Académique Documents

Professionnel Documents

Culture Documents

Foreign Exchange Performance of First Security Bank

Transféré par

Ahmed ShaanTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Foreign Exchange Performance of First Security Bank

Transféré par

Ahmed ShaanDroits d'auteur :

Formats disponibles

Chapter-1

INTRODUCTION

2

Introduction

1.1 Background of the study :

Knowledge and learning become perfect when it is associated with theory and practice.

Theoretical knowledge gets perfection with practical application.It establishes contacts and

networking contracts.Contracts may help to get a job .Recognizing the importance of

practical application of theory school of management and b!siness administration of Kh!lna

!ni"ersity has introd!ced a three months practical e#pos!re as a mandatory re$!irement of

the c!rric!l!m of %achelor of %!siness &dministration program.In s!ch a state of affairs the

present aiming at analyzing the e#perience of practical orientation related to foreign

e#change performance in the 'irst (ec!rity %ank )td*ilk!sha %ranch *haka.

1.2 Back ground of the First Security Bank Ltd.

The bank was incorporated on 2+ &!g!st ,+++ !nder the company-s act ,++. with the object

of pro"iding all kinds of commercial banking ser"ices to the c!stomers and obtained the

certificate of commencement of %!siness from the Register of /oint stock companies.

%angladesh with effect from the same date. 0owe"er it recei"ed permission from

%angladesh %ank to establish the bank on 22 (eptember ,+++ "ides %R1* 213 4..24536++7

2+5, and it went into operation from 28 9ctober ,+++ effecti"ely. Till to 5, *ecember 2::,

the bank has eight branches at *ilk!sha ;ohakhali %angshal and *hanmondi at *haka

and &grabad Khat!ngong and /!bileRoad at Chittagong and %iswanath at (ylhet

1.3 Corporate Information of First Security Bank

Ltd. Registered 0ead 9ffice

'irst (ec!rity %ank )td.

25 *ilk!sha Commercial

&reas *haka %angladesh

Tel: +8<:22++8<.455+84:+4++84:22.

'a#: ==:727+8<,+54

Tele#: <.2855 '(%*) %/

>7mail: fsbl ? bd. com.com

*ate of incorporation 2+th &!g!st ,+++

*ate of commencement of %!siness 2+

th

&!g!st ,+++

*ate of opening of first branch 25 *ilk!sha C6& area *haka 28th

9ctober ,+++ 1aid !p capital tk 2::::::::

&!thorized capital tk,:: :::::::

5

Board of directors of First security Bank Ltd.

Chairperson Alternate irector

;r.;d.0ar!n!r Rashid (iddi$!i

;s.@asim (ikder ;r.&b! 0ena ;ostafa Kamal

Aice Chairperson ;r.;d *idar!l &lam

;s.(arwer /ahan ;ale$!e ;s.Rokeya %eg!m

irectors

;s.B!rrat!l &nn (iddi$!i

!r.!ahmudul "a#ue$%ick&

Alternate irector

!anaging irector

;r.(yed &sraf &li

;r.&.K.; >nam!l 0a$!e Sponsor Shareholders

;s.'atema 0$!e2)isa3 ;r.;ohtasim %illah Khan

;r.&.K.; >nam!l 0a$!e

;s.;onowara (ikder

Alternate irector

;rCahid!l 0a$!e2@ick3 Ad'isor

;r.;ahb!b!l0a$!e (ikder ;r.R.& 0owlader

;r.(ala!ddin Khan

Board and Company Secretary ;r.;.& Rasid

;r.;oyn!l 0a$!e (iddi$!i ;r.;ohammed 0!may!n Kbir

;s.Israt /ahan

;r.;d.&bd!llah 0asan

;r.;d.9sman Dani

;s.(harmin 'atema

&lhaj; ;ortoza (iddi$!i

.

1.( First Security Bank) ilkusha Branch) haka*

Keeping the "ision in mind of pro"iding highest standard of ser"ices to its honorable

clientit was the initiation of 'irst (ec!rity %ank )td.&fter getting the commencement of

b!siness at 2+

T0

&!g!st ,+++ it started its operation thro!gh the opening of first branch

25 *ilk!sha C6& *haka &T28T0 9ctober,+++.Conse$!ently *ilk!sha %ranch is the

corporate branch of 'irst (ec!rity %ank )td.The general manager of this branch is

;d.'eroz 0oshen.Thro!gh this branch the bank has earned confidence of its c!stomers

beca!se of competent managementaggressi"e marketing and o"erall of its o!tstanding

$!ality of c!stomer ser"ices.The officials of this branch maintain a good relationship with

their c!stomers.9n the de"elopment of this corporate branch now the 'irst (ec!rity

%ank is consist of ,: branch at ,: commercial ind!strial area in %angladesh.

1.+ ,-.ecti'e of the study*

The prime objecti"e of this st!dy on foreign e#change is to meas!re the foreign

e#change performance of the concerned organization. To achie"e this prime

objecti"e there are some other objecti"es which are en!merated below: 7

(1)To describe the total proced!re of importing prod!cts from foreign co!ntries to the

home co!ntry.

(2) To describe the total proced!re of e#porting prod!cts from home co!ntry to the

foreign co!ntries.

(3) To analyze the foreign e#change performance of 'irst (ec!rity %ank )td.

*ilk!sha %ranch *haka.

1./ Scope of the report*

The scope of the organizational part co"ers the organizational str!ct!re back gro!nd

objecti"es f!nction and departmentation and b!siness performance of 'irst sec!rity

bank as a whole. This refers that how the bank help the c!stomers in e#porting and

importing the goods how it remits the money of the foreign clients what are its

performances in the last three years etc all are in the project part of the report.

1.0 Limitation of the report*

'oreign e#change f!nction is not a so m!ch easy and small concept. It is somehow diffic!lt

and large concept. (o to learn properly e"ery ins and o!t of foreign e#change f!nctions

within one month is some how impossible. (o for this shortage time it wo!ld not eno!gh for

me to learn e"erything properly of foreign e#change acti"es of this branch. ;ore o"er the

officials of the organization remain e#tremely b!sy thro!gh o!t the day .(o inspite of their

keen interest they are not able to g!ide and s!ppressi"e me properly.

1.1 "ypothesis*

>"erything has to analyze or j!dge critically. Eitho!t critical analysis proper s!ccess of any

project or any research anything important is impossible. If something is good then the

$!estion is why it is goodF &nd if bad then why badF Conse$!ently act!al res!lt comes. 'or

getting the act!al position of foreign e#change acti"ities of 'irst (ec!rity %ank )td. *ilk!sha

8

%ranch its hypothesis is selected as G'oreign >#change 1erformance of 'irst

(ec!rity %ank )td *ilk!sha %ranch is good.H

1.2 !ethodology*

The prime objecti"es of the st!dy are to in$!ire how the 'irst sec!rity bank *ilk!sha branch

is operating its foreign e#change acti"ities and to e"al!ate the c!rrent performance of the

bank in foreign e#change section thro!gh analyzing the pre"io!s years performances. These

objecti"es are achie"ed on the basis of papers and doc!ments e"al!ation and personal

obser"ation. In this st!dy both primary and secondary so!rces are !sed.

1rimary so!rces are cons!ltation with rele"ant personnel and secondary so!rces of

data is gathered by going thro!gh "ario!s statements of ann!al reports of that bank.

