Académique Documents

Professionnel Documents

Culture Documents

My Pro Forma Indv. Assignment

Transféré par

GhieAliciaDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

My Pro Forma Indv. Assignment

Transféré par

GhieAliciaDroits d'auteur :

Formats disponibles

Analyzing Pro Forma Statements for XYZ Company, INC.

An initiative has been proposed by one of the executives to use expansion of the product

line in attemp to increase XYZ's sales. .

The expansion of the product line will cost $200,000 of capital.

This strategic move is expected to generate increase in sales by 20% s each year for the next five years

A Pro Forma finacial statement covering the next five years is neede to present to determine the possible

impact of this strategic move. The Pro Forma statements will be based on the current year's Balance Sheet

and Profit/Loss Statement and are projected for a 10% increase in sales each year for the next five years.

Assumptions:

1. Projection of 10% increase in sales each year for the next five year as the result of this product line expansion.

2. The product line expansion will cost $200,000 using internal financing.

Net sales $1,747,698 Assets $369,525 Debt $146,000

Costs 1,050,270 Equity 223,525

Net income $697,428 Total $369,525 Total $369,525

XYZ Company expects sales to increase by 20% as a result in expanding product line in the market.

Compute for the projected sales, costs, assets, debt and equity.

Projected sales = $1,747,698 x 1.10 = $1,922,467.80

Projected costs = $1,050,270 x 1.10 = $1,155,279

Projected assets = $369,525 x 1.10 = $406,477.50

Projected Debt = $146,000 x 1.10 = $160,600

Projected Equity = $223,525 x 1.10 = $245,877.50

Net sales $1,922,467.80

Costs 1,155,279

Net income $767,188.80

XYZ Company, INC.

Current Financial Statements ($ thousands)

XYZ Company, INC.

Pro Forma Income Statement ($ thousands)

Income Statement Balance Sheet

Assets $406,477.50 ($36,952.50) Debt $160,600 ($14,600)

Equity 245877.5 ($22,352.50)

Total $406,477.50 ($36,952.50) Total $406,477.50 ($36,952.50)

Analysis:

The balance sheet is now balance because both the sources and use of funds have increased by 10%.

The $36,952.50 in new asset is being financed by $22,352.50 from retained earning (internal financing using equity)

and $14,600 from new long-term debt (external financing).

However, the equity account does not look right. XYZ's projected net income was $767,188.80.

Adding this ammount to the initial equity account balance of $223,525 yields a final equity balance

of $990,713.80 which is an apparent conflict. To solve for this problem, it is important to reconcile

the account. If the firm is not expected to sell or repurchase stock, there are two basic transactions that

could take place during the year. One, the firm could generate income that is added to the retained earnings.

Second option is that the management could pay a cash dividend , which is subtracted from the retained earnings.

Because the pro forma equity balance is lower than the sum of the initial equity account balance plus XYZ's net income,

the forecast assume the firm will pay a dividend. But for this activity, I will choose to add the retained

earning in the pro forma balance sheet.

initial equity $223,525

XYZ Company, INC.

Pro Forma Balance Sheet ($ thousands)

plus net income $697,428

Total $920,953 Pro forma equity = $245,877.50 lower than the initial equity

and net income

Calculation for the payment of cash dividend:

Formula:

Dividends = Beginning equity balance + Net income - Ending equity balance

Dividends = $223,525 + $767,188.80 - $245,877.50

Dividends = $990,713.80-$245,877.50

Dividends = $744,836.30

The net income of $767,188.80 and the constraint that the ending equity balance is $268,230 will make

the company to pay $744,836.30 of dividends.

Percent Ratio

to the Sales

Income Statement

Net sales 100%

Cost of goods sold 60.1%

Gross profit 39.9%

Selling expense 7.2%

Operating expense 16.4%

Operating profit (EBITDA) 16.4%

Other income (expense) 1.4%

Pretax profit (EBITDA - Total other Income (Expense) 15.0%

Income tax allowance (45%)

Net Profit

Balance Sheet

Current Assets

Cash 0.60%

Account Receivable 1.54%

Inventory 1.72%

Prepaid Expenses 0.11%

Total Current Assets

Fixed Assets

Net Property, Equipment and Vehicle Depreciation Fixed

Total Fixed Assets

Total Assets

Liabilities

XYZ Company, INC.

