Académique Documents

Professionnel Documents

Culture Documents

Company Rescue Under UK Administration and US Chapter 11

Transféré par

vidovdan98520 évaluation0% ont trouvé ce document utile (0 vote)

308 vues4 pages...

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce document...

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

308 vues4 pagesCompany Rescue Under UK Administration and US Chapter 11

Transféré par

vidovdan9852...

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 4

A comparison: company rescue under UK

administration and US Chapter 11

Standard Note: SN/HA/5527

Last updated: 18 May 2010

Author: Lorraine Conway, Home Affairs Section

Section Home Affairs Section

In the UK, a company is insolvent if it cannot meet its debts as and when they fall due.

Broadly speaking, an insolvent company has two options: compulsory liquidation or company

rescue via administration. Under the Insolvency Act 1986 (IA 1986) and the Enterprise Act

2002 (EA 2002), compulsory liquidation (or winding up) involves the closing down of the

business and the realisation of company assets for the benefit of creditors. In contrast,

administration provides an opportunity to rescue the company or its business. The

administration procedure is designed to hold a business together while plans are formed

either to put in place a financial restructuring to rescue the company, or to sell the business

and assets to produce a better result for creditors than a liquidation. It is possible for a viable

business in financial difficulty to emerge in tact from administration.

In the US, an insolvent business also has two options under the US Bankruptcy Code: file

with a federal bankruptcy court for protection under either Chapter 7 or Chapter 11. Chapter

7 deals with liquidation; under Chapter 7 the business stops trading and all assets are sold

for the benefit of the creditors. In contrast, the aim of Chapter 11 is to restructure debts and

save the business. It is also possible for a viable business in financial difficulty to emerge in

tact from Chapter 11 proceedings.

Comparisons are often made between UK administration and US Chapter 11 proceedings.

They share the same purpose: to rescue a viable business in temporary financial difficulty.

The EA 2002, which came into force in September 2003, substantially reformed the

administration procedure. However, it has been argued variously that the Act could have

gone much further - it could have introduced in the UK new procedures more akin to Chapter

11 of the US Bankruptcy Code. Certainly, at the time of this insolvency law reform in the UK,

comparisons were made to Chapter 11.

This note has two aims. First, to outline the background to the reform of administration in the

UK in order to facilitate greater company rescue and second, to provide a comparison

between the UK administration insolvency procedure and US Chapter 11.

Separate Library note SN/HA/4915 provides an explanation of how administration works in

practice in the UK. Another Library note SN/HA/4798 provides an overview of Chapter 11

and an explanation of how this insolvency procedure works in the US.

This information is provided to Members of Parliament in support of their parliamentary duties

and is not intended to address the specific circumstances of any particular individual. It should

not be relied upon as being up to date; the law or policies may have changed since it was last

updated; and it should not be relied upon as legal or professional advice or as a substitute for

it. A suitably qualified professional should be consulted if specific advice or information is

required.

This information is provided subject to our general terms and conditions which are available

online or may be provided on request in hard copy. Authors are available to discuss the

content of this briefing with Members and their staff, but not with the general public.

Contents

1 Introduction 2

2 Government consultations on Chapter 11 type reforms in the UK 2

3 Overview of administration under the EA 2002 3

4 Comparisons between the UK administration and US Chapter 11 4

1 Introduction

The Enterprise Act 2002 (EA 2002), which came into force in September 2003, substantially

reformed administration law in the UK. However, it has been argued variously that the EA

2002 could have gone further - it could have introduced US Chapter 11 type procedures in

the UK. Certainly, at the time of this insolvency law reform, comparisons were made to

Chapter 11 procedures under the US Bankruptcy Code.

2 Government consultations on Chapter 11 type reforms in the UK

Reform of the UK insolvency law regime was considered in December 1998 in the

Governments White Paper Our Competitive Future: Building the Knowledge Driven

Economy.

1

In this White Paper, the Government announced its intention to review

arrangements for business rescues and reassess the relative rights of creditors, including

possible changes to the Crowns preferential status. The Governments aim being to

encourage risk-taking and facilitate company rescue when things go wrong. It argued that

when fundamentally viable businesses are lost there are consequences for creditors,

employees and the wider economy.

A joint DTI and Treasury working party was set up in 1999 to review company rescue and

business reconstruction mechanisms. In September 1999, this working party published a

consultation document, A Review of Company Rescue and Business Reconstruction

Mechanisms.

