Académique Documents

Professionnel Documents

Culture Documents

Report Vastimal Banaji

Transféré par

SeemaNaik0 évaluation0% ont trouvé ce document utile (0 vote)

35 vues3 pagesReport Vastimal Banaji

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentReport Vastimal Banaji

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

35 vues3 pagesReport Vastimal Banaji

Transféré par

SeemaNaikReport Vastimal Banaji

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 3

GOVERNMENT OF KARNATAKA

(Department of Commercial Taxes)

NO.ADCOM/ENF/SZ/AC-V/INS- 14/13-14 Office of the Addl. Commissioner of

Commercial Taxes (Enforcement),

South Zone, V.T.K.II, 6th Floor, 80

Feet Road, Near National Games

Housing Complex, Vivek Nagar Post,

Koramangala, Bangalore.47.

Dated 29-01-2014

CATEGORY: B

INTELLIGENCE REPORT

1 Name and address of the

dealer

M/s. Sha Vasthimal Banaji & Co.

154/55, A.S. Char Street,

BVK Iyengar Road,Bangalore-53

2 Additional places inspected Nil

3 TIN 29910132450

Assignment No. 15853782/27-09-2013

4 Date of inspection 26-09-2013

5 Nature of business Traders in electrical goods and appliances

6 Books of accounts produced

for verification

Purchase and sales register, Purchase and

sales invoices, VAT returns

7 Books of accounts seized Nil

8 Period to which the report is

related

13-14 under KVAT Act

9 Name & designation of the

Inspecting Officer

Sri M.B.Harishbabu

ACCT(Enf)-V, SZ, Bangalore.

10 Name & designation of the

person in charge

Sri Dinesh Jain, person in-charge

BRIEF DETAILS OF THE INSPECTION:

The placeof business of the above dealer was inspected on 26-09-2013. At

the time of inspection Sri Dinesh Jain, person incharge was present, produced

the books of accounts and attended to the entire inspection proceedings.

Contd.2/-

As per the assignment allotted and issued, the place of business was

inspected on 26-09-2013. On the date of inspection the manager of the concern Sri.

Dinesh Jain person incharge was present.He has produced sales and purchase registers

and bills. They are verified. The business is medium and the dealer procures goods from

local dealers in majority and also in the course of interstate also.The sales in electrical

appliances are local and tax collected . Returns are filed regularly. The details of physical

stock of goods held at the tome of inspection was taken and the same was compared with

the books of account produced at a later date in office. The details are as follows,

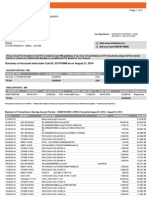

As per accounts:

Opening stock value : 5.5% Rs. 6,13,466-00

14.5% Rs. 1, 26,03,049-00

-------------------------

Rs. 1,32,16,515-00

Purchases up to date of

Inspection 26-09-2013

5.5% goods Rs. 1,50,921-00

14.5% Rs. 1,80,84,542-00

-------------------------

Rs. 1,82,35,463-00

-------------------------

Total Rs. 3,14,51,978-00

Less Sales up to the date of inspection

5.5% goods Rs. 1,34,102-00

14.5% Rs. 1,67,49,275-00

------------------

Rs. 1,68,83,377-00

Less G.P Rs. 8,34,540-00

---------------------- Rs. 1,60,48,837-00

5.2% as per trading a/c for 2012-13 ----------------------

Value of physical stock as on the

Date of inspection

as per accounts Rs. 1,54,03,141-00

value of physical stock actually found Rs. 1,51,29,280-00

----------------------

Difference Rs. 2,73,861-00

----------------------

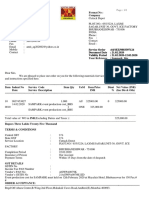

In addition to the above the dealer had sold old car for Rs. 80,000/- which was

purchased for Rs. 1,40,000/- The dealer is liable to pay tax on that sale also. In

response to the notice issued on the above lines the dealer has replied stating that there

is a misclassification in arriving at the difference in stock to alittle extent and he has

admitted a liability of Rs. 39,611/-.

the dealer agreed the above and discharged the tax voluntarily through DD No. 503302 dated 20-

12-2013 for Rs. 40,000/- drawn on Corporation Bank, City Market Branch Bangalore.

