Académique Documents

Professionnel Documents

Culture Documents

Financial Condition Report (FCR) For General Insurance Companies

Transféré par

raheja_ashish0 évaluation0% ont trouvé ce document utile (0 vote)

69 vues28 pagesfccc

Titre original

FCR-Cir_Revised_v7-09.06.2014

Copyright

© © All Rights Reserved

Formats disponibles

DOC, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentfccc

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOC, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

69 vues28 pagesFinancial Condition Report (FCR) For General Insurance Companies

Transféré par

raheja_ashishfccc

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOC, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 28

Financial Condition Report (FCR) for

General insurance companies

Page 1 of 28

Financial Condition Report

For the financial year ended: 31

st

March 20..___________

Of

(Name of the Non-Life Insrance !om"any#

$y

(Name of the %""ointed %ctary#

&ection 'o"ic (a)e no

1. *etails of the Insrer + %""ointed %ctary ,

2. -.ecti/e smmary 0

3. $siness (ro1ections 2

3. %nalysis of 4siness )ro5th 6

,. %nalysis of e."erience 7

0. %de8acy of "remim 11

2. %de8acy of reser/es 12

6. 9einsrance 13

7. 9is: mana)ement 13

10. %de8acy of ca"ital 12

11. In/estment and %sset lia4ility mana)ement 16

12. Miscellaneos 17

13. !rrent Financial !ondition 20

13. Ftre Financial !ondition 21

1,. %d/ise on %ctarial Matters 22

10. !omments of the $oard of the insrer 23

%""ointed %ctary;s certificate 23

<lossary 2,

FCR Preparation

Page 2 of 28

I. The Objectives :

The objective of Financial Condition Report is to investigate the entire general insurance

business carried on by the insurer as on the date of valuation and to report the

strengths and weaknesses in terms of the risk the insurers carry with respect to meeting

solvency requirements, profitability, morbidity, liquidity, credit, expense, investment

return, assetliability mismatch, insurer!s future position, other risksspecific to the

business etc"

This report shall specifically address#

a" The sensitivity of the future solvency position to potential changes in the

economic environment, claims experience, pricing strategy and all other relevant

factors, if any

b" $uilding of early warning signals to assess the financial condition

c" Comprehensive view on the company

II. Instructions

%" The %% shall ensure the following#

a. 'he Financial !ondition 9e"ort alon) 5ith the $oard comments= dly

si)ned 4y the !-O and the %""ointed %ctary= shall 4e s4mitted to the

%thority 4y the end of %)st of e/ery financial year. %lso the soft co"y

of the said re"ort shall 4e sent to actarial>irda.)o/.in

4. 'he soft co"y shall inclde the %nne.re in e.cel formats.

c. 'he format and ta4les sti"lated in this docment shall 4e adhered to

5ithot any alternation" 'he fields 5hich are not rele/ant shall not 4e left

4lan:= 4t shall state ?not a""lica4le@ or ?N%@.

d. 'he nm4ers "ro/ided in the F!9 shall 4e:

i" 9econciled 5ith the financial statements of accounts and

I$N9, wherever applicable"

ii. (ro/ide in nit of thosands

iii" %ll outgo entries in the %nnexure shall be shown in brackets &'

e. 'he chronolo)ical order in the LO$ ta4le shall 4e strictly follo5ed.

Page 3 of 28

f. &e"arate 'a4les shall 4e frnished for each !lassificationA !om4ination of

!lassifications (5here/er the classification is more than one#.

). The soft copy of the %nnual Report &Tables()chedules in excel format' shall also

be furnished to the %uthority at actarial>irda.)o/.in

$" The %ppointed %ctuary &%%' shall provide detailed analysis along with the actions

proposed, if any, on each section of the FCR"

C" The %% shall also discuss the areas of concern under each section with specific

emphasis on business operations inside(outside *ndia &wherever applicable' and its

impact on the insurer as a whole"

Page 4 of 28

!ection " #etails of Insurer $ %ppointed %ctuar&

Sl.No. Item Current Year Last Year

1.

Name of the Insurer

2. Address with Phone/fax numbers ;

website address email

!. "e#istration number issued b$ the

I"%A

&.

%ate of re#istration

'. %ate of (ommen(ement of

o)erations

*.

Paid u) Ca)ital

+.

Net ,orth

-.

Name of C./

0.

A))ointed A(tuar$ %etails

a.

Name

b.

Qualification

(.

Date of Birth

d.

Appointment with the insurer

e.

Appointment as AA

f.

Date of issue of latest COP from IAI

#.

Date of expiry of COP

&i)natre of %% &i)natre of (rinci"al Officer

(Name# (Name#

Page 5 of 28

!ection ' : ()ecutive summar&

+", For each -.$, the %% shall provide the required data in Tables +",, +"+ &a' / &b' /

+"0 of %nnexure and discuss pointwise the following#

+",", The key issues in relation to the factors that influence the performance of

the company"

+","+ .verview of the financial condition of the company without omission of any

material facts"

+","0 *n detail the insights and recommendations provided to the insurer on the

overall risk profile, the financial condition and the business profile of the

company"

+","1 The strengths and weaknesses of the company and also highlight the

areas of concern"

+","2 The reasons for any significant variation in the current key ratios with

respect to previous year!s ratios as well as current year expected values

having regard to#

+",",", -ine of business and inherent year to year variations in nature of

business

+",","+ Tail length of claims in each line of business

+",","0 )easonal variations and any C%T events common to the *ndustry

+",","1 Company si3e and number of years since establishment

+","4 The remedial steps planned in case of adverse experience in key ratios

compared to expected and last two years ratios"

+"+ The %% shall provide a detailed analysis of quantitative information, with regard to

volume of business, underwriting, insurance profit, key ratios and business

composition, provided in table +",, +"+ &a' / &b' / +"0 of %nnexure"

