Académique Documents

Professionnel Documents

Culture Documents

Five Competitive Forces

Transféré par

amisha2562585Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Five Competitive Forces

Transféré par

amisha2562585Droits d'auteur :

Formats disponibles

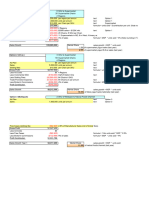

Five Competitive Forces (Porter)

The Five Forces model of Porter is an Outside-in business unit strategy tool that is used to make an analysis of the

attractiveness (value) of an industry structure. The Competitive Forces analysis is made by the identification of

fundamental competitive forces!

". #ntry of competitors. $o% easy or difficult is it for ne% entrants to start competing& %hich barriers do

e'ist.

(. Threat of substitutes. $o% easy can a product or service be substituted& especially made cheaper.

). *argaining po%er of buyers. $o% strong is the position of buyers. Can they %ork together in ordering

large volumes.

+. *argaining po%er of suppliers. $o% strong is the position of sellers. ,o many potential suppliers e'ist or

only fe% potential suppliers& monopoly-

. .ivalry among the e'isting players. ,oes a strong competition bet%een the e'isting players e'ist- /s one

player very dominant or are all e0ual in strength and si1e.

2ometimes a si'th competitive force is added!

3. 4overnment.

Porter5s Competitive Forces model is probably one of the most often used business strategy tools. /t has proven its

usefulness on numerous occasions. Porter5s model is particularly strong in thinking Outside-in.

Threat of 6e% #ntrants depends on!

7 #conomies of scale.

7 Capital 8 investment re0uirements.

7 Customer s%itching costs.

7 9ccess to industry distribution channels.

7 9ccess to technology.

7 *rand loyalty. 9re customers loyal-

7 The likelihood of retaliation from e'isting industry players.

7 4overnment regulations. Can ne% entrants get subsidies-

Threat of 2ubstitutes depends on!

7 :uality. /s a substitute better-

7 *uyers5 %illingness to substitute.

7 The relative price and performance of substitutes.

7 The costs of s%itching to substitutes. /s it easy to change to another product-

*argaining Po%er of 2uppliers depends on!

7 Concentration of suppliers. 9re there many buyers and fe% dominant suppliers- Compare! ;ral<ic =odel.

7 *randing. /s the brand of the supplier strong-

7 Profitability of suppliers. 9re suppliers forced to raise prices-

7 2uppliers threaten to integrate for%ard into the industry (for e'ample! brand manufacturers

threatening to set up their o%n retail outlets).

7 *uyers do not threaten to integrate back%ards into supply.

7 .ole of 0uality and service.

7 The industry is not a key customer group to the suppliers.

7 2%itching costs. /s it easy for suppliers to find ne% customers-

*argaining Po%er of *uyers depends on!

7 Concentration of buyers. 9re there a fe% dominant buyers and many sellers in the industry-

7 ,ifferentiation. 9re products standardi1ed-

7 Profitability of buyers. 9re buyers forced to be tough-

7 .ole of 0uality and service.

7 Threat of back%ard and for%ard integration into the industry.

7 2%itching costs. /s it easy for buyers to s%itch their supplier-

/ntensity of .ivalry depends on!

7 The structure of competition. .ivalry %ill be more intense if there are lots of small or e0ually si1ed

competitors> rivalry %ill be less if an industry has a clear market leader.

7 The structure of industry costs. /ndustries %ith high fi'ed costs encourage competitors to

manufacture at full capacity by cutting prices if needed.

7 ,egree of product differentiation. /ndustries %here products are commodities (e.g. steel& coal)

typically have greater rivalry.

7 2%itching costs. .ivalry is reduced %hen buyers have high s%itching costs.

7 2trategic ob<ectives. /f competitors pursue aggressive gro%th strategies& rivalry %ill be more intense. /f

competitors are merely ?milking? profits in a mature industry& the degree of rivalry is typically lo%.

7 #'it barriers. @hen barriers to leaving an industry are high& competitors tend to e'hibit greater rivalry.

2trengths of the Five Competitive Forces =odel. *enefits

7 The model is a strong tool for competitive analysis at industry level. Compare! P#2T 9nalysis

7 /t provides useful input for performing a 2@OT 9nalysis.