2

A principal theme of the document was whether there was a need to shift the

balance of the UK insolvency regime from being creditor-friendly to being debtor-friendly.

In its report, which was published for consultation in November 2000, the Working Party

recommended certain legislative changes. These recommendations were considered in the

Governments White Paper, Insolvency A Second Chance, published in J uly 2001.

3

In the

foreword to this insolvency White Paper, Patricia Hewitt, Secretary of State for Trade and

Industry, explained the main aim of insolvency reform:

Promoting enterprise will boost UK business and improve productivity. Our Enterprise

Bill will strengthen competition and the power of consumers by radically reforming

competition law, transforming our approach to bankruptcy and corporate rescue and

1

Department of Trade and Industry (now Business Innovation and Skills) White Paper, Our Competitive Future:

Building the Knowledge Driven Economy, 1998

2

Department of Trade and Industry (now Business Innovation and Skills) and HM Treasury consultation

document, A Review of Company Rescue and Business Reconstruction Mechanisms, November 2000,

http://www.insolvency.gov.uk/insolvencyprofessionandlegislation/con_doc_register/con_doc_archive/consultati

on/condoc/condocreport.htm

3

Department of Trade and Industry (now Department of Business Innovation and Skills), Insolvency A

Second Chance, 2001, Cm 5234, http://www.insolvency.gov.uk/cwp/cm5234.pdfe

2

promoting new safeguards for consumers. We believe that promoting enterprise will

release the entrepreneurial skills of the British people.

In this White Paper I am setting out my proposals for the reform of insolvency law.

Companies in financial difficulties must not be allowed to go to the wall unnecessarily.

Administrative receivership, which places effective control of the direction and

outcome of the procedure in the hands of the secured creditor, is now seen by many

as outdated. There are many other important interests involved in the fate of such a

company, including unsecured creditors, shareholders and employees. We propose to

create a streamlined administration procedure, which will ensure that all interest

groups get a fair say and have an opportunity to influence the outcome.

4

At the time that these proposals were considered, a comparison was made between the UK

regime and the entrepreneurial regime in the US. It was argued that bankruptcy in the US

does not have the same stigma as it has in the UK. To some extent, it was this theme which

drove the reforms of the EA 2002.

3 Overview of administration under the EA 2002

In terms of reform of corporate insolvency and restructuring, the EA 2002 fell short of

implementing a full Chapter 11 style process. The main corporate insolvency measures

introduced by the Act were:

a streamlined administration procedure (making it more efficient and accessible in

order to facilitate the rescue of viable companies)

the out of court appointment of insolvency practitioners to act as administrators

the abolition of administrative receivership (with certain exceptions)

the introduction of new powers to extend certain insolvency proceedings, with

modifications, to foreign companies, Industrial and Provident Societies and Friendly

Societies

The EA 2002 promotes administration as an important vehicle for company rescue. The

original characteristics of administration, as introduced by the IA 1986, were retained: its

collective nature, its moratorium, and the opportunity to achieve different outcomes for

businesses. Other characteristics of administration introduced by the EA 2002 include:

without court order entry into the procedure;

the express power for the administrator to distribute realised assets;

new exit routes from administration into dissolution and voluntary liquidation; and

a faster and fairer procedure

Under the EA 2002 the primary aim of administration is to rescue the company as a going

concern (i.e. with as much as possible of its business) where it would provide the best result

for the company's creditors as a whole. If this is not possible, then the aim of the

administrator is to perform his functions with the objective of achieving a better return for

creditors than would be achieved in a winding-up. For example, a better return may result

from trading on for a period whilst seeking to sell off the business and/or assets.

4

Ibid

3

4

4 Comparisons between the UK administration and US Chapter 11

Some insolvency specialists have argued variously that the EA 2002 was a missed

opportunity for more radical reform of the UK administration procedure. In making their case,

they point out that the EA 2002 failed to introduce:

The US concept of the debtor stays in possession (DIP). Under the EA 2002, the

administration process does not leave directors in possession of a company with the

benefit of a statutory moratorium on creditor action and enforcement of security.

5

Instead, an insolvency practitioner is appointed administrator with responsibility for

the day-to-day running of the business and the goals of the administration.

The US concept of a DIP priority financing arrangement. In the US, there is an

established industry of DIP lenders who, because of the super-priority status granted

to them in a Chapter 11 process, will make funding available to support a company

through its restructuring. This is significant because it means that a US company in

financial difficulties is not dependent on attempting to persuade its existing banks to

lend more money.

