Académique Documents

Professionnel Documents

Culture Documents

Capital Budgeting Examples

Transféré par

aldamati2010Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Capital Budgeting Examples

Transféré par

aldamati2010Droits d'auteur :

Formats disponibles

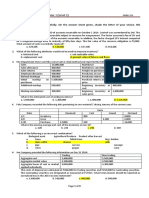

Capital Budgeting Page 1

Capital Budgeting

Capital Budgeting: is the decision process that manager use to identify those projects that add to

the firms value and as such it is perhaps the most important task faced by financial managers

and their staff.

Methods of Capital Budgeting

1. Payback

2. Discounted Payback

3. Net Present Value (NPV)

4. Internal rate of Return (IRR)

5. Modified Internal rate of Return (MIRR)

6. Profitability Index (PI)

1. Payback Period Method

The payback period defined as the expected number of years required to recover the original

investment, it is the formal method used to evaluate capital budgeting project.

Example

0 1 2 3 4

* -----------------* ---------------* -------------------* -------------------*

-1000 500 400 300 100

-1000 + 500+400 = 100

100/300 = 0.33

Payback = 2.33 Years

Advantage

1. Easy to calculate

2. provide an indication of a projects risk and liquidity

Disadvantage

1. Ignore cash flow after payback period

2. Doesnt consider time value of money (TVM)

Capital Budgeting Page 2

2. Discounted Payback

It is a similar to the regular payback period except that the expected cash flow is discounted

by the projects cost of capital. Thus the discounted payback period is defined as the number

of years required to cover the investment from discounted net cash flows.

0 1 2 3 4

* -----------------* -----------------* ------------------* -------------------*

-1000 500 400 300 100

455 330 225 68

Assume that cost of capital is equal to 10%

Year 1= 500 = 455

(1.10)

Year 2= 400 = 330

(1.10)

Year 3= 300 = 225

(1.10)

Year 4= 100 = 68

(1.10)

4

- 1000 + 455 + 330 = 215/225 = 0.95

Discounted payback period = 2.95 Years

Advantage

Consider Time value of Money

Disadvantage

Ignore cash flow after payback period

Capital Budgeting Page 3

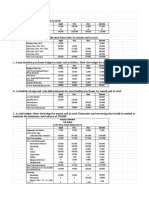

3. Net Present Value (NPV)

the net present value ( NPV) Method is based upon the discounted cash flow (DCF) Technique ,

it is based on all discounted cash flows of the project by using cost of capital rate and then sums

those cash flows, the project should be accepted if NPV is positive or = Zero.

0 1 2 3 4

* -----------------* -----------------* ------------------* -------------------*

-1000 500 400 300 100

455

330

225

68

---------------

NPV= + 78 (Cost of Capital @10%)

--------------

Year 1= 500 = 455

(1.10)

Year 2= 400 = 330

(1.10)

Year 3= 300 = 225

(1.10)

Year 4= 100 = 68

(1.10)

4

Positive NPV so we will accept the project ()

Capital Budgeting Page 4

4. Internal Rate of Return (IRR)

Internal rate of Return (IRR) is defined as the discounted rate that forces a projects NPV to

equal zero. The project should be accepted if the IRR is greater than cost of capital.

0 1 2 3 4

* -----------------* -----------------* ------------------* -------------------*

-1000 500 400 300 100

-1000+ 500 + 400 + 300 + 100 = Zero

(1+IRR)

1

(1+IRR)

2

(1+IRR)

3

(1+IRR)

4

Using trial and error or financial calculator, the internal rate of return will be 14.50%

If IRR > WACC we will accept the project because the projects rate of return is greater than its

cost.

If IRR < WACC we will Reject the project because the projects rate of return is less than its

cost.

For our example IRR = 14.50% while cost of capital is 10% therefore, IRR>WACC thus we will

accept the project ()

Independent Project vs. mutually Exclusive Projects

Independent project: if the cash flows of one project is unaffected by the acceptance of the

other. IRR > WACC

Mutually exclusive projects: if the cash flows of one can be adversely impacted by the

acceptance of the other. IRR

L

> IRR

S

The NPV and IRR make the same accept/reject decisions for independent projects, but if projects

are mutually exclusive, then conflicts can arise. If conflicts arise NPV Method should be used

because reinvestment at cost is more realistic as well as conservative, so NPV Method will be the

best one, therefore NPV should be used to select between mutually exclusive projects.