Page 6 of 28

!ection * : +usiness Projections

0", The %% shall discuss the business philosophy separately for direct business and

inward reinsurance business with respect to the expected business lines and

the direction that the insurer intends to move in future with specific reference to

the core functions of the company"

0"+ *n addition to the above qualitative analysis, the %% shall provide quantitative

information in ta4le 3.1 )i/en in %nne.re, capturing line of business wise the

actual to expected analysis of various key elements of the company"

0"0 %% shall discuss in detail the reasons for any significant variations between the

actual and expected results furnished in table 0", of %nnexure"

Page 7 of 28

!ection , : %nal&sis of business -ro.th

,." For each -.$, the %% shall provide the required data in Tables 1", &a' / &b' of

%nnexure and comment explicitly on the following#

1",", The business strategy adopted by the company

1","+ The new business written and renewal business &Customer Retention' of

the company

1","0 5arious key parameters that influence the business growth of the

company including those given in table 1",&b'"

,.' For the "r"ose of this re"ort, renewal business is defined as follows#

1"+", The policies with term one year shall be treated as renewed in the

second and subsequent years, if the policy is continued in the

subsequent years without any gap i"e" customer is retained for the

subsequent years

1"+"+ &in)le "remim policies with term more than one year shall be treated

as renewed from second year onwards till the end of the policy term

provided the policy is continued with the insurer"

1"+"0 The policies with term more than one year with an option to pay the

single premium in installments shall be shown as renewal business in

second and subsequent years if the installment due is received as per

the terms and conditions of the contract"

1"+"1 Regular premium policies with term more than one year shall be treated

as renewed in subsequent years if the renewal premium is received as

per the terms and conditions of the contract"

Page 8 of 28

!ection / %nal&sis of ()perience

/." Persistenc& %nal&sis :

5.1.1 For each -.$, the %% shall provide the required data in Table 2", of

%nnexure and discuss the renewal business( renewal rate of the company,

implementation of previous year!s initiatives and provide future initiatives

planned in this regard" For the "r"ose of this re"ort= rene5al

4siness is as defined in )ection 1 &1"+' of this circular"

/.' Free loo0 %nal&sis

2"+", %% shall furnish the quantitative information on free look cancellations in

table 2"+ of %nnexure and comment on the same"

/.* ()pense %nal&sis

2"0", For each -.$, the %% shall provide the required data in Tables 2"0 &a' and

2"0 &b' of %nnexure and discuss pointwise the following #

2"0",", The methodology adopted for expense analysis in the entire

financial planning of the *nsurance $usiness"

2"0","+ The impact of Renewals on the total expenses

2"0","0 The method of allocation of expenses to different lines of

business"

2"0"+ The %% shall discuss the reasons for any significant variation in the actual

from expected expense ratio furnished in table 2"0 &b' along with the

proposed course of action, if any"

/., Claims %nal&sis

2"1", For each -.$, the %% shall provide the required data in Tables 2"1 &a', &b',

&c' / &d' of %nnexure and discuss pointwise the following#

2"1",", The impact of change in frequency / severity of reported and

settled claims on the financial condition of the insurer

2"1","+ The impact of -arge Claims on the financial condition of the

insurer along with the specific definition used for the -arge

Claims"

Page 9 of 28

2"1","0 The methodology followed to provide reserves as and when the

claim is intimated and subsequent updation of reserves till the

claim settlement

2"1","1 The impact of catastrophe claims on the financial condition of the

insurer

2"1","2 The impact of recoveries from(to reinsurers on the financial

condition of the insurer

2"1","4 The impact of salvage and subrogation on gross claims

2"1","6 The impact of closed and reopened claims on the financial

condition of the insurer

2"1","7 The impact of any new or latent claims, that has emerged in the

current financial year, on the financial condition of the insurer

2"1","8 The impact of any court awards setting precedence in claims

settlements on the financial condition of the insurer

2"1",",9 The impact of any other relevant factors that have affected the

financial condition of the insurer

2"1",",, The changes &if any' in the claim processing procedure and its

impact on the financial condition of the insurer"

2"1",",+ The changes &if any' in the underwriting processes or guidelines

and its impact on the financial condition of the insurer"

2"1"+ %% shall explicitly comment on the quantitative information furnished in

table 2"1 &a', &b', &c' / &d' of %nnexure

Page 10 of 28

!ection 1 %de2uac& of premium

6.1 For each -.$, the %% shall provide the required data in Tables 4",, 4"+ / 4"0 of

%nnexure and discuss pointwise the following#

4",", The pricing strategy( methodology adopted

4","+ The effect of large claims and catastrophe claims on the pricing strategy

4","0 The profit testing procedure adopted"

4","1 The effect of inflation on pricing

4","2 The effect of various major risks on pricing

4","4 The effect of reinsurance arrangements on pricing

4","6 The effect of court awards on pricing

4","7 :ow the ;ricing is addressed considering the premium deficiencies &if

any' and the respective ;<R!s as given in table 4","

4","8 :ow the financial condition of the company is impacted due to high

discounts offered on the base premiums &as per F/= approval'"

4",",9 The reasons for producing underwriting loss &if any'"

4",",, The impact of underwriting loss &if any' on the financial condition of the

company"

4",",+ The steps initiated to minimi3e the underwriting loss &if any'

4",",0 The impact of underwriting loss &if any' on pricing

4",",1 The steps initiated to minimi3e the loss ratios furnished in table 4"0"