From the above, it is evident that, he is not maintaining true and correct books of account

thereby contravened provisions of the Act. Non-maintenance of proper books of accounts is an offence

punishable under Section 74(1) of the Act. Therefore, on propose to levy penalty of Rs.5000-00, the dealer

has agreed and paid Rs. 5000/- vide Reciept No. 32831 dated 18-12- 2013

I am forwarding herewith the above information to utilise the said

information while concluding the /re-assessment of the dealer. The result of

action taken may please be intimated to this office for records.

Receipt of this report may please be acknowledged.

Asst. Commissioner of Commercial Taxes

(Enforcement)-5 South Zone.,Bangalore.

To

The Joint Commissioner of

Commercial Taxes(Admn.)

Divisional Vat Office-I

Bangalore.

Copy to the LVO 010 for information.

Vous aimerez peut-être aussi

- 21St Century Computer Solutions: A Manual Accounting SimulationD'Everand21St Century Computer Solutions: A Manual Accounting SimulationPas encore d'évaluation

- Report Lal MachineryDocument2 pagesReport Lal MachinerySeemaNaikPas encore d'évaluation

- Category: B Intelligence Report: (Department of Commercial Taxes)Document2 pagesCategory: B Intelligence Report: (Department of Commercial Taxes)SeemaNaikPas encore d'évaluation

- Category: B Intelligence Report: (Department of Commercial Taxes)Document2 pagesCategory: B Intelligence Report: (Department of Commercial Taxes)SeemaNaikPas encore d'évaluation

- Seller Purchase Order - Preview: Delivery AddressDocument9 pagesSeller Purchase Order - Preview: Delivery AddressshibbuPas encore d'évaluation

- Morph Ser202324027 31102023 277Document6 pagesMorph Ser202324027 31102023 277gokulpics1Pas encore d'évaluation

- Seller Purchase Order - Preview: Delivery AddressDocument9 pagesSeller Purchase Order - Preview: Delivery AddressshibbuPas encore d'évaluation

- 75d5968 4608HTML000002Document6 pages75d5968 4608HTML000002DIpakPas encore d'évaluation

- 1Document2 pages1asad khokharPas encore d'évaluation

- 1Document2 pages1asad khokharPas encore d'évaluation

- INCOME TAX DEPT OFFICE ASSESSMENTDocument3 pagesINCOME TAX DEPT OFFICE ASSESSMENTGeetu DhimanPas encore d'évaluation

- Government crackdown on tax evasion by real estate firmDocument6 pagesGovernment crackdown on tax evasion by real estate firmSeemaNaikPas encore d'évaluation

- 2023 153 Taxmann Com 686 Punjab Haryana 01 03 2023 Mahavir Rice Mills Vs CommissioDocument7 pages2023 153 Taxmann Com 686 Punjab Haryana 01 03 2023 Mahavir Rice Mills Vs CommissioThe Chartered Professional NewsletterPas encore d'évaluation

- 03-PDPS Entomologist Bee Keeping & Hill Fruit Pests Research Station Rawalpindi 2013-15Document4 pages03-PDPS Entomologist Bee Keeping & Hill Fruit Pests Research Station Rawalpindi 2013-15Waqas GhulamnabiPas encore d'évaluation

- Non-payment of GST on railway material purchasesDocument2 pagesNon-payment of GST on railway material purchasesMuhammad IshaqPas encore d'évaluation

- DuplicateDocument3 pagesDuplicateBhimsen ShindePas encore d'évaluation

- VAT 240 Audit ReportDocument5 pagesVAT 240 Audit ReportarunupadhyaPas encore d'évaluation

- 1274 PDFDocument1 page1274 PDFAbhilashKrishnanPas encore d'évaluation

- 1274 PDFDocument1 page1274 PDFAbhilashKrishnanPas encore d'évaluation

- E NEWSLETTER May 2013Document9 pagesE NEWSLETTER May 2013sd naikPas encore d'évaluation

- TX 34108426062021Document3 pagesTX 34108426062021Abhishek PandeyPas encore d'évaluation

- 5e12c28 - 5809smart DivakarDocument1 page5e12c28 - 5809smart Divakarrasmi143Pas encore d'évaluation

- Appeal Regarding Excise-Stamp Duty (DRAFT)Document33 pagesAppeal Regarding Excise-Stamp Duty (DRAFT)AnujPas encore d'évaluation

- DuplicateDocument4 pagesDuplicatevishnu sri koppulaPas encore d'évaluation

- RECEIPTDocument2 pagesRECEIPTsavan anvekarPas encore d'évaluation

- Office of The District Audit Officer-Cum Assistant Examiner of Local Accounts: Local Fund Audit: BalangirDocument3 pagesOffice of The District Audit Officer-Cum Assistant Examiner of Local Accounts: Local Fund Audit: BalangirSandeep PairaPas encore d'évaluation