Five Year Projection on 20% increase in sale

Pro Forma

Inventory

Accounts payable 0.29%

Revolving line of credit 1.14

Current Portion of Long-term Debt 0.86%

Total Current Liabilities

Long-term Liabilities

Long-term debt and capital leases 2.60%

Loans payable to stockholders 3.46%

Total Long-Term Liabilities

Total Liabilities

Stockholders Equity

Common stock 0.06%

Additional Paid-in Capital 1.43%

Retained earnings

Total Stockholders Equity

Total Liabilities and Stockholders Equity

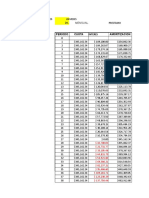

0 1 2 3

20XX 20x1 20x2 20x3

1,747,698 $ 2,097,237.60 $ 2,516,685.12 $ 3,020,022.14 $

1,050,270 $ 1,260,324 $ 1,512,388.80 $ 1,814,866.56 $

697,428 $ 836,913.60 $ 1,004,296.32 $ 1,205,155.58 $

125,000 $ 151,001.11 $ 181,201.33 $ 217,441.59 $

285,850 $ 343,946.97 $ 412,736.36 $ 495,283.63 $

286,578 $ 341,965.53 $ 410,358.63 $ 492,430.36 $

24,150 $ 29,361.33 $ 35,233.59 $ 42,280.31 $

262,428 $ 312,604.20 $ 375,125.04 $ 450,150.05 $

118,093 $ 140,671.89 $ 168,806.27 $ 202,567.52 $

144,335 $ 171,932.31 $ 206,318.77 $ 247,582.53 $

10,525 $ 12,583.43 $ 15,100.11 $ 18,120.13 $

27,000 $ 32,297.46 $ 38,756.95 $ 46,508.34 $

30,000 $ 36,072.49 $ 43,286.98 $ 51,944.38 $

2,000 $ 2,306.96 $ 2,768.35 $ 3,322.02 $

69,525 $ 83,260.33 $ 99,912.40 $ 119,894.88 $

300,000 $ 300,000.00 $ 300,000.00 $ 300,000.00 $

300,000 $ 300,000.00 $ 300,000.00 $ 300,000.00 $

369,525 $ 383,260.33 $ 399,912.40 $ 419,894.88 $

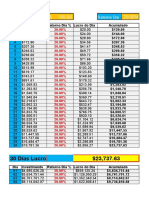

XYZ Company, INC.

Five Year Projection on 20% increase in sale

Pro Forma

Year

30,000 $

5,000 $ 6,081.99 $ 7,298.39 $ 8,758.06 $

20,000 $ 23,908.51 $ 20,000.00 $ 20,000.00 $

15,000 $ 18,036.24 $ 21,643.49 $ 25,972.19 $

40,000 $ 48,026.74 $ 48,941.88 $ 54,730.25 $

45,500 $ 54,528 $ 65,433.81 $

60,500 $ 72,564.42 $ 87,077.31 $ 60,500.00 $

106,000 $ 127,092.60 $ 152,511.12 $

146,000 $ 175,119.34 $ 201,453.00 $

$1,000 1,258.34 $ 1,510.01 $ 1,000.00 $

$25,000 29,990.50 $ 25,000.00 $ 25,000.00 $

$197,525 171,932.31 $ 206,318.77 $

$223,525 203,181.15 $ 232,828.78 $

$369,525 378,300.49 $ 434,281.78 $

4 5

20x4 20x5

3,624,026.57 $ 4,348,831.89 $

2,177,839.87 $ 2,613,407.85 $

1,446,186.70 $ 1,735,424.04 $

260,929.91 $ 313,115.90 $

594,340.36 $ 713,208.43 $

590,916.43 $ 709,099.72 $

50,736.37 $ 60,883.65 $

540,180.06 $ 648,216.07 $

243,081.03 $ 291,697.23 $

297,099.03 $ 405,135.04 $

21,744.16 $ 26,092.99 $

55,810.01 $ 66,972.01 $

62,333.26 $ 74,799.91 $

3,986.43 $ 4,783.72 $

143,873.85 $ 172,648.63 $

300,000.00 $ 300,000.00 $

300,000.00 $ 300,000.00 $

443,873.85 $ 472,648.63 $

XYZ Company, INC.

