Académique Documents

Professionnel Documents

Culture Documents

Pro 2013 Iss87 Saip IUL Market Report

Transféré par

ppooskurCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Pro 2013 Iss87 Saip IUL Market Report

Transféré par

ppooskurDroits d'auteur :

Formats disponibles

Article from:

Product Matters!

October 2013 Issue 87

prior year quarter

2

. The dominance of cash accumula-

tion IUL (AccumIUL) sales within all IUL business and

the decline of indexed UL with secondary guarantees

(IULSG) are seen in the graph in Figure 2.

Long-term Care and Chronic Illness

Rider Sales

The popularity of UL/IUL products with chronic illness

and long-term care (LTC) riders can be seen as more

and more companies begin to offer and track such prod-

ucts. Nearly seventy-nine percent of survey participants

I

t is practical for life insurance carriers to keep up

with the current dynamics of the universal life (UL)

market since its market share has hovered around 40

percent since 2005

1

. Also, UL products were the biggest

driver of growth in life insurance sales during the frst

quarter of 2013

1

. Milliman Inc. recently conducted its

sixth annual survey of leading UL carriers to discover

the current dynamics of the market, and to provide car-

riers with competitive benchmarking to evaluate where

they stand relative to their peers. The scope of the sur-

vey included UL with secondary guarantees (ULSG),

cash accumulation UL (AccumUL), current assumption

UL (CAUL), and the indexed UL (IUL) counterparts

of these products. Results are based on responses from

twenty-eight carriers of UL/IUL products. Here are

highlights of the key fndings of the survey.

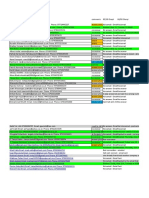

UL Sales

The mix of UL sales (excluding IUL sales) reported

by survey participants for calendar years 2009 through

2011 and for 2012 as of September 30, 2012 (YTD

9/30/12) is shown in the graph in Figure 1. For purpos-

es of the survey, sales were defined as the sum of recur-

ring premiums plus ten percent of single premiums.

Eleven participants reported a shift of at least ten per-

cent from or to any one UL product when looking at

the YTD 9/30/12 product mix relative to that of 2009.

Fourteen participants reported movement to ULSG

products, at the expense of both AccumUL and CAUL

products. Four participants discontinued sales of ULSG

products and two discontinued CAUL products. For all

survey responses combined, the product mix over the

survey period looks relatively stable since many of the

individual company changes offset each other.

Indexed UL Sales

The IUL market has continued to draw considerable

interest as evidenced by more companies entering the

market. This product is attractive in todays environ-

ment due to its upside potential and downside protec-

tion to the policyowner.

Total IUL sales as a percentage of total UL and IUL

sales combined have increased from eighteen percent

in 2009 to forty percent through the first nine months

of 2012. IUL sales alone showed a twenty-three percent

growth during the first quarter of 2013 relative to the

Susan J. Saip, FSA,

MAAA, is a consulting

actuary with Milliman

Inc in Lake Forest, Ill.

She can be reached

at sue.saip@milliman.

com.

Current Dynamics of Universal Life and

Indexed UL

By Susan J. Saip

CONTINUED ON PAGE 8

Product Matters! | OCTOBER 2013 | 7

Figure 1: UL Product Mix by Year

0

20

40

60

80

100

120

0

10

20

30

40

50

60

70

80

2009 2010 2011 YTD 9/30/12

66%

21%

73%

6%

14%

81%

4%

9%

88%

3%

10%

87%

2%

9%

25%

65%

11%

23%

69%

9%

22%

68%

11%

22%

0

20

40

60

80

100

0

20

40

60

80

100

120

66%

11%

26%

63%

26%

32%

42%

50%

50%

13%

63%

25%

13%

63%

44%

20%

60%

U

S

L

G

C

a

s

h

A

c

c

u

m

u

l

a

t

i

o

n

U

L

C

u

r

r

e

n

t

A

s

s

u

m

p

t

i

o

n

U

L

I

U

L

S

G

C

a

s

h

A

c

c

u

m

u

l

a

t

i

o

n

U

L

C

a

s

h

A

s

s

u

m

p

t

i

o

n

U

L

39%

6%

21%

47%

32%

6%

59%

35%

17%

33%

50%

6%

63%

31%

20%

40%

40%

U

S

L

G

C

a

s

h

A

c

c

u

m

u

l

a

t

i

o

n

U

L

C

u

r

r

e

n

t

A

s

s

u

m

p

t

i

o

n

U

L

I

U

L

S

G

C

a

s

h

A

c

c

u

m

u

l

a

t

i

o

n

U

L

C

a

s

h

A

s

s

u

m

p

t

i

o

n

U

L

ULSG

Met

Fell Short

Cash Accumulation Current Assumption UL ULSG Cash Accumulation Current Assumption UL

