Académique Documents

Professionnel Documents

Culture Documents

Reliable Textile Limited

Transféré par

Nikhil ReddyCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Reliable Textile Limited

Transféré par

Nikhil ReddyDroits d'auteur :

Formats disponibles

Submitted to: Dr. S.V.

Ramana Rao

Presented By:

Nikita Gupta (86)

Sravya Palukuru (88)

Shruthi Gundu (76)

Rajiv Krishna (78)

Lok Prashanth (90)

INTRODUCTION: WORKING CAPITAL

A measure of both a company's efficiency and its short-term financial health. The

working capital is calculated as:

Working Capital: Current Assets- Current Liabilities

The working capital ratio (Current Assets/Current Liabilities) indicates whether a

company has enough short term assets to cover its short term debt. Anything below

1 indicates negative W/C (working capital). While anything over 2 means that the

company is not investing excess assets. Most believe that a ratio between 1.2 and

2.0 is sufficient.

Company Profile

CMD of Reliable Texamill Ltd. Mr. Shyam Lal

RTL commenced production in 2005

It manufactures synthetic blended yarn which is a raw material for other textile

weaving mills and also for handlooms and power looms.

The company is situated in an industrially less developed area in Northern state.

The synthetic yarn originates with the mixing up of the different fibers i.e.

acrylic. Polyester and Viscose as per the blend proposed to be manufactured.

COMPANY BACKGROUND

The company has licensed capacity of 80000 spindles and existing installed

capacity of 26390 spindles (this includes 6210 spindles added during FY

2007-08).

The average capacity utilization of the company was 81% during FY 2006-

07 and 85% during FY 2007-08.

In the year 2005-06, the company could generate net sales of Rs. 191.13

lakh, and incurred a net loss of Rs. 57.11 Lakh. The acute power shortage

was the dominant reason.

RTL has since been able to increase its sales to Rs. 973.32 Lakh in 2006-07

and to Rs. 1,203.61 Lakh in 2007-08 as against the estimated sales of Rs.

1,767.55 Lakh. It produced 1,315 tons of yarn in 2007-08 against 1,182 tons

during the previous year.

The management of RTL has distributed the lower actual sales to the

sluggish market conditions that prevailed during the second half of the year

2007-08, forcing the company to keep its production at low level, and also to

a certain extent due to the company manufacturing substantial quantity of

yarn of lesser counts and blends of lower value to suit the market conditions.

After incurring a loss in the first year, the company made a net profit before

depreciation of Rs. 32.42 Lakh in 2007-08.Power cuts, high input costs and

increased administrative expenses on account of expansion resulted in poor

profitability.

RTL has not so far paid any tax and dividends. Its tax Liability is expected

to be nil for quite some time as it enjoys tax benefits being a new unit

located in an industrially less developed area.

PRODUCTION FACILITIES

The companys existing production facilities are considered adequate for

operating the spinning mills at the enhanced installed capacity.

The production process for obtaining the main product, viz.. The synthetic

yarn , originates with the mixing up of the different fibers i.e. acrylic,

polyester and viscose as the blend proposed to be manufactured.

The annual consumption of these fibers generally depend on the product mix

manufactured during the particular year; the actual consumption during the

years 2006-07 and 2007-08 being about 1,973 tons and 2,303 tons, valued

respectively at Rs. 713.11 Lakh and Rs.902.30 Lakh.

Because of the frequent power cuts, the company built up adequate captive

power generating capacity by installing one more set of 860 kVA diesel

power generator.

RTL is now planning to replace two sets of 250 kVA by the purchase of one

imported SKODA set of 869 kVA at a cost of Rs. 47.70. The new set is

expected to be more economical from the point of view of diesel

consumption and usage for longer period.

Competition and Selling

The companys end products cater to the needs of large and medium scale

manufactures of fabrics and also handlooms and power looms

The major accounting , for 80-85 percent of sales.

The remaining 15-20 percent is sold to small dealers and traders.

About 65 percent of the companys sales are being affected on credit terms

ranging from 45 to 60 days depending on market conditions.