Five Year Projection on 20% increase in sale

Pro Forma

Year

10,509.68 $ 12,611.61 $

20,000.00 $ 20,000.00 $

31,166.63 $ 37,399.95 $

61,676.31 $ 70,011.57 $

60,500.00 $ 60,500.00 $

1,000.00 $ 1,000.00 $

25,000.00 $ 25,000.00 $

Balance Sheet

Current Assets

Cash

Account Receivable

Inventory

Prepaid Expenses

Total Current Assets

Fixed Assets

Net Property, Equipment and Vehicle Depreciation

Total Fixed Assets

Total Assets

Liabilities

Accounts payable

Revolving line of credit

Current Portion of Long-term Debt

Total Current Liabilities

Long-term Liabilities

Long-term debt and capital leases

Long-term loan (for product expansion)

Loans payable to stockholders

Total Long-Term Liabilities

Total Liabilities

Stockholders Equity

Common stock

Additional Paid-in Capital

Retained earnings

Total Stockholders Equity

Total Liabilities and Stockholders Equity

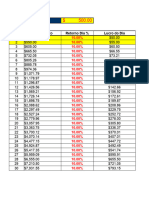

10,525 $ 12,630.00 $

27,000 $ 32,400.00 $

30,000 $ 36,000.00 $

2,000 $ 2,400.00 $

69,525 $ 83,430.00 $

Net Property, Equipment and Vehicle Depreciation Fixed 300,000 $ 300,000.00 $

300,000 $ 300,000.00 $

369,525 $ 383,430.00 $

5,000 $ 6,000.00 $

20,000 $ 24,000.00 $

15,000 $ 18,000.00 $

40,000 $ 48,000.00 $

45,500 $ 54,600 $

- $ 200,000 $

60,500 $ 72,600.00 $

106,000 $ 127,200.00 $

146,000 $ 175,200.00 $

Fixed $1,000 $1,000

$25,000 35,297.69 $

$197,525 171,932.31 $

$223,525 208,230.00 $

$369,525 383,430.00 $

15,156.00 $ #REF! #REF! #REF!

38,880.00 $ #REF! #REF! #REF!

43,200.00 $ #REF! #REF! #REF!

2,880.00 $ #REF! #REF! #REF!

100,116.00 $ #REF! #REF! #REF!

300,000.00 $ 300,000.00 $ 300,000.00 $ 300,000.00 $

300,000.00 $ 300,000.00 $ 300,000.00 $ 300,000.00 $

400,116.00 $ #REF! #REF! #REF!

7,200.00 $ #REF! #REF! #REF!

28,800.00 $ 20,000.00 $ 20,000.00 $ 20,000.00 $

21,600.00 $ #REF! #REF! #REF!

57,600.00 $ #REF! #REF! #REF!

65,520.00 $

- $

87,120.00 $ 60,500.00 $ 60,500.00 $ 60,500.00 $

152,640.00 $

210,240.00 $

$1,000 1,000.00 $ 1,000.00 $ 1,000.00 $

25,000.00 $ 25,000.00 $ 25,000.00 $

206,318.77 $

Percent

Ratio to the

Sales

Income Statement

Net sales 100%

Cost of goods sold 60.1%

Gross profit 39.9%

Selling expense 7.2%

Operating expense 16.4%

Operating profit (EBITDA) 16.4%

Other income (expense) 1.4%

Pretax profit (EBITDA - Total other Income (Expense) 15.0%

Income tax allowance (45%)

Net Profit

XYZ Company, INC.

Five Year Projection on 20% increase in sale

Pro Forma

0 1 2 3 4

20XX 20x1 20x2 20x3 20x4

1,747,698 $ 2,097,237.60 $ 2,516,685.12 $ 3,020,022.14 $ 3,624,026.57 $

1,050,270 $ 1,260,324 $ 1,512,388.80 $ 1,814,866.56 $ 2,177,839.87 $

697,428 $ 836,913.60 $ 1,004,296.32 $ 1,205,155.58 $ 1,446,186.70 $

125,000 $ 151,001.11 $ 181,201.33 $ 217,441.59 $ 260,929.91 $

285,850 $ 343,946.97 $ 412,736.36 $ 495,283.63 $ 594,340.36 $

286,578 $ 341,965.53 $ 410,358.63 $ 492,430.36 $ 590,916.43 $

24,150 $ 29,361.33 $ 35,233.59 $ 42,280.31 $ 50,736.37 $

262,428 $ 312,604.20 $ 375,125.04 $ 450,150.05 $ 540,180.06 $

118,093 $ 140,671.89 $ 168,806.27 $ 202,567.52 $ 243,081.03 $

144,335 $ 171,932.31 $ 206,318.77 $ 247,582.53 $ 297,099.03 $

XYZ Company, INC.