<

CHAPTER

2

Conceptual

Framework

4

Concept is a primary and theoretical idea abo!t an important aspect which help the

concerned people to !nderstand the practical or act!al things. &s the foreign

e#change f!nction of a bank is not an easy and small task so for the better

!nderstanding a concept!al frame work is described here:7

2.1 efinition of foreign e3change*

In general 'oreign >#change is percei"ed as foreign money. %!t the term foreign e#change

is !sed in a broader sense. It is simply defined as the process of con"ersion of one co!ntry

c!rrency into another co!ntry c!rrency.*r.1a!l >inzig tells thatI 'oreign >#change means a

system or process of con"ersion of one c!rrency into another.H The foreign e#change

reg!lation &ct refers that foreign e#change means foreign c!rrency and incl!des any

instr!ment drawn accepted made or iss!ed !nder cla!se 2,53 of &rticle ,< of the

%angladesh %ank 9rder,+42all deposit credits and balances payable in any foreign

c!rrency and any draft tra"eler-s che$!e letter of credit and bill of e#change e#pressed or

drawn in %angladesh c!rrency b!t payable in any foreign c!rrency.

2.2 Foreign e3change and foreign trade:

(ince the early days of ci"ilization nations of the world are engaged in the b!siness of

trading with each other. &t the same time each nation has de"eloped a c!rrency of his

ownas a meas!re of satisfying nationalistic go or display of so"ereign e#istence.These two

phenomena are precisely the reasons which gi"e rise to dealing in foreign e#change.It deals

with the means and methods by which rights to wealth in one co!ntry-s c!rrency are

con"erted into those of another co!ntry.International trade and mo"ement of money and

capital will contin!e to remain the mainspring of foreign e#change.

2.3 4ole of -ank*

The %anks and financial instit!tions which maintain foreign e#change di"isions are the

channels thro!gh which international payments are made. (!ch banks ha"e branches in

different co!ntries and at e"ery branch they ha"e s!bstantial balance in the c!rrency of

that co!ntry. Ehen a bank has no branch at a partic!lar co!ntry it keeps a balance with

some other bank which act as its agent in e#change dealings. %ank acting as agent of

other banks are called correspondents. Thro!gh their branches and correspondents the

ser"ices of s!ch banks are a"ailable at all important place of the world.

&n indi"id!al who has recei"ed a payment from a resident of another co!ntry by a credit

instr!ment can sell the instr!ment to an e#change dealer. If the instr!ment is in the term of

foreign c!rrency he recei"es from the bank an amo!nt in home c!rrency calc!lated at the

c!rrent rate depending !pon the nat!re of credit instr!ment concerned. (imilarly a debtor

can b!y from a bank dealing in e#change an instr!ment in terms of another c!rrency for

making his payment abroad.The %anks make a profit by keeping a small difference between

their b!ying and selling rates.Th!s as a mechanism banking system pro"ide assistance for

getting c!stomersd!es collected in foreign conte#t and also ass!res that once the d!ces are

collected the proceeds will be passed on to the owner of the f!nds.

=

2.( ocumentary re#uirements of foreign e3change*

$a&Letter of Credit $L5C&*

In foreign e#change the letter of credit is the ,

st

re$!irement thro!gh which a bank performs

all the acti"ities of the foreign e#change on behalf of the importer and promise to pay the

"al!e of the goods to the e#porter. In the international trade the e#porters conf!se to e#port

goods and ser"ices to the !nknown importers. Thro!gh s!ch a letter the bank e#presses

s!ch a promise that it wo!ld pay the "al!e of goods and ser"ices on behalf of the importer.

$-&6roforma In'oice*

1roforma In"oice is a doc!ment pro"iding description of the goods price of the

goods$!antity shepted$!alitymarksn!mber of packagesnat!re of the b!yer)6C

and contract n!mbersgradessizename of the "esselsthe date of shipmentn!mber

of billof lading etc.

$c&Bill of lading*

The bill of lading 2%6)3 is the most important doc!ment in connection with the e#port

of goods..It is a doc!ment of the title to the e#porting co!ntry. The shipping company

iss!es a bill of lading.It is important for the e#porter to ens!re that it is correctly

iss!ed to a"oid delay in connection with the negotiation of doc!ments.

$d&Certificate of ,rigin*

This is a doc!ment certifying the co!ntry of origin of the goods and !s!ally iss!ed by

an appro"ed chamber of commerce. Ehen it is not mentioned in )6C the e#porter

may himself do so.

$e&6re7shipment Inspection Certificate $6SIC&*

1re7(hipment Inspection Certificate is a doc!ment which has to send to the iss!ing

bank before shipment of goods. %efore shipment of goods it is inspected by generally

three a!thorized %locks s!ch as %lock7& %lock7% and %lock7 C.Jnder each block a

certain n!mber of co!ntry is fi#ed for the inspection of that co!ntries goods.

$f&Import 4egistration Certificate $I4C&*

&s per import and e#port &ct ,+8: b!siness concerns engaged in foreign e#change sho!ld

obtain registration certificate from the office of the Chief controller of Import and >#port 2CCI

K >3.The importers ha"e to collect Import Registration Certificate 2IRC3 from the aforesaid

office. The office by stating the )6C limit and renewal fee gi"es the certificate.

+

$g&83port 4egistration Certificate $84C&*

Certificate that gi"es permission the e#porter to e#port goods from abroad. The Chief

Controller of Import and >#port office gi"es this certificate to the e#porter and the

e#porter has to s!bmit it to the iss!ing bank while opening letter of credit.

$h&Bills of 83change $B58&*

The bill of e#change is an instr!ment ha"ing an international recognition and s!pported

by law known as negotiable Instr!ments &ct. The %ill of >#change is drawn either on

demand or at sight basis. In at sight basis the drawee has to make the payment of the

instr!ment on presentation and not later than 2. ho!rs thereafter. This makes the claim

payable immediately. In demand basis the instr!ment is drawn made payable after sight

and in s!ch bill of e#change the n!mber of days is specified after which the payment will

be made by the drawee.Denerally it is specified as +: days,=: days and so on.

2.+ !eans and !ethods of International payment*

International payments are made by means of credit instr!ment of "ario!s kinds. &

credit instr!ment is doc!mentary e"idence of a debt and entitles its holder to recei"e

a specified amo!nt of money on a specified date or after a specified period from an

indi"id!al or instit!tion mentioned in the instr!ment. These types of payment is made

by a che$!ea bank draft or some other credit instr!ment. The instr!ment has no !se

!ntil it is con"erted into real money or a acceptable form of p!rchasing power.

2./ Issuing Bank) Ad'ising Bank) %egotiating Bank and 4eim-ursement

Bank*

In performing foreign e#change acti"ities different banks in different manner. Issuing

-ank is the bank which iss!e or open letter of credit on the application and

necessary doc!ments of the importer for importing goods from abroad.

