Académique Documents

Professionnel Documents

Culture Documents

Indian Weeakly Currency Market Tips

Transféré par

rajnishtrifidCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Indian Weeakly Currency Market Tips

Transféré par

rajnishtrifidDroits d'auteur :

Formats disponibles

14 JULY 18 JULY 2014

W E E K L Y

R

E

P

O

R

T

Buy on fear, sell on greed.

Buy on the rumor, sell on the news.

The trend is your friend.

Amateurs want to be right.

Professionals want to make money.

WWW.TRIFIDRESEARCH.COM

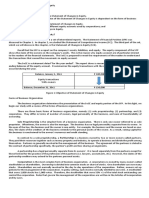

REFERENCE RATE

(USD)

60.1855

REPO RATE 8%

REVERSE REPO 7%

CRR 4%

INFLATION 6.01%

KEY RATES As on 11/07/2014

MARKET EVENTS

MARKET OUTLOOK

Markets eyed on Union Budget to be

presented last week but reeled

disappointment due lack of specifics

in it by Govt. as they left open

questions on how it will reduce the

fiscal deficit and restore investor

confidence and hence rupee

depreciated on the same day.

However, it gained on Friday on

dollar sales by a large corporate but

that was not enough to prevent the

weekly fall of rupee by 0.3%

snapping two weeks of gains.

Coming week is looking out for CPI

and WPI data to be released on

Monday which may be key factors

for its direction further.

Rupee posts 1st weekly fall in

3; gains on day on corp dollar

sales.

Euro dips in Asia on

Portuguese bank woes.

Yuan set to fall slightly this

week underperforms

midpoint.

Pound Rally Wanes Amid Signs

of Slowing U.K. Growth

CURRENCIES

PREVIOUS

RATE

CURRENT

RATE

% CHANGE

USDINR 60.0350 60.1850 0.24

EURINR 81.5550 81.8875 0.40

GBPINR 102.8225 103.0425 0.21

JPYINR 58.8400 59.4000 0.95

USDINR

EURINR

USDINR last week consolidated mainly in a tight range and finally closed on a flat note. It found

support around 59.9000 and strong rebounding was seen towards 60.4000. Consolidation is

continuing since last four weeks and it needs a closing above 60.6000 to gain strength and move

on higher side while 59.7000 may act as key support for the coming week.

EURINR last week consolidated near the lower band of upward channel pattern and closed on a

flat note with positive bias. If the positive biasness continues then it may move towards the upper

band i.e. in the resistance range of 82.6000-82.9000. While on lower side, breakout of channel

pattern may happen if it decisively surpasses the level of 81.4000.

CURRENCIES S1 S2 S3 R1 R2 R3

USDINR 59.7000

59.3000 59.0000 60.7000 61.0000 61.4000

EURINR 81.4000 80.9000 80.4000 82.3000 82.7000 83.2000

GBPINR 102.4000 102.0000 101.6000 103.6000 104.0000

104.4000

JPYINR 58.9000 58.6000 58.3000 59.8000

60.2000 60.6000

PIVOT TABLE

DATE TIME COUNTRY EVENT

BLOOMBERG

ESTIMATE

PREVIOUS

LEVEL

14-JULY-2014

5:30

PM

INDIA Indian CPI (YOY) 7.95% 8.28%

15-JULY-2014

06:00

PM

US

Core Retail Sales

m/m

0.5% 0.1%

15-JULY-2014

6:00

PM

US Retail Sales m/m 0.6% 0.3%

17-JULY-2014

6:00

PM

US

Unemployment

Claims

310k 304k

INTERNATIONAL UPDATES

Canadian Dollar Drops amid Unexpected Decline in Jobs.

Brazils Real Posts Weekly Decline on Renewed Portugal Stress.

Yen Rises Versus Most Majors on European Bank Stress.