Capital Budgeting Page 5

NPV & IRR (No Conflict)

IRR > WACC while NPV Zero Accept the project

IRR < WACC while NPV < Zero Reject the project

NPV & IRR (Conflict)

Project (S) Project (L)

IRR 14% 13%

NPV 300 350

We will select the one with highest NPV

NPV assumes reinvest cash flow at cost of capital rate

IRR assume reinvest cash flow at IRR

5. Modified Internal rate of Return (MIRR)

Modified Internal rate of Return (MIRR) correct some of the problem with regular IRR since

MIRR involves finding the terminal value (TV) of the cash inflows, compounded at the firms

cost of capital and then determining the discount rate that forces the Present value of the TV to

equal the PV of the out flows.

0 1 2 3 4

* -----------------* -----------------* ------------------* -------------------*

-1000 500 400 300 100

330

484

665.50

============

TV 1579.50

============

Capital Budgeting Page 6

PV = FV (TV)

(1+MIRR)

4

1000 = 1579.50

(1+MIRR)

4

MIRR = 12.10%

6. Profitability Index (PI )

Profitability index shows the dollars of present value divided by the initial cost, so it measure

relative profitability.

0 1 2 3 4

* -----------------* -----------------* ------------------* -------------------*

-1000 500 400 300 100

455

330

225

68

========

1078

========

PI = 1078 = $ 1.08

1000

So the project is expected to produce $1.08 for each $ 1 of investment, if we compare 2 projects

we will select the project with higher (PI) and must be greater than (1).

Capital Budgeting Page 7

Comparing 2 projects with unequal life:

Project (c) with 6 years cash flow

Project (F) with 3 years cash flow

Project (c) @ cost of capital 11.50%

0 1 2 3 4 5 6

* ---------------* -----------------* ----------------* ----------------*-----------------*--------------*

-40000 8000 14000 13000 12000 11000 10000

Project (F) @ cost of capital 11.50%

0 1 2 3

* ---------------* -----------------* ----------------*

- 20000 7000 13000 12000

Here we will assume that cost and annual cash flow will not change, if the project is repeated

again in 3 years and cost of capital remain at 11.50%

Project (c) @ cost of capital 11.50%

0 1 2 3 4 5 6

* ---------------* -----------------* ----------------* ----------------*-----------------*--------------*

-40000 8000 14000 13000 12000 11000 10000

7175

11261

9378

7764

6383

5204

======

NPV + 7165

Capital Budgeting Page 8

Project (F) @ cost of capital 11.50%

0 1 2 3 4 5 6

* ---------------* -----------------* ----------------* ----------------*-----------------*--------------*

-20000 7000 13000 (8000) 7000 13000 12000

6278

10456

(5770)

4529

7543

6245

======

NPV + 9281

Therefore we will select the project with Highest NPV, so Project (F) is accepted ()

Assignment

(ST-1), (11-1), (11-2), (11-3), (11-4), (11-5), (11-6), (11-7) (11-8), (11-9) , (11-10), (11-11),

(11-12), (11-13)

Vous aimerez peut-être aussi

- Marketing Strategy AmazonDocument40 pagesMarketing Strategy AmazonMukesh Manwani40% (5)

- Management Reporting A Complete Guide - 2019 EditionD'EverandManagement Reporting A Complete Guide - 2019 EditionPas encore d'évaluation

- Ilovepdf MergedDocument100 pagesIlovepdf MergedVinny AujlaPas encore d'évaluation

- Chap 11Document67 pagesChap 11Reina Erasmo SulleraPas encore d'évaluation

- Quiz 3Document6 pagesQuiz 3BibliophilioManiac100% (1)

- Confidential offer letter for Agent positionDocument7 pagesConfidential offer letter for Agent positionBobby GenitaPas encore d'évaluation

- Capstone Project ReportDocument12 pagesCapstone Project ReportManisha VermaPas encore d'évaluation

- Chapter 07Document34 pagesChapter 07Lea WehbePas encore d'évaluation

- Capital Budgeting: Year Cash FlowDocument5 pagesCapital Budgeting: Year Cash FlowNaeem Uddin100% (3)

- CASEDocument18 pagesCASEJay SabioPas encore d'évaluation

- Tutorial 6 Capital Budgeting QuestionDocument4 pagesTutorial 6 Capital Budgeting Questiontichien100% (2)