Its four branches located in different parts of the country manage the selling

operations of the company.

The company has been finding it difficult to realize its dues within the

normal credit period allowed to customers.

The company however, allows a discount ranging between 2 to 2 and half

per cent for sales on demand/cash basis.

Expansion

After starting commercial production in 2005 it had planned for installation

of 20,000 additional spindles

Since the company incurred a loss in the very first year, The company

attempted a modest expansion programme involving installation of

additional 6,210 spindles during 2007-08

The expansion programme was completed with a capital expenditure of

about Rs.276 lakhs against the estimated of Rs.253 lakhs

FUTURE PROSPECTS

The prices of the basic raw material, viz., viscose/polyester fibers, are lower

in the international market than in India.

While the prices of viscose/polyester fibers have increased substantially

during the last 2 years i.e., 2006-07 and 2007-08, the prices of RTLs end

products have, more or less, remained at the same level. The company has

not been able to absorb in the selling prices, the increased cost of inputs.

With the consumer preference during the recent years having shifted to

blended fabrics and the companys products being of good quality and well

accepted in the market.

RTL produced 1182 tons and 1315 tons of yarn during the years 2006-07

and 2007-08 resp.

In 2008-09, it has planned production of 1758 tones.

RTLs production plan for 2008-09 has been devised keeping in view the

changes in the market conditions and other factors.

RTL has planned to manufacture more quantities of yarn in blends of higher

value during the period 2008-09. Those blends are expected to be more

acceptable in the market.

The company has projected its energy costs at about 3.4 % of the total cost

of production. The other expenses have been estimated in line with the past

experience.

RTL had depended on trade credit for meeting its working capital needs and

the trade credits forms about 1/3

rd

of the current liabilities.

The normal credit period allowed by the suppliers is 45 days.

In the past, creditors did not object to RTLs stretching of payment to them.

In view of the credit squeeze, they are likely to pressurize hard for early

payment of dues.

Questions and Answers

Q 1.critically evaluates RTLs performance and financing of its operations.

In the year 2005-2006, The Company has faced a Net loss of RS.57.11 lakh.

This loss is due to power cuts and teething troubles.

In the year 2006-07 the company has generated a Net profit of Rs.24.48

lakh.

This increase in profits is due to enhanced capacity of the spindles, Effective

usage of Raw materials.

RTL is received in the market and is supposed to enjoy a premium over the

yarn manufactured by other leading manufacturer in the country.

Q 2 How has the company managed its working capital in the past?

Illustrate with appropriate calculations.

RTL has dependent on quiet substantially on trade creditors for meeting its

working capital need.

Trade credit forms one third of the current liability. ( In 2007, 32% is the

trade creditors in total current liabilities. Again in 2008 it is 30%.But they

projected in 2009 the percentage should decreases to 8%.)

About 65% of the companys sale are being affected on credit terms ranging

from 45-60 days depending on the market conditions.

The company is allowing 2- 2.5 % discount for sales on demand or cash

basis.

The normal credit period allowed by the suppliers is 45 days.

However, a discount of 2 % for payments within 15 days of the purchase

date is allowed.

Refer Excel sheet for further Calculations.

Working Capital Calculations

Working Capital = Current Assets-Current Liabilities

Year 2007 2008 2009

Current Assets 580.03 757.47 913.59

Current Liabilities 625.95 805.78 866.16

Working Capital -45.92 -48.31 47.43

Debt Turnover Ratio

Debt Turnover Ratio = Net Sales/ Avg Receivables

Year 2007 2008 2009

Net Sales 973.32 1208.61 2185.94

Q 3-What are RTLS plans to improve its working capital management?

Show the calculation of operating cycle to justify your answer.

RTL planned to replace two sets of 250 kVA by the purchase of one

imported SKODA set of 869 KVA at a cost of Rs.47.70.

It planned to undertake an expansion Program for installation of another

20000 additional spindles. This expansion Program was completed with a

capital expenditure of about Rs.276 lakh against estimated cost of Rs.253

lakh.

