Académique Documents

Professionnel Documents

Culture Documents

Application of Business Sciences To Solve Business Problems - Marketelligent

Transféré par

Marketelligent0 évaluation0% ont trouvé ce document utile (0 vote)

34 vues17 pagesCRM Analytics

Titre original

Application of Business Sciences to Solve Business Problems_Marketelligent

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentCRM Analytics

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

34 vues17 pagesApplication of Business Sciences To Solve Business Problems - Marketelligent

Transféré par

MarketelligentCRM Analytics

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 17

Application of Decision Sciences

to Solve Business Problems

Customer Relationship Management

Acquisition Usage & Loyalty

V

a

l

u

e

Time

Retention

Activation

Make targeted decisions for effective relationship

management with the customer through every phase of

their lifecycle

CRM

Analytics

Acquisitions

Prospect Targeting

Prospect acquisition is specifically concerned with issues like acquiring the right prospect at an optimal cost,

acquiring as many prospects as possible, optimizing across channels, etc. The main objectives are ensuring

high profitability of new customers and acquiring them at a low cost. By analyzing prospect demographics,

predictive modeling techniques are employed to identify their propensity to respond. Profitability models are

then built for different segments.

It helps in answering business questions like:

How do we proactively acquire new customers?

Who will be the most profitable customers? And in which channels do we target them?

Can the varied data sources be leveraged to expand prospect universe and implement efficient direct

marketing campaigns?

How can direct marketing spend be lowered while maintaining results?

Response models to optimize Acquisition budgets

0%

5%

10%

15%

20%

25%

1 2 3 4 5 6 7 8 9 10

Hot Leads Warm Leads

Random; 10.9% leads bought a new car

Predictive

Model

%

L

e

a

d

s

w

h

o

p

u

r

c

h

a

s

e

d

a

c

a

r

Predictive Model Deciles; Each decile has 10% of Leads

Cold Leads

Who are my

Customers?

Customer Segmentation

In todays competitive business scenario with customers having a multitude of options, their preferences and

buying patterns have been constantly evolving. For retaining the profitable and loyal customers, it is

therefore necessary to keep track of changing customer trends and accordingly tailor the offerings.

Segmentation is the practice of identifying homogenous groups of customers based on their needs, attitudes,

interests and purchase behavior. It enables identifying profitable customer segments and customizing

product and service offerings and marketing campaigns to target them effectively. It is typically done using a

combination of transaction data, demographic data and psychographic information.

It aids in answering critical business questions like:

Which are the most profitable and loyal customer segments and how do we have tailored offerings for

these segments?

How do we have special promotion campaigns, specifically to reach the high value customer segments?

What are the revenue and profit contributions by different customer segments?

Platinum: Current investment > 50K

Gold: Current investment > 5K; < 50K

Silver: Current investment < 5K

Tenure<12mo

All Customers

1,889

1,637 MM EAD

87k AED/Customer

New Customers

4,568 (24%)

433 MM EAD (27%)

95k AED/Customer

Existing Customers

11,573 (76%)

1,203 MM EAD

(73%)

84k AED/Customer

Savers

2,944 (16%)

39 MM EAD (2%)

13k AED/Customer

Investors

7,316 (38%)

812 MM EAD (50%)

111k

AED/Customer

Redeemers

871 (5%)

60 MM EAD (4%)

69k AED/Customer

Revolvers

3,190 (17%)

292 MM EAD (18%)

92k AED/Customer

Platinum

Gold

Silver

Platinum

Gold

Silver

Platinum

Gold

Silver

Platinum

Gold

Silver

Platinum

Gold

Silver

Segmenting customers based on their revenue contribution

Who are my

Profitable

Customers?

Profitability & Loyalty analysis

For the sustainable growth of any enterprise, it is very important to identify the most profitable and loyal

customers. Having special schemes for these customers in form of offers and discounts, can help in realizing

the long termgoals of increasing profits and expanding customer base.

Organizations use customer profitability and loyalty analysis to identify the most valuable customer segments

to prioritize marketing, sales and service investments. Transactional behaviour is analysed for creating a

Customer Value Score (C-score) for each customer, which explains their engagement levels. The C-Score can

be leveraged for proactive action to defend, retain and grow the customer base.

This can help answer key business questions like:

Which are the most profitable and loyal customer segments and how much they contribute to the firms

profit?

Which are the customer segments to be targeted for marketing programs and special offers?

Which are the customer segments that can have a negative impact on the companys profitability?

0%

10%

20%

30%

50%

P

r

o

f

i

t

C

o

n

t

r

i

b

u

t

i

o

n

10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

Watch Out:

Customers accounting

for losses.

Focus:

Customers who

have growth

potential

Sustain:

Highly profitable customers

Invest & Sustain:

Profitable customers

%Customers

Invest :

Highly profitable

customers

40%

Cross Selling & Upselling Strategies

It is not just enough to retain the profitable and loyal customers, but it has become a necessity to increase

the revenue contribution from the existing customer base. Cross Sell involves the sale of additional items in

order to increase the wallet share fromthe customers.

Market basket analysis is the technique used to evaluate customers purchasing behaviour and to identify the

different items bought together in the same shopping session. It uses transactional data and employs

predictive modelling techniques to identify customers preferences based on the associations between the

products recently purchased. It helps to determine which products are to be offered and which are the

customer segments most likely to be receptive to these cross selling propositions.