4",",2 The impact of loss ratios &if any' on pricing

4",",4 The effect of any other relevant factors on pricing

4",",6 <etails of any rating analysis performed" *f no such study has been

done, the reason thereof shall be mentioned and a plan for the next

round of study shall be mentioned

Page 11 of 28

6.2 %% shall provide a detailed analysis on the quantitative information furnished in

table 4",, 4"+ / 4"0 of %nnexure

!ection 3 %de2uac& of Reserves

7.1 For each -.$, the %% shall provide the required data in Tables 6",, 6"+ / 6"0

of %nnexure and discuss pointwise the following#

6",", The detailed methodology followed in estimation of reserves specifying

whether pointestimates or stochastic or any other models are used in

estimation of reserves in respect of the following#

6",",", <irect insurance business for short tailed and long tailed

6",","+ Reinsurance(coinsurance accepted business separately

6",","0 Catastrophes and large claims

6","+ *n case of stochastic reserving, the percentile at which the final

reserve is estimated shall be provided along with the rationale

6","0 The data and system constraints in respect of direct insurance

business, reinsurance(coinsurance accepted(ceded business

separately"

6","1 The methodology adopted to review the adequacy of premium rates

and the setting up of suitable reserves, if inadequate"

6","2 %ny other relevant factors that have a significant impact on the

estimation of reserves"

6","4 The methodology followed in monitoring the actual loss development

with expected loss development and the proposed action &if any'

7.2 The %% shall provide a detailed analysis of quantitative information furnished in

table 6",, 6"+ / 6"0 of %nnexure

Page 12 of 28

!ection 4 Reinsurance

7", For each -.$, the %% shall provide the required data in Tables 7",, 7"+, 7"0 / 7"1

of %nnexure and discuss pointwise the following#

7",", The Company!s Reinsurance, Coinsurance and *nward(.utward

Reinsurance ;hilosophy

7","+ The facultative reinsurance arrangements for .utward and *nward of the

company"

7","0 The multilateral reinsurance arrangements &such as declined pool' of the

company"

7","1 The process of reinsurance renewals

7","2 The reinsurance disputes, if any"

7","4 The methodology followed in arriving at maximum retention of the

company"

7","6 %vailability of relevant reinsurance capacities

7"+ The %% shall provide a detailed analysis of quantitative information furnished in

table 7",, 7"+, 7"0 / 7"1 of %nnexure

Page 13 of 28

!ection 5 : Ris0 6ana-ement

The %% shall detail for each -.$ the assessment and management of Risk in terms of

identification, estimation and management of significant risks specific to the insurer"

7.1!om"any o/er/ie5

The %% shall discuss the following pointwise#

8",", The material lines of business written

8","+ >ey risks

8","0 Risk mitigation in place

8","1 Risk concentration# Region wise, product wise, line of business wise,

business allocation wise etc",& distribution channel wise '

8","2 >ey trends or factors that have or may have a significant impact on the

financial condition of the company"

8","4 The impact arising out of discounts, pricing competition, under reserving,

catastrophes, business volumes"

7.29is: mana)ement system #

The %% shall discuss the following pointwise#

8"+", Risk strategy

8"+"+ Risk management roles and responsibilities

8"+"0 Risk monitoring procedures adopted

8"+"1 %pproaches(tools used to identify and assess risks, including details of key

risk indicators and metrics used

8"+"2 %pproach adopted to identify emerging risks

8"+"4 The existing internal controls

Page 14 of 28

8"+"6 The review process and feedback loop

8"+"7 %ny risks that are not considered within the company!s risk management

system, along with the reasons as to why they are not included"

8"+"8 The appropriateness of the risk management system, given the nature,

scale and complexity of the business"

7.3 9is: e."osre

The %% shall discuss the following pointwise#

8"0", ?ature and extent of the risk exposure, and how this has developed

8"0"+ ;roducts and investments that give rise to risk, including for investment

risk, details of the investment strategy

8"0"0 @ualitative and quantitative measures used to assess the risk

8"0"1 The level of risk the company is prepared to take, or the company!s

tolerance for the risk

8"0"2 Controls in place to manage the level of risk

8"0"4 Ahether the current level of risk is at an acceptable level

8"0"6 :ow experience compares with pricing assumptions

Page 15 of 28

7.3 Miti)ation #

The %% shall discuss the following pointwise#

8"1", %ppropriateness of reinsurance and other risk mitigation tools in place to

reduce risk exposures"

8"1"+ <etails of any risk mitigation tools currently in place and the processes

for monitoring their effectiveness"

8"1"0 Risk mitigation methodologies used"

7., &ensiti/ity #

8",", For each -.$, the %% shall provide the required data in Tables 8", of

%nnexure and discuss pointwise the following#

8"2",", The sensitivity of the business to the key risk exposures

8"2","+ The methods and assumptions used to assess the sensitivities"

8"2","0 The sensitivity of the risks that have a significant impact on the

solvency of the company

8","+ The %% shall define explicitly the base / the pessimistic scenarios

assumed in arriving at the projections given in table 8", of %nnexure"

Page 16 of 28

!ection "7: Capital %de2uac&

,9", For each -.$, the %% shall provide the required data in Tables ,9", / ,9"+ of

%nnexure and discuss pointwise the following#

,9",", The current and future capital adequacy of the company

,9","+ The company!s perspective on capital management

,9","0 The scenario testing being done

,9","1 The impact of business plans on the capital requirement of the

company"

,9"+ The %% shall provide detailed analysis of quantitative information, with regard

to business level solvency margins and business plans for the current year,

furnished in table ,9", / ,9"+ of %nnexure"

