESSION

TRANSPORT

SUBSCRIBE

Figure 1. BLPAPI Interface Components

>> Flexible Service-Based Architecture

The concept of a service is central to BLPAPI. The interface supports the subscription and request/response paradigms

but is not tied to any specic data dictionary, event model or symbology.

Services are fully specied using schemas, which can be dynamically congured and introspected by applications. Multiple

services can share common data dictionary elements, thus allowing them to be used as building blocks within a larger

market data ecosystem. Powerful functionality can be easily achieved by managing the service metadata. For example, the

implementation of the Bloomberg Platform product uses the service metadata to determine whether the subscription recaps

should be provided directly by the infrastructure or by publishers themselves.

When establishing a subscription, the client proceeds through a resolve step in which subscription topics may be resolved

to canonical names. This provides another powerful abstraction, since it allows a market data supplier to work internally with

normalized subscription topics, regardless of how they were requested by individual users or applications. For example, one

user may identify securities via CUSIP and another via ISIN; once their subscriptions are set up, they will receive the same

data stream. The resolve step also allows for event ltering based on elds or type of event if these are specied together

with securities.

Open Market Data Initiative

OPEN MARKET DATA INITIATIVE // 07

The interfaces service orientation further allows pub/sub applications to be agnostic to the

location of their destination or sources. Different groups within Bloomberg have followed this

model in ways that did not depend on their being internal to the rm. Bloombergs Trading

System products created a request/response service (logically synchronous) for order

submission, with a corresponding subscription providing order lls asynchronously. Technical

Analysis and intraday bar services were likewise built on top of a pricing feed.

>> Centralized Symbology Management

The services topic resolution step frees applications from needing to implement their own

symbology mapping solutions. If a service offers a full-featured symbology lookup, applications

can easily leverage this.

>> Simple Things Are Simple

Usage examples came to the forefront during the early design of BLPAPI, and a rich set of

sample programs provided with the SDK gave the skeletal beginnings of many customer

applications. Specifying relevant options at the service, session and subscription levels

makes for terse, easily modied client applications.

>> Multiple Language Bindings

The BLPAPI SDK includes a comprehensive set of bindings for C, C++, Java, .NET, COM

and Perl, supported on Linux, Windows and Solaris. The Java binding is implemented in native

Java (not using JNI), allowing for truly platform-neutral client applications. The BLPAPI.NET

implementation is fully managed within Microsoft CLR (Common Language Runtime),

leveraging its memory management, type safety and exception handling.

>> Support High-Volume, Low-Latency Implementations

The BLPAPI interface supports both synchronous and asynchronous processing, allowing an

implementation to scale to ever-growing data rates by efciently supporting event-driven and

multi-threaded client applications.

At a lower level, BLPAPI interfaces were designed to allow messages to be constructed and

processed efciently, with in-place parsing and composition, with a minimum number of copies.

Sophisticated communication patterns between client and server are possible, with support

for partial responses. At the same time, the interface does not impose arbitrary restrictions on

message content (e.g., no limits on request size).

>> Full-Featured Infrastructure

The BLPAPI is a comprehensive denition of a market data interface. It includes publish/

subscribe, request/response paradigms, and service streams. In addition, the BLPAPI interface

includes authentication that allows the implementation to positively identify the source or the

consumer of the data, which, in turn, enables the ability to permission and entitle any usage.

With many market data distribution environments, permissioning is a critical feature as

contractual obligations such as exchange fees are involved, and management requirements,

including resource allocations, are in place. The authentication interface in BLPAPI is extremely

exible, allowing a wide range of authenticating credentials to be implemented and accepted.

For example, the BLPAPI implementation supports strong permissioning requirements for

Bloomberg Professional Terminal users, as well as fairly relaxed requirements for applications.

The BLPAPI interface

is comprehensive, clear

and simple to use.

>> Canonical Messaging

Data is exposed to applications without exposing details of the wire format or underlying transport through self-describing

messages containing strongly typed data (e.g., integer, oating point, string) together with eld descriptions. Data elements

may be simple (e.g., a price) or complex (e.g., time series pricing or a coupon payment schedule for a bond). For example,

reference data is implemented with its own service, data schema and metadata, separate from real-time market data.