- DuplicateDocument3 pagesDuplicateTrupti UpalePas encore d'évaluation

- SRIIRAMAN 20231118 191402 EreceiptDocument2 pagesSRIIRAMAN 20231118 191402 EreceiptSri RamanPas encore d'évaluation

- Guide de SAP 1697127495Document9 pagesGuide de SAP 1697127495facillenegoce.alaouiPas encore d'évaluation

- All INDL Expo Booking Form(4)(10)Document4 pagesAll INDL Expo Booking Form(4)(10)teamindoreexpoPas encore d'évaluation

- PO Event PDN Cost SAMPARK - RklaDocument2 pagesPO Event PDN Cost SAMPARK - RklaIndia's TalentPas encore d'évaluation

- Monthly CcaDocument61 pagesMonthly Ccaroshan sahPas encore d'évaluation

- GR - IR Account ClearingDocument8 pagesGR - IR Account Clearingabhijeetp7Pas encore d'évaluation

- Reliance Industries Limited issues purchase order to Bhakti EnterprisesDocument23 pagesReliance Industries Limited issues purchase order to Bhakti EnterprisesumeshPas encore d'évaluation

- Cash Count Certificate: N Code: - .. Sap-Sem Code: - ...................Document5 pagesCash Count Certificate: N Code: - .. Sap-Sem Code: - ...................Manjeet SinghPas encore d'évaluation

- C Invoices 20190708 SLF02W142040003643Document3 pagesC Invoices 20190708 SLF02W142040003643Vasanthi RamyaPas encore d'évaluation

- Revised Financial Results & Limited Review For Sept 30, 2015 (Standalone) (Result)Document7 pagesRevised Financial Results & Limited Review For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Duplicate invoice for router purchaseDocument2 pagesDuplicate invoice for router purchasesri_dk1294Pas encore d'évaluation

- Appeal SummaryDocument49 pagesAppeal Summarymaapitambraenterprises700Pas encore d'évaluation

- SLF02Z137010019340Document2 pagesSLF02Z137010019340Demo HbuserPas encore d'évaluation

- Duplicate invoice receiptDocument4 pagesDuplicate invoice receiptjalanayushPas encore d'évaluation

- Indianoil Citibank Platinum Credit CardDocument4 pagesIndianoil Citibank Platinum Credit CardraunakgokhalePas encore d'évaluation

- Exe123 SoftDocument18 pagesExe123 SoftVanessa WertyPas encore d'évaluation

- Ramesh GPF Old StatementDocument2 pagesRamesh GPF Old StatementSHARANUPas encore d'évaluation

- Sri Chowdeshwari Rice TradersDocument2 pagesSri Chowdeshwari Rice Tradershemanth1234Pas encore d'évaluation

- ICICI Bank Savings Account Statement SummaryDocument3 pagesICICI Bank Savings Account Statement SummaryJayaDeyBodhakPas encore d'évaluation

- PO Event PDN Cost SAMPARK - BbsDocument2 pagesPO Event PDN Cost SAMPARK - BbsIndia's TalentPas encore d'évaluation

- 9757Document3 pages9757rajeshkanade121Pas encore d'évaluation

- Annex J Notice To TaxpayerDocument2 pagesAnnex J Notice To TaxpayerChris RodriguezPas encore d'évaluation

- DCIT v. Punjab Retail - ITAT IndoreDocument17 pagesDCIT v. Punjab Retail - ITAT IndorekalravPas encore d'évaluation

- 16911642150243342M 01Document2 pages16911642150243342M 01Pallavi KumariPas encore d'évaluation

- Internet BillDocument5 pagesInternet BillSubhankarPas encore d'évaluation

- M&CW Centre Zakhira Inderlok 2019Document6 pagesM&CW Centre Zakhira Inderlok 2019Subhas MishraPas encore d'évaluation

- Bhau MahaduDocument3 pagesBhau MahaduSHREYAS KHANOLKARPas encore d'évaluation

- Form 11: (See Rule 58 (2) )Document1 pageForm 11: (See Rule 58 (2) )Pawan KumarPas encore d'évaluation

- InvoiceDocument3 pagesInvoiceNikit ShahPas encore d'évaluation

- Rs 22,510 Rs 743 367 Rs.36,748: TotalDocument2 pagesRs 22,510 Rs 743 367 Rs.36,748: Totalasad khokharPas encore d'évaluation