It also has planned to manufacture more quantities of yarn in blends of

higher value during the period 2008-2009.

Average receivables 293.25 269.48 303.19

Debt Turnover Ratio 3.31907928 4.48497106 7.20980243

Average payable period = 365/ Debt Turnover Ratio

Year 2007 2008 2009

Average payable period 109.970256 81.3829109 50.6255204

Creditor Turnover ratio

Creditor Turnover ratio = Net Purchases/ Avg Payables

Year 2007 2008 2009

Net Purchase 685.94 933.67 1649.36

Average Payable 200.94 239.16 70.79

Creditor Turnover ratio 3.41365582 3.90395551 23.2993361

Q 4- do you accept the financial plan prepared by RTL? What modification

would you suggest in the plan and why?

The financial plan of the firm is to increase the sales by producing high

quality yarn and also increase the production.

Many factors are supporting their plan

1. The power supply in the state is showing signs of improvement.

2. Consumers prefer good quality blended fabrics and RTL is known for its

premium product.

So, if the company goes for increasing its production then the company will

get more number of customers.

Scope for Modification

They may go for importing their basic raw materials from the international

markets as prices of polyester and fibers are lower in international market.

In domestic market they are procuring raw material at a high price. They

may go for strategic supplier relationship management.

They have scope for increasing their production capacity up to 80,000

spindles as they are currently using 26390 spindles.

From the future perspective, they can also go for one more diesel power

generator so that they can maximize capacity utilization.

Vous aimerez peut-être aussi

- Working Capital Case StudyDocument4 pagesWorking Capital Case StudyRahul SinghPas encore d'évaluation

- Null 5 PDFDocument620 pagesNull 5 PDFJames100% (2)

- Project Report On The Neogi Chemical CompanyDocument7 pagesProject Report On The Neogi Chemical Companyabhisheknagpal27Pas encore d'évaluation

- Tutorial 07-Capital BudgetingDocument2 pagesTutorial 07-Capital BudgetingShekhar Singh0% (1)

- Tata SteelDocument32 pagesTata SteelAngad KalraPas encore d'évaluation

- Ava Case SolutionDocument50 pagesAva Case Solution121923601018Pas encore d'évaluation

- 7 P's of PatanjaliDocument4 pages7 P's of PatanjaliRavi Gautam20% (5)

- SGC Report Maruti SuzukiDocument18 pagesSGC Report Maruti SuzukiKehar Singh80% (5)

- Solution To QB QuestionsDocument3 pagesSolution To QB QuestionsSurabhi Suman100% (1)

- Vce Summmer Internship Program (Equity Research)Document9 pagesVce Summmer Internship Program (Equity Research)Annu KashyapPas encore d'évaluation

- Managing Hindustan Unilever StrategicallyDocument8 pagesManaging Hindustan Unilever StrategicallySatish Kannaujiya67% (6)

- Summer Internship Project Report 1Document37 pagesSummer Internship Project Report 1Pushpender Singh100% (1)

- Final Project TataDocument22 pagesFinal Project TataSubhendu Ghosh67% (3)

- Case 27.1: Reliable Texamill Limited: PBF: IDocument2 pagesCase 27.1: Reliable Texamill Limited: PBF: IMukul KadyanPas encore d'évaluation

- Bharat Chemicals Ltd. SolnDocument4 pagesBharat Chemicals Ltd. SolnJayash KaushalPas encore d'évaluation

- Abstract of TitanDocument8 pagesAbstract of TitanVinod NairPas encore d'évaluation

- Cool-Aid Private LimitedDocument8 pagesCool-Aid Private Limitedpankajbhatt1993Pas encore d'évaluation

- Case US-64 ControversyDocument4 pagesCase US-64 ControversyBiweshPas encore d'évaluation

- COST SHEET OF RelianceDocument16 pagesCOST SHEET OF Reliancejaskirat100% (1)

- HCL Technology Financial Analysis: A Project Report OnDocument22 pagesHCL Technology Financial Analysis: A Project Report OnGoutham SunderPas encore d'évaluation