Exceeded Exceeded

Met

Fell Short

Figure 2: IUL Product Mix by Year

0

20

40

60

80

100

120

0

10

20

30

40

50

60

70

80

2009 2010 2011 YTD 9/30/12

66%

21%

73%

6%

14%

81%

4%

9%

88%

3%

10%

87%

2%

9%

25%

65%

11%

23%

69%

9%

22%

68%

11%

22%

0

20

40

60

80

100

0

20

40

60

80

100

120

66%

11%

26%

63%

26%

32%

42%

50%

50%

13%

63%

25%

13%

63%

44%

20%

60%

U

S

L

G

C

a

s

h

A

c

c

u

m

u

l

a

t

i

o

n

U

L

C

u

r

r

e

n

t

A

s

s

u

m

p

t

i

o

n

U

L

I

U

L

S

G

C

a

s

h

A

c

c

u

m

u

l

a

t

i

o

n

U

L

C

a

s

h

A

s

s

u

m

p

t

i

o

n

U

L

39%

6%

21%

47%

32%

6%

59%

35%

17%

33%

50%

6%

63%

31%

20%

40%

40%

U

S

L

G

C

a

s

h

A

c

c

u

m

u

l

a

t

i

o

n

U

L

C

u

r

r

e

n

t

A

s

s

u

m

p

t

i

o

n

U

L

I

U

L

S

G

C

a

s

h

A

c

c

u

m

u

l

a

t

i

o

n

U

L

C

a

s

h

A

s

s

u

m

p

t

i

o

n

U

L

ULSG

Met

Fell Short

Cash Accumulation Current Assumption UL ULSG Cash Accumulation Current Assumption UL

Exceeded Exceeded

Met

Fell Short

expect to market either a chronic illness or LTC rider

within twelve to twenty-four months. Sales of chronic

illness riders and LTC riders as a percentage of total

sales reported by survey participants are shown sepa-

rately for UL and IUL in Figure 3. There is little overlap

between companies that offer chronic illness riders and

those that offer LTC riders. In some cases, the chronic

illness rider is automatically included on certain UL/

IUL policies. These are no-cost riders that provide an

accelerated death benefit using the discounted death

benefit or lien approach.

Profit Measures

The median return on investment or internal rate of

return (ROI/IRR) reported by survey participants is

twelve percent for all UL product types, consistent

with prior survey results. With the exception of IULSG,

the percentage of survey respondents that fell short of

profit goals increased from 2011 through September

30, 2012. For IULSG, fifty percent met their profit

goals in 2011 and this figure increased to seventy-six

percent during the first three quarters of 2012.

The chart in Figure 4 shows the percentage of survey

participants reporting they fell short of, met, or exceed-

ed their profit goals by UL product type. Low interest

earnings continue to be the primary reason cited for

failure to meet profit goals.

8 | OCTOBER 2013 | Product Matters!

Current Dynamics | FROM PAGE 7

CALENDAR

YEAR

UL SALES I UL SALES

WI TH

CHRONI C

I LLNESS

RI DERS AS

A PERCENT

OF TOTAL UL

SALES

WI TH

LTC

RI DERS AS

A PERCENT

OF TOTAL

UL SALES

WI TH

CHRONI C

I LLNESS

RI DERS AS A

PERCENT OF

TOTAL I UL

SALES

WI TH LTC

RI DERS AS

A PERCENT

OF TOTAL

I UL SALES

2011 11% 15% 18% 1%

YTD

9/30/12

14% 16% 13% 4%

Figure 3: Chronic Illness and LTC Rider Sales as a Percentage of Total Sales

Figure 4: Actual Results Relative to Profit Goals

0

20

40

60

80

100

120

0

10

20

30

40

50

60

70

80

2009 2010 2011 YTD 9/30/12

66%

21%

73%

6%

14%

81%

4%

9%

88%

3%

10%

87%

2%

9%

25%

65%

11%

23%

69%

9%

22%

68%

11%

22%

0

20

40

60

80

100

0

20

40

60

80

100

120

66%

11%

26%

63%

26%

32%

42%

50%

50%

13%

63%

25%

13%

63%

44%

20%

60%

U

S

L

G

C

a

s

h

A

c

c

u

m

u

l

a

t

i

o

n

U

L

C

u

r

r

e

n

t

A

s

s

u

m

p

t

i

o

n

U

L

I

U

L

S

G

C

a

s

h

A

c

c

u

m

u

l

a

t

i

o

n

U

L

C

a

s

h

A

s

s

u

m

p

t

i

o

n

U

L

39%

6%

21%

47%

32%

6%

59%

35%

17%

33%

50%

6%

63%

31%

20%

40%

40%

U

S

L

G

C

a

s

h

A

c

c

u

m

u

l

a

t

i

o

n

U

L

C

u

r

r

e

n

t

A

s

s

u

m

p

t

i

o

n

U

L

I

U

L

S

G

C

a

s

h

A

c

c

u

m

u

l

a

t

i

o

n

U

L

C

a

s

h

A

s

s

u

m

p

t

i

o

n

U

L

ULSG

Met

Fell Short

Cash Accumulation Current Assumption UL ULSG Cash Accumulation Current Assumption UL

