Académique Documents

Professionnel Documents

Culture Documents

Form No. 24Q: (See Section 192 and Rule 31A)

Transféré par

Sajith Malappurath SasidharanTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Form No. 24Q: (See Section 192 and Rule 31A)

Transféré par

Sajith Malappurath SasidharanDroits d'auteur :

Formats disponibles

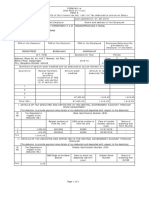

Form No.

24Q

(See section 192 and rule 31A)

Quarterly statement of deduction of tax under sub section ( 3 ) of section 200 of the Income tax Act, 1961 in respect of Salary

for the quarter ended June / September / December / March (tick which ever appicable) .. (year)

1 ( a ) Tax Deduction Account No ( d ) Assessment year

( b ) Permanent Account No. ( e ) Has any statement been filed

earlier for this quarter (Yes / no)

( c ) Financial year ( f ) If answer to (e) is Yes, then

Provisional Receipt no. of original statement

2 Particulars of the deductor (employer)

(a) Name

(b) Type of deductor

1

(c) Branch / division (if any)

(d) Address

Flat No.

Name of the premises / building

Road / street / lane

Area / location

Town / City / District

State

Pin code

Telephone No.

E-mail

3 Particulars of the person responsible for deduction of tax

(a) Name

(b) Address

Flat No.

Name of the premises / building

Road / street / lane

Area / location

Town / City / District

State

Pin code

Telephone No.

E-mail

4 Details of tax deducted and paid to the credit of Central Government :

Sr. No. TDS Surcharge Education Interest Others Total tax Cheque/ BSR code Date on Transfer Whether

Rs. Rs. Cess Rs. Rs. deposited DD No. which tax voucher / TDS

Rs. Rs. (if any) Deposited Challan deposited

(302+303 serial No.

2

by book

+304+305 entry ?

+306) Yes/No

3

(301) (302) (303) (304) (305) (306) (307) (308) (309) (310) (311) (312)

1

2

3

4

5

5 Details of salary paid and tax deducted thereon from the employees

(Enclose annexures I,II and III)

VERIFICATION

I, , hereby certify that all the particulars furnished above are correct and complete.

Place : Signature of person responsible for deducting tax at source

Date : Name and designation of person responsible for deducting tax at source

Note :- (1) Indicate the type of deductor Government/Others

(2) Government deductors to give particulars of transfer vouchers; other deductors to give particulars of challan no. regarding deposit into bank.

(3) Column is relevant only for Government deductors.

(4) Salary includes wages, annuity, pension, gratuity, fees, commission, bonus, repayment of amount deposited under the Additional Emoluments (Compulsory

Deposit) Act, 1974, or profits in lieu of or in addition to salary or wages, including payments made at or in connection with termination of employment advance of

salary or any other sums chargeable to income-tax under the head Salaries.

(5) Where an employer deducts from the emoluments paid to an employee or pays on his behalf any contributions of that employee to any approved superannuation

fund, all such deductions or payments should be included in the statements.

(6) Please record on every page the totals of each of the columns.

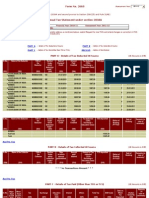

Annexure I - Deductee wise break-up of TDS

(Please use separate Annexure for each line - item in the table at S.No. 04 of main Form 24Q)

Details of salary paid and tax deducted thereon from the employees

BSR code of the branch where tax is deposited Name of Employer

Date on which tax deposited (dd-mm-yyyy)

Challan Serial No.

Section under which payment made TAN

Total TDS to be allocated among deductees as

in the vertical total of col. 323

Interest

Others

Total of the above

Sr. No. Employee PAN of the Name of Date of Taxable TDS Surcharge Educational Total Tax Total Tax Date of Date of Reason for

reference employee the payment / amount on Rs. Rs. Cess Deducted deposited deduction Deposit non-deduction

no. employee credit which tax Rs. (319+320+ Rs. / lower

provided deducted 321) deduction*

by Rs. Rs.

employer

(313) (314) (315) (316) (317) (318) (319) (320) (321) (322) (323) (324) (325) (326)

1

2

3

4

5

Total

VERIFICATION

I, , hereby certify that all the particulars furnished above are correct and complete.