It aids in strengthening relations with customers by:

Customizing layouts, product assortments and pricing so that it appeals to the customers

Designing effective affinity promotions

Stimulating trials and increase customer awareness during launch of new products and variants

Handling excess stock by designing offers among associated products

Deepening

Engagement

CONFIDENCE Product 1 Product 2 Product 3 Product 4 Product 5 Product 6 Product 7 Product8

Product 1 100% 25% 9% 6% 18% 2% 28% 31%

Product 2 42% 100% 7% 8% 22% 6% 29% 22%

Product 3 31% 16% 100% 5% 10% 4% 18% 17%

Product 4 35% 29% 8% 100% 28% 7% 26% 12%

Product 5 47% 35% 8% 12% 100% 3% 37% 24%

Product 6 37% 66% 18% 19% 21% 100% 25% 21%

Product 7 45% 28% 8% 7% 23% 2% 100% 25%

Product 8 57% 24% 9% 3% 17% 2% 29% 100%

Probability that Product 8 is purchased given that Product 1 is bought is 31%

Probability that Product 1 is purchased given that Product 8

is bought is 57%

Increasing sales by creating cross-selling opportunities using MBA

Campaign

Management

Promotion dashboard to track the effectiveness of different campaigns

Campaign Effectiveness

Campaigns include a variety of short term programs directed at consumers to stimulate product awareness,

trial or purchase. The most commonly implemented programs include sampling and free trials, free gifts,

couponing , loyalty reward programs, special pricing, promotional contests and so on. Advanced econometric

modeling techniques are used to help companies refine their promotion strategies, to understand the lift

generated by various campaigns and the associated ROI.

This information is then used by marketers to:

Identify the impact of different campaigns and find out the most effective one

Optimally allocate budget among different campaigns while increasing sales and maximizing ROI

Design campaigns specific to a category instead of following one-size fits all approach

Measure the campaign effectiveness for continuous improvement and track the profitability of retained

customers

Customer

Lifetime Value

Customer Lifetime Value

Customer lifetime value (CLV) represents how much a customer is worth in monetary terms and is based on

customers expected retention and spending rate. It can be defined as the present value of the total profit

expected from the customers during the entire period they do business with the company. CLV analysis uses

customers past transaction data and employs predictive modelling techniques to forecast how much each

customer would contribute to the companys revenues and profits till they remain with the company and do

not attrite. The analysis can also be extended to estimate the lifetime values of new customers. CLV analysis

takes into account estimated annual profits from customers, duration of business relation of the customer,

and the discount rate to assess the net present value of the customers.

CLV analysis is used for:

Forecasting the expected revenue from new customers and weighing it against the acquisition and

retention cost for them

Deciding how much to spend on marketing programs for different customers

Identifying the high value customer segments that can contribute the maximum to companys revenue

and have special offers for them

Identify the prospects who can become profitable for the company

Computing CLV for a Cards Portfolio

Monthly

Expenses

Monthly

Net Revenues

Customer

Tenure

Net Margin

Accumulated

Margin

Acquisition

Costs

Customer Lifetime

Value

Predict monthly Revenues

Predict Customer Attrition

Predict Response Rates From existing P&Ls

Customer

Retention

Churn Management

To retain customers, it is very essential to keep tracking customers activity regularly their frequency of

shopping, evolution of their shopping patterns, how often do they shop and so on. Customers attrite on a

definite path to inactivity which can be identified and therefore managed. Also, acquiring new customers has

become far more expensive than retaining existing ones and hence customer retention has become a major

corporate priority. By employing attrition analysis, customers whose engagement levels have lowered and

who are likely to attrite can be identified and appropriate retention strategies can be formulated.

Churn analysis helps answer key business questions like:

Which are the customer segments, to be targeted for retention programs?

How do we identify the factors which are most likely to drive customers to remain:

Creating segments based on preferences and buying patterns so that right offers can be made to the

right people

Understand the variables that make high-value customers most likely to purchase and offer

incentives and personalized service

Attrition rate by customer tenure

A

t

t

r

i

t

i

o

n

R

a

t

e

%

0%

10%

20%

30%

40%

50%

60%

70%

-

1

2

3

4

5

0 - 0.5 year 0.5 - 1 year 1 - 3 years 3 - 5 years > 5 years

#

C

u

s

t

o

m

e

r

s

(

M

M

)

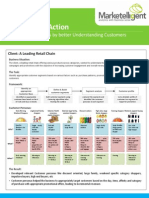

Business Situation:

The client, a leading retail chain offering various products across categories, wanted to understand its customers to better plan customized

campaigns and promotions with the objective of increasing customer engagement and overall revenues.

The Task:

Identify appropriate customer segments based on various factors such as purchase patterns, promotion response and demographics of the

customers.

Framework:

Customer Personas:

Analytics in Action

Increasing Revenues by better Understanding Customers

Client: A Leading Retail Chain

Define & Build

customer segments

Segment analysis Customer profile

Identified an appropriate

customer base based on the #

of visits and days on books

Built customer segments using

clustering algorithms after

treating the outliers

Analyzed the segments and

identified the customer

personas in each segment

Got a detailed profile of

customer in a segment to

target for promotion

Who?

What?

When?

70% sales

from FMCG &

Staples

Early morning

Weekend

Early Morning

Weekend Shoppers

Large family

High visits

60% sales

from FMCG &

Staples.