Page 17 of 28

!ection "": Investments and %sset 8iabilit& 6ana-ement

,,", For each -.$, the %% shall provide the required data in Tables ,,", of

%nnexure and discuss pointwise the following with respect to the insurer!s

liability profile and liquidity needs#

,,",", The insurer!s investment strategy

,,","+ The methodology of asset liability management of the company

,,","0 The areas of concern in asset liability management

,,","1 The investment philosophy of the company including the mix and

quality of investment assets

,,","2 The changes &if any' in the asset allocation, investment strategy etc

based on the %-B analysis

,,","4 Ahether assets and liabilities are matched and if not, reasons and

implications on financial condition of the company"

,,","6 The impact of various significant risks on the investments of the

company

,,","7 The impact of various risks on asset liability management of the

company

,,"+ The %% shall provide detailed analysis of quantitative information, with regard

to assets and liabilities of the company, furnished in table ,,", of %nnexure

Page 18 of 28

!ection "': 6iscellaneous

,+", %% shall furnish the number of complaints received by the company under

various heads in table ,+", &a', &b' / &c' of %nnexure and shall

,+",", ;rovide a detailed analysis of various complaints along with the

intensity of complaints and the time taken by the company to settle

them"

,+","+ <iscuss the impact of these complaints on the financial condition

of the company

,+","0 <iscuss the steps initiated by the company to reduce the

complaints

,+","1 <iscuss the steps initiated to reduce the time taken by the

company to resolve the complaints

Page 19 of 28

!ection "*: Current Financial Condition

,0", For each -.$, the %% shall provide the required data in Tables ,0", / ,0"+

of %nnexure and shall discuss pointwise the following#

,0",", The current financial condition of the Company with specific

focus on each of the previous sections of this report"

,0","+ The financial condition of the company based on his

understanding of the business and adequacy of reserves"

,0","0 The solvency position of the company

,0","1 @uarterly solvency ratios, premium / expense details of the

company furnished in table ,0", / ,0"+ of %nnexure"

,0","2 The adequacy of premium

,0","4 The changes &if any' in reserving methodology from the previous

years, and explain reasons for such changes"

,0","6 The impact of change in reserving methodology on the financial

condition of the insurer"

,0"+ The %% shall provide insights into profitability &i"e surplus ( deficit' of the

company including trends based on previous years and the company!s

future plans"

Page 20 of 28

!ection ",: Future Financial Condition

,1", For each -.$, the %% shall provide the required data in Tables ,1", / ,1"+

of %nnexure and shall discuss pointwise the following#

,1",", *n detail the future financial condition of the company"

,1","+ The company!s projected financial statements and solvency

position for next three years, allowing for expected future new

business furnished in table ,1", of %nnexure"

,1","0 The results of stress tests for two plausible adverse scenarios

&i"e" events that could have a negative impact on solvency

position' furnished in table ,1"+ of %nnexure" Two adverse

scenarios must be selected by the company as felt appropriate

for the company!s business based on judgment of the likelihood

of events or combination of events in each of the + scenarios that

could have a negative impact on solvency position of the

company"

,1","1 $riefly the proposed management actions to ensure maintenance

of regulatory solvency even under the adverse conditions

,1"+ %% shall define explicitly the two plausible adverse scenarios assumed in

stress testing"

Page 21 of 28

!ection "/: %dvise on %ctuarial 6atters

,2", The %% shall provide the details of meetings attended visa vis conducted

in accordance with Regulation &6' of *R<% &%ppointed %ctuary'

Regulations, +999" *f any of the meetings are not attended to, the

reasons thereof"

,2"+ The %% shall discuss the details of the advice provided to the

management in accordance with Regulation &7' of *R<% &%ppointed

%ctuary' Regulations, +999 and any other relevant matter along with

course of action(proposed course of action"

Page 22 of 28

!ection "1# Comments of the +oard of the Insurer

,4", .n each of the chapters above, the insurer shall provide the comments of the

$oard and proposed course of action, if any"

Page 23 of 28

%ppointed %ctuar&9s Certi:cate

This is to certify that * have considered the data and information provided by the

Company in the preparation of this Financial Condition Report" Reasonable steps have

been taken to ensure the accuracy and completeness of the data"

(%""ointed %ctary#

Countersigned by# (M* A !-O#

Company )eal#

<ate#

Page 24 of 28

Glossar&

," %/era)e <ross "remim : Cross premium ( number of exposures

+" %/era)e net "remim : ?et premium ( ?umber of exposures

0" %/era)e &m insred : Total sum insured ( ?umber of exposures

1" %llocated loss ad1stment e."enses: correspond to those costs that the

insurer is able to assign to a particular claim"

2" %nnaliBed (remim: (For the "r"ose of this re"ort' it is defined as

a# For Regular ;remium policies : 9e)lar "remim amont

"aya4le in a year

4# For )ingle premium policies : &in)le "remim amont A term of

the "olicy

4" !om4ined ratio # ?et commission ratio D expense ratio D ?et incurred claim

ratio

6" !laim Fre8ency : ?umber of incurred claims ( ?umber of exposures

7" !laim &e/erity : Cross &net' *ncurred claim amount ( ?umber of *ncurred

claims

8" !losed claim 5ithot claim "ayment (nm4er#: *ncludes all the claims

that are closed without claim payment"

,9" !losed claim 5ithot claim "ayment (amont# : &For the "r"ose of

this re"ort' includes claim amount of all the claims closed without claim

payment exclusive of allocated loss adjusted expenses and these expenses

should be included in the claims closed with payment &amount'"

,," !losed claim 5ith claim "ayment (nm4er#: *ncludes all the claims that

are closed with claim payment"

,+" !losed claim 5ith claim "ayment (amont#: (For the "r"ose of this

re"ort' includes claim amount of all the claims closed with payment inclusive

of allocated loss ad1sted e."enses of 4oth claims closed 5ith +

5ithot "ayment.