- Case THE INTERNATIONALISATION OF KALYANI GROUP Module 2Document2 pagesCase THE INTERNATIONALISATION OF KALYANI GROUP Module 2vijay50% (2)

- SFM CaseDocument12 pagesSFM Casedht6885100% (2)

- Cool AidDocument11 pagesCool AidSuman SouravPas encore d'évaluation

- Narayana Health: The Initial Ipo DecisionDocument9 pagesNarayana Health: The Initial Ipo DecisionKANVI KAUSHIKPas encore d'évaluation

- Assignement - 1 (Help Age India)Document9 pagesAssignement - 1 (Help Age India)AmanSethiya88% (8)

- 1.infosys PPT FinalDocument13 pages1.infosys PPT FinalTapan ShahPas encore d'évaluation

- From Beranek To Stone ModelDocument9 pagesFrom Beranek To Stone ModelShaikh Saifullah KhalidPas encore d'évaluation

- Case Asignment On Central Equipment CompanyDocument2 pagesCase Asignment On Central Equipment Companykeshav18125% (4)

- IPM Talbros Case StudyDocument9 pagesIPM Talbros Case Studytech& GamingPas encore d'évaluation

- CH 18Document7 pagesCH 18Amit ChaturvediPas encore d'évaluation

- HULDocument28 pagesHULSneha Jais100% (2)

- Hul Ratio AnalysisDocument14 pagesHul Ratio Analysisvviek100% (1)

- Problems On Cash FlowsDocument4 pagesProblems On Cash FlowsDeepakPas encore d'évaluation

- Swot Analysis of Tata SteelDocument11 pagesSwot Analysis of Tata Steelkausysnitdgp458283% (6)

- (Rs MN.) : Case 10.1: Hind Petrochemicals CompanyDocument1 page(Rs MN.) : Case 10.1: Hind Petrochemicals Companylefteris82Pas encore d'évaluation

- A Project Report ON Cost Sheet Analysis OF Coca - Cola: Institute of Technology and ManagementDocument11 pagesA Project Report ON Cost Sheet Analysis OF Coca - Cola: Institute of Technology and Managementkattyperrysherry33% (3)

- Analysis On Financial Performance of Tata Steel and Jindal Steel & PowerDocument6 pagesAnalysis On Financial Performance of Tata Steel and Jindal Steel & PowerDeep ShahPas encore d'évaluation

- Cost of Cap. & Cap. StructureDocument72 pagesCost of Cap. & Cap. StructureaanillllPas encore d'évaluation

- Tata Motors - AnalysisDocument22 pagesTata Motors - Analysissdhamangaonkar726489% (18)

- Tata Motors Analysis PDF NewDocument23 pagesTata Motors Analysis PDF NewAlay Desai73% (11)

- Strategic Management Assignment #1A: Akshat BansalDocument8 pagesStrategic Management Assignment #1A: Akshat BansalAkshat BansalPas encore d'évaluation

- Sun HRMDocument4 pagesSun HRMAkash Goyal100% (3)

- Cost Analysis Sheet DaburDocument11 pagesCost Analysis Sheet DaburrohitPas encore d'évaluation

- TITAN Case AnalysisDocument28 pagesTITAN Case AnalysisBrajesh Singh100% (2)

- Porter S Value Chain Tata SteelDocument6 pagesPorter S Value Chain Tata SteelAndreea CriclevitPas encore d'évaluation

- Indian Electricals LimitedDocument8 pagesIndian Electricals LimitedJoseph MathewPas encore d'évaluation

- TATA Group-BCG AnalysisDocument18 pagesTATA Group-BCG AnalysisParveen Rathee100% (6)

- Pricing Strategies of ItcDocument2 pagesPricing Strategies of ItcManisha Sonkusale100% (1)

- FMDocument17 pagesFMRaghav Agarwal100% (3)

- Market Structure of Indian IT Industry-InFOSYSDocument20 pagesMarket Structure of Indian IT Industry-InFOSYSNitin ChidarPas encore d'évaluation