Five Year Projection on 20% increase in sale

Pro Forma

Year

5

20x5

4,348,831.89 $

2,613,407.85 $

1,735,424.04 $

313,115.90 $

713,208.43 $

709,099.72 $

60,883.65 $

648,216.07 $

291,697.23 $

405,135.04 $

XYZ Company, INC.

Five Year Projection on 20% increase in sale

Pro Forma

Year

0

20XX

Income Statement

Cost of goods sold 1,050,270 $

Gross profit 697,428 $

Selling expense 125,000 $

Operating expense 285,850 $

Operating profit (EBITDA) 286,578 $

Other income (expense) 24,150 $

Pretax profit (EBITDA - Total other Income (Expense) 262,428 $

Income tax allowance (45%) 118,093 $

Net Profit 144,335 $

*Through the expanssion of product line in the market, the sales are expected to grow by 20% every year for the next five years.

XYZ Company, INC.

Five Year Projection on 20% increase in sale

Pro Forma Income Statement

Year

0

20XX

Income Statement

Sales 1,750,450 $

Returns and allowances 2752

Net Sales 1,747,698 $

Cost of goods sold 1,050,270 $

Gross profit 697,428 $

Selling expense 125,000 $

Operating expense 285,850 $

Operating profit (EBITDA) 286,578 $

Other income (expense) 24,150 $

Pretax profit (EBITDA - Total other Income (Expense) 262,428 $

Income tax allowance (45%) 118,093 $

Net Profit 144,335 $

*Through the expanssion of product line in the market, the sales are expected to grow by 10% every year for the next five years.

XYZ Company, INC.

Five Year Projection on 20% increase in sale

Pro Forma Income Statement

Year

1 2 3 4 5

20X1 20X2 20X3 20X4 20X5

1,260,324 $ 1,512,388.80 $ 1,814,866.56 $ 2,177,839.87 $ 2,613,407.85 $

836,913.60 $ 1,004,296.32 $ 1,205,155.58 $ 1,446,186.70 $ 1,735,424.04 $

150,000.00 $ 180,000.00 $ 216,000.00 $ 259,200.00 $ 311,040.00 $

343,020.00 $ 411,624.00 $ 493,948.80 $ 592,738.56 $ 711,286.27 $

343,893.60 $ 412,672.32 $ 495,206.78 $ 594,248.14 $ 713,097.77 $

28,980.00 $ 34,776.00 $ 41,731.20 $ 50,077.44 $ 60,092.93 $

314,913.60 $ 377,896.32 $ 453,475.58 $ 544,170.70 $ 653,004.84 $

141,711.12 $ 170,053.34 $ 204,064.01 $ 244,876.82 $ 293,852.18 $

173,202.48 $ 207,842.98 $ 249,411.57 $ 299,293.89 $ 359,152.66 $

*Through the expanssion of product line in the market, the sales are expected to grow by 20% every year for the next five years.

XYZ Company, INC.

Five Year Projection on 20% increase in sale

Pro Forma Income Statement

Year

1 2 3 4 5

20X1 20X2 20X3 20X4 20X5

1,925,495.0 $ 2,118,044.50 $ 2,329,848.95 $ 2,562,833.85 $ 2,819,117.23 $

3027.2 3329.92 3662.912 4029.2032 4432.12352

1,922,467.8 $ 2,114,714.58 $ 2,326,186.04 $ 2,558,804.64 $ 2,814,685.11 $

1,155,297 $ 1,270,826.70 $ 1,397,909.37 $ 1,537,700.31 $ 1,691,470.34 $

767,170.80 $ 843,887.88 $ 928,276.67 $ 1,021,104.33 $ 1,123,214.77 $

137,500.00 $ 151,250.00 $ 166,375.00 $ 183,012.50 $ 201,313.75 $

314,435.00 $ 345,878.50 $ 380,466.35 $ 418,512.99 $ 460,364.28 $

315,235.80 $ 346,759.38 $ 381,435.32 $ 419,578.85 $ 461,536.73 $

26,565.00 $ 29,221.50 $ 32,143.65 $ 35,358.02 $ 38,893.82 $

288,670.80 $ 317,537.88 $ 349,291.67 $ 384,220.83 $ 422,642.92 $

129,901.86 $ 142,892.05 $ 157,181.25 $ 172,899.38 $ 190,189.31 $

158,768.94 $ 174,645.83 $ 192,110.42 $ 211,321.46 $ 232,453.61 $

*Through the expanssion of product line in the market, the sales are expected to grow by 10% every year for the next five years.