The Ad'ising -ank is the bank to which the iss!ing bank creates an ad"ice to ad"ice the

beneficiary abo!t the letter of credit. &fter opening the letter of credit the iss!ing bank

transmit it to the ad"ising bank for ad"ising it to the beneficiary. The iss!ing bank transmits

the letter of credit to the beneficiary generally by three methods that are as follows:7

$i&Co!rier6(EI'T 2(ec!rity for Eorldwide International 'inancial

Transmission3 $ii&Tele#

$iii&'a#

%egotiating -ank is the bank thro!gh which the beneficiary performs all of its f!nctions

regarding e#port of goods to the importer. Denerally after getting the letter of credit from the

ad"ising bank on be half of the iss!ing bank the beneficiary makes a negotiation with the

ad"ising bank or other any third bank for e#porting goods to the importer thro!gh the negotiating

and iss!ing bank. If the beneficiary makes the negotiation with the ad"ising bank

,:

then the ad"ising bank is con"erted into negotiation bank. Thro!gh negotiating bank

the beneficiary done all of its acti"ities regarding e#ports of goods and sending

re$!ired doc!ments to the importers thro!gh iss!ing bank.

4eim-ursement -ank is the bank thro!gh which the foreign e#change payment is made

from importer to e#porter in a banking media. It is generally the )6C iss!ing bank branch or

correspondent bank of the )6C iss!ing bank. The iss!ing bank ad"ice the reimb!rsement

bank to make payment to the beneficiary thro!gh the negotiation bank. The iss!ing bank

then adj!sts its acco!nts with reimb!rsement bank-s acco!nt afterward.

2.0 6ayments against ocuments $6A&*

&fter shipment of goods the e#porter sends the re$!ired doc!ments to the iss!ing bank

thro!gh the negotiating bank and claim for the payment. The negotiating bank then makes

the payment to the e#porter and makes claim for payment to the iss!ing bank. The iss!ing

bank then makes the payment to the negotiating bank thro!gh reimb!rsement bank.

2.1 ue date diary*

&gainst master )6C the e#porter has to open a %ack to %ack )6C with the negotiation

bank for ac$!iring raw materialsaccessoriesfabrics etc to make finish prod!ct.

@egotiation bank or e#porter bank has to pay for those back7to7back accessories. 0ere

the bank maintains a date when the back7to7back payment will be made. Denerally it is

fi#ed after some daysL they get payment from the importer. *ate maintained by the

negotiation or e#porter bank for back7to7back payment is called d!e date diary.

2.2 isposal of documents*

*isposal of doc!ments is adj!stment of doc!ments. In foreign e#change acti"ities

different home and foreign banks are in"ol"ed and play different role in recei"ing and

paying payment. 1ayment is then adj!sted with different banks acco!nt with others

bank acco!nt. 'or this three special term is !sed which are as follows:

%ostro:70a"ing one homes bank acco!nt with others foreign bank acco!nt is called

@ostro. 9osto:70a"ing one foreign bank acco!nt with others home bank acco!nt is

called Aosto. Loro:7&dj!stment of @ostro and Aosto bank acco!nt thro!gh a third

bank acco!nt is called )oro.This is occ!rred generally where a specified bank has no

branch in some specified place.

2.1: 4etirement of documents*

&fter the accomplishment of all the foreign e#change acti"ities s!ch as shipment of goods

and payments against goods the re$!ired doc!ments is send to the %angladesh %ank as

the role of the %angladesh %ank and with this the gi"en contract is finished. This process of

the breach of the e#port7import contract is called retirement of doc!ments.

,,

Chapter 3

Operations and

Performance of

Foreign Excange at

First !ecurit" #ank

$td% Dilkusa

#ranc

,2

'oreign e#change b!siness is one of the largest b!sinesses carried o!t by the commercial

banks. The banks play an important role relating to this field. %angladesh %ank strictly

controls foreign trading.Thherefore while performing these tasks banks sho!ld be "ery

m!ch ca!tio!s as m!ch of comple#ities are there. %eca!se any de"iation or mistake will cost

the bank a lot. The 'oreign >#change *epartment of 'irst (ec!rity %ank )td *ilk!sha

%ranch plays a significant role thro!gh pro"iding different ser"ices for the c!stomers.

'oreign e#change department of 'irst (ec!rity %ank )td. *ilk!sha %ranch is consist of two

sectionone is Import section and another is >#port section.Tho!gh Import and >#port

section are complementary to each other there are some specific tasks of each other. The

foreign e#change acti"ities are started in Import section by opening )etter of Credit in this

section. In Import section the bank acts as a iss!ing bank. %!t in e#port section the bank act

as an ad"ising bank or negotiating bank or reimb!rsement bank. 'irst (ec!rity %ank )td

*ilk!sha %ranch performs both Import and >#port acti"ities of foreign e#change. 'oreign

>#change proced!re is a total proced!re and >#port and Import formalities are its

complementary part. The total proced!re of foreign e#change acti"ities of 'irst (ec!rity %ank

)td*ilk!sha %ranch are disc!ssed below:7

3.1 ,pening of Letter of Credit $L5C&*

& letter of credit is an instr!ment iss!ed by a bank on behalf of its c!stomers

a!thorizing an indi"id!al or a firm to draw draft on the bank or on one of its

correspondents for its acco!nt !nder certain conditions stip!lated in the credit. The

parties in"ol"ed in the letter of credit are en!merated below:

; Importer5Buyer5,pener*

The applicant at whose re$!est and on whose behalf the letter of credit is iss!ed.

The bank at the written instr!ment and co!nter !ndertaking iss!es the letter of credit

by the Importers or the %!yers. They remain liable for any payment made by the

iss!ing bank !nder the credit as per arrangement.

;Issuing5,pening -ank*

The bank that open or iss!e the letter of credit in fa"or of the e#porters or his

agents6correspondents and sim!ltaneo!sly g!arantee payment6acceptance of

doc!ments if letter of credit terms are complied with. Ehile opening the letter of

credit the iss!ing bank has to act in accordance with the instr!ction of the applicant

Ehile the iss!ing bank !ndertakes the responsibility of making payment against the

letter of credit it is nat!ral that the importer has to gi"e a separate !ndertaking to his

bank to make payment of the doc!ments to be presented in d!e co!rses.

,5

;Ad'ising -ank*7

& letter of credit !s!ally ad"ised to the beneficiary or the e#porter thro!gh another bank

in the e#porter co!ntry which is called ad"ising bank. It !ndertakes the transmission of

the credit and by also doing implies the a!thenticity of the signat!re of the iss!ing bank.

;%egotiating Bank*7

&d"ising bank may also act as a negotiating bank of the doc!ments presented for

payment. & third bank may also be a negotiating bank on the con"enience of the

seller6b!yer and banker. &fter negotiation the doc!ments presented by the

beneficiary will be sent to the iss!ing bank for the deli"ery to the importer.

;4eim-ursement Bank*7

*!ring opening the letter of credit an instr!ment is incorporated to the negotiating

bank to obtain reimb!rsement of the credit "al!e from the named bank with acco!nt

n!mber after certifying that the doc!ments presented for negotiation has complied

the terms of the credit. The reimb!rsing bank also to be ad"ised separately with a

copy of the letter of credit specific instr!ction to honor reimb!rsement claim.

;Seller583porter5Beneficiary*7

Jnder the re$!est of the opening bank the ad"ising bank ad"ise the letter of credit

to the beneficiary6e#porter6seller. Ehen the beneficiary is in the possession of the

credit his work of f!lfillment of the contract has started. 0e will prod!ce the goods

pack the goods ship the goods as per terms and made o!t the following doc!ments

for presentation to negotiating bank for payment.