WWW.TRIFIDRESEARCH.COM

DISCLAIMER

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1091)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Statement of Changes in EquityDocument9 pagesStatement of Changes in Equityheart lelim100% (1)

- Spieringhs, Wouter - Risk in Emerging MarketsDocument13 pagesSpieringhs, Wouter - Risk in Emerging MarketsEdwin HauwertPas encore d'évaluation

- MCX and Ncdex ReportDocument21 pagesMCX and Ncdex ReportGaurav SinglaPas encore d'évaluation

- TOFC 2012 Member InvitationDocument7 pagesTOFC 2012 Member InvitationLivonne PatrickPas encore d'évaluation

- Chapter 18 - Portfolio Performance EvaluationDocument53 pagesChapter 18 - Portfolio Performance EvaluationMarwa HassanPas encore d'évaluation

- Week 1 Lecture NotesDocument23 pagesWeek 1 Lecture NoteswinfldPas encore d'évaluation

- Sulzer Annual Results Presentation 2012Document29 pagesSulzer Annual Results Presentation 2012Diana PoltlPas encore d'évaluation

- How I Orginize My DeskDocument1 pageHow I Orginize My DeskbrdmonteiroPas encore d'évaluation

- Web: WWW - Smartinvestment.in: Phone: 079 - 2657 66 39 Fax: 079 - 2657 99 96Document57 pagesWeb: WWW - Smartinvestment.in: Phone: 079 - 2657 66 39 Fax: 079 - 2657 99 96Luke RobinsonPas encore d'évaluation

- Conso Subsequent To Date of Acqui (Advance Accounting)Document3 pagesConso Subsequent To Date of Acqui (Advance Accounting)Chloe Ann SeverinoPas encore d'évaluation

- BS ADFREE 11.07.2017 @TheHindu - Zone.Document15 pagesBS ADFREE 11.07.2017 @TheHindu - Zone.Roshan SinghPas encore d'évaluation

- AmldraftDocument249 pagesAmldraftadhavvikasPas encore d'évaluation

- V12-021 Flash Boys PollDocument10 pagesV12-021 Flash Boys PolltabbforumPas encore d'évaluation

- Licensees List Update January 2018 1 PDFDocument14 pagesLicensees List Update January 2018 1 PDFMónika FeketeováPas encore d'évaluation

- JPM Credit Derivatives HandbookDocument180 pagesJPM Credit Derivatives HandbookPierre Chamberland100% (1)

- Boards and Shareholders in European Listed Companies PDFDocument454 pagesBoards and Shareholders in European Listed Companies PDFМилена СпасовскаPas encore d'évaluation

- Comparitive Study of Mutual Funds in IndiaDocument78 pagesComparitive Study of Mutual Funds in Indiasheemankhan85% (33)

- Oracle Applications - Oracle R12 Credit Card Payments Setups and ProcessDocument34 pagesOracle Applications - Oracle R12 Credit Card Payments Setups and ProcessAsif Sayyed100% (1)

- TIS - Lazy Me-EnDocument72 pagesTIS - Lazy Me-EnMaximiliano A. SireraPas encore d'évaluation

- Financial ServicesDocument10 pagesFinancial ServicesDinesh Sugumaran100% (4)

- Msci India Value Index (Inr) : Cumulative Index Performance - Price Returns Annual PerformanceDocument3 pagesMsci India Value Index (Inr) : Cumulative Index Performance - Price Returns Annual Performancekishore13Pas encore d'évaluation

- EES - FX Trader Magazine - High Frequency Trading and Market StabilityDocument3 pagesEES - FX Trader Magazine - High Frequency Trading and Market StabilityElite E Services FXPas encore d'évaluation

- Fund Performance MetlifeDocument11 pagesFund Performance MetlifeDeepak DharmarajPas encore d'évaluation

- ?trading SessionsDocument6 pages?trading SessionsTebohoPas encore d'évaluation

- VAS - GIS 2024 Converted From ExcelDocument10 pagesVAS - GIS 2024 Converted From Excelmarkanthony031986Pas encore d'évaluation

- Saudi Arabia Investment Guide EngDocument98 pagesSaudi Arabia Investment Guide EngZafr O'Connell100% (1)

- Intershi Report On Uttora Bank Ltd.Document114 pagesIntershi Report On Uttora Bank Ltd.Sirajul Islam Srabon100% (1)

- Public Islamic Sector Select FundDocument4 pagesPublic Islamic Sector Select FundArmi Faizal AwangPas encore d'évaluation

- R36 Evaluating Portfolio PerformanceDocument65 pagesR36 Evaluating Portfolio PerformanceRayBrianCasazolaPas encore d'évaluation

- WWW - Simplil: 1 Module 1: Introduction To CFA® Level 1 2 Module 2: EthicsDocument4 pagesWWW - Simplil: 1 Module 1: Introduction To CFA® Level 1 2 Module 2: Ethicskhani.naser8834Pas encore d'évaluation