Multi-

category

shopping

Afternoon to

Evening

High sales, large

family shoppers

Salaried

staples

shoppers

70% sales

from Staples

Shops in rice,

oil, pulses and

flour

Morning to

Afternoon

1

st

10 days

Salaried, Health

conscious,

staples shoppers

Salaried

Large family

50% sales-

staples, 30%-

FMCG.

Multi-

category

shopping

Morning to

Afternoon

Weekend 1

st

10 days

Salaried, large family,

weekend shoppers

Low visits

Low sales and

high margin

45% sales

from Apparels

Shops in

Mens casual

and formal,

ethnic wear

Morning to

Afternoon

Weekend

Weekend, apparel buying

shoppers

Single family

with kids

Health

conscious

70% sales-

FMCG

High

proportion of

baby care and

health SKUs

Morning to

Afternoon

single/small family

shoppers

Discount

seekers

50% sales

from Home

needs.

Shops in

utensils, bed

and luggage

Afternoon to

Evening

Weekend

Discount seekers

70% sales

from Staples

& FMCG

Evening

Evening shoppers

The Result:

Developed relevant Customer personas like discount oriented, large family, weekend specific category shoppers,

impulsive buyers, high end buyers, etc

Customer personas helped the business to appropriately target customers based on the day, time, affinity and category

of purchase with appropriate promotional offers, leading to incremental revenues

Identify an

appropriate

Customer Base

Small to

Medium size

families

Large families

shops mostly

in FMCG and

Staples

Business Situation :

The insurance provider generated leads through cross-selling. Potential customers were targeted in a 4-stage process, and they generally

displayed 4 possible outcomes:

Resources were being wasted on pursuing unlikely Prospects classified in red boxes above. The insurance provider wanted to determine which

members were more likely to complete at each stage , and then fast track the application through the approval process. By reducing the

proportion of declined and incomplete applications, operating costs could be optimized.

The Task :

- Develop a framework of predictive models to calculate the probability of a prospect purchasing the insurance product

- Get a more targeted base of Prospects, and hence reduce costs by removing prospects with least probability of buying the Product

Analytical Framework :

- Historical data , which contained information fromboth, internal and external sources, was analyzed

- Logistic models were built for identifying separate probabilities for each stage of the approval process

- Testing was done if Oversampling or Undersampling would improve the performance of the predictive models

- All the models were then combined to identify the best leads

- The models were validated and implemented as SAS Macros to enable real-time scoring

The Result :

The framework of 3 models provided useful insights on probabilities associated with approvals and important factors affecting it

Up to 25% of total applications were removed with a loss of just 5% of Paid customers

With costs going down by 25%, we were able to achieve an increment 14% net profits.

Analytics in Action

Targeted Prospecting. Increasing Profits by 14%.

Client : An Insurance Provider in the US

Targeted

Prospects

Approved

Completed

Forms

Paid Premium

Didnt Pay Did not Declined

Target : 100

Approved : 85

Completed: 68 Paid : 58

Predictive Models

Target : 75

Approved : 70

Completed: 62 Paid : 55

Business Situation :

The Automotive OEM, with dealerships across the US, was receiving almost 30,000 leads every month from various lead aggregator sites

across the internet. Individual leads came with limited information name, address, email, time frame of purchase, vehicle of interest and

trade-in type. The auto retailer wanted to put in place a ranking systemso as to classify each incoming lead into hot, warmor cold; depending

on the leads propensity to buy a new car in the next 30 days. This ranking system would enable the OEMto be the first to reach out to a Lead

and convert himinto a Customer.

The Task :

- Develop a predictive model that will tag each incoming lead as hot; warm or cold depending on the leads propensity to buy a new car in the

next 30 days

- Implement the predictive model in a real-time system so that hot leads get scored and automatically routed to the appropriate dealership

depending on the location of the lead and the dealer

Analytical Framework :

A 4-step analytical process was used:

1. Lead information along with auto purchase status over the past 2 years was analyzed. It was found that on average, 10.9% of leads

converted and bought a new car within 30 days.

2. Lead information variables like name, address, email, time frame of purchase, vehicle of interest and trade-in type, etc were transformed

into derived variables. Text data entered online by leads as comments was also considered.

3. A predictive model was built to classify each lead into hot, warmor cold.

4. The model was validated and implemented as a SQL Stored Procedure to enable real-time delivery of hot leads to the right dealerships.

The Result :

The predictive model was able to segregate each incoming lead into hot, mediumor cold.

Hot leads had an auto purchase rate of 19%; almost twice that of an average lead. These hot leads were instantly routed to the

appropriate dealership for immediate follow-up by their best salesmen. Warm leads had a purchase rate of 11% and were actioned upon

in the usual manner. Cold leads were not actioned upon.

After 3 months of using the lead rating system, auto sales went up by 12% across dealerships.

Analytics in Action

Identifying Hot Auto Leads. Increasing Sales by 12%

Client : An Automotive OEM in the US

0%

5%

10%

15%

20%

25%

1 2 3 4 5 6 7 8 9 10

%

L

e

a

d

s

w

h

o

p

u

r

c

h

a

s

e

d

a

C

a

r

Predictive Model Deciles; Each decile has 10% of Leads

Hot Leads Warm Leads Cold Leads

Random; 10.9% leads bought a new car

Predictive

Model

Business Situation:

The client, a US based technology corporation with a Global presence, has hundreds of partnerships across verticals and solutions. Recently

they noticed that some partners dilute their brand, are not strategically aligned, and are not being fully leveraged. Lacking a framework to

evaluate and prioritize partners, the client has witnessed a decline in brand equity which has stressed Marketing capabilities.