,0" -."ense 9atio # .perating expenses ( Cross written premium

Page 25 of 28

,1" -."osres : %n e."osre is the basic unit of risk that underlies the

insurance premium

,2" Insrance "rofit : =nderwriting profit D *nvestment income on insurance

funds

,4" <ross -arned (remim (<-(# : ;remium from direct business written D

;remium on reinsurance accepted D(%djustment for change in reserve for

unexpired risk (*efinition as "er annal re"ort#

,6" <ross "remim : ;remium from direct business written D ;remium on

reinsurance accepted

,7" <ross claims "aid : Claim amount paid on direct business written D Claim

amount paid on reinsurance accepted business

,8" <ross Incrred claim : Claim amount paid &gross' D Claims outstanding

&*nclusive of *$?R' amount at the end of the Financial Eear &gross' F Claims

outstanding &*nclusive of *$?R' amount at the beginning of the Financial

Eear &gross' (*efinition as "er annal re"ort#

+9" <ross Incrred Loss 9atio : Cross incurred claim ( Cross earned premium

+," <ross claims (aid Loss 9atio # Cross claims paid ( Cross earned premium

++" <ross commission: Commission paid on direct written business D

Commission paid on reinsurance accepted business"

+0" Net -arned (remim (N-(# # ;remium from direct business written D

;remium on reinsurance accepted F ;remium on reinsurance ceded D(

%djustment for change in reserve for unexpired risk (*efinition as "er

annal re"ort#

+1" Net "remim : ;remium from direct business written D ;remium on

reinsurance accepted F ;remium on reinsurance ceded (*efinition as "er

annal re"ort#

+2" Net claims "aid : Claim amount paid on direct business written D Claim

amount paid on reinsurance accepted business FClaim amount received

from ceded business

+4" Net Incrred claim : !laim amount paid &net' D Claims outstanding

&*nclusive of *$?R' amount at the end of the Financial Eear &net' F Claims

Page 26 of 28

outstanding &*nclusive of *$?R' amount at the beginning of the Financial Eear

&net' (*efinition as "er annal re"ort#

+6" Net !ommission # Commission paid with respect to direct business D

Commission paid with respect to Reinsurance accepted F Commission

received with respect to Reinsurance ceded (*efinition as "er annal

re"ort#

+7" Net Incrred Loss 9atio : ?et *ncurred claim ( ?et earned premium

+8" Net claims "aid loss ratio # ?et claims paid ( ?et earned premium

09" Net !ommission ratio # ?et commission ( ?et ;remium

0," Nm4er of Incrred claims : ?umber of settled claims &i"e" claims are

closed with ( without payment' D open claims

0+" O"eratin) e."enses # %s per )chedule 1 of the %nnual Report

00" (remim deficiency reser/e# ;remium deficiency shall be recogni3ed if the

sum of expected claim costs, related expenses and maintenance costs

exceeds related reserve for unearned premium reserve"

01" 9etention ratio # ?et Aritten ;remium( Cross Aritten ;remium

02" 9ene5al $siness : Refer )ection 1 &1"+' of FCR document

04" &al/a)e and s4ro)ation: )alvage represents any amount that the insurer

is able to collect from the sale of damaged property" )ubrogation refers to an

insurer!s right to recover the amount of claim payment to a covered insured

from a thirdparty responsible for the injury or damage

06" &ol/ency ratio : %)B ( R)B &as per Regulations'

07" 'ail len)th # Gstimated time taken for settlement of claim from the date of

loss occurrence

08" Cnder5ritin) "rofit : ?et earned premium F ?et incurred claimsD(?et

Commission.perating expenses

19" Cnallocated loss ad1stment e."enses: are the claim related expenses

but cannot be allocated to a specific claim" Gxamples of =-%G include

salaries, rent, and computer expenses for the claims department of an

insurer"

1," Cnearned (remim 9eser/e (C(9#: % reserve for unexpired risks

shall be created as the amount representing that part of the premium

Page 27 of 28

written which is attributable to, and to be allocated to the succeeding

accounting periods and shall not be less than

Fire business, 29 per cent,

Biscellaneous business, 29 per cent,

Barine business other than marine hull business, 29 per centH %nd

Barine hull business, ,99 per cent,

.f the premium, net of reinsurances, during the preceding twelve

monthsH

Page 28 of 28

Vous aimerez peut-être aussi

- Resume Book 2006Document127 pagesResume Book 2006Edwin WangPas encore d'évaluation

- Gap Analysis TemplateDocument6 pagesGap Analysis Templateswissdude100% (2)

- The Great Divide Over Market EfficicnecyDocument10 pagesThe Great Divide Over Market EfficicnecynamgapPas encore d'évaluation

- Internal Audit ManualDocument92 pagesInternal Audit Manualdhuvadpratik100% (8)

- Ch24 Full Disclosure in Financial ReportingDocument31 pagesCh24 Full Disclosure in Financial ReportingAries BautistaPas encore d'évaluation

- Events After The Reporting Period: Myanmar Accounting Standard 10Document5 pagesEvents After The Reporting Period: Myanmar Accounting Standard 10Kyaw Htin WinPas encore d'évaluation

- By CA Rajeev Kumar Ranjan Mob. No. 8100052661: Management's Responsibility For The Financial StatementsDocument3 pagesBy CA Rajeev Kumar Ranjan Mob. No. 8100052661: Management's Responsibility For The Financial Statementspathan1990Pas encore d'évaluation

- AIOU Report FormatDocument6 pagesAIOU Report FormatZain NabiPas encore d'évaluation

- Muthoot Fincorp CalrificationsDocument6 pagesMuthoot Fincorp CalrificationslulughoshPas encore d'évaluation

- Ind AS1Document33 pagesInd AS1SaibhumiPas encore d'évaluation

- Audit Programe For Statutory AuditDocument20 pagesAudit Programe For Statutory AuditTekumani Naveen KumarPas encore d'évaluation