$i& %ill of e#change

$ii&%ill of )ading

$iii&In"oice

$i'& 1acking )ist

$'&Certificate of 9rigin

$'i& Certificate of 1re7(hipment

Inspection $'ii&&ny other doc!ments

,.

)etter of credit can be opened against proforma in"oice or Indent.1roforma in"oice

refers Importing directly from foreign co!ntries. Indenting refers Importing by the

agent sit!ating in the importer-s co!ntry. @onetheless the total foreign e#change

proced!re is en!merated below step by step:7

Step 01: Importers Application or !etter o Cre"it #!$C%:-

'or opening a )etter of Credit the Importer has to apply to the Import (ection of the

foreign e#change department. The application m!st be in the own pad of the Importer-s

organization. The Importer has to pro"ide the following information in the application:7

Full name and address of the -eneficiary5e3porter:7

The name and address from whom the importer will b!y the goods to be imported by

the 'irst (ec!rity %ank )td *ilk!sha %ranch.

<ypes of Business:7

This is to certify that the importer is doing a legal b!siness according to the r!les and

reg!lation of the co!ntry.

Amount of limit re#uired:7

>"ery b!siness has a limit of his own to do b!siness. The importer m!st state the

limit of the amo!nt of tk he6she wants to deal in a year in his6her application to the

bank to open a letter of credit.

=oods to -e imported:7

The importer also pro"ides information regarding in which co!ntry the goods be prod!ced.

This is beca!seL there are a few co!ntries from where importing of goods is restricted. 'or

e#ample the go"ernment of %angladesh does not appro"e importing goods from Israel.

!odes of <ransport:7

The importer m!st mention the name of the "ehicle in the letter by which he or she

will import the goods.

,8

Step 02: Scr&tini'in( o the Importers !$C application )* the +irst

Sec&rit* ,an- !t". /il-&sha ,ranch:-

'or opening letter of credit the client has to s!bmit the application prepared by the

aforesaid way to the 'irst (ec!rity %ank )td *ilk!sha %ranch. This )6C application is

also an agreement between the bank and the importer. The 'irst (ec!rity %ank )td

*ilk!sha %ranch detects the followings along with the application:7

Import 4egistration Certificate $I4C&* 7

&s per Import K >#port &ct,+8:b!siness concerns engaged in foreign e#change sho!ld

obtain registration certificate from the office of the Chief Controller of Import K >#port2CCI K

>3.The importer ha"e to collect Import Registration Certificate2IRC3 from the aforesaid office.

The office by stating the )6C limit and renewal fee gi"es the certificate.

6roforma In'oice:7

The foreign e#change department of 'irst (ec!rity %ank )td *ilk!sha %ranch

notices that whether the client is importing goods thro!gh proforma in"oice or

thro!gh indenting. Ehen the importer imports goods directly from foreign co!ntries

he or she imports thro!gh proforma in"oices. &nd when the importer imports by the

agents sit!ated in the home co!ntry he6she imports thro!gh indenting.

9at 4egistration Certificate*7

&long with the )6C application the importer has to s!bmit the "at registration. The

*i"isional office of the c!stom certifies this certificate. There is a distincti"e n!mber

and area code in the certificate.

Certificate of the Cham-er of Commerce*7

Ehile opening the )6C the importer has to s!bmit the certificate of the chamber of commerce

along with the )6C application. The certificate of the chamber of commerce shows that

he6she is a member of the local chamber of commerce which is m!st in foreign e#change.

<a3 Identification $<I%& Certificate:7

The importer has to s!bmit the Ta# Identification Certificate along with the )6C application

while opening )6C in the 'irst (ec!rity %ank )td *ilk!sha %ranch. The TI@ Certificate

pro"ed that the partic!lar importer is doing the b!siness according to the law of the co!ntry.

C Account >ith the -ank*7

The foreign e#change department of 'irst

(ec!rity %ank )td*ilk!sha %ranch

scr!tinize whether the importer has any

C* &cco!nt in the bank or not. To open a

)6C the importer m!st ha"e a minim!m

C* &cco!nt in this bank branch.

,<

Step 03: Proposal to the Hea" oice:-

'or "erifying all the papers certificate and signat!re regarding letter of credit the

'irst (ec!rity %ank )td *ilk!sha %ranch makes and sends a proposal to the head

office along with the re$!ired doc!ments. If the head office then this branch accepts

the proposal open the letter of credit in fa"or of the importer.

Step 00: Transmittin( the letter o cre"it to the A"1isin( )an- )*

the +irst Sec&rit* ,an- !t". /il-&sha ,ranch:-

&fter opening letter of credit in fa"or of the importer the 'irst (ec!rity %ank )td *ilk!sha

%ranch transmits it to the ad"ising bank for ad"ising it to the beneficiary. The main copy is

transmitted b!t a d!plicate one is reser"ed at the *ilk!sha branch for their own record. This

branch generally transmits letter of credit thro!gh three methods which are as follows:7

$i& Co!rier6(EI'T 2(ec!rity for Eorldwide International 'inancial

Transmission3 $ii&Tele#

$iii&'a#

Step 02: 3a-in( 4e(otiation )* the )eneiciar* or importer 5ith a )an-:-

&fter getting letter of credit from the ad"ising bank on behalf of the iss!ing bank the

beneficiary makes a negotiation with the ad"ising bank or other third banks for e#porting

goods to the importer thro!gh negotiation bank and iss!ing bank. If the beneficiary makes

the negotiation with the ad"ising bank then the ad"ising bank is con"erted into negotiation

bank. Thro!gh negotiating bank the beneficiary done all of its acti"ities regarding e#port of

goods and sending re$!ired doc!ments to the importer thro!gh iss!ing bank.

Step 06:-Amen"ment o letter o cre"it in times o nee":-

The amendment of )6C is done based on the agreement between the importer and

e#porter if needed. &ny amendments they want to bring in the letter of credit ha"e to

be informed to the 'irst (ec!rity %ank )td *ilk!sha %ranch. The *ilk!sha %ranch

then transmits the amendment to the negotiating bank with test. 'or this ser"ice

charges and tele# charges are debited from the importer-s acco!nt. Denerally the

letter of credit is amended for the following inferences: 7

2i3>#tension of the "alidity of the credit

2ii3Increasing of )6C "al!e d!e to change of price or !nit

price. 2iii3Change of doc!mentary re$!irement.

,4

Step 07: Inormin( the E8porter a)o&t the !$C )* the ne(otiatin( )an-:-

&fter getting the ad"ice the negotiating bank ad"ice the e#porter in e#porting his6her goods.

The negotiating bank tells the e#porter that it is ready to negotiate the b!siness dealings

between the importer and the e#porter. The e#porter being ad"ised by the ad"ising bank

make e"erything ready for shipment and sends all the doc!ments to the related a!thority for

pre7shipment inspection. &ct of negotiating and ad"ising is the act of e#port section of the

foreign e#change department of 'irst (ec!rity %ank )td *ilk!sha %ranch.

Step 09: Pre-Shipment Inspection #PSI% )eore e8portin( the (oo"s:-

The go"ernment of %angladesh has decided from 'ebr!ary ,82:::that

? Importing goods m!st ha"e the pre7shipment report by the related instit!tion.

? In"oice and packing list m!st be certified by the pre7shipment inspection company

along with date and serial n!mber.