Place : Signature of person responsible for deducting tax at source

Date : Name and designation of person responsible for deducting tax at source

Note : * Write A if lower deduction or Write B if no deduction is on account of a certificate under section 197.

Vous aimerez peut-être aussi

- Pan Card FormDocument6 pagesPan Card FormAniruddha SamantaPas encore d'évaluation

- 26q DetailsDocument3 pages26q DetailsAmit TiwariPas encore d'évaluation

- Itr 62 Form 16Document4 pagesItr 62 Form 16Hardik ShahPas encore d'évaluation

- Printed From WWW - Incometaxindia.gov - in Page 1 of 4Document4 pagesPrinted From WWW - Incometaxindia.gov - in Page 1 of 4Thil ThilPas encore d'évaluation

- Form2FandInstructions 06062006Document11 pagesForm2FandInstructions 06062006Mnaoj PatelPas encore d'évaluation

- GC 13-03Document2 pagesGC 13-03nlrbdocsPas encore d'évaluation

- Anspg5953f 2018-19Document3 pagesAnspg5953f 2018-19virajv1Pas encore d'évaluation

- Cit (TDS) : Emp CodeDocument3 pagesCit (TDS) : Emp CodeMahaveer DhelariyaPas encore d'évaluation

- Form 16, Tax Deduction at Source... Income Tax of IndiaDocument2 pagesForm 16, Tax Deduction at Source... Income Tax of IndiaDrAnilkesar GohilPas encore d'évaluation

- Form No. 16: Finotax 1 of 3Document3 pagesForm No. 16: Finotax 1 of 3dugdugdugdugiPas encore d'évaluation

- As Approved by Income Tax DepartmentDocument5 pagesAs Approved by Income Tax DepartmentRicha JoshiPas encore d'évaluation

- Form16fy10 11Document3 pagesForm16fy10 11atishroyPas encore d'évaluation

- Form 16 FormatDocument2 pagesForm 16 FormatParthVanjaraPas encore d'évaluation

- New Form No 15GDocument4 pagesNew Form No 15GDevang PatelPas encore d'évaluation

- New Form 16 AY 11 12Document4 pagesNew Form 16 AY 11 12Sushma Kaza DuggarajuPas encore d'évaluation

- Gopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Document2 pagesGopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Gopal TrivediPas encore d'évaluation

- Law Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16Document3 pagesLaw Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16api-247505461Pas encore d'évaluation

- New Tds CertificateDocument1 pageNew Tds Certificatechowdhary_akshayPas encore d'évaluation

- Ahrpv0731f 2013-14Document2 pagesAhrpv0731f 2013-14Shiva KumarPas encore d'évaluation

- Form 16 For The AY 2017-18Document4 pagesForm 16 For The AY 2017-18Suman HalderPas encore d'évaluation

- ITR-2 Indian Income Tax Return: Part A-GENDocument10 pagesITR-2 Indian Income Tax Return: Part A-GENNeeraj AgarwalPas encore d'évaluation

- ITR-3 Indian Income Tax Return: Part A-GENDocument8 pagesITR-3 Indian Income Tax Return: Part A-GENRahul SharmaPas encore d'évaluation

- (See Sections 192A, 193, 194, 194A, 194B, 194BB, 194C, 194D, 194DA, 194EE, 194F, 194G, 194H, 194-I, 194J, 194K, 194LA, 194LBA, 194LBB, 194LBC, 194NDocument6 pages(See Sections 192A, 193, 194, 194A, 194B, 194BB, 194C, 194D, 194DA, 194EE, 194F, 194G, 194H, 194-I, 194J, 194K, 194LA, 194LBA, 194LBB, 194LBC, 194NRavi PrakashPas encore d'évaluation

- (See Rule 31 (1) (A) ) : Form No. 16Document4 pages(See Rule 31 (1) (A) ) : Form No. 16Ejaj HassanPas encore d'évaluation

- Sachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Document3 pagesSachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Sachin KumarPas encore d'évaluation