- Ross 9e FCF SMLDocument425 pagesRoss 9e FCF SMLAlmayayaPas encore d'évaluation

- Guidance Manual FinalDocument27 pagesGuidance Manual FinalrosdobPas encore d'évaluation

- For Review Annex B: Pre-Qualification Questionnaire Core QuestionsDocument12 pagesFor Review Annex B: Pre-Qualification Questionnaire Core QuestionsNCVOPas encore d'évaluation

- Karpagam Institute of Technology Mca Continuous Assessment Internal Test-IDocument5 pagesKarpagam Institute of Technology Mca Continuous Assessment Internal Test-IanglrPas encore d'évaluation

- Introduction: This Memorandum Sets Out Our Proposed Strategy For Auditing The Karnataka State Khadi and Village Industries Board (KVIB) For The Year Ended 31 March 2006Document3 pagesIntroduction: This Memorandum Sets Out Our Proposed Strategy For Auditing The Karnataka State Khadi and Village Industries Board (KVIB) For The Year Ended 31 March 2006Rachyl SacramedPas encore d'évaluation

- Chapter 14 Capital Structure and Financial Ratios: 1. ObjectivesDocument17 pagesChapter 14 Capital Structure and Financial Ratios: 1. Objectivessamuel_dwumfourPas encore d'évaluation

- Master MDA Guidelines MDA 2013Document17 pagesMaster MDA Guidelines MDA 2013sukritgoelPas encore d'évaluation

- 15 - Proposal Template May 2011Document16 pages15 - Proposal Template May 2011uromancyPas encore d'évaluation

- Interim Order in The Matter of Progress Cultivation Limited.Document12 pagesInterim Order in The Matter of Progress Cultivation Limited.Shyam SunderPas encore d'évaluation

- Fin 635 Project FinalDocument54 pagesFin 635 Project FinalCarbon_AdilPas encore d'évaluation

- Allama Iqbal Open University, Islamabad (Department of Commerce)Document11 pagesAllama Iqbal Open University, Islamabad (Department of Commerce)ziabuttPas encore d'évaluation

- Accounting Standard 16: Borrowing CostsDocument33 pagesAccounting Standard 16: Borrowing CostsP VenkatesanPas encore d'évaluation

- Revision Pack 2009-10Document9 pagesRevision Pack 2009-10Tosin YusufPas encore d'évaluation

- 201455200239Amendments-F.a. 2013 - For UplaodingDocument7 pages201455200239Amendments-F.a. 2013 - For UplaodingvishalniPas encore d'évaluation

- O o o o o O: Amortisation, Acquisition, Restructure Charges, In-Process R&D, Pension CurtailmentDocument18 pagesO o o o o O: Amortisation, Acquisition, Restructure Charges, In-Process R&D, Pension CurtailmentmkPas encore d'évaluation

- Banking Risk and Efficiency An Evidence From Commercial Banks of PakistanDocument15 pagesBanking Risk and Efficiency An Evidence From Commercial Banks of Pakistanjojee2k6Pas encore d'évaluation

- Financial Risk and Financial Performance of Commercial Banks in Rwanda A Case of Equity Bank RwandaDocument8 pagesFinancial Risk and Financial Performance of Commercial Banks in Rwanda A Case of Equity Bank RwandaSolomon MainaPas encore d'évaluation

- Minimum Corporate Income Tax: A Bane or A Boon? by Rosalino G. Fontanosa, Cpa, MbaDocument14 pagesMinimum Corporate Income Tax: A Bane or A Boon? by Rosalino G. Fontanosa, Cpa, MbaanggandakonohPas encore d'évaluation

- Common Loan ApplicationDocument9 pagesCommon Loan Application26155152Pas encore d'évaluation

- Usiness AW Axation: Easy RoundDocument5 pagesUsiness AW Axation: Easy RoundJason JohnstonPas encore d'évaluation

- Business Law and Taxation ReviewerDocument5 pagesBusiness Law and Taxation ReviewerSheena Mae Palaspas100% (1)

- Iat ManualDocument8 pagesIat Manualpraboda1991Pas encore d'évaluation

- Revised Schedule VIDocument23 pagesRevised Schedule VIJitendra GahandulePas encore d'évaluation

- Ch13 RevAnsDocument16 pagesCh13 RevAnssamuel_dwumfourPas encore d'évaluation

- PortfolioDocument24 pagesPortfolioAditi SharmaPas encore d'évaluation

- Chapter 1 Introduction of Accounting and Financial Reporting For Government and Not For Profit.Document5 pagesChapter 1 Introduction of Accounting and Financial Reporting For Government and Not For Profit.molango007Pas encore d'évaluation

- Form No 15HDocument2 pagesForm No 15HPrajesh SrivastavaPas encore d'évaluation

- Artisan Card BimayoyonaDocument8 pagesArtisan Card BimayoyonayahooshuvajoyPas encore d'évaluation

- D & G Case StudyDocument10 pagesD & G Case StudyVrusti RaoPas encore d'évaluation

- 1.1 Overview-Ratios 1.2 Companies For Analysis 1.3 Objective & Scope of Research Study 1.4 Limitation of Study 1.5 Research MethodologyDocument55 pages1.1 Overview-Ratios 1.2 Companies For Analysis 1.3 Objective & Scope of Research Study 1.4 Limitation of Study 1.5 Research Methodologysauravv7Pas encore d'évaluation

- Accounts - Module 6 Provisions of The Companies Act 1956Document15 pagesAccounts - Module 6 Provisions of The Companies Act 19569986212378Pas encore d'évaluation

- Annex VI E3h5 Interreport enDocument3 pagesAnnex VI E3h5 Interreport ensdiaman100% (1)