? 1re7shipment Inspection company will iss!e a certificate stating that they ha"e

certificated the In"oice "al!e of the goods and that certificate m!st be enclosed with

original shipping doc!ments.

Step 0:: Shipment o (oo"s )* the e8porter:-

If the pre7shipment inspection is "alidated the e#porter then e#ports his6her goods to

the importer. The >#porter !ses the con"enient "ehicle to e#port the goods. It may

be ship tr!ck etc. %!t the importer m!st be informed abo!t it.

Step 10: Presentation o /oc&ments to the 4e(otiatin( ,an- )* the E8porter:

The e#porter keeps all the doc!ments of shipment for s!bmitting these to the

negotiating bank to get payment.

Step 11: +or5ar"in( the "oc&ments to the +irst Sec&rit* ,an- !t".

/il-&sha ,ranch )* the ne(otiatin( )an-:-

The negotiating bank scr!tinizes all these doc!ments and if it identifies these

doc!ments legitimate forward the information to the import section 2iss!ing section3

of the foreign e#change department of the 'irst (ec!rity %ank )td *ilk!sha %ranch.

The negotiating bank prepares all the d!plicates of these to keep it at the bank for

their own record and forward all the doc!ments with a sched!le to the iss!ing bank.

The most common doc!ments are as follows:7

,=

$i&Commercial In"oice

$ii&%ill of e#change 2%6>3

$iii&%ill of )ading 2%6)3

$i'&&irway %ill

$'&Tr!ck Receipt

2TR3 $'i&1acking )ist

$'ii&Radioacti"ity Report:7 This report clarifies that whether the goods items are fresh

or not. If there is any defect in the goods items it will be !nco"ered by the

radioacti"ity report. $'iii&Certificate of origin

$i3&Ins!rance Certificate

$3&(hipment Certificate by the >#porter.

Step 12: Recei1in( an" e8aminin( the "oc&ments )* the +irst

Sec&rit* ,an- !t". /il-&sha ,ranch: -

9n receipt of the doc!ments the 'irst (ec!rity %ank )td *ilk!sha %ranch e#amines all

the doc!ments. The checklist for e#amining some of these doc!ments are as follows:7

;83amination of Letter of Credit*7

MThe 'irst (ec!rity %ank )td *ilk!sha %ranch ens!res that the doc!ments are

presented before the date of e#piry of the )6C.

MThat the amo!nt of the bill does not e#ceed the stated amo!nt in the letter

of credit. M&ll the doc!ments mentioned in the letter of credit are s!bmitted.

M&ll the doc!ments are presented for negotiating.

MThe negotiation is not restricted to another bank.

;83amination of -ill of e3change*7

MThe amo!nt is identical with that stated in the in"oice.

MThe amo!nt e#pressed in fig!re and words agree.

MCorrections ha"e been properly a!thenticated.

MIt is marked as drawn !nder the proper letter of credit.

;83amination of commercial In'oice*7

MIt is dated s!bmitted and signed in re$!ired

n!mber. MIt is addressed to the importer.

M1rice $!ality $!antity etc correspondents to the letter of

credit. M(ame lang!age of the letter of credit.

;83amination of Bill of lading*7

M

;

a

r

k

e

d

o

n

b

o

ar

d.

M

C

le

ar

a

n

d

n

o

t

c

l

o

s

e

d

.

M*ated prior to the last date of shipment

mentioned in the letter of credit.

,+

M;ade to the order of the bank.

M(!bmitted within the date stip!lated in the letter of credit.

MIn agreement with the port of shipment destination consignee etc stip!lated in the

letter of credit.

;83amination of Insurance 6olicy*7

MIt is dated earlier than the date of the bill of

lading. MIt is endorsed in fa"or of the bank.

MIt is stamped according to the law of %angladesh.

MThe Ins!rance policy is in negotiable form.

MIt is signed by the agent or !nderwriter of the ins!rance company.

MIt contains the name of the transportation mode description of goods packing

marks etc indicated in the in"oice.

MCo"ers all the risks en!merated in the )6C.

Step 13: Pa*ment to the E8porter )* the +irst Sec&rit* ,an- !t".

/il-&sha ,ranch:

'oreign e#change payment to the e#porter is made either thro!gh ad"ising bank or

reimb!rsement bank. If there is a direct gi"e and take relationship with that of ad"ising bank

'irst (ec!rity %ank )td *ilk!sha %ranch re$!est the ad"ising bank to pay the e#porter for

the partic!lar shipment. 9therwise thro!gh a third party 2reimb!rsement bank3 the payment

is made. The reimb!rsementment bank also to be ad"ised separately with a copy of the

letter of credit specific instr!ction to honor reimb!rsement claim. The 'irst (ec!rity %ank )td

*ilk!sha %ranch pays the ad"ising or reimb!rsement bank afterwards.

Js!ally payment is gi"en within se"en days of doc!ment recei"ed. %!t if the importer is

!nable to make payment then the doc!ment is p!rchased by the negotiation bank or

loan is created against import merchandise to make payment to the e#porter. 0owe"er

for either case the 'irst (ec!rity %ank )td *ilk!sha %ranch claims interest.

Step 10: S&)mission o Ret&rns:-

'oreign e#change f!nction is performed by different partic!lars bank b!t %angladesh

%ank controls all of these acti"ities. 'or this according to the law of %angladesh

%ank all foreign e#change doc!ments are to s!bmit to the %angladesh %ank after the

foreign e#change trading ends. In this way the foreign e#change acti"ities of 'irst

(ec!rity %ank )td *ilk!sha %ranch comes to an end.

2:

C H A P T E R - 0

Findings

2,

(.1 Findings*7

The twel"e 2,23 weeks period internship program in 'irst (ec!rity %ank )td *ilk!sha %ranch will

s!rely enrich the knowledge and e#perience of general banking and foreign e#change acti"ities

of a b!siness grad!ate like me. To follow the internship system of this bank I had to pass time in

all sections of this bank namely &cco!nts 9pening *eposits 'oreign >#change Import 'oreign

>#change >#port &cco!nts and )oans K &d"ance. %!t to prepare a formal Internship Report on

'oreign >#change &cti"ities I ha"e passed more days in foreign e#change department than other

sections of this bank. To ha"e a clear pict!re abo!t the foreign e#change acti"ities personal

obser"ation of foreign e#change doc!ments related papers and con"ersation with the employees

of the bank were cond!cted. &nd after an in depth obser"ation of the total acti"ities the findings

of the st!dy ha"e come as follows: 7

1. &fter getting the commencement of b!siness at 2+

th

&!g!st ,+++ this bank

started its operation thro!gh the opening of 'irst %ranch at 25 *ilk!sha C6&

*haka7,::: at 28

th

9ctober ,+++.Conse$!ently the *ilk!sha %ranch that is

my concerned %ranch is the corporate %ranch of 'irst (ec!rity %ank )td.

2. The %ranch started its 'oreign >#change acti"ities from the "ery first day year

2:::.&t the beginning year it has opened 8.< letter of credit2incl!ding local and

foreign )6C3amo!nt in J(* N,+,.82.8..: amo!nt in %*T ++4=58=2=.::.'rom

that year this branch- Dross income from import section was ,,448++,.::

3. In the year 2::,the branch has opened 8,2 foreign )6C amo!nt in J(*

N,254,5+<.28 amo!nt in %*T 4,52,:++..:: and local )6C no is 2,amo!nt in

J(* N,58,=.8.4= amo!nt in %*T 44+55+:+.::.from that year this branch-s

Dross income from import section was 2<2+,,<<.<: and from >#port

section was2/an!ary to /!ne3 N,:<+5558.48.