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormShyamala SubramanianPas encore d'évaluation

- Jwalamala JewellersDocument9 pagesJwalamala Jewellersbharath289Pas encore d'évaluation

- Aam Admi Under GSTDocument5 pagesAam Admi Under GSTSeemaNaikPas encore d'évaluation

- Compliance ResponseDocument1 pageCompliance ResponseSeemaNaikPas encore d'évaluation

- Implement GST by April 1Document4 pagesImplement GST by April 1SeemaNaikPas encore d'évaluation

- GST3Document4 pagesGST3SeemaNaikPas encore d'évaluation

- Tax Notification SummaryDocument24 pagesTax Notification SummarySeemaNaikPas encore d'évaluation

- GST1Document4 pagesGST1SeemaNaikPas encore d'évaluation

- Place of Supply Under GST RegimeDocument3 pagesPlace of Supply Under GST RegimeSeemaNaikPas encore d'évaluation

- 15846Document4 pages15846SeemaNaikPas encore d'évaluation

- NoticeDocument2 pagesNoticeSeemaNaikPas encore d'évaluation

- Integrated GSTDocument5 pagesIntegrated GSTSeemaNaikPas encore d'évaluation

- GST4Document4 pagesGST4SeemaNaikPas encore d'évaluation

- IGSTDocument6 pagesIGSTSeemaNaikPas encore d'évaluation

- GSTDocument7 pagesGSTSeemaNaikPas encore d'évaluation

- GST2Document2 pagesGST2SeemaNaikPas encore d'évaluation

- FM may consider extending GST credit benefit to individuals tooDocument7 pagesFM may consider extending GST credit benefit to individuals tooSeemaNaikPas encore d'évaluation

- JULY 14, 2010: by Pritam Mahure, CA A Business Group Venturing in Different Business Segments UsuallyDocument8 pagesJULY 14, 2010: by Pritam Mahure, CA A Business Group Venturing in Different Business Segments UsuallySeemaNaikPas encore d'évaluation

- Goods and Services TaxDocument15 pagesGoods and Services TaxSeemaNaikPas encore d'évaluation

- GST ImplementationDocument3 pagesGST ImplementationSeemaNaikPas encore d'évaluation

- FM Pitches in For Dual Rates For GSTDocument8 pagesFM Pitches in For Dual Rates For GSTSeemaNaikPas encore d'évaluation

- Empowered Committee of FM 091109 GST First DraftDocument59 pagesEmpowered Committee of FM 091109 GST First DraftrdpathPas encore d'évaluation

- Discussion Paper On GSTDocument19 pagesDiscussion Paper On GSTSeemaNaikPas encore d'évaluation

- Finance Commission Task Force Report On GSTDocument3 pagesFinance Commission Task Force Report On GSTSeemaNaikPas encore d'évaluation

- Centre Prepares ForDocument3 pagesCentre Prepares ForSeemaNaikPas encore d'évaluation

- Discussion Paper On GSTDocument19 pagesDiscussion Paper On GSTSeemaNaikPas encore d'évaluation

- Comments of The Department of RevenueDocument8 pagesComments of The Department of RevenueSeemaNaikPas encore d'évaluation

- Budget - 2010Document6 pagesBudget - 2010SeemaNaikPas encore d'évaluation

- Finance Commission Group Wants Five GST ExemptionsDocument2 pagesFinance Commission Group Wants Five GST ExemptionsSeemaNaikPas encore d'évaluation

- VJ Shroff & Co Circular on First GST Discussion PaperDocument3 pagesVJ Shroff & Co Circular on First GST Discussion PaperSeemaNaikPas encore d'évaluation

- By Steven D' Souza, Former IRS & Management Consultant Dear Finance MinisterDocument5 pagesBy Steven D' Souza, Former IRS & Management Consultant Dear Finance MinisterSeemaNaikPas encore d'évaluation

- Budget 2010Document2 pagesBudget 2010SeemaNaikPas encore d'évaluation

- BIR Ruling 055-99 - Fringe BenefitsDocument2 pagesBIR Ruling 055-99 - Fringe BenefitsCha GalangPas encore d'évaluation

- Pacio V BillonDocument2 pagesPacio V BillonJazem Ansama100% (1)

- Case Digests For FinalsDocument40 pagesCase Digests For FinalsJayson YuzonPas encore d'évaluation

- Public Sector Vs pu-WPS OfficeDocument8 pagesPublic Sector Vs pu-WPS OfficeDawit TilahunPas encore d'évaluation