Chapter 11 provisions as apply to so-called executory contracts and leases. Chapter

11 renders unenforceable any provision purportedly terminating a lease or executory

contract by reason of the debtors financial difficulties. Under the UK administration

process of the EA 2002, it is argued that administrators often struggle to hold together

and sell a business as a going concern without these powers.

However, other insolvency specialists have argued that the EA 2002, and the reformed

administration procedure it has introduced, has carefully avoided problems associated with

US Chapter 11 style proceedings. For example, it is argued that:

Chapter 11 imposes greater administrative burdens on the debtor business than the

EA 2002. The DIP is subject to substantial financial reporting requirements to

creditors and other interested parties. This imposes a significant administrative

burden on the DIP, not least because all parties have the right to be consulted during

the Chapter 11 process. In contrast, most of the provisions of the EA 2002, which

sought to give greater powers to creditors committees, were dropped by the time the

Act came into force.

Chapter 11 procedures is excessively lenient in giving an escape route to the

incompetent management of a failing company, damaging the efficiency of the

economy as a whole and allowing poor managers to continue managing. This is not

the case with administration.

It is worth pointing out that in the UK, it is the responsibility of the Insolvency Service to

keep under review the effectiveness of all insolvency legislation including the EA 2002.

6

5

It is correct that changes introduced by the Insolvency Act 2000 introduced a statutory moratorium to protect

companies seeking a Company Voluntary Arrangement, but this protection is only available to small

companies (a company that has a turnover of not more than 2.8m and/or a balance sheet total of not more

than 1.4m and no more than fifty employees)

6

The Insolvency Service is an executive agency of the Department of Business Innovation and Business (BIS)

Vous aimerez peut-être aussi

- Private Client Practice: An Expert Guide, 2nd editionD'EverandPrivate Client Practice: An Expert Guide, 2nd editionPas encore d'évaluation

- Directors DutiesDocument134 pagesDirectors DutiesMatthew Evan ThomasPas encore d'évaluation

- Company Law Modernisation and Corporate GovernanceDocument20 pagesCompany Law Modernisation and Corporate GovernanceMagda ShavadzePas encore d'évaluation

- The First Basic Plan For Immigration Policy, 2008-2012, Ministry of Justice, Republic of KoreaDocument129 pagesThe First Basic Plan For Immigration Policy, 2008-2012, Ministry of Justice, Republic of KoreakhulawPas encore d'évaluation

- T1 General PDFDocument4 pagesT1 General PDFbatmanbittuPas encore d'évaluation

- Corporate Governance: A practical guide for accountantsD'EverandCorporate Governance: A practical guide for accountantsÉvaluation : 5 sur 5 étoiles5/5 (1)

- Final Draft of The Role of IRP Under IBC CodeDocument24 pagesFinal Draft of The Role of IRP Under IBC CodeHemantPrajapatiPas encore d'évaluation

- Chapter - Money Creation & Framwork of Monetary Policy1Document6 pagesChapter - Money Creation & Framwork of Monetary Policy1Nahidul Islam IUPas encore d'évaluation

- Skills For Smart Industrial Specialization and Digital TransformationDocument342 pagesSkills For Smart Industrial Specialization and Digital TransformationAndrei ItemPas encore d'évaluation

- SWOT-ToWS Analysis of LenovoDocument2 pagesSWOT-ToWS Analysis of Lenovoada9ablao100% (4)

- Extremely Entertaining Short Stories PDFDocument27 pagesExtremely Entertaining Short Stories PDFvidovdan9852Pas encore d'évaluation

- Cross-Border Insolvency Problems - Is The UNCITRAL Model Law The Answer PDFDocument27 pagesCross-Border Insolvency Problems - Is The UNCITRAL Model Law The Answer PDFvidovdan9852Pas encore d'évaluation

- Chapter One ProjectDocument11 pagesChapter One ProjectDickson Tk Chuma Jr.Pas encore d'évaluation

- INTRODUCTIONDocument11 pagesINTRODUCTIONBhumika KhandelwalPas encore d'évaluation

- The UK's Company Law ReviewDocument6 pagesThe UK's Company Law ReviewSabeeb M RazeenPas encore d'évaluation