Exceeded Exceeded

Met

Fell Short

0

20

40

60

80

100

120

0

10

20

30

40

50

60

70

80

2009 2010 2011 YTD 9/30/12

66%

21%

73%

6%

14%

81%

4%

9%

88%

3%

10%

87%

2%

9%

25%

65%

11%

23%

69%

9%

22%

68%

11%

22%

0

20

40

60

80

100

0

20

40

60

80

100

120

66%

11%

26%

63%

26%

32%

42%

50%

50%

13%

63%

25%

13%

63%

44%

20%

60%

U

S

L

G

C

a

s

h

A

c

c

u

m

u

l

a

t

i

o

n

U

L

C

u

r

r

e

n

t

A

s

s

u

m

p

t

i

o

n

U

L

I

U

L

S

G

C

a

s

h

A

c

c

u

m

u

l

a

t

i

o

n

U

L

C

a

s

h

A

s

s

u

m

p

t

i

o

n

U

L

39%

6%

21%

47%

32%

6%

59%

35%

17%

33%

50%

6%

63%

31%

20%

40%

40%

U

S

L

G

C

a

s

h

A

c

c

u

m

u

l

a

t

i

o

n

U

L

C

u

r

r

e

n

t

A

s

s

u

m

p

t

i

o

n

U

L

I

U

L

S

G

C

a

s

h

A

c

c

u

m

u

l

a

t

i

o

n

U

L

C

a

s

h

A

s

s

u

m

p

t

i

o

n

U

L

ULSG

Met

Fell Short

Cash Accumulation Current Assumption UL ULSG Cash Accumulation Current Assumption UL

Exceeded Exceeded

Met

Fell Short

Reserves

Eleven of twenty-two participants expressed concern

about the net premium reserve floor that is included in

the valuation manual. The reasons for concern included

the following

the net premium reserve is too high

there is a significant amount of work in implement-

ing the new regulations with little reserve relief,

and

there are potential tax inefficiencies

Product Design

Thirteen of the twenty-eight participants in the survey

re-priced their ULSG design in the last twelve months.

The majority of participants that re-priced also reported

that premium rates increased on the new basis versus

the old basis. Ten of these thirteen, plus three additional

participants, intend to modify their secondary guaran-

tee products in the next twelve months. The fact that

seven of these thirteen survey respondents were short

of their profit goals through the first nine months of

2012 may be driving such re-pricing and modification

plans. In addition to interest earnings, recent regula-

tory changes to Actuarial Guideline 38 are also driving

expected modifications to secondary guarantees.

Product Matters! | OCTOBER 2013 | 9

Conclusion

Keeping on top of the dynamic and ever-changing mar-

ket is critical to the development of creative solutions

for the issues and challenges that arise. Resources such

as the UL survey provide UL insurers with competitive

benchmarking to determine where they stand within

the industry.

In addition to sales, profitability, reserves, and product

design, the study also includes information on other

product and actuarial issues, such as target surplus,

risk management, underwriting, compensation, pric-

ing, administration, and illustration testing. A compli-

mentary copy of the executive summary of the April

2013 Universal Life and Indexed Universal Life Issues

report may be found at http://insight.milliman.com/

article.php?cntid=8358.

Vous aimerez peut-être aussi

- Oracle PersonalizationDocument17 pagesOracle PersonalizationppooskurPas encore d'évaluation

- PM Tools and TipsDocument4 pagesPM Tools and TipsppooskurPas encore d'évaluation

- How 2 UploadDocument1 pageHow 2 UploadppooskurPas encore d'évaluation

- Datasheet Quest Stat5 3 2 EBS12 0 FINALDocument3 pagesDatasheet Quest Stat5 3 2 EBS12 0 FINALppooskurPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Review Questions Financial Accounting and Reporting PART 1Document3 pagesReview Questions Financial Accounting and Reporting PART 1Claire BarbaPas encore d'évaluation

- Vocabulary Practice Unit 8Document4 pagesVocabulary Practice Unit 8José PizarroPas encore d'évaluation