XYZ Company, INC.

Five Year Projection on 20% increase in sale

Pro Forma Income Statement

Year

Assets

Fixed assets Fixed

Current Assets

Cash

Inventory

Accounts receivable

Prepaid Expenses

Total Assets

Liabilities and Equity

Current Liability

Accounts Payables

Revolving line of credit Fixed

Total Current Liability

Long-term Liability

Loans payable to stockholders Fixed

Long-term debt and capital leases

Total Long-term Liability

Equity

Common Stock Fixed

Additional Paid -in Capital Assumed

Retained earnings

Reserves

Total Equity

Total Equity and Liabilities

XYZ Company, INC.

Five Year Projection on 20% increase in sale

Pro Forma Balance Sheet

20XX 20X1 20X2 20X3 20X4

300,000 $ 300,000 $ 300,000 $ 300,000 $ 300,000 $

10,525 $ 11,578 $ 12,735 $ 14,009 $ 15,410 $

30,000 $ 33,000 $ 36,300 $ 39,930 $ 43,923 $

27,000 $ 29,700 $ 32,670 $ 35,937 $ 39,531 $

2,000 $ 2,200 $ 2,420 $ 2,662 $ 2,928 $

369,525 $ 376,478 $ 384,125 $ 392,538 $ 401,792 $

20,000 $ 22,000 $ 24,200 $ 26,620 $ 29,282 $

20,000 $ 20,000 $ 20,000 $ 20,000 $ 20,000 $

40,000 $ 42,000 $ 44,200 $ 46,620 $ 49,282 $

60,500 $ 60,500 $ 60,500 $ 60,500 $ 60,500 $

45,500 $ 45,500 $ 45,500 $ 45,500 $ 45,500 $

106,000 $ 106,000 $ 106,000 $ 106,000 $ 106,000 $

1,000 $ 1,000 $ 1,000 $ 1,000 $ 1,000 $

25,000 $ 25,000 $ 25,000 $ 25,000 $ 25,000 $

197,525 $ 158,768.94 $ 174,645.83 $ 192,110.42 $ 211,321.46 $

- $ 43,709.06 $ 33,279.00 $ 21,807.58 $ 9,188 $

223,525 $ 228,478.00 $ 233,925 $ 239,918 $ 246,510 $

369,525 $ 376,478.00 $ 384,125 $ 392,538 $ 401,792 $

The only items affected by the sale percent change in sale are the current assets and liabilities.

XYZ Company, INC.

Five Year Projection on 20% increase in sale

Pro Forma Balance Sheet

Year

20X5

300,000 $

16,951 $

48,315 $

43,484 $

3,221 $

411,971 $

32,210 $

20,000 $

52,210 $

60,500 $

45,500 $

106,000 $

1,000 $

20,307 $

232,453.61 $

- $

253,761 $

411,971 $

The only items affected by the sale percent change in sale are the current assets and liabilities.

XYZ Company, INC.

Five Year Projection on 20% increase in sale

Pro Forma Balance Sheet

Year

Vous aimerez peut-être aussi

- Compound Interest CalculatorDocument3 pagesCompound Interest CalculatorLast PlayerPas encore d'évaluation

- Compound Interest CalculatorDocument3 pagesCompound Interest CalculatorAubie MaopePas encore d'évaluation

- Income Expenses: Monthly X 12 X Annual 1.03 X 2023 2024 2025 2026 2027 2028 AnnualDocument11 pagesIncome Expenses: Monthly X 12 X Annual 1.03 X 2023 2024 2025 2026 2027 2028 Annualapi-291884427Pas encore d'évaluation

- 1 TradesDocument6 pages1 TradesHuub SPas encore d'évaluation

- Proforma Statement of Income of Walt Disney: RevenueDocument44 pagesProforma Statement of Income of Walt Disney: RevenueArif.hossen 30Pas encore d'évaluation