Use Case: Request/Response

The BLPAPI interface is comprehensive, clear and simple to use. This section illustrates the use of the request/response

interface to obtain reference data.

The rst step is for the application to establish a session with the server. This is trivial if authentication is not required as the

following sequence diagram shows:

Open Market Data Initiative

OPEN MARKET DATA INITIATIVE // 08

Figure 2. Session establishment (using synchronous API)

APPLICATION BLPAPI SERVER(S)

Requests are, by denition, asynchronous. Asynchronous operation is also supported for session establishment and for opening

services (e.g., above, using the openServiceAsync interface).

In the next step, a synchronous request is made for specic elds for a single security. Note that the service needs to be opened

only once, no matter how many requests are made. The response(s) provide the requested information, and the use case

is complete:

Figure 3. Reference data request/response

Open Market Data Initiative

OPEN MARKET DATA INITIATIVE // 09

APPLICATION BLPAPI SERVER(S)

Use Case: Subscription Data

This section illustrates an asynchronous subscription to real-time market data (publish/subscribe paradigm). The initial value

(i.e., recap) is delivered as an event callback, as are the subsequent real-time updates. The applications event loop is not shown

but is the same as shown in Figure 3 for the request/response mode:

Open Market Data Initiative

OPEN MARKET DATA INITIATIVE // 10

Figure 4. Real-time subscription data

APPLICATION BLPAPI SERVER(S)

Open Market Data Initiative

OPEN MARKET DATA INITIATIVE // 11

THE FUTURE: INDUSTRY STANDARDS FOR MARKET DATA

When digital distribution of market data was a new technology, it was understandable that

vendors protected their symbology and programming interfaces with proprietary licenses

technology innovations that were new and unique. At the time, this intellectual property was

their core product.

The market data environment is now mature and these technologies are well-understood.

The differentiating factors have shifted to the data and analytics products themselves, not

their delivery mechanisms. The industry is moving to an open model, which will force vendors

to compete on customer-centric terms. Open technologies will create a true community,

encouraging the next round of innovation while lowering costs and vastly improving time to

market of new products for both vendors and end-user applications.

Bloomberg is committed to openness in the market data environment as demonstrated by the

release of its symbology and the free-use licensing of its programming interface. Bloomberg

will follow these efforts by creating partnerships with vendors and clients to produce an open

standard interface and release an open-source reference implementation. It is Bloombergs

belief that restrictions and barriers enforced by proprietary symbology and interfaces are no

longer acceptable.

It is Bloombergs

belief that restrictions

and barriers enforced by

proprietary symbology

and interfaces are no

longer acceptable.

Open Market Data Initiative

APPENDIX BLPAPI LICENSE TEXT

Header Files and Example Code

Permission is hereby granted, free of charge, to any person obtaining a copy of this software and associated documentation les

(the Software), to deal in the Software without restriction, including without limitation the rights to use, copy, modify, merge,

publish, distribute, sublicense, and/or sell copies of the Software, and to permit persons to whom the Software is furnished to

do so, subject to the following conditions: The above copyright notice and this permission notice shall be included in all copies

or substantial portions of the Software.

THE SOFTWARE IS PROVIDED AS IS, WITHOUT WARRANTY OF ANY KIND, EXPRESS OR IMPLIED, INCLUDING

BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE AND

NONINFRINGEMENT. IN NO EVENT SHALL THE AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM,

DAMAGES OR OTHER LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM,

OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN THE SOFTWARE.

License File in Package Archives

Permission is hereby granted, free of charge, to any person obtaining a copy of this proprietary software and associated

documentation les (the Software), to use, publish, or distribute copies of the Software, and to permit persons to whom the

Software is furnished to do so. Any other use, including modifying, adapting, reverse engineering, decompiling, or disassembling,

is not permitted. The above copyright notice and this permission notice shall be included in all copies or substantial portions

of the Software.