- Corporate Governance Reform and Corporate Failure in The UKDocument15 pagesCorporate Governance Reform and Corporate Failure in The UKGolam KibriaPas encore d'évaluation

- Control and Corporate Rescue - An Anglo-American Evaluation - Gerard McCormack (2007) (Pp. 517 y SS.)Document38 pagesControl and Corporate Rescue - An Anglo-American Evaluation - Gerard McCormack (2007) (Pp. 517 y SS.)Vicente Javier Tapia InfantePas encore d'évaluation

- Part 1Document108 pagesPart 1Thirnugnanasampandar ArulananthasivamPas encore d'évaluation

- Corporate Governance in The CaribbeanDocument46 pagesCorporate Governance in The CaribbeanJamal ShamsudeenPas encore d'évaluation

- Benefits of Ai in Corporate GovernanceDocument14 pagesBenefits of Ai in Corporate GovernanceAyushman SinghPas encore d'évaluation

- A Report On Business Law and EthicsDocument19 pagesA Report On Business Law and Ethicssharaf fahimPas encore d'évaluation

- Corporate Governance of Unilever and MicDocument22 pagesCorporate Governance of Unilever and MicAnushk ShuklaPas encore d'évaluation

- Bankruptcy and ReorganizationDocument13 pagesBankruptcy and ReorganizationAnkita ChauhanPas encore d'évaluation

- Corporate Insolvency Resolution Procedure Under Indian Insolvency and Bankruptcy Code, 2016: A Comparative PerspectiveDocument8 pagesCorporate Insolvency Resolution Procedure Under Indian Insolvency and Bankruptcy Code, 2016: A Comparative PerspectiveDeva SharmaPas encore d'évaluation

- SubmissionDocument8 pagesSubmissionAnonymous F9E2kpF5LePas encore d'évaluation

- Article - Prerna Tomar - CompressedDocument16 pagesArticle - Prerna Tomar - CompressedprernaPas encore d'évaluation

- Corporate Reorganization and Strategic Behaviour - An Economic AnaDocument38 pagesCorporate Reorganization and Strategic Behaviour - An Economic AnaAmanuel BirhanPas encore d'évaluation

- Insolvency and Bankruptcy Code 2016Document2 pagesInsolvency and Bankruptcy Code 2016Sweta AgrawalPas encore d'évaluation

- The Growth in Corporate Governance CodesDocument15 pagesThe Growth in Corporate Governance CodesSudip BaruaPas encore d'évaluation

- U-4 Insolvency and Bankruptcy Code 2016Document26 pagesU-4 Insolvency and Bankruptcy Code 2016HIMANI PALAKSHAPas encore d'évaluation

- Corporate LawDocument35 pagesCorporate Lawnicrome buringPas encore d'évaluation

- Reforming Capital Maintenance Law: The Companies (Amendment) Act 2005Document43 pagesReforming Capital Maintenance Law: The Companies (Amendment) Act 2005yohannis asfachewPas encore d'évaluation

- Acra Legal DigestDocument15 pagesAcra Legal DigestAudrey ArdanentyaPas encore d'évaluation

- Shasi, Urvashi and Kumar, Tushar - Changing Paradigm of Insolvency Jurisprudence Without CommentsDocument9 pagesShasi, Urvashi and Kumar, Tushar - Changing Paradigm of Insolvency Jurisprudence Without CommentsTushar KumarPas encore d'évaluation

- Law of Business Associations GPR 304 Director DutiesDocument15 pagesLaw of Business Associations GPR 304 Director Dutiesnkita MaryPas encore d'évaluation

- File146909 KDocument62 pagesFile146909 KMask ManPas encore d'évaluation

- Reverse PiercingDocument18 pagesReverse PiercingDhirenPas encore d'évaluation

- Understanding Insolvency: October 2008Document49 pagesUnderstanding Insolvency: October 2008Shakti SinghPas encore d'évaluation

- Financial Distress, Reorganization, and Organizational EfficiencyDocument26 pagesFinancial Distress, Reorganization, and Organizational EfficiencyFadil YmPas encore d'évaluation

- Caa 18Document14 pagesCaa 18Salman AsimPas encore d'évaluation

- Merger and Acquisition Project ReportDocument59 pagesMerger and Acquisition Project ReportSatish ChavanPas encore d'évaluation

- Tentative ChapterisationDocument13 pagesTentative ChapterisationNikhil kumarPas encore d'évaluation