- Financial+Statements+ +Maruti+Suzuki+&+Tata+MotorsDocument5 pagesFinancial+Statements+ +Maruti+Suzuki+&+Tata+MotorsApoorv GuptaPas encore d'évaluation

- Economic NumericalDocument26 pagesEconomic NumericalSantosh ThapaPas encore d'évaluation

- Cipla Performance AnalysisDocument33 pagesCipla Performance Analysis9987303726Pas encore d'évaluation

- Working Capital Case Study PDFDocument4 pagesWorking Capital Case Study PDFNishuPas encore d'évaluation

- ProfitabilityDocument9 pagesProfitabilityNaheed AdeelPas encore d'évaluation

- Bhel Group 1Document16 pagesBhel Group 1arijitguha07Pas encore d'évaluation

- ProfitabilityDocument3 pagesProfitabilityNaheed AdeelPas encore d'évaluation

- Voltamp Transformers Limited - ICMPLDocument16 pagesVoltamp Transformers Limited - ICMPLvenugopallPas encore d'évaluation

- LGB Q4FY12Update 05may2012Document4 pagesLGB Q4FY12Update 05may2012equityanalystinvestorPas encore d'évaluation

- Final Fadm Presentation2Document58 pagesFinal Fadm Presentation2shubbhi27Pas encore d'évaluation

- Standard Costing Practice QuestionsDocument3 pagesStandard Costing Practice Questionsmohammad AliPas encore d'évaluation

- Intermediate Accounting CH 4 SolutionsDocument65 pagesIntermediate Accounting CH 4 SolutionsTracy Wright100% (1)

- Tarea de InglesDocument3 pagesTarea de Inglesmariapaniagua83Pas encore d'évaluation

- Pmo Framework and Pmo Models For Project Business ManagementDocument22 pagesPmo Framework and Pmo Models For Project Business Managementupendras100% (1)

- Freemark Abbey WineryDocument14 pagesFreemark Abbey WineryKunal Kaushal100% (1)

- Zendiggi Kebab House MenuDocument2 pagesZendiggi Kebab House MenukatayebPas encore d'évaluation

- Entrepreneurship EXAM AugDocument3 pagesEntrepreneurship EXAM AugBJ ShPas encore d'évaluation

- Verb Tense Exercise 5 8Document8 pagesVerb Tense Exercise 5 8Delia CatrinaPas encore d'évaluation

- F18, H24 Parts CatalogDocument299 pagesF18, H24 Parts CatalogKLE100% (6)

- African Development BankDocument7 pagesAfrican Development BankAasma HaseebPas encore d'évaluation

- Infineon SPP04N80C3 DS v02 91 enDocument10 pagesInfineon SPP04N80C3 DS v02 91 entombeanPas encore d'évaluation

- Book On Marine InsuranceDocument64 pagesBook On Marine InsurancenipundaPas encore d'évaluation

- International Macroeconomics: Slides For Chapter 1: Global ImbalancesDocument54 pagesInternational Macroeconomics: Slides For Chapter 1: Global ImbalancesM Kaderi KibriaPas encore d'évaluation

- List of Cost CenterDocument1 pageList of Cost Centersivasivasap100% (1)

- Business Proposal FormatDocument4 pagesBusiness Proposal FormatAgnes Bianca MendozaPas encore d'évaluation

- WORLD BANK PresentationDocument30 pagesWORLD BANK PresentationAmna FarooquiPas encore d'évaluation

- Sol14 4eDocument103 pagesSol14 4eKiều Thảo Anh100% (1)

- Examination No. 1Document4 pagesExamination No. 1Cristel ObraPas encore d'évaluation

- Country RiskDocument3 pagesCountry RiskBet TranPas encore d'évaluation

- Portfolio AnalysisDocument36 pagesPortfolio Analysissalman200867100% (2)

- Algo - Lec3 - Verifying Correctness of Algorithm PDFDocument126 pagesAlgo - Lec3 - Verifying Correctness of Algorithm PDFHamza BhattiPas encore d'évaluation

- National Sales Account Manager in Cincinnati OH Resume Robert TeetsDocument2 pagesNational Sales Account Manager in Cincinnati OH Resume Robert TeetsRobertTeetsPas encore d'évaluation