THE SOFTWARE IS PROVIDED AS IS, WITHOUT WARRANTY OF ANY KIND, EXPRESS OR IMPLIED, INCLUDING

BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE AND

NONINFRINGEMENT. IN NO EVENT SHALL THE AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM,

DAMAGES OR OTHER LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM,

OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN THE SOFTWARE.

OPEN MARKET DATA INITIATIVE // 12

2012 Bloomberg Finance L.P. 47424623 0212

open.bloomberg.com New York

+1 212 318 2000

London

+44 20 7330 7500

Frankfurt

+ 49 69 9204 1210

San Francisco

+1 415 912 2960

Hong Kong

+852 2977 6000

Sao Paulo

+55 11 3048 4500

Singapore

+65 6212 1000

Tokyo

+81 3 3201 8900

To learn more about the Bloomberg Open Market Data Initiative, visit open.bloomberg.com. Questions and comments about

BLPAPI can be sent to open-tech@bloomberg.net. Questions and comments about BSYM can be sent to bsym@bloomberg.net.

The BLOOMBERG PROFESSIONAL service, BLOOMBERG Data and BLOOMBERG Order Management Systems (the "Services") are owned and distributed locally by Bloomberg Finance L.P. ("BFLP")

and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the "BLP Countries"). BFLP is a wholly-owned subsidiary of Bloomberg L.P. ("BLP"). BLP provides

BFLP with all global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. The Services include

electronic trading and order-routing services, which are available only to sophisticated institutional investors and only where the necessary legal clearances have been obtained. BFLP, BLP and their afliates

do not provide investment advice or guarantee the accuracy of prices or information in the Services. Nothing on the Services shall constitute an offering of nancial instruments by BFLP, BLP or their afliates.

BLOOMBERG is a trademark of BFLP or its subsidiaries.

Vous aimerez peut-être aussi

- Analysis and Design of Next-Generation Software Architectures: 5G, IoT, Blockchain, and Quantum ComputingD'EverandAnalysis and Design of Next-Generation Software Architectures: 5G, IoT, Blockchain, and Quantum ComputingPas encore d'évaluation

- Presentation Group 5 - The Digital Macro-EnvironmentDocument118 pagesPresentation Group 5 - The Digital Macro-Environmentnhungoc1482005Pas encore d'évaluation

- White Paper: by Miguel Valdés Faura - Ceo and Co-Founder, BonitasoftDocument5 pagesWhite Paper: by Miguel Valdés Faura - Ceo and Co-Founder, BonitasoftNikola DubljevicPas encore d'évaluation

- The Ecosystem For Open Gateway NaaS API DevelopmentDocument13 pagesThe Ecosystem For Open Gateway NaaS API DevelopmentP KPas encore d'évaluation

- Operations Management in Automotive Industries: From Industrial Strategies to Production Resources Management, Through the Industrialization Process and Supply Chain to Pursue Value CreationD'EverandOperations Management in Automotive Industries: From Industrial Strategies to Production Resources Management, Through the Industrialization Process and Supply Chain to Pursue Value CreationPas encore d'évaluation

- Information TechnologyDocument6 pagesInformation TechnologyMartin BonillaPas encore d'évaluation

- A Framework To Speed Manufacturing's Digital Business TransformationDocument17 pagesA Framework To Speed Manufacturing's Digital Business TransformationCognizant100% (1)

- Net Profit (Review and Analysis of Cohan's Book)D'EverandNet Profit (Review and Analysis of Cohan's Book)Pas encore d'évaluation

- Name Netid Group Number: Website Link: Tutorial Details Time Spent On AssignmentDocument11 pagesName Netid Group Number: Website Link: Tutorial Details Time Spent On AssignmentJasonch26Pas encore d'évaluation

- Agile Procurement: Volume II: Designing and Implementing a Digital TransformationD'EverandAgile Procurement: Volume II: Designing and Implementing a Digital TransformationPas encore d'évaluation

- Business: Berend de Jong Michael Little Luca GagliardiDocument14 pagesBusiness: Berend de Jong Michael Little Luca GagliardiRajeev RanjanPas encore d'évaluation

- Magic Quadrant For User AuthenticationDocument55 pagesMagic Quadrant For User AuthenticationForense OrlandoPas encore d'évaluation