Aimitation of Porter5s Five Forces model

7 Care should be taken %hen using this model for the follo%ing! do not underestimate or underemphasi1e the

importance of the (e'isting) strengths of the organi1ation (/nside-out strategy). 2ee! Core Competence

7 The model %as designed for analy1ing individual business strategies. /t does not cope %ith synergies and

interdependencies %ithin the portfolio of large corporations. 2ee! Parenting 9dvantage

7 From a more theoretical perspective& the model does not address the possibility that an industry

could be attractive because certain companies are in it.

7 2ome people claim that environments %hich are characteri1ed by rapid& systemic and radical change re0uire

more fle'ible& dynamic or emergent approaches to strategy formulation. 2ee! ,isruptive /nnovation

7 2ometimes it may be possible to create completely ne% markets instead of selecting from e'isting ones. 2ee!

*lue Ocean 2trategy

Overvie% of the *ook ?Competitive 2trategy?

7 /n Part /& Porter discusses the structural analysis of industries (%ith the five forces)& the three generic

competitive strategies (overall Cost Aeadership& Focus& and ,ifferentiation)& offering an e'cellent frame%ork for

competitor analysis& competitive moves& strategy to%ard buyers and suppliers& structural analysis %ithin

industries (strategic groups& strategic mapping& mobility barriers)& and industry evolution (life cycle& evolutionary

processes).

7 /n Part //& Porter discusses competitive strategy %ithin various generic industry environments. 2uch as!

fragmented industries (%ith no real market leader)& emerging industries& mature industries& declining industries&

and global industries.

7 /n Part ///& Porter discusses strategic decisions %hich businesses8firms can take. 2uch as! vertical

integration (for%ard& back%ard& partnerships)& capacity e'pansion& and entry into ne% industries8businesses.

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- P S. D - PMPDocument6 pagesP S. D - PMPamisha2562585Pas encore d'évaluation

- Leadership StylesDocument2 pagesLeadership Stylesamisha2562585Pas encore d'évaluation

- Steel Report: Steel Sector News (Domestic and Global)Document2 pagesSteel Report: Steel Sector News (Domestic and Global)amisha2562585Pas encore d'évaluation

- DC Programming: The Optimization Method You Never Knew You Had To KnowDocument13 pagesDC Programming: The Optimization Method You Never Knew You Had To Knowamisha2562585Pas encore d'évaluation

- Kaizen: The Five Foundation Elements of KaizenDocument2 pagesKaizen: The Five Foundation Elements of Kaizenamisha2562585Pas encore d'évaluation

- Errata Chapters1 5Document3 pagesErrata Chapters1 5amisha2562585Pas encore d'évaluation

- How Industries ChangeDocument1 pageHow Industries Changeamisha2562585Pas encore d'évaluation

- Medical Check Up1Document2 pagesMedical Check Up1amisha2562585Pas encore d'évaluation

- Medical Center AddressesDocument7 pagesMedical Center Addressesamisha2562585Pas encore d'évaluation

- ChurnDocument112 pagesChurnamisha2562585Pas encore d'évaluation

- MA Freelance Photography PSDocument6 pagesMA Freelance Photography PSamisha2562585Pas encore d'évaluation

- How To Use DocusignDocument4 pagesHow To Use Docusignamisha2562585Pas encore d'évaluation

- Ch26 ExercisesDocument14 pagesCh26 Exercisesamisha2562585Pas encore d'évaluation

- Abhay Tilwankar 11P174 Final ReportDocument50 pagesAbhay Tilwankar 11P174 Final Reportamisha2562585Pas encore d'évaluation

- Chacha Chaudhary - Sabu Ke BootDocument41 pagesChacha Chaudhary - Sabu Ke Bootamisha2562585100% (5)

- Horn Opportunities and Challenges enDocument10 pagesHorn Opportunities and Challenges enamisha2562585Pas encore d'évaluation

- Statement On Financial Guarantee - Suhail JainDocument12 pagesStatement On Financial Guarantee - Suhail Jainamisha2562585Pas encore d'évaluation

- Frosty DistributorsDocument14 pagesFrosty Distributorsamisha2562585Pas encore d'évaluation

- Homework 4Document3 pagesHomework 4amisha25625850% (1)

- Ch25 ExercisesDocument16 pagesCh25 Exercisesamisha2562585Pas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Sale of Goods Act, 1930Document12 pagesSale of Goods Act, 1930Pranav ChandakPas encore d'évaluation

- Haigh's Chocolates - An Analysis On Its Marketing PracticesDocument20 pagesHaigh's Chocolates - An Analysis On Its Marketing PracticesSukanya Fuad50% (2)