- Community-Based Monitoring System (CBMS) : An Overview: Celia M. ReyesDocument28 pagesCommunity-Based Monitoring System (CBMS) : An Overview: Celia M. ReyesDiane Rose LacenaPas encore d'évaluation

- For Email Daily Thermetrics TSTC Product BrochureDocument5 pagesFor Email Daily Thermetrics TSTC Product BrochureIlkuPas encore d'évaluation

- 1 Ton Per Hour Electrode Production LineDocument7 pages1 Ton Per Hour Electrode Production LineMohamed AdelPas encore d'évaluation

- China Ve01 With Tda93xx An17821 Stv9302a La78040 Ka5q0765-SmDocument40 pagesChina Ve01 With Tda93xx An17821 Stv9302a La78040 Ka5q0765-SmAmadou Fall100% (1)

- Unit 10-Maintain Knowledge of Improvements To Influence Health and Safety Practice ARDocument9 pagesUnit 10-Maintain Knowledge of Improvements To Influence Health and Safety Practice ARAshraf EL WardajiPas encore d'évaluation

- Module 5 - Multimedia Storage DevicesDocument10 pagesModule 5 - Multimedia Storage Devicesjussan roaringPas encore d'évaluation

- Pharmaceutical Microbiology NewsletterDocument12 pagesPharmaceutical Microbiology NewsletterTim SandlePas encore d'évaluation

- MG206 Chapter 3 Slides On Marketing Principles and StrategiesDocument33 pagesMG206 Chapter 3 Slides On Marketing Principles and StrategiesIsfundiyerTaungaPas encore d'évaluation

- Ewellery Ndustry: Presentation OnDocument26 pagesEwellery Ndustry: Presentation Onharishgnr0% (1)

- Org ChartDocument1 pageOrg Chart2021-101781Pas encore d'évaluation

- Management Interface For SFP+: Published SFF-8472 Rev 12.4Document43 pagesManagement Interface For SFP+: Published SFF-8472 Rev 12.4Антон ЛузгинPas encore d'évaluation

- Auto Report LogDocument3 pagesAuto Report LogDaniel LermaPas encore d'évaluation

- Faculty of Business and Law Assignment Brief Mode E and R RegulationsDocument4 pagesFaculty of Business and Law Assignment Brief Mode E and R RegulationsSyeda Sana Batool RizviPas encore d'évaluation

- Fin 3 - Exam1Document12 pagesFin 3 - Exam1DONNA MAE FUENTESPas encore d'évaluation

- Computer Vision and Action Recognition A Guide For Image Processing and Computer Vision Community For Action UnderstandingDocument228 pagesComputer Vision and Action Recognition A Guide For Image Processing and Computer Vision Community For Action UnderstandingWilfredo MolinaPas encore d'évaluation

- Chapter 1.4Document11 pagesChapter 1.4Gie AndalPas encore d'évaluation

- SyllabusDocument9 pagesSyllabusrr_rroyal550Pas encore d'évaluation

- CORDLESS PLUNGE SAW PTS 20-Li A1 PDFDocument68 pagesCORDLESS PLUNGE SAW PTS 20-Li A1 PDFΑλεξης ΝεοφυτουPas encore d'évaluation

- The Website Design Partnership FranchiseDocument5 pagesThe Website Design Partnership FranchiseCheryl MountainclearPas encore d'évaluation

- Tle 9 Module 1 Final (Genyo)Document7 pagesTle 9 Module 1 Final (Genyo)MrRightPas encore d'évaluation

- 1 075 Syn4e PDFDocument2 pages1 075 Syn4e PDFSalvador FayssalPas encore d'évaluation

- S SSB29 - Alternator Cables PM: WARNING: This Equipment Contains Hazardous VoltagesDocument3 pagesS SSB29 - Alternator Cables PM: WARNING: This Equipment Contains Hazardous VoltagesMohan PreethPas encore d'évaluation

- Sikkim Manipal MBA 1 SEM MB0038-Management Process and Organization Behavior-MQPDocument15 pagesSikkim Manipal MBA 1 SEM MB0038-Management Process and Organization Behavior-MQPHemant MeenaPas encore d'évaluation

- Ahakuelo IndictmentDocument24 pagesAhakuelo IndictmentHNNPas encore d'évaluation

- MML3 Journal To CapcomDocument103 pagesMML3 Journal To CapcomFer BarcenaPas encore d'évaluation

- QP 4Document4 pagesQP 4Yusra RaoufPas encore d'évaluation

- Technical Manual: 110 125US 110M 135US 120 135UR 130 130LCNDocument31 pagesTechnical Manual: 110 125US 110M 135US 120 135UR 130 130LCNKevin QuerubinPas encore d'évaluation

- VRIODocument3 pagesVRIOJane Apple BulanadiPas encore d'évaluation