- Global Restructuring Insolvency Guide 12 2016new Logo ItalyDocument28 pagesGlobal Restructuring Insolvency Guide 12 2016new Logo ItalyaltieroloPas encore d'évaluation

- 001 Grant Thornton Corporate Governance Review 2011Document60 pages001 Grant Thornton Corporate Governance Review 2011Ali LoughreyPas encore d'évaluation

- Dissertation Covid-19Document41 pagesDissertation Covid-19BAFE 20-05 Rimsha ZaffarPas encore d'évaluation

- Article 4Document31 pagesArticle 4Abdul OGPas encore d'évaluation

- UK Approach To Corporate Governance Oct 20101Document16 pagesUK Approach To Corporate Governance Oct 20101Alice PhamPas encore d'évaluation

- Dwnload Full Auditing Assurance A Business Risk Approach 3rd Edition Jubb Solutions Manual PDFDocument35 pagesDwnload Full Auditing Assurance A Business Risk Approach 3rd Edition Jubb Solutions Manual PDFbendvvduncan100% (16)

- Bankruptcy Is A Determination of Insolvency Made by A Court of Law With Resulting Legal Orders Intended To Resolve The InsolvencyDocument9 pagesBankruptcy Is A Determination of Insolvency Made by A Court of Law With Resulting Legal Orders Intended To Resolve The InsolvencyHarsha VardhanPas encore d'évaluation

- Corporate Governance1Document17 pagesCorporate Governance1Deshan1989Pas encore d'évaluation

- Are Laws Needed For Public ManagemenDocument25 pagesAre Laws Needed For Public ManagemenYard AssociatesPas encore d'évaluation

- Comparative Corporate InsolvencyDocument30 pagesComparative Corporate InsolvencyChuyi WeiPas encore d'évaluation

- The Cadbury Report 1992: Shared Vision and Beyond: Related PapersDocument43 pagesThe Cadbury Report 1992: Shared Vision and Beyond: Related Paperstinashe chavundukatPas encore d'évaluation

- Corporate Restructuring by Dr. Fancy TooDocument26 pagesCorporate Restructuring by Dr. Fancy TooDavid MunyuaPas encore d'évaluation

- Chap 012Document20 pagesChap 012Hemali MehtaPas encore d'évaluation

- Selective Strategy RestructuringDocument30 pagesSelective Strategy RestructuringMikha DetalimPas encore d'évaluation

- CH 13 - Current LiabilitiesDocument85 pagesCH 13 - Current LiabilitiesViviane Tavares60% (5)

- SOXDocument15 pagesSOXRafael BazaniPas encore d'évaluation

- 2011 Giovanni Fasano Corporate Governance h17Document151 pages2011 Giovanni Fasano Corporate Governance h17MoatasemMadianPas encore d'évaluation

- ComparativeDocument19 pagesComparativetemivaughnPas encore d'évaluation

- Research Paper 4Document16 pagesResearch Paper 4Akshayveer Singh SehrawatPas encore d'évaluation

- Comparitive Analysis of Insolvency and Bankruptcy Laws in India, US and Germany.Document7 pagesComparitive Analysis of Insolvency and Bankruptcy Laws in India, US and Germany.Prasanna KumarPas encore d'évaluation

- MSME IBC2 FootDocument26 pagesMSME IBC2 FootPriyadarshan NairPas encore d'évaluation

- Enterprise Act 2002 Guidance MergerDocument13 pagesEnterprise Act 2002 Guidance MergerdakappakvPas encore d'évaluation

- Corporate GovernanceDocument2 pagesCorporate GovernanceMehedi Hasan ShaikotPas encore d'évaluation

- Pre-Packaged Insolvency Framework - A Boon or Bane For IndiaDocument8 pagesPre-Packaged Insolvency Framework - A Boon or Bane For IndiaBhai Ki Vines (Shivansh Gupta)Pas encore d'évaluation

- AC301 Off Balance Sheet FinancingDocument25 pagesAC301 Off Balance Sheet Financinghui7411Pas encore d'évaluation

- Declassified UK Paper On Srebrenica - PREM-19-5487 - 1Document110 pagesDeclassified UK Paper On Srebrenica - PREM-19-5487 - 1vidovdan9852Pas encore d'évaluation

- Benign Congenital HypotoniaDocument4 pagesBenign Congenital Hypotoniavidovdan9852Pas encore d'évaluation