- Duty-Free and - Travel - Retail - MarketDocument45 pagesDuty-Free and - Travel - Retail - MarketSharjahmanPas encore d'évaluation

- CC Unit 4, Cover Letters of Offers - To StsDocument19 pagesCC Unit 4, Cover Letters of Offers - To StsThanh PhạmPas encore d'évaluation

- MGT 212 ReportDocument28 pagesMGT 212 ReportSAWAhmed ZarrarPas encore d'évaluation

- Chapter 15 Evans BermanDocument14 pagesChapter 15 Evans BermanthesimplePas encore d'évaluation

- Final Research PaperDocument13 pagesFinal Research PaperAnjaliPas encore d'évaluation

- Baba Transport Company: ConsigneeDocument1 pageBaba Transport Company: ConsigneeARSGAPas encore d'évaluation

- Sap MM Interview QuestionsDocument50 pagesSap MM Interview Questionsgadhireddy75% (4)

- Natureview Farm Case Calculations Pre-Class SpreadsheetDocument12 pagesNatureview Farm Case Calculations Pre-Class Spreadsheet1010478907Pas encore d'évaluation

- HMCost3e SM Ch18Document36 pagesHMCost3e SM Ch18Yogi Dwi Jaya Perkasa0% (1)

- Point-Of-Purchase Displays in The FMCG Sector: A Retailer PerspectiveDocument9 pagesPoint-Of-Purchase Displays in The FMCG Sector: A Retailer PerspectiveNandani SinghPas encore d'évaluation

- A. Find The Values of The Missing Variables, Which Are Defined As FollowsDocument3 pagesA. Find The Values of The Missing Variables, Which Are Defined As FollowsHermione Eyer - TanPas encore d'évaluation

- The Book of Buffalo Pottery (Art Ebook) PDFDocument204 pagesThe Book of Buffalo Pottery (Art Ebook) PDFAnonymous s6WwRJVSxm100% (1)

- Blue Nile Case Analysis EssayDocument9 pagesBlue Nile Case Analysis EssayMohammad Junaid HanifPas encore d'évaluation

- Sample Proposal 1Document8 pagesSample Proposal 1gauravdhawan199180% (5)

- Ebiz - Batch 2 HandoutDocument56 pagesEbiz - Batch 2 HandoutjnlyjunPas encore d'évaluation

- Spring 2016 Remington RebateDocument2 pagesSpring 2016 Remington RebateKristin LerdahlPas encore d'évaluation

- Steps Plus Dla Klasy VI DVD Worksheet 5 Shopping in LondonDocument2 pagesSteps Plus Dla Klasy VI DVD Worksheet 5 Shopping in LondonMonika aqwer0% (1)

- MKT-301 (Agora)Document21 pagesMKT-301 (Agora)Raphael QiLongPas encore d'évaluation

- Matrix Organizational StructureDocument8 pagesMatrix Organizational StructureMunazzah AnjumPas encore d'évaluation

- Mba 3 Sem Mbamk02 Integrated Marketing Communications 2014 15Document6 pagesMba 3 Sem Mbamk02 Integrated Marketing Communications 2014 15Mohit MehndirattaPas encore d'évaluation

- 1.audi Volkswagen Korea enDocument4 pages1.audi Volkswagen Korea enRahayu Yuni SusantiPas encore d'évaluation

- Mice Hub (Mega International Convention Center) : Project Proposal - 1 (Live)Document16 pagesMice Hub (Mega International Convention Center) : Project Proposal - 1 (Live)Abdur 1166Pas encore d'évaluation

- Interdependence Is A Higher Value Than IndependenceDocument5 pagesInterdependence Is A Higher Value Than IndependenceHimesh KuraniPas encore d'évaluation

- Retail Session 2,3,4 Retail FormatsDocument135 pagesRetail Session 2,3,4 Retail FormatsArun KumarPas encore d'évaluation

- Organizational Structure of The Coca Cola CompanyDocument24 pagesOrganizational Structure of The Coca Cola CompanyPennyLiPas encore d'évaluation

- Uniglobe Case StudyDocument7 pagesUniglobe Case StudyHarish G RautPas encore d'évaluation

- Sejarah Nya UPSDocument8 pagesSejarah Nya UPSHamza Agung SedayuPas encore d'évaluation

- What Is Haute CoutureDocument4 pagesWhat Is Haute CoutureSampatkumar Kalpana KrishnanPas encore d'évaluation