- Form No. 26AS: (See Section 203AA and Second Proviso To Section 206C (5) and Rule 31AB)Document4 pagesForm No. 26AS: (See Section 203AA and Second Proviso To Section 206C (5) and Rule 31AB)jay_yashwantePas encore d'évaluation

- I.t.challan BlankDocument4 pagesI.t.challan Blankmaliktariq78100% (1)

- Form 24Q4Document6 pagesForm 24Q4Anonymous Nmwl1wwFuPas encore d'évaluation

- FORM-15G: (Please Tick The Relevant Box)Document4 pagesFORM-15G: (Please Tick The Relevant Box)Kayam BalajiPas encore d'évaluation

- Form 16 Word FormatDocument4 pagesForm 16 Word FormatVenkee SaiPas encore d'évaluation

- Accounts Officer Details: Form No. 24G TDS/TCS Book Adjustment StatementDocument5 pagesAccounts Officer Details: Form No. 24G TDS/TCS Book Adjustment StatementManikdnathPas encore d'évaluation

- Form 16Document3 pagesForm 16Bijay TiwariPas encore d'évaluation

- PDF Editor: Form No. 15GDocument2 pagesPDF Editor: Form No. 15GImissYouPas encore d'évaluation

- IT Return 2011 2012Document3 pagesIT Return 2011 2012swapnil6121986Pas encore d'évaluation

- TDS Payment ChallanDocument3 pagesTDS Payment ChallanmejarirajeshPas encore d'évaluation

- Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument2 pagesForm No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceAkshay DhawanPas encore d'évaluation

- (See Rule 31 (1) (A) ) : Form No. 16Document8 pages(See Rule 31 (1) (A) ) : Form No. 16Amol LokhandePas encore d'évaluation

- Itr-2 Indian Income Tax Return: (For Individuals and Hufs Not Having Income From Business or Profession) Assessment YearDocument7 pagesItr-2 Indian Income Tax Return: (For Individuals and Hufs Not Having Income From Business or Profession) Assessment YearVarun ChhabraPas encore d'évaluation

- ITR-3 Indian Income Tax Return: Part A-GENDocument7 pagesITR-3 Indian Income Tax Return: Part A-GENmohitsharma1996Pas encore d'évaluation

- Kaushik Sarkar Form 16 DynProDocument5 pagesKaushik Sarkar Form 16 DynProKaushik SarkarPas encore d'évaluation

- New Income Tax Return BIR Form 1700 - November 2011 RevisedDocument4 pagesNew Income Tax Return BIR Form 1700 - November 2011 RevisedBusinessTips.Ph100% (2)

- Form No. 27A (See Rule 37B) Form For Furnishing Information With The Return or Statement of Deduction of Tax at Source Filed On Computer MediaDocument2 pagesForm No. 27A (See Rule 37B) Form For Furnishing Information With The Return or Statement of Deduction of Tax at Source Filed On Computer Mediabestperson86Pas encore d'évaluation

- For Withholding Taxes Only: Name of LTU/ MTU/ RTO Salary Month Nature of Tax Payment Tax YearDocument1 pageFor Withholding Taxes Only: Name of LTU/ MTU/ RTO Salary Month Nature of Tax Payment Tax YearJazzy BadshahPas encore d'évaluation

- Form 26 QADocument2 pagesForm 26 QAhimanshukathuria30Pas encore d'évaluation

- Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument2 pagesForm No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceAnonymous glyBR9Pas encore d'évaluation

- IT FormDocument8 pagesIT Formapi-3829020Pas encore d'évaluation

- IT-11GHA: Return of Income Under The Income Tax ORDINANCE, 1984 (XXXVI OF 1984)Document7 pagesIT-11GHA: Return of Income Under The Income Tax ORDINANCE, 1984 (XXXVI OF 1984)Amanat AhmedPas encore d'évaluation

- Govtdeductors 220805Document2 pagesGovtdeductors 220805taxscribdPas encore d'évaluation

- Itr 2Document9 pagesItr 2Arvind PaulPas encore d'évaluation

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Kamlesh PatelPas encore d'évaluation

- Form ITR-1Document3 pagesForm ITR-1Rajeev PuthuparambilPas encore d'évaluation

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesD'EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesPas encore d'évaluation