- Overview of Low-CodeDocument15 pagesOverview of Low-CodeKyanon Digital100% (2)

- ASP 101: Understanding The Application Service Provider ModelDocument12 pagesASP 101: Understanding The Application Service Provider ModelNkím YunJaePas encore d'évaluation

- INFOSYS110 2014 Deliverable 02 Tyler VickDocument12 pagesINFOSYS110 2014 Deliverable 02 Tyler Vicktvic796Pas encore d'évaluation

- LMProductGuide 2011 PDFDocument41 pagesLMProductGuide 2011 PDFEric DunnPas encore d'évaluation

- Sourcebook 2015 - CTRM Software Suppliers and ProductsDocument97 pagesSourcebook 2015 - CTRM Software Suppliers and ProductsCTRM CenterPas encore d'évaluation

- Open Group Togaf BianDocument42 pagesOpen Group Togaf BianSteven McGettigan100% (1)

- Name Netid Group Number: Website Link: Tutorial Details Time Spent On AssignmentDocument11 pagesName Netid Group Number: Website Link: Tutorial Details Time Spent On AssignmentPatrickFaheyPas encore d'évaluation

- InfoSys D2 Assignment Lbla545Document12 pagesInfoSys D2 Assignment Lbla545lbla545Pas encore d'évaluation

- Bloomberg Request Response Terminal OverviewDocument9 pagesBloomberg Request Response Terminal OverviewsanthipriyaanakarlaPas encore d'évaluation

- Soft CommDocument4 pagesSoft CommK J JosewinPas encore d'évaluation

- Blockchain for Business with Hyperledger Fabric: A complete guide to enterprise blockchain implementation using Hyperledger FabricD'EverandBlockchain for Business with Hyperledger Fabric: A complete guide to enterprise blockchain implementation using Hyperledger FabricPas encore d'évaluation

- Blockchain Technology in AdvertisingDocument20 pagesBlockchain Technology in AdvertisingKittuPas encore d'évaluation

- Middlewere TechnologyDocument16 pagesMiddlewere TechnologyMujahid UsmanPas encore d'évaluation

- Blockchain Technology for Paperless Trade Facilitation in MaldivesD'EverandBlockchain Technology for Paperless Trade Facilitation in MaldivesPas encore d'évaluation

- SE Protocols Guide A4 v21Document20 pagesSE Protocols Guide A4 v21alex aliPas encore d'évaluation

- L4 CRM Data and ITDocument56 pagesL4 CRM Data and ITHenryVuPas encore d'évaluation

- Gartner Reprint Low Code DevelopmentDocument33 pagesGartner Reprint Low Code DevelopmentSiddhartha DwivediPas encore d'évaluation

- 7 Reasons "Enterprise Labeling" Is Vital To The Manufacturing Supply ChainDocument9 pages7 Reasons "Enterprise Labeling" Is Vital To The Manufacturing Supply ChainsinghalneetiPas encore d'évaluation

- Addressing Commodity Market Challenges With Digitalization Enabled by Platform TechnologyDocument8 pagesAddressing Commodity Market Challenges With Digitalization Enabled by Platform TechnologyCTRM CenterPas encore d'évaluation

- ESC23 - 42G Esc23 - 42gDocument24 pagesESC23 - 42G Esc23 - 42gEmilio Pérez de TenaPas encore d'évaluation

- Global Wizard Announces The Launch of New Export Compliance Application and APIsDocument3 pagesGlobal Wizard Announces The Launch of New Export Compliance Application and APIsPR.comPas encore d'évaluation

- World Quality Report Consumer Products Retail and Distribution Sector Pull OutDocument4 pagesWorld Quality Report Consumer Products Retail and Distribution Sector Pull OutAnoop KumarPas encore d'évaluation

- Building Business Apps in C A Step-by-Step Guide to Enterprise Application DevelopmentD'EverandBuilding Business Apps in C A Step-by-Step Guide to Enterprise Application DevelopmentPas encore d'évaluation

- Magic Quadrant For User Authentication - December 2014Document54 pagesMagic Quadrant For User Authentication - December 2014Karthik JagannathanPas encore d'évaluation