- Taller Funciones SolverDocument10 pagesTaller Funciones SolverLeidy Carolina MEDINA GOMEZPas encore d'évaluation

- Question 1: Profit MaximazationDocument2 pagesQuestion 1: Profit MaximazationYirgalem AmanuelPas encore d'évaluation

- Omg I Need To Open A Roth IRADocument1 pageOmg I Need To Open A Roth IRAirina.issakova6516100% (1)

- Savings CalculatorDocument3 pagesSavings Calculatoradamgross155Pas encore d'évaluation

- Retirement Planner1Document4 pagesRetirement Planner1happyenglishht.kgPas encore d'évaluation

- Marketing ExcelDocument4 pagesMarketing ExcelMaria Camila Sierra RamosPas encore d'évaluation

- Stock Dads Compound Interest CalculatorDocument4 pagesStock Dads Compound Interest CalculatorMPas encore d'évaluation

- Financiera Glox de Pagos Sobre Saldos InsolutosDocument1 pageFinanciera Glox de Pagos Sobre Saldos InsolutosMarcko Antonio100% (1)

- TareaS7 MarvinZ (Escenarios)Document17 pagesTareaS7 MarvinZ (Escenarios)Marvin Yovany ZelayaPas encore d'évaluation

- Material 2022F1 FIN331 01 198413Document6 pagesMaterial 2022F1 FIN331 01 198413Leonela CajasPas encore d'évaluation

- SENADocument4 pagesSENAJessicaPas encore d'évaluation

- AMORTIZACIONDocument4 pagesAMORTIZACION90faf37d72Pas encore d'évaluation

- Tablas Amortización Cat 49%-1Document8 pagesTablas Amortización Cat 49%-1adan daniel rodriguez silvaPas encore d'évaluation

- Financiera GLOX Pagos FijosDocument4 pagesFinanciera GLOX Pagos FijosLETICIA CRUZ GOMEZPas encore d'évaluation

- GrowthDocument7 pagesGrowthFarooq HaiderPas encore d'évaluation

- Tablas de Amortizacion Credito Consumo 36: Tasa Interés MensualDocument8 pagesTablas de Amortizacion Credito Consumo 36: Tasa Interés MensualSergio Antonio MayorgaPas encore d'évaluation

- Inversión VariableDocument15 pagesInversión VariableWilberSebastianSivintaPas encore d'évaluation

- C 1Document9 pagesC 1api-291884427Pas encore d'évaluation

- Gerenciamento Blaze 2.0Document16 pagesGerenciamento Blaze 2.0LEOzinhoPas encore d'évaluation

- Pagos Variables: Saldo Interes IVA Seguro Abono A Capital Mensualid ADDocument10 pagesPagos Variables: Saldo Interes IVA Seguro Abono A Capital Mensualid ADAlexia CasteloPas encore d'évaluation

- Planilha de Risco - 1Document12 pagesPlanilha de Risco - 1TCG RURALPas encore d'évaluation

- Flujo de Caja Proyectado1Document8 pagesFlujo de Caja Proyectado1CHARLES WILLIAM SALAZAR SANCHEZPas encore d'évaluation

- 2011 Tax ChartDocument8 pages2011 Tax ChartmreagansPas encore d'évaluation

- Plazo (Meses, Saldo Insoluto Pago Mensual TotalDocument6 pagesPlazo (Meses, Saldo Insoluto Pago Mensual Totalfelixomar1Pas encore d'évaluation

- Tabla de AmortizacionDocument2 pagesTabla de AmortizacionJulio OrdazPas encore d'évaluation

- Planilha de GerenciamentoDocument10 pagesPlanilha de Gerenciamentobetoloko89.bsPas encore d'évaluation

- Retirement Planner: OOPS! This Plan Will Only Provide Income To Age 61. You'll Need To Makes Some ModificationsDocument4 pagesRetirement Planner: OOPS! This Plan Will Only Provide Income To Age 61. You'll Need To Makes Some ModificationsRaden Arif RifaiPas encore d'évaluation

- Gerenciamento CasinoDocument15 pagesGerenciamento CasinoLucas AnjosPas encore d'évaluation

- Plazo (Mesesaldo Insoluto Pago Mensual TotalcapitalDocument4 pagesPlazo (Mesesaldo Insoluto Pago Mensual TotalcapitalDiego OrozcoPas encore d'évaluation