The Task:

To develop a framework that evaluates and prioritizes partnerships based on relevant criteria. This will score every partner on an index and

can be used to prioritize existing partnerships, identify future partnerships, or review risky partnerships.

Analytical Framework:

Developed a framework based on Multi Criteria Decision Analysis (MCDA) technique. Partnerships are evaluated on criteria like Brand equity,

financial health, strategic alignment, consumer perception, etc and scored on an index of 1-10.

The Result:

After evaluating existing partnerships, 7 were identified as brand diluting and risky, and have been reviewed.

The marketing team compared the scores for existing partners against the marketing funding received from partners for joint marketing

activities. When viewed from a strategic alignment perspective, some partners had very high synergy but were not being fully leveraged in

terms of marketing activities. This resulted in $20M increased partner funding towards marketing activities.

This framework was further used to identify and prioritize new partnerships in Education, Healthcare and Technology segments.

Analytics in Action

Evaluate and Prioritize Business Partnerships

Client: Among the top PC manufacturers in the world

Decision scorecard for new partners in Education

Decision scorecard for existing partners

Define parameters

Gather data and

score the

parameters

Assign weights

based on user

preferences

Score partnerships

and derive insights

Identify all parameters that evaluate a

partnership. Can vary by vertical,

geography, etc.

Qualitative and quantitative data is scored

by ranking the outcomes in a hierarchy.

After a discussion with all the stakeholders,

assign weights to parameters based on the

decision makers preference.

Score the partnerships on an index of 1-10

based on the weighted average of selected

parameters.

MCDA framework process flow

Business Situation:

The client, a US based database publisher, has 12-15 specific products designed for Enterprise Markets. Products vary from repository of

research documents, tools that aid research processes; research documentation; databases that identify new technologies, and technology

partners; engineering, Oil and Gas, pharmaceutical and other domain specific databases. Higher versions of a product package are also

available. Corporate clients that are research oriented subscribe to some products, and not to others due to lack of need and/or awareness.

The Task:

To build a cross-sell strategy that identifies customers with a propensity to buy a specific product in addition to their current portfolio. To build

an up-sell strategy that identifies customers with a propensity to upgrade current products to higher versions. The exercise consisted of

scoring both the customer and each product with respect to the customers profile and life-cycle.

Analytical Framework:

The analytical framework was built using Market Basket principles. A scoring model was then developed to evaluate each Customer, followed

by evaluation of each product with respect to the Customer.

The Result:

Cross-sell and up-sell recommendations implemented by business in a targeted fashion

Revenues from current customers increased by 18% in Q1 and Q2 2013 as compared to the same period last year

The Marketing team now uses the Cross-sell framework as an enabler in setting new Account Expansion strategies

Analytics in Action

Increasing B2B Customer Engagement via Targeted Cross-sell

Client: Leading Business Database Publishing House

Business Situation:

The client, a South-east Asia based oil and gas Retailer encountered a significant increase in customer churn at their gas filling stations despite

having a tried and tested loyalty program in place. This resulted in a 4.6 % drop in sales during Q2 2012. The business wanted to monitor and

control Customer churn at regular intervals.

The Task:

To develop and implement a program that monitors Customer engagement levels and attrition risk, measure business impact from Customer

churn, and develop actionable strategies to manage Customer Attrition.

Analytical Framework:

High value customers that left the business impacted sales significantly. Segments were developed to slot each high-value Customer on the

basis of recent purchase patterns. Movement of Customers across segments and over time was used to identify the level of engagement the

Customer had with the Business. Segment-specific offers and campaigns were implemented to manage customer attrition. Results from the

campaigns were used to continuously refine targeting and messaging.

The Result:

Based on the analysis, the Business was able to identify high value Customers at risk of attrition. Suitable Retention programs were

designed and implemented for these Customers.

Business was able to more efficiently utilize its Retention budget as targeted customers consisted of only 15% of the overall customer base

Sales in Q4 2012 were up by an average of 2.1 % as compared to the previous two quarters.

Analytics in Action

Proactively Retaining your most Valuable Customers

Client: A Leading Petroleum Retailer

10%

39%

21%

32%

39%

24%

30%

6%

# of customers Revenue contribution

0%

25%

50%

75%

100%

High Medium-High Medium-Low Low

MANAGEMENT TEAM

GLOBAL EXPERIENCE.

PROVEN RESULTS.

Roy K. Cherian

CEO

Roy has over 20 years of rich experience in marketing, advertising and media

in organizations like Nestle India, United Breweries, FCB and Feedback

Ventures. He holds an MBA fromIIMAhmedabad.

Anunay Gupta, PhD

COO &Head of Analytics

Anunay has over 15 years of experience, with a significant portion focused

on Analytics in Consumer Finance. In his last assignment at Citigroup, he was

responsible for all Decision Management functions for the US Cards

portfolio of Citigroup, covering approx $150B in assets. Anunay holds an

MBA in Finance fromNYU Stern School of Business.

Kakul Paul

Business Head, CPG & Retail

Kakul has over 8 years of experience within the CPG industry. She was

previously part of the Analytics practice as WNS, leading analytic initiatives

for top Fortune 50 clients globally. She has extensive experience in what

drives Consumer purchase behavior, market mix modeling, pricing &

promotion analytics, etc. Kakul has an MBA fromIIMAhmedabad.