- Assignment 3: Submitted ToDocument7 pagesAssignment 3: Submitted ToIshan KakkarPas encore d'évaluation

- 05 NFM 05 de 12Document23 pages05 NFM 05 de 12Oz GPas encore d'évaluation

- What The Automotive Cio Need 441828Document9 pagesWhat The Automotive Cio Need 441828ngotu142Pas encore d'évaluation

- Report - Digital Commerce 2Document17 pagesReport - Digital Commerce 2Tabitha PeñaPas encore d'évaluation

- B2B Emarketplaces: A Classification Framework To Analyse Business Models and Critical Success FactorsDocument44 pagesB2B Emarketplaces: A Classification Framework To Analyse Business Models and Critical Success FactorsYatin MalhotraPas encore d'évaluation

- Iot Platforms: Chasing Value in A Maturing MarketDocument25 pagesIot Platforms: Chasing Value in A Maturing Marketrajeshtripathi20040% (1)

- Citizen Development: The Handbook for Creators and Change MakersD'EverandCitizen Development: The Handbook for Creators and Change MakersÉvaluation : 4 sur 5 étoiles4/5 (1)

- E-Business Models and Web Strategies for AgribusinessD'EverandE-Business Models and Web Strategies for AgribusinessÉvaluation : 3 sur 5 étoiles3/5 (1)

- Evaluating The Business To Business Ecommerce Systems Of Dell & CiscoD'EverandEvaluating The Business To Business Ecommerce Systems Of Dell & CiscoPas encore d'évaluation

- Magic Quadrant For Web Application FirewallsDocument13 pagesMagic Quadrant For Web Application Firewallsnao2001Pas encore d'évaluation

- 4030 JamcrackerDocument3 pages4030 Jamcrackerdangbang007100% (1)

- Building Regulatory and Supervisory Technology Ecosystems: For Asia’s Financial Stability and Sustainable DevelopmentD'EverandBuilding Regulatory and Supervisory Technology Ecosystems: For Asia’s Financial Stability and Sustainable DevelopmentPas encore d'évaluation

- The Perfect StormDocument8 pagesThe Perfect Stormban5heePas encore d'évaluation

- Assignment: Name: Trupti Deore Roll No: 2K191133 Specialisation: Business AnalyticsDocument6 pagesAssignment: Name: Trupti Deore Roll No: 2K191133 Specialisation: Business Analyticstrupti deorePas encore d'évaluation

- Quality of Experience Paradigm in Multimedia Services: Application to OTT Video Streaming and VoIP ServicesD'EverandQuality of Experience Paradigm in Multimedia Services: Application to OTT Video Streaming and VoIP ServicesPas encore d'évaluation

- Accenture Open Platform Banking New EraDocument12 pagesAccenture Open Platform Banking New EraKaren L YoungPas encore d'évaluation

- Cots or In-House Tools in The Electrical DomainDocument9 pagesCots or In-House Tools in The Electrical DomainMohamed Anas BenhebibiPas encore d'évaluation

- Magic Quadrant For Global Re 368239 PDFDocument38 pagesMagic Quadrant For Global Re 368239 PDFNorberto J. E. GeilerPas encore d'évaluation

- Gartner Magic Quadrant For Application Release Orchestration 2018Document43 pagesGartner Magic Quadrant For Application Release Orchestration 2018pepeqfPas encore d'évaluation

- Gartner Magic Quadrant - Customer Engagement Center 2021Document30 pagesGartner Magic Quadrant - Customer Engagement Center 2021Wygor AlvesPas encore d'évaluation

- Contents Page: Business PlanDocument43 pagesContents Page: Business Plankasahun bedasoPas encore d'évaluation

- EcommerceDocument8 pagesEcommerceogoo tomPas encore d'évaluation

- Summary of Heather Brilliant & Elizabeth Collins's Why Moats MatterD'EverandSummary of Heather Brilliant & Elizabeth Collins's Why Moats MatterPas encore d'évaluation

- PresPrescient3 Extinguishing Control Panelcient 3 SLDocument4 pagesPresPrescient3 Extinguishing Control Panelcient 3 SLIgor NedeljkovicPas encore d'évaluation