- Assignment 2 PDFDocument10 pagesAssignment 2 PDFvamshiPas encore d'évaluation

- Lecture 4 - Cost Quality (Extra Notes) - With AnswerDocument7 pagesLecture 4 - Cost Quality (Extra Notes) - With AnswerHafizah Mat NawiPas encore d'évaluation

- (Fingerprints Group) 2011 CIMA Global Business Challenge ReportDocument23 pages(Fingerprints Group) 2011 CIMA Global Business Challenge Reportcrazyfrog1991Pas encore d'évaluation

- For Students Capital BudgetingDocument3 pagesFor Students Capital Budgetingripplerage0% (1)

- Capital BudgetingDocument6 pagesCapital BudgetingJaylin DizonPas encore d'évaluation

- CH 12Document63 pagesCH 12Grace VersoniPas encore d'évaluation

- Chapter 16 ProblemsDocument4 pagesChapter 16 ProblemsOkiPas encore d'évaluation

- Prequalifying Exam Level 2 3 Set B FSUU AccountingDocument9 pagesPrequalifying Exam Level 2 3 Set B FSUU AccountingRobert CastilloPas encore d'évaluation

- ABC and Standard CostingDocument16 pagesABC and Standard CostingCarlo QuinlogPas encore d'évaluation

- Final Practice ExamDocument15 pagesFinal Practice ExamRaymond KeyesPas encore d'évaluation

- MS-Q1 Concepts - Behavior.cvp - Ac ANSDocument5 pagesMS-Q1 Concepts - Behavior.cvp - Ac ANSSteff LeePas encore d'évaluation

- Preparatory Program: Cma/CfmDocument26 pagesPreparatory Program: Cma/CfmpaperdollsxPas encore d'évaluation

- Chapter 16 Budgeting Capital Expenditures Research and Development Expenditures and Cash Pert Cost The Flexible BudgetDocument17 pagesChapter 16 Budgeting Capital Expenditures Research and Development Expenditures and Cash Pert Cost The Flexible BudgetZunaira ButtPas encore d'évaluation

- Chapter 11 Capital Budgeting: Answers To QuestionsDocument35 pagesChapter 11 Capital Budgeting: Answers To Questionsafsdasdf3qf4341f4asDPas encore d'évaluation

- Leverage and Capital StructureDocument63 pagesLeverage and Capital Structurepraveen181274Pas encore d'évaluation

- Hilton 2222Document70 pagesHilton 2222Dianne Garcia RicamaraPas encore d'évaluation

- Decision Theory & Decision Tree PDFDocument5 pagesDecision Theory & Decision Tree PDFAfiq FuadPas encore d'évaluation

- Chapter 16Document22 pagesChapter 16Dominic RomeroPas encore d'évaluation

- Chapter 10 Plant Assets, Natural Resources, and Intangible Assets (13 E)Document18 pagesChapter 10 Plant Assets, Natural Resources, and Intangible Assets (13 E)Raa100% (1)

- Managerial Accounting BudgetingDocument3 pagesManagerial Accounting BudgetingJoelyn Grace MontajesPas encore d'évaluation

- Capital BudgetingDocument7 pagesCapital BudgetingnurmazkiyaniPas encore d'évaluation

- Factory Overhead Variances: Flexible Budget ApproachDocument4 pagesFactory Overhead Variances: Flexible Budget ApproachMeghan Kaye LiwenPas encore d'évaluation

- Capital Budgeting: Decision Criteria: True-FalseDocument40 pagesCapital Budgeting: Decision Criteria: True-Falsedavid80dcnPas encore d'évaluation

- ABC Company's Allowance for Doubtful Accounts and Notes Receivable AnalysisDocument20 pagesABC Company's Allowance for Doubtful Accounts and Notes Receivable Analysissino akoPas encore d'évaluation

- College of Accountancy Final Examination - Accounting For Business Combination I. Theories. Write The Letter of The Correct AnswerDocument11 pagesCollege of Accountancy Final Examination - Accounting For Business Combination I. Theories. Write The Letter of The Correct AnswerLouisse OrtigozaPas encore d'évaluation

- Total Quality ManagementDocument70 pagesTotal Quality ManagementPritjot GillPas encore d'évaluation

- Financial Statement Analysis Chapter 15Document13 pagesFinancial Statement Analysis Chapter 15April N. Alfonso100% (1)