ADVANCED ANALYTICAL SOLUTIONS

MARKETELLIGENT, INC.

80 Broad Street, 5th Floor, New York, NY 10004

1.212.837.7827 (o) 1.208.439.5551 (fax) info@marketelligent.com

CONTACT

www.marketelligent.com

Industry Business Focus Tools and Techniques

Consumer Finance Investment Optimization SAS, SPSS, R, VBA

Credit Cards Revenue Maximization Cluster analysis

Loans and Mortgages Cost and Process Efficiencies Factor analysis

Retail Banking & Insurance Forecasting Structural Equation Modeling

Wealth Management Predictive Modeling Conjoint analysis

Consumer Goods and Retail Risk Management Perceptual maps

CPG & Retail Pricing Optimization Neural Networks

Consumer Durables Customer Segmentation Chaid / CART

Manufacturing and Supply Chain Drivers Analysis Genetic Algorithms

High Tech OEMs Supply Chain Management Support Vector Machines

Automotive Sentiment Analysis

Logistics & Distribution

YOUR PARTNER FOR

DATA ANALYTI CS SERVI CES

Greg Ferdinand

EVP, Business Development

Greg has over 20 years of experience in global marketing, strategic planning,

business development and analytics at Dell, Capital One and AT&T. He has

successfully developed and embedded analytic-driven programs into a

variety of go-to-market, customer and operational functions. Greg holds an

MBA fromNYU Stern School of Business

Vous aimerez peut-être aussi

- Measuring Customer Lifetime ValueDocument16 pagesMeasuring Customer Lifetime ValuekharismaPas encore d'évaluation

- Womens Clothing Boutique Business PlanDocument51 pagesWomens Clothing Boutique Business PlanIsaac Andy86% (7)

- New Venture and Long-Term EnterpriseDocument3 pagesNew Venture and Long-Term Enterpriseshania aranda50% (2)

- How To Retain Existing CustomersDocument15 pagesHow To Retain Existing CustomersPioneer MarketersPas encore d'évaluation

- Company Background: Trader Joe's Written Case Analysis Key FactsDocument5 pagesCompany Background: Trader Joe's Written Case Analysis Key FactsDominique Andrea CasiñoPas encore d'évaluation

- Customer Retention ADocument21 pagesCustomer Retention ArajuPas encore d'évaluation

- Employee Retention ProjectDocument27 pagesEmployee Retention ProjectAshish Kashyap86% (7)

- Loyalty Marketing & Loyal CustomersDocument17 pagesLoyalty Marketing & Loyal Customerssushildas2990% (1)

- Transactional Vs Relationship ApproachDocument14 pagesTransactional Vs Relationship Approachkarthinaidu100% (2)

- Analytics in Action - How Marketelligent Helped A B2B Retailer Increase Its Lead VelocityDocument2 pagesAnalytics in Action - How Marketelligent Helped A B2B Retailer Increase Its Lead VelocityMarketelligentPas encore d'évaluation

- Calculate Customer Lifetime Value (CLVDocument3 pagesCalculate Customer Lifetime Value (CLVAyush KesriPas encore d'évaluation

- Business English Vocabulary: Word MeaningDocument39 pagesBusiness English Vocabulary: Word MeaningJonathasPas encore d'évaluation

- Anthony Robbins - Interviews Jay Abraham - How To Get Any Business Going and GrowingDocument24 pagesAnthony Robbins - Interviews Jay Abraham - How To Get Any Business Going and Growingapi-38044790% (1)

- M&S Effective Loyalty Schemes Within Travel and LeisureDocument14 pagesM&S Effective Loyalty Schemes Within Travel and LeisureMarks and Spencer for businessPas encore d'évaluation

- Analytics in Action - How Marketelligent Helped A Retailer Rationalize SKU'sDocument2 pagesAnalytics in Action - How Marketelligent Helped A Retailer Rationalize SKU'sMarketelligentPas encore d'évaluation

- Accenture How Successful Is Your Campaign and Promotion ManagementDocument8 pagesAccenture How Successful Is Your Campaign and Promotion ManagementritenbPas encore d'évaluation

- Loyalty: Professor: Ehab Mohamed Abou AishDocument54 pagesLoyalty: Professor: Ehab Mohamed Abou AishMohamed Abo ElKomsanPas encore d'évaluation

- Customer equity value and lifetime revenue importanceDocument10 pagesCustomer equity value and lifetime revenue importanceSniper ShaikhPas encore d'évaluation

- CRMDocument50 pagesCRMAshley_RulzzzzzzzPas encore d'évaluation

- Customer RetentionDocument60 pagesCustomer RetentionRAHULAVIATORPas encore d'évaluation

- 3 Creating Customer Value & Customer RelationshipsDocument35 pages3 Creating Customer Value & Customer RelationshipsFaryal MasoodPas encore d'évaluation

- Introduction to the Meaning and Framework of Customer Relationship ManagementDocument48 pagesIntroduction to the Meaning and Framework of Customer Relationship ManagementAsif KhanPas encore d'évaluation

- CRM Strategies For B2B MarketsDocument33 pagesCRM Strategies For B2B MarketsFaisal Ahmad JafriPas encore d'évaluation

- Types of Merchandising Basic Functions of Retail MerchandisingDocument40 pagesTypes of Merchandising Basic Functions of Retail MerchandisingSWAPNIL KRISHNAPas encore d'évaluation