- Sales Price (Property Sold Under 45 Days) Net Proceeds From Sale Purchase Price (Equal or Less Than)Document1 pageSales Price (Property Sold Under 45 Days) Net Proceeds From Sale Purchase Price (Equal or Less Than)api-26010927Pas encore d'évaluation

- County Steel Inc.Document20 pagesCounty Steel Inc.ingrid619Pas encore d'évaluation

- Dec. 6 2021 Grand Forks Lyon's PILOT EstimatesDocument1 pageDec. 6 2021 Grand Forks Lyon's PILOT EstimatesJoe BowenPas encore d'évaluation

- Plazo (Mesesaldo Insoluto Pago Mensual Total CapitalDocument2 pagesPlazo (Mesesaldo Insoluto Pago Mensual Total CapitalCristhian NavarroPas encore d'évaluation

- Planilha-Bruninho - 2Document6 pagesPlanilha-Bruninho - 2palmeiras199920202021mdmPas encore d'évaluation

- Periodo Capital Insoluto Interes Cuota Capital Pagado Saldo DeudaDocument9 pagesPeriodo Capital Insoluto Interes Cuota Capital Pagado Saldo DeudaDanny SaltoPas encore d'évaluation

- Matemáticas Financieras: Evidencia de AprendizajeDocument5 pagesMatemáticas Financieras: Evidencia de AprendizajeMas JovPas encore d'évaluation

- 30 Year Mortgage With Extra Payments - Mortgage CalculatorDocument9 pages30 Year Mortgage With Extra Payments - Mortgage Calculatorapi-351849605Pas encore d'évaluation

- Gerenciamento de Juros CompostoDocument9 pagesGerenciamento de Juros CompostoGeneral KamikaziPas encore d'évaluation

- Long-Term Savings CalculatorDocument52 pagesLong-Term Savings CalculatorRomina Flores-TatiniPas encore d'évaluation

- pj4 2 5Document6 pagespj4 2 5api-557133689Pas encore d'évaluation

- Untitled 9Document2 pagesUntitled 9Omar HassanPas encore d'évaluation

- Plazo (Meses, Semanas, Saldo InsolutoDocument12 pagesPlazo (Meses, Semanas, Saldo InsolutoMartín ForezPas encore d'évaluation

- Morgagtebottom Calculator - Mortgage Calculator 2Document10 pagesMorgagtebottom Calculator - Mortgage Calculator 2api-351849605Pas encore d'évaluation

- Estudio de Caso Sobre Alternativas de FinanciaciónDocument24 pagesEstudio de Caso Sobre Alternativas de FinanciaciónKevin DiazPas encore d'évaluation

- CM TABLAS DE DESCUENTO IMSS LEY J&P CAT 30 - 5% SEP 2021 V - 14 MENSUAL (Act18oc)Document5 pagesCM TABLAS DE DESCUENTO IMSS LEY J&P CAT 30 - 5% SEP 2021 V - 14 MENSUAL (Act18oc)MARIA LUZ MARTINEZ CRUZPas encore d'évaluation

- 2tabla de Amortizacion T2 - CompressedDocument4 pages2tabla de Amortizacion T2 - CompressedCarolina HernandezPas encore d'évaluation

- 3120 Project 2Document9 pages3120 Project 2Hakimuddin KotwalPas encore d'évaluation

- Taller Final #5 L BarreraDocument16 pagesTaller Final #5 L BarreraFRANXIS ALMEYDAPas encore d'évaluation

- GERENCIAMENTODocument15 pagesGERENCIAMENTOsued monteiroPas encore d'évaluation

- Kelvin Retirement CalculatorDocument8 pagesKelvin Retirement Calculatorwakema08Pas encore d'évaluation

- Planilha Gerenciamento AtualDocument12 pagesPlanilha Gerenciamento AtualLaísa SantosPas encore d'évaluation

- MS F4 Reducing-Balance-LoanDocument14 pagesMS F4 Reducing-Balance-LoanPratyush singhPas encore d'évaluation

- LAM DCF ModelDocument1 pageLAM DCF ModelAzureSilhouettePas encore d'évaluation

- Percent Per Day Binary Options CalculatorDocument4 pagesPercent Per Day Binary Options CalculatorJohn BoydPas encore d'évaluation

- Annual Report 2022 en Final WebsiteDocument76 pagesAnnual Report 2022 en Final WebsiteSin SeutPas encore d'évaluation