- Chhatrapati Shahu Ji Maharaj University, Kanpur PDFDocument1 pageChhatrapati Shahu Ji Maharaj University, Kanpur PDFNicunj guptaPas encore d'évaluation

- NAR 2018 Proposed Budget SummaryDocument6 pagesNAR 2018 Proposed Budget SummaryRobert HahnPas encore d'évaluation

- Wollo University Assigmt - TaxationDocument11 pagesWollo University Assigmt - TaxationkasimPas encore d'évaluation

- Unnati - FMCG, Consumer Durable, Retail, Brewery - 2018Document138 pagesUnnati - FMCG, Consumer Durable, Retail, Brewery - 2018Wuzmal HanduPas encore d'évaluation

- 2013-2019 Iloilo City, Comprehensive Development PlanDocument39 pages2013-2019 Iloilo City, Comprehensive Development PlanJawo Jimenez60% (5)

- Amazon Order Details for Sunglasses and Bike AccessoriesDocument1 pageAmazon Order Details for Sunglasses and Bike AccessoriesJuanse CeballosPas encore d'évaluation

- Deposit Interest Certificate 40903908Document2 pagesDeposit Interest Certificate 40903908adityaPas encore d'évaluation

- Tax Problems Questin and Answer CH 21Document8 pagesTax Problems Questin and Answer CH 21DoreenPas encore d'évaluation

- Final Withholding Tax FWT and CapitalDocument40 pagesFinal Withholding Tax FWT and CapitalEdna PostrePas encore d'évaluation

- Oral Presentation Carbon TaxDocument3 pagesOral Presentation Carbon TaxShai Shazza GrossPas encore d'évaluation

- RCBC v. CIR GR No. 170257 Sep. 7, 2011Document14 pagesRCBC v. CIR GR No. 170257 Sep. 7, 2011AlexandraSoledadPas encore d'évaluation

- QuizDocument4 pagesQuizYong RenPas encore d'évaluation

- Tax Invoice detailsDocument1 pageTax Invoice detailsJaideep SinghPas encore d'évaluation

- Chapter 6 Monitoring and ControllingDocument86 pagesChapter 6 Monitoring and ControllingJeff PanPas encore d'évaluation

- PESTEL Analysis (External) : PoliticalDocument3 pagesPESTEL Analysis (External) : PoliticalWasif AzimPas encore d'évaluation

- Analyzing The Changes in Sales and Consumption of Alcohol Upon The Imposition of Taxes in GurugramDocument23 pagesAnalyzing The Changes in Sales and Consumption of Alcohol Upon The Imposition of Taxes in GurugramInternational Journal of Advance Study and Research WorkPas encore d'évaluation

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageLaviPas encore d'évaluation

- Omkar Black Book PDFDocument99 pagesOmkar Black Book PDFsam torresPas encore d'évaluation

- Establishing A Financial Services Institution in The UKDocument56 pagesEstablishing A Financial Services Institution in The UKCrowdfundInsiderPas encore d'évaluation

- RDO No. 99 - Malaybalay City, BukidnonDocument368 pagesRDO No. 99 - Malaybalay City, BukidnonCzar Ian AgbayaniPas encore d'évaluation

- 3 Application of ARTIFICIAL NEURAL NETWORKS To Predict Occupancy PermitDocument85 pages3 Application of ARTIFICIAL NEURAL NETWORKS To Predict Occupancy PermitChioma UchePas encore d'évaluation

- Feminist EconomicsDocument8 pagesFeminist EconomicsOxfamPas encore d'évaluation

- Ledgers and Group PDFDocument6 pagesLedgers and Group PDFShivani SainiPas encore d'évaluation

- SIE ReviewerDocument5 pagesSIE ReviewerMina G.Pas encore d'évaluation

- Assam Budget Analysis 2022-23Document7 pagesAssam Budget Analysis 2022-23Guwahati RangePas encore d'évaluation

- Bell The Role of The State and The Hierarchy of Money PDFDocument16 pagesBell The Role of The State and The Hierarchy of Money PDFcosmelliPas encore d'évaluation

- An Unfinished Love Story: A Personal History of the 1960sD'EverandAn Unfinished Love Story: A Personal History of the 1960sÉvaluation : 5 sur 5 étoiles5/5 (1)

- Age of Revolutions: Progress and Backlash from 1600 to the PresentD'EverandAge of Revolutions: Progress and Backlash from 1600 to the PresentÉvaluation : 4.5 sur 5 étoiles4.5/5 (6)