- Marketing Assignment MKW1120Document20 pagesMarketing Assignment MKW1120slim0008100% (1)

- Application of Decision Sciences To Solve Business Problems - MarketelligentDocument17 pagesApplication of Decision Sciences To Solve Business Problems - MarketelligentMarketelligentPas encore d'évaluation

- Managing Different Stages of CRM: Dr. Savita SharmaDocument28 pagesManaging Different Stages of CRM: Dr. Savita SharmaShaurya VirmaniPas encore d'évaluation

- CRM Analytics - MarketelligentDocument2 pagesCRM Analytics - MarketelligentMarketelligentPas encore d'évaluation

- AMM 1 To 30Document88 pagesAMM 1 To 30Sai KrishnaPas encore d'évaluation

- Marketing AnalyticsDocument14 pagesMarketing AnalyticsayushPas encore d'évaluation

- connecting-with-customer_0Document40 pagesconnecting-with-customer_0eurainnepacleb710Pas encore d'évaluation

- Creating Customer ValueDocument6 pagesCreating Customer ValueSserwadda Abdul RahmanPas encore d'évaluation

- Summary Note For Module 3Document2 pagesSummary Note For Module 3Xiaowei SHEPas encore d'évaluation

- Cost Accounting - Customer Profitability AnalysisDocument18 pagesCost Accounting - Customer Profitability AnalysisNayeem AhmedPas encore d'évaluation

- Customer Value and Retention in Consumer BehaviorDocument10 pagesCustomer Value and Retention in Consumer BehaviorAtikurRahmanNadimPas encore d'évaluation

- Customer Retention Challenges Research PaperDocument9 pagesCustomer Retention Challenges Research PaperrahulrupvyasPas encore d'évaluation

- Chapter 3 - CRM and It'S EconomicsDocument7 pagesChapter 3 - CRM and It'S EconomicsYogesh GomsalePas encore d'évaluation

- CLC - Analytics Problem StatementDocument13 pagesCLC - Analytics Problem StatementRana UsamaPas encore d'évaluation

- Understanding Marketing Management: Defining Marketing For The New Realities Developing Marketing Strategies and PlansDocument59 pagesUnderstanding Marketing Management: Defining Marketing For The New Realities Developing Marketing Strategies and PlansNandan ChoudharyPas encore d'évaluation

- Customer Relationship StrategyDocument5 pagesCustomer Relationship StrategyDah NEPALPas encore d'évaluation

- 7b7d3francis Buttle CRM Value ChainDocument5 pages7b7d3francis Buttle CRM Value ChainamityPas encore d'évaluation

- Relationship marketing strategyDocument9 pagesRelationship marketing strategyAlonewith BrokenheartPas encore d'évaluation

- Marketing MGTDocument10 pagesMarketing MGTKomal SamaniPas encore d'évaluation

- Meeting Customer Expectations and Maximizing Customer ValueDocument2 pagesMeeting Customer Expectations and Maximizing Customer ValueDonna Marie BibasPas encore d'évaluation

- MBA CRMDocument54 pagesMBA CRMKavitha NairPas encore d'évaluation

- 10 Power-Of-Subscription-Based-MarketingDocument18 pages10 Power-Of-Subscription-Based-Marketinganiket paulzadePas encore d'évaluation

- Creating Customer Value, Satisfaction, and LoyaltyDocument14 pagesCreating Customer Value, Satisfaction, and Loyaltyvinay saiPas encore d'évaluation

- How To Win Over CustomerDocument14 pagesHow To Win Over Customershrenikjc7121Pas encore d'évaluation

- Marketing AnalyticsDocument3 pagesMarketing AnalyticsdomsiitmPas encore d'évaluation

- Module 3Document71 pagesModule 3Balu JagadishPas encore d'évaluation

- b2b AssignmentDocument10 pagesb2b AssignmentNavya SurapaneniPas encore d'évaluation

- Customer Life ValueDocument8 pagesCustomer Life Valuefoxahef779Pas encore d'évaluation

- What Are Customer Value, Satisfaction, and Loyalty, and How Can Companies Deliver Them?Document1 pageWhat Are Customer Value, Satisfaction, and Loyalty, and How Can Companies Deliver Them?tsega-alem100% (1)

- Customer Profitability Is The Profit The Firm Makes From Serving A Customer or Customer GroupDocument3 pagesCustomer Profitability Is The Profit The Firm Makes From Serving A Customer or Customer GroupAkshay IratkarPas encore d'évaluation

- Marketing Managment: Creating Customer Value, Satisfaction and LoyaltyDocument32 pagesMarketing Managment: Creating Customer Value, Satisfaction and LoyaltyAnkit YadavPas encore d'évaluation

- Creating Customer Value, Loyalty and SatisfactionDocument20 pagesCreating Customer Value, Loyalty and Satisfactionmansi singhPas encore d'évaluation

- Strategic Market Management 11th Edition Aaker Solutions ManualDocument6 pagesStrategic Market Management 11th Edition Aaker Solutions Manualdanielxavia55fok100% (24)

- Currys Pyramid ModelDocument10 pagesCurrys Pyramid ModelChandra SekharPas encore d'évaluation

- Final Note MS 224 (Encrypted) PDFDocument119 pagesFinal Note MS 224 (Encrypted) PDFshahaneauez alamPas encore d'évaluation

- What Is Customer Lifetime Value (CLV) ?Document15 pagesWhat Is Customer Lifetime Value (CLV) ?Mohit RanaPas encore d'évaluation