- Lab 1 Silicon Diode S21314Document5 pagesLab 1 Silicon Diode S21314Muhd RzwanPas encore d'évaluation

- ECE 240 - Project1-CMOS InverterDocument7 pagesECE 240 - Project1-CMOS InverterAbhishek Sthanik GubbiPas encore d'évaluation

- Investments, Chapter 4: Answers To Selected ProblemsDocument5 pagesInvestments, Chapter 4: Answers To Selected ProblemsRadwan MagicienPas encore d'évaluation

- Kopie Van The Lazy Goldmaker's Jewelcrafting SpreadsheetDocument14 pagesKopie Van The Lazy Goldmaker's Jewelcrafting SpreadsheetAnonymous 7jb17EQPPas encore d'évaluation

- Fisa Stocuri - Bar 04.04.2012Document3 pagesFisa Stocuri - Bar 04.04.2012Georgiana FintoiuPas encore d'évaluation

- Olympics, A Zim AppraisalDocument3 pagesOlympics, A Zim Appraisalbheki213Pas encore d'évaluation

- Barringer E3 TB 06 PDFDocument17 pagesBarringer E3 TB 06 PDFXiAo LengPas encore d'évaluation

- G.o.no12 Amended To Go 59 by Telangana Govt.Document2 pagesG.o.no12 Amended To Go 59 by Telangana Govt.Murali Emani75% (8)

- PPL Exam Secrets Guide: Aviation Law & Operational ProceduresD'EverandPPL Exam Secrets Guide: Aviation Law & Operational ProceduresÉvaluation : 4.5 sur 5 étoiles4.5/5 (3)

- Preclinical Pathology Review 2023: For USMLE Step 1 and COMLEX-USA Level 1D'EverandPreclinical Pathology Review 2023: For USMLE Step 1 and COMLEX-USA Level 1Évaluation : 5 sur 5 étoiles5/5 (1)

- Improve Your Global Business English: The Essential Toolkit for Writing and Communicating Across BordersD'EverandImprove Your Global Business English: The Essential Toolkit for Writing and Communicating Across BordersÉvaluation : 4 sur 5 étoiles4/5 (14)

- The NCLEX-RN Exam Study Guide: Premium Edition: Proven Methods to Pass the NCLEX-RN Examination with Confidence – Extensive Next Generation NCLEX (NGN) Practice Test Questions with AnswersD'EverandThe NCLEX-RN Exam Study Guide: Premium Edition: Proven Methods to Pass the NCLEX-RN Examination with Confidence – Extensive Next Generation NCLEX (NGN) Practice Test Questions with AnswersPas encore d'évaluation

- Note Taking Mastery: How to Supercharge Your Note Taking Skills & Study Like a GeniusD'EverandNote Taking Mastery: How to Supercharge Your Note Taking Skills & Study Like a GeniusÉvaluation : 3.5 sur 5 étoiles3.5/5 (10)

- NASM CPT Study Guide 2024-2025: Review Book with 360 Practice Questions and Answer Explanations for the Certified Personal Trainer ExamD'EverandNASM CPT Study Guide 2024-2025: Review Book with 360 Practice Questions and Answer Explanations for the Certified Personal Trainer ExamPas encore d'évaluation

- Outliers by Malcolm Gladwell - Book Summary: The Story of SuccessD'EverandOutliers by Malcolm Gladwell - Book Summary: The Story of SuccessÉvaluation : 4.5 sur 5 étoiles4.5/5 (17)

- Nursing School Entrance Exams: HESI A2 / NLN PAX-RN / PSB-RN / RNEE / TEASD'EverandNursing School Entrance Exams: HESI A2 / NLN PAX-RN / PSB-RN / RNEE / TEASPas encore d'évaluation

- Adult CCRN Exam Premium: For the Latest Exam Blueprint, Includes 3 Practice Tests, Comprehensive Review, and Online Study PrepD'EverandAdult CCRN Exam Premium: For the Latest Exam Blueprint, Includes 3 Practice Tests, Comprehensive Review, and Online Study PrepPas encore d'évaluation