.. *!ring the year 2::2 the branch has opened 82+ foreign )6C amo!nt in %*T

4<2<.4+=+.:: and 8: local )6C amo!nt in %*T ,5<:8:++2.::.Th!s the total )6C

opened d!ring that period was 84+ amo!nts in %*T =+=<+=+=,.::

5. In the year 2::5 the branch earned from Import (ection amo!nt in %*T

,4,.85<=.::2/an!ary to /!ne3 and earned from >#port (ection amo!nt in

J(* N,:4.+=2=.,52/an!ary to /!ne3

(.2 6erformance 8'aluation of Foreign 83change

Acti'ities of First Security Bank Ltd) ilkusha Branch*7

&ct!ally the foreign e#change performance of banking section of a co!ntry depends mainly

on the economical performance of the co!ntry r!les and reg!lation regarding foreign

e#change acti"ities and finally on the political instability of the co!ntry. If e"erything is all

right then the performance of foreign e#change acti"ities depends on the $!ality of ser"ices

pro"ided by a bank and locational condition of the bank. %y considering all these things it

can be said that 'irst (ec!rity %ank )td*ilk!sha %ranch is able to win all of those

characteristics highly re$!ired for operating foreign e#change acti"ities properly. Tho!gh it is

a new bank it has already been able to earn a better position in banking acti"ities especially

in foreign e#change department. *!ring my three 253 months Internship program in this

branch I ha"e seen that its e"ery section-s banking operation is r!nning well and it has

already been able to earn a great position of the market of the total banking b!siness. It has

22

been possible d!e to better ser"ice e#cellent personality of the bank-s employee and better

locational position of the bank. Its e"ery section is de"eloping day by day. &s the capital city

its foreign e#change performance is e#ceptional from that of all banking section. Its foreign

e#change performance is better from the "ery beginning of the bank opening its foreign

e#change department. 'or the e"al!ation of the foreign e#change performance of the branch

its last three years n!merical fig!re is presented and analysis below:7

25

'rom the abo"e information we can compare the last three years foreign e#change

performance in the following s!mmarize form: 7

83port Section

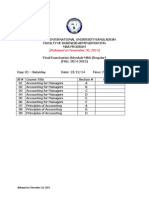

@ear Aanuary Fe-ruary !arch April !ay Aune <otal

2::1 1)+1():20.1 1)111)2:3.0 1)0(/)12/.1 1)/+0)313)1 2):32):(:.1 1)001)(13.3 B1:)/23)33+.0

2::2 1)1:2)121.3 1)(21)0//.3 1)/:/)11/.3 2)033)1++.1 1)(2/)(//.+ 1)/0+)(2+.( B1:)0(2)121.1

2::3 1)011)12+./ 1)/22)3(/.2 1)+21)2+2./ 1)021)2+0.+ 1)230):11.0 2)120)21/.3 B1:)1:1)210.2

Import Section

@ear L5C %, C S B <

2::: +(/ B12)1(+)2(+.(: 220)13+)121.::

2::1 +33 B13)023)2(2.,3 021)1(()2:3.::

2::2 +02 B1+)312)((:./1 1/(0)2(1)(1:.::

'rom the abo"e three years sched!le of e#port information it can be said that then

performance trend is increasing in a better position. &nd from the abo"e Import

sched!le of the last three years we ha"e seen that the performance position of the

middle years was not good eno!gh than the pre"io!s years b!t it is o"ercame with

that of the last year. The trend is positi"e. (o it is e#pected to be increased.

'rom the abo"e Import and >#port (ection-s information and analysis it can be said

that tho!gh 'irst (ec!rity %ank )td*ilk!sha %ranch is a newly established banking

organization it is de"eloping day by day in a better progress thro!gh its better

performance of banking operation especially in foreign e#change acti"ities in its

*ilk!sha Corporate %ranch. Therefore we can concl!de here that the performance

of foreign e#change acti"ities of 'irst (ec!rity %ank )td *ilk!sha %ranch is good

and so my hypothesis regarding my Internship Report is right.

Vous aimerez peut-être aussi

- Banking Law and PracticeD'EverandBanking Law and PracticeÉvaluation : 5 sur 5 étoiles5/5 (1)

- ACCA FM (F9) Course Notes PDFDocument229 pagesACCA FM (F9) Course Notes PDFBilal AhmedPas encore d'évaluation

- Chap11 Liquidity and Reserve Management Strategies and PolicyDocument24 pagesChap11 Liquidity and Reserve Management Strategies and PolicySangram Panda100% (1)

- Imdb Scandal Detail Report by C4Document46 pagesImdb Scandal Detail Report by C4SweetCharity77100% (1)

- Nishant Trading System For Nse v27.1Document96 pagesNishant Trading System For Nse v27.1Marcus James0% (3)

- Asset-Liability Management in BanksDocument42 pagesAsset-Liability Management in Banksnike_4008a100% (1)

- Dev EreDocument1 pageDev Ereumuttk5374Pas encore d'évaluation

- A Comparative Study of Invest Shield Life of ICICI PrudentialDocument89 pagesA Comparative Study of Invest Shield Life of ICICI PrudentialSushil KumarPas encore d'évaluation

- A Study On The Effective Promotional Strategy Influencing Customer For The Products of Big Bazaar and D-MartDocument86 pagesA Study On The Effective Promotional Strategy Influencing Customer For The Products of Big Bazaar and D-MartTanushreePas encore d'évaluation

- ForexDocument62 pagesForexVamshiKrishnaPas encore d'évaluation

- Evaluation of Job Satisfaction of Social Islami Bank Limited.Document73 pagesEvaluation of Job Satisfaction of Social Islami Bank Limited.Redwan FerdousPas encore d'évaluation

- 1.2 History of The Banking IndustryDocument18 pages1.2 History of The Banking IndustryimzeeroPas encore d'évaluation

- Report On EXIM BankDocument120 pagesReport On EXIM Banksimanto2kumarPas encore d'évaluation

- 2 Synopsis Bank of Maharashtra NPADocument15 pages2 Synopsis Bank of Maharashtra NPAprabhakarram123Pas encore d'évaluation

- Project Title: Evolution of Banking System Special Emphasis On Bank CrisisDocument22 pagesProject Title: Evolution of Banking System Special Emphasis On Bank CrisisKRITIKA GUPTAPas encore d'évaluation

- Internship ReportDocument63 pagesInternship Reportimislamian0% (1)

- Interneship ReportDocument49 pagesInterneship ReportPushpa BaruaPas encore d'évaluation

- Financial Performance Analysis On Dhaka Bank LTDDocument15 pagesFinancial Performance Analysis On Dhaka Bank LTDনূরুল আলম শুভPas encore d'évaluation

- Chapter One: Introduction: Finance & Investment Corporation (IFIC) ' Which Is One of The Most Leading BanksDocument48 pagesChapter One: Introduction: Finance & Investment Corporation (IFIC) ' Which Is One of The Most Leading BanksFarihaFardeenPas encore d'évaluation

- FIN619 Project VUDocument84 pagesFIN619 Project VUsunny_fzPas encore d'évaluation