- Project Report: "A Study To Understand Coustomer Loyaliy Program in Online Shoppling Portals"Document29 pagesProject Report: "A Study To Understand Coustomer Loyaliy Program in Online Shoppling Portals"JassiPas encore d'évaluation

- What Is Customer Acquisition? Definition & Strategies (39Document4 pagesWhat Is Customer Acquisition? Definition & Strategies (39sagar sadamastulaPas encore d'évaluation

- Comprehensive Report-CRM CLVDocument33 pagesComprehensive Report-CRM CLVFlorante De LeonPas encore d'évaluation

- Final Business Analytic and Marketing MetricsDocument44 pagesFinal Business Analytic and Marketing MetricskeiwmrPas encore d'évaluation

- Marketing of Services 2Document7 pagesMarketing of Services 2stocksshankarPas encore d'évaluation

- How Can Banks Meet Customers' Changing Needs and Preferences?Document12 pagesHow Can Banks Meet Customers' Changing Needs and Preferences?vinitanaidu29Pas encore d'évaluation

- Customer-Centricity: Putting Clients at the Heart of BusinessD'EverandCustomer-Centricity: Putting Clients at the Heart of BusinessPas encore d'évaluation

- Customer Analysis & Insight: An Introductory Guide To Understanding Your AudienceD'EverandCustomer Analysis & Insight: An Introductory Guide To Understanding Your AudiencePas encore d'évaluation

- Analytics in Action - How Marketelligent Helped A Petroleum Retailer Identify 'At Risk' CustomersDocument2 pagesAnalytics in Action - How Marketelligent Helped A Petroleum Retailer Identify 'At Risk' CustomersMarketelligentPas encore d'évaluation

- Order of Magnitude Forecast - How Marketelligent Helped A Leading OTC Company Launch New Products in Emerging MarketsDocument2 pagesOrder of Magnitude Forecast - How Marketelligent Helped A Leading OTC Company Launch New Products in Emerging MarketsMarketelligent100% (1)

- Application of Decision Sciences To Solve Business Problems - MarketelligentDocument14 pagesApplication of Decision Sciences To Solve Business Problems - MarketelligentMarketelligentPas encore d'évaluation

- Analytics in Action - How Marketelligent Helped A CPG Company Boost Store Order ValueDocument2 pagesAnalytics in Action - How Marketelligent Helped A CPG Company Boost Store Order ValueMarketelligentPas encore d'évaluation

- Automotive Capabilities - MarketelligentDocument17 pagesAutomotive Capabilities - MarketelligentMarketelligentPas encore d'évaluation

- Application of Decision Sciences To Solve Business Problems - MarketelligentDocument25 pagesApplication of Decision Sciences To Solve Business Problems - MarketelligentMarketelligentPas encore d'évaluation

- Marketelligent Capabilities & Offerings For Sales AnalyticsDocument10 pagesMarketelligent Capabilities & Offerings For Sales AnalyticsMarketelligentPas encore d'évaluation

- Analytics in Action - How Marketelligent Helped A Retailer Increase RevenuesDocument2 pagesAnalytics in Action - How Marketelligent Helped A Retailer Increase RevenuesMarketelligentPas encore d'évaluation

- Analytics in Action - How Marketelligent Helped An Online Remittance Firm Identify Risky TransactionsDocument2 pagesAnalytics in Action - How Marketelligent Helped An Online Remittance Firm Identify Risky TransactionsMarketelligentPas encore d'évaluation

- Analytics in Action - How Marketelligent Helped A Beverage Manufacturer Better Its Production PlanningDocument2 pagesAnalytics in Action - How Marketelligent Helped A Beverage Manufacturer Better Its Production PlanningMarketelligentPas encore d'évaluation

- Analytics in Action - How Marketelligent Helped Increase Customer Engagement Via Targeted Cross-SellDocument2 pagesAnalytics in Action - How Marketelligent Helped Increase Customer Engagement Via Targeted Cross-SellMarketelligentPas encore d'évaluation

- Analytics in Action - How Marketelligent Helped A US Manufacturer Improve Demand ForecastsDocument2 pagesAnalytics in Action - How Marketelligent Helped A US Manufacturer Improve Demand ForecastsMarketelligentPas encore d'évaluation

- Analytics in Action - How Marketelligent Helped A Quick Service Restaurant Chain Identify Customer Pain PointsDocument2 pagesAnalytics in Action - How Marketelligent Helped A Quick Service Restaurant Chain Identify Customer Pain PointsMarketelligentPas encore d'évaluation

- Analytics in Action - How Marketelligent Helped A Publishing House Identify Its Social InfluencersDocument2 pagesAnalytics in Action - How Marketelligent Helped A Publishing House Identify Its Social InfluencersMarketelligentPas encore d'évaluation

- Analytics in Action - How Marketelligent Helped A Hair Care Manufacturer Re-Design Its Product Communication StrategiesDocument2 pagesAnalytics in Action - How Marketelligent Helped A Hair Care Manufacturer Re-Design Its Product Communication StrategiesMarketelligentPas encore d'évaluation

- Analytics in Action - How Marketelligent Helped A Bank Validate A Predictive ModelDocument2 pagesAnalytics in Action - How Marketelligent Helped A Bank Validate A Predictive ModelMarketelligentPas encore d'évaluation