- Nine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesD'EverandNine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesPas encore d'évaluation

- The Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteD'EverandThe Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteÉvaluation : 4.5 sur 5 étoiles4.5/5 (16)

- Prisoners of Geography: Ten Maps That Explain Everything About the WorldD'EverandPrisoners of Geography: Ten Maps That Explain Everything About the WorldÉvaluation : 4.5 sur 5 étoiles4.5/5 (1143)

- The Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpD'EverandThe Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpÉvaluation : 4.5 sur 5 étoiles4.5/5 (11)

- Broken Money: Why Our Financial System Is Failing Us and How We Can Make It BetterD'EverandBroken Money: Why Our Financial System Is Failing Us and How We Can Make It BetterÉvaluation : 5 sur 5 étoiles5/5 (1)

- Son of Hamas: A Gripping Account of Terror, Betrayal, Political Intrigue, and Unthinkable ChoicesD'EverandSon of Hamas: A Gripping Account of Terror, Betrayal, Political Intrigue, and Unthinkable ChoicesÉvaluation : 4.5 sur 5 étoiles4.5/5 (490)

- Ten Years to Save the West: Lessons from the only conservative in the roomD'EverandTen Years to Save the West: Lessons from the only conservative in the roomPas encore d'évaluation

- Jesus and the Powers: Christian Political Witness in an Age of Totalitarian Terror and Dysfunctional DemocraciesD'EverandJesus and the Powers: Christian Political Witness in an Age of Totalitarian Terror and Dysfunctional DemocraciesÉvaluation : 5 sur 5 étoiles5/5 (5)

- The Exvangelicals: Loving, Living, and Leaving the White Evangelical ChurchD'EverandThe Exvangelicals: Loving, Living, and Leaving the White Evangelical ChurchÉvaluation : 4.5 sur 5 étoiles4.5/5 (12)

- Thomas Jefferson: Author of AmericaD'EverandThomas Jefferson: Author of AmericaÉvaluation : 4 sur 5 étoiles4/5 (107)

- How to Destroy America in Three Easy StepsD'EverandHow to Destroy America in Three Easy StepsÉvaluation : 4.5 sur 5 étoiles4.5/5 (21)

- Nazi Hunting: A Love Story: The husband and wife who, for six decades and counting, have made catching war criminals the family businessD'EverandNazi Hunting: A Love Story: The husband and wife who, for six decades and counting, have made catching war criminals the family businessÉvaluation : 4.5 sur 5 étoiles4.5/5 (58)

- Hunting Eichmann: How a Band of Survivors and a Young Spy Agency Chased Down the World's Most Notorious NaziD'EverandHunting Eichmann: How a Band of Survivors and a Young Spy Agency Chased Down the World's Most Notorious NaziÉvaluation : 4 sur 5 étoiles4/5 (157)

- Get It Together: Troubling Tales from the Liberal FringeD'EverandGet It Together: Troubling Tales from the Liberal FringeÉvaluation : 2.5 sur 5 étoiles2.5/5 (3)

- Here, Right Matters: An American StoryD'EverandHere, Right Matters: An American StoryÉvaluation : 4 sur 5 étoiles4/5 (24)

- A River in Darkness: One Man's Escape from North KoreaD'EverandA River in Darkness: One Man's Escape from North KoreaÉvaluation : 4.5 sur 5 étoiles4.5/5 (649)

- Franklin & Washington: The Founding PartnershipD'EverandFranklin & Washington: The Founding PartnershipÉvaluation : 3.5 sur 5 étoiles3.5/5 (14)

- Reading the Constitution: Why I Chose Pragmatism, not TextualismD'EverandReading the Constitution: Why I Chose Pragmatism, not TextualismPas encore d'évaluation

- The Conservative Heart: How to Build a Fairer, Happier, and More Prosperous AmericaD'EverandThe Conservative Heart: How to Build a Fairer, Happier, and More Prosperous AmericaÉvaluation : 3.5 sur 5 étoiles3.5/5 (9)

- The Franklin Scandal: A Story of Powerbrokers, Child Abuse & BetrayalD'EverandThe Franklin Scandal: A Story of Powerbrokers, Child Abuse & BetrayalÉvaluation : 4.5 sur 5 étoiles4.5/5 (45)

- Modern Warriors: Real Stories from Real HeroesD'EverandModern Warriors: Real Stories from Real HeroesÉvaluation : 3.5 sur 5 étoiles3.5/5 (3)