- Floppy Infant SyndromeDocument5 pagesFloppy Infant Syndromevidovdan9852Pas encore d'évaluation

- JFK50 ShortlinksDocument7 pagesJFK50 Shortlinksvidovdan9852Pas encore d'évaluation

- Russia vs. Ukraine Eurobond - Final Judgment - Judgement 29.03.2017Document107 pagesRussia vs. Ukraine Eurobond - Final Judgment - Judgement 29.03.2017vidovdan9852100% (1)

- 275 Export DeclarationDocument3 pages275 Export Declarationvidovdan9852Pas encore d'évaluation

- Declassified UK Files On Srebrenica - PREM-19-5487 - 2Document100 pagesDeclassified UK Files On Srebrenica - PREM-19-5487 - 2vidovdan9852Pas encore d'évaluation

- Article IV Montenego 2017Document92 pagesArticle IV Montenego 2017vidovdan9852Pas encore d'évaluation

- Global Dollar Credit and Carry Trades - A Firm-Level AnalysisDocument53 pagesGlobal Dollar Credit and Carry Trades - A Firm-Level Analysisvidovdan9852Pas encore d'évaluation

- Floppy Infant SyndromeDocument5 pagesFloppy Infant Syndromevidovdan9852Pas encore d'évaluation

- List of 616 English Irregular VerbsDocument21 pagesList of 616 English Irregular Verbsمحمد طه المقطري67% (3)

- A Unified Model of Early Word Learning - Integrating Statistical and Social CuesDocument8 pagesA Unified Model of Early Word Learning - Integrating Statistical and Social Cuesvidovdan9852Pas encore d'évaluation

- How Children Learn WordsDocument6 pagesHow Children Learn Wordsvidovdan9852Pas encore d'évaluation

- A Determination of The Risk of Ruin PDFDocument36 pagesA Determination of The Risk of Ruin PDFvidovdan9852Pas encore d'évaluation

- Example Mutual Non Disclosure AgreementDocument2 pagesExample Mutual Non Disclosure Agreementvidovdan9852Pas encore d'évaluation

- A Convenient Untruth - Fact and Fantasy in The Doctrine of Odious DebtsDocument45 pagesA Convenient Untruth - Fact and Fantasy in The Doctrine of Odious Debtsvidovdan9852Pas encore d'évaluation

- Chapter 11 at TwilightDocument30 pagesChapter 11 at Twilightvidovdan9852Pas encore d'évaluation

- Artigo Previsão de Falência Com Lógica Fuzzy Bancos TurcosDocument13 pagesArtigo Previsão de Falência Com Lógica Fuzzy Bancos TurcosAndrew Drummond-MurrayPas encore d'évaluation

- Balancing The Public Interest - Applying The Public Interest Test To Exemption in The UK Freedom of Information Act 2000Document62 pagesBalancing The Public Interest - Applying The Public Interest Test To Exemption in The UK Freedom of Information Act 2000vidovdan9852Pas encore d'évaluation

- Hanlon Illegitimate DebtDocument16 pagesHanlon Illegitimate DebtVinícius RitterPas encore d'évaluation

- From Privilege To Right - Limited LiabilityDocument22 pagesFrom Privilege To Right - Limited Liabilitymarcelo4lauarPas encore d'évaluation

- A Reply To Alan Schwartz's 'A Contract Theory Approach To Business Bankruptcy' PDFDocument26 pagesA Reply To Alan Schwartz's 'A Contract Theory Approach To Business Bankruptcy' PDFvidovdan9852Pas encore d'évaluation

- After The Housing Crisis - Second Liens and Contractual InefficienciesDocument21 pagesAfter The Housing Crisis - Second Liens and Contractual Inefficienciesvidovdan9852Pas encore d'évaluation

- Too Many To Fail - The Effect of Regulatory Forbearance On Market DisciplineDocument38 pagesToo Many To Fail - The Effect of Regulatory Forbearance On Market Disciplinevidovdan9852Pas encore d'évaluation

- A Convenient Untruth - Fact and Fantasy in The Doctrine of Odious DebtsDocument45 pagesA Convenient Untruth - Fact and Fantasy in The Doctrine of Odious Debtsvidovdan9852Pas encore d'évaluation

- Leases and InsolvencyDocument32 pagesLeases and Insolvencyvidovdan9852Pas encore d'évaluation

- Assessing The Probability of BankruptcyDocument47 pagesAssessing The Probability of Bankruptcyvidovdan9852Pas encore d'évaluation