- Strategic business analysis questionsDocument11 pagesStrategic business analysis questionsLyka DiarosPas encore d'évaluation

- Standard Cost and Components and Variance AnalysisDocument7 pagesStandard Cost and Components and Variance AnalysisNaveen RajputPas encore d'évaluation

- Sequence of Events in A RecapitalizationDocument4 pagesSequence of Events in A RecapitalizationWawex DavisPas encore d'évaluation

- Capital Budgeting MethodsDocument3 pagesCapital Budgeting MethodsRobert RamirezPas encore d'évaluation

- Gross Profit Analysis ExplainedDocument4 pagesGross Profit Analysis ExplainedLady Lhyn LalunioPas encore d'évaluation

- Capital BudgetingDocument6 pagesCapital BudgetingMaricel S. TanganPas encore d'évaluation

- Waiting Line ModelsDocument30 pagesWaiting Line ModelsPinky GuptaPas encore d'évaluation

- Ifrs 3Document4 pagesIfrs 3Ken ZafraPas encore d'évaluation

- Chapter 19Document9 pagesChapter 19Marc Siblag IIIPas encore d'évaluation

- IAS 2 - InventoriesDocument16 pagesIAS 2 - InventoriesletmelearnthisPas encore d'évaluation

- Chap 1 Test BankDocument22 pagesChap 1 Test BankMike SerafinoPas encore d'évaluation

- Accounting 1 FinalDocument2 pagesAccounting 1 FinalchiknaaaPas encore d'évaluation

- Statement of AffairsDocument28 pagesStatement of AffairsMd shahjahanPas encore d'évaluation

- Chapter 1: Flexible Budgeting and The Management of Overhead and Support Activity Costs Answer KeyDocument33 pagesChapter 1: Flexible Budgeting and The Management of Overhead and Support Activity Costs Answer KeyRafaelDelaCruz50% (2)

- SolutionDocument6 pagesSolutionaskdgasPas encore d'évaluation

- Chapter 2 WACC Q BankDocument22 pagesChapter 2 WACC Q Bankuzair ahmed siddiqi100% (1)

- Case 8-31: April May June QuarterDocument2 pagesCase 8-31: April May June QuarterileviejoiePas encore d'évaluation

- 2.1. Property Plant and Equipment IAS 16Document7 pages2.1. Property Plant and Equipment IAS 16Priya Satheesh100% (1)

- ACC51112 Transfer PricingDocument7 pagesACC51112 Transfer PricingjasPas encore d'évaluation

- BEcon416-Chapter2 (Organization Strategy & Project Selection)Document9 pagesBEcon416-Chapter2 (Organization Strategy & Project Selection)jayzPas encore d'évaluation

- Capital BudgetingDocument4 pagesCapital Budgetingrachmmm0% (3)

- Chapter Three CVP AnalysisDocument65 pagesChapter Three CVP AnalysisBettyPas encore d'évaluation

- Corporate Financial Analysis with Microsoft ExcelD'EverandCorporate Financial Analysis with Microsoft ExcelÉvaluation : 5 sur 5 étoiles5/5 (1)

- 2.chapter 11 - Capital BudgetingDocument24 pages2.chapter 11 - Capital BudgetingMohamed Sayed FadlPas encore d'évaluation

- Capital Budgeting PresentationDocument18 pagesCapital Budgeting Presentationaldamati2010Pas encore d'évaluation

- Capital Budgeting PresentationDocument18 pagesCapital Budgeting Presentationaldamati2010Pas encore d'évaluation

- Capital Budgeting PresentationDocument18 pagesCapital Budgeting Presentationaldamati2010Pas encore d'évaluation

- Problem DefinitionDocument1 pageProblem Definitionaldamati2010Pas encore d'évaluation

- Course: Marketing Management Class: GD-GB 13 / Spring 2014 Assignment: 1 Group: CDocument1 pageCourse: Marketing Management Class: GD-GB 13 / Spring 2014 Assignment: 1 Group: Caldamati2010Pas encore d'évaluation

- Corporate ChartsDocument11 pagesCorporate Chartsaldamati2010Pas encore d'évaluation

- Lecture Two Pulse ShapingDocument53 pagesLecture Two Pulse Shapingaldamati2010Pas encore d'évaluation

- Survey, Product (Interactive Customer Satisfaction Rating System) يف يأر ءادبإ جذومنDocument3 pagesSurvey, Product (Interactive Customer Satisfaction Rating System) يف يأر ءادبإ جذومنaldamati2010Pas encore d'évaluation