- The General Ledger of Corso Care Corp A Veterinary CompanyDocument2 pagesThe General Ledger of Corso Care Corp A Veterinary CompanyBube KachevskaPas encore d'évaluation

- Horngrens Accounting 11th Edition Miller Nobles Solutions ManualDocument26 pagesHorngrens Accounting 11th Edition Miller Nobles Solutions ManualColleenWeberkgsq100% (52)

- NISM Series XXII Fixed Income Securities Workbook May 2021Document182 pagesNISM Series XXII Fixed Income Securities Workbook May 2021Karthick S Nair100% (2)

- CH 010Document24 pagesCH 010melodie03Pas encore d'évaluation

- Islamic Indices: Oil and Gas Tradable Sector Index (OGTI)Document2 pagesIslamic Indices: Oil and Gas Tradable Sector Index (OGTI)Talha Iftekhar KhanPas encore d'évaluation

- ReferencesDocument12 pagesReferencesRachelMayaMalauPas encore d'évaluation

- Profit Prior To IncorporationDocument4 pagesProfit Prior To Incorporationgourav mishraPas encore d'évaluation

- Vansh Pandhi - IGCSE Accounting Revision 21122021 Tuesday Work EmptyDocument3 pagesVansh Pandhi - IGCSE Accounting Revision 21122021 Tuesday Work EmptyVansh PandhiPas encore d'évaluation

- Fulvian Zahid Kuis MenkeuDocument3 pagesFulvian Zahid Kuis MenkeuCarihunian DepokPas encore d'évaluation

- Construction All RisksDocument6 pagesConstruction All RisksAzman YahayaPas encore d'évaluation

- ExcelDocument55 pagesExcelJashPas encore d'évaluation

- 282 B-CR NewDocument4 pages282 B-CR Newwrite2ashishmalik6269100% (1)

- Brokers' Voice Survey Results - January 29th, 2021Document17 pagesBrokers' Voice Survey Results - January 29th, 2021Avishek JaiswalPas encore d'évaluation

- Netflix Inc.: Content Ramp Adding Torque To The FlywheelDocument30 pagesNetflix Inc.: Content Ramp Adding Torque To The FlywheelManvinder SinghPas encore d'évaluation

- Lease Finance and Investment Banking PDFDocument105 pagesLease Finance and Investment Banking PDFnayanPas encore d'évaluation

- 9 - The Relationship Between CEO Characteristics and Leverage - The Role of Independent CommissionersDocument10 pages9 - The Relationship Between CEO Characteristics and Leverage - The Role of Independent Commissionerscristina.llaneza02100% (1)

- Accountant - MIS Reporting.Document3 pagesAccountant - MIS Reporting.Fazlihaq DurraniPas encore d'évaluation

- Bdo Cash It Easy RefDocument2 pagesBdo Cash It Easy RefJC LampanoPas encore d'évaluation

- Presentation For AO IIDocument103 pagesPresentation For AO IIClerica Realingo100% (1)

- Basic Underwriting (ATG)Document402 pagesBasic Underwriting (ATG)dwrighte1Pas encore d'évaluation

- COVID-19 Outbreak: Impact On Sri Lanka and RecommendationsDocument19 pagesCOVID-19 Outbreak: Impact On Sri Lanka and RecommendationsMohamed FayazPas encore d'évaluation

- Pedrosa Excel1Document11 pagesPedrosa Excel1Madaum Elementary100% (1)

- Land Law NotesDocument7 pagesLand Law NoteshibaPas encore d'évaluation

- Muntiariani - NTUC Income-Security BondDocument2 pagesMuntiariani - NTUC Income-Security BondSyscom PrintingPas encore d'évaluation

- A.P.S Iapm Unit 3Document19 pagesA.P.S Iapm Unit 3vinayak mishraPas encore d'évaluation

- 8 PDFDocument77 pages8 PDFHemanthThotaPas encore d'évaluation

- General Growth Properties' Full PetitionDocument63 pagesGeneral Growth Properties' Full PetitionDealBook100% (2)

- What Is The Formula For Creditor DaysDocument9 pagesWhat Is The Formula For Creditor DaysKathir HaiPas encore d'évaluation

- Sustainability Reporting Strategy: Creating Impact Through TransparencyDocument6 pagesSustainability Reporting Strategy: Creating Impact Through TransparencyakashPas encore d'évaluation