- Pre-Disciplinary and Post-Disciplinary Perspectives: Bob Jessop & Ngai-Ling SumDocument13 pagesPre-Disciplinary and Post-Disciplinary Perspectives: Bob Jessop & Ngai-Ling SumMc_RivPas encore d'évaluation

- Building A Custom Rifle StockDocument38 pagesBuilding A Custom Rifle Stock24HR Airgunner Channel100% (1)

- ALR Compact Repeater: Future On DemandDocument62 pagesALR Compact Repeater: Future On DemandmickycachoperroPas encore d'évaluation

- TWITCH INTERACTIVE, INC. v. JOHN AND JANE DOES 1-100Document18 pagesTWITCH INTERACTIVE, INC. v. JOHN AND JANE DOES 1-100PolygondotcomPas encore d'évaluation

- Clean Energy Council Installers Checklist PDFDocument3 pagesClean Energy Council Installers Checklist PDFAndre SPas encore d'évaluation

- Classification Essay On FriendsDocument8 pagesClassification Essay On Friendstycheknbf100% (2)

- Abuyog 2018 PDFDocument503 pagesAbuyog 2018 PDFJackelyn Fortaliza RosquettesPas encore d'évaluation

- Container Parts in Detail PDFDocument32 pagesContainer Parts in Detail PDFSathishSrs60% (5)

- Dell's Marketing Strategy - 2006Document58 pagesDell's Marketing Strategy - 2006Preeti IyerPas encore d'évaluation

- 14 QuestionnaireDocument14 pages14 QuestionnaireEkta SinghPas encore d'évaluation

- '11!01!05 NEC Femtocell Solution - Femto Specific FeaturesDocument25 pages'11!01!05 NEC Femtocell Solution - Femto Specific FeaturesBudi Agus SetiawanPas encore d'évaluation

- Glastic Utr Angles ChannelsDocument2 pagesGlastic Utr Angles Channelsdanielliram993Pas encore d'évaluation

- C8813 ÇDocument39 pagesC8813 ÇZawHtet Aung100% (1)

- Aiwa MC CSD-A120, A140 PDFDocument35 pagesAiwa MC CSD-A120, A140 PDFRodrigo NegrelliPas encore d'évaluation

- SimonKucher Ebook A Practical Guide To PricingDocument23 pagesSimonKucher Ebook A Practical Guide To PricingHari Krishnan100% (1)

- Lexium Motion Control 200401Document130 pagesLexium Motion Control 200401Mohamed Elsayed HasanPas encore d'évaluation

- Water System Validation ExampleDocument6 pagesWater System Validation Exampledvdynamic1100% (2)

- Yamaha Model Index 1958 2010 PDFDocument442 pagesYamaha Model Index 1958 2010 PDFSanja Krajinovic100% (2)

- Spring Setting of Piping Connected To A CompressorDocument4 pagesSpring Setting of Piping Connected To A CompressorSharun SureshPas encore d'évaluation

- Dlms DocumentDocument71 pagesDlms DocumentSudarshan ReddyPas encore d'évaluation

- Be Katalog-Grabenfr 2013 Engl RZ KleinDocument36 pagesBe Katalog-Grabenfr 2013 Engl RZ Kleincherif100% (1)

- Blogs To Submit Music ToDocument6 pagesBlogs To Submit Music Totheo theoPas encore d'évaluation

- Doppler NavigationDocument21 pagesDoppler NavigationRe-ownRe-ve100% (3)

- HC110110007 Data Forwarding ScenarioDocument17 pagesHC110110007 Data Forwarding ScenariojscansinoPas encore d'évaluation

- MM LabDocument4 pagesMM LabJstill54Pas encore d'évaluation

- DC GenDocument66 pagesDC Genjonathan_awayan733286% (71)

- Xiaopan OS InstallationDocument6 pagesXiaopan OS InstallationMuhammad SyafiqPas encore d'évaluation

- CONTRIBN MADE by Deming, Juran and CrosbyDocument14 pagesCONTRIBN MADE by Deming, Juran and CrosbySachin Methree100% (1)