- A Sample Questionnaire For Corporate Customers - CorporateDocument3 pagesA Sample Questionnaire For Corporate Customers - Corporatealdamati2010Pas encore d'évaluation

- 10brittany King - Resume - Associate Director of Strategy and Analytics PDFDocument1 page10brittany King - Resume - Associate Director of Strategy and Analytics PDFBrittany KingPas encore d'évaluation

- Social Media Strategies for MilvikDocument29 pagesSocial Media Strategies for MilvikMin HajPas encore d'évaluation

- Personal Selling: Presented By: Ruchika Singh Shikha SehgalDocument20 pagesPersonal Selling: Presented By: Ruchika Singh Shikha Sehgaltony_njPas encore d'évaluation

- Understanding Consumer and Producer Surplus in MarketsDocument27 pagesUnderstanding Consumer and Producer Surplus in Marketsraj kumarPas encore d'évaluation

- Prepare, match and process receipts training (FNSICACC303ADocument4 pagesPrepare, match and process receipts training (FNSICACC303ASintayehu AnimutPas encore d'évaluation

- June 2016 - QuestionsDocument8 pagesJune 2016 - Questionsnasir_m68Pas encore d'évaluation

- Case Studymarketing Plan PDFDocument6 pagesCase Studymarketing Plan PDFKashifntcPas encore d'évaluation

- Magi Case StudyDocument6 pagesMagi Case StudylingzenpauliPas encore d'évaluation

- Theory of Cost & ProductionDocument4 pagesTheory of Cost & ProductionAkshay ModakPas encore d'évaluation

- Referensi Buku2 Mata KuliahDocument3 pagesReferensi Buku2 Mata KuliahRizael JrsPas encore d'évaluation

- Management Accounting Ii-Budgeting Solve Each Problem Carefully. No Solution, No Credit. Time Limit: Strictly 30 MinutesDocument2 pagesManagement Accounting Ii-Budgeting Solve Each Problem Carefully. No Solution, No Credit. Time Limit: Strictly 30 MinutesJade TanPas encore d'évaluation

- External Environmental AnalysisDocument19 pagesExternal Environmental AnalysisHale Bulasan100% (1)

- PresentationDocument29 pagesPresentationpermafrostXx0% (1)

- TBChap 009Document115 pagesTBChap 009alaamabood6Pas encore d'évaluation

- Industrial SicknessDocument19 pagesIndustrial SicknessAnkit SoniPas encore d'évaluation

- Income Tax Rules, 2002 PDFDocument244 pagesIncome Tax Rules, 2002 PDFAli Minhas100% (1)

- GSK Pakistan Annual Report 2021Document44 pagesGSK Pakistan Annual Report 2021SaadPas encore d'évaluation

- Unit 3 E-Marketing Mix: StructureDocument21 pagesUnit 3 E-Marketing Mix: Structureprskrs2Pas encore d'évaluation

- Introduction of CRMDocument20 pagesIntroduction of CRMMuazzam AhmedPas encore d'évaluation

- Using The Balanced Scorecard As A Strategic Management SystemDocument19 pagesUsing The Balanced Scorecard As A Strategic Management Systemkaran jainPas encore d'évaluation

- Reviewer Module 1 To 5 TheoryDocument8 pagesReviewer Module 1 To 5 TheoryDharylle CariñoPas encore d'évaluation

- Dmba104 Financial Management and AccountingDocument9 pagesDmba104 Financial Management and AccountingShashi SainiPas encore d'évaluation

- Chapter 3 QuizDocument7 pagesChapter 3 QuizMaria PiaPas encore d'évaluation

- CharlesGoodluck 2016 ChapterFive InternationalMarketinDocument22 pagesCharlesGoodluck 2016 ChapterFive InternationalMarketinRalph MallariPas encore d'évaluation

- Business Profile: Albay, Kristina Lacson, Joceleen Naldoza, Rominna Noro, Aljerico Ubas, GivenDocument51 pagesBusiness Profile: Albay, Kristina Lacson, Joceleen Naldoza, Rominna Noro, Aljerico Ubas, GivenKCPas encore d'évaluation

- Promote QueDocument15 pagesPromote Quesahrul ashakPas encore d'évaluation

- Chap 009Document69 pagesChap 009Brey Callao0% (1)