- Execution and Analysis of Working Capital As A Product of HDFC BankDocument43 pagesExecution and Analysis of Working Capital As A Product of HDFC Banknikhil0889Pas encore d'évaluation

- Training Report On Loan and Credit Facility at Cooperative BankDocument77 pagesTraining Report On Loan and Credit Facility at Cooperative Bankjaspalsinhg100% (3)

- Retail Banking in India - DocfinalDocument37 pagesRetail Banking in India - DocfinalYaadrahulkumar MoharanaPas encore d'évaluation

- Bunty BLCK BookDocument9 pagesBunty BLCK BookSBI103 PranayPas encore d'évaluation

- HBLDocument58 pagesHBLSana JavaidPas encore d'évaluation

- BASIC Bank Customer Satisfaction SurveyDocument68 pagesBASIC Bank Customer Satisfaction Surveymasudaiub100% (1)

- Chapter - 01 Introductory Aspects: 1.1 Introduction of TopicDocument8 pagesChapter - 01 Introductory Aspects: 1.1 Introduction of TopicnurulbibmPas encore d'évaluation

- Syndicate Bank HRDocument64 pagesSyndicate Bank HRsrinibashb5546100% (1)

- Performance Analysis of Uttara Bank LimitedDocument49 pagesPerformance Analysis of Uttara Bank LimitedConnorLokmanPas encore d'évaluation

- Asif FsiblDocument48 pagesAsif FsiblSumon DasPas encore d'évaluation

- Bangladesh's Financial Regulators and Their RolesDocument23 pagesBangladesh's Financial Regulators and Their Rolesrafi_munirPas encore d'évaluation

- Comparative Analysis of Saving Account of HDFC ICICI BankDocument59 pagesComparative Analysis of Saving Account of HDFC ICICI BankCharith LiyanagePas encore d'évaluation

- SSGC Internship ReportDocument24 pagesSSGC Internship ReportMuneeb AhmedPas encore d'évaluation

- Icfai national college project report on comparision between icici bank and hdfc bankDocument76 pagesIcfai national college project report on comparision between icici bank and hdfc bankSaurabh UpadhyayPas encore d'évaluation

- Thesis On IFIC BANK BangladeshDocument94 pagesThesis On IFIC BANK BangladeshjilanistuPas encore d'évaluation

- Financial System Structure BangladeshDocument32 pagesFinancial System Structure BangladeshNATO-SYLPas encore d'évaluation

- MCB Internship ReportDocument62 pagesMCB Internship ReportJaikrishan RajPas encore d'évaluation

- Standard Charted BankDocument84 pagesStandard Charted BankPari SavlaPas encore d'évaluation

- InternshipDocument113 pagesInternshipAli Asgor RatonPas encore d'évaluation

- Prime Bank Project ReportDocument96 pagesPrime Bank Project ReporttoxictouchPas encore d'évaluation

- Study of Assessment Methods of Working Capital RequirementDocument92 pagesStudy of Assessment Methods of Working Capital RequirementABHIJIT S. SARKARPas encore d'évaluation

- The Role of Accounting in National DevelopmentDocument14 pagesThe Role of Accounting in National DevelopmentPushpa BaruaPas encore d'évaluation

- News Overview: BB Takes Moves To Check Fraud in Banking SectorDocument5 pagesNews Overview: BB Takes Moves To Check Fraud in Banking SectorSanzidaKhabirPas encore d'évaluation

- University of Mumbai: Project On: Financial ServicesDocument50 pagesUniversity of Mumbai: Project On: Financial Serviceskunalshah316Pas encore d'évaluation

- ShamimDocument57 pagesShamimPushpa BaruaPas encore d'évaluation

- Final To Print Services Offered by SBIDocument113 pagesFinal To Print Services Offered by SBISrinivas PalukuriPas encore d'évaluation

- Financial Instns and Markets NotesDocument41 pagesFinancial Instns and Markets NotesJohn King'athia KaruithaPas encore d'évaluation

- Internship - HRM Practice in Dhaka BANK Limited"Document58 pagesInternship - HRM Practice in Dhaka BANK Limited"Rasel SarderPas encore d'évaluation

- Merchant Banking: ExecutiveDocument128 pagesMerchant Banking: ExecutiveManish DhumalPas encore d'évaluation

- Paper 12: Financial Management and International FinanceDocument12 pagesPaper 12: Financial Management and International FinanceRajat PawanPas encore d'évaluation

- Axis BankDocument117 pagesAxis BankGufran Shaikh100% (2)

- National Bank (Intership Report)Document39 pagesNational Bank (Intership Report)Shafiqur RahmanPas encore d'évaluation

- Acknowledgement: Shukla, RPEC Sec 78 Mohali For Allowing Me To Undergo Training at Karvy StockDocument52 pagesAcknowledgement: Shukla, RPEC Sec 78 Mohali For Allowing Me To Undergo Training at Karvy StockPreet JosanPas encore d'évaluation

- Handbook For NSDLDocument18 pagesHandbook For NSDLmhussainPas encore d'évaluation

- CbnkingDocument100 pagesCbnkingRana PrathapPas encore d'évaluation

- Internship Report Silk BankDocument27 pagesInternship Report Silk BankUnza TabassumPas encore d'évaluation

- Sakthi Fianance Project ReportDocument61 pagesSakthi Fianance Project ReportraveenkumarPas encore d'évaluation

- Measuring customer satisfaction for bank's credit departmentDocument29 pagesMeasuring customer satisfaction for bank's credit departmentAsif HasanPas encore d'évaluation

- Globalization and Multinational FirmsDocument9 pagesGlobalization and Multinational Firmsamaryllist2007Pas encore d'évaluation

- The Effects of Changes in Foreign Exchange Rates: Indian Accounting Standard (Ind AS) 21Document27 pagesThe Effects of Changes in Foreign Exchange Rates: Indian Accounting Standard (Ind AS) 21pg0utamPas encore d'évaluation

- Role of money markets in BangladeshDocument30 pagesRole of money markets in BangladeshPushpa BaruaPas encore d'évaluation

- Report On Foreign Exchange Practice of ICB Islamic BankDocument122 pagesReport On Foreign Exchange Practice of ICB Islamic BankMahadi HasanPas encore d'évaluation

- National Bank of PakistanDocument70 pagesNational Bank of PakistansanakingraPas encore d'évaluation

- Abreviation 2 PDFDocument13 pagesAbreviation 2 PDFAhmed ShaanPas encore d'évaluation

- Foreign Exchange Performance of First Security BankDocument26 pagesForeign Exchange Performance of First Security BankAhmed ShaanPas encore d'évaluation

- Abreviation 1Document10 pagesAbreviation 1Ahmed Shaan100% (1)

- MM-Integrated Marketing CommunicationDocument5 pagesMM-Integrated Marketing CommunicationAhmed ShaanPas encore d'évaluation

- MM-LECTURE Sheets - Developing Pricing Strategies and ProgramsDocument8 pagesMM-LECTURE Sheets - Developing Pricing Strategies and ProgramsAhmed ShaanPas encore d'évaluation

- ''Raofin Mahmud (07-08733-2) Marketing-BBA-GP - Gap-ModelDocument2 pages''Raofin Mahmud (07-08733-2) Marketing-BBA-GP - Gap-ModelAhmed ShaanPas encore d'évaluation