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionD'EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionPas encore d'évaluation

- CD - 10. Fortune Insurance vs. Court of Appeals and Producers BankDocument1 pageCD - 10. Fortune Insurance vs. Court of Appeals and Producers BankAlyssa Alee Angeles JacintoPas encore d'évaluation

- Case StudyDocument6 pagesCase StudyMark Magracia67% (12)

- Open and Closed System AnalysisDocument5 pagesOpen and Closed System AnalysisAkhwat MujahidahPas encore d'évaluation

- Disney Case StudyDocument12 pagesDisney Case StudyTrina SantillanPas encore d'évaluation

- Employees Compensation Act 1923Document14 pagesEmployees Compensation Act 1923Divyang Patil100% (1)

- S 5 Bba (HRM)Document2 pagesS 5 Bba (HRM)Anjali GopinathPas encore d'évaluation

- 18.induction and Orientation ProgramDocument5 pages18.induction and Orientation Programkomalnkish0% (1)

- HCL Retention StrategyDocument3 pagesHCL Retention Strategyshobhana sharma0% (2)

- Message To Public Servants From Public Services MinisterDocument2 pagesMessage To Public Servants From Public Services MinisterCTV NewsPas encore d'évaluation

- Cna Presentation by Dir AlegriaDocument18 pagesCna Presentation by Dir AlegriaAnonymous ykxB88cJPas encore d'évaluation

- Pantoja vs. SCA Hygiene Products Digested CaseDocument1 pagePantoja vs. SCA Hygiene Products Digested CaseLorelie Dema-alaPas encore d'évaluation

- 2.3 Managing EthicsDocument4 pages2.3 Managing EthicsPunithaPas encore d'évaluation

- HR Project TopicsDocument2 pagesHR Project Topicsnetcity_ootyPas encore d'évaluation

- 11 Umali Vs Bacani GR L-40570Document2 pages11 Umali Vs Bacani GR L-40570FZ MacapugasPas encore d'évaluation

- Police Verification Form For TenantsDocument2 pagesPolice Verification Form For TenantsHimanshuPas encore d'évaluation

- Psychological Contract Rousseau PDFDocument9 pagesPsychological Contract Rousseau PDFSandy KhanPas encore d'évaluation

- Someone Is Stealing Your LifeDocument5 pagesSomeone Is Stealing Your LifeEducate YourselfPas encore d'évaluation

- Abstract of The Contract Labour ActDocument1 pageAbstract of The Contract Labour ActJitendra DasPas encore d'évaluation

- PAgibigDocument2 pagesPAgibigMark DacascusPas encore d'évaluation

- Case Study BMWDocument2 pagesCase Study BMWHarsh BhatiaPas encore d'évaluation

- G.R. No. 167334 Case DigestDocument2 pagesG.R. No. 167334 Case DigestDaniel Galzote100% (1)

- Ethics in The WorkplaceDocument14 pagesEthics in The Workplacenestor dones100% (1)

- TelysiaDocument2 pagesTelysiaLouis SmithPas encore d'évaluation

- Cusap Vs Adidas Digest (Almirante)Document1 pageCusap Vs Adidas Digest (Almirante)HenteLAWcoPas encore d'évaluation

- Annual Reports HEC RanchiDocument2 pagesAnnual Reports HEC RanchiRupali GoyalPas encore d'évaluation

- Metro Motorbikes Corporation: General Performance Evaluation FormDocument2 pagesMetro Motorbikes Corporation: General Performance Evaluation FormGerry SonPas encore d'évaluation

- Govph: Search ..Document16 pagesGovph: Search ..Princess AudreyPas encore d'évaluation

- CV Syed Saad AlamDocument3 pagesCV Syed Saad AlamFaisal MajeedPas encore d'évaluation

- Hours of Work - LaborDocument35 pagesHours of Work - LaborJonalyn Maraña-Manuel100% (3)

- Terms of Employment: Delta International Petroleum Services (Dips)Document4 pagesTerms of Employment: Delta International Petroleum Services (Dips)MIRZA MUKHTAR BaigPas encore d'évaluation