- Application of Decision Sciences To Solve Business Problems in The Consumer Packaged Goods (CPG) IndustryDocument24 pagesApplication of Decision Sciences To Solve Business Problems in The Consumer Packaged Goods (CPG) IndustryMarketelligentPas encore d'évaluation

- Analytics in Action - How Marketelligent Helped A Technology Firm Prioritize Business PartnershipsDocument2 pagesAnalytics in Action - How Marketelligent Helped A Technology Firm Prioritize Business PartnershipsMarketelligentPas encore d'évaluation

- Analytics in Action - How Marketelligent Helped A CPG Company Optimize Its Media PlanningDocument2 pagesAnalytics in Action - How Marketelligent Helped A CPG Company Optimize Its Media PlanningMarketelligentPas encore d'évaluation

- Analytics in Action - How Marketelligent Helped A B2B Retailer Minimize Bad DebtsDocument2 pagesAnalytics in Action - How Marketelligent Helped A B2B Retailer Minimize Bad DebtsMarketelligentPas encore d'évaluation

- Analytics in Action - How Marketelligent Helped A Retailer Rationalize SKU'sDocument2 pagesAnalytics in Action - How Marketelligent Helped A Retailer Rationalize SKU'sMarketelligent100% (1)

- Analytics in Action - How Marketelligent Helped An Insurance Provider Optimize Acquisition InvestmentsDocument2 pagesAnalytics in Action - How Marketelligent Helped An Insurance Provider Optimize Acquisition InvestmentsMarketelligentPas encore d'évaluation

- Analytics in Action - How Marketelligent Helped A Manufacturer Optimize Trade Promotion SpendsDocument2 pagesAnalytics in Action - How Marketelligent Helped A Manufacturer Optimize Trade Promotion SpendsMarketelligentPas encore d'évaluation

- Trade Promotion Optimization - MarketelligentDocument12 pagesTrade Promotion Optimization - MarketelligentMarketelligentPas encore d'évaluation

- Analytics in Action - How Marketelligent Helped A Leading Alcobev Manufacturer Forecast SalesDocument2 pagesAnalytics in Action - How Marketelligent Helped A Leading Alcobev Manufacturer Forecast SalesMarketelligentPas encore d'évaluation

- Analytics in Action - How Marketelligent Helped A Leading OTC Manufacturer Track Market DevelopmentDocument2 pagesAnalytics in Action - How Marketelligent Helped A Leading OTC Manufacturer Track Market DevelopmentMarketelligent100% (1)

- Pantaloon Retail IndiaDocument9 pagesPantaloon Retail IndiaPawan Kr MishraPas encore d'évaluation

- Conclusion: Rising CostsDocument2 pagesConclusion: Rising CostswahidPas encore d'évaluation

- Bangladesh Machine Tools FactoryDocument27 pagesBangladesh Machine Tools FactoryChouchir Sohel100% (2)

- Marketing Resume Jasmeet SinghDocument2 pagesMarketing Resume Jasmeet SinghJasmeetsingh09Pas encore d'évaluation

- Cable LimiterDocument6 pagesCable Limiterjavedsmg1Pas encore d'évaluation

- IAS 2: InventoriesDocument6 pagesIAS 2: InventoriescolleenyuPas encore d'évaluation

- In The Nutshell of Malaysia's Retail MarketDocument42 pagesIn The Nutshell of Malaysia's Retail MarketMaizul Deraman0% (1)

- Baby Dream Case Study (Rene)Document5 pagesBaby Dream Case Study (Rene)Jeenika S SingaravaluPas encore d'évaluation

- E-Commerce and BangladeshDocument15 pagesE-Commerce and BangladeshShihab KabirPas encore d'évaluation

- Loan Scheme CodesDocument4 pagesLoan Scheme Codesvikas100% (1)

- 10 Key Functions of Marketing ChannelsDocument24 pages10 Key Functions of Marketing ChannelsStephen John Hernandez MendozaPas encore d'évaluation

- 1968-02-28 The Enterprise RomanDocument24 pages1968-02-28 The Enterprise RomanRomulus Historical NewspapersPas encore d'évaluation

- Progress Test 2Document7 pagesProgress Test 2Nguyễn Bích ThuậnPas encore d'évaluation

- Chapter 9 ReportDocument1 pageChapter 9 ReportJobelle Baran DecelisPas encore d'évaluation

- Store Manager - WikipediaDocument9 pagesStore Manager - WikipediaRinu RoyPas encore d'évaluation

- Soal Soal BHS InggrisDocument10 pagesSoal Soal BHS InggrisRicky Aldi Firdaus0% (1)

- Marketing Notes 2-Marketing Channels of DistributionDocument8 pagesMarketing Notes 2-Marketing Channels of DistributionInformation should be FREEPas encore d'évaluation

- Financial Analysis On Tesco 2012Document25 pagesFinancial Analysis On Tesco 2012AbigailLim SieEngPas encore d'évaluation

- Thesis Raw Data For Direct Selling BusinessDocument2 pagesThesis Raw Data For Direct Selling BusinessEymard Siojo0% (2)

- Project Report of Raj NandanDocument74 pagesProject Report of Raj Nandanabhishekrawat88Pas encore d'évaluation

- Marketing Project: by Anu Thomas 11 ADocument11 pagesMarketing Project: by Anu Thomas 11 AThomas AntoPas encore d'évaluation

- Culinarian Cookware - Group 1Document10 pagesCulinarian Cookware - Group 1Subham Mohta0% (1)