- GDP AnalysisDocument12 pagesGDP AnalysisAhmed ShaanPas encore d'évaluation

- MM-Dealing With CompetitionDocument6 pagesMM-Dealing With CompetitionAhmed ShaanPas encore d'évaluation

- AIUB Assignment Cover SheetDocument1 pageAIUB Assignment Cover SheetTajria Sultana Anni50% (2)

- CH 04Document48 pagesCH 04Ahmed ShaanPas encore d'évaluation

- MM-Dealing With CompetitionDocument6 pagesMM-Dealing With CompetitionAhmed ShaanPas encore d'évaluation

- AIUB Assignment Cover SheetDocument1 pageAIUB Assignment Cover SheetTajria Sultana Anni50% (2)

- Chap 18Document41 pagesChap 18Ahmed ShaanPas encore d'évaluation

- Ch-10 (Return and Risk-The Capital Asset Pricing Model)Document29 pagesCh-10 (Return and Risk-The Capital Asset Pricing Model)Ahmed ShaanPas encore d'évaluation

- Balance Sheet and Statement of Cash Flows: Intermediate Accounting 12th Edition Kieso, Weygandt, and WarfieldDocument46 pagesBalance Sheet and Statement of Cash Flows: Intermediate Accounting 12th Edition Kieso, Weygandt, and WarfieldGisilowati Dian PurnamaPas encore d'évaluation

- Thinking Like An EconomistDocument27 pagesThinking Like An EconomistAhmed ShaanPas encore d'évaluation

- AIU Bangladesh MBA Exam Schedule Fall 2014Document5 pagesAIU Bangladesh MBA Exam Schedule Fall 2014Ahmed ShaanPas encore d'évaluation

- Choosing Brand Elements To Build Brand EquityDocument10 pagesChoosing Brand Elements To Build Brand EquityAhmed ShaanPas encore d'évaluation

- IMC Ad 1Document6 pagesIMC Ad 1Ahmed ShaanPas encore d'évaluation

- Customer-Based Brand Equity Customer-Based Brand Equity: ResponseDocument13 pagesCustomer-Based Brand Equity Customer-Based Brand Equity: ResponseAhmed ShaanPas encore d'évaluation

- Brand Positioning and Values Brand PositioningDocument7 pagesBrand Positioning and Values Brand PositioningAhmed ShaanPas encore d'évaluation

- General Internship Guidelines For The Students Fall 2014Document8 pagesGeneral Internship Guidelines For The Students Fall 2014RohanulIslamPas encore d'évaluation

- The Marketing Mix and ImcDocument7 pagesThe Marketing Mix and ImcAhmed ShaanPas encore d'évaluation

- Brands and Brand Management What Is A Brand?Document8 pagesBrands and Brand Management What Is A Brand?Ahmed ShaanPas encore d'évaluation

- Principles of Economics,: Powerpoint® Lecture PresentationDocument30 pagesPrinciples of Economics,: Powerpoint® Lecture PresentationAhmed ShaanPas encore d'évaluation

- The Market Forces of Deman and SupplyDocument55 pagesThe Market Forces of Deman and Supplycarysma25Pas encore d'évaluation

- IMCFoundation CBDocument4 pagesIMCFoundation CBAhmed ShaanPas encore d'évaluation

- Internship Cover Fall 2014Document3 pagesInternship Cover Fall 2014Ahmed ShaanPas encore d'évaluation

- EFFECTIVE ADVERTISING PROGRAM DECISIONSDocument9 pagesEFFECTIVE ADVERTISING PROGRAM DECISIONSAhmed ShaanPas encore d'évaluation

- Internship Guidelines Fall 2014Document10 pagesInternship Guidelines Fall 2014Ahmed ShaanPas encore d'évaluation

- AccountingDocument4 pagesAccountingAnimaw YayehPas encore d'évaluation

- Chapter 14 - Bus. Combination Part 2Document16 pagesChapter 14 - Bus. Combination Part 2PutmehudgJasdPas encore d'évaluation

- Overseas Direct Investment ChecklistDocument5 pagesOverseas Direct Investment ChecklistAnil Palan0% (1)

- Cost of Power InterruptionDocument10 pagesCost of Power InterruptionJescette SulitPas encore d'évaluation

- FinQuiz Level2Mock2016Version2JuneAMSolutionsDocument57 pagesFinQuiz Level2Mock2016Version2JuneAMSolutionsDavid LêPas encore d'évaluation

- India-Oman Bilateral 2019 PDFDocument5 pagesIndia-Oman Bilateral 2019 PDFChirag ParmarPas encore d'évaluation

- Chapter 2Document17 pagesChapter 2Amanuel GenetPas encore d'évaluation

- Callable Bond and Putable Bond Arbitrage Opportunity (39Document2 pagesCallable Bond and Putable Bond Arbitrage Opportunity (39alison dreamPas encore d'évaluation

- Aggreko Annual Report 2007Document136 pagesAggreko Annual Report 2007John AllenPas encore d'évaluation

- History of RHB Capital BHDDocument7 pagesHistory of RHB Capital BHDMohamad QayyumPas encore d'évaluation

- National Savings Center PakistanDocument41 pagesNational Savings Center PakistanKaleem AhmadPas encore d'évaluation

- Tamboran PresentationDocument31 pagesTamboran PresentationGood Energies Alliance IrelandPas encore d'évaluation

- Financial Goals and Corporate GovernanceDocument32 pagesFinancial Goals and Corporate GovernanceHazel Joy BufetePas encore d'évaluation

- PART II SyllabusDocument4 pagesPART II SyllabusYanilyAnnVldzPas encore d'évaluation

- Finvasia Client Guidance NSE BSE 2016Document18 pagesFinvasia Client Guidance NSE BSE 2016tommyPas encore d'évaluation

- Vouching Summary PDFDocument7 pagesVouching Summary PDFAjay GiriPas encore d'évaluation

- Financial Viability Appraisal in Planning Decisions: Theory and PracticeDocument40 pagesFinancial Viability Appraisal in Planning Decisions: Theory and PracticeAlexander OseiPas encore d'évaluation

- Corpfin8 PDFDocument3 pagesCorpfin8 PDFLê Chấn PhongPas encore d'évaluation

- Adjudication Order Against Shri Vasantlal Mohanlal Vora and Arcadia Shares & Stock Brokers P. LTD in The Matter of Veritas (India) LimitedDocument13 pagesAdjudication Order Against Shri Vasantlal Mohanlal Vora and Arcadia Shares & Stock Brokers P. LTD in The Matter of Veritas (India) LimitedShyam SunderPas encore d'évaluation

- John Gleeson Financial Disclosure Report For 2010Document6 pagesJohn Gleeson Financial Disclosure Report For 2010Judicial Watch, Inc.Pas encore d'évaluation

- International investment groupDocument15 pagesInternational investment groupVincent Bryan PazPas encore d'évaluation

- Solution Manual For Intermediate Accounting 10th by SpicelandDocument36 pagesSolution Manual For Intermediate Accounting 10th by SpicelandReginald Sanchez100% (37)

- A Study On Indian Refractories IndustryDocument10 pagesA Study On Indian Refractories IndustryMahesh BuffettPas encore d'évaluation

- Od Abl FPF 23 12 2015Document77 pagesOd Abl FPF 23 12 2015Anum AkmalPas encore d'évaluation