- CPAR Conceptual FrameworkDocument5 pagesCPAR Conceptual Frameworkrommel_007Pas encore d'évaluation

- 15663valuation Standard V7-IcaiDocument62 pages15663valuation Standard V7-IcaiSourabh GargPas encore d'évaluation

- Chap 004 G HanniDocument14 pagesChap 004 G Hannipeachrose12Pas encore d'évaluation

- Investments in Equity Securities: Solutions Manual, Chapter 2Document39 pagesInvestments in Equity Securities: Solutions Manual, Chapter 2um2345Pas encore d'évaluation

- CPAR Financial StatementsDocument5 pagesCPAR Financial StatementsAnjo EllisPas encore d'évaluation

- Teoria PT ExamenDocument6 pagesTeoria PT ExamenVlad MarleneanuPas encore d'évaluation

- Chap 010Document16 pagesChap 010trinhbang100% (1)

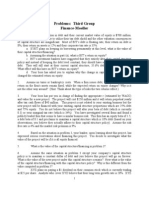

- Problems: Third Group Finance-MoellerDocument4 pagesProblems: Third Group Finance-MoellerEvan BenedictPas encore d'évaluation

- SECTION 1. Presidential Decree No. 1146, As Amended, Otherwise Known AsDocument24 pagesSECTION 1. Presidential Decree No. 1146, As Amended, Otherwise Known AsClarissa Beth DegamoPas encore d'évaluation

- UploadedFile 130364571293527064Document73 pagesUploadedFile 130364571293527064salujahimanshu1691Pas encore d'évaluation

- Solution Financial Management Strategy May 2009Document7 pagesSolution Financial Management Strategy May 2009samuel_dwumfourPas encore d'évaluation

- Assignment Guide Title PageDocument19 pagesAssignment Guide Title PageAli NAPas encore d'évaluation

- Ch3 AnsDocument19 pagesCh3 Anssamuel_dwumfourPas encore d'évaluation

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19D'EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19Pas encore d'évaluation

- Audit Risk Alert: General Accounting and Auditing Developments, 2017/18D'EverandAudit Risk Alert: General Accounting and Auditing Developments, 2017/18Pas encore d'évaluation

- Audit Risk Alert: Employee Benefit Plans Industry Developments, 2018D'EverandAudit Risk Alert: Employee Benefit Plans Industry Developments, 2018Pas encore d'évaluation

- Aircraft Engines & Parts World Summary: Market Sector Values & Financials by CountryD'EverandAircraft Engines & Parts World Summary: Market Sector Values & Financials by CountryPas encore d'évaluation

- Reinsurance Carrier Revenues World Summary: Market Values & Financials by CountryD'EverandReinsurance Carrier Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Case Studies in Not-for-Profit Accounting and AuditingD'EverandCase Studies in Not-for-Profit Accounting and AuditingPas encore d'évaluation

- Modifications + Conversions & Overhaul of Aircraft World Summary: Market Sector Values & Financials by CountryD'EverandModifications + Conversions & Overhaul of Aircraft World Summary: Market Sector Values & Financials by CountryPas encore d'évaluation

- Medical Fitness CertificateDocument1 pageMedical Fitness Certificateraheja_ashishPas encore d'évaluation

- Axis GIP LeafletDocument6 pagesAxis GIP Leafletraheja_ashishPas encore d'évaluation

- Backing Up 101Document28 pagesBacking Up 101AustraliaOnePas encore d'évaluation

- DFIC AddressDocument1 pageDFIC Addressraheja_ashishPas encore d'évaluation

- David Clements1.15201539Document45 pagesDavid Clements1.15201539raheja_ashishPas encore d'évaluation

- 2012 Council Rome Ifa SummaryDocument7 pages2012 Council Rome Ifa SummaryHåvard NilssonPas encore d'évaluation

- FCR Final PDFDocument66 pagesFCR Final PDFraheja_ashishPas encore d'évaluation

- Report On Resolution Regime For Financial InstitutionsDocument254 pagesReport On Resolution Regime For Financial Institutionsraheja_ashishPas encore d'évaluation

- Exposure Draft On Replacement Guidelines RevDocument7 pagesExposure Draft On Replacement Guidelines Revraheja_ashishPas encore d'évaluation

- Cir - Revised SyllabusDocument13 pagesCir - Revised Syllabusraheja_ashishPas encore d'évaluation

- Share HoldingDocument3 pagesShare Holdingraheja_ashishPas encore d'évaluation

- NB Data of Non-Life Industry For The Month of March 2014Document3 pagesNB Data of Non-Life Industry For The Month of March 2014raheja_ashishPas encore d'évaluation

- Status of Brokers - Mar, 2014Document57 pagesStatus of Brokers - Mar, 2014raheja_ashishPas encore d'évaluation

- Guidelines On Usage of Trade LogoDocument2 pagesGuidelines On Usage of Trade Logoraheja_ashishPas encore d'évaluation

- First Year NB For The Period Ended 31st March, 2014Document3 pagesFirst Year NB For The Period Ended 31st March, 2014raheja_ashishPas encore d'évaluation

- Brochure and Registration Form IEEE Workshop 12-4-2014Document3 pagesBrochure and Registration Form IEEE Workshop 12-4-2014raheja_ashishPas encore d'évaluation

- One To One Contact in Current Semester (Jan-June, 2014) 30-6-14Document1 pageOne To One Contact in Current Semester (Jan-June, 2014) 30-6-14raheja_ashishPas encore d'évaluation

- Circulation of Fictitious Information On Social MediaDocument1 pageCirculation of Fictitious Information On Social Mediaraheja_ashishPas encore d'évaluation

- Under One To One Mode Contact For B. Tech 30-6-2014Document3 pagesUnder One To One Mode Contact For B. Tech 30-6-2014raheja_ashishPas encore d'évaluation