- CUNY Proficiency Examination (CPE): Passbooks Study GuideD'EverandCUNY Proficiency Examination (CPE): Passbooks Study GuidePas encore d'évaluation

- 2024/2025 ASVAB For Dummies: Book + 7 Practice Tests + Flashcards + Videos OnlineD'Everand2024/2025 ASVAB For Dummies: Book + 7 Practice Tests + Flashcards + Videos OnlinePas encore d'évaluation

- USMLE Step 1: Integrated Vignettes: Must-know, high-yield reviewD'EverandUSMLE Step 1: Integrated Vignettes: Must-know, high-yield reviewÉvaluation : 4.5 sur 5 étoiles4.5/5 (7)

- Norman Hall's Firefighter Exam Preparation BookD'EverandNorman Hall's Firefighter Exam Preparation BookÉvaluation : 5 sur 5 étoiles5/5 (3)

- Check Your English Vocabulary for TOEFL: Essential words and phrases to help you maximise your TOEFL scoreD'EverandCheck Your English Vocabulary for TOEFL: Essential words and phrases to help you maximise your TOEFL scoreÉvaluation : 5 sur 5 étoiles5/5 (1)

- Clinical Internal Medicine Review 2023: For USMLE Step 2 CK and COMLEX-USA Level 2D'EverandClinical Internal Medicine Review 2023: For USMLE Step 2 CK and COMLEX-USA Level 2Pas encore d'évaluation

- The Official U.S. Army Survival Guide: Updated Edition: FM 30-05.70 (FM 21-76)D'EverandThe Official U.S. Army Survival Guide: Updated Edition: FM 30-05.70 (FM 21-76)Évaluation : 4 sur 5 étoiles4/5 (1)

- Drilling Supervisor: Passbooks Study GuideD'EverandDrilling Supervisor: Passbooks Study GuidePas encore d'évaluation

- Certified Professional Coder (CPC): Passbooks Study GuideD'EverandCertified Professional Coder (CPC): Passbooks Study GuideÉvaluation : 5 sur 5 étoiles5/5 (1)

- Pilot's Handbook of Aeronautical Knowledge (2024): FAA-H-8083-25CD'EverandPilot's Handbook of Aeronautical Knowledge (2024): FAA-H-8083-25CPas encore d'évaluation

- EMT (Emergency Medical Technician) Crash Course with Online Practice Test, 2nd Edition: Get a Passing Score in Less TimeD'EverandEMT (Emergency Medical Technician) Crash Course with Online Practice Test, 2nd Edition: Get a Passing Score in Less TimeÉvaluation : 3.5 sur 5 étoiles3.5/5 (3)

- College Level Anatomy and Physiology: Essential Knowledge for Healthcare Students, Professionals, and Caregivers Preparing for Nursing Exams, Board Certifications, and BeyondD'EverandCollege Level Anatomy and Physiology: Essential Knowledge for Healthcare Students, Professionals, and Caregivers Preparing for Nursing Exams, Board Certifications, and BeyondPas encore d'évaluation

- The Science of Self-Discipline: The Willpower, Mental Toughness, and Self-Control to Resist Temptation and Achieve Your GoalsD'EverandThe Science of Self-Discipline: The Willpower, Mental Toughness, and Self-Control to Resist Temptation and Achieve Your GoalsÉvaluation : 4.5 sur 5 étoiles4.5/5 (77)

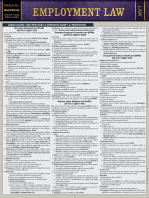

- Employment Law: a Quickstudy Digital Law ReferenceD'EverandEmployment Law: a Quickstudy Digital Law ReferenceÉvaluation : 1 sur 5 étoiles1/5 (1)

- Summary of Sapiens: A Brief History of Humankind By Yuval Noah HarariD'EverandSummary of Sapiens: A Brief History of Humankind By Yuval Noah HarariÉvaluation : 1 sur 5 étoiles1/5 (3)