- (ISDA, Altman) Analyzing and Explaining Default Recovery RatesDocument97 pages(ISDA, Altman) Analyzing and Explaining Default Recovery Rates00aaPas encore d'évaluation

- L03 ECO220 PrintDocument15 pagesL03 ECO220 PrintAli SioPas encore d'évaluation

- Air Asia CompleteDocument18 pagesAir Asia CompleteAmy CharmainePas encore d'évaluation

- Seminar Topic: Fill All ContentDocument7 pagesSeminar Topic: Fill All ContentRanjith GowdaPas encore d'évaluation

- Rise of Hitler Inquiry Sources-3CDocument15 pagesRise of Hitler Inquiry Sources-3CClaudia ChangPas encore d'évaluation

- Project Feasibility Report: BBA 5th SemesterDocument15 pagesProject Feasibility Report: BBA 5th SemesterChandan RaiPas encore d'évaluation

- Social Integration Approaches and Issues, UNRISD Publication (1994)Document16 pagesSocial Integration Approaches and Issues, UNRISD Publication (1994)United Nations Research Institute for Social DevelopmentPas encore d'évaluation

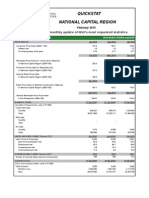

- Quickstat National Capital Region: A Monthly Update of NSO's Most Requested StatisticsDocument3 pagesQuickstat National Capital Region: A Monthly Update of NSO's Most Requested StatisticsDaniel John Cañares LegaspiPas encore d'évaluation

- VAT Registration CertificateDocument1 pageVAT Registration Certificatelucas.saleixo88Pas encore d'évaluation

- Pay Slip For The Month of April 2018Document1 pagePay Slip For The Month of April 2018srini reddyPas encore d'évaluation

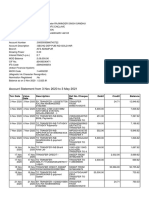

- Account Statement From 3 Nov 2020 To 3 May 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument8 pagesAccount Statement From 3 Nov 2020 To 3 May 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceRajwinder SandhuPas encore d'évaluation

- ESSAY01 - Advantages and Disadvantages of GlobalizationDocument5 pagesESSAY01 - Advantages and Disadvantages of GlobalizationJelo ArtozaPas encore d'évaluation

- Complete Data About Swiss Grid PDFDocument7 pagesComplete Data About Swiss Grid PDFManpreet SinghPas encore d'évaluation

- Strategic Plan DRAFTVolunteerDocument85 pagesStrategic Plan DRAFTVolunteerLourdes SusaetaPas encore d'évaluation

- Sabc Directory2014-2015Document48 pagesSabc Directory2014-2015api-307927988Pas encore d'évaluation

- Tugas Problem Set 5 Ekonomi ManajerialDocument3 pagesTugas Problem Set 5 Ekonomi ManajerialRuth AdrianaPas encore d'évaluation

- Amma Mobile InsuranceDocument1 pageAmma Mobile InsuranceANANTH JPas encore d'évaluation

- DTH IndustryDocument37 pagesDTH IndustrySudip Vyas100% (1)

- OD126193179886369000Document6 pagesOD126193179886369000Refill positivityPas encore d'évaluation

- Raki RakiDocument63 pagesRaki RakiRAJA SHEKHARPas encore d'évaluation

- Methods To Initiate Ventures: Leoncio, Ma. Aira Grabrielle R. Mamigo, Princess Nicole B. G12-AB126Document21 pagesMethods To Initiate Ventures: Leoncio, Ma. Aira Grabrielle R. Mamigo, Princess Nicole B. G12-AB126Precious MamigoPas encore d'évaluation

- AbstractDocument12 pagesAbstractanmolPas encore d'évaluation

- Daftar Industrial EstatesDocument2 pagesDaftar Industrial EstatesKepo DehPas encore d'évaluation

- Plan Contable EmpresarialDocument432 pagesPlan Contable EmpresarialJhamil Nirek PascasioPas encore d'évaluation

- Spot THE Error: Detai L Ed Expl Anati OnDocument131 pagesSpot THE Error: Detai L Ed Expl Anati OnopprakasPas encore d'évaluation

- Malabon AIP 2014+amendments PDFDocument81 pagesMalabon AIP 2014+amendments PDFCorics HerbuelaPas encore d'évaluation