- Student Guidelines For Online StudentsDocument1 pageStudent Guidelines For Online Studentsraheja_ashishPas encore d'évaluation

- VA Sessions Schedule 27-4-2014Document1 pageVA Sessions Schedule 27-4-2014raheja_ashishPas encore d'évaluation

- Isep PosterDocument1 pageIsep Posterraheja_ashishPas encore d'évaluation

- Resultnotice 4-4-2014Document1 pageResultnotice 4-4-2014raheja_ashishPas encore d'évaluation

- Feedback of B. Tech. Students For Even Semester (Jan - June 2014) 4-4-2014Document1 pageFeedback of B. Tech. Students For Even Semester (Jan - June 2014) 4-4-2014raheja_ashishPas encore d'évaluation

- Feedback of B. Tech. Students For Even Semester (Jan - June 2014) 4-4-2014Document1 pageFeedback of B. Tech. Students For Even Semester (Jan - June 2014) 4-4-2014raheja_ashishPas encore d'évaluation

- SOM-Mid Term Project Evaluation Notice 25-4-2014Document1 pageSOM-Mid Term Project Evaluation Notice 25-4-2014raheja_ashishPas encore d'évaluation

- Annexure To IRDA Circular Regarding Submission of DataDocument99 pagesAnnexure To IRDA Circular Regarding Submission of Dataraheja_ashishPas encore d'évaluation

- Cir-24 03 2014-Submission of Insurance Data To IIB PDFDocument1 pageCir-24 03 2014-Submission of Insurance Data To IIB PDFraheja_ashishPas encore d'évaluation

- AMC Annexure A AmmendedDocument2 pagesAMC Annexure A Ammendedraheja_ashishPas encore d'évaluation

- Contoh Tesis Thesis BAB 1 - 5Document55 pagesContoh Tesis Thesis BAB 1 - 5Rolan Mart SasongkoPas encore d'évaluation

- SOFP HartaDocument1 pageSOFP Hartaワンピ ースPas encore d'évaluation

- IandF CT5 201604 ExamDocument7 pagesIandF CT5 201604 ExamPatrick MugoPas encore d'évaluation

- Chapter 23 CPWD ACCOUNTS CODEDocument17 pagesChapter 23 CPWD ACCOUNTS CODEarulraj1971Pas encore d'évaluation

- Islamic AccountingDocument9 pagesIslamic AccountingMohamed QubatiPas encore d'évaluation

- MRP Finalproject Report: Comparative Analysis Onnon Performing Assets of Private and Public Sector BanksDocument69 pagesMRP Finalproject Report: Comparative Analysis Onnon Performing Assets of Private and Public Sector BanksrajmalalePas encore d'évaluation

- Fin 542Document3 pagesFin 542hanuman001Pas encore d'évaluation

- The University of Western Australia: Financial Distress: Lifecycle and Corporate RestructuringDocument35 pagesThe University of Western Australia: Financial Distress: Lifecycle and Corporate RestructuringErick WilsonPas encore d'évaluation

- Ifrs15 - BdoDocument110 pagesIfrs15 - BdoSajjad CheemaPas encore d'évaluation

- Foreign Direct Investment: Johanna C. Claro-Pichay, RCH Mpa 2Document21 pagesForeign Direct Investment: Johanna C. Claro-Pichay, RCH Mpa 2Tristan Lindsey Kaamiño AresPas encore d'évaluation

- FHA Handbook 4000.1 12-30-16Document1 009 pagesFHA Handbook 4000.1 12-30-16timlegPas encore d'évaluation

- 5 Perspectives of BSCDocument9 pages5 Perspectives of BSCAlexander Ruiz100% (1)

- JPM CDS PrimerDocument11 pagesJPM CDS PrimerJorge AraujoPas encore d'évaluation

- Britannia FinalDocument39 pagesBritannia FinalNitinAgnihotri100% (1)

- Ok Engineering & Capital GoodsDocument3 pagesOk Engineering & Capital GoodsSaurabh JadhavPas encore d'évaluation

- India - Sri Lanka RelationsDocument7 pagesIndia - Sri Lanka Relationsவிஷ்ணு பிரேம்செல்வா100% (1)

- FSAP ManualDocument7 pagesFSAP ManualJose ArmazaPas encore d'évaluation

- B.P. Exploration Co. (Libya) Ltd.Document20 pagesB.P. Exploration Co. (Libya) Ltd.thinkkimPas encore d'évaluation

- Deepak Nitarte FY18Document216 pagesDeepak Nitarte FY18PRABHAT SHANKARPas encore d'évaluation

- Fiats Extreme MakeoverDocument13 pagesFiats Extreme MakeoverSaieesh GandhiPas encore d'évaluation

- CAPE Accounting 2007 U1 P2Document7 pagesCAPE Accounting 2007 U1 P2preshPas encore d'évaluation

- Macro Economic Policy MBADocument63 pagesMacro Economic Policy MBABabasab Patil (Karrisatte)0% (1)

- An Internship Report On Organizational Study at Voltas.Document88 pagesAn Internship Report On Organizational Study at Voltas.Sandeep Saraswat50% (4)

- Big Secret of Intermarket TradingDocument7 pagesBig Secret of Intermarket TradingadolfinoPas encore d'évaluation

- Crisil SmeDocument60 pagesCrisil SmeUtkarsh PandeyPas encore d'évaluation

- Progress Test 2Document8 pagesProgress Test 2Minh Phung VoPas encore d'évaluation

- Effect of Operating Leverage: Analisa Laporan KeuanganDocument5 pagesEffect of Operating Leverage: Analisa Laporan KeuanganNadya LovitaPas encore d'évaluation